John Lee's Rich School

|

Description

Book Introduction

John Lee's financial education for national economic independence

“Okay, shall we start the meeting now?”

John Lee, mentor to stock investors, has returned as a financial educator.

"John Lee's Rich School" is a financial education book composed of conversations between John Lee, a financial educator, and members of the financial study group "Rich School."

Although there are already dozens of financial books on the market under the name 'John Lee,' this book is significant in that it is the first financial education book created by John Lee together with the average stock investor in Korea.

South Korea has achieved remarkable growth recognized worldwide, but its education system, which needs improvement, and its lack of financial awareness are holding back its national competitiveness.

In order for our next generation, our children, to live in a happy and wealthy country like the Republic of Korea, we must improve these two issues.

Korean education instills a mindset of constantly comparing oneself to others from beginning to end.

The first thing we must get rid of now is this attitude of considering ourselves more unfortunate than others.

Here, they are in a state of severe financial illiteracy, having never properly learned how to make money since childhood, so they are constantly focused on 'how to look rich' rather than becoming rich.

Wealth is made first of all by attitude.

The participants who studied finance with John Lee in this book are K-stock investors representing all ages and various occupations in Korea.

We invite you now to join us for a million-dollar conversation about becoming rich with these people and John Lee.

“Okay, shall we start the meeting now?”

John Lee, mentor to stock investors, has returned as a financial educator.

"John Lee's Rich School" is a financial education book composed of conversations between John Lee, a financial educator, and members of the financial study group "Rich School."

Although there are already dozens of financial books on the market under the name 'John Lee,' this book is significant in that it is the first financial education book created by John Lee together with the average stock investor in Korea.

South Korea has achieved remarkable growth recognized worldwide, but its education system, which needs improvement, and its lack of financial awareness are holding back its national competitiveness.

In order for our next generation, our children, to live in a happy and wealthy country like the Republic of Korea, we must improve these two issues.

Korean education instills a mindset of constantly comparing oneself to others from beginning to end.

The first thing we must get rid of now is this attitude of considering ourselves more unfortunate than others.

Here, they are in a state of severe financial illiteracy, having never properly learned how to make money since childhood, so they are constantly focused on 'how to look rich' rather than becoming rich.

Wealth is made first of all by attitude.

The participants who studied finance with John Lee in this book are K-stock investors representing all ages and various occupations in Korea.

We invite you now to join us for a million-dollar conversation about becoming rich with these people and John Lee.

index

introduction

A book containing practical investment guidance on stocks and finance that Koreans need now.

Chapter 1: Korea is not a rich country.

It all started with 'comparison'

Comparative Education Has Made Us Impoverished | Why We Can't Escape Financial Illiteracy | The Trap of Telling Those Who Have Worked to Leave

The illusion that studying hard will make you rich

Private education makes children poorer | Economic independence education is crucial now | Living in Gangnam without a quality of life

Korea's rigid labor market

The Need for Diversity in Occupations | Entrepreneurship, Blue-Collar/White-Collar Jobs, and Equality | The Korean Labor Market

Korea will survive only when women change.

Children need to learn what they want | Focus on what you need to do right now | If Korean women change, the Korean economy will develop | To escape emotional dependence, achieve financial independence.

Chapter 2: What is Rich?

If you don't know what riches are, you can't become rich.

Why Financial Independence Matters | Thinking Differently Can Help You Overcome Financial Illiteracy | Parents Are Financial Role Models for Their Children

Why '1 Billion' is Possible

"This life is a mess" | Not a 'league of their own' | Money isn't something you take with you when you die?

The concept of 'rich'

Bad Rich vs. Good Rich | Learn How to Become Good Rich | Money-Free = Happy Rich

My own reason for becoming 'rich'

Chapter 3: A Rich Nation Where I Get Rich First

If you overcome financial illiteracy, you won't be scammed.

Stories from those who fell for romance scams and email fraud | Be aware of your money when entrusting it | Beware of romance scams that make lonely people cry twice | Even Jews fall for financial fraud

Hang out with the right person

Why You Need a Stock Investment Club | The Benefits of Unearned Income | Stocks vs. Real Estate

Look at the company, not the market

Why Bear Markets Can Be Weathered | Why Investing in a Country Doesn't Matter

The Truth About Investing

Investing is your perspective on a company's future | Find companies that are driving creative destruction | Companies loved by customers | Stock investing is owning a company | What you should never do in stock investing

Education holds all the answers

The Need for Self-Esteem Education About Money | Self-Esteem Education is Urgent | A Plan for Change

In closing the book

A book containing practical investment guidance on stocks and finance that Koreans need now.

Chapter 1: Korea is not a rich country.

It all started with 'comparison'

Comparative Education Has Made Us Impoverished | Why We Can't Escape Financial Illiteracy | The Trap of Telling Those Who Have Worked to Leave

The illusion that studying hard will make you rich

Private education makes children poorer | Economic independence education is crucial now | Living in Gangnam without a quality of life

Korea's rigid labor market

The Need for Diversity in Occupations | Entrepreneurship, Blue-Collar/White-Collar Jobs, and Equality | The Korean Labor Market

Korea will survive only when women change.

Children need to learn what they want | Focus on what you need to do right now | If Korean women change, the Korean economy will develop | To escape emotional dependence, achieve financial independence.

Chapter 2: What is Rich?

If you don't know what riches are, you can't become rich.

Why Financial Independence Matters | Thinking Differently Can Help You Overcome Financial Illiteracy | Parents Are Financial Role Models for Their Children

Why '1 Billion' is Possible

"This life is a mess" | Not a 'league of their own' | Money isn't something you take with you when you die?

The concept of 'rich'

Bad Rich vs. Good Rich | Learn How to Become Good Rich | Money-Free = Happy Rich

My own reason for becoming 'rich'

Chapter 3: A Rich Nation Where I Get Rich First

If you overcome financial illiteracy, you won't be scammed.

Stories from those who fell for romance scams and email fraud | Be aware of your money when entrusting it | Beware of romance scams that make lonely people cry twice | Even Jews fall for financial fraud

Hang out with the right person

Why You Need a Stock Investment Club | The Benefits of Unearned Income | Stocks vs. Real Estate

Look at the company, not the market

Why Bear Markets Can Be Weathered | Why Investing in a Country Doesn't Matter

The Truth About Investing

Investing is your perspective on a company's future | Find companies that are driving creative destruction | Companies loved by customers | Stock investing is owning a company | What you should never do in stock investing

Education holds all the answers

The Need for Self-Esteem Education About Money | Self-Esteem Education is Urgent | A Plan for Change

In closing the book

Detailed image

Into the book

While publishing over a dozen books under the name of 'John Lee', if given the opportunity, I wanted to compile a collection of stock discussions that would not be a book on stock investment for oneself, but rather a book that would be shared by many people who want to get started in stock investment and who would warmly advise and meticulously examine the lonely path of 'Korean financial illiteracy' and stock investment.

When Medici Media approached me with a project to share diverse perspectives on stocks and finance through readings with a diverse group of people, I was able to take a bold step forward because I saw in the participants the potential to realize a long-held dream of mine.

The participants were average Korean stock investors with diverse careers, ranging from a former university professor in his 50s, a female entrepreneur in her 40s, a school teacher in her 30s, and the CEO of a fashion mall from the MZ generation.

I wanted to share and critique a wide range of stories, from the reality of financial illiteracy in Korea to the gambling-like nature of stock investment to becoming a happy rich person, and hear the real-life stories of stock market ants and offer advice.

At the same time, I wanted to present the correct value of ‘money’.

--- pp.9-10, from the "Preface"

While reading and discussing financial books with the participants who participated in the publication of this book, I gained a deep understanding of the struggles faced by various individual investors and the field, and I reflected deeply on them.

Above all, through their voices, I was able to clearly understand why we, a nation with global companies that lead the world and are the envy of the world, and a diverse K-culture, are so lacking in financial knowledge and backward in investment.

Above all, the fundamental problem Koreans have is a flawed investment outlook resulting from a lack of philosophy on 'stock investment' and a lack of a long-term investment mindset.

I think it was fortunate that, compared to other typical individual investors, they had a certain level of financial knowledge, and that by spending about five months with them, I was able to naturally discover the "gleam of hope" I had felt when I first came to Korea, while working with them to confront their own problems and develop their own financial philosophy.

--- pp.13-14, from the 「Preface」

hello.

My name is Kim Hyun-joo.

I think I am the person who has both the 'financial illiteracy' and 'financial poverty' that Professor John Lee talks about.

The most urgent thing for me right now is 'money'.

I realized that I had never really felt desperate for money.

(Omitted) I wanted to define myself as a ‘growing person’, and even though I resolved my complex about my academic background by transferring and studying abroad, I returned to Korea and went to graduate school again.

And at some point, I realized that even though I worked hard at a small business, I was living in the red with nothing left in my bank account.

I wanted to maintain my 'availability' so badly that I was carrying around a design bag and maintaining an overdraft account.

I didn't even dare to read Mr. John Lee's books or watch YouTube.

But when it came time to take responsibility for myself, I felt like I wanted to learn more about money.

--- pp.19-20, from “Chapter 1 Korea is not a rich country”

There are two things I want to talk about in this meeting.

I think that if these two things are achieved, South Korea will become the most competitive country in the world.

These are ‘education reform’ and ‘financial reform.’

The future of the Republic of Korea will depend on the decisions we make now.

Now is the 'critical time' that will determine the future.

Now we really need to overcome financial illiteracy.

Now we need to create an environment where we can actively talk about money.

We need to expand the opportunities for systematic learning about finance nationwide and promote investment.

And we need to continue to cultivate talent that can not only receive financial education, but also provide financial education.

We are considering various ways to expand financial education.

This meeting is also the result of that concern.

--- pp.21-22, from “Chapter 1 Korea is not a rich country”

When you first say the amount of money '1 billion', you think 'I don't think I can do it'.

First, we need to let them know that 'you have to become rich', 'you have to reduce consumption and change consumption into investment', and '1 billion is definitely not a lot of money'.

A billion may seem like a lot of money, but it's not because children have time, and the magic of compound interest is possible.

We must tell the story that “you can do it because you have time.”

Because of the 'magic of compound interest', I must teach you that a billion won is not a lot of money to you.

--- p.117, from “Chapter 2: What is a Rich Man”

People feel that real estate is going up, but they don't know much about stocks.

That is also an extremely wrong prejudice.

In a way, breaking down prejudices is the purpose of our group.

There are so many things we get wrong.

The idea that people shouldn't invest in stocks is a terrible prejudice.

There are some words we need to discard.

The perception that unearned income is bad is because money is not included in the object of work, and work is only considered physical.

In that respect, we need to be open-minded.

The prejudice against real estate is very serious.

Buying real estate means taking on not only assets but also liabilities.

We need to break away from the prejudice that rent is money that is wasted.

When Medici Media approached me with a project to share diverse perspectives on stocks and finance through readings with a diverse group of people, I was able to take a bold step forward because I saw in the participants the potential to realize a long-held dream of mine.

The participants were average Korean stock investors with diverse careers, ranging from a former university professor in his 50s, a female entrepreneur in her 40s, a school teacher in her 30s, and the CEO of a fashion mall from the MZ generation.

I wanted to share and critique a wide range of stories, from the reality of financial illiteracy in Korea to the gambling-like nature of stock investment to becoming a happy rich person, and hear the real-life stories of stock market ants and offer advice.

At the same time, I wanted to present the correct value of ‘money’.

--- pp.9-10, from the "Preface"

While reading and discussing financial books with the participants who participated in the publication of this book, I gained a deep understanding of the struggles faced by various individual investors and the field, and I reflected deeply on them.

Above all, through their voices, I was able to clearly understand why we, a nation with global companies that lead the world and are the envy of the world, and a diverse K-culture, are so lacking in financial knowledge and backward in investment.

Above all, the fundamental problem Koreans have is a flawed investment outlook resulting from a lack of philosophy on 'stock investment' and a lack of a long-term investment mindset.

I think it was fortunate that, compared to other typical individual investors, they had a certain level of financial knowledge, and that by spending about five months with them, I was able to naturally discover the "gleam of hope" I had felt when I first came to Korea, while working with them to confront their own problems and develop their own financial philosophy.

--- pp.13-14, from the 「Preface」

hello.

My name is Kim Hyun-joo.

I think I am the person who has both the 'financial illiteracy' and 'financial poverty' that Professor John Lee talks about.

The most urgent thing for me right now is 'money'.

I realized that I had never really felt desperate for money.

(Omitted) I wanted to define myself as a ‘growing person’, and even though I resolved my complex about my academic background by transferring and studying abroad, I returned to Korea and went to graduate school again.

And at some point, I realized that even though I worked hard at a small business, I was living in the red with nothing left in my bank account.

I wanted to maintain my 'availability' so badly that I was carrying around a design bag and maintaining an overdraft account.

I didn't even dare to read Mr. John Lee's books or watch YouTube.

But when it came time to take responsibility for myself, I felt like I wanted to learn more about money.

--- pp.19-20, from “Chapter 1 Korea is not a rich country”

There are two things I want to talk about in this meeting.

I think that if these two things are achieved, South Korea will become the most competitive country in the world.

These are ‘education reform’ and ‘financial reform.’

The future of the Republic of Korea will depend on the decisions we make now.

Now is the 'critical time' that will determine the future.

Now we really need to overcome financial illiteracy.

Now we need to create an environment where we can actively talk about money.

We need to expand the opportunities for systematic learning about finance nationwide and promote investment.

And we need to continue to cultivate talent that can not only receive financial education, but also provide financial education.

We are considering various ways to expand financial education.

This meeting is also the result of that concern.

--- pp.21-22, from “Chapter 1 Korea is not a rich country”

When you first say the amount of money '1 billion', you think 'I don't think I can do it'.

First, we need to let them know that 'you have to become rich', 'you have to reduce consumption and change consumption into investment', and '1 billion is definitely not a lot of money'.

A billion may seem like a lot of money, but it's not because children have time, and the magic of compound interest is possible.

We must tell the story that “you can do it because you have time.”

Because of the 'magic of compound interest', I must teach you that a billion won is not a lot of money to you.

--- p.117, from “Chapter 2: What is a Rich Man”

People feel that real estate is going up, but they don't know much about stocks.

That is also an extremely wrong prejudice.

In a way, breaking down prejudices is the purpose of our group.

There are so many things we get wrong.

The idea that people shouldn't invest in stocks is a terrible prejudice.

There are some words we need to discard.

The perception that unearned income is bad is because money is not included in the object of work, and work is only considered physical.

In that respect, we need to be open-minded.

The prejudice against real estate is very serious.

Buying real estate means taking on not only assets but also liabilities.

We need to break away from the prejudice that rent is money that is wasted.

--- p.177, from “Chapter 3: A Rich Nation Where I Become Rich First”

Publisher's Review

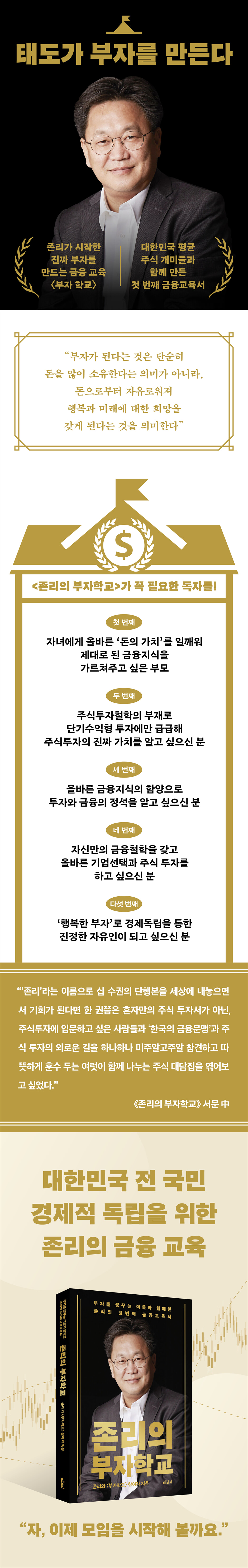

Readers Who Really Need "John Lee's Rich School"

First! Parents who want to teach their children the true value of money and proper financial knowledge.

Second! Those who lack a stock investment philosophy and are focused solely on short-term gains, but want to understand the true value of stock investment.

Third! For those who want to learn the fundamentals of investment and finance by developing sound financial knowledge.

Fourth! For those who want to develop their own financial philosophy and make sound corporate and stock investments.

Fifth! For those who want to become truly free through financial independence as a "happy rich person."

Attitude makes the rich

John Lee's "Wealthy School": A Financial Education Program for Creating Truly Rich People

Financial educator John Lee

The first financial education book created with the average stock investor in Korea.

John Lee, mentor to stock investors, has returned as a financial educator.

"John Lee's Rich School" is a financial education book composed of conversations between John Lee, a financial educator, and members of the financial study group "Rich School."

Although there are already dozens of financial books on the market under the name 'John Lee,' this book is significant in that it is the first financial education book created by John Lee together with the average stock investor in Korea.

South Korea has achieved remarkable growth recognized worldwide, but its education system, which needs improvement, and its lack of financial awareness are holding back its national competitiveness.

In order for our next generation, our children, to live in a happy and wealthy country like the Republic of Korea, we must improve these two issues.

Korean education instills a mindset of constantly comparing oneself to others from beginning to end.

The first thing we must get rid of now is this attitude of considering ourselves more unfortunate than others.

Here, they are in a state of severe financial illiteracy, having never properly learned how to make money since childhood, so they are constantly focused on 'how to look rich' rather than becoming rich.

Wealth is made first of all by attitude.

The fundamental problem for Koreans was their flawed investment outlook and lack of a long-term investment mindset stemming from a lack of philosophy on stock investment.

The participants who studied finance with John Lee in this book are K-stock investors representing all ages and various occupations in Korea.

John Lee and the participants read and discussed financial books together, gaining a deeper understanding of the struggles of various individual investors and those in the field, and reflecting deeply on them.

Through the voices of the participants, we were able to clearly understand why we, a nation with global companies that lead the world and a diverse K-culture that the world envies, are so lacking in financial knowledge and backward in investment.

A happy rich person is one who is free from money.

The philosophy of the rich for freedom, not ownership.

We invite you now to join us for a million-dollar conversation about becoming rich with these people and John Lee.

Chapter 1: Korea is not a rich country.

The first chapter explains why Korea is not a wealthy country.

Of course, despite being a resource-poor country with a population of 50 million, Korea has achieved success in many fields that are the envy of the entire world.

Nuclear technology, automobiles, and semiconductors are at a world-leading level, and in the future, it is highly likely that Korea will lead the world not only in manufacturing but also in culture, music, and food, led by K-pop.

Despite this, Korea is not a rich country.

Even though the country is wealthy, the majority of people living in Korea do not have the 'mindset of the rich.'

Why is this? It's due to a lack of awareness about the education system and finance, which needs to be improved.

In particular, the Korean education system, which constantly 'compares' people with others from childhood, does not create 'rich people', but rather makes people more obsessed with 'looking rich'.

We must improve these two problems now so that our children, the next generation, can live in a truly wealthy country like the Republic of Korea.

Chapter 2: What is Rich?

This chapter covers the concept of wealth and why we should become wealthy.

Like it or not, we live in a capitalist society.

According to John Lee, the reason to be rich is not to earn a lot of money to eat delicious food or buy nice clothes.

So why should we achieve economic independence and become wealthy? Because in a capitalist society, economic independence is inherently linked to "freedom."

In other words, the image of a happy rich person is far from that of a nouveau riche.

Beyond simply having a lot of money, someone who has become free from money by not working for money but letting money work for them.

We must become rich because of the happiness and hope for the future that comes with economic independence.

That is, according to John Lee's words in this book, the freest and happiest people can be seen as rich.

Chapter 3: A Rich Nation Where I Get Rich First

The final chapter discusses the methodology for what individuals, that is, what we ourselves, can do to actually become wealthy.

For South Korea to become a truly wealthy nation, each and every one of its members must become wealthy.

To that end, John Lee consistently talks about improving education.

Especially among Koreans, there are many who are reluctant to talk openly about money.

In addition, there is still a culture that treats money earned through finance, such as stock investment, as “unearned income” and treats it as if it were morally problematic.

We, who make up the current reality of South Korea, have lived in such a rigid culture, but we must not allow the children who will live in South Korea in the future to inherit such foolish values.

As individuals and families' values regarding money change, the prejudices about money that hinder Korea's qualitative growth will also disappear.

First! Parents who want to teach their children the true value of money and proper financial knowledge.

Second! Those who lack a stock investment philosophy and are focused solely on short-term gains, but want to understand the true value of stock investment.

Third! For those who want to learn the fundamentals of investment and finance by developing sound financial knowledge.

Fourth! For those who want to develop their own financial philosophy and make sound corporate and stock investments.

Fifth! For those who want to become truly free through financial independence as a "happy rich person."

Attitude makes the rich

John Lee's "Wealthy School": A Financial Education Program for Creating Truly Rich People

Financial educator John Lee

The first financial education book created with the average stock investor in Korea.

John Lee, mentor to stock investors, has returned as a financial educator.

"John Lee's Rich School" is a financial education book composed of conversations between John Lee, a financial educator, and members of the financial study group "Rich School."

Although there are already dozens of financial books on the market under the name 'John Lee,' this book is significant in that it is the first financial education book created by John Lee together with the average stock investor in Korea.

South Korea has achieved remarkable growth recognized worldwide, but its education system, which needs improvement, and its lack of financial awareness are holding back its national competitiveness.

In order for our next generation, our children, to live in a happy and wealthy country like the Republic of Korea, we must improve these two issues.

Korean education instills a mindset of constantly comparing oneself to others from beginning to end.

The first thing we must get rid of now is this attitude of considering ourselves more unfortunate than others.

Here, they are in a state of severe financial illiteracy, having never properly learned how to make money since childhood, so they are constantly focused on 'how to look rich' rather than becoming rich.

Wealth is made first of all by attitude.

The fundamental problem for Koreans was their flawed investment outlook and lack of a long-term investment mindset stemming from a lack of philosophy on stock investment.

The participants who studied finance with John Lee in this book are K-stock investors representing all ages and various occupations in Korea.

John Lee and the participants read and discussed financial books together, gaining a deeper understanding of the struggles of various individual investors and those in the field, and reflecting deeply on them.

Through the voices of the participants, we were able to clearly understand why we, a nation with global companies that lead the world and a diverse K-culture that the world envies, are so lacking in financial knowledge and backward in investment.

A happy rich person is one who is free from money.

The philosophy of the rich for freedom, not ownership.

We invite you now to join us for a million-dollar conversation about becoming rich with these people and John Lee.

Chapter 1: Korea is not a rich country.

The first chapter explains why Korea is not a wealthy country.

Of course, despite being a resource-poor country with a population of 50 million, Korea has achieved success in many fields that are the envy of the entire world.

Nuclear technology, automobiles, and semiconductors are at a world-leading level, and in the future, it is highly likely that Korea will lead the world not only in manufacturing but also in culture, music, and food, led by K-pop.

Despite this, Korea is not a rich country.

Even though the country is wealthy, the majority of people living in Korea do not have the 'mindset of the rich.'

Why is this? It's due to a lack of awareness about the education system and finance, which needs to be improved.

In particular, the Korean education system, which constantly 'compares' people with others from childhood, does not create 'rich people', but rather makes people more obsessed with 'looking rich'.

We must improve these two problems now so that our children, the next generation, can live in a truly wealthy country like the Republic of Korea.

Chapter 2: What is Rich?

This chapter covers the concept of wealth and why we should become wealthy.

Like it or not, we live in a capitalist society.

According to John Lee, the reason to be rich is not to earn a lot of money to eat delicious food or buy nice clothes.

So why should we achieve economic independence and become wealthy? Because in a capitalist society, economic independence is inherently linked to "freedom."

In other words, the image of a happy rich person is far from that of a nouveau riche.

Beyond simply having a lot of money, someone who has become free from money by not working for money but letting money work for them.

We must become rich because of the happiness and hope for the future that comes with economic independence.

That is, according to John Lee's words in this book, the freest and happiest people can be seen as rich.

Chapter 3: A Rich Nation Where I Get Rich First

The final chapter discusses the methodology for what individuals, that is, what we ourselves, can do to actually become wealthy.

For South Korea to become a truly wealthy nation, each and every one of its members must become wealthy.

To that end, John Lee consistently talks about improving education.

Especially among Koreans, there are many who are reluctant to talk openly about money.

In addition, there is still a culture that treats money earned through finance, such as stock investment, as “unearned income” and treats it as if it were morally problematic.

We, who make up the current reality of South Korea, have lived in such a rigid culture, but we must not allow the children who will live in South Korea in the future to inherit such foolish values.

As individuals and families' values regarding money change, the prejudices about money that hinder Korea's qualitative growth will also disappear.

GOODS SPECIFICS

- Date of issue: August 1, 2024

- Page count, weight, size: 232 pages | 140*210*16mm

- ISBN13: 9791157063628

- ISBN10: 1157063624

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)