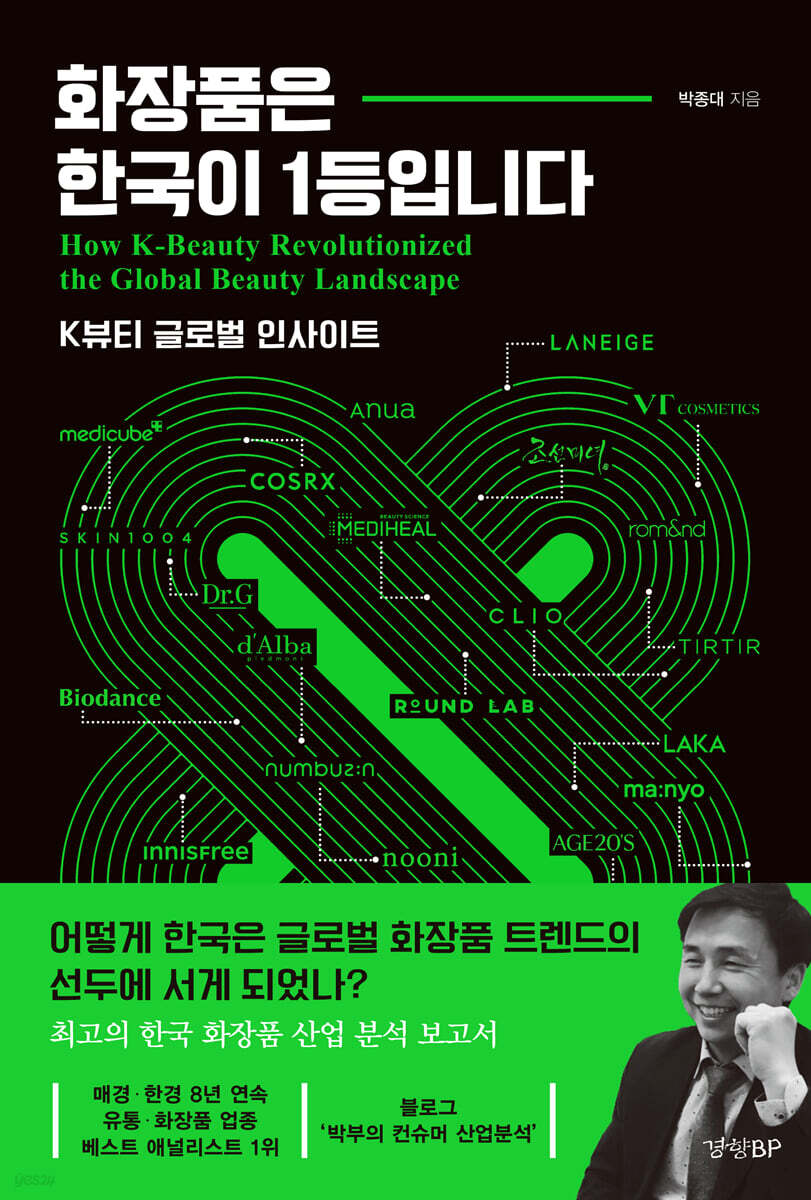

Korea is number one in cosmetics.

|

Description

Book Introduction

Why is the world crazy about K-beauty?

Korean cosmetics continue to show remarkable growth in the global beauty market.

The global rise of the Korean cosmetics industry is by no means a coincidence, riding solely on the Korean Wave.

This is the result of the unique structural changes and increased competitiveness of the Korean cosmetics industry over the past 20 years since 2003.

Although the brand varies from time to time, various formulations are evolving into new forms and spreading globally.

This book deeply analyzes the success factors and background of K-beauty as a sustainable industry, not just a simple "trend."

K-beauty was able to establish itself in the global market through the three pillars of manufacturing, distribution, and entrepreneurship.

This book analyzes that journey from various angles and looks at the future prospects.

The author has been ranked as the best cosmetics industry analyst by Maeil Business Newspaper and Hankyung Business Newspaper for eight consecutive years, and as the securities industry's top cosmetics industry analyst, he has put the cosmetics industry on the right track for industrial analysis. He has comprehensively analyzed the overall flow of the cosmetics industry, domestic and international market trends, distribution structure, and consumer sentiment.

Korean cosmetics continue to show remarkable growth in the global beauty market.

The global rise of the Korean cosmetics industry is by no means a coincidence, riding solely on the Korean Wave.

This is the result of the unique structural changes and increased competitiveness of the Korean cosmetics industry over the past 20 years since 2003.

Although the brand varies from time to time, various formulations are evolving into new forms and spreading globally.

This book deeply analyzes the success factors and background of K-beauty as a sustainable industry, not just a simple "trend."

K-beauty was able to establish itself in the global market through the three pillars of manufacturing, distribution, and entrepreneurship.

This book analyzes that journey from various angles and looks at the future prospects.

The author has been ranked as the best cosmetics industry analyst by Maeil Business Newspaper and Hankyung Business Newspaper for eight consecutive years, and as the securities industry's top cosmetics industry analyst, he has put the cosmetics industry on the right track for industrial analysis. He has comprehensively analyzed the overall flow of the cosmetics industry, domestic and international market trends, distribution structure, and consumer sentiment.

- You can preview some of the book's contents.

Preview

index

Preface - K-Beauty is now global.

Chapter 1: The Third Wave of Korean Cosmetics

K-Beauty Reborn at One Brand Shop

The Chinese market has fostered K-beauty.

Finally number one in the US

America is different from China

Why exports to China were uncertain

Number one in America is number one in the world.

There is no political uncertainty

Chapter 2: Why K-Beauty's Global Success: The Prepared Get Luck

Japan: Exploiting the Lost 30 Years and Aging Population

Japan focuses on weak color markets

The full-scale launch of online distribution presents another opportunity.

Limitations of Japanese ODM capabilities

US: A Perfect Puzzle Piece for the Millennial Generation's Demands

The newly opened niche market of low- to mid-priced 'basics'

K-Beauty Becomes a Symbol of Innovation

Korean entrepreneurs only need to be good at marketing.

A Win-Win for Amazon and K-Beauty

Chapter 3: How far can global momentum go?

The 'Old Future' of K-Beauty

'Innovation' is the result of 20 years of fierce competition.

2003: A Changing Trend in the Korean Cosmetics Market

One Brand Shop, a foundation for growth in the ODM market

Becoming a Platform for Online Indie Brand Startups

K-beauty style isn't available in the US or Japan.

There are no cosmetics factories in the United States.

Japan, losing motivation

Smart talents are moving into cosmetics.

The Korean Wave is a strong supporter of K-beauty.

Chapter 4: Cosmetics Factories That Never Go Out

Raw Material: Small Momentum, Big Effect

The raw material does not have a significant trickle-down effect.

Finding a new 'formulation'

Courage: I can't sell it because I don't have it

Courage is also 'K'

Blood and sweat in small plastic containers

ODM: The Biggest Beneficiary of Global Momentum

Performance momentum grows as you move down the company ladder.

The brand is yours, the prescription is mine

Operating profit margin isn't what matters

US Export Concerns: MoCRA and OTC

MoCRA: US Cosmetics Law Changes for the First Time in 85 Years

OTC: Sunscreen is medicine

Chapter 5: The Golden Age of Indie Brands

Indie Brand Success Stories

There is no business like cosmetics.

Sweat M&A creates a healthy cosmetics ecosystem.

Chapter 6: How did K-beauty go global?

Cosmetics, the top export item for small and medium-sized enterprises

Without silicone, it would have been impossible

It was a semiconductor trading company?

The perfect export partner

The ever-changing triangle of trade vendors, distributors, and brands

Silicon tube alone is not enough

A level that Silicon Two alone cannot cover

burgeoning competition

Why doesn't Olive Young have an export vendor?

Chapter 7: Indie Brand Academy, Olive Young

Olive Young's victory in detail

A bottleneck is occurring.

Only Olive Young remains

A fading gateway to indie brands

Now memorize the stand

Indie brands are abandoning Olive Young.

Was the increase in foreign inbound travelers a poison pill?

The Need for a Meaningful Second Tier

Chapter 8 How to Go Further?

Japan, take the basics offline

The drugstore is the biggest

The three major distributors: Ida, Oyama, and Arata

K-Foundation growing rapidly

China Beauty: A New Threat

America is big and there are many places to sell.

Offline is still a wasteland for K-beauty.

There's a strategy that only K-beauty can achieve.

Expanding to Europe, Russia, and the Middle East

Recognized in France, the leading cosmetics powerhouse

K-beauty craze hits Russia, UAE, and India

What will China do?

The global momentum of K-beauty is just beginning.

Chapter 9: Investing in the Cosmetics Industry

Why the stock market isn't feeling the economic upturn.

K-Beauty: 3 Things You Need to Know

The momentum hasn't slowed down.

3 Investment Principles You Must Remember

Distribution and brands have different appropriate PERs.

Sales are more important than profits

Overshooting, Undershooting, and Value Investing

Appendix - Estimated Size of the Korean Cosmetics Market

Chapter 1: The Third Wave of Korean Cosmetics

K-Beauty Reborn at One Brand Shop

The Chinese market has fostered K-beauty.

Finally number one in the US

America is different from China

Why exports to China were uncertain

Number one in America is number one in the world.

There is no political uncertainty

Chapter 2: Why K-Beauty's Global Success: The Prepared Get Luck

Japan: Exploiting the Lost 30 Years and Aging Population

Japan focuses on weak color markets

The full-scale launch of online distribution presents another opportunity.

Limitations of Japanese ODM capabilities

US: A Perfect Puzzle Piece for the Millennial Generation's Demands

The newly opened niche market of low- to mid-priced 'basics'

K-Beauty Becomes a Symbol of Innovation

Korean entrepreneurs only need to be good at marketing.

A Win-Win for Amazon and K-Beauty

Chapter 3: How far can global momentum go?

The 'Old Future' of K-Beauty

'Innovation' is the result of 20 years of fierce competition.

2003: A Changing Trend in the Korean Cosmetics Market

One Brand Shop, a foundation for growth in the ODM market

Becoming a Platform for Online Indie Brand Startups

K-beauty style isn't available in the US or Japan.

There are no cosmetics factories in the United States.

Japan, losing motivation

Smart talents are moving into cosmetics.

The Korean Wave is a strong supporter of K-beauty.

Chapter 4: Cosmetics Factories That Never Go Out

Raw Material: Small Momentum, Big Effect

The raw material does not have a significant trickle-down effect.

Finding a new 'formulation'

Courage: I can't sell it because I don't have it

Courage is also 'K'

Blood and sweat in small plastic containers

ODM: The Biggest Beneficiary of Global Momentum

Performance momentum grows as you move down the company ladder.

The brand is yours, the prescription is mine

Operating profit margin isn't what matters

US Export Concerns: MoCRA and OTC

MoCRA: US Cosmetics Law Changes for the First Time in 85 Years

OTC: Sunscreen is medicine

Chapter 5: The Golden Age of Indie Brands

Indie Brand Success Stories

There is no business like cosmetics.

Sweat M&A creates a healthy cosmetics ecosystem.

Chapter 6: How did K-beauty go global?

Cosmetics, the top export item for small and medium-sized enterprises

Without silicone, it would have been impossible

It was a semiconductor trading company?

The perfect export partner

The ever-changing triangle of trade vendors, distributors, and brands

Silicon tube alone is not enough

A level that Silicon Two alone cannot cover

burgeoning competition

Why doesn't Olive Young have an export vendor?

Chapter 7: Indie Brand Academy, Olive Young

Olive Young's victory in detail

A bottleneck is occurring.

Only Olive Young remains

A fading gateway to indie brands

Now memorize the stand

Indie brands are abandoning Olive Young.

Was the increase in foreign inbound travelers a poison pill?

The Need for a Meaningful Second Tier

Chapter 8 How to Go Further?

Japan, take the basics offline

The drugstore is the biggest

The three major distributors: Ida, Oyama, and Arata

K-Foundation growing rapidly

China Beauty: A New Threat

America is big and there are many places to sell.

Offline is still a wasteland for K-beauty.

There's a strategy that only K-beauty can achieve.

Expanding to Europe, Russia, and the Middle East

Recognized in France, the leading cosmetics powerhouse

K-beauty craze hits Russia, UAE, and India

What will China do?

The global momentum of K-beauty is just beginning.

Chapter 9: Investing in the Cosmetics Industry

Why the stock market isn't feeling the economic upturn.

K-Beauty: 3 Things You Need to Know

The momentum hasn't slowed down.

3 Investment Principles You Must Remember

Distribution and brands have different appropriate PERs.

Sales are more important than profits

Overshooting, Undershooting, and Value Investing

Appendix - Estimated Size of the Korean Cosmetics Market

Detailed image

Publisher's Review

Talking about the power and future of K-beauty, which is attracting global attention.

The Korean cosmetics industry is at a global leap forward and a historic turning point.

It has the world's best cosmetics manufacturing infrastructure.

There are the best container companies and the best ODM companies.

Additionally, top distributors have opened up global channels, attracting the nation's top talent and entrepreneurs to the cosmetics industry.

Korea now has the world's best cosmetics value chain.

And the enormous cultural asset called K-culture is firmly supporting the entire value chain.

In his previous work, "Where Did K-Beauty Come From and Where Is It Going?", the author describes the changes in the Korean cosmetics industry from 2003 to 2021, and in this book, the future after 2022.

While the previous work focused primarily on the Chinese market, specifically ODMs and duty-free shops, this book focuses on the U.S. and Japanese markets, specifically ODMs and trade vendors.

This book will be helpful to brand planners and marketers seeking practical global expansion strategies, aspiring entrepreneurs and indie brand operators concerned with both survival and growth, and investors and analysts seeking insight into the essence of their industry.

Structure of this book

Chapters 1-3 describe the current status of K-beauty's global momentum, competitiveness, and origins.

It shows that the Korean cosmetics industry is approaching a "third wave" of "global momentum" in 2024, following the "one-brand shop" in 2003 and the "China momentum" in 2014, and points out the differences between this global momentum and the China momentum.

Next, we analyzed the specific reasons and sustainability of Korean cosmetics' success in Japan and the United States.

Chapters 4 through 7 examine specifically how this global momentum impacts individual companies in the cosmetics value chain.

In Chapters 8 and 9, we examine K-beauty's global expansion strategy and potential, and consider rational investment strategies for the cosmetics industry.

The Korean cosmetics industry is at a global leap forward and a historic turning point.

It has the world's best cosmetics manufacturing infrastructure.

There are the best container companies and the best ODM companies.

Additionally, top distributors have opened up global channels, attracting the nation's top talent and entrepreneurs to the cosmetics industry.

Korea now has the world's best cosmetics value chain.

And the enormous cultural asset called K-culture is firmly supporting the entire value chain.

In his previous work, "Where Did K-Beauty Come From and Where Is It Going?", the author describes the changes in the Korean cosmetics industry from 2003 to 2021, and in this book, the future after 2022.

While the previous work focused primarily on the Chinese market, specifically ODMs and duty-free shops, this book focuses on the U.S. and Japanese markets, specifically ODMs and trade vendors.

This book will be helpful to brand planners and marketers seeking practical global expansion strategies, aspiring entrepreneurs and indie brand operators concerned with both survival and growth, and investors and analysts seeking insight into the essence of their industry.

Structure of this book

Chapters 1-3 describe the current status of K-beauty's global momentum, competitiveness, and origins.

It shows that the Korean cosmetics industry is approaching a "third wave" of "global momentum" in 2024, following the "one-brand shop" in 2003 and the "China momentum" in 2014, and points out the differences between this global momentum and the China momentum.

Next, we analyzed the specific reasons and sustainability of Korean cosmetics' success in Japan and the United States.

Chapters 4 through 7 examine specifically how this global momentum impacts individual companies in the cosmetics value chain.

In Chapters 8 and 9, we examine K-beauty's global expansion strategy and potential, and consider rational investment strategies for the cosmetics industry.

GOODS SPECIFICS

- Date of issue: June 4, 2025

- Page count, weight, size: 310 pages | 552g | 152*225*20mm

- ISBN13: 9788969526199

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)