An ETF Guide for Successful Individual Investing

|

Description

Book Introduction

Everything You Need to Know About ETFs in One Book

Take full advantage of ETFs

Increase your investment returns

If you're considering investing in ETFs, read this book immediately! Understanding the nature and structure of ETFs is essential to developing the discernment to select good ETFs and understanding their marketability.

This book covers everything about ETFs, from the basics to practical principles that can be applied in practice, including their concept, structure, nature, history, and how to select a good ETF. You may be interested in investing in ETFs, but don't know where or how to start.

Information on stocks and products abounds, but navigating them can be challenging. ETFs have become a central pillar of the financial industry thanks to their overwhelming marketability, and even today, innovative and diverse products continue to be launched.

This book will serve as a valuable guide for those looking to start investing in ETFs, the most complete financial product and the most superior long-term investment strategy.

And the moment you read this book, no other financial product will catch your eye.

Take full advantage of ETFs

Increase your investment returns

If you're considering investing in ETFs, read this book immediately! Understanding the nature and structure of ETFs is essential to developing the discernment to select good ETFs and understanding their marketability.

This book covers everything about ETFs, from the basics to practical principles that can be applied in practice, including their concept, structure, nature, history, and how to select a good ETF. You may be interested in investing in ETFs, but don't know where or how to start.

Information on stocks and products abounds, but navigating them can be challenging. ETFs have become a central pillar of the financial industry thanks to their overwhelming marketability, and even today, innovative and diverse products continue to be launched.

This book will serve as a valuable guide for those looking to start investing in ETFs, the most complete financial product and the most superior long-term investment strategy.

And the moment you read this book, no other financial product will catch your eye.

- You can preview some of the book's contents.

Preview

index

Introduction Why ETFs are eating the World?

PART 1: ETF Investing is the Best Strategy

CHAPTER 4 The 4% Rule: Most Stocks Are Just Like Bonds

CHAPTER 02 Funds: The Mother of ETFs

CHAPTER 03 Index: A Guide to Understanding Financial Markets

CHAPTER 04 Benchmark: A Criteria for Performance Evaluation

CHAPTER 05 Index Funds: Low-Cost Diversification

CHAPTER 06 Zero-Sum Games: Probabilistic Winning Over the Long Run

PART 2: This is what the pioneers who created ETFs thought

CHAPTER 07 Jack Bogle, the founder of index funds: You can't serve two masters.

CHAPTER 08 The First ETF and Nate Most: From a Product to an Industry

CHAPTER 09 BlackRock and Larry Fink: The Rise of an ETF Empire

CHAPTER 10 The Essence of ETFs: The Tin, the Wrapper, and the Ship

PART 3: Understanding the ETF Structure Makes Other Financial Products Invisible

CHAPTER 11 CU and Cost Effectiveness: Disallowing Transactions Within the Warehouse

CHAPTER 12: DIFFERENCE AND TRACKING ERRORS: WHAT MAKES A GOOD ETF?

CHAPTER 13 Liquidity Providers (LPs): Protecting ETFs Through Arbitrage

CHAPTER 14 The Root Causes of Tracking Error: Complete and Partial Replication

CHAPTER 15: How to Calculate Indexes: Reflecting the Real World

CHAPTER 16 Who Makes the Maps: The Greatest Active Investors Behind the Passive Curtain

CHAPTER 17 Transparency: The Final Piece of the Puzzle that Completes ETF Productivity

PART 4: The ETF Universe Expands Infinitely

CHAPTER 18 Bond ETFs ⓛ What are bonds?: A portfolio cushion

CHAPTER 19 Bond ETFs ② The Magic of Bond Indices and Liquidity: Overcoming the Limitations of Bonds

CHAPTER 20 Bond ETFs ③ The Final Victory: The Price Discovery Effect

CHAPTER 21 Commodity ETFs ⓛ What are Commodities? A Bet on Growth and a Hedge Against Inflation

CHAPTER 22 Commodity ETF ② Futures Trading: Investing Without Physical Assets

CHAPTER 23 Leveraged & Inverse ETFs: Volatility That Drives Negative Compounding

CHAPTER 24: A Little Ghost Story: The Reality Is Different

CHAPTER 25 The Future of ETFs: The Future Starts with Essence

PART 5: How to Choose a Good ETF

CHAPTER 26 How Money Flows: From Developed to Emerging Countries

CHAPTER 27 The Dollar Smile: When You Smile, the Dollar Strengthens

CHAPTER 28 A Unique Theme: A Few Corporations Create the Most Wealth

CHAPTER 29 10 Commandments for Successful ETF Investment

Concluding Remarks: The Legacy of the Pioneers

PART 1: ETF Investing is the Best Strategy

CHAPTER 4 The 4% Rule: Most Stocks Are Just Like Bonds

CHAPTER 02 Funds: The Mother of ETFs

CHAPTER 03 Index: A Guide to Understanding Financial Markets

CHAPTER 04 Benchmark: A Criteria for Performance Evaluation

CHAPTER 05 Index Funds: Low-Cost Diversification

CHAPTER 06 Zero-Sum Games: Probabilistic Winning Over the Long Run

PART 2: This is what the pioneers who created ETFs thought

CHAPTER 07 Jack Bogle, the founder of index funds: You can't serve two masters.

CHAPTER 08 The First ETF and Nate Most: From a Product to an Industry

CHAPTER 09 BlackRock and Larry Fink: The Rise of an ETF Empire

CHAPTER 10 The Essence of ETFs: The Tin, the Wrapper, and the Ship

PART 3: Understanding the ETF Structure Makes Other Financial Products Invisible

CHAPTER 11 CU and Cost Effectiveness: Disallowing Transactions Within the Warehouse

CHAPTER 12: DIFFERENCE AND TRACKING ERRORS: WHAT MAKES A GOOD ETF?

CHAPTER 13 Liquidity Providers (LPs): Protecting ETFs Through Arbitrage

CHAPTER 14 The Root Causes of Tracking Error: Complete and Partial Replication

CHAPTER 15: How to Calculate Indexes: Reflecting the Real World

CHAPTER 16 Who Makes the Maps: The Greatest Active Investors Behind the Passive Curtain

CHAPTER 17 Transparency: The Final Piece of the Puzzle that Completes ETF Productivity

PART 4: The ETF Universe Expands Infinitely

CHAPTER 18 Bond ETFs ⓛ What are bonds?: A portfolio cushion

CHAPTER 19 Bond ETFs ② The Magic of Bond Indices and Liquidity: Overcoming the Limitations of Bonds

CHAPTER 20 Bond ETFs ③ The Final Victory: The Price Discovery Effect

CHAPTER 21 Commodity ETFs ⓛ What are Commodities? A Bet on Growth and a Hedge Against Inflation

CHAPTER 22 Commodity ETF ② Futures Trading: Investing Without Physical Assets

CHAPTER 23 Leveraged & Inverse ETFs: Volatility That Drives Negative Compounding

CHAPTER 24: A Little Ghost Story: The Reality Is Different

CHAPTER 25 The Future of ETFs: The Future Starts with Essence

PART 5: How to Choose a Good ETF

CHAPTER 26 How Money Flows: From Developed to Emerging Countries

CHAPTER 27 The Dollar Smile: When You Smile, the Dollar Strengthens

CHAPTER 28 A Unique Theme: A Few Corporations Create the Most Wealth

CHAPTER 29 10 Commandments for Successful ETF Investment

Concluding Remarks: The Legacy of the Pioneers

Detailed image

Into the book

It is clear that stock markets, which are collections of individual stocks like the S&P 500 and Nasdaq, have yielded higher returns than government bonds over the long term.

However, over the past 90 years, only 4.3% of stocks have outperformed government bonds, creating a divergence between the stock market and stocks, as Bessembinder's paper suggests.

The reason is simple.

This is because a small number of stocks drove most of the stock market returns.

--- p.19

What is the value of funds, the precursors to ETFs, as financial products? Investment services were originally the exclusive domain of the wealthy.

The only means of increasing wealth accessible to the general public were deposits and savings.

Of course, in the past, interest rates were high, so people may not have felt much inconvenience about limited financial services.

This is because, just by depositing money in a bank, you can earn a guaranteed return of around 10% every year with zero risk.

However, as time passed and the public's expectations rose, investment services that had been available only to a select few began to become popular in the form of funds.

This could be called the popularization or democratization of finance.

--- p.25

Simply put, indices are like maps for exploring the financial markets.

The map is not the real world.

It is the result of reinterpreting the real world in a specific way.

Just as exploration is impossible without a map, the complex world of financial markets is impossible to navigate without indices.

Just as a good map best represents the characteristics of the real world, a good index should best reflect the real financial markets.

--- p.34

Although BlackRock has been described as the king of ETFs or a giant of Wall Street, these are not the most appropriate descriptions of the company.

BlackRock started out as a bond management company, and entered the ETF business through the acquisition of BGI.

And at this point, it is doing a bigger and better job in the ETF business than any other operator.

In retrospect, the ETF business opportunity went to Vanguard first.

What if Bogle had accepted Most's offer? Or what if Barclays hadn't sold the iShares brand? Or what if State Street, which first listed SPY alongside Most, had been more serious about the ETF business? These are all hypothetical, but ultimately, the ETF business opportunity was fair to everyone. The god of ETFs was fair.

Pink was the most proactive in seizing this opportunity.

--- p.94

An ETF is a listed index fund.

This product has the characteristics of an index fund that tracks a specific index, such as KOSPI or S&P 500, at low cost, but can be traded freely like stocks.

As a result, many of the core product features and advantages of ETFs can be seen as derived from index funds.

--- p.98

The biggest reason for the dissatisfaction is that, regardless of who creates the index, there is ultimately not much difference in returns.

Although index operators all create their indices based on their own methodologies, the weighting of individual stocks in the index is ultimately similar.

Ultimately, the biggest factor in determining index usage fees is the brand power of the business that created the index, rather than its actual value.

--- p.169

Bonds are safe assets that provide fixed interest rates and have the advantage of protecting investors' portfolios during uncertain times.

That's why bonds, along with stocks, form the foundation of every investment portfolio.

A typical example is 60/40, which is a strategy that puts 60% in stocks and 40% in bonds.

Stocks tend to trend upward consistently, and bonds generally have a negative correlation with stocks.

In fact, until the Fed raised rates in 2022, 60/40 was the simplest yet most effective portfolio.

--- p.196~197

Commodity ETFs, like stock and bond ETFs, track a specific index as a benchmark.

Looking at it this way, it doesn't seem much different from stock and bond ETFs.

But there is a subtle but profound difference hidden here.

The point is that commodity ETFs generally invest in futures rather than physical assets.

Investing in commodity ETFs without understanding these differences can lead to significant losses.

--- p.227

Leveraged and inverse ETFs are intended for short-term trading, not investment purposes, and should not be used for asset allocation purposes.

Despite this, there is a steady demand for these products in the market.

Inverse ETFs are particularly attractive because they allow ordinary individuals to make contrarian bets on the market.

However, over the past 90 years, only 4.3% of stocks have outperformed government bonds, creating a divergence between the stock market and stocks, as Bessembinder's paper suggests.

The reason is simple.

This is because a small number of stocks drove most of the stock market returns.

--- p.19

What is the value of funds, the precursors to ETFs, as financial products? Investment services were originally the exclusive domain of the wealthy.

The only means of increasing wealth accessible to the general public were deposits and savings.

Of course, in the past, interest rates were high, so people may not have felt much inconvenience about limited financial services.

This is because, just by depositing money in a bank, you can earn a guaranteed return of around 10% every year with zero risk.

However, as time passed and the public's expectations rose, investment services that had been available only to a select few began to become popular in the form of funds.

This could be called the popularization or democratization of finance.

--- p.25

Simply put, indices are like maps for exploring the financial markets.

The map is not the real world.

It is the result of reinterpreting the real world in a specific way.

Just as exploration is impossible without a map, the complex world of financial markets is impossible to navigate without indices.

Just as a good map best represents the characteristics of the real world, a good index should best reflect the real financial markets.

--- p.34

Although BlackRock has been described as the king of ETFs or a giant of Wall Street, these are not the most appropriate descriptions of the company.

BlackRock started out as a bond management company, and entered the ETF business through the acquisition of BGI.

And at this point, it is doing a bigger and better job in the ETF business than any other operator.

In retrospect, the ETF business opportunity went to Vanguard first.

What if Bogle had accepted Most's offer? Or what if Barclays hadn't sold the iShares brand? Or what if State Street, which first listed SPY alongside Most, had been more serious about the ETF business? These are all hypothetical, but ultimately, the ETF business opportunity was fair to everyone. The god of ETFs was fair.

Pink was the most proactive in seizing this opportunity.

--- p.94

An ETF is a listed index fund.

This product has the characteristics of an index fund that tracks a specific index, such as KOSPI or S&P 500, at low cost, but can be traded freely like stocks.

As a result, many of the core product features and advantages of ETFs can be seen as derived from index funds.

--- p.98

The biggest reason for the dissatisfaction is that, regardless of who creates the index, there is ultimately not much difference in returns.

Although index operators all create their indices based on their own methodologies, the weighting of individual stocks in the index is ultimately similar.

Ultimately, the biggest factor in determining index usage fees is the brand power of the business that created the index, rather than its actual value.

--- p.169

Bonds are safe assets that provide fixed interest rates and have the advantage of protecting investors' portfolios during uncertain times.

That's why bonds, along with stocks, form the foundation of every investment portfolio.

A typical example is 60/40, which is a strategy that puts 60% in stocks and 40% in bonds.

Stocks tend to trend upward consistently, and bonds generally have a negative correlation with stocks.

In fact, until the Fed raised rates in 2022, 60/40 was the simplest yet most effective portfolio.

--- p.196~197

Commodity ETFs, like stock and bond ETFs, track a specific index as a benchmark.

Looking at it this way, it doesn't seem much different from stock and bond ETFs.

But there is a subtle but profound difference hidden here.

The point is that commodity ETFs generally invest in futures rather than physical assets.

Investing in commodity ETFs without understanding these differences can lead to significant losses.

--- p.227

Leveraged and inverse ETFs are intended for short-term trading, not investment purposes, and should not be used for asset allocation purposes.

Despite this, there is a steady demand for these products in the market.

Inverse ETFs are particularly attractive because they allow ordinary individuals to make contrarian bets on the market.

--- p.238

Publisher's Review

Why You Should Focus on ETF Investing

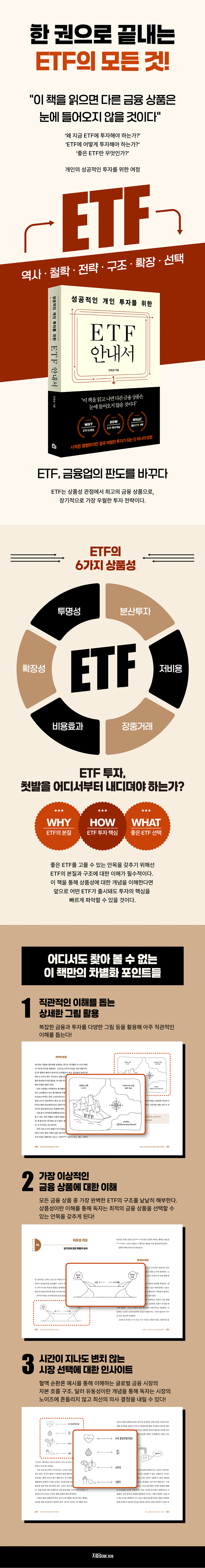

ETFs are funds that are traded like stocks.

However, in addition to diversification, low costs, and intraday trading, it revolutionized the financial industry based on its characteristics of scalability, cost effectiveness, and transparency.

Based on these six elements, it has become the best financial product and is reshaping the investment industry.

This book explores everything about ETFs, the most complete financial product and the most superior long-term investment strategy.

Ultimately, a true understanding of investing and finance begins with understanding ETFs, the benchmark for all financial products.

[PART 1: ETF Investing is the Best Strategy]

Why should you invest in ETFs? The answer lies in two factors: probability and cost.

The success rate of investing in individual stocks is less than 4%.

One way to overcome this is to avoid the 4% chance by buying the entire market, such as the S&P 500. ETFs can increase investment returns in this very way.

In terms of cost, ETFs have significantly lower management fees than other financial products.

ETFs that meet these two criteria are the best strategy for long-term investment success.

[PART 2: This is what the pioneers of ETFs thought]

The best way to understand the essence of something is to examine its original context and intentions. Understanding the philosophies of the pioneers who created ETFs allows us to grasp the essence and direction of ETFs. These include Jack Bogle, the inventor of the index fund, the precursor to ETFs, and founder of Vanguard, Nate Most, who founded ETFs based on Bogle's philosophy, and Larry Fink, who expanded the ETF landscape.

By understanding the philosophies of these pioneers, you can develop a long-term perspective that is not swayed by short-term market fluctuations and noise.

[PART 3: Understanding the ETF Structure Makes Other Financial Products Unappealing]

As the ETF market grows, the ETF product lineup is diversifying.

In the past, ETFs tracked major indices like the KOSPI, S&P 500, and Nasdaq, but as competition intensified, ETFs targeting niche markets began to emerge.

To develop the ability to select the right product from a wide range of products, an understanding of the mechanisms of ETFs is essential. This course explores the fundamental structure of ETFs, examining factors such as CU and cost effectiveness, divergence rates and tracking errors, liquidity providers who protect ETFs through arbitrage, index calculation methods, and transparency, the final piece of the puzzle that completes the product appeal of ETFs.

[PART 4: The ETF Universe Expands Infinitely]

Diversification, the core philosophy of ETFs, doesn't end with simple stocks.

A strategy to buy the entire market through index funds and ETFs to avoid the 4% rule.

However, the concept of diversification discussed by ETFs extends to asset allocation.

You can build a complete asset allocation portfolio by comparing stocks, bonds, and raw material ETFs to Lego blocks.

[PART 5: How to Choose a Good ETF]

Choosing a market is always difficult.

To increase your chances of success in predicting the future, you need to focus on "what won't change," as Amazon's Jeff Bezos puts it.

You can gain insight into why long-term returns on investments in the United States, the key currency country that controls the dollar, are structurally advantageous, and how to increase the investment returns of ETFs by increasing the probability of successful market selection through the flow of money.

Why You Should Read This Book Before Investing in ETFs

This book explains the nature and structure of ETFs.

To develop the discerning eye for good ETFs and the ability to select the right one from a wide variety of products, you need to understand how ETFs work.

By understanding the essence, structure, and concepts of ETFs through this book, you'll be able to quickly grasp the marketability of any new ETFs released in the future. The ETF lineup is expected to become even more diverse and extensive.

But the six marketability factors at its core remain unchanged.

Therefore, if you accurately grasp this center, you will have no difficulty analyzing any ETF that appears in the future.

Ultimately, the future of ETFs begins with their essence.

ETFs are funds that are traded like stocks.

However, in addition to diversification, low costs, and intraday trading, it revolutionized the financial industry based on its characteristics of scalability, cost effectiveness, and transparency.

Based on these six elements, it has become the best financial product and is reshaping the investment industry.

This book explores everything about ETFs, the most complete financial product and the most superior long-term investment strategy.

Ultimately, a true understanding of investing and finance begins with understanding ETFs, the benchmark for all financial products.

[PART 1: ETF Investing is the Best Strategy]

Why should you invest in ETFs? The answer lies in two factors: probability and cost.

The success rate of investing in individual stocks is less than 4%.

One way to overcome this is to avoid the 4% chance by buying the entire market, such as the S&P 500. ETFs can increase investment returns in this very way.

In terms of cost, ETFs have significantly lower management fees than other financial products.

ETFs that meet these two criteria are the best strategy for long-term investment success.

[PART 2: This is what the pioneers of ETFs thought]

The best way to understand the essence of something is to examine its original context and intentions. Understanding the philosophies of the pioneers who created ETFs allows us to grasp the essence and direction of ETFs. These include Jack Bogle, the inventor of the index fund, the precursor to ETFs, and founder of Vanguard, Nate Most, who founded ETFs based on Bogle's philosophy, and Larry Fink, who expanded the ETF landscape.

By understanding the philosophies of these pioneers, you can develop a long-term perspective that is not swayed by short-term market fluctuations and noise.

[PART 3: Understanding the ETF Structure Makes Other Financial Products Unappealing]

As the ETF market grows, the ETF product lineup is diversifying.

In the past, ETFs tracked major indices like the KOSPI, S&P 500, and Nasdaq, but as competition intensified, ETFs targeting niche markets began to emerge.

To develop the ability to select the right product from a wide range of products, an understanding of the mechanisms of ETFs is essential. This course explores the fundamental structure of ETFs, examining factors such as CU and cost effectiveness, divergence rates and tracking errors, liquidity providers who protect ETFs through arbitrage, index calculation methods, and transparency, the final piece of the puzzle that completes the product appeal of ETFs.

[PART 4: The ETF Universe Expands Infinitely]

Diversification, the core philosophy of ETFs, doesn't end with simple stocks.

A strategy to buy the entire market through index funds and ETFs to avoid the 4% rule.

However, the concept of diversification discussed by ETFs extends to asset allocation.

You can build a complete asset allocation portfolio by comparing stocks, bonds, and raw material ETFs to Lego blocks.

[PART 5: How to Choose a Good ETF]

Choosing a market is always difficult.

To increase your chances of success in predicting the future, you need to focus on "what won't change," as Amazon's Jeff Bezos puts it.

You can gain insight into why long-term returns on investments in the United States, the key currency country that controls the dollar, are structurally advantageous, and how to increase the investment returns of ETFs by increasing the probability of successful market selection through the flow of money.

Why You Should Read This Book Before Investing in ETFs

This book explains the nature and structure of ETFs.

To develop the discerning eye for good ETFs and the ability to select the right one from a wide variety of products, you need to understand how ETFs work.

By understanding the essence, structure, and concepts of ETFs through this book, you'll be able to quickly grasp the marketability of any new ETFs released in the future. The ETF lineup is expected to become even more diverse and extensive.

But the six marketability factors at its core remain unchanged.

Therefore, if you accurately grasp this center, you will have no difficulty analyzing any ETF that appears in the future.

Ultimately, the future of ETFs begins with their essence.

GOODS SPECIFICS

- Date of issue: May 28, 2025

- Page count, weight, size: 292 pages | 414g | 146*210*20mm

- ISBN13: 9791193780169

- ISBN10: 1193780160

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)