The Age of Supply Chain Collapse

|

Description

Book Introduction

*** #1 in the US Amazon Economics and Management category

*** Foreign Policy Book of the Year 2024

*** Urgent addition of the Korean version preface!

"A wave of supply chain restructuring triggered by the pandemic and accelerated by the Trump 2.0 era."

- If you want to truly understand American reshoring, read this book!

- What challenges and opportunities does the Korean economy face amid the US-China conflict and the limitations of just-in-time production?

"We were importing too many goods from Asia, including China!" The US was made painfully aware of this during the COVID-19 lockdown.

While Korea temporarily suffered from shortages of masks and vehicle urea solution during the pandemic, the "consumer-oriented nation" of the United States experienced a severe supply chain crisis across all sectors, from individuals to businesses and government, from food to exercise equipment to various electronic chips.

It was a moment when I suddenly realized that countless production and distribution processes were involved in factories all over the world, especially in China, before I could obtain even one ordinary item.

The global supply chain, scarred by the pandemic, is poised for accelerated collapse.

The global supply chain, already teetering on the brink of collapse due to the pursuit of extreme efficiency through just-in-time (JIT) production, loss of market transparency, and poor treatment of workers within the supply chain, is now teetering in the face of the US-China conflict and the "America First" policies of the Trump 2.0 era.

The United States now looks at its previously "efficient" global supply chains—the global collaboration to finish a single product—with a whole new perspective.

The author is Peter S., a veteran business writer at The New York Times.

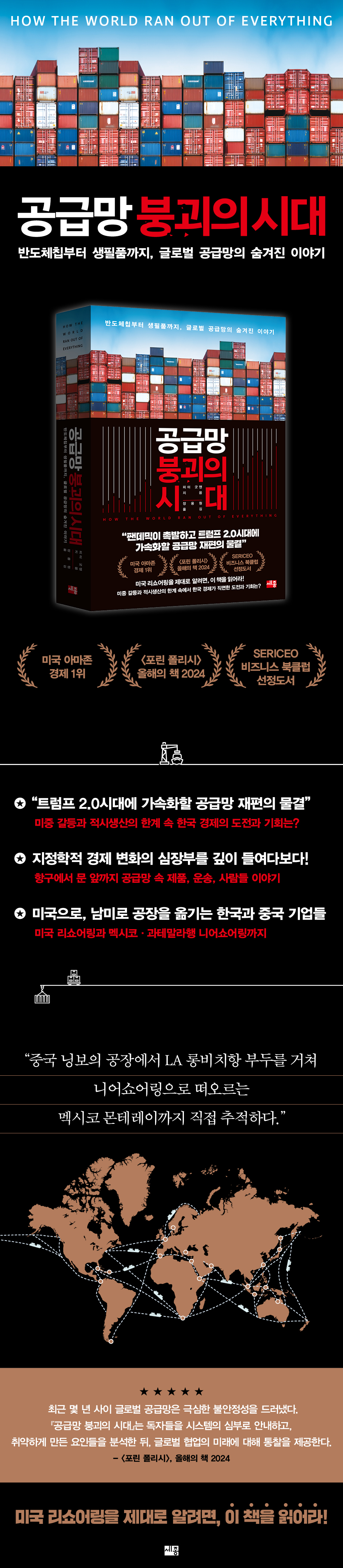

From the port of Ningbo, China, to various parts of the United States and South America, where nearshoring is gaining popularity, Goodman vividly captures the front lines of supply chain restructuring through "people's stories."

As I wrote in the preface to the Korean edition, Korea's future is shrouded in uncertainty, further deepened by Trump's re-election, but another door of opportunity will open.

This book also provides new insights from an investor's perspective.

*** Foreign Policy Book of the Year 2024

*** Urgent addition of the Korean version preface!

"A wave of supply chain restructuring triggered by the pandemic and accelerated by the Trump 2.0 era."

- If you want to truly understand American reshoring, read this book!

- What challenges and opportunities does the Korean economy face amid the US-China conflict and the limitations of just-in-time production?

"We were importing too many goods from Asia, including China!" The US was made painfully aware of this during the COVID-19 lockdown.

While Korea temporarily suffered from shortages of masks and vehicle urea solution during the pandemic, the "consumer-oriented nation" of the United States experienced a severe supply chain crisis across all sectors, from individuals to businesses and government, from food to exercise equipment to various electronic chips.

It was a moment when I suddenly realized that countless production and distribution processes were involved in factories all over the world, especially in China, before I could obtain even one ordinary item.

The global supply chain, scarred by the pandemic, is poised for accelerated collapse.

The global supply chain, already teetering on the brink of collapse due to the pursuit of extreme efficiency through just-in-time (JIT) production, loss of market transparency, and poor treatment of workers within the supply chain, is now teetering in the face of the US-China conflict and the "America First" policies of the Trump 2.0 era.

The United States now looks at its previously "efficient" global supply chains—the global collaboration to finish a single product—with a whole new perspective.

The author is Peter S., a veteran business writer at The New York Times.

From the port of Ningbo, China, to various parts of the United States and South America, where nearshoring is gaining popularity, Goodman vividly captures the front lines of supply chain restructuring through "people's stories."

As I wrote in the preface to the Korean edition, Korea's future is shrouded in uncertainty, further deepened by Trump's re-election, but another door of opportunity will open.

This book also provides new insights from an investor's perspective.

- You can preview some of the book's contents.

Preview

index

Preface to the Korean edition

Prologue: "The World Has Fallen Apart"

Part 1: The Great Supply Chain Collapse

Chapter 1: "It's Better to Just Make It in China": The Origins of the "World's Factory"

Chapter 2: "Everyone's Competing for One Country's Suppliers": The Folly of the Pandemic

Chapter 3: "There is no greater waste than overproduction." The Roots of Just-in-Time Production

Chapter 4: How "Lean Taliban" Consultants Hijacked the Just-in-Time Production System

Chapter 5: "Everyone Wants Everything": A Big Miscalculation in the Global Economy

Chapter 6: "A Whole New Way of Cargo Handling": A Steel Box That Shrinks the Size of the Earth

Chapter 7: "The Shipping Company is Preying on the Shippers": The Cartel of the Sea

Part 2 Across the Ocean

Chapter 8: "Land of the Forgotten": How Did Farmers Get Trapped inland?

Chapter 9: "I've Heard That Name Before" The New Sheriff of the Docks

Chapter 10: "Everything's a Mess": A Prison Floating on Water

Chapter 11: "It's Ridiculously Dangerous" Life on the Pier

Chapter 12: "Is It Worth Getting Up in the Morning?" The Endless Suffering of Truck Drivers

Chapter 13: "Building Railroads Anywhere at Public Expenses": How Investors Ruined the Rail Industry

Chapter 14: "The All-Powerful Indicator: The Operating Profit Ratio": A Modern Approach to Railroad Robbery

Chapter 15: "Sweatshops on Wheels": The Painful Long-Distance Drive

Chapter 16: "Thank You for Your Help to Stock Our Grocery Store Shelves" How the Meat Industry Profits at the Expense of Workers

Chapter 17: "The Free Market is Gone": How Monopolists Exploited the Pandemic

Part 3: Globalization Returns to Home

Chapter 18: “We Need to Diversify Our Production Plants”: Finding Factories Beyond China

Chapter 19: "Globalization is Dead" Bringing Factory Jobs Home

Chapter 20: "Yes, Mexico, Save Us": A Global Supply Chain Turns Its Back on the Sea

Chapter 21: "I Don't Want to Do This": The Future of Robots and Shareholder Satisfaction

Closing Remarks: "It's a great sacrifice for you." Correcting a Bad Deal

Acknowledgements

Americas

Search

Prologue: "The World Has Fallen Apart"

Part 1: The Great Supply Chain Collapse

Chapter 1: "It's Better to Just Make It in China": The Origins of the "World's Factory"

Chapter 2: "Everyone's Competing for One Country's Suppliers": The Folly of the Pandemic

Chapter 3: "There is no greater waste than overproduction." The Roots of Just-in-Time Production

Chapter 4: How "Lean Taliban" Consultants Hijacked the Just-in-Time Production System

Chapter 5: "Everyone Wants Everything": A Big Miscalculation in the Global Economy

Chapter 6: "A Whole New Way of Cargo Handling": A Steel Box That Shrinks the Size of the Earth

Chapter 7: "The Shipping Company is Preying on the Shippers": The Cartel of the Sea

Part 2 Across the Ocean

Chapter 8: "Land of the Forgotten": How Did Farmers Get Trapped inland?

Chapter 9: "I've Heard That Name Before" The New Sheriff of the Docks

Chapter 10: "Everything's a Mess": A Prison Floating on Water

Chapter 11: "It's Ridiculously Dangerous" Life on the Pier

Chapter 12: "Is It Worth Getting Up in the Morning?" The Endless Suffering of Truck Drivers

Chapter 13: "Building Railroads Anywhere at Public Expenses": How Investors Ruined the Rail Industry

Chapter 14: "The All-Powerful Indicator: The Operating Profit Ratio": A Modern Approach to Railroad Robbery

Chapter 15: "Sweatshops on Wheels": The Painful Long-Distance Drive

Chapter 16: "Thank You for Your Help to Stock Our Grocery Store Shelves" How the Meat Industry Profits at the Expense of Workers

Chapter 17: "The Free Market is Gone": How Monopolists Exploited the Pandemic

Part 3: Globalization Returns to Home

Chapter 18: “We Need to Diversify Our Production Plants”: Finding Factories Beyond China

Chapter 19: "Globalization is Dead" Bringing Factory Jobs Home

Chapter 20: "Yes, Mexico, Save Us": A Global Supply Chain Turns Its Back on the Sea

Chapter 21: "I Don't Want to Do This": The Future of Robots and Shareholder Satisfaction

Closing Remarks: "It's a great sacrifice for you." Correcting a Bad Deal

Acknowledgements

Americas

Search

Detailed image

Into the book

Hyundai Motor Company built a state-of-the-art factory in the southeastern United States, hoping it would provide insurance against turbulent events that could shake the global economy.

Hyundai has given its $7.6 billion plant in a small Georgia town a grandiose name: Metaplant America, a nod to the company's ambitions.

Metaplant America was slated to be used as a production base for the latest vehicles designed by South Korean auto giant Hyundai, including electric vehicles under brands such as Hyundai, Kia, and Genesis.

--- From the "Preface to the Korean Edition"

Southern California appeared to have its ports blocked.

Off the coast of the closely connected ports of Los Angeles and Long Beach, more than 50 massive ships were stranded in the frigid waters of the Pacific Ocean.

What was thought to be a matter of days for these ships to dock and wait for their turn to unload their cargo turned out to be weeks.

Some of the affluent people, unable to overcome their curiosity, went to the water's edge with binoculars and tried to count the boats lined up along the dark blue horizon, but to no avail.

It wasn't because of the war.

It was a sight to behold as the world economy came to a standstill.

In October 2021, the Earth was hit by the worst pandemic in a century.

--- From the "Prologue"

Chipmakers shifted chip production from the United States across the Pacific to Japan, South Korea, and Taiwan decades ago.

This was primarily to allow major chip users like Apple to reduce inventory while leveraging low-cost suppliers.

Now, with chip shortages crippling its balance sheet and growing concerns about geopolitical risks weighing on Taiwan, U.S. chipmaker Intel has announced plans to invest $20 billion in a new factory in Arizona.

So why did Intel wait so long? At least part of the answer lies in the $26 billion it spent on stock buybacks in the two years before the pandemic.

The money could have been used to expand production capacity.

The chip shortage has also had a devastating impact on industries far removed from automobiles and electronics, hindering aid to people suffering from life-threatening diseases.

--- From Chapter 4, “Lean Taliban”

The most immediate reason for the shipping industry's turmoil was the severe shortage of shipping containers.

As Americans began to stock their homes to weather the pandemic, Chinese factories churned out so much inventory that they caused container shortages at nearly every port.

Large retailers like Amazon and Walmart essentially have contracts with ocean carriers that guarantee their container shipments.

As the situation became so dire that even these giant companies were having trouble shipping their cargo, they chartered container ships to continue carrying the products they needed.

--- From Chapter 7, “The shipping company is preying on the shipper.”

Unlike the president who had appointed him chairman, Mapei did not believe that the ocean shipping companies' ability to raise freight rates so sharply was due to their market dominance.

He said that the shipping industry is a unique industry where national interests have a greater influence than corporate interests, and therefore should not be viewed through the traditional lens of anti-monopoly.

This situation has long been advantageous to American importers and exporters.

They had been enjoying the benefits of cheap transportation costs until now.

“The current situation has not been a problem for 20 years,” Mapei told me.

--- From Chapter 9, “I’ve Heard That Name Before”

This railway construction project began in 1863.

As Chinese workers played a key role in building what was then the largest infrastructure project in American history, the way they were treated then became the standard by which railroad companies treated their workers for generations to come.

Accordingly, respect for human dignity has been pushed to the back burner, and profitability has become the most important consideration.

--- From Chapter 13, “Building Railroads Anywhere at Public Expenses”

Financial gain has determined the form of almost all production markets.

The investor class has built global production and distribution networks based on efficiency.

But this efficiency was, above all else, a variant of efficiency that prioritized profit even at the expense of credibility.

Companies, obsessed with cutting costs, moved production overseas.

At the same time, just-in-time production and lean manufacturing required inventory reduction.

This created the perfect conditions for problems to arise.

The unbridled celebration of scale has provided monopolists with opportunities to dominate once-competitive markets.

As a result, the economy has become more susceptible to shortages and price hikes once a shock occurs.

--- From Chapter 17, “The Free Market is Gone”

As the world reduced its reliance on Chinese factories, it seemed certain that prices for a wide range of consumer goods would rise.

This essentially meant giving up the efficiency that had long defined the era of profit maximization in exchange for reducing vulnerability to crisis.

Instead of buying large quantities of goods at rock-bottom prices from Chinese factories, multinational corporations would have to expand their production bases around the world.

This would require becoming familiar with other countries' rules, production facilities, and power structures, and would require deploying new personnel.

Then, running a business would become complicated and cost a lot of money and time.

This meant that the prices of the products being sold were likely to increase.

--- From Chapter 18, “There is a need to diversify production plants”

Shupe was acutely aware that producing a product in China gave the impression that something was wrong, while producing it in the United States gave customers the impression that they were on the right side of history.

Manufacturing in the United States not only meant investing in American soil, but also combating climate change by reducing the carbon emissions associated with shipping containers across the ocean.

This was not something that could be achieved by redirecting orders to Vietnam or other countries in Asia.

After all, the ordered goods had to cross the Pacific Ocean to reach American consumers.

--- From Chapter 19, “Globalization is now dead”

Bill Chan, an executive at Wenhua's Shenzhen headquarters, contacted Zhang through the Chinese social media platform WeChat.

His question was direct.

How much land is available? (34 hectares.) What are the local road conditions like? (Not great, but improving.) Are there any authentic Chinese restaurants nearby? (There aren't any.)

A few weeks later, Wenhua contacted us with an offer to purchase the land.

Chan became CEO of Wenhua's Mexican subsidiary.

Chan had never been to Mexico, let alone this industrial complex.

He decided not to hesitate and invested $300 million to build a factory.

“Our main market is the United States.

“I don’t want to lose that market,” Chan said with a shrug.

--- From Chapter 20, “Yes, Mexico, Please Save Us”

The Korean sales manager told me this.

“Many North American manufacturers, having experienced the pandemic, supply chain crisis, and the COVID-19 shutdown in China, are trying to avoid risk as much as possible.

Globalization is over.

Now it's localization.

Globalization only works when the geopolitical situation is stable.

“We are clearly at a turning point where globalization is entering a dangerous phase.”

It is not true that globalization is over.

The mere fact that no place on Earth is self-sufficient makes the advantages of international trade undeniable.

Hyundai has given its $7.6 billion plant in a small Georgia town a grandiose name: Metaplant America, a nod to the company's ambitions.

Metaplant America was slated to be used as a production base for the latest vehicles designed by South Korean auto giant Hyundai, including electric vehicles under brands such as Hyundai, Kia, and Genesis.

--- From the "Preface to the Korean Edition"

Southern California appeared to have its ports blocked.

Off the coast of the closely connected ports of Los Angeles and Long Beach, more than 50 massive ships were stranded in the frigid waters of the Pacific Ocean.

What was thought to be a matter of days for these ships to dock and wait for their turn to unload their cargo turned out to be weeks.

Some of the affluent people, unable to overcome their curiosity, went to the water's edge with binoculars and tried to count the boats lined up along the dark blue horizon, but to no avail.

It wasn't because of the war.

It was a sight to behold as the world economy came to a standstill.

In October 2021, the Earth was hit by the worst pandemic in a century.

--- From the "Prologue"

Chipmakers shifted chip production from the United States across the Pacific to Japan, South Korea, and Taiwan decades ago.

This was primarily to allow major chip users like Apple to reduce inventory while leveraging low-cost suppliers.

Now, with chip shortages crippling its balance sheet and growing concerns about geopolitical risks weighing on Taiwan, U.S. chipmaker Intel has announced plans to invest $20 billion in a new factory in Arizona.

So why did Intel wait so long? At least part of the answer lies in the $26 billion it spent on stock buybacks in the two years before the pandemic.

The money could have been used to expand production capacity.

The chip shortage has also had a devastating impact on industries far removed from automobiles and electronics, hindering aid to people suffering from life-threatening diseases.

--- From Chapter 4, “Lean Taliban”

The most immediate reason for the shipping industry's turmoil was the severe shortage of shipping containers.

As Americans began to stock their homes to weather the pandemic, Chinese factories churned out so much inventory that they caused container shortages at nearly every port.

Large retailers like Amazon and Walmart essentially have contracts with ocean carriers that guarantee their container shipments.

As the situation became so dire that even these giant companies were having trouble shipping their cargo, they chartered container ships to continue carrying the products they needed.

--- From Chapter 7, “The shipping company is preying on the shipper.”

Unlike the president who had appointed him chairman, Mapei did not believe that the ocean shipping companies' ability to raise freight rates so sharply was due to their market dominance.

He said that the shipping industry is a unique industry where national interests have a greater influence than corporate interests, and therefore should not be viewed through the traditional lens of anti-monopoly.

This situation has long been advantageous to American importers and exporters.

They had been enjoying the benefits of cheap transportation costs until now.

“The current situation has not been a problem for 20 years,” Mapei told me.

--- From Chapter 9, “I’ve Heard That Name Before”

This railway construction project began in 1863.

As Chinese workers played a key role in building what was then the largest infrastructure project in American history, the way they were treated then became the standard by which railroad companies treated their workers for generations to come.

Accordingly, respect for human dignity has been pushed to the back burner, and profitability has become the most important consideration.

--- From Chapter 13, “Building Railroads Anywhere at Public Expenses”

Financial gain has determined the form of almost all production markets.

The investor class has built global production and distribution networks based on efficiency.

But this efficiency was, above all else, a variant of efficiency that prioritized profit even at the expense of credibility.

Companies, obsessed with cutting costs, moved production overseas.

At the same time, just-in-time production and lean manufacturing required inventory reduction.

This created the perfect conditions for problems to arise.

The unbridled celebration of scale has provided monopolists with opportunities to dominate once-competitive markets.

As a result, the economy has become more susceptible to shortages and price hikes once a shock occurs.

--- From Chapter 17, “The Free Market is Gone”

As the world reduced its reliance on Chinese factories, it seemed certain that prices for a wide range of consumer goods would rise.

This essentially meant giving up the efficiency that had long defined the era of profit maximization in exchange for reducing vulnerability to crisis.

Instead of buying large quantities of goods at rock-bottom prices from Chinese factories, multinational corporations would have to expand their production bases around the world.

This would require becoming familiar with other countries' rules, production facilities, and power structures, and would require deploying new personnel.

Then, running a business would become complicated and cost a lot of money and time.

This meant that the prices of the products being sold were likely to increase.

--- From Chapter 18, “There is a need to diversify production plants”

Shupe was acutely aware that producing a product in China gave the impression that something was wrong, while producing it in the United States gave customers the impression that they were on the right side of history.

Manufacturing in the United States not only meant investing in American soil, but also combating climate change by reducing the carbon emissions associated with shipping containers across the ocean.

This was not something that could be achieved by redirecting orders to Vietnam or other countries in Asia.

After all, the ordered goods had to cross the Pacific Ocean to reach American consumers.

--- From Chapter 19, “Globalization is now dead”

Bill Chan, an executive at Wenhua's Shenzhen headquarters, contacted Zhang through the Chinese social media platform WeChat.

His question was direct.

How much land is available? (34 hectares.) What are the local road conditions like? (Not great, but improving.) Are there any authentic Chinese restaurants nearby? (There aren't any.)

A few weeks later, Wenhua contacted us with an offer to purchase the land.

Chan became CEO of Wenhua's Mexican subsidiary.

Chan had never been to Mexico, let alone this industrial complex.

He decided not to hesitate and invested $300 million to build a factory.

“Our main market is the United States.

“I don’t want to lose that market,” Chan said with a shrug.

--- From Chapter 20, “Yes, Mexico, Please Save Us”

The Korean sales manager told me this.

“Many North American manufacturers, having experienced the pandemic, supply chain crisis, and the COVID-19 shutdown in China, are trying to avoid risk as much as possible.

Globalization is over.

Now it's localization.

Globalization only works when the geopolitical situation is stable.

“We are clearly at a turning point where globalization is entering a dangerous phase.”

It is not true that globalization is over.

The mere fact that no place on Earth is self-sufficient makes the advantages of international trade undeniable.

--- From Chapter 20, “Yes, Mexico, Please Save Us”

Publisher's Review

A deep dive into the heart of geopolitical and economic change!

How the World Lost Everything

- Stories of products, transportation, and people in the supply chain from port to doorstep

"The Age of Supply Chain Collapse" follows Hagen Walker, a toy company that imports toys from China to the United States in time for the Christmas season during the pandemic.

Veteran journalist Goodman's fluid storytelling takes readers inside the intricate supply chain system.

There are many variables that contribute to the end result of nearshoring and reshoring: producers struggling to find ships to ship their goods, monopolistic shipping companies enjoying the situation, US policymakers trying to curb inflation, and supply chain workers and consumers whose quality of life is declining.

From factories in China, to almond growers in Northern California, to meatpackers with no regard for worker safety, to striking railroad workers in Texas, to the truck driver who carried Goodman across hundreds of kilometers across the prairies, this book sharply dissects the triumphs and struggles of the human players who operate vast supply chains, and the crises and challenges facing companies around the world, including the United States.

The collapse of the global just-in-time supply system that prioritized efficiency and low cost.

The end of a global manufacturing network operating with minimal inventory.

When the pandemic hit, we faced an unprecedented rush to find essential goods.

Even wealthy countries that had an abundance of supplies were unable to obtain masks, and supermarkets in the United States were running out of meat, toilet paper, and even baby formula.

Even the leading automobile companies, after spending billions of dollars to produce new cars, were unable to launch them due to the lack of a single semiconductor chip.

It was a 'shock to the supply chain' brought about by the distortion of the just-in-time production method and the concentration of production plants.

This has led governments and businesses to begin to question the problems of the "global supply chain," the intricate web that weaves the world together.

Giant ships were stranded at sea outside ports waiting their turn, warehouses were overflowing with unprocessed containers, and trucks were grounded.

The pandemic, which has had an unprecedented impact on our daily lives, has revealed to us the reality that systems we never suspected were in fact vulnerable to disruption at any time.

While COVID-19 was the direct cause of the supply chain problems that were clearly evident, it merely unmasked the vulnerability of supply chains that had accumulated over decades.

A vast, seamless market has been transformed into a patchwork geopolitical arena.

An essential book for the Korean economy, both a manufacturing and importing country.

Author Peter Goodman is a leading economic journalist known for capturing pressing but overlooked economic issues and is now one of the most respected global economic analysts.

In "The Age of Supply Chain Collapse," he envisions concrete changes to how supply chains work and the implications for future industrial restructuring (or, for the other side, disaster): America's deglobalization.

The problems of supply chain concentration centered around China, which were revealed only through the pandemic, the emergence of steel box container transportation that reduced the size of the Earth and its subsequent China-centered globalization, the myth of just-in-time production and lean production that consultants have distorted, the cartels of shipping companies and the almond farmers who suffered in the process, the process by which companies minimized inventory by squeezing truck drivers and railroad workers, how monopolists in the meat industry manipulated scarcity to raise meat prices and profited from disasters, corporate executives who inflated their balance sheets and maximized stock prices to please Wall Street, and consumers who bore the brunt of the damage.

As the author wrote in the preface to the Korean edition, nimble Korean companies are trying to find solutions, such as building factories in the United States, Mexico, and Guatemala, but the reality is not so easy.

Hyundai Motor Company, which built the Metaplant America plant in Georgia, is also changing its calculations due to issues such as Trump's decision to eliminate electric vehicle subsidies.

Make it in the US, even if it costs more!

- What kind of inflation will the US export?

As the US-China conflict deepens, multinational corporations are moving some of their production plants to other countries, such as Vietnam.

American companies are pursuing nearshoring policies, either by setting up production plants in Mexico and Central America, where they can maintain lower production costs without having to contend with the volatile Pacific Ocean, or by reshoring, where they bring production back to the United States.

But no one can yet match the low wages and production capacity of Chinese factories.

If that's the case, then goods produced outside of China are bound to be expensive.

The pain of inflation is ultimately borne by ordinary people around the world.

Meanwhile, President Biden has pointed to the shipping cartel as the cause of inflation, which has become his vulnerability.

The pandemic lockdown has forced all companies to shoulder higher freight rates to find containers and ships.

In this regard, rather than directly regulating shipping companies, it is worth reading about the 'nudge' of government officials (Federal Maritime Commission) who skillfully implement policies by distinguishing between normal market price increases and 'rip-offs' by shipping companies.

[Chapter 9] In this way, various players appear in 『The Age of Supply Chain Collapse』, adding fresh perspectives.

Can we completely break away from supply chains of the past, such as those in China?

Just as managers today celebrated the efficiency of just-in-time production in the past, they also pledge to strive for resilience and sustainability.

However, the traditional foundations of the supply chain remain intact, and the temptations of the past are likely to return once the current crisis subsides.

The author argues that what lies at the end of this journey is that humanity has become dependent on a chaotic and fragile global supply chain to access the products of our time, from medicines and computer chips to toys and games.

Many businesspeople argue that the supply chain from China cannot be broken off immediately, as it has been built up over a long period of time.

Meanwhile, this system, which relies on numerous forms of labor exploitation and is vulnerable to collapse at any moment, was built as a means of rewarding the investor class, and the price paid for this is a loss of trust.

The author's warning that the supply chain collapse is not an isolated event triggered by the pandemic, but rather a harbinger of the dysfunction that will inevitably occur if the current system fails to normalize, resonates deeply.

It is clear that going forward, the question of “where to produce” has shifted from being simply a matter of cost and efficiency to a matter of geopolitical strategy.

In Part 3, the author explores how to transform crises into opportunities to restructure supply chains.

How the World Lost Everything

- Stories of products, transportation, and people in the supply chain from port to doorstep

"The Age of Supply Chain Collapse" follows Hagen Walker, a toy company that imports toys from China to the United States in time for the Christmas season during the pandemic.

Veteran journalist Goodman's fluid storytelling takes readers inside the intricate supply chain system.

There are many variables that contribute to the end result of nearshoring and reshoring: producers struggling to find ships to ship their goods, monopolistic shipping companies enjoying the situation, US policymakers trying to curb inflation, and supply chain workers and consumers whose quality of life is declining.

From factories in China, to almond growers in Northern California, to meatpackers with no regard for worker safety, to striking railroad workers in Texas, to the truck driver who carried Goodman across hundreds of kilometers across the prairies, this book sharply dissects the triumphs and struggles of the human players who operate vast supply chains, and the crises and challenges facing companies around the world, including the United States.

The collapse of the global just-in-time supply system that prioritized efficiency and low cost.

The end of a global manufacturing network operating with minimal inventory.

When the pandemic hit, we faced an unprecedented rush to find essential goods.

Even wealthy countries that had an abundance of supplies were unable to obtain masks, and supermarkets in the United States were running out of meat, toilet paper, and even baby formula.

Even the leading automobile companies, after spending billions of dollars to produce new cars, were unable to launch them due to the lack of a single semiconductor chip.

It was a 'shock to the supply chain' brought about by the distortion of the just-in-time production method and the concentration of production plants.

This has led governments and businesses to begin to question the problems of the "global supply chain," the intricate web that weaves the world together.

Giant ships were stranded at sea outside ports waiting their turn, warehouses were overflowing with unprocessed containers, and trucks were grounded.

The pandemic, which has had an unprecedented impact on our daily lives, has revealed to us the reality that systems we never suspected were in fact vulnerable to disruption at any time.

While COVID-19 was the direct cause of the supply chain problems that were clearly evident, it merely unmasked the vulnerability of supply chains that had accumulated over decades.

A vast, seamless market has been transformed into a patchwork geopolitical arena.

An essential book for the Korean economy, both a manufacturing and importing country.

Author Peter Goodman is a leading economic journalist known for capturing pressing but overlooked economic issues and is now one of the most respected global economic analysts.

In "The Age of Supply Chain Collapse," he envisions concrete changes to how supply chains work and the implications for future industrial restructuring (or, for the other side, disaster): America's deglobalization.

The problems of supply chain concentration centered around China, which were revealed only through the pandemic, the emergence of steel box container transportation that reduced the size of the Earth and its subsequent China-centered globalization, the myth of just-in-time production and lean production that consultants have distorted, the cartels of shipping companies and the almond farmers who suffered in the process, the process by which companies minimized inventory by squeezing truck drivers and railroad workers, how monopolists in the meat industry manipulated scarcity to raise meat prices and profited from disasters, corporate executives who inflated their balance sheets and maximized stock prices to please Wall Street, and consumers who bore the brunt of the damage.

As the author wrote in the preface to the Korean edition, nimble Korean companies are trying to find solutions, such as building factories in the United States, Mexico, and Guatemala, but the reality is not so easy.

Hyundai Motor Company, which built the Metaplant America plant in Georgia, is also changing its calculations due to issues such as Trump's decision to eliminate electric vehicle subsidies.

Make it in the US, even if it costs more!

- What kind of inflation will the US export?

As the US-China conflict deepens, multinational corporations are moving some of their production plants to other countries, such as Vietnam.

American companies are pursuing nearshoring policies, either by setting up production plants in Mexico and Central America, where they can maintain lower production costs without having to contend with the volatile Pacific Ocean, or by reshoring, where they bring production back to the United States.

But no one can yet match the low wages and production capacity of Chinese factories.

If that's the case, then goods produced outside of China are bound to be expensive.

The pain of inflation is ultimately borne by ordinary people around the world.

Meanwhile, President Biden has pointed to the shipping cartel as the cause of inflation, which has become his vulnerability.

The pandemic lockdown has forced all companies to shoulder higher freight rates to find containers and ships.

In this regard, rather than directly regulating shipping companies, it is worth reading about the 'nudge' of government officials (Federal Maritime Commission) who skillfully implement policies by distinguishing between normal market price increases and 'rip-offs' by shipping companies.

[Chapter 9] In this way, various players appear in 『The Age of Supply Chain Collapse』, adding fresh perspectives.

Can we completely break away from supply chains of the past, such as those in China?

Just as managers today celebrated the efficiency of just-in-time production in the past, they also pledge to strive for resilience and sustainability.

However, the traditional foundations of the supply chain remain intact, and the temptations of the past are likely to return once the current crisis subsides.

The author argues that what lies at the end of this journey is that humanity has become dependent on a chaotic and fragile global supply chain to access the products of our time, from medicines and computer chips to toys and games.

Many businesspeople argue that the supply chain from China cannot be broken off immediately, as it has been built up over a long period of time.

Meanwhile, this system, which relies on numerous forms of labor exploitation and is vulnerable to collapse at any moment, was built as a means of rewarding the investor class, and the price paid for this is a loss of trust.

The author's warning that the supply chain collapse is not an isolated event triggered by the pandemic, but rather a harbinger of the dysfunction that will inevitably occur if the current system fails to normalize, resonates deeply.

It is clear that going forward, the question of “where to produce” has shifted from being simply a matter of cost and efficiency to a matter of geopolitical strategy.

In Part 3, the author explores how to transform crises into opportunities to restructure supply chains.

GOODS SPECIFICS

- Date of issue: February 1, 2025

- Page count, weight, size: 536 pages | 794g | 152*225*33mm

- ISBN13: 9788984078581

- ISBN10: 8984078581

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)