What is Bitcoin?

|

Description

Book Introduction

The best way to understand Bitcoin's true nature

Breaking down the Bitcoin White Paper and uncovering its underlying concepts.

What is Bitcoin? Who better to get the most accurate answer to this question? The obvious answer would be Satoshi Nakamoto, the creator of Bitcoin.

This book is a complete translation of the eight-page paper, "Bitcoin White Paper," published by Satoshi Nakamoto just before he mined the first block and introduced Bitcoin to the world.

And the concepts and technologies contained within it are explained in detail.

The Bitcoin white paper is the blueprint and blueprint for Bitcoin, the single document directly from its creator explaining how Bitcoin works and why it is special.

It is similar to the case of King Sejong the Great promulgating Hangul and publishing the book Hunminjeongeum, which explains the principles of its creation and how to use it.

A deep understanding of the white paper is essential to being confident in Bitcoin's future and living as a true Bitcoin HODLer with a long-term perspective.

In this book, you'll hear the birth of Bitcoin and its philosophical and technical foundations directly from its founder.

This is a unique experience that goes beyond learning and allows you to explore the profound world of Bitcoin with its founder.

The Bitcoin White Paper is an IT technology paper.

Moreover, because it is written based on complex technical concepts and cryptographic principles, it is not easily understood by general readers.

In particular, it contains specialized terms and difficult algorithms such as blockchain, hash function, proof of work, and distributed network, making it impossible to understand accurately without prior knowledge.

With this in mind, we've focused on explaining the core concepts of Bitcoin in as much detail as possible, making them accessible to readers without a technical background.

Additionally, the system was structured so that readers can enjoy understanding and learning about each and every thing.

Because when you know, you see, and when you see, you love.

The current Bitcoin price, fluctuating around 100 million, remains attractive.

Many experts even argue that the real rally hasn't even begun yet, and that now is the "last chance" for ordinary people like us to own Bitcoin.

Some argue that if you miss this opportunity, the price will become unbearable within just a few years.

This is because the history of Bitcoin's price surge and long-term upward trend over the past 15 years proves this.

This book will help readers safely and fearlessly take their first steps into the world of Bitcoin.

I hope this journey into the world of Bitcoin, understanding its essence and identity, will be a small adventure and a great awakening for you.

Breaking down the Bitcoin White Paper and uncovering its underlying concepts.

What is Bitcoin? Who better to get the most accurate answer to this question? The obvious answer would be Satoshi Nakamoto, the creator of Bitcoin.

This book is a complete translation of the eight-page paper, "Bitcoin White Paper," published by Satoshi Nakamoto just before he mined the first block and introduced Bitcoin to the world.

And the concepts and technologies contained within it are explained in detail.

The Bitcoin white paper is the blueprint and blueprint for Bitcoin, the single document directly from its creator explaining how Bitcoin works and why it is special.

It is similar to the case of King Sejong the Great promulgating Hangul and publishing the book Hunminjeongeum, which explains the principles of its creation and how to use it.

A deep understanding of the white paper is essential to being confident in Bitcoin's future and living as a true Bitcoin HODLer with a long-term perspective.

In this book, you'll hear the birth of Bitcoin and its philosophical and technical foundations directly from its founder.

This is a unique experience that goes beyond learning and allows you to explore the profound world of Bitcoin with its founder.

The Bitcoin White Paper is an IT technology paper.

Moreover, because it is written based on complex technical concepts and cryptographic principles, it is not easily understood by general readers.

In particular, it contains specialized terms and difficult algorithms such as blockchain, hash function, proof of work, and distributed network, making it impossible to understand accurately without prior knowledge.

With this in mind, we've focused on explaining the core concepts of Bitcoin in as much detail as possible, making them accessible to readers without a technical background.

Additionally, the system was structured so that readers can enjoy understanding and learning about each and every thing.

Because when you know, you see, and when you see, you love.

The current Bitcoin price, fluctuating around 100 million, remains attractive.

Many experts even argue that the real rally hasn't even begun yet, and that now is the "last chance" for ordinary people like us to own Bitcoin.

Some argue that if you miss this opportunity, the price will become unbearable within just a few years.

This is because the history of Bitcoin's price surge and long-term upward trend over the past 15 years proves this.

This book will help readers safely and fearlessly take their first steps into the world of Bitcoin.

I hope this journey into the world of Bitcoin, understanding its essence and identity, will be a small adventure and a great awakening for you.

- You can preview some of the book's contents.

Preview

index

prolog

Exploring Satoshi's Mind

: The Bitcoin White Paper and Its Revolutionary Ideas

20 Core Bitcoin Concepts You Need to Know First

0.

Abstract

1.

Introduction

2.

Transaction

3.

Timestamp Server

4.

Proof-of-Work

5.

Network

6.

Incentive

7.

Reclaiming Disk Space

8.

Simplified Payment Verification

9.

Combining and Splitting Value

10.

Privacy

11.

Calculations

12.

Conclusion

Exploring Satoshi's Mind

: The Bitcoin White Paper and Its Revolutionary Ideas

20 Core Bitcoin Concepts You Need to Know First

0.

Abstract

1.

Introduction

2.

Transaction

3.

Timestamp Server

4.

Proof-of-Work

5.

Network

6.

Incentive

7.

Reclaiming Disk Space

8.

Simplified Payment Verification

9.

Combining and Splitting Value

10.

Privacy

11.

Calculations

12.

Conclusion

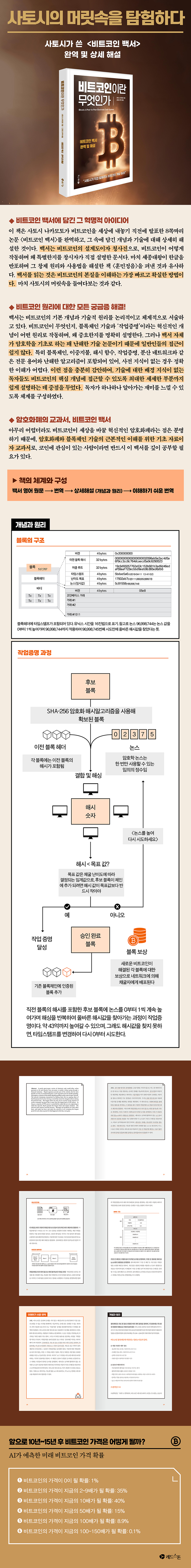

Detailed image

Into the book

20 Core Bitcoin Concepts You Need to Know First

1.

Blockchain

The core technology that makes up Bitcoin.

Blockchain is a way to securely store and manage data, with multiple blocks linked together in a line to form a chain.

Each block contains a record of transactions (transactions) that occurred at a specific time.

In addition to transaction information, blocks also contain a hash value for the 'previous (immediately preceding) block', which allows for connections between blocks.

The biggest feature of blockchain is that it is very difficult to change data.

If you try to modify the information in a block, all blocks after that block must be recalculated, making it virtually impossible.

For this reason, blockchain is considered tamper-proof.

All participants have the same blockchain stored on the network, allowing them to verify the authenticity of transactions with each other.

Additionally, blockchain is a distributed database, meaning there is no central administrator.

Each participant is connected to the network by a computer called a 'node', and each node maintains a copy of the blockchain.

This architecture eliminates single points of failure and makes the network more secure.

2.

Block structure

A block can be broadly divided into two parts: the block header and the body.

Block header

· Version: Version information of the block

· Hash of previous block: Includes the hash value of the previous block to ensure connectivity between blocks.

· Timestamp: Records the time the block was created.

· Difficulty Target: Indicates the difficulty of the proof-of-work required to create the next block.

· Nonce: A randomly varying value used in the proof-of-work process to find the hash value.

· Merkle Root: The final hash value generated by hashing all transactions included in a block, ensuring the integrity of the transactions.

body

This section contains detailed information about all transactions included in the block.

Each transaction contains information such as the sender, recipient, and amount, and is verified through an electronic signature.

It can hold approximately 1,500 to 2,000 transactions, up to a maximum block size of 1 MB.

3.

Transaction

A transaction is the process of sending or receiving Bitcoin.

It consists of input and output.

The input represents the Bitcoin previously received by the sender, and the output contains the recipient's address and the amount of Bitcoin to be sent.

The sender digitally signs the transaction to ensure its validity, which is then broadcast to the Bitcoin network and recorded on all nodes.

Transactions are stored in the mempool, then grouped into blocks and added to the blockchain.

Additionally, transaction fees can be included to ensure that miners receive priority processing.

Transactions are a core element of the Bitcoin ecosystem, and the blockchain securely stores these transaction records.

--- pp.10-11

abstract.

Bitcoin is a digital currency that allows individuals to send and receive money directly online without the intervention of a bank.

Until now, trusted third parties such as banks have solved the "double spending" problem, where people re-spend money they've already spent, but this method hasn't been perfect.

Bitcoin attempts to solve this problem by using a peer-to-peer network.

In a P2P network, whenever people make a transaction (transfer), the time of the transfer is recorded, and this record is called a 'timestamp'.

And the process of verifying this timestamp is called 'proof of work'.

Transaction records verified through proof-of-work are stored in a database called a 'blockchain'.

A blockchain is a series of blocks linked together in a single line, each block containing approximately 2,000 transaction (transfer) records.

For a new transaction record to be added to the blockchain, the block must pass proof-of-work.

This way, the record cannot be changed without redoing the proof-of-work.

The longest chain is created by nodes with the most computing power.

Here, 'node' refers to each computer that participates in the Bitcoin network.

This chain is linked in the order in which blocks were created, so it itself proves the order in which events occurred.

If honest nodes that do not cooperate in network attacks acquire a majority of computing power, they will be able to create the longest chain and outpace the attackers.

The Bitcoin network requires only a very simple structure.

Transaction (transfer) messages are sent to as many nodes as possible, and each node can leave and rejoin the network at any time.

--- p.28

2.

transaction

Electronic money can be thought of as a series of records in which electronic signatures are linked like a chain.

To send coins, the coin owner binds two pieces of information into a digital signature.

One is the hash value of the previous transaction, and the other is the public key (a kind of address) of the next owner.

This signed information is added to the end of the coin, and the coin is transferred to the next owner.

When the recipient receives these coins, he or she must verify that the previous owner has properly transferred ownership.

To do this, you just need to verify the electronic signature.

The problem, however, is that the recipient cannot verify that one of the previous owners did not double-spend.

The traditional solution is to have a central authority, a trusted third party, verify all payments.

In the traditional method, once a coin has been spent, it must be returned to a central authority to be issued as new coins, and only coins issued by a central authority are trusted to have not been spent twice.

The problem with this solution is that the entire monetary system would have to rely on this central authority.

So we need a way for the payee to know that the previous owner has not signed other payments in the past.

Since the first payment that occurs is important, subsequent double-spending attempts are ignored.

The only way to ensure that it has not been used for payment is to verify all payments.

In a traditional approach, a central authority would be aware of all payments and determine which ones came first, but to achieve this without a trusted third party, transactions would need to be public and a system would be needed where participants agree on a single record of the transaction order.

For each transaction, the recipient needs proof that a majority of nodes have agreed that the transaction was the first one received.

Concepts and Principles

A series of records in which electronic signatures are linked like a chain: a 'chain of transactions'.

Every transaction contains a hash of the previous transaction, and transactions are generated with the user's electronic signature.

In this way, transactions are linked sequentially to previous transactions, current owners, and next owners, forming a chain.

Here, chain does not include the concept of blocks, but simply means a continuous link of transactions and electronic signatures.

Once a coin has been paid, it must be returned to the central authority to be issued as new coins, and only coins issued by the central authority are trusted to have not been spent twice: This is not an actual return of money, but a metaphor for how a bank manages debiting the sender's account and crediting the recipient's account.

The recipient needs proof that a majority of nodes have agreed that the transaction was the first received: To prevent double-spending, the Bitcoin network uses a mechanism to verify that each transaction is the first received.

If a majority of nodes verify that the transaction is valid and the first transaction to occur, the transaction is included in a block and recorded on the blockchain.

1.

Blockchain

The core technology that makes up Bitcoin.

Blockchain is a way to securely store and manage data, with multiple blocks linked together in a line to form a chain.

Each block contains a record of transactions (transactions) that occurred at a specific time.

In addition to transaction information, blocks also contain a hash value for the 'previous (immediately preceding) block', which allows for connections between blocks.

The biggest feature of blockchain is that it is very difficult to change data.

If you try to modify the information in a block, all blocks after that block must be recalculated, making it virtually impossible.

For this reason, blockchain is considered tamper-proof.

All participants have the same blockchain stored on the network, allowing them to verify the authenticity of transactions with each other.

Additionally, blockchain is a distributed database, meaning there is no central administrator.

Each participant is connected to the network by a computer called a 'node', and each node maintains a copy of the blockchain.

This architecture eliminates single points of failure and makes the network more secure.

2.

Block structure

A block can be broadly divided into two parts: the block header and the body.

Block header

· Version: Version information of the block

· Hash of previous block: Includes the hash value of the previous block to ensure connectivity between blocks.

· Timestamp: Records the time the block was created.

· Difficulty Target: Indicates the difficulty of the proof-of-work required to create the next block.

· Nonce: A randomly varying value used in the proof-of-work process to find the hash value.

· Merkle Root: The final hash value generated by hashing all transactions included in a block, ensuring the integrity of the transactions.

body

This section contains detailed information about all transactions included in the block.

Each transaction contains information such as the sender, recipient, and amount, and is verified through an electronic signature.

It can hold approximately 1,500 to 2,000 transactions, up to a maximum block size of 1 MB.

3.

Transaction

A transaction is the process of sending or receiving Bitcoin.

It consists of input and output.

The input represents the Bitcoin previously received by the sender, and the output contains the recipient's address and the amount of Bitcoin to be sent.

The sender digitally signs the transaction to ensure its validity, which is then broadcast to the Bitcoin network and recorded on all nodes.

Transactions are stored in the mempool, then grouped into blocks and added to the blockchain.

Additionally, transaction fees can be included to ensure that miners receive priority processing.

Transactions are a core element of the Bitcoin ecosystem, and the blockchain securely stores these transaction records.

--- pp.10-11

abstract.

Bitcoin is a digital currency that allows individuals to send and receive money directly online without the intervention of a bank.

Until now, trusted third parties such as banks have solved the "double spending" problem, where people re-spend money they've already spent, but this method hasn't been perfect.

Bitcoin attempts to solve this problem by using a peer-to-peer network.

In a P2P network, whenever people make a transaction (transfer), the time of the transfer is recorded, and this record is called a 'timestamp'.

And the process of verifying this timestamp is called 'proof of work'.

Transaction records verified through proof-of-work are stored in a database called a 'blockchain'.

A blockchain is a series of blocks linked together in a single line, each block containing approximately 2,000 transaction (transfer) records.

For a new transaction record to be added to the blockchain, the block must pass proof-of-work.

This way, the record cannot be changed without redoing the proof-of-work.

The longest chain is created by nodes with the most computing power.

Here, 'node' refers to each computer that participates in the Bitcoin network.

This chain is linked in the order in which blocks were created, so it itself proves the order in which events occurred.

If honest nodes that do not cooperate in network attacks acquire a majority of computing power, they will be able to create the longest chain and outpace the attackers.

The Bitcoin network requires only a very simple structure.

Transaction (transfer) messages are sent to as many nodes as possible, and each node can leave and rejoin the network at any time.

--- p.28

2.

transaction

Electronic money can be thought of as a series of records in which electronic signatures are linked like a chain.

To send coins, the coin owner binds two pieces of information into a digital signature.

One is the hash value of the previous transaction, and the other is the public key (a kind of address) of the next owner.

This signed information is added to the end of the coin, and the coin is transferred to the next owner.

When the recipient receives these coins, he or she must verify that the previous owner has properly transferred ownership.

To do this, you just need to verify the electronic signature.

The problem, however, is that the recipient cannot verify that one of the previous owners did not double-spend.

The traditional solution is to have a central authority, a trusted third party, verify all payments.

In the traditional method, once a coin has been spent, it must be returned to a central authority to be issued as new coins, and only coins issued by a central authority are trusted to have not been spent twice.

The problem with this solution is that the entire monetary system would have to rely on this central authority.

So we need a way for the payee to know that the previous owner has not signed other payments in the past.

Since the first payment that occurs is important, subsequent double-spending attempts are ignored.

The only way to ensure that it has not been used for payment is to verify all payments.

In a traditional approach, a central authority would be aware of all payments and determine which ones came first, but to achieve this without a trusted third party, transactions would need to be public and a system would be needed where participants agree on a single record of the transaction order.

For each transaction, the recipient needs proof that a majority of nodes have agreed that the transaction was the first one received.

Concepts and Principles

A series of records in which electronic signatures are linked like a chain: a 'chain of transactions'.

Every transaction contains a hash of the previous transaction, and transactions are generated with the user's electronic signature.

In this way, transactions are linked sequentially to previous transactions, current owners, and next owners, forming a chain.

Here, chain does not include the concept of blocks, but simply means a continuous link of transactions and electronic signatures.

Once a coin has been paid, it must be returned to the central authority to be issued as new coins, and only coins issued by the central authority are trusted to have not been spent twice: This is not an actual return of money, but a metaphor for how a bank manages debiting the sender's account and crediting the recipient's account.

The recipient needs proof that a majority of nodes have agreed that the transaction was the first received: To prevent double-spending, the Bitcoin network uses a mechanism to verify that each transaction is the first received.

If a majority of nodes verify that the transaction is valid and the first transaction to occur, the transaction is included in a block and recorded on the blockchain.

--- pp.47-48

GOODS SPECIFICS

- Date of issue: October 24, 2024

- Format: Hardcover book binding method guide

- Page count, weight, size: 152 pages | 516g | 188*257*15mm

- ISBN13: 9791190872577

- ISBN10: 1190872579

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)