Korean Economic Revival Association

|

Description

Book Introduction

Let's make a lot of money and use the national money properly!

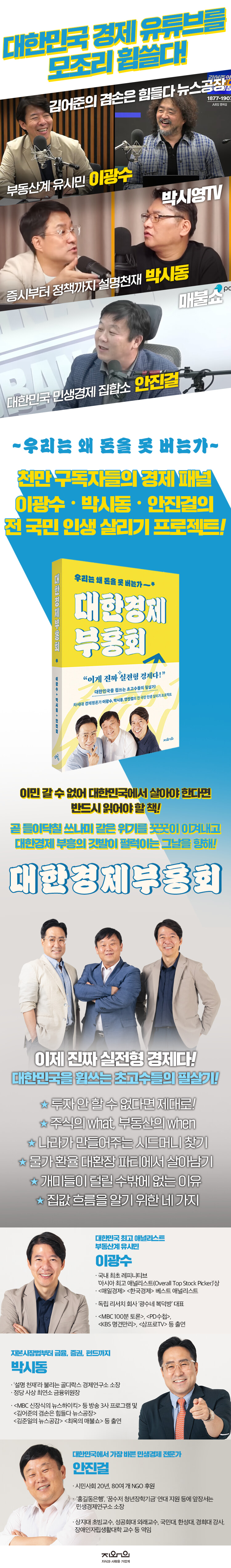

The practical economic secrets of the three economic mentors of Kim Eo-jun, who are sweeping South Korea! From stocks to real estate, from welfare to innovation! A project to revitalize the economy by leading experts! The news talks all day long about when to buy and sell real estate and stocks, but it's so hard to actually do anything about it. Why can't I make money when everyone else seems to? Why does our country seem wealthy, but we struggle to make ends meet? Throw away all the financial advice you can't possibly follow. Let's change all the wrong economic policies that are not helping us at all. Here is a project to save the lives of all citizens, as told by practical, livelihood-oriented economic experts. The real estate industry's Yoo Si-min, Lee Kwang-soo, the economics industry's Heo Jun, Park Si-dong, and the people's livelihood expert Ahn Jin-geol. The three next-generation economic commentators who are sweeping South Korea and leading the economic channel rankings have rolled up their sleeves and stepped up to help the people who are always being taken advantage of. "Investment: What Should I Do If I Can't Avoid It?", "How Can I Solve the Korea Discount That's Making Small Businesses Lose Money?", "In an Era of High Inflation, High Exchange Rates, and High Interest Rates, How Can I Stop Losing Money?" Here are the secrets to making a lot of money and using the country's money wisely. If you can't immigrate and must live in South Korea, this is a must-read! Let's bravely overcome the impending tsunami-like crisis and run toward the day when the flag of Korean economic revival flutters. |

- You can preview some of the book's contents.

Preview

index

Prologue_The Truth of the Shepherd Boy

1.

If You Can't Do It, Do It Right: The Essence of Investing

Whatever it is, the heart is important.

Let us be humble in the face of good fortune

Have the courage to take losses

People who live only for today cannot invest.

Stocks are WHAT and real estate is WHEN

2.

If you don't want to waste money without knowing it: Seed money provided by the government

An era where people try to save even 10 won by walking.

Don't let your guard down, apply now!

Free transportation within 15 minutes

The old saying, "Don't be stingy with your pennies"

3.

Surviving the Price and Exchange Rate Crash Party: Korean-Style Income Insecurity

Are prices really going down?

Exchange rates must be managed to be normal.

Interest rates are in a sandwich situation

Why can't you say it, income is the problem!

4.

Let's Make Money Too: The Story of the Rich 1

Become rich in the next 20 years

Why I'm Not Rich

Countries with many kind people also have many rich people.

There are many things that money can't buy, so I live well.

5.

Earning and Being Happy: The Story of the Rich 2

If you just cry and say it's a crisis, you're a fool

Let's not look down on savings

People are money

Ultimately, it's all a question of happiness

6.

Don't lose, don't be fooled, look to tomorrow: youth, everyone's blue chip

Now I'm tired of saying 'since Dangun'

First of all, never lose!

You guys don't seem to be thinking about long-term investments.

Try to find your own way

7.

Korea Discount: Six Reasons Why Ants Are Inevitably Getting Bullied

Why Korean Stocks Are Undervalued

Aren't shareholders the owners of the company?

Is the National Pension Service making people into households?

Let's launch a movement to burn our own shares.

8.

The Law of Real Estate Fluctuations: Homeownership and the Psychological Anxiety

I don't have a home, what should I do?

It's similar to the Lee Myung-bak administration.

Four Things to Know About Housing Price Trends

I'm an investor, what do I do?

Reconstruction, replacement, and senior real estate

The Future of the Real Estate Republic

9. Am I Trembling Before AI?: Reflecting on the Fundamentals of Innovation

Have you ever used artificial intelligence?

The Consolidation of American Hegemony in the Age of Technological Revolution

Country, if you're going to throw money away, give it to scientists.

AI Regulation: A Matter of Survival for Everyone

Let's not live like we did in the past

Epilogue_Please take care of my old age

1.

If You Can't Do It, Do It Right: The Essence of Investing

Whatever it is, the heart is important.

Let us be humble in the face of good fortune

Have the courage to take losses

People who live only for today cannot invest.

Stocks are WHAT and real estate is WHEN

2.

If you don't want to waste money without knowing it: Seed money provided by the government

An era where people try to save even 10 won by walking.

Don't let your guard down, apply now!

Free transportation within 15 minutes

The old saying, "Don't be stingy with your pennies"

3.

Surviving the Price and Exchange Rate Crash Party: Korean-Style Income Insecurity

Are prices really going down?

Exchange rates must be managed to be normal.

Interest rates are in a sandwich situation

Why can't you say it, income is the problem!

4.

Let's Make Money Too: The Story of the Rich 1

Become rich in the next 20 years

Why I'm Not Rich

Countries with many kind people also have many rich people.

There are many things that money can't buy, so I live well.

5.

Earning and Being Happy: The Story of the Rich 2

If you just cry and say it's a crisis, you're a fool

Let's not look down on savings

People are money

Ultimately, it's all a question of happiness

6.

Don't lose, don't be fooled, look to tomorrow: youth, everyone's blue chip

Now I'm tired of saying 'since Dangun'

First of all, never lose!

You guys don't seem to be thinking about long-term investments.

Try to find your own way

7.

Korea Discount: Six Reasons Why Ants Are Inevitably Getting Bullied

Why Korean Stocks Are Undervalued

Aren't shareholders the owners of the company?

Is the National Pension Service making people into households?

Let's launch a movement to burn our own shares.

8.

The Law of Real Estate Fluctuations: Homeownership and the Psychological Anxiety

I don't have a home, what should I do?

It's similar to the Lee Myung-bak administration.

Four Things to Know About Housing Price Trends

I'm an investor, what do I do?

Reconstruction, replacement, and senior real estate

The Future of the Real Estate Republic

9. Am I Trembling Before AI?: Reflecting on the Fundamentals of Innovation

Have you ever used artificial intelligence?

The Consolidation of American Hegemony in the Age of Technological Revolution

Country, if you're going to throw money away, give it to scientists.

AI Regulation: A Matter of Survival for Everyone

Let's not live like we did in the past

Epilogue_Please take care of my old age

Detailed image

Into the book

Now we need to approach economic problems from a different perspective.

I used to think that economics was a very macro-level story, and that great economists would know the answers.

But I have a feeling that's not the case.

Our economy cannot survive the way we have been doing things so far.

I think we need to change the way we approach economic issues.

We need an economics centered on field experts.

--- From "Prologue_The Truth of the Shepherd Boy"

Now that you've acknowledged your luck and decided to invest, you need to have courage.

It's not the courage to make money, it's the courage to lose money.

You have to think about the loss first.

Many people get frustrated and can't sustain because they don't do this.

It is very important to first have the courage to tolerate loss.

--- 「1.

From "If You Can't Do It, Do It Right: The Essence of Investing"

Some say, “When wages rise, prices rise further.”

However, as wages rise, prices also rise, but when prices rise, wages must also rise accordingly.

I don't think that just because prices are rising, they should necessarily be lowered.

In capitalism, rising prices may in itself be economic growth.

In the era we are entering, price volatility for all products will increase.

To keep the economy stable against that volatility, wages need to rise steadily to some degree.

--- 「3.

From "Surviving the Party of Price and Exchange Rate Crash: Korean-Style Income Insecurity"

When homelessness increased in one US state, they started collecting taxes to help the homeless.

The idea was to provide support such as social dependent income.

There was a lot of opposition at first.

But as the subsidy eliminated homelessness, the number of tourists began to increase.

The economy is booming again and the region is coming back to life.

These changes aren't just 'good-natured noises'.

Ultimately, the core of the economy is 'circulation'.

It has to go around and around.

From that perspective, there are plenty of clever ways to improve the economy.

--- 「4.

Let's make some money too: The Story of the Rich 1"

I've been working as an analyst for a long time and I've met a lot of rich people.

What most of them have in common is that they were lucky.

But would it be convincing to you if I told you, "You need luck to get rich"? It wouldn't be convincing.

So, we need to exclude luck and bring in the stories of people who have failed and compare them.

There is a point where the commonalities of those who become rich overlap with those who fail.

I found this.

--- 「5.

From "Earning and Being Happy: The Story of the Rich 2"

What's important here is the nature of money.

Speed is important.

When investing, speed is key.

It's called the 'snowball effect'.

How do you make a small snowball grow big? You have to roll it quickly.

Likewise, speed is important even when you don't have money.

The amount of money doesn't matter.

Investing can be done with small amounts of money.

Even a small amount of money can quickly grow into a large sum.

The word I hate the most is long-term investment.

--- 「6.

Don't lose, don't be fooled, look to tomorrow: from "Youth, everyone's blue chip"

In order to resolve the Korea discount, we cannot help but point out the issue of treasury stocks.

I cannot help but explain the case of Japan.

When we did the value-up program in Japan, the key point was to 'buy back a lot of treasury stock and burn it all.'

I think I need to explain why this is a value-added product.

--- 「7.

Korea Discount: Six Reasons Why Ants Are Inevitably Lost

When looking at stocks and real estate, it is necessary to carefully consider past examples.

Especially, Korean real estate is a domestic market.

Conservative media reports that foreigners, especially Chinese, are buying real estate, but it hasn't been that long.

So the important point is that the domestic market has limited players.

Simply put, it means that foreigners decide the price and buy and sell.

Even 10 or 20 years ago, Koreans loved houses, wanted to make money from houses, and wanted to own their own homes.

So, the market where Koreans buy and sell among themselves has gone through the same changes in the past as it does now.

That was exactly 2009.

--- 「8.

From "The Law of Real Estate Variables: Homeownership and Psychological Anxiety"

As we discussed earlier in the story of innovation at a steel mill, even if it's not a great AI, we can find ways to live well by utilizing a certain level of AI.

Unless you just try to live the way you've lived.

This is the basis for living in the age of innovation.

--- From "9. Am I Trembling Before AI?: Thinking About the Fundamentals of Innovation"

In the end, even after retirement or old age, most of your assets are real estate.

In terms of a company, it has a lot of fixed assets and a small number of current assets.

But what happens when you get older? Your income decreases and you have more money to spend.

Simply put, we need more liquid assets that can be used than real estate.

Well, now it's a matter of choice.

What should we do with this real estate? In fact, it's considered the most crucial asset for retirement in South Korea.

I used to think that economics was a very macro-level story, and that great economists would know the answers.

But I have a feeling that's not the case.

Our economy cannot survive the way we have been doing things so far.

I think we need to change the way we approach economic issues.

We need an economics centered on field experts.

--- From "Prologue_The Truth of the Shepherd Boy"

Now that you've acknowledged your luck and decided to invest, you need to have courage.

It's not the courage to make money, it's the courage to lose money.

You have to think about the loss first.

Many people get frustrated and can't sustain because they don't do this.

It is very important to first have the courage to tolerate loss.

--- 「1.

From "If You Can't Do It, Do It Right: The Essence of Investing"

Some say, “When wages rise, prices rise further.”

However, as wages rise, prices also rise, but when prices rise, wages must also rise accordingly.

I don't think that just because prices are rising, they should necessarily be lowered.

In capitalism, rising prices may in itself be economic growth.

In the era we are entering, price volatility for all products will increase.

To keep the economy stable against that volatility, wages need to rise steadily to some degree.

--- 「3.

From "Surviving the Party of Price and Exchange Rate Crash: Korean-Style Income Insecurity"

When homelessness increased in one US state, they started collecting taxes to help the homeless.

The idea was to provide support such as social dependent income.

There was a lot of opposition at first.

But as the subsidy eliminated homelessness, the number of tourists began to increase.

The economy is booming again and the region is coming back to life.

These changes aren't just 'good-natured noises'.

Ultimately, the core of the economy is 'circulation'.

It has to go around and around.

From that perspective, there are plenty of clever ways to improve the economy.

--- 「4.

Let's make some money too: The Story of the Rich 1"

I've been working as an analyst for a long time and I've met a lot of rich people.

What most of them have in common is that they were lucky.

But would it be convincing to you if I told you, "You need luck to get rich"? It wouldn't be convincing.

So, we need to exclude luck and bring in the stories of people who have failed and compare them.

There is a point where the commonalities of those who become rich overlap with those who fail.

I found this.

--- 「5.

From "Earning and Being Happy: The Story of the Rich 2"

What's important here is the nature of money.

Speed is important.

When investing, speed is key.

It's called the 'snowball effect'.

How do you make a small snowball grow big? You have to roll it quickly.

Likewise, speed is important even when you don't have money.

The amount of money doesn't matter.

Investing can be done with small amounts of money.

Even a small amount of money can quickly grow into a large sum.

The word I hate the most is long-term investment.

--- 「6.

Don't lose, don't be fooled, look to tomorrow: from "Youth, everyone's blue chip"

In order to resolve the Korea discount, we cannot help but point out the issue of treasury stocks.

I cannot help but explain the case of Japan.

When we did the value-up program in Japan, the key point was to 'buy back a lot of treasury stock and burn it all.'

I think I need to explain why this is a value-added product.

--- 「7.

Korea Discount: Six Reasons Why Ants Are Inevitably Lost

When looking at stocks and real estate, it is necessary to carefully consider past examples.

Especially, Korean real estate is a domestic market.

Conservative media reports that foreigners, especially Chinese, are buying real estate, but it hasn't been that long.

So the important point is that the domestic market has limited players.

Simply put, it means that foreigners decide the price and buy and sell.

Even 10 or 20 years ago, Koreans loved houses, wanted to make money from houses, and wanted to own their own homes.

So, the market where Koreans buy and sell among themselves has gone through the same changes in the past as it does now.

That was exactly 2009.

--- 「8.

From "The Law of Real Estate Variables: Homeownership and Psychological Anxiety"

As we discussed earlier in the story of innovation at a steel mill, even if it's not a great AI, we can find ways to live well by utilizing a certain level of AI.

Unless you just try to live the way you've lived.

This is the basis for living in the age of innovation.

--- From "9. Am I Trembling Before AI?: Thinking About the Fundamentals of Innovation"

In the end, even after retirement or old age, most of your assets are real estate.

In terms of a company, it has a lot of fixed assets and a small number of current assets.

But what happens when you get older? Your income decreases and you have more money to spend.

Simply put, we need more liquid assets that can be used than real estate.

Well, now it's a matter of choice.

What should we do with this real estate? In fact, it's considered the most crucial asset for retirement in South Korea.

--- From "Epilogue_Please Take Care of My Old Age"

Publisher's Review

Recommendation

Oh, really, so informative, fun, and harmless! _@kate***

I really like the show featuring Korea's top three economic geniuses.

_@pjm***

I am being comforted.

Thank you for scratching my itch and broadening my horizons of knowledge.

_@kk***

Please save the country's economy and our family's economy! _@we***

It makes you think about life, starting with money.

_@5om***

I was so surprised by the great content.

I thought I should recommend it to my children too.

_@yjj***

Oh, really, so informative, fun, and harmless! _@kate***

I really like the show featuring Korea's top three economic geniuses.

_@pjm***

I am being comforted.

Thank you for scratching my itch and broadening my horizons of knowledge.

_@kk***

Please save the country's economy and our family's economy! _@we***

It makes you think about life, starting with money.

_@5om***

I was so surprised by the great content.

I thought I should recommend it to my children too.

_@yjj***

GOODS SPECIFICS

- Date of issue: September 5, 2024

- Page count, weight, size: 280 pages | 382g | 138*210*20mm

- ISBN13: 9791191521382

- ISBN10: 1191521389

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)