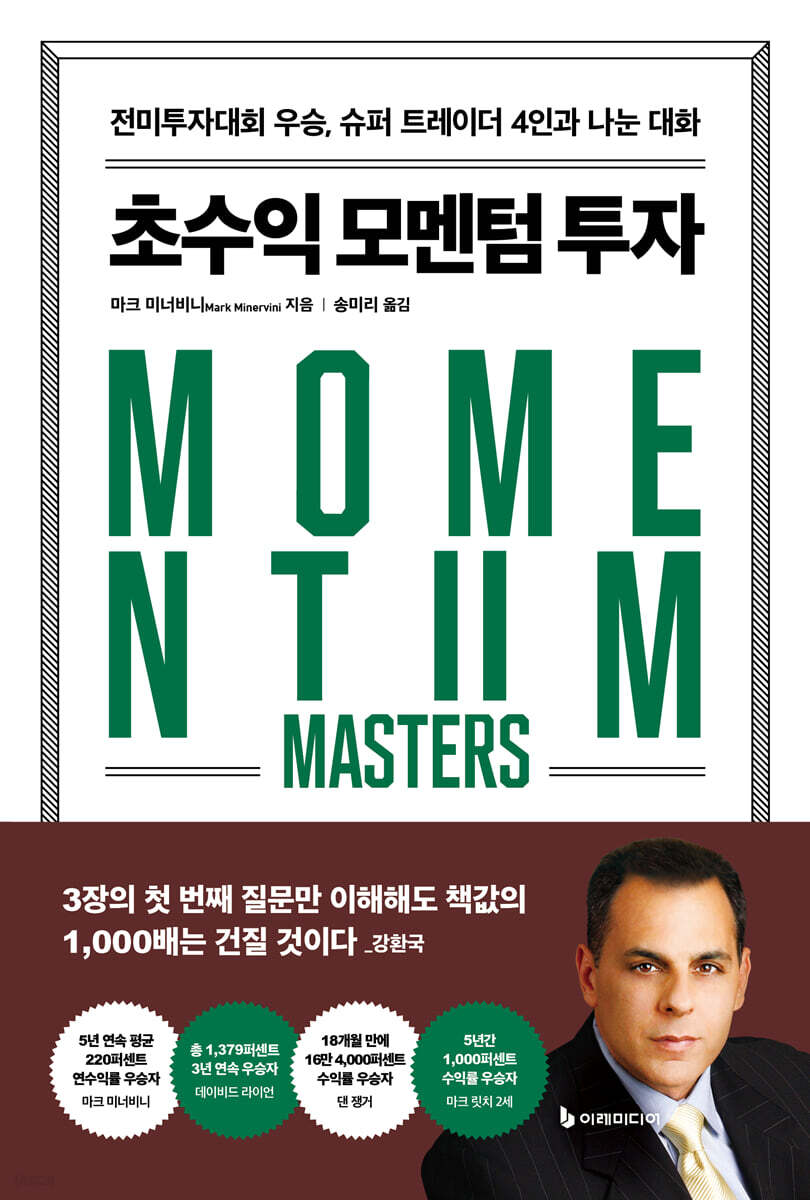

High-yield momentum investing

|

Description

Book Introduction

Mark Minervini, two-time US Investing Championship winner and mentor to numerous other winners

David Ryan, three-time US Investing Championship winner

Dan Zanger, the man who turned $10,000 into $18 million in 18 months

Mark Ritchie Jr., 42.7% compound annual return over 11 and a half years

Four legends reveal their sales techniques!

"High-Yield Momentum Investing" is Mark Minervini's second book, following "High-Yield Growth Investing." It takes the form of a roundtable discussion where four great traders answer questions from readers.

The backgrounds of the four traders are splendid.

David Ryan is a three-time winner of the U.S. Investment Championship, and Dan Zanger is the man who turned $10,000 into $18 million in 18 months.

The least known is Mark Ritchie Jr., winner of Mark Minervini's triple-digit investment competition, where he made a 100 percent return in just six months.

The annual compound interest rate for 11 and a half years is 42.7 percent.

Some may discover the reasons why their investments fail through these answers, while others may discover the secrets of great traders who beat the market and achieve better results.

To quote author systrader79, this book is "a one-on-four private trading lesson exclusively for you from four true masters, the Warren Buffetts of the trading world."

To borrow the words of author Kang Hwan-guk, there are many parts that say, “You will get 1,000 times the price of the book.”

Discover their incredible talents now! How they are masters of high-yield momentum investing!

David Ryan, three-time US Investing Championship winner

Dan Zanger, the man who turned $10,000 into $18 million in 18 months

Mark Ritchie Jr., 42.7% compound annual return over 11 and a half years

Four legends reveal their sales techniques!

"High-Yield Momentum Investing" is Mark Minervini's second book, following "High-Yield Growth Investing." It takes the form of a roundtable discussion where four great traders answer questions from readers.

The backgrounds of the four traders are splendid.

David Ryan is a three-time winner of the U.S. Investment Championship, and Dan Zanger is the man who turned $10,000 into $18 million in 18 months.

The least known is Mark Ritchie Jr., winner of Mark Minervini's triple-digit investment competition, where he made a 100 percent return in just six months.

The annual compound interest rate for 11 and a half years is 42.7 percent.

Some may discover the reasons why their investments fail through these answers, while others may discover the secrets of great traders who beat the market and achieve better results.

To quote author systrader79, this book is "a one-on-four private trading lesson exclusively for you from four true masters, the Warren Buffetts of the trading world."

To borrow the words of author Kang Hwan-guk, there are many parts that say, “You will get 1,000 times the price of the book.”

Discover their incredible talents now! How they are masters of high-yield momentum investing!

- You can preview some of the book's contents.

Preview

index

Recommendation

PROLOGUE

INTERVIEWEE

[SECTION 1] Introduction

01 You have all been trading for a long time.

Are you still using the same chart patterns and trading methods as when you first started trading, or has your trading style evolved with the times?

02 What's your daily routine like? Has your routine changed over time?

03 What are your thoughts on high-frequency trading?

04 How did you first enter the world of trading? What attracted you to it? What motivated you to continue on for so long?

05 Did you become a successful trader right away, or did you go through some difficult times? How long did it take you to become consistently profitable?

06 Do large investors have any advantages over individual investors? How would you respond to claims that the game is rigged?

07 Can an investor who has a job and must trade only based on the closing price still be a successful trader?

If you can't sit in front of your computer during the 8th session, how would you enter and exit positions?

09 Do you use margin or options for leverage?

10. Is top-level trading a natural talent, or can it be learned? How long is the learning curve?

11 Can you get rich through stock trading even with a small amount of money?

[SECTION 2] Selecting a stock

01 What's the best way to find momentum stocks with high upside potential?

02 Is there a minimum trading volume requirement to consider trading?

03 Has dark pools ever changed your trading volume analysis?

04 Do you use low-price buying techniques?

05 What about price limits? Do you buy low-priced stocks? If so, do you trade them differently than you would with high-priced stocks?

06 When selecting individual stocks, do you use a "bottom-up" approach, or do you first identify groups you believe are market leaders and then select individual stocks within those groups?

07 How do I find a leading industry group?

08 Do you trade IPO stocks? How do you define momentum for stocks with little trading history?

09 Are the criteria for selecting large-cap funds different from those for selecting small-cap funds? If so, how?

Do you take short positions in 10 stocks? How do you decide when to go short? Do you sometimes hold both long and short positions simultaneously?

11. Do you ever find yourself waiting for a buy signal from a favorite stock on your watchlist, putting other stocks on hold to trade that stock?

[SECTION 3] Position Size

01 How many stocks do you typically hold? Do you think you should focus on a small number of stocks, or diversify your investments?

02 How much is the risk exposure per transaction compared to capital?

03 If you use up all your capital, how many positions will you have?

04 What is the maximum position size? Have you ever invested your entire account in one stock?

05 What percentage of equity is the minimum position typically traded?

06 Is the position size for each transaction determined based on the risk exposure amount or a certain percentage?

07 As your account balance grows throughout the year, do you increase your position size accordingly, or do you maintain the same amount of risk exposure per trade throughout the year?

08 What confidence do you need to enter a large position?

09 How do you assess the "qualitative requirements" required to enter a trade? If one stock has higher investment value than another, how do you quantify this? Or do you keep all positions the same size?

[SECTION 4] Technical Analysis

01 How do you move from the interest stage to the actual buy stage? What aspects of price and volume do you specifically look for before buying?

02 If price movements are good in a bull market, do you invest even if the fundamentals are poor?

03 If a stock's fundamentals are weak but its relative strength is at a 52-week high, can it be considered a market leader? Some argue that high relative strength requires corresponding performance.

04 I understand that you should consider buying when the stock is in an upward trend.

How do you define an uptrend?

05 Are there any indicators you use, such as Stochastic, MACD, or ATR?

06 From a technical analysis perspective, what aspect do you consider most important when buying?

07 When entering a stock with momentum, should I buy at a pullback or a breakout?

08 How do you define a breakout?

We've had a lot of false breakouts going back to the 09 base area.

If we add 10-20 cents to the buy point price, can we avoid getting caught in a false breakout?

10 Have you ever entered a buy position when the stock price was moving sideways and there was not much volume, or did you wait for the price to break out of the range?

11 What do you think about stocks that continue to hit new highs despite low trading volume?

If the opening price was formed within the previous day's trading range, broke through the buy point, and rose, but the closing volume was average or below average, should this be considered a warning signal?

13 How do you evaluate a stock when its price moves early but there is insufficient information about trading volume?

14 Do you buy at breakouts or pivot points even when there is no significant volume and see the volume follow later?

Why don't you wait until the 15th chapter closes or when significant volume is evident before buying? 16. Do you set a maximum selling grace period after buying, when volume has stopped flowing in and the price is no longer rising?

17 Is there a standard period or percentage of average volume that you use as a reference when judging the volume on the day a breakout appears?

18 How far down are you willing to go when the stock either pulls back shortly after a breakout or falls below the breakout level?

19 How many trading requirements or chart patterns do you usually set?

[SECTION 5] Fundamental Analysis

01 Do you look at the charts after finding stocks that meet the fundamental requirements, or is it the other way around?

02 How much time do you usually spend on research before making a purchase?

03 Where do you get your research and news? How do you use the news in your actual trading?

04 How many stocks do you usually research or browse in a day?

05 Do you think that the same forces that moved the markets long ago still move the markets today?

06 What do you look for in fundamentals when taking a short position?

07 How do you measure performance momentum?

08 Do you need high or accelerating growth rates?

09 Do you use profit margin or return on equity?

10 Momentum stocks are often high-growth, high-P/E stocks.

Have you ever found a low P/E momentum stock?

Which is more important: quarterly profits or long-term growth? Or do you need both, or neither?

[SECTION 6] Market

01 Can trading techniques be applied to indices as well, or only to stocks?

02 Do you try to time the market? Do you have any tools or indicators you monitor to gauge the market?

03 How do I select stocks to sell when a sell signal appears in the market?

04 When the market starts to decline, do you tend to take profits on marginal stocks? Do you adjust your stop order to the break-even price, or do you let the stop order trigger at the initial stop-loss price?

05 If the market is in a downtrend and you see a good upward chart, do you buy the stock or just watch?

06 How do I know if the market is in a distribution or accumulation phase? And how do I leverage this for trading?

07 What aspects of investing do you look for and invest more aggressively? How do you know when it's time to step on the accelerator?

If the stock price had formed a breakout before the FTD occurred, would you buy the stock? If so, would you buy the entire position planned before the FTD occurred?

[SECTION 7] Entry Requirements

01 What aspects of a stock are of interest to you when considering a purchase?

02 Do you buy all at once, or do you buy in portions and then gradually add more? When the stock price moves unfavorably, do you gradually sell, or do you sell everything at once?

03 When a breakout occurs, how high above the breakout price do you buy? Or do you wait until the closing price?

04 How do you go from holding cash to fully investing?

05 How do you manage when trading a large number of stocks? What if four or five of your 15 favorites break out?

06 How do you define the entry point?

07 Do you trade stocks that have recently suffered losses? What are your re-entry plans?

08 What if the stock price on the day hits the initial entry price again after the trade ends unexpectedly?

09 Do you think you should use pullbacks when entering momentum stocks?

Do you have any advice on adding high-yielding stocks?

Do you buy when a gap occurs? If so, what do you do if a gap forms after the market opens, outside your buy point?

[SECTION 8] RISK MANAGEMENT

01 How do I determine the stop price placement?

02 Is there a maximum risk tolerance set as a percentage of total capital?

03 How do you manage the risk of a gap forming even though you've set a strict stop price and are forced to hold the position overnight?

04 Regarding stop-loss settings, which one would be more beneficial for successful trading: one 10 percent stop-loss or two 5 percent stop-loss settings?

05 Can you tell me about a trade that failed due to poor analysis? And why?

06 When the stock price moves against your expectations and you record a loss, do you gradually reduce your position, or do you sell the entire position at once?

07 Do you place stop-loss orders in advance through your broker, or do you trade with mental stops?

It seems like market makers are aiming their guns at stop orders.

Especially when the market starts with a gap down.

08 If a stock price has formed a breakout, but a clear support line is 15-20 percent below the price, what stop would you use? Would a 10 percent stop allow sufficient risk control while still leaving ample room for profit?

09 What should you do if the stock price hits your stop price with weak trading volume? Do you sell to cut your losses, or do you hold on and give yourself a little more leeway?

10 How do you handle situations where trades are automatically closed in a volatile market?

11. What do you do when an unexpected event occurs? For example, what if you buy at $20 and place a stop loss at $19, but news causes a $15 gap down?

[SECTION 9] Transaction Management

01 Do you trade while maintaining your core holding positions?

02 Can you tell me more about your recent successful and unsuccessful transactions?

03 How long do you view your trades? How long do you typically hold momentum stocks?

04 Would you like to buy more when the position price falls?

05 How much higher does the price have to be compared to the entry price to be considered an expansion stage where no further purchases are made?

06 Would you buy more stocks that have generated significant profits when they meet the trading requirements again?

07 Do you also buy put options to hedge against a stock that has made a lot of money when you don't want to sell it for tax purposes, or when you don't expect a large market pullback?

08 When you reach your desired profit, do you gradually sell with a trailing stop?

09 Should I use trailing stops when I can't watch the market all day?

10. When you get close to reaching your target profit, do you adjust your stop price? In other words, do you adjust your stop price to break-even, or do you keep it at the initial price?

Do you partially liquidate your positions when they reach their target profit, or do you only sell when the charts indicate you should?

Would you sell a stock that shows a bearish trend before reaching the 12-stop price? Why would you sell early?

13 Have you ever sold stocks because of a mistake or poor decision?

14 How do you determine when to sell a high-yield stock that has risen significantly and then started to decline, especially when the uptrend is still intact?

15 When a winning stock is strong, how do you walk that delicate balance between taking profits and holding on?

16 Are there times when you hold a position for a bigger move instead of selling it to realize swing trading profits?

17 Do you also use time stops?

18. How do you handle your positions during earnings periods? Do you hold, reduce, or sell stocks when earnings are announced? Or do you hold and immediately sell when a gap appears below your stop price?

19. If a new stock that meets the trading requirements appears while all funds are invested, do you sell your existing position? If so, which one do you sell first? The highest performing one or the lowest performing one?

How do you manage a position in a stock that rises more than 20 percent in a few days or weeks?

21. How do you manage successful trades? What types of sell signals do you use?

[SECTION 10] Psychology

01 How do I combat the urge to over-tradeal? When is it time to let go and do nothing?

02 Can you help me avoid analysis paralysis and give me some advice that will help me actually take action?

03 How do you gain the confidence to pull the trigger for a big position?

04 What do I do when I have a series of losses? How do I adjust my trading?

05 You seem to have been using the same strategy for a long time. How did you avoid style drift, where you strayed from your investment principles and became lax?

Do you ever stray from Principle 06? What causes you to lose focus? And how do you get back on track?

07 Do you prefer to own a few big winners even if you have many small losers, or is it more important to have a large number of winning stocks to maintain a positive mindset?

08 How do you know when your strategy is broken, especially when the market is not favorable?

09 You have all experienced loss.

What was behind your incredibly positive attitude and such strong belief that your method would ultimately work? It must have been a time when it wasn't easy to learn how to beat the market or learn from others.

10. Do you conduct post-mortem analysis? If so, could you explain the process and how you use the information to improve your trading?

[SECTION 11] Conclusion

01 What was the biggest obstacle to becoming a successful trader?

02 When thinking about your learning curve, what helped you the most? Trial and error, a trading book, a mentor, or something else?

03 Do you think you need a mentor or a teacher?

04 What was the most important moment of "realization" in your trading life?

05 What are the top 5 trading rules?

06 Why do ordinary investors fail to achieve great results?

07 What advice would you give to new traders?

PROLOGUE

INTERVIEWEE

[SECTION 1] Introduction

01 You have all been trading for a long time.

Are you still using the same chart patterns and trading methods as when you first started trading, or has your trading style evolved with the times?

02 What's your daily routine like? Has your routine changed over time?

03 What are your thoughts on high-frequency trading?

04 How did you first enter the world of trading? What attracted you to it? What motivated you to continue on for so long?

05 Did you become a successful trader right away, or did you go through some difficult times? How long did it take you to become consistently profitable?

06 Do large investors have any advantages over individual investors? How would you respond to claims that the game is rigged?

07 Can an investor who has a job and must trade only based on the closing price still be a successful trader?

If you can't sit in front of your computer during the 8th session, how would you enter and exit positions?

09 Do you use margin or options for leverage?

10. Is top-level trading a natural talent, or can it be learned? How long is the learning curve?

11 Can you get rich through stock trading even with a small amount of money?

[SECTION 2] Selecting a stock

01 What's the best way to find momentum stocks with high upside potential?

02 Is there a minimum trading volume requirement to consider trading?

03 Has dark pools ever changed your trading volume analysis?

04 Do you use low-price buying techniques?

05 What about price limits? Do you buy low-priced stocks? If so, do you trade them differently than you would with high-priced stocks?

06 When selecting individual stocks, do you use a "bottom-up" approach, or do you first identify groups you believe are market leaders and then select individual stocks within those groups?

07 How do I find a leading industry group?

08 Do you trade IPO stocks? How do you define momentum for stocks with little trading history?

09 Are the criteria for selecting large-cap funds different from those for selecting small-cap funds? If so, how?

Do you take short positions in 10 stocks? How do you decide when to go short? Do you sometimes hold both long and short positions simultaneously?

11. Do you ever find yourself waiting for a buy signal from a favorite stock on your watchlist, putting other stocks on hold to trade that stock?

[SECTION 3] Position Size

01 How many stocks do you typically hold? Do you think you should focus on a small number of stocks, or diversify your investments?

02 How much is the risk exposure per transaction compared to capital?

03 If you use up all your capital, how many positions will you have?

04 What is the maximum position size? Have you ever invested your entire account in one stock?

05 What percentage of equity is the minimum position typically traded?

06 Is the position size for each transaction determined based on the risk exposure amount or a certain percentage?

07 As your account balance grows throughout the year, do you increase your position size accordingly, or do you maintain the same amount of risk exposure per trade throughout the year?

08 What confidence do you need to enter a large position?

09 How do you assess the "qualitative requirements" required to enter a trade? If one stock has higher investment value than another, how do you quantify this? Or do you keep all positions the same size?

[SECTION 4] Technical Analysis

01 How do you move from the interest stage to the actual buy stage? What aspects of price and volume do you specifically look for before buying?

02 If price movements are good in a bull market, do you invest even if the fundamentals are poor?

03 If a stock's fundamentals are weak but its relative strength is at a 52-week high, can it be considered a market leader? Some argue that high relative strength requires corresponding performance.

04 I understand that you should consider buying when the stock is in an upward trend.

How do you define an uptrend?

05 Are there any indicators you use, such as Stochastic, MACD, or ATR?

06 From a technical analysis perspective, what aspect do you consider most important when buying?

07 When entering a stock with momentum, should I buy at a pullback or a breakout?

08 How do you define a breakout?

We've had a lot of false breakouts going back to the 09 base area.

If we add 10-20 cents to the buy point price, can we avoid getting caught in a false breakout?

10 Have you ever entered a buy position when the stock price was moving sideways and there was not much volume, or did you wait for the price to break out of the range?

11 What do you think about stocks that continue to hit new highs despite low trading volume?

If the opening price was formed within the previous day's trading range, broke through the buy point, and rose, but the closing volume was average or below average, should this be considered a warning signal?

13 How do you evaluate a stock when its price moves early but there is insufficient information about trading volume?

14 Do you buy at breakouts or pivot points even when there is no significant volume and see the volume follow later?

Why don't you wait until the 15th chapter closes or when significant volume is evident before buying? 16. Do you set a maximum selling grace period after buying, when volume has stopped flowing in and the price is no longer rising?

17 Is there a standard period or percentage of average volume that you use as a reference when judging the volume on the day a breakout appears?

18 How far down are you willing to go when the stock either pulls back shortly after a breakout or falls below the breakout level?

19 How many trading requirements or chart patterns do you usually set?

[SECTION 5] Fundamental Analysis

01 Do you look at the charts after finding stocks that meet the fundamental requirements, or is it the other way around?

02 How much time do you usually spend on research before making a purchase?

03 Where do you get your research and news? How do you use the news in your actual trading?

04 How many stocks do you usually research or browse in a day?

05 Do you think that the same forces that moved the markets long ago still move the markets today?

06 What do you look for in fundamentals when taking a short position?

07 How do you measure performance momentum?

08 Do you need high or accelerating growth rates?

09 Do you use profit margin or return on equity?

10 Momentum stocks are often high-growth, high-P/E stocks.

Have you ever found a low P/E momentum stock?

Which is more important: quarterly profits or long-term growth? Or do you need both, or neither?

[SECTION 6] Market

01 Can trading techniques be applied to indices as well, or only to stocks?

02 Do you try to time the market? Do you have any tools or indicators you monitor to gauge the market?

03 How do I select stocks to sell when a sell signal appears in the market?

04 When the market starts to decline, do you tend to take profits on marginal stocks? Do you adjust your stop order to the break-even price, or do you let the stop order trigger at the initial stop-loss price?

05 If the market is in a downtrend and you see a good upward chart, do you buy the stock or just watch?

06 How do I know if the market is in a distribution or accumulation phase? And how do I leverage this for trading?

07 What aspects of investing do you look for and invest more aggressively? How do you know when it's time to step on the accelerator?

If the stock price had formed a breakout before the FTD occurred, would you buy the stock? If so, would you buy the entire position planned before the FTD occurred?

[SECTION 7] Entry Requirements

01 What aspects of a stock are of interest to you when considering a purchase?

02 Do you buy all at once, or do you buy in portions and then gradually add more? When the stock price moves unfavorably, do you gradually sell, or do you sell everything at once?

03 When a breakout occurs, how high above the breakout price do you buy? Or do you wait until the closing price?

04 How do you go from holding cash to fully investing?

05 How do you manage when trading a large number of stocks? What if four or five of your 15 favorites break out?

06 How do you define the entry point?

07 Do you trade stocks that have recently suffered losses? What are your re-entry plans?

08 What if the stock price on the day hits the initial entry price again after the trade ends unexpectedly?

09 Do you think you should use pullbacks when entering momentum stocks?

Do you have any advice on adding high-yielding stocks?

Do you buy when a gap occurs? If so, what do you do if a gap forms after the market opens, outside your buy point?

[SECTION 8] RISK MANAGEMENT

01 How do I determine the stop price placement?

02 Is there a maximum risk tolerance set as a percentage of total capital?

03 How do you manage the risk of a gap forming even though you've set a strict stop price and are forced to hold the position overnight?

04 Regarding stop-loss settings, which one would be more beneficial for successful trading: one 10 percent stop-loss or two 5 percent stop-loss settings?

05 Can you tell me about a trade that failed due to poor analysis? And why?

06 When the stock price moves against your expectations and you record a loss, do you gradually reduce your position, or do you sell the entire position at once?

07 Do you place stop-loss orders in advance through your broker, or do you trade with mental stops?

It seems like market makers are aiming their guns at stop orders.

Especially when the market starts with a gap down.

08 If a stock price has formed a breakout, but a clear support line is 15-20 percent below the price, what stop would you use? Would a 10 percent stop allow sufficient risk control while still leaving ample room for profit?

09 What should you do if the stock price hits your stop price with weak trading volume? Do you sell to cut your losses, or do you hold on and give yourself a little more leeway?

10 How do you handle situations where trades are automatically closed in a volatile market?

11. What do you do when an unexpected event occurs? For example, what if you buy at $20 and place a stop loss at $19, but news causes a $15 gap down?

[SECTION 9] Transaction Management

01 Do you trade while maintaining your core holding positions?

02 Can you tell me more about your recent successful and unsuccessful transactions?

03 How long do you view your trades? How long do you typically hold momentum stocks?

04 Would you like to buy more when the position price falls?

05 How much higher does the price have to be compared to the entry price to be considered an expansion stage where no further purchases are made?

06 Would you buy more stocks that have generated significant profits when they meet the trading requirements again?

07 Do you also buy put options to hedge against a stock that has made a lot of money when you don't want to sell it for tax purposes, or when you don't expect a large market pullback?

08 When you reach your desired profit, do you gradually sell with a trailing stop?

09 Should I use trailing stops when I can't watch the market all day?

10. When you get close to reaching your target profit, do you adjust your stop price? In other words, do you adjust your stop price to break-even, or do you keep it at the initial price?

Do you partially liquidate your positions when they reach their target profit, or do you only sell when the charts indicate you should?

Would you sell a stock that shows a bearish trend before reaching the 12-stop price? Why would you sell early?

13 Have you ever sold stocks because of a mistake or poor decision?

14 How do you determine when to sell a high-yield stock that has risen significantly and then started to decline, especially when the uptrend is still intact?

15 When a winning stock is strong, how do you walk that delicate balance between taking profits and holding on?

16 Are there times when you hold a position for a bigger move instead of selling it to realize swing trading profits?

17 Do you also use time stops?

18. How do you handle your positions during earnings periods? Do you hold, reduce, or sell stocks when earnings are announced? Or do you hold and immediately sell when a gap appears below your stop price?

19. If a new stock that meets the trading requirements appears while all funds are invested, do you sell your existing position? If so, which one do you sell first? The highest performing one or the lowest performing one?

How do you manage a position in a stock that rises more than 20 percent in a few days or weeks?

21. How do you manage successful trades? What types of sell signals do you use?

[SECTION 10] Psychology

01 How do I combat the urge to over-tradeal? When is it time to let go and do nothing?

02 Can you help me avoid analysis paralysis and give me some advice that will help me actually take action?

03 How do you gain the confidence to pull the trigger for a big position?

04 What do I do when I have a series of losses? How do I adjust my trading?

05 You seem to have been using the same strategy for a long time. How did you avoid style drift, where you strayed from your investment principles and became lax?

Do you ever stray from Principle 06? What causes you to lose focus? And how do you get back on track?

07 Do you prefer to own a few big winners even if you have many small losers, or is it more important to have a large number of winning stocks to maintain a positive mindset?

08 How do you know when your strategy is broken, especially when the market is not favorable?

09 You have all experienced loss.

What was behind your incredibly positive attitude and such strong belief that your method would ultimately work? It must have been a time when it wasn't easy to learn how to beat the market or learn from others.

10. Do you conduct post-mortem analysis? If so, could you explain the process and how you use the information to improve your trading?

[SECTION 11] Conclusion

01 What was the biggest obstacle to becoming a successful trader?

02 When thinking about your learning curve, what helped you the most? Trial and error, a trading book, a mentor, or something else?

03 Do you think you need a mentor or a teacher?

04 What was the most important moment of "realization" in your trading life?

05 What are the top 5 trading rules?

06 Why do ordinary investors fail to achieve great results?

07 What advice would you give to new traders?

Detailed image

Into the book

I believe trading is no different from exercising.

Some people have genetic strengths—muscle mass, agility, etc.

But that alone won't get you to the ultimate result.

There are geniuses who live unsuccessful lives, and there are athletes who have natural talent but never develop it.

On the other hand, there are people who start out with weaknesses, like me, but achieve high levels.

As for the learning curve, we have some good news for you.

Thanks to the internet and social media, we now have access to an incredible amount of information, unlike before.

If you can filter out the noise and separate the wheat from the chaff, you'll come into contact with some very important people who can significantly reduce the time it takes to learn proper trading methods.

But let's not misunderstand.

Nothing can replace real experience—you can't force it—and it takes time to build it.

It depends on how much time and dedication you put into trading, but generally speaking, the learning curve will take at least five years.

--- p.56~57

Every time I enter a new trade, I calculate the loss I can afford if a gap down occurs tomorrow.

I don't want to manage my losses before I start trading, I want to manage them after I start trading.

Once you feel comfortable with the potential loss amount, consider the stock's liquidity.

This is because it directly affects how quickly you can exit a position when the stock suddenly declines.

Only then do we move on to the crucial final step.

If it's a high-quality company with a solid global presence and good performance, you can invest up to 20 percent of your portfolio in that stock.

When the market moves strongly overall, an average of 5 to 7 percent per stock is sufficient, but in stocks with very strong movements, invest more.

You need to have a good feel for the market to determine the optimal position size.

That kind of instinctive feeling will only come after you've run the washing machine a few times, emptying your pockets of change every time it comes out, and finally, after doing your laundry cleanly.

--- p.110~111

The stock that made a loss is the first stock to be exported.

If the performance after purchase was not good, it will not show good movement even when the market environment is bad.

When the market is going downhill overall, reduce your position by selling stocks in order from the weakest to the strongest.

A good stock will resist most market downturns.

I try to hold these stocks for as long as possible because they may continue to rise when the next bull market begins.

--- p.202

This is what I always try to do better at.

I usually try to maintain key positions in one of two ways.

First, buy when the stock has not yet moved significantly. Then, when consolidation occurs and the stock's trading volume increases, if the stock does not rise, reduce the position. Then, repurchase when the stock price rises again.

The other scenario, which I prefer, is where I partially sell my position when the return is more than double my risk, and then later buy back the portion I sold when the stock moves well and the consolidation phase becomes constructive again.

--- p.280

This is precisely why my approach is based on timeless truths.

I eliminate one important question mark, what I also call the 'strategic factor'.

Then the problem is limited to the most important variable: myself.

I have always taken responsibility for the results and never blamed external factors.

If you can be objective and learn from your mistakes, you will eventually acquire the right knowledge.

After that, it's a matter of training.

You have to believe in your abilities and dedicate yourself to it.

Forget about watches.

It takes time to become good enough at something to be useful, and the amount of time it takes varies from person to person.

If you still can't get the hang of it after a year, take two years. If you still can't get the hang of it after two years, take three years. Keep taking your time like that.

If you set a deadline and say, “If I can’t get it done by x amount of time,” then your fate is already sealed.

Life rewards those who are unconditionally dedicated and committed.

There are many ways to exploit the market.

But ultimately, what matters is not the gun, but the gunman.

Some people have genetic strengths—muscle mass, agility, etc.

But that alone won't get you to the ultimate result.

There are geniuses who live unsuccessful lives, and there are athletes who have natural talent but never develop it.

On the other hand, there are people who start out with weaknesses, like me, but achieve high levels.

As for the learning curve, we have some good news for you.

Thanks to the internet and social media, we now have access to an incredible amount of information, unlike before.

If you can filter out the noise and separate the wheat from the chaff, you'll come into contact with some very important people who can significantly reduce the time it takes to learn proper trading methods.

But let's not misunderstand.

Nothing can replace real experience—you can't force it—and it takes time to build it.

It depends on how much time and dedication you put into trading, but generally speaking, the learning curve will take at least five years.

--- p.56~57

Every time I enter a new trade, I calculate the loss I can afford if a gap down occurs tomorrow.

I don't want to manage my losses before I start trading, I want to manage them after I start trading.

Once you feel comfortable with the potential loss amount, consider the stock's liquidity.

This is because it directly affects how quickly you can exit a position when the stock suddenly declines.

Only then do we move on to the crucial final step.

If it's a high-quality company with a solid global presence and good performance, you can invest up to 20 percent of your portfolio in that stock.

When the market moves strongly overall, an average of 5 to 7 percent per stock is sufficient, but in stocks with very strong movements, invest more.

You need to have a good feel for the market to determine the optimal position size.

That kind of instinctive feeling will only come after you've run the washing machine a few times, emptying your pockets of change every time it comes out, and finally, after doing your laundry cleanly.

--- p.110~111

The stock that made a loss is the first stock to be exported.

If the performance after purchase was not good, it will not show good movement even when the market environment is bad.

When the market is going downhill overall, reduce your position by selling stocks in order from the weakest to the strongest.

A good stock will resist most market downturns.

I try to hold these stocks for as long as possible because they may continue to rise when the next bull market begins.

--- p.202

This is what I always try to do better at.

I usually try to maintain key positions in one of two ways.

First, buy when the stock has not yet moved significantly. Then, when consolidation occurs and the stock's trading volume increases, if the stock does not rise, reduce the position. Then, repurchase when the stock price rises again.

The other scenario, which I prefer, is where I partially sell my position when the return is more than double my risk, and then later buy back the portion I sold when the stock moves well and the consolidation phase becomes constructive again.

--- p.280

This is precisely why my approach is based on timeless truths.

I eliminate one important question mark, what I also call the 'strategic factor'.

Then the problem is limited to the most important variable: myself.

I have always taken responsibility for the results and never blamed external factors.

If you can be objective and learn from your mistakes, you will eventually acquire the right knowledge.

After that, it's a matter of training.

You have to believe in your abilities and dedicate yourself to it.

Forget about watches.

It takes time to become good enough at something to be useful, and the amount of time it takes varies from person to person.

If you still can't get the hang of it after a year, take two years. If you still can't get the hang of it after two years, take three years. Keep taking your time like that.

If you set a deadline and say, “If I can’t get it done by x amount of time,” then your fate is already sealed.

Life rewards those who are unconditionally dedicated and committed.

There are many ways to exploit the market.

But ultimately, what matters is not the gun, but the gunman.

--- p.354

Publisher's Review

The secrets of momentum traders who beat the market!

(Mark Minervini, David Ryan, Dan Zanger, Mark Ritchie Jr.)

It would be great if you could learn all the trading secrets of a master who wrote a book, but that rarely happens.

To fully understand, more experience may be needed, and additional reading of many books may be required several times.

And even if we do that, there will often be times when it will be difficult to properly apply it in practice.

This book is based on the experiences of such meticulous traders.

The heart of this book is not the questions, but the answers.

When readers ask Mark Minervini questions about trading, he felt it was better to share his insights with three accomplished traders rather than answer them alone, resulting in a fascinating chapter in this book.

If you ask what's so great about this being just a question and answer session, I can't help but talk about the people involved.

David Ryan, a disciple of William O'Neil and his direct assistant, won the U.S. Investment Championship three years in a row from 1985 to 1987.

In 1985, it returned 161%, and in 1986, it returned almost the same at 160%.

He also recorded returns exceeding 100% in 1987, bringing his total return over three years to 1,379%.

Dan Zanger is the senior technical analyst at ChartPatternDasum and author of the Zanger Report newsletter. In the late 1990s, he turned $17,775 into $18 million (based on audited financial statements) in 18 months.

That's a whopping 164,000% return.

He was selected as one of the 'Top 100 Traders of the Year' by Monthly Trader for two consecutive years.

Mark Ritchie Jr. won Mark Minervini's triple-digit return contest in 2010, returning 100% in less than six months.

Since then, Ritchie's account has increased by 540%.

He returned 110% in 2014 alone, and his total returns since 2010 have exceeded 1,000%.

He is also the only one among the four with monthly returns from 2011 to 2022 (42.7% annual compound return over 11 and a half years).

They sit around a round table and each question is answered with their own trade secrets.

As you can see from the book, each of them approaches the interview with an honest and clear attitude.

Why Most Investors Fail

A book that contains the clearest answer to that question

Let's talk a little more.

So what makes this book so great? These are all momentum traders who have beaten the market, but their styles are slightly different.

Mark Minervini and David Ryan favor high-growth small- and mid-cap stocks, while Dan Zanger favors large- and mega-cap stocks.

Unlike the three before him, Mark Ritchie Jr. is not afraid to swing trade.

While David Ryan doesn't day trade, Mark Ritchie Jr. does day trade occasionally.

This book contains their solid trading standards.

Surprisingly, they don't hide it.

As author Kang Hwan-guk recommends, the highlight of this book is comparing how these four great traders answered each question.

It is an opportunity to look into their similarities and differences.

What we need to look at more closely are the similarities rather than the differences.

There are some questions that feel like no one is answering without hesitation.

This is the case for the fourth question in Chapter 2.

When asked if they buy at a low price, all four of them answer firmly, “No!”

These answers, while there is no right answer in the stock market, can provide a baseline.

Meanwhile, there are many answers that seem slightly similar but are different, which may be the point that arouses the readers' interest the most.

For example, in the fourth question of Chapter 4, “How do you define an uptrend?” Minervini answers indirectly, “I never go long a stock when its 200-day moving average is falling,” while Ryan answers clearly, “I define an uptrend as when the 50-day moving average is above the 200-day moving average and both are rising.”

The answers of Zange and Ritchie II are also clear.

“For me, a stock in an uptrend is one that makes higher highs and lower lows in a step-by-step manner, establishing a solid and solid price range before moving up a rung,” says Zanger. “Unless it’s trading above its 50-day, 150-day, or 200-day moving averages—in other words, not in a long-term uptrend—I wouldn’t consider buying it,” says Rich Jr.

You can discover unique insights from the seemingly similar yet slightly different answers of others. As author systrader79 says, you'll feel like you're receiving a 1:4 private trading lesson just for you.

Personally, I was deeply impressed by the 19th question in Chapter 4 and the first question in Chapter 3, but I chose Chapter 3, Position Sizing, and Chapter 8, Risk Management, as the book's highlights.

Because I was convinced that the lack of knowledge in these two areas was a major reason why most investors fail.

Here are just a few to consider:

1.

They never lose more than 2.5% of their total assets in any one stock.

There were also investors who did not lose more than 0.5%.

2.

There wasn't a single investor who didn't cut their losses on stocks that had fallen more than 10% from their purchase price, and most said they cut their losses much sooner.

3.

Never invest more than 25% in any one stock.

Usually, I buy much smaller amounts than this, only buying more when the price goes up, and never riding the wave.

As author Kang Hwan-guk says, if you just properly understand the traders' answers to the questions, you can earn 1,000 times the price of the book.

I hope you read the answer yourself and think about it several times.

(Mark Minervini, David Ryan, Dan Zanger, Mark Ritchie Jr.)

It would be great if you could learn all the trading secrets of a master who wrote a book, but that rarely happens.

To fully understand, more experience may be needed, and additional reading of many books may be required several times.

And even if we do that, there will often be times when it will be difficult to properly apply it in practice.

This book is based on the experiences of such meticulous traders.

The heart of this book is not the questions, but the answers.

When readers ask Mark Minervini questions about trading, he felt it was better to share his insights with three accomplished traders rather than answer them alone, resulting in a fascinating chapter in this book.

If you ask what's so great about this being just a question and answer session, I can't help but talk about the people involved.

David Ryan, a disciple of William O'Neil and his direct assistant, won the U.S. Investment Championship three years in a row from 1985 to 1987.

In 1985, it returned 161%, and in 1986, it returned almost the same at 160%.

He also recorded returns exceeding 100% in 1987, bringing his total return over three years to 1,379%.

Dan Zanger is the senior technical analyst at ChartPatternDasum and author of the Zanger Report newsletter. In the late 1990s, he turned $17,775 into $18 million (based on audited financial statements) in 18 months.

That's a whopping 164,000% return.

He was selected as one of the 'Top 100 Traders of the Year' by Monthly Trader for two consecutive years.

Mark Ritchie Jr. won Mark Minervini's triple-digit return contest in 2010, returning 100% in less than six months.

Since then, Ritchie's account has increased by 540%.

He returned 110% in 2014 alone, and his total returns since 2010 have exceeded 1,000%.

He is also the only one among the four with monthly returns from 2011 to 2022 (42.7% annual compound return over 11 and a half years).

They sit around a round table and each question is answered with their own trade secrets.

As you can see from the book, each of them approaches the interview with an honest and clear attitude.

Why Most Investors Fail

A book that contains the clearest answer to that question

Let's talk a little more.

So what makes this book so great? These are all momentum traders who have beaten the market, but their styles are slightly different.

Mark Minervini and David Ryan favor high-growth small- and mid-cap stocks, while Dan Zanger favors large- and mega-cap stocks.

Unlike the three before him, Mark Ritchie Jr. is not afraid to swing trade.

While David Ryan doesn't day trade, Mark Ritchie Jr. does day trade occasionally.

This book contains their solid trading standards.

Surprisingly, they don't hide it.

As author Kang Hwan-guk recommends, the highlight of this book is comparing how these four great traders answered each question.

It is an opportunity to look into their similarities and differences.

What we need to look at more closely are the similarities rather than the differences.

There are some questions that feel like no one is answering without hesitation.

This is the case for the fourth question in Chapter 2.

When asked if they buy at a low price, all four of them answer firmly, “No!”

These answers, while there is no right answer in the stock market, can provide a baseline.

Meanwhile, there are many answers that seem slightly similar but are different, which may be the point that arouses the readers' interest the most.

For example, in the fourth question of Chapter 4, “How do you define an uptrend?” Minervini answers indirectly, “I never go long a stock when its 200-day moving average is falling,” while Ryan answers clearly, “I define an uptrend as when the 50-day moving average is above the 200-day moving average and both are rising.”

The answers of Zange and Ritchie II are also clear.

“For me, a stock in an uptrend is one that makes higher highs and lower lows in a step-by-step manner, establishing a solid and solid price range before moving up a rung,” says Zanger. “Unless it’s trading above its 50-day, 150-day, or 200-day moving averages—in other words, not in a long-term uptrend—I wouldn’t consider buying it,” says Rich Jr.

You can discover unique insights from the seemingly similar yet slightly different answers of others. As author systrader79 says, you'll feel like you're receiving a 1:4 private trading lesson just for you.

Personally, I was deeply impressed by the 19th question in Chapter 4 and the first question in Chapter 3, but I chose Chapter 3, Position Sizing, and Chapter 8, Risk Management, as the book's highlights.

Because I was convinced that the lack of knowledge in these two areas was a major reason why most investors fail.

Here are just a few to consider:

1.

They never lose more than 2.5% of their total assets in any one stock.

There were also investors who did not lose more than 0.5%.

2.

There wasn't a single investor who didn't cut their losses on stocks that had fallen more than 10% from their purchase price, and most said they cut their losses much sooner.

3.

Never invest more than 25% in any one stock.

Usually, I buy much smaller amounts than this, only buying more when the price goes up, and never riding the wave.

As author Kang Hwan-guk says, if you just properly understand the traders' answers to the questions, you can earn 1,000 times the price of the book.

I hope you read the answer yourself and think about it several times.

GOODS SPECIFICS

- Date of issue: October 31, 2023

- Page count, weight, size: 380 pages | 674g | 152*225*23mm

- ISBN13: 9791193394052

- ISBN10: 1193394058

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)