The 100-Billion Stock Immutable Law

|

Description

Book Introduction

How do investment returns explode?

The original "100-Bag Stock," a hot topic on Amazon

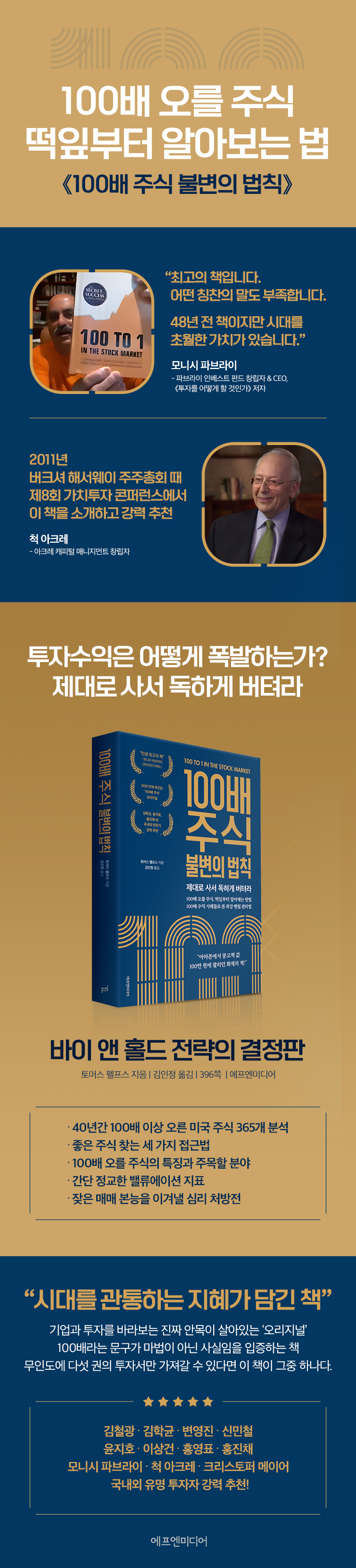

The definitive 'buy and hold' strategy

Mohnish Pabrai, a value investing guru and Warren Buffett's protégé, called this book "one of the best books I've ever read" (2022 CNBC interview).

Chuck Acre, who popularized the concept of the compounding machine, introduced and strongly recommended this book at the Value Investing Conference held at the 2011 Berkshire Hathaway annual shareholder meeting.

Why are such stellar value investors so enthusiastic about this 1972 book about "100-bagger stocks"?

However, the investment method presented in 『The 100-Billion Stock Immutable Law』 is very simple.

In short, buy and hold, 'buy properly and hold on tight.'

To achieve this, we've included three approaches to finding good stocks, the characteristics of stocks that will rise 100-fold and areas to watch, simple and sophisticated valuation indicators, and a psychological prescription to overcome the instinct to trade frequently.

This book went out of print after its publication in 1972, but gained attention again in the 21st century with recommendations from investment experts.

The first edition was officially republished in January 2015, gaining popularity with used copies being sold for 1 million won on Amazon.

Around the same time, Christopher Mayer self-published his book 100 Baggers, inspired by this book, and devoted a chapter to introducing the book and praising its author, Phelps.

Domestic investment experts unanimously agreed that this was “a book filled with timeless wisdom.”

Kim Hak-gyun, head of the research center at Shinyoung Securities, said, “After reading the entire manuscript, my awkwardness about the expression ‘100-fold stock’ disappeared,” and recommended the book, saying, “It is a book with great virtue for investors.”

He also praised the book, saying, “It is not a shallow book that once rode the bull market, but a book that provides wisdom and inspiration that transcends the times” (Hong Jin-chae, CEO of Raccoon Asset Management) and “It is a book that proves that the phrase 100x is not magic but fact” (Yoon Ji-ho, CEO of LS Securities Retail Business Division).

The original "100-Bag Stock," a hot topic on Amazon

The definitive 'buy and hold' strategy

Mohnish Pabrai, a value investing guru and Warren Buffett's protégé, called this book "one of the best books I've ever read" (2022 CNBC interview).

Chuck Acre, who popularized the concept of the compounding machine, introduced and strongly recommended this book at the Value Investing Conference held at the 2011 Berkshire Hathaway annual shareholder meeting.

Why are such stellar value investors so enthusiastic about this 1972 book about "100-bagger stocks"?

However, the investment method presented in 『The 100-Billion Stock Immutable Law』 is very simple.

In short, buy and hold, 'buy properly and hold on tight.'

To achieve this, we've included three approaches to finding good stocks, the characteristics of stocks that will rise 100-fold and areas to watch, simple and sophisticated valuation indicators, and a psychological prescription to overcome the instinct to trade frequently.

This book went out of print after its publication in 1972, but gained attention again in the 21st century with recommendations from investment experts.

The first edition was officially republished in January 2015, gaining popularity with used copies being sold for 1 million won on Amazon.

Around the same time, Christopher Mayer self-published his book 100 Baggers, inspired by this book, and devoted a chapter to introducing the book and praising its author, Phelps.

Domestic investment experts unanimously agreed that this was “a book filled with timeless wisdom.”

Kim Hak-gyun, head of the research center at Shinyoung Securities, said, “After reading the entire manuscript, my awkwardness about the expression ‘100-fold stock’ disappeared,” and recommended the book, saying, “It is a book with great virtue for investors.”

He also praised the book, saying, “It is not a shallow book that once rode the bull market, but a book that provides wisdom and inspiration that transcends the times” (Hong Jin-chae, CEO of Raccoon Asset Management) and “It is a book that proves that the phrase 100x is not magic but fact” (Yoon Ji-ho, CEO of LS Securities Retail Business Division).

- You can preview some of the book's contents.

Preview

index

Recommendation | A Classic that Survived the Bubble Era_ Hong Jin-chae

Publisher's Preface to the Reissue | A Classic Still Relevant Half a Century Later

Introduction | 100 times true

Chapter 1: Seek and you shall find

Chapter 2: Sinbad's Diamond Valley

Chapter 3 What the Elephant Taught Me

Chapter 4 Lemmings travel in groups

Chapter 5: Foresight vs. Perseverance

Chapter 6: The Globe and Rutgers I Want to Die For

Chapter 7: Trees do not grow infinitely.

Chapter 8: How to Win an Argument

Chapter 9: Calculating Probabilities

Chapter 10: The Quality of Profits Declines

Chapter 11: Manipulation Occurs Even with Oversight

Chapter 12: Watch the Random Walk

Chapter 13: Sometimes Lessons Are Poisonous

Chapter 14: Why Computers Won't Take Over the World

Chapter 15: The Benefits of Ethics

Chapter 16: The Almighty Self vs. Almighty Money

Chapter 17: There's No Pill to Control Inflation

Chapter 18 Choosing the Right One

Chapter 19 Where Are the Winners?

Chapter 20: What is far away is always fascinating.

Chapter 21: It's Not Too Late

Chapter 22: Cheers for the Young Generation

Chapter 23: How to Never Miss Your Next Opportunity

Chapter 24: Buying and Holding Properly - Practice

Chapter 25 Can You Do It Yourself?

Chapter 26: Understanding Values

Chapter 27: What Makes Stocks Grow?

Chapter 28: How to Identify and Evaluate True Growth

supplement

[Table 1] 365 stocks with a 100x yield (trading market, price, 1971 market valuation)

[Table 2] 100x stocks and stock prices

Publisher's Preface to the Reissue | A Classic Still Relevant Half a Century Later

Introduction | 100 times true

Chapter 1: Seek and you shall find

Chapter 2: Sinbad's Diamond Valley

Chapter 3 What the Elephant Taught Me

Chapter 4 Lemmings travel in groups

Chapter 5: Foresight vs. Perseverance

Chapter 6: The Globe and Rutgers I Want to Die For

Chapter 7: Trees do not grow infinitely.

Chapter 8: How to Win an Argument

Chapter 9: Calculating Probabilities

Chapter 10: The Quality of Profits Declines

Chapter 11: Manipulation Occurs Even with Oversight

Chapter 12: Watch the Random Walk

Chapter 13: Sometimes Lessons Are Poisonous

Chapter 14: Why Computers Won't Take Over the World

Chapter 15: The Benefits of Ethics

Chapter 16: The Almighty Self vs. Almighty Money

Chapter 17: There's No Pill to Control Inflation

Chapter 18 Choosing the Right One

Chapter 19 Where Are the Winners?

Chapter 20: What is far away is always fascinating.

Chapter 21: It's Not Too Late

Chapter 22: Cheers for the Young Generation

Chapter 23: How to Never Miss Your Next Opportunity

Chapter 24: Buying and Holding Properly - Practice

Chapter 25 Can You Do It Yourself?

Chapter 26: Understanding Values

Chapter 27: What Makes Stocks Grow?

Chapter 28: How to Identify and Evaluate True Growth

supplement

[Table 1] 365 stocks with a 100x yield (trading market, price, 1971 market valuation)

[Table 2] 100x stocks and stock prices

Detailed image

Into the book

When asked what makes a good stock, most people think of the company's performance.

It's not wrong.

But even if it doesn't make any profit at the moment, it can still be a good stock because of its assets.

Quality assets are potential profit generators.

Most people focus on performance.

--- p.72, Chapter 4.

From "Lemmings move in groups"

Like other 100-bagger stocks, Occidental's 1971 price was not its all-time high.

The 1971 high was nearly 60% lower than the 1968 high.

Despite this, these returns were achieved.

In the stock market, luck comes in many forms.

Humans cannot predict the future.

Therefore, we must 'buy and hold properly'.

--- pp.86-87, Chapter 5.

From "Foresight vs. Perseverance"

The fundamental error in using the PER for comparative purposes is the implicit assumption that corporate earnings, like stock prices, are comparable.

Prices are comparable as long as they are expressed in the same currency.

However, the quality and value of profits vary greatly from company to company, making it like comparing a running horse to a running cow.

--- p.144, Chapter 10.

From “The quality of profit is declining”

I figured that if I subtracted the date the uptrend ended from the date the uptrend started, I could find a 'signal' for the bottom of the next downtrend.

Likewise, I thought that if I subtracted the date the downtrend ended (12-5) from the date the downtrend started (2-13), I would be able to find a 'signal' for the upper price of the next uptrend.

That's actually true.

--- p.168, Chapter 12.

From "Watch the Random Walk"

Companies that increase capital expenditures despite low ROIC, claiming it is “to improve competitiveness,” are likely to have egonomists at the top.

If a company is more interested in its headquarters building than in sales and profits, sell it.

Egonomic executives are eating away at the very foundations of the company like termites.

--- p.205, Chapter 16.

From "Almighty Self vs. Almighty Money"

It has been said that parasites are the only living things that do not go extinct.

Default bonds are similar to parasites.

The worst case scenario is that defaults can persist for years until a rehabilitation process is initiated, or the issuing company is liquidated.

But those who buy defaulted bonds need not fear bad news in the morning paper.

--- p.237, from “Chapter 17: There is no pill to control inflation”

I have consistently emphasized the importance of 'low PER' to those seeking 100x return opportunities.

It is difficult to profit from a rise in PER by purchasing high PER stocks.

That profit has already been taken by someone else. The same goes for ROIC. While a low ROIC isn't a good sign, a rising ROIC can significantly boost performance.

--- p.290, Chapter 22.

From “Cheer for the Young Generation”

To buy a stock that will increase in value by at least 100 times in 40 years, you need to find a stock with an average annual increase of 12.2%.

If there was a year in which the stock price increase rate was below this level, it would have to be made up for in another year.

The average annual stock price increase rate for stocks that increase in value 50-fold after 40 years is 10.25%.

--- p.327, Chapter 25.

Can you do it yourself?

Failure to distinguish between temporary fluctuations in earnings and fundamental changes in profit-generating capacity can easily lead to missing out on opportunities for 100-fold returns in the stock market.

However, when analyzing companies in the securities industry, the focus is not on distinguishing between the two.

Why is that?

It's not wrong.

But even if it doesn't make any profit at the moment, it can still be a good stock because of its assets.

Quality assets are potential profit generators.

Most people focus on performance.

--- p.72, Chapter 4.

From "Lemmings move in groups"

Like other 100-bagger stocks, Occidental's 1971 price was not its all-time high.

The 1971 high was nearly 60% lower than the 1968 high.

Despite this, these returns were achieved.

In the stock market, luck comes in many forms.

Humans cannot predict the future.

Therefore, we must 'buy and hold properly'.

--- pp.86-87, Chapter 5.

From "Foresight vs. Perseverance"

The fundamental error in using the PER for comparative purposes is the implicit assumption that corporate earnings, like stock prices, are comparable.

Prices are comparable as long as they are expressed in the same currency.

However, the quality and value of profits vary greatly from company to company, making it like comparing a running horse to a running cow.

--- p.144, Chapter 10.

From “The quality of profit is declining”

I figured that if I subtracted the date the uptrend ended from the date the uptrend started, I could find a 'signal' for the bottom of the next downtrend.

Likewise, I thought that if I subtracted the date the downtrend ended (12-5) from the date the downtrend started (2-13), I would be able to find a 'signal' for the upper price of the next uptrend.

That's actually true.

--- p.168, Chapter 12.

From "Watch the Random Walk"

Companies that increase capital expenditures despite low ROIC, claiming it is “to improve competitiveness,” are likely to have egonomists at the top.

If a company is more interested in its headquarters building than in sales and profits, sell it.

Egonomic executives are eating away at the very foundations of the company like termites.

--- p.205, Chapter 16.

From "Almighty Self vs. Almighty Money"

It has been said that parasites are the only living things that do not go extinct.

Default bonds are similar to parasites.

The worst case scenario is that defaults can persist for years until a rehabilitation process is initiated, or the issuing company is liquidated.

But those who buy defaulted bonds need not fear bad news in the morning paper.

--- p.237, from “Chapter 17: There is no pill to control inflation”

I have consistently emphasized the importance of 'low PER' to those seeking 100x return opportunities.

It is difficult to profit from a rise in PER by purchasing high PER stocks.

That profit has already been taken by someone else. The same goes for ROIC. While a low ROIC isn't a good sign, a rising ROIC can significantly boost performance.

--- p.290, Chapter 22.

From “Cheer for the Young Generation”

To buy a stock that will increase in value by at least 100 times in 40 years, you need to find a stock with an average annual increase of 12.2%.

If there was a year in which the stock price increase rate was below this level, it would have to be made up for in another year.

The average annual stock price increase rate for stocks that increase in value 50-fold after 40 years is 10.25%.

--- p.327, Chapter 25.

Can you do it yourself?

Failure to distinguish between temporary fluctuations in earnings and fundamental changes in profit-generating capacity can easily lead to missing out on opportunities for 100-fold returns in the stock market.

However, when analyzing companies in the securities industry, the focus is not on distinguishing between the two.

Why is that?

--- p.349, Chapter 28.

From “How to Identify and Evaluate True Growth”

From “How to Identify and Evaluate True Growth”

Publisher's Review

"100-bagger stocks aren't fiction, they're fact."

The book begins with the statement, "It is not fiction but fact that there are hundreds of opportunities to make a million dollars by investing $10,000 in just one stock in the stock market and waiting."

As of 1971, there were over 360 U.S. stocks that would have been worth over $1 million if you had invested $10,000 a year in one stock for 32 of the previous 40 years.

The book introduces and analyzes these key cases.

There is a list of 100x stocks in the appendix.

"The one stock I bought right before retirement generated over 100x my return."

One particularly striking example is Paul Garrett, mentioned in Chapter 1. As a former vice president of marketing at GM, Garrett, at age 64 and approaching retirement, set out to identify stocks to invest in to make a quick buck.

Eventually, he chose 'Haloid' (now Xerox) and invested $133,000 in this stock over five years.

Even after donating $3 million to various organizations, including cancer research centers and universities, with his investment profits, he still had $14 million at the age of 80.

Converted to Korean Won in 2024, it is 146 billion won.

I invested in just one stock for 15 years and made over 100 times the profit.

Is there really only one chance to multiply your bet by 100? Garrett wasn't just lucky.

Looking at the cases the author investigated, the timing of purchase was not important in the difference in performance.

There are many cases where people ended up making 100 times their profits even if they bought at the highest price.

There are so many stocks like Eastman Kodak, Melville Shoe, Philip Morris, etc. that it would be tedious to list them all.

Sharp and Dome had the opportunity for 12 consecutive years from 1932 to 1943.

Even though you may have bought at the peak for 6 of those years, you still made a 100x return on your investment.

Even if you bought Frau (now Schering-Frau) in 1942 or at the latest in 1945, you would have made a hundredfold profit by 1971.

“Good stock selection beats timing,” the author says.

“Buy good stocks and take sleeping pills?!”

With so many 100-bagger stocks available, why is it so difficult to realize profits? It's because even if you buy a 100-bagger stock, you make the mistake of selling it too quickly.

The author emphasizes that 'holding (patience)' is more important than buying.

Even when I made poor stock choices, the wisdom of patience paid off.

There are many cases where even risky stocks such as Globe & Rutgers and Cullen Oil (now Commack) have brought in large profits if purchased and held.

There are many quotes that emphasize patience in investing, including Warren Buffett's famous quote, "The stock market is a mechanism for transferring money from the impatient to the patient" (1991 shareholder letter).

Beyond emphasizing "patience," author Phelps delves into human instincts and psychology, the collective delusions of the investment industry, and the systems that foster them, to come up with solutions.

The psychology of being tempted by small prey while pursuing big game, the phenomenon of mistaking profit taking for lost opportunities through short-term trading, the hindsight bias that leads to investing in places that would have been right in the past, and the instinct of fish to be lured by false bait are all interesting.

The author quotes author Josh Billings, who said, “The real problem isn’t that we don’t know, it’s that we get too much wrong.” He provides examples of investment errors and collective delusions.

In particular, he points out that the worst delusion in investing is the indiscriminate use and even misuse of PER to relatively evaluate various stocks, and suggests a solution.

Relative values include relative stock price, relative earnings, and relative PER.

"Needle in a haystack? Find 100-bagger stocks like this!"

The author has summarized the characteristics and fields of stocks that have a 100-fold return, as indicated by 40 years of records.

Times may change, and stocks and fields may change, but the characteristics of 100-bagger stocks and the perspectives on finding them are very worthwhile.

Chapter 19, “Where Are the Winners?” covers eight areas of 100-bagger stock hunting, four categories of 100-bagger stock characteristics, and a very detailed explanation of each.

One of the conclusions drawn here is that “for stock prices to grow 100-fold over 40 years, the average annual growth rate must be around 12.2%.”

It also presents the stock price growth rate required for the value to increase 100-fold in less than 40 years.

Chapter 21, “It’s Not Too Late,” discusses areas to watch when looking for future 100-bagger stocks.

He discusses fields such as nuclear energy, lasers, pollution reduction, and holograms, and some of the content is still relevant today, but what is important is the author's way of approaching the topic.

Times have changed and fields have changed, but “every human problem is an investment opportunity.”

The author's statement that "locks are sold because there are thieves" seems valid.

Insights for the Smart Investor

It's full of insights that stock investors looking to make a lot of money, even if it's not 100x, can't miss.

Chapter 15, “The Benefits of Ethics,” defines ethical investing and argues for its benefits.

It logically explains the direct link between corporate ethics and investment returns. Interesting examples of companies like J.C. Penney, Ford, and Dow Jones that have realized the benefits of ethics are also provided.

Chapter 17, “There is no pill to control inflation,” explains the economic knowledge that investors need to know.

We've extracted only the key points: currency, inflation, interest rates, bonds vs. stocks, etc.

It's easy and fun, backed by deep insight.

Propositions such as 'Taxes determine the value of money' and 'Inflation is the cruelest form of tax' are characteristic.

The 'Interest' section is about the leverage of your investment.

Selling Polaroid stock to pay hospital bills vs.

Taking out a bank loan, selling Xerox stock to build a house vs.

What's more valuable than taking out a bank loan? The value of debt (leverage) is easily explained with examples like this one of two couples traveling abroad.

Chapter 20 presents guidelines for overseas investment: “What is far away is always fascinating.”

Chapter 22, “Cheering for the Young Generation,” analyzes seven stocks that have generated 100-fold returns over a 10-year period.

Chapter 26, “Understanding Value,” uses the hen-and-egg analogy to easily explain discount rates and present value.

Chapter 28, “How to Identify and Evaluate True Growth,” distinguishes between profit and profit-generating capacity.

The entire book, right up to the last chapter, is packed with deep and informative content.

Domestic investment experts unanimously agreed that "this book offers timeless wisdom."

Kim Hak-gyun, head of the research center at Shinyoung Securities, said, “After reading the entire manuscript, my awkwardness about the expression ‘100-fold stock’ disappeared,” and recommended the book, saying, “It is a book with great virtue for investors.”

He also praised the book, saying, “It is not a shallow book that once rode the bull market, but a book that provides wisdom and inspiration that transcends the times” (Hong Jin-chae, CEO of Raccoon Asset Management) and “It is a book that proves that the phrase 100x is not magic but fact” (Yoon Ji-ho, CEO of LS Securities Retail Business Division).

The book begins with the statement, "It is not fiction but fact that there are hundreds of opportunities to make a million dollars by investing $10,000 in just one stock in the stock market and waiting."

As of 1971, there were over 360 U.S. stocks that would have been worth over $1 million if you had invested $10,000 a year in one stock for 32 of the previous 40 years.

The book introduces and analyzes these key cases.

There is a list of 100x stocks in the appendix.

"The one stock I bought right before retirement generated over 100x my return."

One particularly striking example is Paul Garrett, mentioned in Chapter 1. As a former vice president of marketing at GM, Garrett, at age 64 and approaching retirement, set out to identify stocks to invest in to make a quick buck.

Eventually, he chose 'Haloid' (now Xerox) and invested $133,000 in this stock over five years.

Even after donating $3 million to various organizations, including cancer research centers and universities, with his investment profits, he still had $14 million at the age of 80.

Converted to Korean Won in 2024, it is 146 billion won.

I invested in just one stock for 15 years and made over 100 times the profit.

Is there really only one chance to multiply your bet by 100? Garrett wasn't just lucky.

Looking at the cases the author investigated, the timing of purchase was not important in the difference in performance.

There are many cases where people ended up making 100 times their profits even if they bought at the highest price.

There are so many stocks like Eastman Kodak, Melville Shoe, Philip Morris, etc. that it would be tedious to list them all.

Sharp and Dome had the opportunity for 12 consecutive years from 1932 to 1943.

Even though you may have bought at the peak for 6 of those years, you still made a 100x return on your investment.

Even if you bought Frau (now Schering-Frau) in 1942 or at the latest in 1945, you would have made a hundredfold profit by 1971.

“Good stock selection beats timing,” the author says.

“Buy good stocks and take sleeping pills?!”

With so many 100-bagger stocks available, why is it so difficult to realize profits? It's because even if you buy a 100-bagger stock, you make the mistake of selling it too quickly.

The author emphasizes that 'holding (patience)' is more important than buying.

Even when I made poor stock choices, the wisdom of patience paid off.

There are many cases where even risky stocks such as Globe & Rutgers and Cullen Oil (now Commack) have brought in large profits if purchased and held.

There are many quotes that emphasize patience in investing, including Warren Buffett's famous quote, "The stock market is a mechanism for transferring money from the impatient to the patient" (1991 shareholder letter).

Beyond emphasizing "patience," author Phelps delves into human instincts and psychology, the collective delusions of the investment industry, and the systems that foster them, to come up with solutions.

The psychology of being tempted by small prey while pursuing big game, the phenomenon of mistaking profit taking for lost opportunities through short-term trading, the hindsight bias that leads to investing in places that would have been right in the past, and the instinct of fish to be lured by false bait are all interesting.

The author quotes author Josh Billings, who said, “The real problem isn’t that we don’t know, it’s that we get too much wrong.” He provides examples of investment errors and collective delusions.

In particular, he points out that the worst delusion in investing is the indiscriminate use and even misuse of PER to relatively evaluate various stocks, and suggests a solution.

Relative values include relative stock price, relative earnings, and relative PER.

"Needle in a haystack? Find 100-bagger stocks like this!"

The author has summarized the characteristics and fields of stocks that have a 100-fold return, as indicated by 40 years of records.

Times may change, and stocks and fields may change, but the characteristics of 100-bagger stocks and the perspectives on finding them are very worthwhile.

Chapter 19, “Where Are the Winners?” covers eight areas of 100-bagger stock hunting, four categories of 100-bagger stock characteristics, and a very detailed explanation of each.

One of the conclusions drawn here is that “for stock prices to grow 100-fold over 40 years, the average annual growth rate must be around 12.2%.”

It also presents the stock price growth rate required for the value to increase 100-fold in less than 40 years.

Chapter 21, “It’s Not Too Late,” discusses areas to watch when looking for future 100-bagger stocks.

He discusses fields such as nuclear energy, lasers, pollution reduction, and holograms, and some of the content is still relevant today, but what is important is the author's way of approaching the topic.

Times have changed and fields have changed, but “every human problem is an investment opportunity.”

The author's statement that "locks are sold because there are thieves" seems valid.

Insights for the Smart Investor

It's full of insights that stock investors looking to make a lot of money, even if it's not 100x, can't miss.

Chapter 15, “The Benefits of Ethics,” defines ethical investing and argues for its benefits.

It logically explains the direct link between corporate ethics and investment returns. Interesting examples of companies like J.C. Penney, Ford, and Dow Jones that have realized the benefits of ethics are also provided.

Chapter 17, “There is no pill to control inflation,” explains the economic knowledge that investors need to know.

We've extracted only the key points: currency, inflation, interest rates, bonds vs. stocks, etc.

It's easy and fun, backed by deep insight.

Propositions such as 'Taxes determine the value of money' and 'Inflation is the cruelest form of tax' are characteristic.

The 'Interest' section is about the leverage of your investment.

Selling Polaroid stock to pay hospital bills vs.

Taking out a bank loan, selling Xerox stock to build a house vs.

What's more valuable than taking out a bank loan? The value of debt (leverage) is easily explained with examples like this one of two couples traveling abroad.

Chapter 20 presents guidelines for overseas investment: “What is far away is always fascinating.”

Chapter 22, “Cheering for the Young Generation,” analyzes seven stocks that have generated 100-fold returns over a 10-year period.

Chapter 26, “Understanding Value,” uses the hen-and-egg analogy to easily explain discount rates and present value.

Chapter 28, “How to Identify and Evaluate True Growth,” distinguishes between profit and profit-generating capacity.

The entire book, right up to the last chapter, is packed with deep and informative content.

Domestic investment experts unanimously agreed that "this book offers timeless wisdom."

Kim Hak-gyun, head of the research center at Shinyoung Securities, said, “After reading the entire manuscript, my awkwardness about the expression ‘100-fold stock’ disappeared,” and recommended the book, saying, “It is a book with great virtue for investors.”

He also praised the book, saying, “It is not a shallow book that once rode the bull market, but a book that provides wisdom and inspiration that transcends the times” (Hong Jin-chae, CEO of Raccoon Asset Management) and “It is a book that proves that the phrase 100x is not magic but fact” (Yoon Ji-ho, CEO of LS Securities Retail Business Division).

GOODS SPECIFICS

- Date of issue: July 10, 2024

- Page count, weight, size: 396 pages | 794g | 152*225*23mm

- ISBN13: 9791188754984

- ISBN10: 118875498X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)