Pension Snowball ETF Investment Habits

|

Description

Book Introduction

"Pension Snowball ETF Investment Habits" is a book about personal pensions (pension savings funds) that accumulates money monthly and invests it in ETFs, while creating a portfolio of investment items by age and tendency in line with the characteristics of pensions.

Many people are choosing pension savings funds, especially ETFs, instead of pension savings insurance for their personal pensions.

We will tell you what are the advantages of investing in ETFs with your pension and which ETFs can actually form your portfolio.

It provides recommended investment portfolios by age (30/40/50), as well as portfolios by risk appetite (6 levels from seeking stability to seeking high returns), and monthly dividend portfolios (100 million won, 1 million won monthly dividend).

The author, who has studied pensions and ETFs for 25 years, provides an easy and detailed explanation.

Many people are choosing pension savings funds, especially ETFs, instead of pension savings insurance for their personal pensions.

We will tell you what are the advantages of investing in ETFs with your pension and which ETFs can actually form your portfolio.

It provides recommended investment portfolios by age (30/40/50), as well as portfolios by risk appetite (6 levels from seeking stability to seeking high returns), and monthly dividend portfolios (100 million won, 1 million won monthly dividend).

The author, who has studied pensions and ETFs for 25 years, provides an easy and detailed explanation.

- You can preview some of the book's contents.

Preview

index

Pension management habits by life cycle

introduction

Before starting this book

Part 1.

Raising awareness of pensions

1.

The most common misconceptions about pensions

2.

Three-tier pension structure: national pension, retirement pension, and private pension

3.

Pension savings insurance and pension savings funds

4.

There is an order to pension payments.

5.

Pension Investment Restrictions: What You Need to Know

Part 2.

Why You Should Invest in ETFs with Your Pension

1.

Misconceptions about pension ETF investments

2.

ETFs that allow for independent pension investment

3. The benefits of ETFs are absorbed by pensions.

4.

ETFs are easier and more convenient than funds.

5.

ETFs with excellent tax savings

6.

The pinnacle of rebalancing ETFs

7.

General investing and pension investing are different.

Part 3.

How to Choose a Pension Investment ETF

1. Understand ETF names at a glance

2.

How to Trade ETFs Without Losing Money

3.

Choosing an ETF that doesn't lose principal, and earns interest as a bonus.

4.

How to Choose an ETF Tracking a Major Index

5.

How to Consider Exchange Rates in Overseas ETFs

6.

Pension-only products TDF/TIF/TRF ETF

7.

Dividend ETFs like monthly rent

Part 4.

Pension ETF Investment Practices

1.

[By Age] Pension ETF Investment Strategy for People in Their 30s: Accumulating

2.

[By Age] Pension ETF Investment Strategy for People in Their 40s: Rolling

3.

Pension ETF Investment Strategy for People in Their 50s: Withdrawals

4.

[By Personality] Step 1: First Experience: A Taste of Loss-Free ETFs

5.

[By Tendency] Step 2: ETFs with Higher Returns Than Time Deposits

6.

[By Personality] Step 3: Preserve Principal Using Stock and Bond ETFs

7.

[By Tendency] Step 4: ETF Investment Focused on a Balance of Growth and Stability

8.

[By Personality] Step 5: Stock ETF Investment

9.

[By Tendency] Stage 6: Growth Theme ETF

introduction

Before starting this book

Part 1.

Raising awareness of pensions

1.

The most common misconceptions about pensions

2.

Three-tier pension structure: national pension, retirement pension, and private pension

3.

Pension savings insurance and pension savings funds

4.

There is an order to pension payments.

5.

Pension Investment Restrictions: What You Need to Know

Part 2.

Why You Should Invest in ETFs with Your Pension

1.

Misconceptions about pension ETF investments

2.

ETFs that allow for independent pension investment

3. The benefits of ETFs are absorbed by pensions.

4.

ETFs are easier and more convenient than funds.

5.

ETFs with excellent tax savings

6.

The pinnacle of rebalancing ETFs

7.

General investing and pension investing are different.

Part 3.

How to Choose a Pension Investment ETF

1. Understand ETF names at a glance

2.

How to Trade ETFs Without Losing Money

3.

Choosing an ETF that doesn't lose principal, and earns interest as a bonus.

4.

How to Choose an ETF Tracking a Major Index

5.

How to Consider Exchange Rates in Overseas ETFs

6.

Pension-only products TDF/TIF/TRF ETF

7.

Dividend ETFs like monthly rent

Part 4.

Pension ETF Investment Practices

1.

[By Age] Pension ETF Investment Strategy for People in Their 30s: Accumulating

2.

[By Age] Pension ETF Investment Strategy for People in Their 40s: Rolling

3.

Pension ETF Investment Strategy for People in Their 50s: Withdrawals

4.

[By Personality] Step 1: First Experience: A Taste of Loss-Free ETFs

5.

[By Tendency] Step 2: ETFs with Higher Returns Than Time Deposits

6.

[By Personality] Step 3: Preserve Principal Using Stock and Bond ETFs

7.

[By Tendency] Step 4: ETF Investment Focused on a Balance of Growth and Stability

8.

[By Personality] Step 5: Stock ETF Investment

9.

[By Tendency] Stage 6: Growth Theme ETF

Detailed image

Into the book

The real value of future pension payments is likely to be lower than today.

However, rather than worrying about the real value in advance, we should pay more attention to the nominal amount itself.

Simply put, if you have even just 100,000 won to spare in your old age, that in itself will be a great comfort and strength.

If you're preparing for inflation by finding better investments than your pension, you're in luck.

But in reality, most people only calculate in their heads, and few actually prepare and put it into practice.

I think it's because I'm not simple.

The simplest way is to develop the habit of saving a set amount every month and using it for long-term investments.

--- p.34

Defined Benefit (DB) is a system in which a company deposits my retirement benefits in an external financial institution, manages it under its responsibility, and pays a set retirement benefit regardless of the performance of the investment.

In other words, the company will take care of managing the retirement pay I receive.

Instead, the company pays me my guaranteed retirement benefits without fail.

From the worker's perspective, there is nothing to worry about or lose.

(Omitted) Defined contribution (DC) is a method in which retirement benefits are deposited annually into a personal account at an external financial institution and employees directly manage their retirement pension.

Workers can choose their own deposits, investment products, and even ETFs, which can lead to additional profits or losses.

In other words, if you manage it well, you can receive pension + income, but if you manage it poorly, it will be pension - income, so you can receive less than the actual retirement benefit you can receive.

--- p.39

There is a reason why pension savings insurance has the largest accumulation amount.

First, pensions feel like something that happens too far in the future, making it difficult to prepare for them the younger you are.

As a result, there are many cases where people are lured into signing up for insurance by the insurance company's aggressive marketing rather than doing their own research and signing up.

Not long after I got a job, I signed up for pension savings insurance at the recommendation of a friend.

It was hard to turn down my friend's suggestion because it wasn't a whole life insurance policy and it was savings that would be returned at the end of the year.

Moreover, in early 2000, the interest rates on time deposits at commercial banks were around 7%, and those on regular savings were around 10%.

It was a time when you could become rich just by saving money, without having to invest.

The nature of insurance that requires payment on time to be cancelled also played a role.

I think this is why the size of pension savings insurance has grown so overwhelmingly.

But now things are very different.

Interest rates have dropped compared to the past, and insurance business expenses (including insurance planner commissions) have increased relatively.

As a result, if you cancel within 5 to 7 years, you will not be able to get back the principal you paid.

Moreover, the contracts are rigid.

Only regular payments are possible, and if you stop paying, the policy will become invalid (there is a system for temporarily suspending insurance premium payments).

And you may end up getting hit with a tax bomb as you are taxed again for the entire year-end tax refund.

The method and amount of pension receipt are also limited for insurance compared to securities companies.

For these reasons and others, the number of subscribers to pension savings funds has recently increased at an overwhelming rate compared to pension savings insurance.

--- p.48

If you can pay up to 9 million won, which is the year-end tax deduction limit, into your pension, we recommend paying 3 million won into an IRP and 6 million won into a pension savings fund.

If you pay a total of 9 million won like this, you can receive a refund of up to 1.48 million won (based on 16.5%) as a year-end tax deduction.

However, if you do not have the savings capacity of 9 million won, it is recommended to first deposit the money into a pension savings fund and then deposit the remaining amount into an IRP.

--- p.55

Mutual funds, which can be invested in from pension savings accounts, have been considered a representative indirect investment vehicle in a low-interest rate environment due to their ability to allow for small, diversified investments and their relative safety.

For ordinary people who lack investment knowledge or the ability to research investment information, funds managed by experts are a useful investment tool and serve as a standard for pension investment.

In comparison, ETFs were merely a passive (passive, stable) product that tracked a representative index and were merely an alternative to index funds with low fees.

ETFs, which used to be like that, are showing explosive growth and are swallowing up mutual funds.

--- p.86

Let's take a look at the advantages ETFs have over mutual funds.

First, it's transparent. You can check your portfolio in real time, showing where and how much you're investing in HTS.

Changes in weight or type of item are also changed in a pre-specified manner.

In contrast, the stocks and weightings of mutual funds are arbitrarily decided by the fund manager.

Second, it is convenient.

You can buy and sell it at any time during the day, and like stocks, you can withdraw cash within 3 days.

However, mutual funds take several days to buy and sell.

Some overseas funds require more than two weeks to receive cash when redeemed (sold).

Third, it's easy.

You can understand the content at a glance just by looking at the product name.

In a word, it is intuitive.

--- p.87

ETFs seek continuous growth through regular rebalancing, i.e., stock replacement and weight changes.

The survival of the fittest strategy, where only the best stocks survive, is applied to ETFs.

Additionally, through regular rebalancing, the weight of stocks that have risen in price is lowered and the weight of stocks that have risen relatively less is increased.

It is about lowering the average purchase price by buying at a low price while realizing profits.

Rebalancing occurs automatically without the investor having to take care of it separately.

--- p.103

If your investment goal is short-term trading profits, market timing is essential.

If you believe the stock market is overheated and at a peak, you should postpone investing or invest only a portion of your total amount while continuously monitoring the market.

That's why many experts say it's beneficial to set a loss limit and target profit in advance.

But pension investing is a little different.

If you're in your 30s and need to focus on saving for your pension, it's important to steadily accumulate assets without being swayed by market conditions.

--- p.107

Maturity-matched ETFs are perfect for investing in pensions.

I believe that if readers of this book can immediately invest in maturity-matched ETFs and earn higher interest rates than term deposits, then the book will have fulfilled its purpose (return several times the price of the book).

--- p.134

Let's take a look at the advantages of maturity-matched ETFs one by one.

First, if you hold the ETF until maturity, you can earn interest equal to the principal and the maturity yield at the time of purchase without any loss.

Second, it is convenient to trade as it is easy to buy and sell.

If you cancel your deposit before maturity, you will not receive the agreed interest rate.

However, maturity-matched ETFs allow you to receive accumulated interest at any time you sell them, and even capital gains if interest rates fall.

Third, it is easy to manage.

After purchasing, the principal and interest of the ETF will be automatically deposited into your account at maturity, so there is no need to worry about it.

--- p.134

There is no right answer when it comes to exchange rates.

However, if you must choose between currency open and currency hedging regardless of market conditions, I recommend currency open without hesitation.

To put it simply, an open-ended ETF without '(H)' is better for pension purposes.

Because holding dollar assets through open exchange rates was useful as insurance in times of crisis.

--- p.149

Which dividend ETF should I choose? First, it's best to choose a monthly dividend ETF that takes market conditions into account.

When the economy is doing well, high-dividend stock ETFs are good, and during a recession, bond ETFs are good.

If the ups and downs are limited by the so-called box-bound market trend, it is advantageous to invest in an ETF with a covered call strategy (supplementary explanation later).

And as I briefly explained earlier, if the real estate market is booming, it may be worth considering investing in REIT ETFs with stable rental income.

Second, you should invest in dividend ETFs considering your monthly cash needs and the size of your operating assets.

Pension investors with sufficient investment capacity should increase the proportion of their portfolio investments in dividend-paying ETFs and select products with a focus on securing dividends.

However, if your resources are limited, you need to create a portfolio that takes into account both market conditions and the monthly dividends you can secure.

Third, taxes are also important.

Simply delaying or saving taxes can be a huge benefit to pensioners.

It is advisable to invest using a pension account.

--- p.158

Now, I will explain ETF investment strategies in detail.

First, we organized a portfolio that took into account investment needs by age group.

We have organized a portfolio based on the following goals: stable savings in your 30s, asset allocation strategy in your 40s, and withdrawal strategy in your 50s.

Second, we created a six-stage portfolio based on risk appetite.

As the level increases, the expected return increases, but the investment risk also increases.

I recommend that you invest gradually from step 1 to build up experience and skills.

However, rather than worrying about the real value in advance, we should pay more attention to the nominal amount itself.

Simply put, if you have even just 100,000 won to spare in your old age, that in itself will be a great comfort and strength.

If you're preparing for inflation by finding better investments than your pension, you're in luck.

But in reality, most people only calculate in their heads, and few actually prepare and put it into practice.

I think it's because I'm not simple.

The simplest way is to develop the habit of saving a set amount every month and using it for long-term investments.

--- p.34

Defined Benefit (DB) is a system in which a company deposits my retirement benefits in an external financial institution, manages it under its responsibility, and pays a set retirement benefit regardless of the performance of the investment.

In other words, the company will take care of managing the retirement pay I receive.

Instead, the company pays me my guaranteed retirement benefits without fail.

From the worker's perspective, there is nothing to worry about or lose.

(Omitted) Defined contribution (DC) is a method in which retirement benefits are deposited annually into a personal account at an external financial institution and employees directly manage their retirement pension.

Workers can choose their own deposits, investment products, and even ETFs, which can lead to additional profits or losses.

In other words, if you manage it well, you can receive pension + income, but if you manage it poorly, it will be pension - income, so you can receive less than the actual retirement benefit you can receive.

--- p.39

There is a reason why pension savings insurance has the largest accumulation amount.

First, pensions feel like something that happens too far in the future, making it difficult to prepare for them the younger you are.

As a result, there are many cases where people are lured into signing up for insurance by the insurance company's aggressive marketing rather than doing their own research and signing up.

Not long after I got a job, I signed up for pension savings insurance at the recommendation of a friend.

It was hard to turn down my friend's suggestion because it wasn't a whole life insurance policy and it was savings that would be returned at the end of the year.

Moreover, in early 2000, the interest rates on time deposits at commercial banks were around 7%, and those on regular savings were around 10%.

It was a time when you could become rich just by saving money, without having to invest.

The nature of insurance that requires payment on time to be cancelled also played a role.

I think this is why the size of pension savings insurance has grown so overwhelmingly.

But now things are very different.

Interest rates have dropped compared to the past, and insurance business expenses (including insurance planner commissions) have increased relatively.

As a result, if you cancel within 5 to 7 years, you will not be able to get back the principal you paid.

Moreover, the contracts are rigid.

Only regular payments are possible, and if you stop paying, the policy will become invalid (there is a system for temporarily suspending insurance premium payments).

And you may end up getting hit with a tax bomb as you are taxed again for the entire year-end tax refund.

The method and amount of pension receipt are also limited for insurance compared to securities companies.

For these reasons and others, the number of subscribers to pension savings funds has recently increased at an overwhelming rate compared to pension savings insurance.

--- p.48

If you can pay up to 9 million won, which is the year-end tax deduction limit, into your pension, we recommend paying 3 million won into an IRP and 6 million won into a pension savings fund.

If you pay a total of 9 million won like this, you can receive a refund of up to 1.48 million won (based on 16.5%) as a year-end tax deduction.

However, if you do not have the savings capacity of 9 million won, it is recommended to first deposit the money into a pension savings fund and then deposit the remaining amount into an IRP.

--- p.55

Mutual funds, which can be invested in from pension savings accounts, have been considered a representative indirect investment vehicle in a low-interest rate environment due to their ability to allow for small, diversified investments and their relative safety.

For ordinary people who lack investment knowledge or the ability to research investment information, funds managed by experts are a useful investment tool and serve as a standard for pension investment.

In comparison, ETFs were merely a passive (passive, stable) product that tracked a representative index and were merely an alternative to index funds with low fees.

ETFs, which used to be like that, are showing explosive growth and are swallowing up mutual funds.

--- p.86

Let's take a look at the advantages ETFs have over mutual funds.

First, it's transparent. You can check your portfolio in real time, showing where and how much you're investing in HTS.

Changes in weight or type of item are also changed in a pre-specified manner.

In contrast, the stocks and weightings of mutual funds are arbitrarily decided by the fund manager.

Second, it is convenient.

You can buy and sell it at any time during the day, and like stocks, you can withdraw cash within 3 days.

However, mutual funds take several days to buy and sell.

Some overseas funds require more than two weeks to receive cash when redeemed (sold).

Third, it's easy.

You can understand the content at a glance just by looking at the product name.

In a word, it is intuitive.

--- p.87

ETFs seek continuous growth through regular rebalancing, i.e., stock replacement and weight changes.

The survival of the fittest strategy, where only the best stocks survive, is applied to ETFs.

Additionally, through regular rebalancing, the weight of stocks that have risen in price is lowered and the weight of stocks that have risen relatively less is increased.

It is about lowering the average purchase price by buying at a low price while realizing profits.

Rebalancing occurs automatically without the investor having to take care of it separately.

--- p.103

If your investment goal is short-term trading profits, market timing is essential.

If you believe the stock market is overheated and at a peak, you should postpone investing or invest only a portion of your total amount while continuously monitoring the market.

That's why many experts say it's beneficial to set a loss limit and target profit in advance.

But pension investing is a little different.

If you're in your 30s and need to focus on saving for your pension, it's important to steadily accumulate assets without being swayed by market conditions.

--- p.107

Maturity-matched ETFs are perfect for investing in pensions.

I believe that if readers of this book can immediately invest in maturity-matched ETFs and earn higher interest rates than term deposits, then the book will have fulfilled its purpose (return several times the price of the book).

--- p.134

Let's take a look at the advantages of maturity-matched ETFs one by one.

First, if you hold the ETF until maturity, you can earn interest equal to the principal and the maturity yield at the time of purchase without any loss.

Second, it is convenient to trade as it is easy to buy and sell.

If you cancel your deposit before maturity, you will not receive the agreed interest rate.

However, maturity-matched ETFs allow you to receive accumulated interest at any time you sell them, and even capital gains if interest rates fall.

Third, it is easy to manage.

After purchasing, the principal and interest of the ETF will be automatically deposited into your account at maturity, so there is no need to worry about it.

--- p.134

There is no right answer when it comes to exchange rates.

However, if you must choose between currency open and currency hedging regardless of market conditions, I recommend currency open without hesitation.

To put it simply, an open-ended ETF without '(H)' is better for pension purposes.

Because holding dollar assets through open exchange rates was useful as insurance in times of crisis.

--- p.149

Which dividend ETF should I choose? First, it's best to choose a monthly dividend ETF that takes market conditions into account.

When the economy is doing well, high-dividend stock ETFs are good, and during a recession, bond ETFs are good.

If the ups and downs are limited by the so-called box-bound market trend, it is advantageous to invest in an ETF with a covered call strategy (supplementary explanation later).

And as I briefly explained earlier, if the real estate market is booming, it may be worth considering investing in REIT ETFs with stable rental income.

Second, you should invest in dividend ETFs considering your monthly cash needs and the size of your operating assets.

Pension investors with sufficient investment capacity should increase the proportion of their portfolio investments in dividend-paying ETFs and select products with a focus on securing dividends.

However, if your resources are limited, you need to create a portfolio that takes into account both market conditions and the monthly dividends you can secure.

Third, taxes are also important.

Simply delaying or saving taxes can be a huge benefit to pensioners.

It is advisable to invest using a pension account.

--- p.158

Now, I will explain ETF investment strategies in detail.

First, we organized a portfolio that took into account investment needs by age group.

We have organized a portfolio based on the following goals: stable savings in your 30s, asset allocation strategy in your 40s, and withdrawal strategy in your 50s.

Second, we created a six-stage portfolio based on risk appetite.

As the level increases, the expected return increases, but the investment risk also increases.

I recommend that you invest gradually from step 1 to build up experience and skills.

--- p.165

Publisher's Review

In addition to the national pension and retirement pension, the necessity of private pensions can no longer be emphasized.

Many people have signed up for pension savings insurance, mainly through personal pensions (in reality, many people don't even know which product they signed up for).

However, as the rate of return on pension savings insurance continues to be lower than that of bank interest, many people are switching to pension savings funds.

Representative products that can be invested in through pension savings funds include mutual funds and ETFs.

However, it is very difficult for an individual to choose a fund.

It is also difficult to simply trust the fund manager who manages the fund.

At this time, it is better to invest in ETFs that follow the market instead of people.

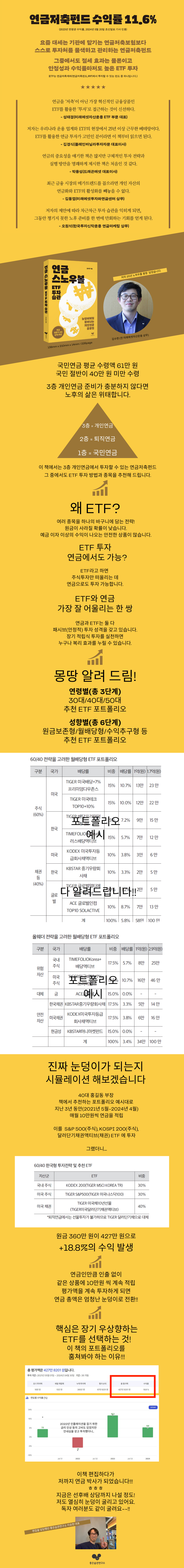

Average monthly national pension amount: 620,000 won

Half of the elderly don't even receive 400,000 won.

When we say pension, most people think of national pension and retirement pension.

However, the average national pension amount is 620,000 won, and half of recipients receive less than 400,000 won.

National Pension is an amount that a high-income salaried worker can take home more than 2 million won per month if he or she pays the pension without fail until the age of 60.

What about retirement pensions? It's not easy for most workers to receive more than 100 million won.

In these days of frequent job changes, many people use their retirement funds for reasons such as overseas travel or purchasing a car.

And even if you save a lot of retirement money, many people end up using it for starting a business or investing in their next project around the age of 50.

For these reasons and others, everyone is trying to earn monthly rental income through real estate investments.

But this is not an easy task either.

Tenants may cause trouble, or the property may become vacant and rent payments may be canceled.

In addition to the national pension and retirement pension, there should be a private pension.

You should save in installments at least from the age of forty.

To sum up, what we need is a private pension in addition to the National Pension Service's retirement pension, and for this, it is important to save some money every month from a young age (from 30 to 40).

The government also provides various incentives for private pensions to ensure a stable retirement for its citizens.

A representative example is the year-end tax deduction and tax saving system for pension savings.

(We provide a year-end refund of up to 6 million won per year and a tax reduction when receiving a pension at age 55 or 60.)

The sector that has benefited the most from this policy so far is pension savings insurance.

This is a product that allows you to receive a certain amount of money every month from age 55 or 60 until age 80 or for life by saving a certain amount every month for a certain number of years.

The problem, however, is that the recent returns on pension savings insurance are not good.

One of the biggest reasons for poor profitability is operating expenses.

Pension savings insurance and pension insurance yields of 1-2% per year

Inflation rate cannot be defended, effectively leading to a 'negative' crisis.

Insurance companies that don't want to incur losses… Focus on bonds

Business expenses and fees are deducted in advance at approximately 8% per month.

If we pay 100,000 won every month, we think the insurance company will manage this money well and return 100,000 won + alpha, but in reality, that is not the case.

First, we usually take 4-8% as business expenses and use the remaining money for management.

As a result, it often takes 10 years for the money I invested to be returned to its original amount after deducting business expenses and reaping profits.

This is why it is said that if you cancel your pension savings insurance policy midway, you will not even be able to receive the principal.

Because insurance has a strong guarantee nature, it is invested primarily in stable assets.

As a result, there are many cases where the interest rate is lower than that of bank interest rates for a long period of time.

90% of pension savings subscribers choose funds in 2021.

Pension insurance popularity plummets, with subscribers dropping 17%.

"A situation where you have to choose only funds with low returns."

If you actually look at the Chosun Ilbo article from May 20, 2024, this point is explained in detail and serialized as a feature article.

“According to the Financial Supervisory Service and the Life Insurance Association on the 20th, the average annual return rate of pension savings insurance of 17 life insurance companies last year was 2.44%, the average annualized return rate of 268 guaranteed variable annuity insurance policies was 0.08%, and the average of 95 non-guaranteed variable annuity insurance policies was -1.1%.

Among the 107 interest rate-linked annuity insurance products for the same period, the product expected to have the highest return is Shinhan Life Insurance's 'Beautiful Annuity Insurance', which, when calculated using the annualized return announced by the association, is 3.34%.

Samsung, Hanwha, and Kyobo Life, known as the Big 3 life insurance companies, have interest rates of 2.1-2.6%.

It is lower than last year's bank deposit and savings interest rates (3.56-3.68%).

From 2004 to last year, the average annual inflation rate was 2.3%.

On the other hand, the return on pension savings funds, which increase retirement funds by investing in stock, bond, and mixed funds with the same pension product, was 11.6% last year.

“In 2021, the pension amount per pension savings account was 2.43 million won for insurance, less than half of the amount for funds (7.23 million won) and trusts (5.91 million won).”

100,000 won per month for 30 years

Rolling a snowball from 36 million won to 100 million won

“Pension savings insurance and pension insurance are products in which the insurance company adds interest to the insurance premium paid by the customer.

“It is the safest option because it preserves the principal, but the interest rate is lower than that of bonds and, recently, it has fallen below the interest rate of bank deposits and savings accounts, so the return is not high.”

“In the personal pension market, products that allow retirement savings through fund investments, such as pension savings funds and individual retirement pensions (IRPs), are popular.

Even customers who have signed up for pension savings insurance are transferring their accounts to funds.

Because the rate of return on pension insurance is hitting rock bottom.

Some point out that the only option left for the public to prepare for retirement is a fund with the potential for principal loss.

If you invest 100,000 won per month for 30 years at an annual interest rate of 5%, the principal of 36 million won will become a total of 83.57 million won.

If we assume that it increases by just 1% to 6%, 36 million won becomes 109.5 million won.

If you invest 100,000 won per month for 30 years and manage your earnings well, you can make 100 million won.

It's a real snowball.

This is the power of long-term investing that everyone talks about.

Compound investments that grow like a snowball

Pension investment is through pension savings funds

As the newspaper article also stated, we should choose pension savings funds instead of pension savings insurance.

For individuals to personally manage their monthly savings by finding appropriate investments (funds) may be a better option than relying on insurance and waiting.

So these days, the trend is to invest in funds instead of insurance through personal pensions.

And there are many people who actually take out pension savings insurance and then cancel it and switch to pension savings funds.

But here an important problem arises.

I understand that it's better to invest in funds instead of insurance, but of course, you have to choose a fund with good returns to make the snowball roll.

In other words, we need to consider how well an individual can select funds.

However, since funds are ultimately managed by people (fund managers), they cannot always maintain high returns.

Because you never know what will happen in the market.

Therefore, to succeed in long-term compounding investment, it is important to choose a product that can generate consistent returns every year.

However, choosing a fund is difficult... and ETFs are the answer.

No one can accurately predict market conditions.

ETFs that invest in the market rather than people

No one can predict the market.

No one is smarter than the market.

So we need to invest in markets instead of people.

Investing in the market means believing in the upward trend of the capital market and investing in a market-tracking index.

Market-tracking indices refer to indices such as the KOSPI 200 or S&P 500, which are comprised of representative stocks in the U.S. or Korean stock markets.

The logic is that while stock prices may fluctuate among companies, including many blue-chip companies, overall growth is expected.

The logic is that while the Korean economy and the American economy may differ in speed, the market capitalization itself will continue to grow as new industries and companies continuously emerge.

Historically, there have been several economic crises, but market capitalization and market indices have continued to grow.

That's why, if you're new to investing and don't know much about economics, it's wise to invest in ETFs linked to major indices.

The same goes for pensions.

In the long run, it is more efficient to invest in ETFs rather than funds, believing that the market will trend upward.

In fact, strictly speaking, ETFs are also a type of fund.

However, since it is linked to major indices such as the S&P 500, NASDAQ, KOSPI, and KOSDAQ, if you know the market trends and have the patience for long-term investment, it is more advantageous in terms of cost management to manage it yourself and buy and sell it from time to time.

In short, it is an investment that believes in the upward trend of the market rather than the fund manager.

You can invest in ETFs with your pension

Investments that believe in the market's upward trend

A stable investment that will not lose 99% of the principal

ETFs can be invested in not only like stocks in a regular account, but also in retirement accounts. ETFs are portfolio products that allow you to put multiple eggs in one basket, offering low volatility and stability.

Moreover, ETFs provide steady dividends (or more accurately, distributions), and reinvesting these dividends can even provide additional compounding benefits.

There are a variety of ETF products that can be invested in with pension funds.

There are safe products with virtually no risk of principal loss, products that aim for high returns, and even products that allow you to earn monthly dividends while keeping your principal intact.

Just look at the book and choose the ETF that's right for you.

Hong Gil-dong, an ordinary office worker

100,000 won per month for the past 3 years

S&P 500, KOSPI 200, and dollar short-term bond ETFs

Invest in a ratio of 30:30:40 respectively

I tried investing in ETFs in my pension savings account three years ago, following the portfolio recommended in this book.

How much profit have you made so far? Specifically, here's what you can expect:

For the past three years (May 2021 - April 2024), I saved 100,000 won per month in pension and invested the saved money in S&P 500, KOSPI 200, and dollar short-term bond ETFs in a 30/30/40% ratio.

Then, the principal of 3.6 million won became 4.27 million won, and I was able to get a profit of +18.8%.

There was a difficult period (-10.7%) due to the interest rate hike to control inflation in 2022, but by persevering through this period and steadily investing in pension savings, I was able to achieve positive returns.

Recommended ETFs by Age: 30s/40s/50s

Recommended ETFs by Risk Approach

Invest 100 million won and get 1 million won in monthly dividends in an ETF

Providing a diverse ETF investment portfolio

The book presents recommended portfolios by age and a variety of portfolios ranging from safe to high-yield to monthly dividends.

We even provide detailed information on ETF products that allow you to earn 1 million won in monthly dividends with 100 million won.

Just choose the one that suits you best.

From Mirae Asset Global Investments with 25 years of experience

Written by Pension & ETF Experts

Having worked for 25 years at securities firms and asset management companies, the author has experienced a variety of investment products, including mutual funds, ETFs, hedge funds, REITs, and alternative assets. He has realized that ETFs are the best way for beginners to maximize their wealth while minimizing principal losses.

Since then, I have realized that ETFs are more suitable for pension investment than stock investment, and I have been introducing long-term savings investment and monthly dividend-generating investment through pension investment in ETFs to many people.

This book was written as part of that effort.

Many people have signed up for pension savings insurance, mainly through personal pensions (in reality, many people don't even know which product they signed up for).

However, as the rate of return on pension savings insurance continues to be lower than that of bank interest, many people are switching to pension savings funds.

Representative products that can be invested in through pension savings funds include mutual funds and ETFs.

However, it is very difficult for an individual to choose a fund.

It is also difficult to simply trust the fund manager who manages the fund.

At this time, it is better to invest in ETFs that follow the market instead of people.

Average monthly national pension amount: 620,000 won

Half of the elderly don't even receive 400,000 won.

When we say pension, most people think of national pension and retirement pension.

However, the average national pension amount is 620,000 won, and half of recipients receive less than 400,000 won.

National Pension is an amount that a high-income salaried worker can take home more than 2 million won per month if he or she pays the pension without fail until the age of 60.

What about retirement pensions? It's not easy for most workers to receive more than 100 million won.

In these days of frequent job changes, many people use their retirement funds for reasons such as overseas travel or purchasing a car.

And even if you save a lot of retirement money, many people end up using it for starting a business or investing in their next project around the age of 50.

For these reasons and others, everyone is trying to earn monthly rental income through real estate investments.

But this is not an easy task either.

Tenants may cause trouble, or the property may become vacant and rent payments may be canceled.

In addition to the national pension and retirement pension, there should be a private pension.

You should save in installments at least from the age of forty.

To sum up, what we need is a private pension in addition to the National Pension Service's retirement pension, and for this, it is important to save some money every month from a young age (from 30 to 40).

The government also provides various incentives for private pensions to ensure a stable retirement for its citizens.

A representative example is the year-end tax deduction and tax saving system for pension savings.

(We provide a year-end refund of up to 6 million won per year and a tax reduction when receiving a pension at age 55 or 60.)

The sector that has benefited the most from this policy so far is pension savings insurance.

This is a product that allows you to receive a certain amount of money every month from age 55 or 60 until age 80 or for life by saving a certain amount every month for a certain number of years.

The problem, however, is that the recent returns on pension savings insurance are not good.

One of the biggest reasons for poor profitability is operating expenses.

Pension savings insurance and pension insurance yields of 1-2% per year

Inflation rate cannot be defended, effectively leading to a 'negative' crisis.

Insurance companies that don't want to incur losses… Focus on bonds

Business expenses and fees are deducted in advance at approximately 8% per month.

If we pay 100,000 won every month, we think the insurance company will manage this money well and return 100,000 won + alpha, but in reality, that is not the case.

First, we usually take 4-8% as business expenses and use the remaining money for management.

As a result, it often takes 10 years for the money I invested to be returned to its original amount after deducting business expenses and reaping profits.

This is why it is said that if you cancel your pension savings insurance policy midway, you will not even be able to receive the principal.

Because insurance has a strong guarantee nature, it is invested primarily in stable assets.

As a result, there are many cases where the interest rate is lower than that of bank interest rates for a long period of time.

90% of pension savings subscribers choose funds in 2021.

Pension insurance popularity plummets, with subscribers dropping 17%.

"A situation where you have to choose only funds with low returns."

If you actually look at the Chosun Ilbo article from May 20, 2024, this point is explained in detail and serialized as a feature article.

“According to the Financial Supervisory Service and the Life Insurance Association on the 20th, the average annual return rate of pension savings insurance of 17 life insurance companies last year was 2.44%, the average annualized return rate of 268 guaranteed variable annuity insurance policies was 0.08%, and the average of 95 non-guaranteed variable annuity insurance policies was -1.1%.

Among the 107 interest rate-linked annuity insurance products for the same period, the product expected to have the highest return is Shinhan Life Insurance's 'Beautiful Annuity Insurance', which, when calculated using the annualized return announced by the association, is 3.34%.

Samsung, Hanwha, and Kyobo Life, known as the Big 3 life insurance companies, have interest rates of 2.1-2.6%.

It is lower than last year's bank deposit and savings interest rates (3.56-3.68%).

From 2004 to last year, the average annual inflation rate was 2.3%.

On the other hand, the return on pension savings funds, which increase retirement funds by investing in stock, bond, and mixed funds with the same pension product, was 11.6% last year.

“In 2021, the pension amount per pension savings account was 2.43 million won for insurance, less than half of the amount for funds (7.23 million won) and trusts (5.91 million won).”

100,000 won per month for 30 years

Rolling a snowball from 36 million won to 100 million won

“Pension savings insurance and pension insurance are products in which the insurance company adds interest to the insurance premium paid by the customer.

“It is the safest option because it preserves the principal, but the interest rate is lower than that of bonds and, recently, it has fallen below the interest rate of bank deposits and savings accounts, so the return is not high.”

“In the personal pension market, products that allow retirement savings through fund investments, such as pension savings funds and individual retirement pensions (IRPs), are popular.

Even customers who have signed up for pension savings insurance are transferring their accounts to funds.

Because the rate of return on pension insurance is hitting rock bottom.

Some point out that the only option left for the public to prepare for retirement is a fund with the potential for principal loss.

If you invest 100,000 won per month for 30 years at an annual interest rate of 5%, the principal of 36 million won will become a total of 83.57 million won.

If we assume that it increases by just 1% to 6%, 36 million won becomes 109.5 million won.

If you invest 100,000 won per month for 30 years and manage your earnings well, you can make 100 million won.

It's a real snowball.

This is the power of long-term investing that everyone talks about.

Compound investments that grow like a snowball

Pension investment is through pension savings funds

As the newspaper article also stated, we should choose pension savings funds instead of pension savings insurance.

For individuals to personally manage their monthly savings by finding appropriate investments (funds) may be a better option than relying on insurance and waiting.

So these days, the trend is to invest in funds instead of insurance through personal pensions.

And there are many people who actually take out pension savings insurance and then cancel it and switch to pension savings funds.

But here an important problem arises.

I understand that it's better to invest in funds instead of insurance, but of course, you have to choose a fund with good returns to make the snowball roll.

In other words, we need to consider how well an individual can select funds.

However, since funds are ultimately managed by people (fund managers), they cannot always maintain high returns.

Because you never know what will happen in the market.

Therefore, to succeed in long-term compounding investment, it is important to choose a product that can generate consistent returns every year.

However, choosing a fund is difficult... and ETFs are the answer.

No one can accurately predict market conditions.

ETFs that invest in the market rather than people

No one can predict the market.

No one is smarter than the market.

So we need to invest in markets instead of people.

Investing in the market means believing in the upward trend of the capital market and investing in a market-tracking index.

Market-tracking indices refer to indices such as the KOSPI 200 or S&P 500, which are comprised of representative stocks in the U.S. or Korean stock markets.

The logic is that while stock prices may fluctuate among companies, including many blue-chip companies, overall growth is expected.

The logic is that while the Korean economy and the American economy may differ in speed, the market capitalization itself will continue to grow as new industries and companies continuously emerge.

Historically, there have been several economic crises, but market capitalization and market indices have continued to grow.

That's why, if you're new to investing and don't know much about economics, it's wise to invest in ETFs linked to major indices.

The same goes for pensions.

In the long run, it is more efficient to invest in ETFs rather than funds, believing that the market will trend upward.

In fact, strictly speaking, ETFs are also a type of fund.

However, since it is linked to major indices such as the S&P 500, NASDAQ, KOSPI, and KOSDAQ, if you know the market trends and have the patience for long-term investment, it is more advantageous in terms of cost management to manage it yourself and buy and sell it from time to time.

In short, it is an investment that believes in the upward trend of the market rather than the fund manager.

You can invest in ETFs with your pension

Investments that believe in the market's upward trend

A stable investment that will not lose 99% of the principal

ETFs can be invested in not only like stocks in a regular account, but also in retirement accounts. ETFs are portfolio products that allow you to put multiple eggs in one basket, offering low volatility and stability.

Moreover, ETFs provide steady dividends (or more accurately, distributions), and reinvesting these dividends can even provide additional compounding benefits.

There are a variety of ETF products that can be invested in with pension funds.

There are safe products with virtually no risk of principal loss, products that aim for high returns, and even products that allow you to earn monthly dividends while keeping your principal intact.

Just look at the book and choose the ETF that's right for you.

Hong Gil-dong, an ordinary office worker

100,000 won per month for the past 3 years

S&P 500, KOSPI 200, and dollar short-term bond ETFs

Invest in a ratio of 30:30:40 respectively

I tried investing in ETFs in my pension savings account three years ago, following the portfolio recommended in this book.

How much profit have you made so far? Specifically, here's what you can expect:

For the past three years (May 2021 - April 2024), I saved 100,000 won per month in pension and invested the saved money in S&P 500, KOSPI 200, and dollar short-term bond ETFs in a 30/30/40% ratio.

Then, the principal of 3.6 million won became 4.27 million won, and I was able to get a profit of +18.8%.

There was a difficult period (-10.7%) due to the interest rate hike to control inflation in 2022, but by persevering through this period and steadily investing in pension savings, I was able to achieve positive returns.

Recommended ETFs by Age: 30s/40s/50s

Recommended ETFs by Risk Approach

Invest 100 million won and get 1 million won in monthly dividends in an ETF

Providing a diverse ETF investment portfolio

The book presents recommended portfolios by age and a variety of portfolios ranging from safe to high-yield to monthly dividends.

We even provide detailed information on ETF products that allow you to earn 1 million won in monthly dividends with 100 million won.

Just choose the one that suits you best.

From Mirae Asset Global Investments with 25 years of experience

Written by Pension & ETF Experts

Having worked for 25 years at securities firms and asset management companies, the author has experienced a variety of investment products, including mutual funds, ETFs, hedge funds, REITs, and alternative assets. He has realized that ETFs are the best way for beginners to maximize their wealth while minimizing principal losses.

Since then, I have realized that ETFs are more suitable for pension investment than stock investment, and I have been introducing long-term savings investment and monthly dividend-generating investment through pension investment in ETFs to many people.

This book was written as part of that effort.

GOODS SPECIFICS

- Date of issue: June 10, 2024

- Page count, weight, size: 226 pages | 138*210*14mm

- ISBN13: 9791193639115

- ISBN10: 1193639115

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)