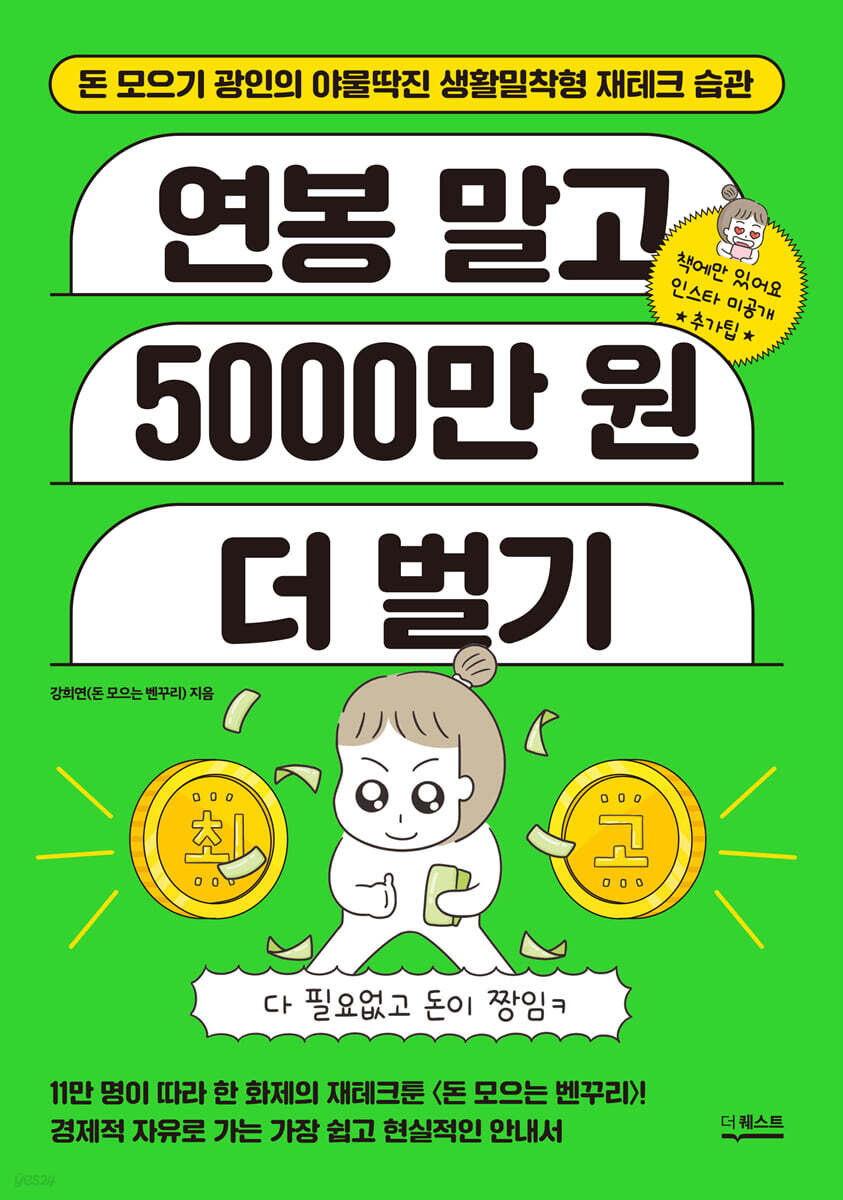

Earn 50 million won more than your annual salary

|

Description

Book Introduction

It's never too late to save money.

The popular financial cartoon "Money Saving Benkuri," followed by 110,000 people

The easiest and most realistic guide to financial freedom

I don't know what to do or how to start

48 Easy Money Tips for You!

*Includes additional tips not revealed on Instagram*

The main character is an ordinary office worker, and the sub-character is a money-saving fanatic and Instagrammer with 110,000 followers! The unique and practical financial habits of "Money Saving Benkuri" have been published in one volume.

As the title suggests, 『Earn 50 million won more than your annual salary』 includes an Instatoon depicting the author Benkuri's journey to save 50 million won in one year, as well as a completely new additional manuscript.

It is packed with know-how that comics cannot provide, so even those just starting out in society or those new to investing can gain the courage and motivation to think, "Should I try it too?"

“If I keep going like this, I feel like I’ll end up working my whole life and have no money in my old age.”

The author, who had been working for five years, had a terrible dilemma.

He had saved a fair amount and made a profit of 70 million won in stocks, but when you add in his annual salary, his bank account, which had been worth hundreds of millions of won, only had 30 million won left.

What went wrong? I realized that I needed to fundamentally change the way I spent money as soon as I earned it.

As a first step, I had to firmly establish the reasons for saving and investing money (Part 1: Strengthening), create a habit of saving without giving up for three days (Part 2: Saving), and think hard about whether there was any way to earn more and make more money (Part 3: Exploiting).

These are things that no one told the author at the time.

From a pittance to a jackpot, the lessons learned through personal experience, from spending close to 100 million won on vacations, overseas trips, and fine dining, to becoming a spending devil who has become a household account fairy, the author has organized the basic knowledge of financial management step by step in the hope that readers will learn it sooner and earn more, just like the author who saved 5,000 a year and found happiness with a stable financial flow.

The popular financial cartoon "Money Saving Benkuri," followed by 110,000 people

The easiest and most realistic guide to financial freedom

I don't know what to do or how to start

48 Easy Money Tips for You!

*Includes additional tips not revealed on Instagram*

The main character is an ordinary office worker, and the sub-character is a money-saving fanatic and Instagrammer with 110,000 followers! The unique and practical financial habits of "Money Saving Benkuri" have been published in one volume.

As the title suggests, 『Earn 50 million won more than your annual salary』 includes an Instatoon depicting the author Benkuri's journey to save 50 million won in one year, as well as a completely new additional manuscript.

It is packed with know-how that comics cannot provide, so even those just starting out in society or those new to investing can gain the courage and motivation to think, "Should I try it too?"

“If I keep going like this, I feel like I’ll end up working my whole life and have no money in my old age.”

The author, who had been working for five years, had a terrible dilemma.

He had saved a fair amount and made a profit of 70 million won in stocks, but when you add in his annual salary, his bank account, which had been worth hundreds of millions of won, only had 30 million won left.

What went wrong? I realized that I needed to fundamentally change the way I spent money as soon as I earned it.

As a first step, I had to firmly establish the reasons for saving and investing money (Part 1: Strengthening), create a habit of saving without giving up for three days (Part 2: Saving), and think hard about whether there was any way to earn more and make more money (Part 3: Exploiting).

These are things that no one told the author at the time.

From a pittance to a jackpot, the lessons learned through personal experience, from spending close to 100 million won on vacations, overseas trips, and fine dining, to becoming a spending devil who has become a household account fairy, the author has organized the basic knowledge of financial management step by step in the hope that readers will learn it sooner and earn more, just like the author who saved 5,000 a year and found happiness with a stable financial flow.

- You can preview some of the book's contents.

Preview

index

Prologue_With the hope that you will learn and learn as soon as possible

[Mixing] MINDSET FOR STARTERS

Now all that's left is to become rich.

For the first time, I had a feeling something was wrong.

Investing? I can do that too!

I thought I would become rich after losing all my assets, but this is what happened instead.

The crashing stock market, chaos

Even if you enter a tiger's den, if you just come to your senses,

Now I'm making some money, but can't I even do this much?

Where did all my large balance go?

Why can't I buy a new villa?

"Mom, where on earth did you get 300 million?"

Why haven't I been able to save money all this time?

"Goodbye everyone~ Even though I can't throw off the bonds and shackles"

Saving to Make More Money

How much were you spending a month anyway?

The pit of evil, the root cause of bankruptcy! How to block installment payments

What Happened While Living on 50,000 Won a Month

A talisman called 'Tongjang' that wards off evil spirits

When in life you need to use your emergency fund

A question that dramatically reduces the impulse to consume

Just follow the rules and money will follow! Household Accounting Magic

I was shivering while buying toilet paper, but I ate pasta calmly.

The price of coffee is like a mountain made up of little things, sprinkle sprinkle!

Of all people, I was soulmates with delivery tteokbokki.

Even while saving, the AllXX Young sale period always comes around again.

Before you go winter coat shopping, be sure to check this out!

Let's take on the final boss, "Fixed Cost."

How to avoid financial hardship while dating

A thought that came to mind on a day when luxury bags caught my eye

The secret to breaking the yo-yo saving cycle

PT or Pilates, that is the question.

“How many days a month do you go without spending?”

[Bulli] GROWING TO BE SUPER RICH

A painful realization: saving alone isn't enough.

What I Learned from Becoming a Flea Market Seller

A small ball shot up by a wedding congratulatory song

I didn't even know about Instagram, Facebook, or Twitter.

The easiest way for office workers to earn more and find new jobs.

Finding the Golden Ratio Between Investment and Earned Income

Why I'm Obsessed with "Buying My Own Home"

6 Things You'll Regret Not Seeing When Buying a Home

Subscription: If you do this, your chances are better than winning the lottery.

The End of Moth Stock Investment

I left the paid reading room I was following like a divine revelation.

It's better to be broke than to be in debt.

So, what stocks should I invest in?

A big nosebleed from "John Burga is the answer"

Why I decided to join the pension plan

Which of the three pension products should you choose?

Honest Thoughts on Financial Freedom

Epilogue: Investing is ultimately about living.

[Mixing] MINDSET FOR STARTERS

Now all that's left is to become rich.

For the first time, I had a feeling something was wrong.

Investing? I can do that too!

I thought I would become rich after losing all my assets, but this is what happened instead.

The crashing stock market, chaos

Even if you enter a tiger's den, if you just come to your senses,

Now I'm making some money, but can't I even do this much?

Where did all my large balance go?

Why can't I buy a new villa?

"Mom, where on earth did you get 300 million?"

Why haven't I been able to save money all this time?

"Goodbye everyone~ Even though I can't throw off the bonds and shackles"

Saving to Make More Money

How much were you spending a month anyway?

The pit of evil, the root cause of bankruptcy! How to block installment payments

What Happened While Living on 50,000 Won a Month

A talisman called 'Tongjang' that wards off evil spirits

When in life you need to use your emergency fund

A question that dramatically reduces the impulse to consume

Just follow the rules and money will follow! Household Accounting Magic

I was shivering while buying toilet paper, but I ate pasta calmly.

The price of coffee is like a mountain made up of little things, sprinkle sprinkle!

Of all people, I was soulmates with delivery tteokbokki.

Even while saving, the AllXX Young sale period always comes around again.

Before you go winter coat shopping, be sure to check this out!

Let's take on the final boss, "Fixed Cost."

How to avoid financial hardship while dating

A thought that came to mind on a day when luxury bags caught my eye

The secret to breaking the yo-yo saving cycle

PT or Pilates, that is the question.

“How many days a month do you go without spending?”

[Bulli] GROWING TO BE SUPER RICH

A painful realization: saving alone isn't enough.

What I Learned from Becoming a Flea Market Seller

A small ball shot up by a wedding congratulatory song

I didn't even know about Instagram, Facebook, or Twitter.

The easiest way for office workers to earn more and find new jobs.

Finding the Golden Ratio Between Investment and Earned Income

Why I'm Obsessed with "Buying My Own Home"

6 Things You'll Regret Not Seeing When Buying a Home

Subscription: If you do this, your chances are better than winning the lottery.

The End of Moth Stock Investment

I left the paid reading room I was following like a divine revelation.

It's better to be broke than to be in debt.

So, what stocks should I invest in?

A big nosebleed from "John Burga is the answer"

Why I decided to join the pension plan

Which of the three pension products should you choose?

Honest Thoughts on Financial Freedom

Epilogue: Investing is ultimately about living.

Detailed image

Into the book

After repeated declines every day, the investment of 24 million won was reduced to 7 million won, and the loss ratio was close to 71%.

Despair itself.

After a period of self-reproach, I finally felt a sense of detachment. For a week, I lay in my room, doing nothing.

The missing 17 million won lingered before my eyes and I couldn't move.

"Are you really going to stay still like this? Are you always like this?" It might be a small amount to some, but to me, it was everything.

They say that even if you go into a tiger's den, you can survive if you just keep your wits about you.

'Now is the moment!'

--- p.35

At the time, my monthly salary was around 3.5 million won, but upon checking, I found that my credit card bill alone was averaging 3.5 million won per month.

Aside from the credit card bill, there were also additional cash expenses of 1.5 to 2 million won per month, including allowance from parents, insurance premiums paid in cash, check card usage fees, and amounts transferred via Kakao Pay.

In short, my salary was 350, but my expenses were over 500.

To manage my assets systematically, I decided to take a closer look at my expenses.

--- p.77

If you become addicted to the number 'spending = 0', you will start to feel aversion to consumption itself.

There was a time when I thought saving was the whole point of financial management.

I had intentionally closed my eyes and ears to stocks, funds, and real estate.

Friends who actively invested and learned and gained experience at that time quickly achieved investment results.

Saving isn't a panacea, and it must also be accompanied by appropriate investments for growth.

--- p.174

The money that should have been paid out as installment is gradually saved up in a savings account.

And while you're saving up for the installment, think back on the value of this item.

Think carefully about whether it is something you really need or whether it is just conspicuous consumption.

If you feel like you don't need to buy something, then you're happy to have some money in hand. If you feel like you absolutely have to buy something, then you should happily buy it.

Of course, in a lump sum.

--- p.84

It goes without saying that spending money is 100 times more fun than saving it.

The secret to making savings last is to set short-term goals and allow yourself small rewards.

--- p.161

Changing jobs is a risky challenge because it means venturing into a new world.

Once you move, you may be assigned tasks that are different from your current job, and the organizational atmosphere may be more rigid than it appears from the outside.

One more thing to consider is the 'promotion' aspect.

There are many cases where people are disadvantaged in promotions and compensation, whether knowingly or unknowingly.

Therefore, if you are close to being promoted at your original company or expect it to take a long time to get promoted after changing jobs, you should consider these factors when negotiating your salary.

--- p.202

After leaving the paid reading room, I reflected on what my mistakes were and what caused my endless anxiety.

The first reason that came to mind was a lack of understanding of market trends.

The second reason is that you did not judge for yourself.

All I did while in the paid room was wait for the signal and do as I was told.

As a result, I was unable to deal with the crisis situation.

--- p.231

No matter how much money I earned, I would feel sad when my friends and family around me were lonely, and I would feel depressed when I was too busy to pursue my only hobbies, traveling and singing.

I realized that filling my life with health is just as important as becoming rich.

After deciding to base wealth on myself, the first thing I did was delete YouTube.

Despair itself.

After a period of self-reproach, I finally felt a sense of detachment. For a week, I lay in my room, doing nothing.

The missing 17 million won lingered before my eyes and I couldn't move.

"Are you really going to stay still like this? Are you always like this?" It might be a small amount to some, but to me, it was everything.

They say that even if you go into a tiger's den, you can survive if you just keep your wits about you.

'Now is the moment!'

--- p.35

At the time, my monthly salary was around 3.5 million won, but upon checking, I found that my credit card bill alone was averaging 3.5 million won per month.

Aside from the credit card bill, there were also additional cash expenses of 1.5 to 2 million won per month, including allowance from parents, insurance premiums paid in cash, check card usage fees, and amounts transferred via Kakao Pay.

In short, my salary was 350, but my expenses were over 500.

To manage my assets systematically, I decided to take a closer look at my expenses.

--- p.77

If you become addicted to the number 'spending = 0', you will start to feel aversion to consumption itself.

There was a time when I thought saving was the whole point of financial management.

I had intentionally closed my eyes and ears to stocks, funds, and real estate.

Friends who actively invested and learned and gained experience at that time quickly achieved investment results.

Saving isn't a panacea, and it must also be accompanied by appropriate investments for growth.

--- p.174

The money that should have been paid out as installment is gradually saved up in a savings account.

And while you're saving up for the installment, think back on the value of this item.

Think carefully about whether it is something you really need or whether it is just conspicuous consumption.

If you feel like you don't need to buy something, then you're happy to have some money in hand. If you feel like you absolutely have to buy something, then you should happily buy it.

Of course, in a lump sum.

--- p.84

It goes without saying that spending money is 100 times more fun than saving it.

The secret to making savings last is to set short-term goals and allow yourself small rewards.

--- p.161

Changing jobs is a risky challenge because it means venturing into a new world.

Once you move, you may be assigned tasks that are different from your current job, and the organizational atmosphere may be more rigid than it appears from the outside.

One more thing to consider is the 'promotion' aspect.

There are many cases where people are disadvantaged in promotions and compensation, whether knowingly or unknowingly.

Therefore, if you are close to being promoted at your original company or expect it to take a long time to get promoted after changing jobs, you should consider these factors when negotiating your salary.

--- p.202

After leaving the paid reading room, I reflected on what my mistakes were and what caused my endless anxiety.

The first reason that came to mind was a lack of understanding of market trends.

The second reason is that you did not judge for yourself.

All I did while in the paid room was wait for the signal and do as I was told.

As a result, I was unable to deal with the crisis situation.

--- p.231

No matter how much money I earned, I would feel sad when my friends and family around me were lonely, and I would feel depressed when I was too busy to pursue my only hobbies, traveling and singing.

I realized that filling my life with health is just as important as becoming rich.

After deciding to base wealth on myself, the first thing I did was delete YouTube.

--- p.259

Publisher's Review

From motivation to concrete action plans, these inspiring and passionate reviews are truly inspiring.

"Thanks to you, author, I've finally figured out how to manage my money! I'll work hard. Thank you!!"

"I was feeling hopeless and lost, wondering how to save money, but this was a ray of light."

A to Z explained at a low eye level

My money-making operation!

Readers who are taking their first steps into financial management, such as the “money-saving Benkuri,” who is neither a billionaire nor a professional financial planner, gave him enthusiastic support, saying he was like “a ray of light.”

This may be because we sympathize with the sad and funny struggles that authors of the same level share in detail.

The author has loved money since he was young, but because his purpose was ultimately 'consumption', he had nothing left.

I started buying bags one after another with my bonus out of jealousy of my friend's luxury goods, and it became a habit every year.

When the stock market was soaring, my salary felt like pocket change, so I couldn't concentrate on my work (I looked at the stock market window instead).

When I was saving a lot, I was embarrassed that I was secretly worried about the cost of even a single meal on a date.

This vivid story of going through various trials and errors to find the answer to truly healthy money saving and financial management powerfully motivates readers with the message, "I can do it too."

"I really want it, but can't I get an interest-free installment plan?" "How much of my salary should I save?" "Is it worth saving during the All Young sale?" "How can I reduce my food and coffee expenses?" "I think I should invest in stocks and real estate, but I'm scared!" If you've ever wondered anything like this, open "Earn 50 Million Won More Than Your Annual Salary" right now.

From the moment your paycheck comes in, create your own system to block money leaks, from the new technique of splitting your bank account to creating a household budget optimized for saving, how to deal with the main causes of empty bank accounts such as installment plans, delivery food, and sales periods, how to increase your side income pipeline by saying, “Saving alone won’t do it!”, developing a wise eye for stock investment and real estate, etc. It may not be grand, but if you follow them one by one, you will soon develop habits that will give you solid confidence in money management.

We hope that this guide, written in simple and detailed terms so that you can immediately apply it to your daily life, will serve as a stepping stone to saving money beyond your annual salary and taking a big leap toward the happy financial life you dream of.

"Thanks to you, author, I've finally figured out how to manage my money! I'll work hard. Thank you!!"

"I was feeling hopeless and lost, wondering how to save money, but this was a ray of light."

A to Z explained at a low eye level

My money-making operation!

Readers who are taking their first steps into financial management, such as the “money-saving Benkuri,” who is neither a billionaire nor a professional financial planner, gave him enthusiastic support, saying he was like “a ray of light.”

This may be because we sympathize with the sad and funny struggles that authors of the same level share in detail.

The author has loved money since he was young, but because his purpose was ultimately 'consumption', he had nothing left.

I started buying bags one after another with my bonus out of jealousy of my friend's luxury goods, and it became a habit every year.

When the stock market was soaring, my salary felt like pocket change, so I couldn't concentrate on my work (I looked at the stock market window instead).

When I was saving a lot, I was embarrassed that I was secretly worried about the cost of even a single meal on a date.

This vivid story of going through various trials and errors to find the answer to truly healthy money saving and financial management powerfully motivates readers with the message, "I can do it too."

"I really want it, but can't I get an interest-free installment plan?" "How much of my salary should I save?" "Is it worth saving during the All Young sale?" "How can I reduce my food and coffee expenses?" "I think I should invest in stocks and real estate, but I'm scared!" If you've ever wondered anything like this, open "Earn 50 Million Won More Than Your Annual Salary" right now.

From the moment your paycheck comes in, create your own system to block money leaks, from the new technique of splitting your bank account to creating a household budget optimized for saving, how to deal with the main causes of empty bank accounts such as installment plans, delivery food, and sales periods, how to increase your side income pipeline by saying, “Saving alone won’t do it!”, developing a wise eye for stock investment and real estate, etc. It may not be grand, but if you follow them one by one, you will soon develop habits that will give you solid confidence in money management.

We hope that this guide, written in simple and detailed terms so that you can immediately apply it to your daily life, will serve as a stepping stone to saving money beyond your annual salary and taking a big leap toward the happy financial life you dream of.

GOODS SPECIFICS

- Date of issue: October 11, 2023

- Page count, weight, size: 264 pages | 402g | 148*210*18mm

- ISBN13: 9791140706617

- ISBN10: 1140706616

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)