The Dirty Market and the Lizard Brain

|

Description

Book Introduction

“Understanding irrational humans “A must-read book for market insight!” - Jaeseung Jeong (neuroscientist, KAIST professor) The Gospel of Stock Investment, Read for 20 Years, Regardless of Bull or Bear Market Terry Burnham, who served as an economics professor at Harvard University, including Harvard Kennedy School and Harvard Business School, and was called "the greatest investment economist of his time," has published the only investment book, "Mean Markets and Lizard Brains," which has been completely revised and published in 2023. In addition to enhancing the quality of the translation, the book's completeness was enhanced by the meticulous review of Lee Sang-geon, CEO of Mirae Asset Investment & Pension, a recognized expert in Korea in imparting investment knowledge. In addition, the author's 2023 Korean edition preface provides the most optimal information for investors anxious about the turbulent stock market. This book dispassionately analyzes how the "lizard brain," like our "primitive brain," hinders our economic choices for making money, and clearly explains how various signals can be interpreted to benefit investment from this perspective. According to the author's research, we humans are much more influenced by the survival instinct that has developed since our ancestors, or the "lizard brain", than we think. In the distant past, when people lived as hunters and gatherers, they had to remember where edible fish and rabbits were found to obtain food, and they had to understand the patterns of predators to survive. That is why the brain has developed to be ‘retrospective’ and ‘pattern-oriented’. However, the financial markets we participate in are completely different from our natural environment, so our lizard brain keeps making mistakes. Especially, a market that has been in an upward trend for a long time is very fatal to the lizard brain. Our old brains only remember the past glories of rising prosperity, so they blind us to truly dire economic signals and cause us to lose money. This is precisely why you should read "Mean Markets and Lizard Brains," newly published in 2023. Korean investors are currently going through a period of turmoil. Some people, remembering only the incredible bull market that followed the COVID-19 pandemic, continue to "ride the wave" and lower their average purchase price, while others are cowering, completely withdrawing from the investment market, saying, "The boom is now completely over." Which of these two positions should we take to profit from the market? Is the boom finally over? Or is the recession just a temporary setback, and will the golden age of investing return? The author weaves together warp and weft across various fields to explain the environment of the "financial market," an environment that could not be understood solely through neuroscience or macroeconomics, in a clear and easy-to-understand manner. The author says that since it is ultimately the 'human' participants who create the market, the puzzle can only be solved by understanding both the human brain and the economy. Even if this book can't perfectly predict the future, it will at least give you an idea of what position you should take now to make money. Whether the market is bullish or bearish, anyone can enjoy a comfortable investment life as long as they remember these fundamental insights about people and the market. |

- You can preview some of the book's contents.

Preview

index

Foreword to the 2023 Korean Edition | To Korean Readers Struggling in a Difficult Market

Reviewer's Note | Are you good at investing? Are you making good money?

Recommended Reading | A Guide to Surviving the Bloody Game of Investing

Introduction | Your Brain Is Too Old to Make Money

Prologue | Where to Invest

Part 1 Why Didn't You Make Money?

Chapter 1: The Irrational Human | The Lizard Brain: Designed to Fail at Investing

Chapter 2: Irrational Markets | Villains Preying on Investors

Part 2: The Big Players Who Move the Dirty Market

Chapter 3: The American Economy at a Crossroads | Rise or Fizzle

Chapter 4: Inflation | The Return of the Giant Monster

Chapter 5: The Dollar and Exchange Rates | America Becomes an International Beggar

Part 3: Surviving the Jungle of Investment Markets

Chapter 6: Stocks | To Hunt or to Be Hunted

Chapter 7: Bonds | The Cowards' Counterattack

Chapter 8: Real Estate | Build Strength, Become Strong, and Survive Difficult Times

Part 4: The truly rich don't trust anyone, not even themselves!

Chapter 9: Shackling the Lizard's Brain

Chapter 10: Invest in the Most Dirty Markets

Epilogue | The Only Way the Ancient Brain Can Win in the Modern Market

Americas

Reviewer's Note | Are you good at investing? Are you making good money?

Recommended Reading | A Guide to Surviving the Bloody Game of Investing

Introduction | Your Brain Is Too Old to Make Money

Prologue | Where to Invest

Part 1 Why Didn't You Make Money?

Chapter 1: The Irrational Human | The Lizard Brain: Designed to Fail at Investing

Chapter 2: Irrational Markets | Villains Preying on Investors

Part 2: The Big Players Who Move the Dirty Market

Chapter 3: The American Economy at a Crossroads | Rise or Fizzle

Chapter 4: Inflation | The Return of the Giant Monster

Chapter 5: The Dollar and Exchange Rates | America Becomes an International Beggar

Part 3: Surviving the Jungle of Investment Markets

Chapter 6: Stocks | To Hunt or to Be Hunted

Chapter 7: Bonds | The Cowards' Counterattack

Chapter 8: Real Estate | Build Strength, Become Strong, and Survive Difficult Times

Part 4: The truly rich don't trust anyone, not even themselves!

Chapter 9: Shackling the Lizard's Brain

Chapter 10: Invest in the Most Dirty Markets

Epilogue | The Only Way the Ancient Brain Can Win in the Modern Market

Americas

Detailed image

Into the book

The lizard brain is great at finding food and shelter, but terrible at navigating financial markets.

So, using the lizard brain when making decisions about money creates several problems.

The problem is that when we handle money, we too often use this archaic part of our brain—our lizard brain—that helped us survive for tens of thousands of years before financial markets were even invented, instead of our cool, analytical prefrontal cortex.

The lizard brain isn't stupid, but it causes us to lose our reasoning when faced with problems our ancestors never faced.

---From "Chapter 1, Irrational Humans | The Lizard Brain: Designed to Fail at Investing"

Many people make bold predictions about future inflation rates.

Some books advise against preparing for the coming deflationary period, while others argue that inflation is coming and investors should buy gold to protect themselves.

However, I don't really believe people who guarantee that inflation or deflation will come in the future.

The inflation rate in the United States will depend on the decisions of the Federal Reserve, the monetary authority.

I am of the opinion that those who decide monetary policy are not controlled by circumstances.

Therefore, to effectively predict inflation, we need to understand in detail the “push and pull forces” that determine inflation.

Inflation forecasting also depends on the ability to predict human behavior.

Just like when playing poker.

---From "Chapter 4, Inflation | The Return of the Giant Monster"

Remember, when the market goes to extremes, the lizard brain always points to the opposite side of where the opportunity is.

Even when rational economic figures suggest the dollar's decline against major currencies is over, the ruthless market won't stop at "fair value."

Just as the dollar was grossly overvalued before it stopped rising, the science of irrationality suggests that the dollar will only end its decline after it becomes significantly undervalued and despised by experts.

---From "Chapter 5, The Dollar and Exchange Rates | The United States, the International Beggar"

Optimism and pessimism come up again and again in investing.

If everyone is bullish on stocks, they are probably not a good investment.

On the other hand, if there is widespread pessimism and a gloomy outlook for stocks, then a rise in the stock market can be expected.

This psychology is reflected in stock prices.

Let's say an investor decides to forgo the guaranteed $4.40 in interest from bonds and opt for the S&P 500, which only receives a dividend of about $1.81.

Why would this person willingly accept a lower yield? In this case, they accept today's lower yield because they believe the dividend will increase in the future.

However, if the stock market is in a downturn, investors will only choose stocks when the dividend is higher than the bond interest rate, that is, when the yield is clearly high.

---From "Chapter 6, Stocks | To Hunt or to Be Hunted"

Adjustable rate mortgages are very tempting because they offer very low monthly payments.

One day, I was sitting in my apartment jacuzzi when my neighbor, Alec, told me that he was moving out of Cambridge and into a bigger house he had bought in the Boston suburbs.

As always, I asked, “Did you get a fixed-rate mortgage or a variable-rate mortgage?”

Alec answered that it was a variable rate.

When asked why he took out a variable-rate mortgage, he replied, “I can’t afford to buy with a fixed-rate mortgage.”

I would recommend exactly the opposite strategy.

If the price of a house is so high that you can't afford the monthly payment when taking out a fixed-rate loan, lower your standards.

The answer is to buy less expensive real estate.

---From "Chapter 8, Real Estate | Build Strength, Become Strong, and Endure Difficult Times"

The brain shouldn't be thought of as a single, cohesive entity. According to MIT professor Marvin Minsky, it should be understood as "a society of minds with different and sometimes competing goals."

The part of the lizard's brain that thinks and perceives more is located in the prefrontal cortex, whereas the lizard's brain is located elsewhere.

Additionally, recent neuroscience research suggests that the lizard brain is associated with behaviors that bring us loss.

If you feel the urge to trade, it may be a tip from your lizard brain, not your prefrontal cortex.

Although this old brain may have guided our ancestors towards prey, it won't make us rich.

So, if your brain gives you a tip that it's an investment idea, you should look at it with a skeptical eye.

Was that idea truly born from sound, cool-headed analysis? Or did it magically appear without my knowledge? If it feels like a golden opportunity, a moment that will pass, and an urgent need to act immediately, then it's the lizard brain at work.

Whenever I have an investment idea, whether I'm feeling inspired or not, I wait at least a week before acting on it.

This principle may cause you to miss out on big opportunities, but it will at least prevent you from making a lot of bad decisions.

---From "Chapter 9, Put Shackles on the Lizard's Brain"

Rather than looking for ideas that are "unprofitable," we should look for ideas that are "stupid and unlikely to make money."

This applies not only to general investment risks but also to specific investment assets.

We must take risks when safe investments are in vogue.

For example, if there is a widespread belief that debt is bad, that is a good sign that taking risks can yield high returns.

In general, wait until you hear the word "avoid stocks."

Only when you can invest based on visible human psychology rather than uncertain predictions will you be able to wisely overcome the temptation of the lizard brain.

So, using the lizard brain when making decisions about money creates several problems.

The problem is that when we handle money, we too often use this archaic part of our brain—our lizard brain—that helped us survive for tens of thousands of years before financial markets were even invented, instead of our cool, analytical prefrontal cortex.

The lizard brain isn't stupid, but it causes us to lose our reasoning when faced with problems our ancestors never faced.

---From "Chapter 1, Irrational Humans | The Lizard Brain: Designed to Fail at Investing"

Many people make bold predictions about future inflation rates.

Some books advise against preparing for the coming deflationary period, while others argue that inflation is coming and investors should buy gold to protect themselves.

However, I don't really believe people who guarantee that inflation or deflation will come in the future.

The inflation rate in the United States will depend on the decisions of the Federal Reserve, the monetary authority.

I am of the opinion that those who decide monetary policy are not controlled by circumstances.

Therefore, to effectively predict inflation, we need to understand in detail the “push and pull forces” that determine inflation.

Inflation forecasting also depends on the ability to predict human behavior.

Just like when playing poker.

---From "Chapter 4, Inflation | The Return of the Giant Monster"

Remember, when the market goes to extremes, the lizard brain always points to the opposite side of where the opportunity is.

Even when rational economic figures suggest the dollar's decline against major currencies is over, the ruthless market won't stop at "fair value."

Just as the dollar was grossly overvalued before it stopped rising, the science of irrationality suggests that the dollar will only end its decline after it becomes significantly undervalued and despised by experts.

---From "Chapter 5, The Dollar and Exchange Rates | The United States, the International Beggar"

Optimism and pessimism come up again and again in investing.

If everyone is bullish on stocks, they are probably not a good investment.

On the other hand, if there is widespread pessimism and a gloomy outlook for stocks, then a rise in the stock market can be expected.

This psychology is reflected in stock prices.

Let's say an investor decides to forgo the guaranteed $4.40 in interest from bonds and opt for the S&P 500, which only receives a dividend of about $1.81.

Why would this person willingly accept a lower yield? In this case, they accept today's lower yield because they believe the dividend will increase in the future.

However, if the stock market is in a downturn, investors will only choose stocks when the dividend is higher than the bond interest rate, that is, when the yield is clearly high.

---From "Chapter 6, Stocks | To Hunt or to Be Hunted"

Adjustable rate mortgages are very tempting because they offer very low monthly payments.

One day, I was sitting in my apartment jacuzzi when my neighbor, Alec, told me that he was moving out of Cambridge and into a bigger house he had bought in the Boston suburbs.

As always, I asked, “Did you get a fixed-rate mortgage or a variable-rate mortgage?”

Alec answered that it was a variable rate.

When asked why he took out a variable-rate mortgage, he replied, “I can’t afford to buy with a fixed-rate mortgage.”

I would recommend exactly the opposite strategy.

If the price of a house is so high that you can't afford the monthly payment when taking out a fixed-rate loan, lower your standards.

The answer is to buy less expensive real estate.

---From "Chapter 8, Real Estate | Build Strength, Become Strong, and Endure Difficult Times"

The brain shouldn't be thought of as a single, cohesive entity. According to MIT professor Marvin Minsky, it should be understood as "a society of minds with different and sometimes competing goals."

The part of the lizard's brain that thinks and perceives more is located in the prefrontal cortex, whereas the lizard's brain is located elsewhere.

Additionally, recent neuroscience research suggests that the lizard brain is associated with behaviors that bring us loss.

If you feel the urge to trade, it may be a tip from your lizard brain, not your prefrontal cortex.

Although this old brain may have guided our ancestors towards prey, it won't make us rich.

So, if your brain gives you a tip that it's an investment idea, you should look at it with a skeptical eye.

Was that idea truly born from sound, cool-headed analysis? Or did it magically appear without my knowledge? If it feels like a golden opportunity, a moment that will pass, and an urgent need to act immediately, then it's the lizard brain at work.

Whenever I have an investment idea, whether I'm feeling inspired or not, I wait at least a week before acting on it.

This principle may cause you to miss out on big opportunities, but it will at least prevent you from making a lot of bad decisions.

---From "Chapter 9, Put Shackles on the Lizard's Brain"

Rather than looking for ideas that are "unprofitable," we should look for ideas that are "stupid and unlikely to make money."

This applies not only to general investment risks but also to specific investment assets.

We must take risks when safe investments are in vogue.

For example, if there is a widespread belief that debt is bad, that is a good sign that taking risks can yield high returns.

In general, wait until you hear the word "avoid stocks."

Only when you can invest based on visible human psychology rather than uncertain predictions will you be able to wisely overcome the temptation of the lizard brain.

---From "Chapter 10: Invest in the Most Dirty Market"

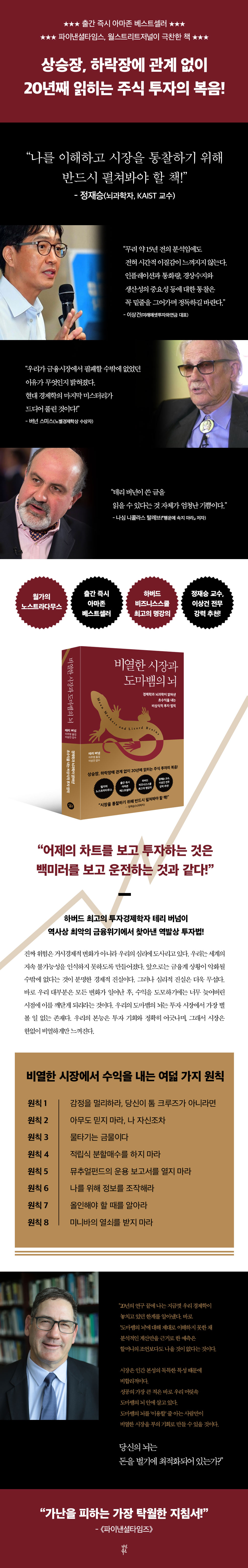

Publisher's Review

Investors saved during every financial crisis

The Nostradamus of Wall Street is back!

Terry Burnham, Harvard's top investment economist

A contrarian investment strategy discovered during the worst financial crisis in history.

There is someone who accurately predicted the 2008 financial crisis.

Terry Burnham is considered 'Harvard's best investment economist.'

In his 2005 book, "Mean Markets and the Lizard Brain," he revealed that humans are heavily influenced by a part of the brain called the "lizard brain," which evolved to suit primitive times, and that this is why they often fail in investments.

Additionally, he provided a method for successful investment by predicting the future trends of representative investment targets such as stocks, bonds, and real estate through macroeconomic indicators such as exchange rates, productivity, inflation, and fiscal deficit.

And his prediction turned out to be surprisingly accurate.

American investors who followed Burnham's advice were able to smile brightly in 2008 when the world was crying.

In fact, this is not the only time Burnham has foreseen the market.

He boldly took a short position on EMC, a computer disk memory manufacturer, in the early 2000s when it was all the media and analyst attention, and the strategy worked perfectly.

EMC's stock price, which had been over $100 per share, soon fell to below $4, giving Burnham a taste of sweet profits.

In this way, he has been involved in the investment industry since the 1980s, and has even experienced several stock market crashes and financial crises, including those in 1995, 2000, and 2008, while further solidifying his assets through his keen insight into people and the market.

That's why Terry Burnham enjoys a strong reputation among global economic leaders and investment professionals.

He also gained enthusiastic support from American investors after the 2008 global financial crisis by sharing his wisdom in books.

“Is your brain optimized for making money?”

Surviving the bloody game of investment and finally

A must-read guide to finding wealth opportunities!

Eighteen years have passed since the first edition of 『Mean Markets and Lizard Brains』 was published in 2005.

What is the current market like? Surprisingly, the investment market's movements since the COVID-19 pandemic have been exactly as Terry Burnham predicted in 2005.

As liquidity was released around the world due to the coronavirus, consumption increased and savings decreased.

Naturally, stock and real estate prices skyrocketed.

It was a stark resemblance to the market of the early 2000s, which Terry Burnham described as "the most dangerous and lethal environment for a lizard brain that is designed to fail at investing."

The lizard brain told us that the bull market would continue, and investors were fooled into buying stocks and real estate.

Even when there were clear signs of a market crash, most investors blindly believed in stocks, believing that they would soon see profits if they just rode the wave.

What about real estate? "If you ask everyone to imagine a bear market, they'll think of a flat market.

They never thought that house prices would fall.

Terry Burnham's words, "This is when things are most dangerous," have come true in Korea as well.

Contrary to what lizard-brained investors had thought, the real estate market was in a consolidation phase and would soon rebound, with transactions gradually decreasing and entering a full-blown bear market.

In this way, Terry Burnham conveys timeless wisdom by going beyond the economic situation or outlook of a single point in time to insight into people and markets.

Mirae Asset Investment & Pension CEO Lee Sang-geon praised the book, saying, “It is a weighty insight that requires careful reading, even in 2023, with no sense of temporal incongruity.”

“Investing by looking at yesterday’s chart

“It’s like driving while looking in the rearview mirror!”

A contrarian investment method that overcomes the irrational mind and irrational market!

If our instincts, our lizard brains, are inherently designed to "fail at investing," does that mean we can never make money investing? Fortunately, Terry Burnham offers a book that teaches us how to make money.

According to Burnham's analysis, the capitalist market is inherently irrational and an "unnatural environment" completely different from the natural world in which we instinctively survive.

Contrary to the lizard brain, which is developed to 'obsess over the past' and 'find patterns in past behavior', investing is best done by looking to the future, not the past.

So the author says the only way to make money is to “lock the lizard brain with a lock and throw away the key so it can never be found again.”

In this book, Burnham reveals step-by-step how to harness the lizard brain and invest using the prefrontal cortex, the most rational part of our brain.

It also provides guidance on how to invest in the stock, bond, and real estate markets without distorting the market through the most important macroeconomic indicators for investment.

The author confidently states that anyone can achieve long-term prosperity through contrarian investments that generate extreme profits if they understand the "humans" who make investment decisions and the "irrational market trends" created by these irrational individuals.

The 2023 revised edition includes a Korean-language foreword by Terry Burnham, offering his outlook on the Korean economy, to make the book even more useful to Korean investors.

Burnham is encouraging us, offering both sober advice and warm comfort to Korean investors.

Terry Burnham's timeless analysis and insights will be a valuable resource for Korean investors struggling with the recession in 2023.

The Nostradamus of Wall Street is back!

Terry Burnham, Harvard's top investment economist

A contrarian investment strategy discovered during the worst financial crisis in history.

There is someone who accurately predicted the 2008 financial crisis.

Terry Burnham is considered 'Harvard's best investment economist.'

In his 2005 book, "Mean Markets and the Lizard Brain," he revealed that humans are heavily influenced by a part of the brain called the "lizard brain," which evolved to suit primitive times, and that this is why they often fail in investments.

Additionally, he provided a method for successful investment by predicting the future trends of representative investment targets such as stocks, bonds, and real estate through macroeconomic indicators such as exchange rates, productivity, inflation, and fiscal deficit.

And his prediction turned out to be surprisingly accurate.

American investors who followed Burnham's advice were able to smile brightly in 2008 when the world was crying.

In fact, this is not the only time Burnham has foreseen the market.

He boldly took a short position on EMC, a computer disk memory manufacturer, in the early 2000s when it was all the media and analyst attention, and the strategy worked perfectly.

EMC's stock price, which had been over $100 per share, soon fell to below $4, giving Burnham a taste of sweet profits.

In this way, he has been involved in the investment industry since the 1980s, and has even experienced several stock market crashes and financial crises, including those in 1995, 2000, and 2008, while further solidifying his assets through his keen insight into people and the market.

That's why Terry Burnham enjoys a strong reputation among global economic leaders and investment professionals.

He also gained enthusiastic support from American investors after the 2008 global financial crisis by sharing his wisdom in books.

“Is your brain optimized for making money?”

Surviving the bloody game of investment and finally

A must-read guide to finding wealth opportunities!

Eighteen years have passed since the first edition of 『Mean Markets and Lizard Brains』 was published in 2005.

What is the current market like? Surprisingly, the investment market's movements since the COVID-19 pandemic have been exactly as Terry Burnham predicted in 2005.

As liquidity was released around the world due to the coronavirus, consumption increased and savings decreased.

Naturally, stock and real estate prices skyrocketed.

It was a stark resemblance to the market of the early 2000s, which Terry Burnham described as "the most dangerous and lethal environment for a lizard brain that is designed to fail at investing."

The lizard brain told us that the bull market would continue, and investors were fooled into buying stocks and real estate.

Even when there were clear signs of a market crash, most investors blindly believed in stocks, believing that they would soon see profits if they just rode the wave.

What about real estate? "If you ask everyone to imagine a bear market, they'll think of a flat market.

They never thought that house prices would fall.

Terry Burnham's words, "This is when things are most dangerous," have come true in Korea as well.

Contrary to what lizard-brained investors had thought, the real estate market was in a consolidation phase and would soon rebound, with transactions gradually decreasing and entering a full-blown bear market.

In this way, Terry Burnham conveys timeless wisdom by going beyond the economic situation or outlook of a single point in time to insight into people and markets.

Mirae Asset Investment & Pension CEO Lee Sang-geon praised the book, saying, “It is a weighty insight that requires careful reading, even in 2023, with no sense of temporal incongruity.”

“Investing by looking at yesterday’s chart

“It’s like driving while looking in the rearview mirror!”

A contrarian investment method that overcomes the irrational mind and irrational market!

If our instincts, our lizard brains, are inherently designed to "fail at investing," does that mean we can never make money investing? Fortunately, Terry Burnham offers a book that teaches us how to make money.

According to Burnham's analysis, the capitalist market is inherently irrational and an "unnatural environment" completely different from the natural world in which we instinctively survive.

Contrary to the lizard brain, which is developed to 'obsess over the past' and 'find patterns in past behavior', investing is best done by looking to the future, not the past.

So the author says the only way to make money is to “lock the lizard brain with a lock and throw away the key so it can never be found again.”

In this book, Burnham reveals step-by-step how to harness the lizard brain and invest using the prefrontal cortex, the most rational part of our brain.

It also provides guidance on how to invest in the stock, bond, and real estate markets without distorting the market through the most important macroeconomic indicators for investment.

The author confidently states that anyone can achieve long-term prosperity through contrarian investments that generate extreme profits if they understand the "humans" who make investment decisions and the "irrational market trends" created by these irrational individuals.

The 2023 revised edition includes a Korean-language foreword by Terry Burnham, offering his outlook on the Korean economy, to make the book even more useful to Korean investors.

Burnham is encouraging us, offering both sober advice and warm comfort to Korean investors.

Terry Burnham's timeless analysis and insights will be a valuable resource for Korean investors struggling with the recession in 2023.

GOODS SPECIFICS

- Date of issue: June 19, 2023

- Page count, weight, size: 420 pages | 748g | 152*225*27mm

- ISBN13: 9791130643632

- ISBN10: 1130643638

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)