The easiest 7-day financial statement reading in Korea

|

Description

Book Introduction

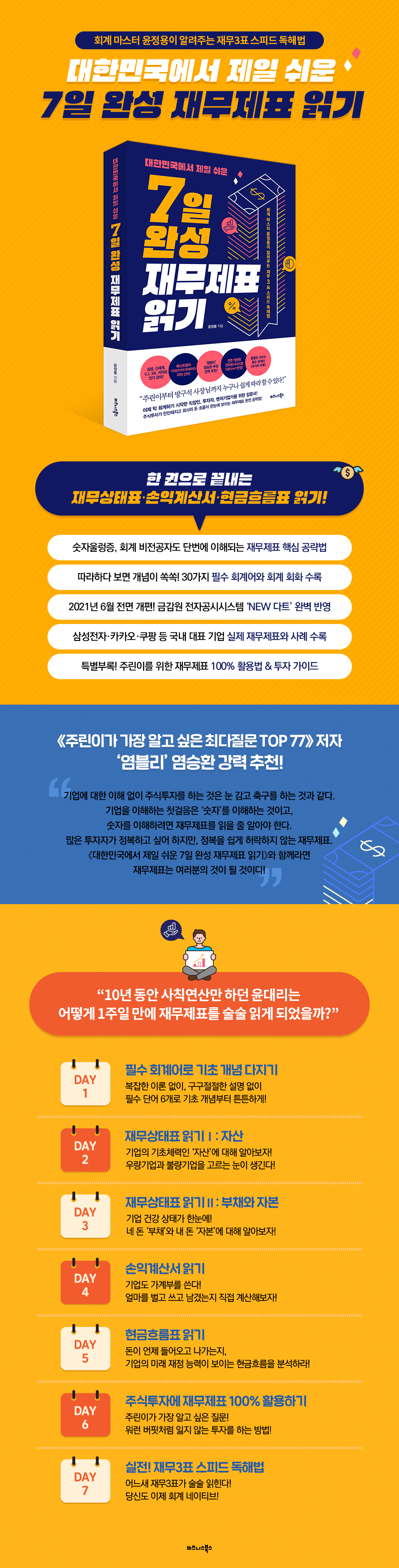

“Conquering financial statements is possible with this book!” -Yeom Seung-hwan, author of "The 77 Most Frequently Asked Questions by Children" Manager Yoon, who had only done basic arithmetic operations for 10 years The secret to reading financial statements fluently in just one week! A one-volume, speed-reading guide to the three financial statements. For office workers, accounting is not an option, it is a necessity. To accurately understand my work and assess the value of the company I work for, I need to know accounting, the language of business. Besides, these days, 'N-jobs' are the trend. As the investment and financial management craze sweeps across all generations, the number of workers who plan to pursue secondary economic activities such as financial management, investment, and entrepreneurship while maintaining their main job is increasing. Accounting thinking and understanding financial statements are necessary not only to do one's job well but also to improve the basic physical strength for all economic activities. Here's why you need to overcome financial statement illiteracy right now. Reading financial statements is like sifting through the countless pieces of information about a company to find the most useful information I need. All company activities are recorded numerically and organized in tables. It contains all the information about the company, including how it makes money, how much cash it has, and whether its quarterly performance is good or bad. However, reading financial statements is by no means easy for non-accounting majors. Many people give up because they are overwhelmed by difficult accounting terms and theories. "The Easiest 7-Day Financial Statement Reading in Korea" is a book written by the author, who has helped tens of thousands of office workers escape from being accounting novices, for those who lack basic accounting knowledge but want to start reading financial statements right away. We will teach you the '7-Day Financial Statement Reading Method' that will enable anyone to read the balance sheet, income statement, and cash flow statement fluently in just one week. Since the author himself was a non-accounting major with a fear of numbers, it was written in an easy and fun way for beginners to understand. Instead of exhaustive explanations and theories, we've included only the essential accounting knowledge and core principles needed to understand financial statements. Have you been avoiding financial statements because you thought they were too difficult or didn't understand why they were necessary? Then invest in just seven days. After a week, you'll find yourself fluently reading the three financial statements. |

- You can preview some of the book's contents.

Preview

index

Preface_You are already accounting

DAY 1_Building Basic Concepts with Essential Accounting Terms

Complete the concept with just 6 words, without complicated theories!

[Enter] Why I Do Accounting

01 Let's start by understanding what accounting is.

02 Master key to financial statements at a glance, accounting equation

03 The electronic disclosure system is a treasure trove for accounting beginners.

04 All the company's secrets are contained in its financial statements.

05 Consolidated and Separate Financial Statements

DAY 2_Reading the Balance Sheet I: Assets

Let's learn about "assets," the foundation of a company's strength.

[Introduction] Understanding the 'Assets' section of the financial statements

01 When you're wondering whether this company will go bankrupt or not, consider current assets.

02 What does this company sell? If you don't know, look at inventory assets.

03 If you sell, you should get paid! Accounts Receivable

04 Investment assets are the company's investment returns

05 Visible and tangible tangible assets

06 Intangible assets that work hard even when invisible

DAY 3_Reading the Balance Sheet II: Liabilities and Equity

If your money is 'debt', my money is 'capital'

[Introduction 1] Understanding the 'Liabilities' section of the financial statements

01 Advance payment is a good debt

02 If you bought it on credit, you must make a purchase account.

03 Another name for a loan, a borrowing

[Introduction 2] Understanding 'Capital' in the Balance Sheet

04 My strong money, capital

05 Retained earnings are evidence of a successful business.

DAY 4_Reading the Income Statement: Revenues and Expenses

Let's look at how much a company earns and how much it spends.

[Introduction] What does an income statement look like?

01 The real name of margin is gross profit

02 Selling and administrative expenses are the money spent on selling.

03 Money earned through investment, non-operating income

04 Interest coverage ratio is a measure of interest repayment ability.

05 The share that the company ultimately holds, net income

06 Keywords that predict the future of a company: growth potential and profitability

DAY 5_Reading the Cash Flow Statement: Cash and Cash Flow

Cash flow, which shows the company's future financial ability

[Introduction] What does a cash flow statement look like?

01 The cash flow statement shows the flow of money.

02 Complete Mastery of Cash Flow Pattern Analysis

03 Cash flow that I can manage as I please, free cash flow

DAY 6_How to Use Financial Statements 100% for Children

How to Invest Without Losing Like Warren Buffett

[Introduction] Reading Essential Terms for Beginners

01 The #1 essential check when investing in stocks: Audit opinion

02 Return on Equity (ROE), the investor return that Buffett so strongly emphasized

03 Secret Weapons of Corporate Valuation: PER and PBR

04 Completely analyze your business with financial ratios.

05 If you don't know how to do accounting, your stocks could become worthless.

[Special Appendix] Stock Investment Guide for Prospective Investors

DAY 7_Practice! Speed Reading Techniques for the Financial Statements

Financial 3 Tables are easy to understand, now you can become an accounting expert

You are now an accounting expert

DAY 1_Building Basic Concepts with Essential Accounting Terms

Complete the concept with just 6 words, without complicated theories!

[Enter] Why I Do Accounting

01 Let's start by understanding what accounting is.

02 Master key to financial statements at a glance, accounting equation

03 The electronic disclosure system is a treasure trove for accounting beginners.

04 All the company's secrets are contained in its financial statements.

05 Consolidated and Separate Financial Statements

DAY 2_Reading the Balance Sheet I: Assets

Let's learn about "assets," the foundation of a company's strength.

[Introduction] Understanding the 'Assets' section of the financial statements

01 When you're wondering whether this company will go bankrupt or not, consider current assets.

02 What does this company sell? If you don't know, look at inventory assets.

03 If you sell, you should get paid! Accounts Receivable

04 Investment assets are the company's investment returns

05 Visible and tangible tangible assets

06 Intangible assets that work hard even when invisible

DAY 3_Reading the Balance Sheet II: Liabilities and Equity

If your money is 'debt', my money is 'capital'

[Introduction 1] Understanding the 'Liabilities' section of the financial statements

01 Advance payment is a good debt

02 If you bought it on credit, you must make a purchase account.

03 Another name for a loan, a borrowing

[Introduction 2] Understanding 'Capital' in the Balance Sheet

04 My strong money, capital

05 Retained earnings are evidence of a successful business.

DAY 4_Reading the Income Statement: Revenues and Expenses

Let's look at how much a company earns and how much it spends.

[Introduction] What does an income statement look like?

01 The real name of margin is gross profit

02 Selling and administrative expenses are the money spent on selling.

03 Money earned through investment, non-operating income

04 Interest coverage ratio is a measure of interest repayment ability.

05 The share that the company ultimately holds, net income

06 Keywords that predict the future of a company: growth potential and profitability

DAY 5_Reading the Cash Flow Statement: Cash and Cash Flow

Cash flow, which shows the company's future financial ability

[Introduction] What does a cash flow statement look like?

01 The cash flow statement shows the flow of money.

02 Complete Mastery of Cash Flow Pattern Analysis

03 Cash flow that I can manage as I please, free cash flow

DAY 6_How to Use Financial Statements 100% for Children

How to Invest Without Losing Like Warren Buffett

[Introduction] Reading Essential Terms for Beginners

01 The #1 essential check when investing in stocks: Audit opinion

02 Return on Equity (ROE), the investor return that Buffett so strongly emphasized

03 Secret Weapons of Corporate Valuation: PER and PBR

04 Completely analyze your business with financial ratios.

05 If you don't know how to do accounting, your stocks could become worthless.

[Special Appendix] Stock Investment Guide for Prospective Investors

DAY 7_Practice! Speed Reading Techniques for the Financial Statements

Financial 3 Tables are easy to understand, now you can become an accounting expert

You are now an accounting expert

Detailed image

Into the book

"Accounting is too much for me." To you, who's about to close the book after just three pages, I have some good news to share.

The 'accounting equation' you will learn from now on is the whole of accounting.

If you know just this word, you know half of accounting.

But there is also bad news.

The fact is that you must 'completely' understand this accounting equation.

'I can see your heart~ Om mani bam mi om.' Just like Gung Ye (a character in the drama 'Taejo Wang Geon'), who had no eyes but could see through people's hearts, if you know the accounting equation, you can see through accounting.

--- p.25 From "Master Key to Financial Statements at a Glance, Accounting Equation"

Financial statements consist of five types of tables.

The financial statements are the statement of financial position, income statement, statement of changes in equity, statement of cash flows, and notes in a separate appendix.

Don't be intimidated or nervous by difficult explanations.

Do you know the four kings of Hong Kong acting? They were Aaron Kwok, Andy Lau, Jacky Cheung, and Leung Ming, who dominated the film industry in the 1990s.

There are also four heavenly kings in financial statements.

Balance sheet, income statement, statement of changes in equity, and statement of cash flows.

And there is a chief secretary who serves the four heavenly kings.

Then, let’s look at them one by one.

--- p.47 From “All the secrets of a company are contained in its financial statements”

When economic crises such as the foreign exchange crisis, global financial crisis, and COVID-19 occur, we often see companies experiencing liquidity crises.

If the company lacks cash or liquid assets that can be converted into cash at this time, the company may go bankrupt.

Because I have a debt that needs to be paid right now, but I can't pay it off.

If there is no debt, the company will not fail.

But most companies are in debt.

However, even if you have debt, you should have plenty of liquid assets.

Current assets are the shiny assets that cover debt.

By looking at current assets, you can predict whether a company will go bankrupt or not.

Let's look at the financial statements of The Born Korea, managed by Baek Jong-won.

--- p.69~70 From "When you're wondering whether this company will go bankrupt or not, look at current assets"

When we receive our salary, we usually use it for living expenses and leave the remaining money in a bank account or put it in a savings account to earn interest.

More proactive people invest in stocks or bonds, or subscribe to financial products such as pension savings.

These days, people also invest in cryptocurrencies like Bitcoin.

If you have saved a lot of money, you can try to become a landlord by purchasing a commercial building and generating rental income.

The same goes for companies.

Invest in stocks or bonds, and purchase buildings to generate rental income.

The company's investment assets include deposits, savings, stocks, bonds, and financial products.

However, it is not easy to find investment assets on the financial statements.

It was hidden tightly like a treasure hunt.

--- p.93~94 From “Investment Assets are the Company’s Investment Returns”

What about Kakao, the IT company that has devoured every chat app in Korea and is still hungry for more, indiscriminately absorbing all platforms, both online and offline? Kakao, too, is steadily increasing its cash flow from operating activities.

Cash flow from investing activities is increasing and decreasing, and cash flow from financing activities is also (+).

It shows the cash flow pattern of a rapidly growing company.

It goes without saying that a company with poor financial health is a company whose operating account starts with a minus (-).

Let's look at the cash flow of Asana Airlines, which was acquired by Korean Air due to deteriorating management.

Even considering that 2020 was a difficult year for business operations due to the impact of COVID-19, we can see that cash flow from operating activities has been declining since 2019, before the COVID-19 outbreak.

--- p.231~232 from "Complete Mastery of Cash Flow Pattern Analysis"

When you search for Samsung Electronics, the price-to-earnings ratio (PER) appears on the right. There are two types: PER and estimated PER. The PER is calculated based on the company's actual performance, while the estimated PER is calculated based on the company's performance as estimated by the securities firm.

Looking at Samsung Electronics' PER, it is 24.49 times.

This means that if you invest in Samsung Electronics, you can recover your principal in 24 to 25 years.

The expected return is 4.08%. Multiply the reciprocal of the PER [1/24.49 = 0.0408] by 100.

How does it compare to current interest rates? Now you can compare expected returns and interest rates to make investment decisions.

The 'accounting equation' you will learn from now on is the whole of accounting.

If you know just this word, you know half of accounting.

But there is also bad news.

The fact is that you must 'completely' understand this accounting equation.

'I can see your heart~ Om mani bam mi om.' Just like Gung Ye (a character in the drama 'Taejo Wang Geon'), who had no eyes but could see through people's hearts, if you know the accounting equation, you can see through accounting.

--- p.25 From "Master Key to Financial Statements at a Glance, Accounting Equation"

Financial statements consist of five types of tables.

The financial statements are the statement of financial position, income statement, statement of changes in equity, statement of cash flows, and notes in a separate appendix.

Don't be intimidated or nervous by difficult explanations.

Do you know the four kings of Hong Kong acting? They were Aaron Kwok, Andy Lau, Jacky Cheung, and Leung Ming, who dominated the film industry in the 1990s.

There are also four heavenly kings in financial statements.

Balance sheet, income statement, statement of changes in equity, and statement of cash flows.

And there is a chief secretary who serves the four heavenly kings.

Then, let’s look at them one by one.

--- p.47 From “All the secrets of a company are contained in its financial statements”

When economic crises such as the foreign exchange crisis, global financial crisis, and COVID-19 occur, we often see companies experiencing liquidity crises.

If the company lacks cash or liquid assets that can be converted into cash at this time, the company may go bankrupt.

Because I have a debt that needs to be paid right now, but I can't pay it off.

If there is no debt, the company will not fail.

But most companies are in debt.

However, even if you have debt, you should have plenty of liquid assets.

Current assets are the shiny assets that cover debt.

By looking at current assets, you can predict whether a company will go bankrupt or not.

Let's look at the financial statements of The Born Korea, managed by Baek Jong-won.

--- p.69~70 From "When you're wondering whether this company will go bankrupt or not, look at current assets"

When we receive our salary, we usually use it for living expenses and leave the remaining money in a bank account or put it in a savings account to earn interest.

More proactive people invest in stocks or bonds, or subscribe to financial products such as pension savings.

These days, people also invest in cryptocurrencies like Bitcoin.

If you have saved a lot of money, you can try to become a landlord by purchasing a commercial building and generating rental income.

The same goes for companies.

Invest in stocks or bonds, and purchase buildings to generate rental income.

The company's investment assets include deposits, savings, stocks, bonds, and financial products.

However, it is not easy to find investment assets on the financial statements.

It was hidden tightly like a treasure hunt.

--- p.93~94 From “Investment Assets are the Company’s Investment Returns”

What about Kakao, the IT company that has devoured every chat app in Korea and is still hungry for more, indiscriminately absorbing all platforms, both online and offline? Kakao, too, is steadily increasing its cash flow from operating activities.

Cash flow from investing activities is increasing and decreasing, and cash flow from financing activities is also (+).

It shows the cash flow pattern of a rapidly growing company.

It goes without saying that a company with poor financial health is a company whose operating account starts with a minus (-).

Let's look at the cash flow of Asana Airlines, which was acquired by Korean Air due to deteriorating management.

Even considering that 2020 was a difficult year for business operations due to the impact of COVID-19, we can see that cash flow from operating activities has been declining since 2019, before the COVID-19 outbreak.

--- p.231~232 from "Complete Mastery of Cash Flow Pattern Analysis"

When you search for Samsung Electronics, the price-to-earnings ratio (PER) appears on the right. There are two types: PER and estimated PER. The PER is calculated based on the company's actual performance, while the estimated PER is calculated based on the company's performance as estimated by the securities firm.

Looking at Samsung Electronics' PER, it is 24.49 times.

This means that if you invest in Samsung Electronics, you can recover your principal in 24 to 25 years.

The expected return is 4.08%. Multiply the reciprocal of the PER [1/24.49 = 0.0408] by 100.

How does it compare to current interest rates? Now you can compare expected returns and interest rates to make investment decisions.

--- p.267 From "The Secret Weapons of Corporate Value Evaluation, PER and PBR"

Publisher's Review

“These days, successful people read financial statements!”

The Secret to Transforming a Number-Scared New Employee into an Accounting Master

Author Jeongyong Yoon, who helped 50,000 office workers escape from being accounting novices with his best-selling book, "Accounting for Office Workers," has returned with a "financial statement book."

He is famous for his easy and fun basic accounting lectures, and this time he will teach the 'Financial 3 Tables Speed Reading Method' that allows anyone to read difficult and complex financial statements quickly and easily.

The author says, “Accounting is not mathematics, it is a language.

It took me a long time to realize that.

To save you the trouble I had, I've condensed the information you need to read financial statements into a single, easy-to-understand summary.

“You will be reading financial statements in a week,” he says, offering encouragement to countless accounting novices and quitters (those who have given up on accounting).

Although he is now a veteran accounting instructor, accounting was not easy for him from the beginning.

I hated numbers, so I prayed to be assigned to a department that didn't have any related work. Contrary to my wishes, after being assigned to the finance team, I was often disciplined for my work mistakes.

This book contains the essence of the author's '7-Day Financial Statement Reading Method', which was developed by a non-accounting major who was assigned to Samsung Group's finance team and, after much struggle, became an accounting master.

In this one book, you can learn not only how to analyze and utilize the three financial statements, but also the author's "Sales Secrets," which have been recognized by 50,000 students.

“A speed reading method that even children and the boss in the corner can follow right away!”

The first book to reflect the completely revamped 'New Dart'!

"The Easiest 7-Day Financial Statement Reading in Korea" explains step-by-step how to find and read financial statements, from which items and indicators to pay attention to.

In particular, the book perfectly reflects the changed screens and menu structure of the Financial Supervisory Service's electronic disclosure system 'New Dart' website, which was completely revamped in June 2021, so you won't miss out on the latest accounting issues.

It also includes actual financial statements from major domestic companies such as Samsung Electronics, Kakao, and Coupang, and provides real-world business examples to help readers develop a practical sense.

Anyone from a complete accounting novice to a seasoned entrepreneur or even a small business owner can quickly and easily identify the key metrics that matter when making decisions about their company.

Above all, the best thing about this book is that it is structured so that anyone can read financial statements in just seven days.

On the first day, you will learn the essential accounting terms and grammar needed to read financial statements, and on the second and third days, you will focus on learning how to read financial statements.

On the fourth day, we use the income statement to directly calculate how much the company earns and how much it leaves, and on the fifth day, we use the cash flow statement to check how much cash is in the company's bank account.

On the 6th day, we gathered the financial statement utilization methods that children are most curious about.

Finally, on the 7th day, we will challenge ourselves to read the financial statements at speed based on what we have learned so far.

Follow the author's lead and start reading 'Reading Financial Statements in 7 Days'.

Even someone who was blind to financial statements will be able to read and discuss them in just one week.

The Secret to Transforming a Number-Scared New Employee into an Accounting Master

Author Jeongyong Yoon, who helped 50,000 office workers escape from being accounting novices with his best-selling book, "Accounting for Office Workers," has returned with a "financial statement book."

He is famous for his easy and fun basic accounting lectures, and this time he will teach the 'Financial 3 Tables Speed Reading Method' that allows anyone to read difficult and complex financial statements quickly and easily.

The author says, “Accounting is not mathematics, it is a language.

It took me a long time to realize that.

To save you the trouble I had, I've condensed the information you need to read financial statements into a single, easy-to-understand summary.

“You will be reading financial statements in a week,” he says, offering encouragement to countless accounting novices and quitters (those who have given up on accounting).

Although he is now a veteran accounting instructor, accounting was not easy for him from the beginning.

I hated numbers, so I prayed to be assigned to a department that didn't have any related work. Contrary to my wishes, after being assigned to the finance team, I was often disciplined for my work mistakes.

This book contains the essence of the author's '7-Day Financial Statement Reading Method', which was developed by a non-accounting major who was assigned to Samsung Group's finance team and, after much struggle, became an accounting master.

In this one book, you can learn not only how to analyze and utilize the three financial statements, but also the author's "Sales Secrets," which have been recognized by 50,000 students.

“A speed reading method that even children and the boss in the corner can follow right away!”

The first book to reflect the completely revamped 'New Dart'!

"The Easiest 7-Day Financial Statement Reading in Korea" explains step-by-step how to find and read financial statements, from which items and indicators to pay attention to.

In particular, the book perfectly reflects the changed screens and menu structure of the Financial Supervisory Service's electronic disclosure system 'New Dart' website, which was completely revamped in June 2021, so you won't miss out on the latest accounting issues.

It also includes actual financial statements from major domestic companies such as Samsung Electronics, Kakao, and Coupang, and provides real-world business examples to help readers develop a practical sense.

Anyone from a complete accounting novice to a seasoned entrepreneur or even a small business owner can quickly and easily identify the key metrics that matter when making decisions about their company.

Above all, the best thing about this book is that it is structured so that anyone can read financial statements in just seven days.

On the first day, you will learn the essential accounting terms and grammar needed to read financial statements, and on the second and third days, you will focus on learning how to read financial statements.

On the fourth day, we use the income statement to directly calculate how much the company earns and how much it leaves, and on the fifth day, we use the cash flow statement to check how much cash is in the company's bank account.

On the 6th day, we gathered the financial statement utilization methods that children are most curious about.

Finally, on the 7th day, we will challenge ourselves to read the financial statements at speed based on what we have learned so far.

Follow the author's lead and start reading 'Reading Financial Statements in 7 Days'.

Even someone who was blind to financial statements will be able to read and discuss them in just one week.

GOODS SPECIFICS

- Publication date: July 20, 2021

- Page count, weight, size: 304 pages | 554g | 152*225*18mm

- ISBN13: 9791162542248

- ISBN10: 1162542241

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)