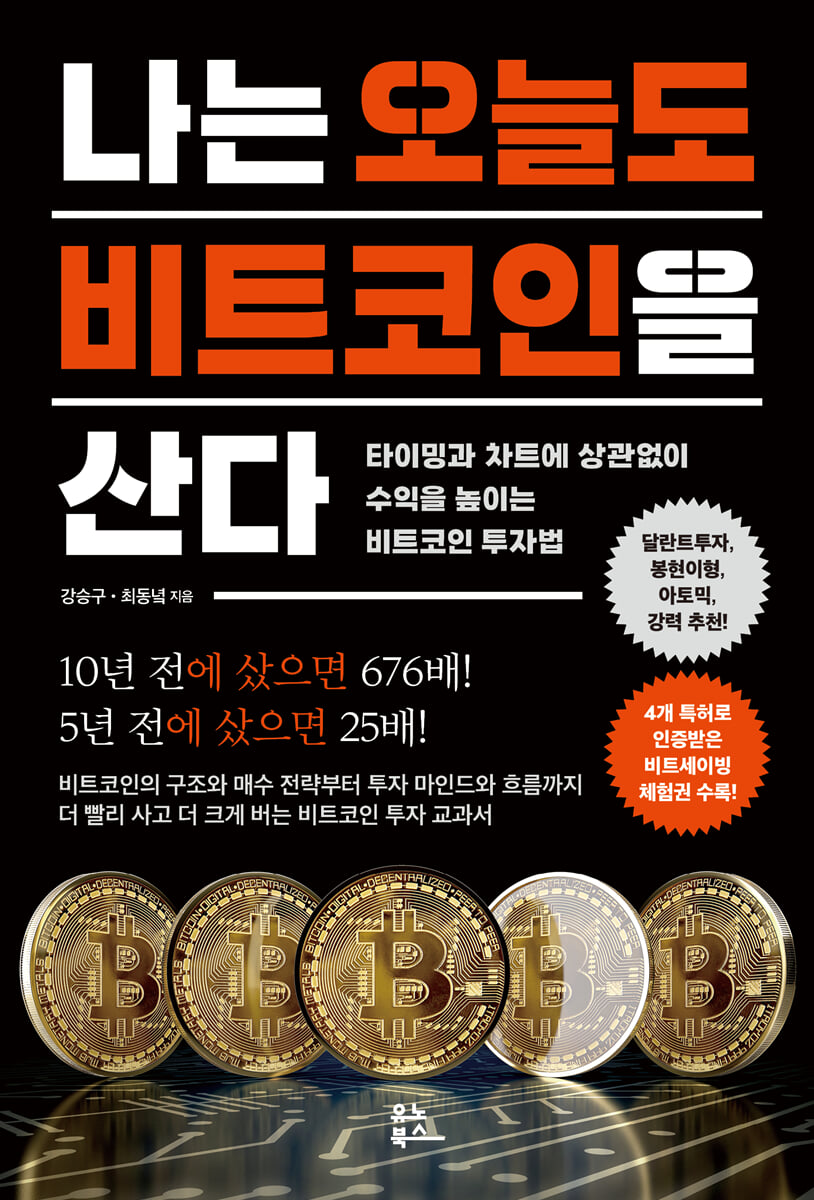

I'm buying Bitcoin today too

|

Description

Book Introduction

If you bought it 10 years ago, it's 676 times! If you bought it 5 years ago, it's 25 times!

From Bitcoin's structure and buying strategies to investment mindset and trends.

Bitcoin Investing: Buy Faster, Earn Bigger

★Iraehak Dallant Investment CEO, Bong Hyeon-i, strongly recommends Atomic!★

If you invested 10 million won in Bitcoin in 2015, your principal would be a whopping 6.76 billion won by 2025.

If you had started even late in 2020, you could have earned 250 million won by 2025.

This is the amazing return of Bitcoin, which is called 'digital gold'.

The key to investing in Bitcoin is simple.

The idea is to buy Bitcoin as soon as possible.

When prices rise, it is a great opportunity to ride the uptrend, and when prices fall, it is a great opportunity to buy at a cheaper price.

So, you should start investing in Bitcoin today.

If you keep regretting, 'If only I had started investing back then,' you will end up repeating the same regret 10 years later.

Kang Seung-gu, founder of 'Bit Saving,' Korea's first service that allows for savings-based Bitcoin investment, met with blockchain expert reporter Choi Dong-nyeok.

Based on their practical investment experience and deep understanding of the cryptocurrency market, the two authors argue that the most important thing in Bitcoin investment is not timing or charts, but 'time.'

He emphasizes that a consistent, habitual investment attitude, such as investing a lump sum at once or investing consistently daily, weekly, or monthly, determines long-term returns.

Both authors also buy Bitcoin today without being swayed by the market's ups and downs.

Because it is the most reliable investment method.

The surest way to succeed in investing is to hold good assets for a long time.

The asset that most clearly demonstrates this simple truth is Bitcoin.

Looking at data from the past 10 years, the returns when purchased at a specific point and held for four years were 391.4% in 2016, 659.43% in 2017, 395.24% in 2018, and 85.53% in 2019.

This outperforms the returns of traditional investment assets such as real estate, stocks, and gold, clearly demonstrating that the most important factors in Bitcoin investment are 'consistent purchases' and 'long-term holding.'

This book is a practical introduction for beginners just starting out with Bitcoin investing, investors who have suffered losses due to emotional sway, and those who understand the value of long-term holding but lack an execution strategy.

You'll understand the essence of Bitcoin, learn simple yet powerful investment strategies, develop a solid investment mindset that resists sudden fluctuations, and gain insight into the global economic outlook.

It also includes a ‘Beat Saving 1-month trial voucher’ certified with 4 patents.

If you want to make money with Bitcoin, this is the only book you need to read right now.

From Bitcoin's structure and buying strategies to investment mindset and trends.

Bitcoin Investing: Buy Faster, Earn Bigger

★Iraehak Dallant Investment CEO, Bong Hyeon-i, strongly recommends Atomic!★

If you invested 10 million won in Bitcoin in 2015, your principal would be a whopping 6.76 billion won by 2025.

If you had started even late in 2020, you could have earned 250 million won by 2025.

This is the amazing return of Bitcoin, which is called 'digital gold'.

The key to investing in Bitcoin is simple.

The idea is to buy Bitcoin as soon as possible.

When prices rise, it is a great opportunity to ride the uptrend, and when prices fall, it is a great opportunity to buy at a cheaper price.

So, you should start investing in Bitcoin today.

If you keep regretting, 'If only I had started investing back then,' you will end up repeating the same regret 10 years later.

Kang Seung-gu, founder of 'Bit Saving,' Korea's first service that allows for savings-based Bitcoin investment, met with blockchain expert reporter Choi Dong-nyeok.

Based on their practical investment experience and deep understanding of the cryptocurrency market, the two authors argue that the most important thing in Bitcoin investment is not timing or charts, but 'time.'

He emphasizes that a consistent, habitual investment attitude, such as investing a lump sum at once or investing consistently daily, weekly, or monthly, determines long-term returns.

Both authors also buy Bitcoin today without being swayed by the market's ups and downs.

Because it is the most reliable investment method.

The surest way to succeed in investing is to hold good assets for a long time.

The asset that most clearly demonstrates this simple truth is Bitcoin.

Looking at data from the past 10 years, the returns when purchased at a specific point and held for four years were 391.4% in 2016, 659.43% in 2017, 395.24% in 2018, and 85.53% in 2019.

This outperforms the returns of traditional investment assets such as real estate, stocks, and gold, clearly demonstrating that the most important factors in Bitcoin investment are 'consistent purchases' and 'long-term holding.'

This book is a practical introduction for beginners just starting out with Bitcoin investing, investors who have suffered losses due to emotional sway, and those who understand the value of long-term holding but lack an execution strategy.

You'll understand the essence of Bitcoin, learn simple yet powerful investment strategies, develop a solid investment mindset that resists sudden fluctuations, and gain insight into the global economic outlook.

It also includes a ‘Beat Saving 1-month trial voucher’ certified with 4 patents.

If you want to make money with Bitcoin, this is the only book you need to read right now.

- You can preview some of the book's contents.

Preview

index

Recommendation 1: Bitcoin's value continues to rise today.

Recommendation 2: Buy Bitcoin every month, every week, every day.

Testimonial 3: I learned how to live life with Bitcoin.

Author's Note: There is a foolproof Bitcoin investment method.

Author's Note: Bitcoin, the prelude to a great transformation.

Chapter 1: Why Buy Bitcoin Today?: Understanding the World of Bitcoin: Its Essence, Flow, and Structure

01 Bitcoin, the only means for ordinary individuals to survive

02 Why don't you have Bitcoin yet?

03 Your money is spinning in a giant hamster wheel.

04 Leave behind the stability in front of you and look beyond the system.

05 When technology presents a new paradigm, which trend will you ride?

06 There is no inflation in Bitcoin.

07 True investment is understanding the structure.

08 Before starting an investment, you must read the market trends.

09 Convert volatile fiat currencies into safe assets.

10 No one can be absolutely sure of the timing.

11 Holding Bitcoin is more than just making money.

12 If you lose your eyes on the ups and downs, you will lose your direction.

13 Questions You Must Answer Before Buying Bitcoin

Chapter 2: When and How Much Should You Buy to Benefit from Bitcoin?: Everything You Need to Know About Bitcoin Investing: Debt, Accumulation, and On-Chain Data

14 Even people who didn't believe in Bitcoin are buying it.

15. Investing in lump sums: If you've read the value, buy with your money.

16. Term Investments: When to Start and Until When to Invest

17 Gold More Important Than Digital Gold: The Power of Time

18 Accumulated Investments: A Smart Investment Method That Takes Advantage of Ups and Downs

19 If you're interested in investing in Bitcoin, start now.

20. Accumulated Investment: Learn from the Masters

21. Read market fear and greed with on-chain data.

22. Accumulated Investments: Leverage AI and On-Chain Data

23. How to Win at Fixed-Term and Accumulation Investments and Cycle Investments

Chapter 3: What Mindset Should You Have When Buying Bitcoin?: From Investment Philosophy to Life Attitude, How Bitcoin Changes Your Life

24 Bitcoin Investing is a Lonely Journey

25 Bitcoin gives everyone a fair chance

26 Bitcoin is a total waste of money.

27 Bitcoin is an asset that requires study.

28 Stay away from altcoins and get closer to bitcoiners.

29 Share your Bitcoin investment values with your family.

If you invested in 30 Bitcoins, now live your life.

31 Bitcoin is a time-dependent asset.

If you choose 32 Bitcoins, you will eventually be rewarded.

33 The choice is always yours

34 From Consumer to Builder, Towards a Healthy Premium

Chapter 4: What will tomorrow look like, transformed by Bitcoin?: Policy shifts, global competition, and institutional integration bring about a golden age for Bitcoin.

35. The Double-Edged Sword of K-Premium: Opportunity or Warning?

Beyond Regulation: A Strategy: Korea's Bitcoin Adoption Roadmap

37 Now is the time to enter the system.

38 The Trump 2.0 Era: Bitcoin's Compass

39 The US and Trump are betting their future on Bitcoin.

40 The US Cryptocurrency Policy Shift Ignites a Spark in the Global Financial Landscape

41 Spot ETF Approval Sets Market on a Full-Fledged Upward Track

42 How the Debt Republic of the United States Chose Bitcoin

43 The world's vaults are shrinking the dollar and increasing Bitcoin.

44 China and Europe are already at war.

Bitcoin begins to appear on Wall Street

46 The rise of digital gold is inevitable.

Appendix: Smart Bitcoin Accumulation Investment Method: Bitsaving

Recommendation 2: Buy Bitcoin every month, every week, every day.

Testimonial 3: I learned how to live life with Bitcoin.

Author's Note: There is a foolproof Bitcoin investment method.

Author's Note: Bitcoin, the prelude to a great transformation.

Chapter 1: Why Buy Bitcoin Today?: Understanding the World of Bitcoin: Its Essence, Flow, and Structure

01 Bitcoin, the only means for ordinary individuals to survive

02 Why don't you have Bitcoin yet?

03 Your money is spinning in a giant hamster wheel.

04 Leave behind the stability in front of you and look beyond the system.

05 When technology presents a new paradigm, which trend will you ride?

06 There is no inflation in Bitcoin.

07 True investment is understanding the structure.

08 Before starting an investment, you must read the market trends.

09 Convert volatile fiat currencies into safe assets.

10 No one can be absolutely sure of the timing.

11 Holding Bitcoin is more than just making money.

12 If you lose your eyes on the ups and downs, you will lose your direction.

13 Questions You Must Answer Before Buying Bitcoin

Chapter 2: When and How Much Should You Buy to Benefit from Bitcoin?: Everything You Need to Know About Bitcoin Investing: Debt, Accumulation, and On-Chain Data

14 Even people who didn't believe in Bitcoin are buying it.

15. Investing in lump sums: If you've read the value, buy with your money.

16. Term Investments: When to Start and Until When to Invest

17 Gold More Important Than Digital Gold: The Power of Time

18 Accumulated Investments: A Smart Investment Method That Takes Advantage of Ups and Downs

19 If you're interested in investing in Bitcoin, start now.

20. Accumulated Investment: Learn from the Masters

21. Read market fear and greed with on-chain data.

22. Accumulated Investments: Leverage AI and On-Chain Data

23. How to Win at Fixed-Term and Accumulation Investments and Cycle Investments

Chapter 3: What Mindset Should You Have When Buying Bitcoin?: From Investment Philosophy to Life Attitude, How Bitcoin Changes Your Life

24 Bitcoin Investing is a Lonely Journey

25 Bitcoin gives everyone a fair chance

26 Bitcoin is a total waste of money.

27 Bitcoin is an asset that requires study.

28 Stay away from altcoins and get closer to bitcoiners.

29 Share your Bitcoin investment values with your family.

If you invested in 30 Bitcoins, now live your life.

31 Bitcoin is a time-dependent asset.

If you choose 32 Bitcoins, you will eventually be rewarded.

33 The choice is always yours

34 From Consumer to Builder, Towards a Healthy Premium

Chapter 4: What will tomorrow look like, transformed by Bitcoin?: Policy shifts, global competition, and institutional integration bring about a golden age for Bitcoin.

35. The Double-Edged Sword of K-Premium: Opportunity or Warning?

Beyond Regulation: A Strategy: Korea's Bitcoin Adoption Roadmap

37 Now is the time to enter the system.

38 The Trump 2.0 Era: Bitcoin's Compass

39 The US and Trump are betting their future on Bitcoin.

40 The US Cryptocurrency Policy Shift Ignites a Spark in the Global Financial Landscape

41 Spot ETF Approval Sets Market on a Full-Fledged Upward Track

42 How the Debt Republic of the United States Chose Bitcoin

43 The world's vaults are shrinking the dollar and increasing Bitcoin.

44 China and Europe are already at war.

Bitcoin begins to appear on Wall Street

46 The rise of digital gold is inevitable.

Appendix: Smart Bitcoin Accumulation Investment Method: Bitsaving

Detailed image

.jpg)

Into the book

The government issues currency, intentionally manipulating prices and changing the value of assets.

However, the majority of the population lacks the means to protect their assets against such a drastic change.

The solution is clear.

It is about owning assets that are 'scarce, in high demand, portable, durable and manageable.'

Gangnam apartments are rare, but have low liquidity and high management fees and taxes.

Stocks are a subject of abundant information, but they are highly volatile and difficult to enter and manage.

On the other hand, if you understand Bitcoin properly, you will know that it is an asset free from such restrictions.

This is the most important value that Bitcoin provides.

---From "Bitcoin, the only means for ordinary individuals to survive"

We are now at the dawn of a new era.

Change is gradual but irreversible.

It is a trend that no one can go against.

Those who quickly recognize and respond to change will become the new owners of wealth.

Now I want to ask you.

Have you ever wondered how the world will change in the future? How will you adapt to those changes? I hope you move beyond a life focused on just getting through each day and move toward designing your future on a larger scale.

The decisions you must make now are more than just investments.

It is a shift in thinking that redesigns life.

There is definitely a way to get off the hamster wheel that goes backwards.

It all depends on your choice.

---From "When Technology Presents a New Paradigm, Which Flow Will You Ride?"

Many people have 'heard' of Bitcoin.

But many people 'don't really know' about Bitcoin.

If you're reading this and find it difficult to agree that Bitcoin is a new store of value that will replace gold, you can put it down.

You are the kind of person who cannot change your mind even if the facts change.

You might be better off not investing.

However, if you agree but are still hesitant to invest, read this book thoroughly.

The seeds of change have been planted in you.

Buffett said this:

“It’s not when you enter the market, it’s how long you stay in it that matters.” If you’ve discovered the value of Bitcoin, “buy it.”

Also, if you find value in Bitcoin, 'hold long'.

---From "Even People Who Didn't Believe in Bitcoin Are Buying It"

On-chain data goes beyond just a series of numbers; it's a trace of market participants' actions and choices.

This is not simply a record of the past, but rather a clue to understanding market trends and forecasting future possibilities.

In particular, key indicators such as MVRV, short-term SOPR, and Puell Multiple help distinguish between overheated signals and opportunities for bottoming in the market.

However, on-chain data is just one indicator, and ultimately, it is we who hold the key to the voyage of investment.

What is always important is unwavering firmness and consistency.

---From "Reading the Announcements and Greed of the On-Chain Market"

If I am among altcoiners, I become an altcoiner.

Every day, I find myself swayed by new coins, fixated on short-term profits, and eventually, sitting at the gambling table.

But when I'm among Bitcoiners, I become a Bitcoiner too.

You will learn how to grow your assets without being swayed by market noise, by sticking to your principles, and with a long-term perspective.

Mencius's mother's teachings are a matter of choice.

I have to choose who I surround myself with for my growth and success.

Look around you.

Who's talking about investing next to me? Are they the people who tout new altcoins every day, boasting about short-term gains? Or are they the people who champion Bitcoin's value and uphold its principles and philosophy?

---From "Stay away from altcoins and get closer to bitcoiners"

Investing in Bitcoin should be a means to enrich your life, not an end in itself.

Excessive worry and stress about investing will only harm your health, relationships, and daily life.

Spend time with your loved ones, connect with friends, and pursue your hobbies and your main job.

While you focus on your life, the magic of time and compound interest will quietly grow your assets.

Bitcoin has moved beyond its days as a speculative asset and solidified its position as a new store of value in the digital age.

The involvement of major countries and large financial institutions is turning this trend into a massive, irreversible wave.

Amidst this wave of enormous change, a wise investor is one who remains steadfast and maintains his or her own course, unshaken by short-term waves.

“If you invested in Bitcoin, now live your life.”

---From "If You Invested in Bitcoin, Now Live Your Life"

South Korea's ultimate goal should be to go beyond simply allowing capital inflows and integrate Bitcoin into the national economy's sound asset portfolio.

To this end, long-term custodians like the National Pension Service should establish formal guidelines to carefully evaluate Bitcoin and incorporate it into their strategic asset allocations.

Furthermore, we must foster a competitive domestic industrial ecosystem by encouraging the development of diverse domestic institutional products beyond ETFs, including structured bonds, derivatives, and professional asset management services.

This will create new financial added value and lay the foundation for Korea to leap forward as Asia's digital financial hub.

---From "It's Time to Enter the System"

The US nationalization of Bitcoin as a national asset has become a catalyst for cracks in the dollar-centric global economic order.

China, Russia, and emerging countries seeking to reduce their dependence on the dollar, as well as those facing volatile currencies, have turned their attention to Bitcoin as a new alternative reserve asset, alongside gold.

Amidst these changes, Bitcoin's decentralized nature, free from the control of any particular country, further solidifies its status as digital gold.

The US's preemptive move has spurred other countries to adopt Bitcoin, and the world is now reorganizing into a multipolar reserve asset system centered around the dollar, gold, and Bitcoin.

This marks the beginning of a new 'Great Game' surrounding digital assets.

However, the majority of the population lacks the means to protect their assets against such a drastic change.

The solution is clear.

It is about owning assets that are 'scarce, in high demand, portable, durable and manageable.'

Gangnam apartments are rare, but have low liquidity and high management fees and taxes.

Stocks are a subject of abundant information, but they are highly volatile and difficult to enter and manage.

On the other hand, if you understand Bitcoin properly, you will know that it is an asset free from such restrictions.

This is the most important value that Bitcoin provides.

---From "Bitcoin, the only means for ordinary individuals to survive"

We are now at the dawn of a new era.

Change is gradual but irreversible.

It is a trend that no one can go against.

Those who quickly recognize and respond to change will become the new owners of wealth.

Now I want to ask you.

Have you ever wondered how the world will change in the future? How will you adapt to those changes? I hope you move beyond a life focused on just getting through each day and move toward designing your future on a larger scale.

The decisions you must make now are more than just investments.

It is a shift in thinking that redesigns life.

There is definitely a way to get off the hamster wheel that goes backwards.

It all depends on your choice.

---From "When Technology Presents a New Paradigm, Which Flow Will You Ride?"

Many people have 'heard' of Bitcoin.

But many people 'don't really know' about Bitcoin.

If you're reading this and find it difficult to agree that Bitcoin is a new store of value that will replace gold, you can put it down.

You are the kind of person who cannot change your mind even if the facts change.

You might be better off not investing.

However, if you agree but are still hesitant to invest, read this book thoroughly.

The seeds of change have been planted in you.

Buffett said this:

“It’s not when you enter the market, it’s how long you stay in it that matters.” If you’ve discovered the value of Bitcoin, “buy it.”

Also, if you find value in Bitcoin, 'hold long'.

---From "Even People Who Didn't Believe in Bitcoin Are Buying It"

On-chain data goes beyond just a series of numbers; it's a trace of market participants' actions and choices.

This is not simply a record of the past, but rather a clue to understanding market trends and forecasting future possibilities.

In particular, key indicators such as MVRV, short-term SOPR, and Puell Multiple help distinguish between overheated signals and opportunities for bottoming in the market.

However, on-chain data is just one indicator, and ultimately, it is we who hold the key to the voyage of investment.

What is always important is unwavering firmness and consistency.

---From "Reading the Announcements and Greed of the On-Chain Market"

If I am among altcoiners, I become an altcoiner.

Every day, I find myself swayed by new coins, fixated on short-term profits, and eventually, sitting at the gambling table.

But when I'm among Bitcoiners, I become a Bitcoiner too.

You will learn how to grow your assets without being swayed by market noise, by sticking to your principles, and with a long-term perspective.

Mencius's mother's teachings are a matter of choice.

I have to choose who I surround myself with for my growth and success.

Look around you.

Who's talking about investing next to me? Are they the people who tout new altcoins every day, boasting about short-term gains? Or are they the people who champion Bitcoin's value and uphold its principles and philosophy?

---From "Stay away from altcoins and get closer to bitcoiners"

Investing in Bitcoin should be a means to enrich your life, not an end in itself.

Excessive worry and stress about investing will only harm your health, relationships, and daily life.

Spend time with your loved ones, connect with friends, and pursue your hobbies and your main job.

While you focus on your life, the magic of time and compound interest will quietly grow your assets.

Bitcoin has moved beyond its days as a speculative asset and solidified its position as a new store of value in the digital age.

The involvement of major countries and large financial institutions is turning this trend into a massive, irreversible wave.

Amidst this wave of enormous change, a wise investor is one who remains steadfast and maintains his or her own course, unshaken by short-term waves.

“If you invested in Bitcoin, now live your life.”

---From "If You Invested in Bitcoin, Now Live Your Life"

South Korea's ultimate goal should be to go beyond simply allowing capital inflows and integrate Bitcoin into the national economy's sound asset portfolio.

To this end, long-term custodians like the National Pension Service should establish formal guidelines to carefully evaluate Bitcoin and incorporate it into their strategic asset allocations.

Furthermore, we must foster a competitive domestic industrial ecosystem by encouraging the development of diverse domestic institutional products beyond ETFs, including structured bonds, derivatives, and professional asset management services.

This will create new financial added value and lay the foundation for Korea to leap forward as Asia's digital financial hub.

---From "It's Time to Enter the System"

The US nationalization of Bitcoin as a national asset has become a catalyst for cracks in the dollar-centric global economic order.

China, Russia, and emerging countries seeking to reduce their dependence on the dollar, as well as those facing volatile currencies, have turned their attention to Bitcoin as a new alternative reserve asset, alongside gold.

Amidst these changes, Bitcoin's decentralized nature, free from the control of any particular country, further solidifies its status as digital gold.

The US's preemptive move has spurred other countries to adopt Bitcoin, and the world is now reorganizing into a multipolar reserve asset system centered around the dollar, gold, and Bitcoin.

This marks the beginning of a new 'Great Game' surrounding digital assets.

---From "The US and Trump Bet Their Future on Bitcoin"

Publisher's Review

The founder of Korea's first Bitcoin savings investment service

The country's top blockchain expert reporter reveals

A Bitcoin Investment Strategy That Never Fails

★Recommended by Lee Rae-hak, CEO of Dallant Investment, and Bong Hyeon-i, Atomic★

Smart Investment Using AI and On-Chain Data

★Includes a 1-month trial of Bitsaving, certified with 4 patents★

Kang Seung-gu, Vice President of Uproot Company and founder of 'Bit Saving', Korea's first Bitcoin savings investment service, and Choi Dong-nyeok, Head of Strategy at [Block Media], Korea's leading digital asset analysis media, reveal a Bitcoin investment method that increases profits regardless of timing or charts.

If you bought it 10 years ago, it's 676 times more!

If you bought it 5 years ago, it's 25 times more!

If you bought it 10 years ago, it would be 676 times, and if you bought it 5 years ago, it would be 25 times.

It's an incredible return, but it's not an exaggeration; it's actual data.

If you had invested 10 million won in Bitcoin in 2015, you would have over 6.7 billion won by now, and even if you had entered the market in 2020, you could have earned over 250 million won.

Some people bought it early and held on to it for a long time, while others just looked at it and hesitated.

Are you still stuck today, wondering, "Should I buy now?" This book was written to answer that very question.

Bitcoin is no longer an object of speculation.

In June 2025, Trump signed into law the Genius Act, a new cryptocurrency bill in the United States, marking the first explicit regulatory legislation for stablecoins in the country.

In July 2025, the United States also passed the Clarity Act and the Anti-CBDC Surveillance State Act, aimed at clarifying the digital asset market structure.

South Korea is also extending its tax deferral period to 2027 and is actively incorporating Bitcoin into its institutional system through institutional reforms.

Supply is decreasing and demand is increasing.

Even from a simple economic perspective, price increases are inevitable.

In this flow, what's important is neither the charts nor the news.

It's about time.

The most powerful strategy is to start as soon as possible and stick with it for a long time.

Kang Seung-gu, founder of Korea's first Bitcoin savings investment service, "Bit Saving," and Choi Dong-nyeok, a blockchain journalist and head of strategy at Block Media.

The two authors analyze a large amount of data and speak based on their practical investment experience.

“Bitcoin is not a battle of timing, it’s a battle of time.”

The most rational approach, rather than emotional short-term trading, is to understand the structure, create a system, and invest habitually. This book is a practical introduction for those new to investing, those curious about Bitcoin, and those seeking a long-term approach but lacking a solid strategy.

It clearly explains why, when, and how to buy Bitcoin, and provides concrete strategies and tools to put them into action.

After reading this book, anyone will be able to confidently answer the question, "Why should I buy Bitcoin right now?"

From Bitcoin's structure and buying strategies to investment mindset and trends.

Bitcoin Investing: Buy Faster, Earn Bigger

The book organizes information surrounding Bitcoin into four chapters.

This book is helpful to everyone: those who are completely unfamiliar with Bitcoin, those who know about it but aren't sure how to invest, those who have invested but are feeling uneasy, and those who are curious about the latest news related to Bitcoin.

“Those who understand Bitcoin buy Bitcoin.”

Chapter 1 answers the question, "Why should you buy Bitcoin now?"

Starting with Bitcoin's fundamental design—its scarcity, halving structure, decentralized system, and limited supply—we delve into its position in the global asset market.

As you read the book, you will clearly understand why you should buy Bitcoin.

People who failed at investing in Bitcoin simply didn't understand it.

In particular, it explains the flow of entering the institutional market after ETF approval and the favorable conditions given to investors ahead of the halving period, and provides data to help them understand why now is the 'time to buy.'

“No one has ever lost money by holding Bitcoin for four years.”

Chapter 2 covers practical investment strategies and explains how to buy Bitcoin without losing money.

The key is ‘hang-up investment’ and ‘accumulation investment’.

For investors with spare funds, lump-sum investing is efficient, with lump-sum investments being made all at once.

A savings strategy that involves regularly purchasing a set amount of your salary to lower your average purchase price can help you create a routine that's free from emotions.

Chapter 2 also introduces methods for assessing the current market situation using AI analysis, on-chain indicators, and investor sentiment indicators.

Rather than simply shouting "You should buy," we provide solid evidence-based advice on "which buying strategy is advantageous now."

In reality, no one has ever lost money by holding Bitcoin for more than four years.

A strategy of consistently holding valuable assets is always powerful.

“You don’t change Bitcoin, Bitcoin changes you.”

Chapter 3 talks about a healthy investment mindset.

The reason so many people fail at investing is not because of the wrong stocks, but because of the wrong attitude.

They repeat the mistake of selling when they are anxious and buying when they are greedy.

Chapter 3 discusses how to create an internal system that allows you to invest without being swayed by emotions.

It's important to set your own investment principles and stick to them regardless of market conditions. It's important to have a standard for "How long will I hold my investments?" rather than "When should I sell?"

More important than buying Bitcoin is creating a structure that can sustain it.

Readers will be able to develop the strength to invest consistently without being overly excited or depressed.

“We will make America the capital of cryptocurrency.”

Chapter 4 examines the relationship between global economic trends and Bitcoin.

We analyze how movements in various countries, including U.S. interest rate policy, China's push for the digital yuan, regulatory changes in Europe, and Japan's policy easing, are affecting Bitcoin.

It broadens your perspective from the perspective of an individual investor, providing insights into global policies and capital flows.

It also covers the structural analysis of price differences between foreign and domestic exchanges and the "kimchi premium," as well as the institutional opportunities and risks faced by Korean investors.

After reading Chapter 4, we will be able to understand Bitcoin not as a single asset, but as part of the global economic landscape.

And you gain not just a 'way to live' but an 'eye to judge'.

I'm buying Bitcoin today too

People who don't understand Bitcoin still worry, "Is it too late to invest in Bitcoin now?"

Whether it's 1 million won, 10 million won, or 100 million won, people ask, "Isn't this the peak?"

But as time went on, the price always hit rock bottom.

Every time, someone was afraid and someone bought it.

The structure is simple, although there is volatility.

Supply is decreasing and demand is increasing.

If it's an asset that is bound to go up, the important thing isn't timing, but how long you hold it.

So the best time to buy is always now.

Investing is about structure, not emotion.

The question isn't "When should I buy?" but "How can I get involved with this asset?"

And a good strategy should be simple.

Lump sum investing, where you invest a lump sum, and installment investing, where you invest a fixed amount daily, weekly, or monthly, are both stable investment methods that are perfectly suited to the asset class of Bitcoin.

Maintaining solid habits is more profitable than trying to predict the market and charts.

If you can't control the market, you have to control me.

If you leave the market, there is no profit.

The most powerful strategy is to start as soon as possible and stick with it for as long as possible.

Buy today, buy tomorrow, and the small habits that accumulate like that eventually make a big difference.

Successful investors are those who bet on long-term growth without being swayed by short-term fluctuations.

If you want to be that kind of investor, buy Bitcoin today.

The country's top blockchain expert reporter reveals

A Bitcoin Investment Strategy That Never Fails

★Recommended by Lee Rae-hak, CEO of Dallant Investment, and Bong Hyeon-i, Atomic★

Smart Investment Using AI and On-Chain Data

★Includes a 1-month trial of Bitsaving, certified with 4 patents★

Kang Seung-gu, Vice President of Uproot Company and founder of 'Bit Saving', Korea's first Bitcoin savings investment service, and Choi Dong-nyeok, Head of Strategy at [Block Media], Korea's leading digital asset analysis media, reveal a Bitcoin investment method that increases profits regardless of timing or charts.

If you bought it 10 years ago, it's 676 times more!

If you bought it 5 years ago, it's 25 times more!

If you bought it 10 years ago, it would be 676 times, and if you bought it 5 years ago, it would be 25 times.

It's an incredible return, but it's not an exaggeration; it's actual data.

If you had invested 10 million won in Bitcoin in 2015, you would have over 6.7 billion won by now, and even if you had entered the market in 2020, you could have earned over 250 million won.

Some people bought it early and held on to it for a long time, while others just looked at it and hesitated.

Are you still stuck today, wondering, "Should I buy now?" This book was written to answer that very question.

Bitcoin is no longer an object of speculation.

In June 2025, Trump signed into law the Genius Act, a new cryptocurrency bill in the United States, marking the first explicit regulatory legislation for stablecoins in the country.

In July 2025, the United States also passed the Clarity Act and the Anti-CBDC Surveillance State Act, aimed at clarifying the digital asset market structure.

South Korea is also extending its tax deferral period to 2027 and is actively incorporating Bitcoin into its institutional system through institutional reforms.

Supply is decreasing and demand is increasing.

Even from a simple economic perspective, price increases are inevitable.

In this flow, what's important is neither the charts nor the news.

It's about time.

The most powerful strategy is to start as soon as possible and stick with it for a long time.

Kang Seung-gu, founder of Korea's first Bitcoin savings investment service, "Bit Saving," and Choi Dong-nyeok, a blockchain journalist and head of strategy at Block Media.

The two authors analyze a large amount of data and speak based on their practical investment experience.

“Bitcoin is not a battle of timing, it’s a battle of time.”

The most rational approach, rather than emotional short-term trading, is to understand the structure, create a system, and invest habitually. This book is a practical introduction for those new to investing, those curious about Bitcoin, and those seeking a long-term approach but lacking a solid strategy.

It clearly explains why, when, and how to buy Bitcoin, and provides concrete strategies and tools to put them into action.

After reading this book, anyone will be able to confidently answer the question, "Why should I buy Bitcoin right now?"

From Bitcoin's structure and buying strategies to investment mindset and trends.

Bitcoin Investing: Buy Faster, Earn Bigger

The book organizes information surrounding Bitcoin into four chapters.

This book is helpful to everyone: those who are completely unfamiliar with Bitcoin, those who know about it but aren't sure how to invest, those who have invested but are feeling uneasy, and those who are curious about the latest news related to Bitcoin.

“Those who understand Bitcoin buy Bitcoin.”

Chapter 1 answers the question, "Why should you buy Bitcoin now?"

Starting with Bitcoin's fundamental design—its scarcity, halving structure, decentralized system, and limited supply—we delve into its position in the global asset market.

As you read the book, you will clearly understand why you should buy Bitcoin.

People who failed at investing in Bitcoin simply didn't understand it.

In particular, it explains the flow of entering the institutional market after ETF approval and the favorable conditions given to investors ahead of the halving period, and provides data to help them understand why now is the 'time to buy.'

“No one has ever lost money by holding Bitcoin for four years.”

Chapter 2 covers practical investment strategies and explains how to buy Bitcoin without losing money.

The key is ‘hang-up investment’ and ‘accumulation investment’.

For investors with spare funds, lump-sum investing is efficient, with lump-sum investments being made all at once.

A savings strategy that involves regularly purchasing a set amount of your salary to lower your average purchase price can help you create a routine that's free from emotions.

Chapter 2 also introduces methods for assessing the current market situation using AI analysis, on-chain indicators, and investor sentiment indicators.

Rather than simply shouting "You should buy," we provide solid evidence-based advice on "which buying strategy is advantageous now."

In reality, no one has ever lost money by holding Bitcoin for more than four years.

A strategy of consistently holding valuable assets is always powerful.

“You don’t change Bitcoin, Bitcoin changes you.”

Chapter 3 talks about a healthy investment mindset.

The reason so many people fail at investing is not because of the wrong stocks, but because of the wrong attitude.

They repeat the mistake of selling when they are anxious and buying when they are greedy.

Chapter 3 discusses how to create an internal system that allows you to invest without being swayed by emotions.

It's important to set your own investment principles and stick to them regardless of market conditions. It's important to have a standard for "How long will I hold my investments?" rather than "When should I sell?"

More important than buying Bitcoin is creating a structure that can sustain it.

Readers will be able to develop the strength to invest consistently without being overly excited or depressed.

“We will make America the capital of cryptocurrency.”

Chapter 4 examines the relationship between global economic trends and Bitcoin.

We analyze how movements in various countries, including U.S. interest rate policy, China's push for the digital yuan, regulatory changes in Europe, and Japan's policy easing, are affecting Bitcoin.

It broadens your perspective from the perspective of an individual investor, providing insights into global policies and capital flows.

It also covers the structural analysis of price differences between foreign and domestic exchanges and the "kimchi premium," as well as the institutional opportunities and risks faced by Korean investors.

After reading Chapter 4, we will be able to understand Bitcoin not as a single asset, but as part of the global economic landscape.

And you gain not just a 'way to live' but an 'eye to judge'.

I'm buying Bitcoin today too

People who don't understand Bitcoin still worry, "Is it too late to invest in Bitcoin now?"

Whether it's 1 million won, 10 million won, or 100 million won, people ask, "Isn't this the peak?"

But as time went on, the price always hit rock bottom.

Every time, someone was afraid and someone bought it.

The structure is simple, although there is volatility.

Supply is decreasing and demand is increasing.

If it's an asset that is bound to go up, the important thing isn't timing, but how long you hold it.

So the best time to buy is always now.

Investing is about structure, not emotion.

The question isn't "When should I buy?" but "How can I get involved with this asset?"

And a good strategy should be simple.

Lump sum investing, where you invest a lump sum, and installment investing, where you invest a fixed amount daily, weekly, or monthly, are both stable investment methods that are perfectly suited to the asset class of Bitcoin.

Maintaining solid habits is more profitable than trying to predict the market and charts.

If you can't control the market, you have to control me.

If you leave the market, there is no profit.

The most powerful strategy is to start as soon as possible and stick with it for as long as possible.

Buy today, buy tomorrow, and the small habits that accumulate like that eventually make a big difference.

Successful investors are those who bet on long-term growth without being swayed by short-term fluctuations.

If you want to be that kind of investor, buy Bitcoin today.

GOODS SPECIFICS

- Date of issue: July 31, 2025

- Page count, weight, size: 268 pages | 486g | 152*224*22mm

- ISBN13: 9791171831234

- ISBN10: 1171831234

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)