Absolute principles for investing in technology stocks

|

Description

Book Introduction

“From individuals to institutional investors, “Everyone will gain confidence from this book!” - Cathy Wood Wall Street's most trusted tech expert with 25 years of experience The first analyst to write a Google investment report The fundamentals of technology investing, with Mark Mahaney's unparalleled insights. From the foresight to select super-quality stocks that will return tens or hundreds of times over Key indicators and signals that tech investors must know. Everything You Need to Know About Tech Investing from a Top 1% Analyst on Wall Street - Recommended by Cathy Wood, Ed Hyman, Scott Galloway, Jang Woo-seok, Hong Jin-chae, and Choi Cheol - Amazon Investment Bestseller "Tech Stock Investing: Absolute Rules" is the first book by Mark Mahaney, an analyst who has been analyzing the U.S. technology sector for the past 25 years and is considered one of Wall Street's top technology stock experts. Mahaney has witnessed firsthand the growth of companies like Google and Amazon through IPOs in the 1990s, as well as the decline of stocks that once held investors' expectations, such as Yahoo and eBay. Although the author is now known as "The Financial Times' Stock Picker" and "Wall Street's Top 1% Tech Analyst," his investments haven't always been successful. There were days when I accurately predicted stock price fluctuations, but there were also days when I misinterpreted various indicators and signals and made hasty decisions, which I deeply regretted. This book shares ten lessons Mahaney has gleaned from his 25 years of experience in the ever-changing technology market, both success and failure. This book will reveal for the first time timeless principles of technology stock investment, including the know-how to select super blue-chip stocks that will return with enormous profits, such as Amazon, which rose 1,800-fold from its IPO price, and Netflix, which rose over 400-fold, as well as key indicators and sell signals that technology investors should keep an eye on, and insights that can be gained from the ups and downs of past internet and platform stocks. Mahaney's insightful analysis, encompassing the 30-year history, trends, and future direction of the technology sector, offers readers not only successful technology investment know-how but also a thorough understanding of the world's most dynamic capital market. |

- You can preview some of the book's contents.

Preview

index

Intro | "Only tech stocks!"

To begin with, we are in the midst of a tech bull market.

Lesson 1 | Avoiding Stock Selection Pitfalls

Stocks of companies with overly complex businesses—Blue Apron

Stocks of companies that fail to meet the most important requirements - Juliely

Stocks of Overextended Companies─Groupon

Lesson 2 | Fundamentals and Trends Are Completely Separate

Facebook's self-inflicted 43 percent stock price drop

Stock price corrections are the best opportunity to find blue-chip stocks that have fallen out of favor.

Google's 2019 Performance and What Remains a Mystery

Why Did a Stock with a Market Cap of $1 Trillion Fall 32 Percent?

Lesson 3 | Sometimes stock prices move completely unrelated to fundamentals.

How Short-Term Investing Misses Out on Huge Opportunities - Snap

Between a 10 percent drop and a 103 percent rise─trend

When an unrelated event shakes the stock price─Uber

Lesson 4 | Remember the '20 Percent Rule' and the '2 Percent Rule'

Correlation between sales growth rate and valuation

Tech investors need to think differently.

Why did the stock that had been living up to market expectations crash? - ① eBay

Why did the stock that had been living up to market expectations crash? - ② Yahoo

Why did the stock that lived up to market expectations crash? ─③ Priceline

Why Netflix's Stock Price Has Soared 420-Fold

Netflix's Growth Curve Acceleration Plan and its Valuation Change

Find the wide open 'gap'

How to compare growth rates excluding pandemic effects

Some Evidence for the '20 Percent Rule'

Lesson 5 | Innovation is reflected in the numbers.

When a completely new revenue stream emerged—Amazon

Innovation, akin to a bet, lifts a plummeting stock price—Netflix

Product Innovation Drives 136 Percent Stock Price Increase—Stitch Fix

Don't miss the event that will replace innovation─Spotify

Spotify vs. Pandora: What Decided the Battle

The "Failed IPO" that has been sluggish for 10 years - Twitter

Lesson 6 | Stock Prices Ultimately Driven by Size

Google had a whole new 'this'

Google absorbs 15 percent of global marketing funding

Reaching $25 Billion in Sales: What's Next?

What the number '1 trillion dollars' means

April 29, 2004 and October 21, 2004

Is the company's estimated market size reasonable? - ① Uber

Is the company's estimated market size reasonable? - ② DoorDash

Are the company's market estimates reasonable?─③Spotify·Priceline

Companies that have achieved scale vs. those that have not

Lesson 7 | Ditch the stocks of companies that serve investors.

A distribution giant that once surpassed Amazon

Five Reasons Why Amazon Was Bound to Win

Long-term stock price fluctuations of investor-first and customer-first companies

Investor-focused companies make poor investments—Grubhub

How Pivots Change Stock Prices - Jill

Find stocks with a 'flywheel'

Lesson 8 | Seeing People Can Reveal Future Stock Prices

What's Behind the Highest-Rate Tech Stocks of All Time

What's different about a company led by its founder?

Do you have a long-term orientation?

Is there a compelling vision for the industry?

Do you have a commitment to customer satisfaction?

Other important features

Lesson 9 | Valuation Isn't the Ultimate Guide to Stock Selection

When a stock can be good even if its PER is high

Questions to Ask When Investing in Companies with Strong Current Profitability

Three Questions to Ask When Investing in Companies with Low Earnings and High P/Es

How to Evaluate Valuation When Profits Are Unavailable

How long can sales growth rates be sustained?

Is this a company that can ultimately make a profit?

Four Tests to Determine Future Profitability

Beware the 'Accuracy Trap'

Lesson 10 | Hunt Down the Outliers, Fiercely

What does 'out-of-stock' mean?

Blue chip stocks down 43 percent over five months

What Netflix Investors Gained From Two Exits

Could Uber Be the Breakaway Blue Chip?

Comparing the returns of blue-chip big tech stocks that left the market

So when should I sell?

summation

In closing | A look back at recent tech-related issues

Acknowledgements

Search

To begin with, we are in the midst of a tech bull market.

Lesson 1 | Avoiding Stock Selection Pitfalls

Stocks of companies with overly complex businesses—Blue Apron

Stocks of companies that fail to meet the most important requirements - Juliely

Stocks of Overextended Companies─Groupon

Lesson 2 | Fundamentals and Trends Are Completely Separate

Facebook's self-inflicted 43 percent stock price drop

Stock price corrections are the best opportunity to find blue-chip stocks that have fallen out of favor.

Google's 2019 Performance and What Remains a Mystery

Why Did a Stock with a Market Cap of $1 Trillion Fall 32 Percent?

Lesson 3 | Sometimes stock prices move completely unrelated to fundamentals.

How Short-Term Investing Misses Out on Huge Opportunities - Snap

Between a 10 percent drop and a 103 percent rise─trend

When an unrelated event shakes the stock price─Uber

Lesson 4 | Remember the '20 Percent Rule' and the '2 Percent Rule'

Correlation between sales growth rate and valuation

Tech investors need to think differently.

Why did the stock that had been living up to market expectations crash? - ① eBay

Why did the stock that had been living up to market expectations crash? - ② Yahoo

Why did the stock that lived up to market expectations crash? ─③ Priceline

Why Netflix's Stock Price Has Soared 420-Fold

Netflix's Growth Curve Acceleration Plan and its Valuation Change

Find the wide open 'gap'

How to compare growth rates excluding pandemic effects

Some Evidence for the '20 Percent Rule'

Lesson 5 | Innovation is reflected in the numbers.

When a completely new revenue stream emerged—Amazon

Innovation, akin to a bet, lifts a plummeting stock price—Netflix

Product Innovation Drives 136 Percent Stock Price Increase—Stitch Fix

Don't miss the event that will replace innovation─Spotify

Spotify vs. Pandora: What Decided the Battle

The "Failed IPO" that has been sluggish for 10 years - Twitter

Lesson 6 | Stock Prices Ultimately Driven by Size

Google had a whole new 'this'

Google absorbs 15 percent of global marketing funding

Reaching $25 Billion in Sales: What's Next?

What the number '1 trillion dollars' means

April 29, 2004 and October 21, 2004

Is the company's estimated market size reasonable? - ① Uber

Is the company's estimated market size reasonable? - ② DoorDash

Are the company's market estimates reasonable?─③Spotify·Priceline

Companies that have achieved scale vs. those that have not

Lesson 7 | Ditch the stocks of companies that serve investors.

A distribution giant that once surpassed Amazon

Five Reasons Why Amazon Was Bound to Win

Long-term stock price fluctuations of investor-first and customer-first companies

Investor-focused companies make poor investments—Grubhub

How Pivots Change Stock Prices - Jill

Find stocks with a 'flywheel'

Lesson 8 | Seeing People Can Reveal Future Stock Prices

What's Behind the Highest-Rate Tech Stocks of All Time

What's different about a company led by its founder?

Do you have a long-term orientation?

Is there a compelling vision for the industry?

Do you have a commitment to customer satisfaction?

Other important features

Lesson 9 | Valuation Isn't the Ultimate Guide to Stock Selection

When a stock can be good even if its PER is high

Questions to Ask When Investing in Companies with Strong Current Profitability

Three Questions to Ask When Investing in Companies with Low Earnings and High P/Es

How to Evaluate Valuation When Profits Are Unavailable

How long can sales growth rates be sustained?

Is this a company that can ultimately make a profit?

Four Tests to Determine Future Profitability

Beware the 'Accuracy Trap'

Lesson 10 | Hunt Down the Outliers, Fiercely

What does 'out-of-stock' mean?

Blue chip stocks down 43 percent over five months

What Netflix Investors Gained From Two Exits

Could Uber Be the Breakaway Blue Chip?

Comparing the returns of blue-chip big tech stocks that left the market

So when should I sell?

summation

In closing | A look back at recent tech-related issues

Acknowledgements

Search

Detailed image

Into the book

The internet and technology sectors are littered with 10x stocks.

By my calculations, there will be at least 23 10x stocks (stocks that have risen by at least 10x) in the US by the end of 2020, including two 300x stocks (Booking.com, Lending Tree), one 400x stock (J2 Global), one 500x stock (Akamai), and two super jumbo stocks (Netflix, Amazon).

Netflix rose from $0.37 in October 2002 to $557 in September 2020, becoming a 1,500x stock, while Amazon rose from $1.40 in May 1997 to $3,531 in September 2020, becoming a 2,500x stock.

Of course, there are plenty of underperforming stocks in the tech sector, or even mediocre stocks that trade at market rates for significant periods of time.

But there are definitely stocks that can deliver dramatic 10x returns like this.

---From "We are in the midst of a tech stock boom"

Investing in technology stocks requires a different mindset.

Traditional investment books focus readers' attention on net income, profit maximization, stock buybacks, and dividends.

But tech investors should think differently.

Tech investors should focus on growth.

So, if a company starts aggressively increasing profitability, skeptical tech investors should ask, "Is there a growth plan to invest in later?"

When a company begins paying dividends, a critical tech investor should ask, "Is this the end? Are they running out of ideas to grow the business and just giving shareholders a dividend?"

Of course, there is nothing wrong with policies that increase profitability and provide dividends, and if implemented at the right time, they are undoubtedly the right measures.

But by the time this action was taken, tech investors would have lost interest in the stock.

---From "Technology Investors Should Think Differently"

For those seeking consistent sales growth, the COVID-19 pandemic has presented some challenges.

Companies related to travel demand (Airbnb, Booking, Expedia), ride-sharing (Lyft, Uber), and advertising revenue (Google, Twitter) saw significant declines in sales in 2020 compared to the same period last year.

Meanwhile, clear winners of the work-from-home trend, including Amazon, Etsy, Netflix, Peloton, and Zoom, experienced significant revenue growth in 2020.

This presented a problem for investors looking for consistent revenue growth in 2020 and 2021.

This is because the "COVID-19 losers" will see impressive sales recovery or even sales growth in 2021, while the "COVID-19 winners" will experience a sharp decline in sales.

In both cases, the key is to normalize the results.

The COVID-19 crisis was a black swan.

Just as we need to calculate net income after excluding unusual one-time expenses and gains to see the true trend in profitability, we also need to adjust for the dramatic impact of the pandemic on growth.

There are two ways.

---From "How to Compare Growth Rates Excluding the Pandemic Effect"

I've often wondered if we simply should focus on companies with a low single-digit total addressable market share.

But what investors really want to look for are companies that can grow and achieve significant sales.

Because growth has inherent advantages.

Therefore, the ideal combination is a company with a large total addressable market and a low single-digit market share.

Next are companies with large total addressable markets and double-digit market share.

Next are companies with small total addressable markets and low single-digit market shares.

This rule of thumb will help, although it may vary somewhat depending on your actual market share and the size of your actual total addressable market.

---From "Is the market size estimated by the company a reasonable figure? ③ Spotify·Priceline"

Therefore, when deciding whether to invest in a company with solid earnings, one must consider, "Is this company's earnings growth sustainable?" A stock with a projected EPS growth rate of 20 percent and a P/E of 30 is likely to maintain a P/E of 30 as long as the 20 percent EPS growth forecast remains unchanged (and assuming no significant changes to the balance sheet or cash flow). This is consistent with the underlying market or sector multiples.

This also means that multiples are likely to decline if the company's EPS growth rate and growth outlook slow down.

The rate at which the multiple declines depends on the rate at which EPS growth slows.

The value of a stock depends on whether its earnings growth rate can be sustained at a rate higher than its multiple decline.

The worst-case scenario for stocks is when forward EPS estimates decline and forward EPS growth projections are also reduced.

It is a double whammy as both profits and PER are falling.

This is what happened to Snap a year after its IPO.

---From "Questions You Must Ask When Investing in a Company with a Strong Current Profitability"

There are four feasibility tests to determine a company's profit potential.

The first validity test asks, “Are there any publicly traded companies with similar business models that are profitable?”

By asking this question, professional investors were able to comfortably invest in Pinterest, Snap, and Twitter, which failed to generate profits when they went public.

When I first published my analysis of Pinterest in May 2019, I pointed out that one of the key investment risks was its lack of profitability to date.

The March 2017 Snap Analytics Initiative report also pointed out the lack of a track record of profitability as one of the major investment risks, while the November 2013 Twitter Analytics Initiative report highlighted the uncertain profitability outlook as an investment risk.

---From "Four Tests to Determine Future Profitability"

Investors can find the exact value of a stock by running a 10-year discounted cash flow model.

However, because of the numerous assumptions that go into the 10-year discounted cash flow model, it is difficult to take its results as the answer.

Just how many assumptions are involved? For starters, a standard discounted cash flow model requires inputs for sales, operating income, depreciation, stock-based compensation, taxes, capital expenditures, and working capital.

There are as many as seven.

In 10 years, 70 input values are entered.

Next, the weighted average cost of capital and future growth rates must also be applied.

This way, there are 72 input values.

Any change in these values, even a little, can cause a huge change in the exact stock value.

In particular, the weighted average cost of capital and future growth rate should be given attention.

I'm not saying you shouldn't do this kind of valuation assessment.

The point is to avoid overconfidence that can arise from relying on one valuation framework and one outcome.

By my calculations, there will be at least 23 10x stocks (stocks that have risen by at least 10x) in the US by the end of 2020, including two 300x stocks (Booking.com, Lending Tree), one 400x stock (J2 Global), one 500x stock (Akamai), and two super jumbo stocks (Netflix, Amazon).

Netflix rose from $0.37 in October 2002 to $557 in September 2020, becoming a 1,500x stock, while Amazon rose from $1.40 in May 1997 to $3,531 in September 2020, becoming a 2,500x stock.

Of course, there are plenty of underperforming stocks in the tech sector, or even mediocre stocks that trade at market rates for significant periods of time.

But there are definitely stocks that can deliver dramatic 10x returns like this.

---From "We are in the midst of a tech stock boom"

Investing in technology stocks requires a different mindset.

Traditional investment books focus readers' attention on net income, profit maximization, stock buybacks, and dividends.

But tech investors should think differently.

Tech investors should focus on growth.

So, if a company starts aggressively increasing profitability, skeptical tech investors should ask, "Is there a growth plan to invest in later?"

When a company begins paying dividends, a critical tech investor should ask, "Is this the end? Are they running out of ideas to grow the business and just giving shareholders a dividend?"

Of course, there is nothing wrong with policies that increase profitability and provide dividends, and if implemented at the right time, they are undoubtedly the right measures.

But by the time this action was taken, tech investors would have lost interest in the stock.

---From "Technology Investors Should Think Differently"

For those seeking consistent sales growth, the COVID-19 pandemic has presented some challenges.

Companies related to travel demand (Airbnb, Booking, Expedia), ride-sharing (Lyft, Uber), and advertising revenue (Google, Twitter) saw significant declines in sales in 2020 compared to the same period last year.

Meanwhile, clear winners of the work-from-home trend, including Amazon, Etsy, Netflix, Peloton, and Zoom, experienced significant revenue growth in 2020.

This presented a problem for investors looking for consistent revenue growth in 2020 and 2021.

This is because the "COVID-19 losers" will see impressive sales recovery or even sales growth in 2021, while the "COVID-19 winners" will experience a sharp decline in sales.

In both cases, the key is to normalize the results.

The COVID-19 crisis was a black swan.

Just as we need to calculate net income after excluding unusual one-time expenses and gains to see the true trend in profitability, we also need to adjust for the dramatic impact of the pandemic on growth.

There are two ways.

---From "How to Compare Growth Rates Excluding the Pandemic Effect"

I've often wondered if we simply should focus on companies with a low single-digit total addressable market share.

But what investors really want to look for are companies that can grow and achieve significant sales.

Because growth has inherent advantages.

Therefore, the ideal combination is a company with a large total addressable market and a low single-digit market share.

Next are companies with large total addressable markets and double-digit market share.

Next are companies with small total addressable markets and low single-digit market shares.

This rule of thumb will help, although it may vary somewhat depending on your actual market share and the size of your actual total addressable market.

---From "Is the market size estimated by the company a reasonable figure? ③ Spotify·Priceline"

Therefore, when deciding whether to invest in a company with solid earnings, one must consider, "Is this company's earnings growth sustainable?" A stock with a projected EPS growth rate of 20 percent and a P/E of 30 is likely to maintain a P/E of 30 as long as the 20 percent EPS growth forecast remains unchanged (and assuming no significant changes to the balance sheet or cash flow). This is consistent with the underlying market or sector multiples.

This also means that multiples are likely to decline if the company's EPS growth rate and growth outlook slow down.

The rate at which the multiple declines depends on the rate at which EPS growth slows.

The value of a stock depends on whether its earnings growth rate can be sustained at a rate higher than its multiple decline.

The worst-case scenario for stocks is when forward EPS estimates decline and forward EPS growth projections are also reduced.

It is a double whammy as both profits and PER are falling.

This is what happened to Snap a year after its IPO.

---From "Questions You Must Ask When Investing in a Company with a Strong Current Profitability"

There are four feasibility tests to determine a company's profit potential.

The first validity test asks, “Are there any publicly traded companies with similar business models that are profitable?”

By asking this question, professional investors were able to comfortably invest in Pinterest, Snap, and Twitter, which failed to generate profits when they went public.

When I first published my analysis of Pinterest in May 2019, I pointed out that one of the key investment risks was its lack of profitability to date.

The March 2017 Snap Analytics Initiative report also pointed out the lack of a track record of profitability as one of the major investment risks, while the November 2013 Twitter Analytics Initiative report highlighted the uncertain profitability outlook as an investment risk.

---From "Four Tests to Determine Future Profitability"

Investors can find the exact value of a stock by running a 10-year discounted cash flow model.

However, because of the numerous assumptions that go into the 10-year discounted cash flow model, it is difficult to take its results as the answer.

Just how many assumptions are involved? For starters, a standard discounted cash flow model requires inputs for sales, operating income, depreciation, stock-based compensation, taxes, capital expenditures, and working capital.

There are as many as seven.

In 10 years, 70 input values are entered.

Next, the weighted average cost of capital and future growth rates must also be applied.

This way, there are 72 input values.

Any change in these values, even a little, can cause a huge change in the exact stock value.

In particular, the weighted average cost of capital and future growth rate should be given attention.

I'm not saying you shouldn't do this kind of valuation assessment.

The point is to avoid overconfidence that can arise from relying on one valuation framework and one outcome.

---From "Beware of the Pitfalls of Accuracy"

Publisher's Review

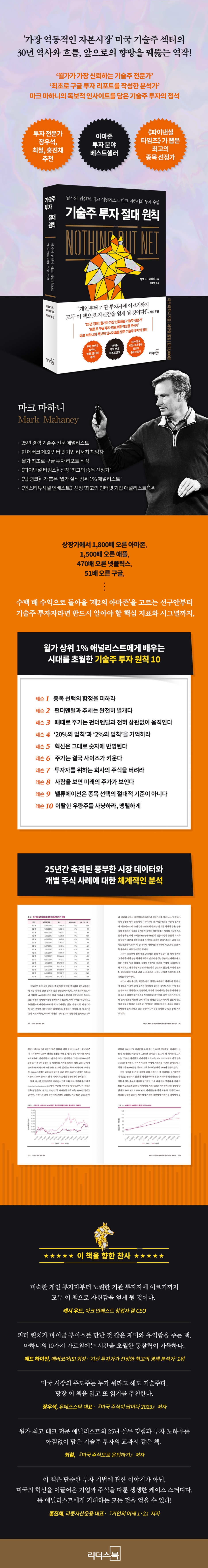

"Wall Street's Top 1% Tech Stock Expert"

Best Stock Picker by the Financial Times

The first analyst to write a Google investment report

Mark Mahaney's 25 Years of Investment Insights Revealed for the First Time

Mark Mahaney, a technology analyst, is a leading expert on Wall Street when discussing the internet, platform, and tech sectors.

He is also known as the first expert to write a Google investment report on Wall Street, and has been included in the "Best Internet Company Analysts" rankings by Institutional Invest every year for the past 15 years, ranking first in five of those years.

The Financial Times named him the best stock picker, and Tip Rank ranked him in the top 1% of Wall Street analysts for stock-picking performance over the past year.

Mahaney's first book, "The Absolute Principles of Technology Investment," has finally been published in Korean.

This book, which shares 10 investment principles gleaned from 25 years of experience in the dynamic technology market and countless stocks, has become a bestseller in the Amazon investment category, receiving rave reviews from readers who called it “the best book on investing in technology stocks ever” and “the most valuable advice among books on individual stocks.”

Wall Street also showed their anticipation for this book, which contains 25 years of experience from a veteran analyst, with enthusiastic responses such as, “This book will give confidence to everyone from inexperienced individual investors to seasoned institutional investors (Cathy Wood, CEO of Ark Investments)” and “This book is as fun and informative as Peter Lynch meeting Michael Lewis (Ed Hyman, Chairman of Evercore ISI).”

Amazon, which rose 1,800 times from its IPO price, and Apple, which rose 1,500 times.

Netflix's stock price soared 470-fold, while Google's rose 51-fold.

The technology sector, which is experiencing its biggest bull market ever,

How to Find the Next Amazon or Google That Will Return Dozens, Hundreds of Times

There is a concept called the 'ten-bagger' that first appeared in Peter Lynch's famous book, 'The Heroes of Wall Street' and is now widely known.

It refers to a stock that has risen more than 10 times from the purchase price and has significantly outperformed the market return.

Mark Mahaney emphasizes that the technology sector is experiencing the greatest bull market in history and is a market full of hidden 10-baggers.

The technology sector, which began 25 years ago with the advent of the internet, has experienced rapid growth driven by ever-increasing innovation and the unexpected emergence of COVID-19.

As of 2020, there were 23 technology stocks in the US that rose at least 10 times their IPO price, and when comparing the 10-year average returns, the return of the technology market (Nasdaq) was twice that of the overall market (S&P 500).

How are the performances of blue chip stocks?

As of February 2024, Amazon had risen 1,800 times from its IPO price, Apple 1,500 times, Netflix 470 times, Google 51 times, and Meta 12 times. These are dramatic returns rarely seen in other sectors.

If chosen correctly, technology stocks can bring great wealth to investors who are diligent in their investments.

So, ultimately, investors are left with just one question:

"How can we identify the super-blue chip stocks that will become the next Amazon, Google, or Apple?" Mahaney, who wrote the first Google investment report on Wall Street over 20 years ago and has recommended buying Amazon, Netflix, and others since their initial public offerings, offers 10 hints to answer this question in "The Absolute Rules of Technology Investment."

From a completely new mindset that avoids stock-picking pitfalls to the know-how to identify promising prospects and seize them at the right moment, this master's insightful stock picks, backed by 25 years of practical experience, offer the most concrete and reliable insights in the uncertain technology market.

“Tech investors need to think differently!”

From the '20 percent rule' to the 'valuation trap',

10 Timeless Tech Stock Investing Principles

Analysis of individual stock cases accumulated over 25 years

One thing to remember when investing in technology stocks is that they require a completely different mindset and approach than other stocks.

Many investors know that in the long run, stock prices are determined by fundamentals.

So, among all the fundamentals, which should we focus on when it comes to technology stocks? Sales? Operating profit? Cash flow? Market share? Mahaney points to "sales growth rate" as the answer.

Generally, companies that achieve sales growth rates exceeding 20% for five years or more have the potential to deliver good returns regardless of their short-term outlook (the 20% rule), and in fact, only 2% of all S&P 500 stocks achieve this (the 2% rule).

So, if there's a tech company that's achieving 20 percent or more revenue growth for five or six consecutive quarters, its stock is likely to be a "10-bagger."

Meanwhile, regarding valuation, which assesses the fair value of a stock, the author asserts that "valuation should not be the most important criterion for stock selection."

Because it has a blind spot that gives accurate answers even when it is impossible or unreasonable to derive the accuracy.

For example, the PER, which is the stock price divided by the earnings per share, is used as a key indicator of valuation.

Typically, a lower PER is considered to mean that the stock is undervalued, and so stocks with lower PERs are often sought after. However, more important than the PER value itself is a comprehensive judgment that takes into account the current fundamentals.

Stocks with a P/E ratio of over 50 can also be good stocks, depending on whether the company can maintain a high sales growth rate for a significant period of time, whether current profits are significantly decreasing due to significant investments, and whether there is reason to believe that the long-term operating profit margin will be higher than the current level.

Throughout the book, ten timeless investment principles are included, including the hidden meaning of trends and fundamentals in the tech market, the real correlation between innovation and stock prices in internet and platform companies, a valuation approach that is subtly differentiated based on the circumstances of a company, and the timing of buying and selling outperforming blue-chip stocks, along with a wealth of individual stock case studies accumulated over 25 years.

This investment lesson, specialized solely in technology stocks and unavailable anywhere else, will serve as a powerful tool for both beginners just starting out and anyone feeling lost.

“This book is not just about simple investment techniques!”

The US tech sector, the 'most dynamic capital market in the world'

A masterpiece that penetrates 30 years of history, trends, and future directions.

Another compelling aspect of this book is that it's not just advice on simple investment techniques, but a vivid case study of companies and stocks that have driven innovation in the world.

The author guides readers into the fascinating world of technology by engagingly unraveling the stories of the founding, IPO, and stock price fluctuations of various tech companies, including Google, Amazon, Netflix, Meta, Snap, Uber, Spotify, Booking.com, Stitch Fix, Zillow, and DoorDash.

Through a masterful analysis that spans 30 years of history and trends in the U.S. technology sector, "the most dynamic capital market," readers will learn not only the rules of successful technology investing, but also a fascinating glimpse into the rise and future of some of the most valuable companies on the planet.

Best Stock Picker by the Financial Times

The first analyst to write a Google investment report

Mark Mahaney's 25 Years of Investment Insights Revealed for the First Time

Mark Mahaney, a technology analyst, is a leading expert on Wall Street when discussing the internet, platform, and tech sectors.

He is also known as the first expert to write a Google investment report on Wall Street, and has been included in the "Best Internet Company Analysts" rankings by Institutional Invest every year for the past 15 years, ranking first in five of those years.

The Financial Times named him the best stock picker, and Tip Rank ranked him in the top 1% of Wall Street analysts for stock-picking performance over the past year.

Mahaney's first book, "The Absolute Principles of Technology Investment," has finally been published in Korean.

This book, which shares 10 investment principles gleaned from 25 years of experience in the dynamic technology market and countless stocks, has become a bestseller in the Amazon investment category, receiving rave reviews from readers who called it “the best book on investing in technology stocks ever” and “the most valuable advice among books on individual stocks.”

Wall Street also showed their anticipation for this book, which contains 25 years of experience from a veteran analyst, with enthusiastic responses such as, “This book will give confidence to everyone from inexperienced individual investors to seasoned institutional investors (Cathy Wood, CEO of Ark Investments)” and “This book is as fun and informative as Peter Lynch meeting Michael Lewis (Ed Hyman, Chairman of Evercore ISI).”

Amazon, which rose 1,800 times from its IPO price, and Apple, which rose 1,500 times.

Netflix's stock price soared 470-fold, while Google's rose 51-fold.

The technology sector, which is experiencing its biggest bull market ever,

How to Find the Next Amazon or Google That Will Return Dozens, Hundreds of Times

There is a concept called the 'ten-bagger' that first appeared in Peter Lynch's famous book, 'The Heroes of Wall Street' and is now widely known.

It refers to a stock that has risen more than 10 times from the purchase price and has significantly outperformed the market return.

Mark Mahaney emphasizes that the technology sector is experiencing the greatest bull market in history and is a market full of hidden 10-baggers.

The technology sector, which began 25 years ago with the advent of the internet, has experienced rapid growth driven by ever-increasing innovation and the unexpected emergence of COVID-19.

As of 2020, there were 23 technology stocks in the US that rose at least 10 times their IPO price, and when comparing the 10-year average returns, the return of the technology market (Nasdaq) was twice that of the overall market (S&P 500).

How are the performances of blue chip stocks?

As of February 2024, Amazon had risen 1,800 times from its IPO price, Apple 1,500 times, Netflix 470 times, Google 51 times, and Meta 12 times. These are dramatic returns rarely seen in other sectors.

If chosen correctly, technology stocks can bring great wealth to investors who are diligent in their investments.

So, ultimately, investors are left with just one question:

"How can we identify the super-blue chip stocks that will become the next Amazon, Google, or Apple?" Mahaney, who wrote the first Google investment report on Wall Street over 20 years ago and has recommended buying Amazon, Netflix, and others since their initial public offerings, offers 10 hints to answer this question in "The Absolute Rules of Technology Investment."

From a completely new mindset that avoids stock-picking pitfalls to the know-how to identify promising prospects and seize them at the right moment, this master's insightful stock picks, backed by 25 years of practical experience, offer the most concrete and reliable insights in the uncertain technology market.

“Tech investors need to think differently!”

From the '20 percent rule' to the 'valuation trap',

10 Timeless Tech Stock Investing Principles

Analysis of individual stock cases accumulated over 25 years

One thing to remember when investing in technology stocks is that they require a completely different mindset and approach than other stocks.

Many investors know that in the long run, stock prices are determined by fundamentals.

So, among all the fundamentals, which should we focus on when it comes to technology stocks? Sales? Operating profit? Cash flow? Market share? Mahaney points to "sales growth rate" as the answer.

Generally, companies that achieve sales growth rates exceeding 20% for five years or more have the potential to deliver good returns regardless of their short-term outlook (the 20% rule), and in fact, only 2% of all S&P 500 stocks achieve this (the 2% rule).

So, if there's a tech company that's achieving 20 percent or more revenue growth for five or six consecutive quarters, its stock is likely to be a "10-bagger."

Meanwhile, regarding valuation, which assesses the fair value of a stock, the author asserts that "valuation should not be the most important criterion for stock selection."

Because it has a blind spot that gives accurate answers even when it is impossible or unreasonable to derive the accuracy.

For example, the PER, which is the stock price divided by the earnings per share, is used as a key indicator of valuation.

Typically, a lower PER is considered to mean that the stock is undervalued, and so stocks with lower PERs are often sought after. However, more important than the PER value itself is a comprehensive judgment that takes into account the current fundamentals.

Stocks with a P/E ratio of over 50 can also be good stocks, depending on whether the company can maintain a high sales growth rate for a significant period of time, whether current profits are significantly decreasing due to significant investments, and whether there is reason to believe that the long-term operating profit margin will be higher than the current level.

Throughout the book, ten timeless investment principles are included, including the hidden meaning of trends and fundamentals in the tech market, the real correlation between innovation and stock prices in internet and platform companies, a valuation approach that is subtly differentiated based on the circumstances of a company, and the timing of buying and selling outperforming blue-chip stocks, along with a wealth of individual stock case studies accumulated over 25 years.

This investment lesson, specialized solely in technology stocks and unavailable anywhere else, will serve as a powerful tool for both beginners just starting out and anyone feeling lost.

“This book is not just about simple investment techniques!”

The US tech sector, the 'most dynamic capital market in the world'

A masterpiece that penetrates 30 years of history, trends, and future directions.

Another compelling aspect of this book is that it's not just advice on simple investment techniques, but a vivid case study of companies and stocks that have driven innovation in the world.

The author guides readers into the fascinating world of technology by engagingly unraveling the stories of the founding, IPO, and stock price fluctuations of various tech companies, including Google, Amazon, Netflix, Meta, Snap, Uber, Spotify, Booking.com, Stitch Fix, Zillow, and DoorDash.

Through a masterful analysis that spans 30 years of history and trends in the U.S. technology sector, "the most dynamic capital market," readers will learn not only the rules of successful technology investing, but also a fascinating glimpse into the rise and future of some of the most valuable companies on the planet.

GOODS SPECIFICS

- Date of issue: March 3, 2024

- Page count, weight, size: 432 pages | 592g | 145*215*24mm

- ISBN13: 9788901280332

- ISBN10: 8901280337

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)