Son, you need to study stocks 2

|

Description

Book Introduction

“Take a closer look inside the company!” Learn Public Investment Know-How with Key Financial Statements, Real-World Corporate Case Studies, and Charts Don't worry, it'll all work out! A lifelong, unwavering, profit-making investment strategy revealed! Volume 2 of "Son, You Need to Study Stocks," which contains the author's 24 years of investment experience, explains winning investment strategies based on financial statements and public disclosures. Investors often shy away from financial statements and disclosures that are filled with complex and unfamiliar terms. But here lies the key to truly successful investing. Investing with a clear understanding of a company's internal circumstances can prevent mistakes and generate profits. Here, through over 100 real-world charts and examples, we provide practical application techniques rather than just theoretical study, providing the know-how to help beginners jump into the market and make profits at any time. “I have never lost money on an investment,” says the author, a 24-year veteran of the securities industry and an individual investor in Yeouido. He is an investment expert who consistently generates positive returns even in the current economic downturn. This book, packed with the author's investment expertise, is a whopping 500 pages long, but it will serve as a solid weapon for beginners just diving into investing to ensure they always win in the investment market. If you are an investor, I highly recommend keeping it on your bookshelf and referring to it often. You will gain a winning strategy to survive in the stock market. |

- You can preview some of the book's contents.

Preview

index

Volume 2 Financial Statements and Disclosures

prolog

Part 1 Financial Statements

Chapter 1: Son, You Must Know This: The Key to Financial Statements

01 Why You Should Pay Attention to Financial Statements for Performance-Based Investment

One-Point Investment Lesson: Viewing Financial Statements Through DART and Naver Securities

02 Understand the core concepts of financial statements.

03 Understand the key differences between financial statements.

04 Understand only the key points of the financial statement relationship diagram.

Chapter 2: Son, the Key Points of the Financial Statement: Know This

05 Balance Sheet/Basic Balance Sheet is arranged according to liquidity.

06 Financial Statements/Assets - ① Let's understand the core concepts of assets.

07 Financial Statements/Assets - ② Understand the Key Points of Useful Life and Depreciation

08 Financial Statements/Assets - ③ Understand the Key Points of Impairment Loss

09 Balance Sheet/Assets - ④ Understand the Key Points of Current Assets

10 Financial Statements/Assets - ⑤ Understand the Key Points of Inventory Assets

11 Balance Sheet/Assets - ⑥ Understand the Key Points of Working Capital

12 Financial Statements/Assets - ⑦ Understanding the Key Non-Current Assets (Part 1)

13 Financial Statements/Assets - ⑧ Understanding the Key Non-Current Assets (Part 1)

14 Financial Statements/Assets - ⑨ Understanding the Key Non-Current Assets (Part 2)

15 Balance Sheet/Liabilities - ① Understand the Key Current Liabilities

16 Balance Sheet/Liabilities - ② Understand the Key Points of Non-Current Liabilities

17 Balance Sheet/Liabilities - ③ Let's Understand the Key Points of Interest Coverage Ratio

18 Balance Sheet/Capital - ① Understand the Key Points of Total Capital

19 Financial Statements/Capital -② Understand the Keys of Capital, Capital Surplus, and Capital Adjustments

20 Balance Sheet/Capital-③ Understand the Key Points of Retained Earnings

21 Balance Sheet/Capital-④ Understand the Key Points of Accumulated Other Comprehensive Income

Chapter 3: Son, Know This: The Key to the Income Statement

22 Income Statement - ① Understanding the Basic Structure of the Income Statement (Part 1)

23 Income Statement - ② Understanding the Basic Structure of the Income Statement (Part 2)

Understanding the Key Points of Financial Statement Processing Based on Equity Ratio (Part 1)

Understanding the Key Points of Financial Statement Processing Based on Equity Ratio (Part 2)

Chapter 4: Son, the Key to Cash Flow Statements: Know This

26 Cash Flow Statement - ① Let's understand only the key points of the cash flow statement.

27 Cash Flow Statement - ② Understand the Three Key Cash Flows

28 Cash Flow Statement - ③ Look at the income statement and cash flow statement together.

Part 2 Public Notice

Chapter 5: Son, Learn the Basics of Public Speaking

29 Let's brush up on the basic knowledge of public notice.

30 Focus more on bad news disclosure reviews.

31 Get familiar with the Financial Supervisory Service's public disclosure site, DART.

Let's check the contents of each type of DART announcement.

33 Let's get into the habit of checking business reports.

Chapter 6: Son, Develop a Public Investment Strategy

34 The announcement is timing.

35 Find only the public offerings you want at a high cost-effective price every day.

36 Check out news comparable to public notices

37 Quickly judge the good news

38 Finding Public Sustainability and Life Cycle

39 Examples of performance-related disclosures

40 Complex Publications: Use a Highlighter to Focus on the Key Points

41 The three-step core process of public announcement analysis

If you want to analyze 42 stocks, find 10 key disclosures.

43 Write a public analysis table

Chapter 7 Public Disclosure Cases and Investment Strategies ① Paid and Bonus Capital Increase/Reduction

44 Key Information on Paid and Unpaid Capital Increases

One-Point Investment Lesson: ROA, ROE, ROIC

45 Paid and Unpaid Capital Increase Investment Strategy

46 Key Points of the Public Notice of Paid-for Capital Increase

47 Key Information on Paid and Unpaid Potatoes

48 Key Points of the Disclosure of Paid and Unpaid Income Tax

Chapter 8 Public Disclosure Cases and Investment Strategies ② Stock-Related Bonds

49 Key Information on Stock-Related Bonds

50 Equity-Related Bond Investment Strategies

51 Key Points in the Disclosure of Stock-Related Bonds

Chapter 9 Public Disclosure Cases and Investment Strategies ③ IPO Stocks

52 Key Information on IPO Stocks

53 IPO Investment Strategies

One-Point Investment Lesson: Interpreting Securities Reports (Equity Securities)

Chapter 10: Public Disclosure Cases and Investment Strategies ④ Dividends

54 Dividend Key Information

55 Dividend Stock Investment Strategies

56 Key Points of Dividend Disclosure

Chapter 11: Disclosure Cases and Investment Strategies ⑤ Stock Split/Stock Consolidation

57 Key Information on Stock Splits/Share Splits

58 Stock Split/Single-Price Investment Strategy

59 Key Points of the Stock Split/Stock Consolidation Announcement

Chapter 12 Public Disclosure Cases and Investment Strategies ⑥ Merger

60 Key Merger Information

61 Merger Investment Strategy

62 Key Points of the Merger Announcement

One-Point Investment Lesson: Comprehensive Stock Exchange

Chapter 13 Public Disclosure Cases and Investment Strategies ⑦ Human/Physical Division

63 Key Information on Human/Physical Division

64 Human/Physical Division Investment Strategy

65 Key Points of the Human/Material Division Announcement

Chapter 14: Public Disclosure Cases and Investment Strategies ⑧ Treasury Stock

66 Key Information on Treasury Stock

67 Treasury Stock Investment Strategy

68 Key Points in Treasury Stock Disclosure

Chapter 15 Public Disclosure Cases and Investment Strategies ⑨ Changes in Shareholding Ratio

69 Key information on shareholding ratio changes

70 Equity Ratio Fluctuation Investment Strategy

71 Key Points in Disclosure of Changes in Shareholding Ratio

Chapter 16: Public Disclosure Cases and Investment Strategies ⑩ Market Measures

72 Key Market Action Information

73 Market Action Investment Strategy

74 Key Points of Market Measures Disclosure

prolog

Part 1 Financial Statements

Chapter 1: Son, You Must Know This: The Key to Financial Statements

01 Why You Should Pay Attention to Financial Statements for Performance-Based Investment

One-Point Investment Lesson: Viewing Financial Statements Through DART and Naver Securities

02 Understand the core concepts of financial statements.

03 Understand the key differences between financial statements.

04 Understand only the key points of the financial statement relationship diagram.

Chapter 2: Son, the Key Points of the Financial Statement: Know This

05 Balance Sheet/Basic Balance Sheet is arranged according to liquidity.

06 Financial Statements/Assets - ① Let's understand the core concepts of assets.

07 Financial Statements/Assets - ② Understand the Key Points of Useful Life and Depreciation

08 Financial Statements/Assets - ③ Understand the Key Points of Impairment Loss

09 Balance Sheet/Assets - ④ Understand the Key Points of Current Assets

10 Financial Statements/Assets - ⑤ Understand the Key Points of Inventory Assets

11 Balance Sheet/Assets - ⑥ Understand the Key Points of Working Capital

12 Financial Statements/Assets - ⑦ Understanding the Key Non-Current Assets (Part 1)

13 Financial Statements/Assets - ⑧ Understanding the Key Non-Current Assets (Part 1)

14 Financial Statements/Assets - ⑨ Understanding the Key Non-Current Assets (Part 2)

15 Balance Sheet/Liabilities - ① Understand the Key Current Liabilities

16 Balance Sheet/Liabilities - ② Understand the Key Points of Non-Current Liabilities

17 Balance Sheet/Liabilities - ③ Let's Understand the Key Points of Interest Coverage Ratio

18 Balance Sheet/Capital - ① Understand the Key Points of Total Capital

19 Financial Statements/Capital -② Understand the Keys of Capital, Capital Surplus, and Capital Adjustments

20 Balance Sheet/Capital-③ Understand the Key Points of Retained Earnings

21 Balance Sheet/Capital-④ Understand the Key Points of Accumulated Other Comprehensive Income

Chapter 3: Son, Know This: The Key to the Income Statement

22 Income Statement - ① Understanding the Basic Structure of the Income Statement (Part 1)

23 Income Statement - ② Understanding the Basic Structure of the Income Statement (Part 2)

Understanding the Key Points of Financial Statement Processing Based on Equity Ratio (Part 1)

Understanding the Key Points of Financial Statement Processing Based on Equity Ratio (Part 2)

Chapter 4: Son, the Key to Cash Flow Statements: Know This

26 Cash Flow Statement - ① Let's understand only the key points of the cash flow statement.

27 Cash Flow Statement - ② Understand the Three Key Cash Flows

28 Cash Flow Statement - ③ Look at the income statement and cash flow statement together.

Part 2 Public Notice

Chapter 5: Son, Learn the Basics of Public Speaking

29 Let's brush up on the basic knowledge of public notice.

30 Focus more on bad news disclosure reviews.

31 Get familiar with the Financial Supervisory Service's public disclosure site, DART.

Let's check the contents of each type of DART announcement.

33 Let's get into the habit of checking business reports.

Chapter 6: Son, Develop a Public Investment Strategy

34 The announcement is timing.

35 Find only the public offerings you want at a high cost-effective price every day.

36 Check out news comparable to public notices

37 Quickly judge the good news

38 Finding Public Sustainability and Life Cycle

39 Examples of performance-related disclosures

40 Complex Publications: Use a Highlighter to Focus on the Key Points

41 The three-step core process of public announcement analysis

If you want to analyze 42 stocks, find 10 key disclosures.

43 Write a public analysis table

Chapter 7 Public Disclosure Cases and Investment Strategies ① Paid and Bonus Capital Increase/Reduction

44 Key Information on Paid and Unpaid Capital Increases

One-Point Investment Lesson: ROA, ROE, ROIC

45 Paid and Unpaid Capital Increase Investment Strategy

46 Key Points of the Public Notice of Paid-for Capital Increase

47 Key Information on Paid and Unpaid Potatoes

48 Key Points of the Disclosure of Paid and Unpaid Income Tax

Chapter 8 Public Disclosure Cases and Investment Strategies ② Stock-Related Bonds

49 Key Information on Stock-Related Bonds

50 Equity-Related Bond Investment Strategies

51 Key Points in the Disclosure of Stock-Related Bonds

Chapter 9 Public Disclosure Cases and Investment Strategies ③ IPO Stocks

52 Key Information on IPO Stocks

53 IPO Investment Strategies

One-Point Investment Lesson: Interpreting Securities Reports (Equity Securities)

Chapter 10: Public Disclosure Cases and Investment Strategies ④ Dividends

54 Dividend Key Information

55 Dividend Stock Investment Strategies

56 Key Points of Dividend Disclosure

Chapter 11: Disclosure Cases and Investment Strategies ⑤ Stock Split/Stock Consolidation

57 Key Information on Stock Splits/Share Splits

58 Stock Split/Single-Price Investment Strategy

59 Key Points of the Stock Split/Stock Consolidation Announcement

Chapter 12 Public Disclosure Cases and Investment Strategies ⑥ Merger

60 Key Merger Information

61 Merger Investment Strategy

62 Key Points of the Merger Announcement

One-Point Investment Lesson: Comprehensive Stock Exchange

Chapter 13 Public Disclosure Cases and Investment Strategies ⑦ Human/Physical Division

63 Key Information on Human/Physical Division

64 Human/Physical Division Investment Strategy

65 Key Points of the Human/Material Division Announcement

Chapter 14: Public Disclosure Cases and Investment Strategies ⑧ Treasury Stock

66 Key Information on Treasury Stock

67 Treasury Stock Investment Strategy

68 Key Points in Treasury Stock Disclosure

Chapter 15 Public Disclosure Cases and Investment Strategies ⑨ Changes in Shareholding Ratio

69 Key information on shareholding ratio changes

70 Equity Ratio Fluctuation Investment Strategy

71 Key Points in Disclosure of Changes in Shareholding Ratio

Chapter 16: Public Disclosure Cases and Investment Strategies ⑩ Market Measures

72 Key Market Action Information

73 Market Action Investment Strategy

74 Key Points of Market Measures Disclosure

Detailed image

Into the book

Unlike Volume 1, Volume 2 is more difficult.

Readers who have not previously encountered financial statements may find them difficult.

However, performance-based value investing is difficult if you don't understand financial statements.

We've compiled only the essential information for corporate analysis, so don't give up and read through it all.

If you have trouble understanding the content, reading it several times is also a good idea.

If you read it repeatedly, your logical thinking will continue, and the financial statements will become yours easily.

I have a request for the readers.

I hope you read the financial statements section of this book at least three times.

--- p.17

Although we think of financial statements as tables filled with numbers, there are also explanatory notes.

The meaning of the hard numbers between the lines can be found by looking at the footnotes.

It's the same as the process of solving the answer sheet in a math workbook.

However, the amount of comments is so vast that I don't have the courage to read them all.

Conversely, I only look it up when I'm curious.

It's like watching the process of solving a math problem that is wrong.

Let's look at the comments condensed to focus on unusual number fluctuations or things that raise questions.

--- p.34

Free Cash Flow (FCF) is the money that is left over.

Cash flow from operating activities minus investment costs required for operations.

There is no need to calculate free cash flow.

It's all on the Naver Securities screen.

The portal interprets cash flow from operating activities as cash flow minus capital expenditures (CAPEX). The English meaning of CAPEX (Capital Expenditures) is capital expenditures.

This is an expenditure for facility investment, such as acquisition of tangible and intangible assets.

In short, FCF is the cash remaining after investing in facilities with operating profit.

If there is a lot of money left over, there is room not only for debt repayment but also for shareholder-friendly actions such as dividend payments and stock buybacks.

--- p.133

Financial statements, such as balance sheets and income statements, are lists of numbers.

The numbers you see on a computer screen don't make sense.

The amount of information contained in the notes is also extensive.

If there is a lot of public information, it is difficult to see it all at a glance.

Printed materials are good for reading calmly and with concentration.

If it is an important announcement, I recommend printing it out and looking at it.

The key is to read all the notices carefully.

Let's read it all without missing a single one.

If you star it and underline it, your thoughts will become deeper.

Analog sensibility is more helpful for analysis.

Unlike mathematics, stock investing requires emotional logic.

--- p.190

After a sharp rise on the day of the capital increase announcement, the stock price tends to rise as the reference date approaches.

Let's aim for the low point where the stock price moves sideways after the announcement.

The date of assignment of rights is two business days prior to the reference date.

As the rights issue date approaches, demand for purchases increases.

People who want to receive free capital increases and those who want to make short-term investments by taking advantage of the ex-rights illusion are flocking to the market.

Investors who held the shares before the announcement of the bonus issue have several options.

① Sell on the short-term surge on the day of the announcement of the free capital increase ② Sell on the rise in stock price around the free capital increase rights issue date ③ Hold until the free capital increase rights issue date.

If you hold the rights, you will receive a free capital increase.

--- p.221

Stock dividends lower the stock price by the amount of stock that has increased.

Stock price adjustments are only made on the ex-dividend date.

For example, it is convenient to think that if the number of shares increases by 10%, the stock price decreases by 10%.

Market capitalization is the product of the number of shares and the stock price.

The logic is that the stock price should fall as the number of shares increases to maintain the same market capitalization.

Cash dividends do not increase the number of shares, so there is no stock price adjustment.

--- p.329

Not all mergers and acquisitions are good news.

First, there is the case of acquisition at a high price compared to the corporate value.

This is because it is a loss if the acquisition effect is less than the money spent.

Second, there are cases where a lot of loans are used for acquisition funds.

Debt ratios also rise, and interest expenses also increase during periods of rising interest rates.

Increased debt may lower your credit rating.

As your credit rating goes down, your financing interest rate goes up.

Third, if the performance of the acquired company deteriorates after the acquisition.

If the acquired company is consolidated into financial statements, the performance of the acquiring company will also deteriorate.

In mergers and acquisitions, it is necessary to determine whether there is good or bad news for each issue.

There is a lot of related analysis in news, securities reports, etc., so let's refer to it and make a decision.

Readers who have not previously encountered financial statements may find them difficult.

However, performance-based value investing is difficult if you don't understand financial statements.

We've compiled only the essential information for corporate analysis, so don't give up and read through it all.

If you have trouble understanding the content, reading it several times is also a good idea.

If you read it repeatedly, your logical thinking will continue, and the financial statements will become yours easily.

I have a request for the readers.

I hope you read the financial statements section of this book at least three times.

--- p.17

Although we think of financial statements as tables filled with numbers, there are also explanatory notes.

The meaning of the hard numbers between the lines can be found by looking at the footnotes.

It's the same as the process of solving the answer sheet in a math workbook.

However, the amount of comments is so vast that I don't have the courage to read them all.

Conversely, I only look it up when I'm curious.

It's like watching the process of solving a math problem that is wrong.

Let's look at the comments condensed to focus on unusual number fluctuations or things that raise questions.

--- p.34

Free Cash Flow (FCF) is the money that is left over.

Cash flow from operating activities minus investment costs required for operations.

There is no need to calculate free cash flow.

It's all on the Naver Securities screen.

The portal interprets cash flow from operating activities as cash flow minus capital expenditures (CAPEX). The English meaning of CAPEX (Capital Expenditures) is capital expenditures.

This is an expenditure for facility investment, such as acquisition of tangible and intangible assets.

In short, FCF is the cash remaining after investing in facilities with operating profit.

If there is a lot of money left over, there is room not only for debt repayment but also for shareholder-friendly actions such as dividend payments and stock buybacks.

--- p.133

Financial statements, such as balance sheets and income statements, are lists of numbers.

The numbers you see on a computer screen don't make sense.

The amount of information contained in the notes is also extensive.

If there is a lot of public information, it is difficult to see it all at a glance.

Printed materials are good for reading calmly and with concentration.

If it is an important announcement, I recommend printing it out and looking at it.

The key is to read all the notices carefully.

Let's read it all without missing a single one.

If you star it and underline it, your thoughts will become deeper.

Analog sensibility is more helpful for analysis.

Unlike mathematics, stock investing requires emotional logic.

--- p.190

After a sharp rise on the day of the capital increase announcement, the stock price tends to rise as the reference date approaches.

Let's aim for the low point where the stock price moves sideways after the announcement.

The date of assignment of rights is two business days prior to the reference date.

As the rights issue date approaches, demand for purchases increases.

People who want to receive free capital increases and those who want to make short-term investments by taking advantage of the ex-rights illusion are flocking to the market.

Investors who held the shares before the announcement of the bonus issue have several options.

① Sell on the short-term surge on the day of the announcement of the free capital increase ② Sell on the rise in stock price around the free capital increase rights issue date ③ Hold until the free capital increase rights issue date.

If you hold the rights, you will receive a free capital increase.

--- p.221

Stock dividends lower the stock price by the amount of stock that has increased.

Stock price adjustments are only made on the ex-dividend date.

For example, it is convenient to think that if the number of shares increases by 10%, the stock price decreases by 10%.

Market capitalization is the product of the number of shares and the stock price.

The logic is that the stock price should fall as the number of shares increases to maintain the same market capitalization.

Cash dividends do not increase the number of shares, so there is no stock price adjustment.

--- p.329

Not all mergers and acquisitions are good news.

First, there is the case of acquisition at a high price compared to the corporate value.

This is because it is a loss if the acquisition effect is less than the money spent.

Second, there are cases where a lot of loans are used for acquisition funds.

Debt ratios also rise, and interest expenses also increase during periods of rising interest rates.

Increased debt may lower your credit rating.

As your credit rating goes down, your financing interest rate goes up.

Third, if the performance of the acquired company deteriorates after the acquisition.

If the acquired company is consolidated into financial statements, the performance of the acquiring company will also deteriorate.

In mergers and acquisitions, it is necessary to determine whether there is good or bad news for each issue.

There is a lot of related analysis in news, securities reports, etc., so let's refer to it and make a decision.

--- p.361

Publisher's Review

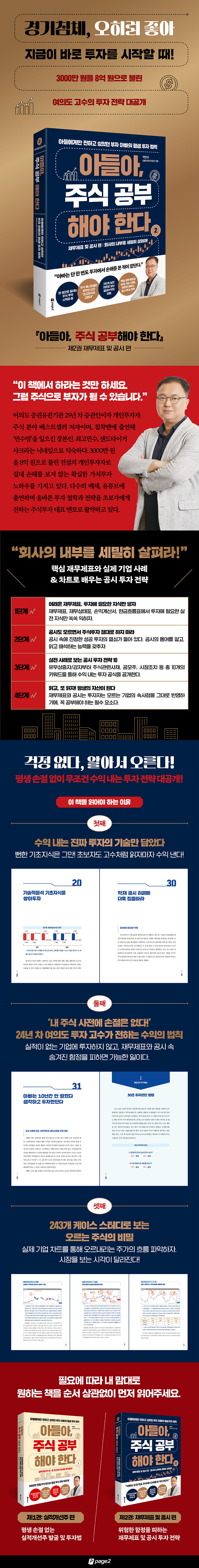

A recession is actually a good thing! Now is the time to start investing.

From the beginning to the end of your stock studies, Choi Go-min is in charge!

A comfortable investment is a real investment.

From discovering investment stocks that will rise on their own to buying and selling know-how.

The investment strategy of an investment expert who turned 30 million won into 800 million won is revealed!

Park Min-su, a bestselling author in the stock market and better known by his nicknames Sand Tiger Shark and Choi Go-min-su, has returned to us with the series, “Son, You Need to Study Stocks.”

Author Park Min-soo has recently gone beyond the stock market and created the meme "I like it, thank you" on his YouTube channel "Calm Man" with 2.1 million subscribers.

The fourth book, "Son, You Need to Study Stocks, Vol. 1 and 2," which took over a year to write and edit, is a book that stands out for its passion and sincerity, to the point that the author himself says that it contained his entire investment life.

It is a book that can be proudly said to contain the essence of the author's 20 years of investment experience as a Yeouido securities broker and individual investor.

This book, which is filled with the concerns and hopes of a father who wants his twin sons to profit from stock investment with peace of mind, contains everything about value investing that he wanted to share only with his family.

This expanded edition, which covers the previous bestseller, 『Stock Study in 5 Days Starting at Age 40』, in more depth, consists of two volumes with a total of 948 pages.

This will be an excellent textbook for those who want to study stock investment from A to Z in detail without any unnecessary information.

Volume 1 focuses on improving performance (invest in companies that are making money), and Volume 2 focuses on financial statements and disclosures (investing in detail in the company's internal workings). This book provides more specificity through 243 charts of real-world examples and investment strategies.

Author Park Min-su's books are famous for containing his own know-how and investment strategies.

It is clearly different from other books that simply list basic knowledge.

This time, you can also experience know-how and investment strategies that are uniquely yours.

Volume 1 focuses on investing in stocks with improved performance.

We've also added a significant portion of information on safe investment methods, including dividend stocks, SPACs, REITs, and ETFs.

All are attractive investment vehicles that can generate safe and steady profits.

It covers everything from basic stock investment knowledge to detailed investment mindset, real-life investment cases, and investment strategies.

Here, we also present specific practical methods, including a securities company report analysis table, daily investment notes, and a 5-step stock analysis table specifically for stocks with improving performance.

The key is to invest in companies that make a lot of money (performance improvement stocks) and companies that pay a lot of money (high dividend stocks).

Volume 2 covers key issues related to financial statements and disclosures.

Although it is a summary, it is a massive volume of over 500 pages because the content was meticulously put in.

Financial statements cover only the essentials for stock investment.

Understanding financial statements is essential for investing in stocks with improving performance.

Rather than simple accounting starting with debits and credits, it covers only the essential financial statement techniques needed for practical stock investment.

The disclosure is divided into 10 sectors, and includes sector-specific disclosure basics, investment strategies, examples of reading disclosures, and practical examples for each disclosure.

The 10 sectors of public disclosure are capital increase (capital reduction), stock-related bonds, public offerings, dividends, par value split (merger), merger, corporate division (physical division, human division), treasury stock, equity ratio, and market measures.

This book will likely be a ray of hope for investors who have suffered losses by investing without principles.

You can study specific methods for identifying attractive stocks with improving performance, identifying the right time to buy and sell, and developing in-depth investment principles and financial statement and public disclosure investment strategies.

'Son, never lose money investing in stocks' is the true message this book wants to convey.

This book is highly recommended as a textbook for readers seeking a systematic study of stock investment methodology, financial statements, and publicly disclosed investment strategies.

From the beginning to the end of your stock studies, Choi Go-min is in charge!

A comfortable investment is a real investment.

From discovering investment stocks that will rise on their own to buying and selling know-how.

The investment strategy of an investment expert who turned 30 million won into 800 million won is revealed!

Park Min-su, a bestselling author in the stock market and better known by his nicknames Sand Tiger Shark and Choi Go-min-su, has returned to us with the series, “Son, You Need to Study Stocks.”

Author Park Min-soo has recently gone beyond the stock market and created the meme "I like it, thank you" on his YouTube channel "Calm Man" with 2.1 million subscribers.

The fourth book, "Son, You Need to Study Stocks, Vol. 1 and 2," which took over a year to write and edit, is a book that stands out for its passion and sincerity, to the point that the author himself says that it contained his entire investment life.

It is a book that can be proudly said to contain the essence of the author's 20 years of investment experience as a Yeouido securities broker and individual investor.

This book, which is filled with the concerns and hopes of a father who wants his twin sons to profit from stock investment with peace of mind, contains everything about value investing that he wanted to share only with his family.

This expanded edition, which covers the previous bestseller, 『Stock Study in 5 Days Starting at Age 40』, in more depth, consists of two volumes with a total of 948 pages.

This will be an excellent textbook for those who want to study stock investment from A to Z in detail without any unnecessary information.

Volume 1 focuses on improving performance (invest in companies that are making money), and Volume 2 focuses on financial statements and disclosures (investing in detail in the company's internal workings). This book provides more specificity through 243 charts of real-world examples and investment strategies.

Author Park Min-su's books are famous for containing his own know-how and investment strategies.

It is clearly different from other books that simply list basic knowledge.

This time, you can also experience know-how and investment strategies that are uniquely yours.

Volume 1 focuses on investing in stocks with improved performance.

We've also added a significant portion of information on safe investment methods, including dividend stocks, SPACs, REITs, and ETFs.

All are attractive investment vehicles that can generate safe and steady profits.

It covers everything from basic stock investment knowledge to detailed investment mindset, real-life investment cases, and investment strategies.

Here, we also present specific practical methods, including a securities company report analysis table, daily investment notes, and a 5-step stock analysis table specifically for stocks with improving performance.

The key is to invest in companies that make a lot of money (performance improvement stocks) and companies that pay a lot of money (high dividend stocks).

Volume 2 covers key issues related to financial statements and disclosures.

Although it is a summary, it is a massive volume of over 500 pages because the content was meticulously put in.

Financial statements cover only the essentials for stock investment.

Understanding financial statements is essential for investing in stocks with improving performance.

Rather than simple accounting starting with debits and credits, it covers only the essential financial statement techniques needed for practical stock investment.

The disclosure is divided into 10 sectors, and includes sector-specific disclosure basics, investment strategies, examples of reading disclosures, and practical examples for each disclosure.

The 10 sectors of public disclosure are capital increase (capital reduction), stock-related bonds, public offerings, dividends, par value split (merger), merger, corporate division (physical division, human division), treasury stock, equity ratio, and market measures.

This book will likely be a ray of hope for investors who have suffered losses by investing without principles.

You can study specific methods for identifying attractive stocks with improving performance, identifying the right time to buy and sell, and developing in-depth investment principles and financial statement and public disclosure investment strategies.

'Son, never lose money investing in stocks' is the true message this book wants to convey.

This book is highly recommended as a textbook for readers seeking a systematic study of stock investment methodology, financial statements, and publicly disclosed investment strategies.

GOODS SPECIFICS

- Date of issue: May 10, 2023

- Page count, weight, size: 508 pages | 185*240*35mm

- ISBN13: 9791169850247

- ISBN10: 1169850243

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)