Peter Lynch's Investment Story

|

Description

Book Introduction

A timeless investment guru

Peter Lynch's Investment Story for Every Investor

As many aspects of our lives change, the way we approach investing is also undergoing significant changes.

It's no longer uncommon for parents, recognizing the need to teach their children about investing from an early age, to open securities accounts in their children's names, and the number of people who consider stock investment not a choice but a necessity is also increasing.

Despite a fundamental shift in perceptions about investing, many people still invest without proper study, relying on the advice of those around them or their own intuition.

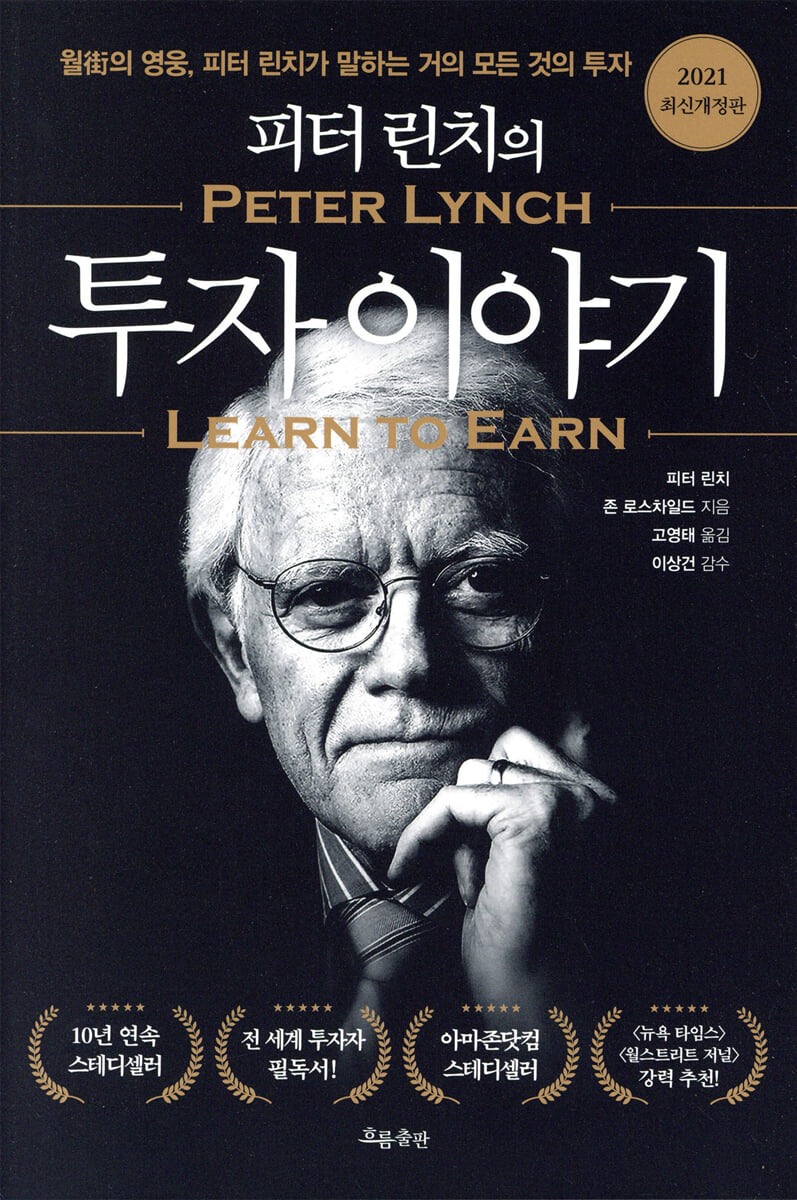

This book is the latest revised edition of "Peter Lynch's Investment Story," written by Peter Lynch, known as the "Hero of Wall Street," for investors who want to develop proper investment habits.

Lynch is a legendary investor who managed the world's largest Magellan Fund and turned the fund's assets from about $18 million to $14 billion in just 13 years.

In this book, he emphasizes the importance of having basic knowledge before developing your own investment strategy and know-how.

Peter Lynch said, “They teach you history in school, but they don’t teach you that the sooner you start saving and the sooner you learn to invest in stocks, the more financially comfortable you will be.” In this book, he covers all the basic investment common sense and knowledge that schools don’t teach you.

It is packed with essential information for investors, including how capitalism works, the relationship between investment and our lives, stock selection, and fund investment tips.

Peter Lynch's Investment Story for Every Investor

As many aspects of our lives change, the way we approach investing is also undergoing significant changes.

It's no longer uncommon for parents, recognizing the need to teach their children about investing from an early age, to open securities accounts in their children's names, and the number of people who consider stock investment not a choice but a necessity is also increasing.

Despite a fundamental shift in perceptions about investing, many people still invest without proper study, relying on the advice of those around them or their own intuition.

This book is the latest revised edition of "Peter Lynch's Investment Story," written by Peter Lynch, known as the "Hero of Wall Street," for investors who want to develop proper investment habits.

Lynch is a legendary investor who managed the world's largest Magellan Fund and turned the fund's assets from about $18 million to $14 billion in just 13 years.

In this book, he emphasizes the importance of having basic knowledge before developing your own investment strategy and know-how.

Peter Lynch said, “They teach you history in school, but they don’t teach you that the sooner you start saving and the sooner you learn to invest in stocks, the more financially comfortable you will be.” In this book, he covers all the basic investment common sense and knowledge that schools don’t teach you.

It is packed with essential information for investors, including how capitalism works, the relationship between investment and our lives, stock selection, and fund investment tips.

- You can preview some of the book's contents.

Preview

index

Recommended Reading|The Best Textbooks for Young Children

Author's Note

Introduction

Chapter 1: The History of Capitalism

The birth of capitalism

Pioneers of Investment

early-stage entrepreneurs

Father of the Financial System

father of modern economics

The first millionaires

Evolution of the Stock Market

American creativity

Railways and Commerce

Growth of famous brands

The Industrial Age and the Rise of the Unscrupulous Capitalist

The evils of monopoly

The Economics of the Dow

The Birth of a Corporate City

Karl Marx's fatal error

Capitalism before the Great Depression

fear of panic

Rumors about panic

Good news in the midst of panic

The recovery of the US economy

Investor Protection

Typical American shareholder

Chapter 2: Fundamentals of Investing

Start as soon as possible

The beginning of investment, saving

Pros and Cons of Five Basic Investment Methods

Long-term investment that beats the market

The easiest investment: mutual funds

History of the Fund

How to Choose a Good Fund

Pick profitable stocks yourself

Advice for your first real-world stock investment

The role of the stock exchange

The role of securities firms and brokers

Nasdaq and market makers

Stock market analysis by economic newspapers

Shareholder benefits

Pursuit of corporate profits

Corporate growth

Discovering 12x Return Stocks

Investing Fundamentals from Johnson & Johnson

Chapter 3: The Life of a Company

The birth of a company

Corporate IPO

Youth Enterprise

mid-aged companies

Older companies

Corporate mergers and acquisitions

corporate extinction

Economic environment: another force influencing businesses

Bull and bear markets

Chapter 4: The Invisible Hand That Moves Business

The Secret to Building Great Wealth

Coca-Cola, see clear evidence

Wrigley, product development

Campbell Soup: It's Time to Sell

Levi's obtains patent

Ben & Jerry's issues stock

Microsoft, digging a well

Home Depot: Focus on Strength, Not Expansion

The myth is not over

Corporate Heroes

Chapter 5: Analyzing Financial Statements Like Peter Lynch

Translator's Note | Everything You Need to Know About Investing from Wall Street Hero Peter Lynch

Author's Note

Introduction

Chapter 1: The History of Capitalism

The birth of capitalism

Pioneers of Investment

early-stage entrepreneurs

Father of the Financial System

father of modern economics

The first millionaires

Evolution of the Stock Market

American creativity

Railways and Commerce

Growth of famous brands

The Industrial Age and the Rise of the Unscrupulous Capitalist

The evils of monopoly

The Economics of the Dow

The Birth of a Corporate City

Karl Marx's fatal error

Capitalism before the Great Depression

fear of panic

Rumors about panic

Good news in the midst of panic

The recovery of the US economy

Investor Protection

Typical American shareholder

Chapter 2: Fundamentals of Investing

Start as soon as possible

The beginning of investment, saving

Pros and Cons of Five Basic Investment Methods

Long-term investment that beats the market

The easiest investment: mutual funds

History of the Fund

How to Choose a Good Fund

Pick profitable stocks yourself

Advice for your first real-world stock investment

The role of the stock exchange

The role of securities firms and brokers

Nasdaq and market makers

Stock market analysis by economic newspapers

Shareholder benefits

Pursuit of corporate profits

Corporate growth

Discovering 12x Return Stocks

Investing Fundamentals from Johnson & Johnson

Chapter 3: The Life of a Company

The birth of a company

Corporate IPO

Youth Enterprise

mid-aged companies

Older companies

Corporate mergers and acquisitions

corporate extinction

Economic environment: another force influencing businesses

Bull and bear markets

Chapter 4: The Invisible Hand That Moves Business

The Secret to Building Great Wealth

Coca-Cola, see clear evidence

Wrigley, product development

Campbell Soup: It's Time to Sell

Levi's obtains patent

Ben & Jerry's issues stock

Microsoft, digging a well

Home Depot: Focus on Strength, Not Expansion

The myth is not over

Corporate Heroes

Chapter 5: Analyzing Financial Statements Like Peter Lynch

Translator's Note | Everything You Need to Know About Investing from Wall Street Hero Peter Lynch

Detailed image

Into the book

On Wall Street, anything that goes up in price is bound to fall again.

Bank stocks, which early American investors had bought at overpriced prices, suffered a major crash in 1792.

This was the first major crash in Wall Street history.

The Great Crash of 1792 served as a valuable lesson for newly independent nations and novice investors.

Shareholders can only make money if the company they invested in succeeds.

However, a significant number of companies do not succeed.

This is the risk of stock investing.

The company you invested in may end up being worthless.

However, it is worth taking the risk of failure because if you choose the right company, you can make a lot of money.

--- p.46

Twenty years after the panic, most Americans still fear investing in stocks and keep their money in banks, where they believe it is safe.

You've probably heard the saying, "Better safe than sorry."

Those who saved their money in banks kept it safe, but they regretted it after missing out on the incredible bull market of the 1950s.

As of 1952, about 6.5 million people, or 4.2% of the total population, owned stocks.

And 80% of this stock was concentrated in a small group of people who accounted for 1.6% of the total population.

The profits from the investment went to a small number of investors who were not afraid of stock investment and believed that the profits outweighed the risks.

--- p.119

Most people have some spare money.

But I don't use that money for investments.

Use it to eat out at a fancy restaurant or buy an expensive car and pay off the mortgage.

And then you enter the twilight of your life empty-handed.

At an age when you should be enjoying life comfortably, you have to live frugally.

Living in poverty when you're old is much more depressing than living frugally when you're young.

By the time you realize later that you should have invested when you were younger, all the precious time for stock prices to rise has already passed.

If you had started investing early, your investment would have grown steadily over time.

--- p.125

Looking at the world from the perspective of a professional investor who considers everything an investment, you'll carefully examine the companies you're interested in and the companies you do business with.

If you work in a hospital, you will come into contact with companies that make surgical gowns, X-ray equipment, beds, etc.

You will also come across companies or insurance companies that can help you save money.

Large supermarkets are showrooms for companies.

You can find dozens of companies on the product display shelves.

--- p.178

If you're thinking about investing in stocks, understanding the company is important.

One area where investors struggle is analyzing and understanding companies.

Since the only indicator that investors know in detail is the stock price, they buy stocks without understanding the company and follow the stock price fluctuations.

If the stock price rises, the company's financial condition is good, but if the stock price moves sideways or falls, people's trust in the company is shaken and they sell their stocks.

Bank stocks, which early American investors had bought at overpriced prices, suffered a major crash in 1792.

This was the first major crash in Wall Street history.

The Great Crash of 1792 served as a valuable lesson for newly independent nations and novice investors.

Shareholders can only make money if the company they invested in succeeds.

However, a significant number of companies do not succeed.

This is the risk of stock investing.

The company you invested in may end up being worthless.

However, it is worth taking the risk of failure because if you choose the right company, you can make a lot of money.

--- p.46

Twenty years after the panic, most Americans still fear investing in stocks and keep their money in banks, where they believe it is safe.

You've probably heard the saying, "Better safe than sorry."

Those who saved their money in banks kept it safe, but they regretted it after missing out on the incredible bull market of the 1950s.

As of 1952, about 6.5 million people, or 4.2% of the total population, owned stocks.

And 80% of this stock was concentrated in a small group of people who accounted for 1.6% of the total population.

The profits from the investment went to a small number of investors who were not afraid of stock investment and believed that the profits outweighed the risks.

--- p.119

Most people have some spare money.

But I don't use that money for investments.

Use it to eat out at a fancy restaurant or buy an expensive car and pay off the mortgage.

And then you enter the twilight of your life empty-handed.

At an age when you should be enjoying life comfortably, you have to live frugally.

Living in poverty when you're old is much more depressing than living frugally when you're young.

By the time you realize later that you should have invested when you were younger, all the precious time for stock prices to rise has already passed.

If you had started investing early, your investment would have grown steadily over time.

--- p.125

Looking at the world from the perspective of a professional investor who considers everything an investment, you'll carefully examine the companies you're interested in and the companies you do business with.

If you work in a hospital, you will come into contact with companies that make surgical gowns, X-ray equipment, beds, etc.

You will also come across companies or insurance companies that can help you save money.

Large supermarkets are showrooms for companies.

You can find dozens of companies on the product display shelves.

--- p.178

If you're thinking about investing in stocks, understanding the company is important.

One area where investors struggle is analyzing and understanding companies.

Since the only indicator that investors know in detail is the stock price, they buy stocks without understanding the company and follow the stock price fluctuations.

If the stock price rises, the company's financial condition is good, but if the stock price moves sideways or falls, people's trust in the company is shaken and they sell their stocks.

--- p.208

Publisher's Review

Steady seller for 10 consecutive years,

The complete edition of Peter Lynch's masterpiece, "Peter Lynch's Investment Story," has been published!

Since its publication, Peter Lynch's "Learn to Earn" has been considered a must-read for stock investors.

This book, which is still loved by countless readers and has become a steady seller, has supplemented some of the content of the previous edition and improved the editing format to make it easier to read.

This book is a comprehensive introductory book that explains things in an easy-to-understand manner, tailored to the level of beginner investors. If you are interested in investing, this is the book by Peter Lynch that you should read first and underline the most.

This book covers the basic knowledge you must know before investing, from what stocks are and how they came into existence and evolved, to what investing is and why you should do it, and how to succeed in investing.

While existing books have focused solely on investment guidelines or investment methods, this book is, as the author says, "for people of all ages who are confused about stock investment and have not had the opportunity to learn the basics of investing." It is a must-read for investors worldwide.

“There are no natural investors in the world.”

Peter Lynch's teachings about learning and learning about investing

“The more I read Peter Lynch, the more new he becomes.”

“Peter Lynch's investment method appears to offer a solution even when applied to the current Korean situation.”

“You don’t have to force yourself to turn the next page.

“It’s so fun and easy.”

“I’ve read hundreds of investment books, but the best introductory book I’ve ever read was by Peter Lynch.”

The admiration for Peter Lynch from professional and individual investors explains why he is still revered as a legend.

Additionally, whenever there is a bull market or bear market in the domestic stock market, Peter Lynch's maxims are mentioned in various investment communities, providing guidance to investors.

This is proof that Peter Lynch's wisdom resonates with everyone, regardless of the era.

Chapter 1 of this book, consisting of five chapters, explains the birth and history of American capitalism and the background to the emergence of stocks.

Chapter 2 comprehensively examines the fundamentals of investing, from saving, the starting point of investing, to the role of stock exchanges and brokers in buying and selling stocks, to the pros and cons of five basic investment methods.

In addition, Chapter 3 analyzes the life cycle of a company from its inception to its decline, using examples such as Microsoft and Apple, and Chapter 4 analyzes in detail the "invisible hand" that moves a company, using real-life examples of famous companies such as Coca-Cola and Levi's.

The final five chapters cover how to analyze financial statements like Peter Lynch, who never had a single year of negative returns.

By reading this book, which covers everything about investing, you will gain insight and insight that goes beyond simply telling you which stocks to buy and how to achieve high returns.

Even simply recommending stocks or figuring out when to buy or sell can only be done with a foundation of basic knowledge about stock investment.

Peter Lynch says in his book that "learning about investing is an experience that enriches life," and that you should learn about investing step by step from the basics.

He also emphasizes education about investment, saying, “There is no such thing as a ‘natural investor’ in the world.”

Smart investment advice from Peter Lynch: Let time make money!

Peter Lynch, the most successful fund manager in Wall Street history.

He is a Wall Street hero who achieved a whopping 2,700% return over 13 years from 1977 to 1990.

The smart investment advice Lynch offers investors is simple.

“Choose a good company, invest in it, and hold it for the long term.”

Even Peter Lynch, who has outperformed the S&P index for eight consecutive years, confesses in his book that it is impossible to predict stock prices.

Rather than simply trying to predict stock prices, he preaches that the best investment method is to select good companies that are unlikely to fail, buy their stocks, and hold them for the long term.

Warren Buffett, the world's richest man, invests in a similar way.

He was able to accumulate his wealth today by investing in blue-chip companies with monopolies like Coca-Cola and Gillette and holding their stocks for decades.

While his exceptional insight into identifying undervalued companies was undoubtedly the most important factor, other key success factors were time and making wise investment choices from the outset.

To this end, Peter Lynch advises:

Investing should begin a day earlier than others, and once you've chosen a good company to invest in, you need to take a step back and let your time and money do the work.

Should I invest in stocks now? Or should I not? And if I do, how should I proceed? This book is for those who have these questions.

His writing is full of confidence and belief in stock investment.

In that respect, the translator of this book also recommends it as “a classic that I would recommend to anyone who wants to start investing in stocks from a long-term perspective, rather than speculation.”

If I had to pick just one book among the many investment books out there that I would read over and over again, it would be this one.

GOODS SPECIFICS

- Date of issue: December 1, 2021

- Page count, weight, size: 344 pages | 524g | 152*225*23mm

- ISBN13: 9788965964797

- ISBN10: 8965964792

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)