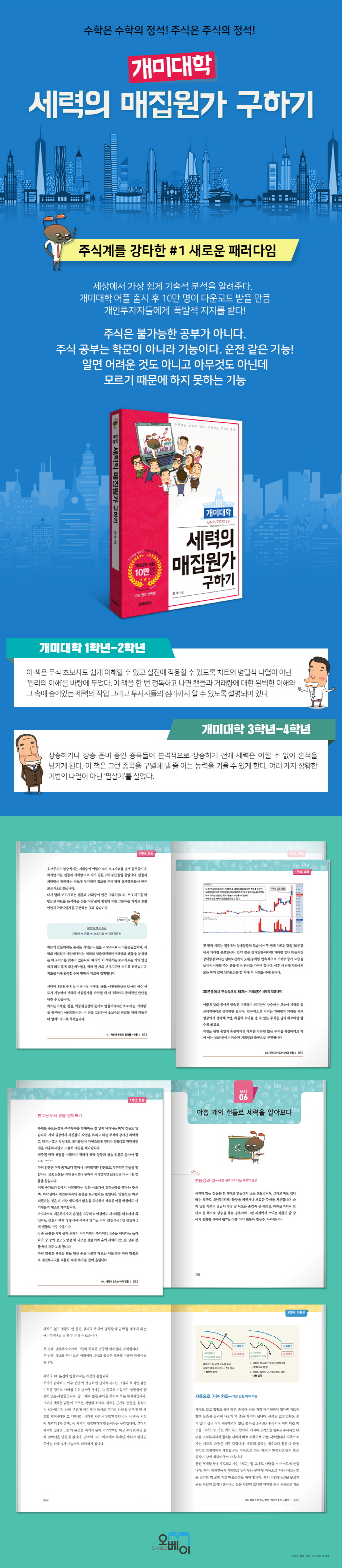

Finding the acquisition cost of the Ant University faction

|

Description

Book Introduction

Stock study that even beginners can easily understand!

When you first start studying technical analysis, the part that you give up on because it is too difficult is 'candles and trading volume'.

The reason is the fatigue caused by the listing of parallel pictures and the forced memorization.

To apply it in practice, understanding the principles, not memorization, is necessary.

This book devotes a lot of space to 'understanding the principles'.

After reading it once, you will have a complete understanding of candlesticks and trading volume, the workings of the forces hidden within them, and even the psychology of investors.

One of the most important factors for success in stock investing is having the eye to identify stocks that can generate profits.

Before stocks that are currently rising or preparing to rise can fully rise, the forces inevitably leave their mark.

This book will help you develop the ability to distinguish between such items.

In the third and fourth grades, we explained in detail about waves and the traces left by forces so that students could develop an eye for rising stocks.

In other words, it is easy to detect buy signals that appear during an upward wave.

Rather than a long list of techniques, it only contains ‘secret techniques.’

When you first start studying technical analysis, the part that you give up on because it is too difficult is 'candles and trading volume'.

The reason is the fatigue caused by the listing of parallel pictures and the forced memorization.

To apply it in practice, understanding the principles, not memorization, is necessary.

This book devotes a lot of space to 'understanding the principles'.

After reading it once, you will have a complete understanding of candlesticks and trading volume, the workings of the forces hidden within them, and even the psychology of investors.

One of the most important factors for success in stock investing is having the eye to identify stocks that can generate profits.

Before stocks that are currently rising or preparing to rise can fully rise, the forces inevitably leave their mark.

This book will help you develop the ability to distinguish between such items.

In the third and fourth grades, we explained in detail about waves and the traces left by forces so that students could develop an eye for rising stocks.

In other words, it is easy to detect buy signals that appear during an upward wave.

Rather than a long list of techniques, it only contains ‘secret techniques.’

- You can preview some of the book's contents.

Preview

index

[1st grade candle]

1. Candle: The result of desire and fear

- Calculating the acquisition cost of a force - An unprecedented technical analysis method

- Think from the perspective of the powers that be

- The three elements of technical analysis

- Two Psychological 60 Candlesticks - Do I Need to Memorize Them All?

- A result of the desire for beekeeping profits

- Inflection point: where a new trend begins

- The result of fear of loss of the negative candlestick

2. Nine candles created by the force

- The first work of the group, Jangdaeyangbong

(Focus on the volume that bursts continuously during the session)

- The second work of the force, Jangdaeumbong

(Withdrawal record of the power)

- The third and fourth works of the force are long upper tail candles (yin candles).

(Traces of the escape of power using volatility)

- The fifth and sixth works of the force are long lower tail candles (yin candles).

(Traces of gathering power through fear)

- The seventh and eighth works of the force - single candles and large crosshair candles (inflection point candles)

(starting point of trend change)

- The ninth work of the force, Maejibong

(A friendly signal of a price explosion)

- The real chart is the weekly chart.

3. Price gap created by power

- Size of the gap rise positive factor

- Conditions for the end of a sideways movement and the beginning of an upward movement: a gap-up candlestick

- A device that prevents individual chase buying in the gap-up trend that appears at the beginning of an upward trend.

- A gap-up from near the high point - The appearance of forces leaving when the mood is good.

- Size of the gap decline negative news

- Gap down is more emotional than gap up.

4. Bottom candle made by force

- Pinwheel candle

- The bottom candle of the buying force's face

- Bottom candle clearly visible in the main candle

- Understanding the Varied Bottom Candle

- Floor candle countermeasure manual created by the force (ultimate move)

5. The power-driven candlestick

- The power is feeding individual investors with two gaps.

- Variation of the topknot candle

- A Response Manual for Inflection Point Candles During an Uptrend - Tips for Professional Investors

6. Finding out the strength of nine candles

- Nine candles created by the force

- The face of the forces revealed above the surface of volatility and gaps

- You need to be able to explain things to invest in stocks.

- Practical problems of top candles/bottom candles created by forces

- Problem explanation section

[2nd year trading volume]

1. Analysis of deposit and withdrawal history of trading volume analysis forces

*Trading volume is the most important indicator, but it is often overlooked because it is difficult to understand.

*The size of interest projected onto the trading volume of the stock

*Trading volume - the primary indicator that most quickly and accurately reflects human psychology.

Love, sneezing, and trading volume have one thing in common: they can't be hidden.

*Trading volume patterns 2-1 and 2-2 you need to know to avoid being scammed

2. Section 1 where the acquisition cost of the force is hidden

*How the powerful make individual investors bored

*Sideways from the perspective of the power's investment funds

*A sideways movement cannot be made by an individual.

3. Section where the acquisition cost of the force is hidden -2

*Why power moves stock prices sideways

*The forces are never kind

*The very place where the power's acquisition cost is hidden

*Narrow box zone section's secret gathering area

*Summary and basic response manual for the sidewalk section

*In-depth manual for responding to the power's acquisition section

4. The true face of the power of Maejibong

*It is ultimately the power that makes the charts.

*The powerful hate attention

*Definition of a buying bar

*Judgment on the purchase price is after 3 o'clock!

*How to determine a buying candlestick during the market: Using a 30-minute candlestick

*Why the powers that be create a buying power

5. The power base is created here.

*The section where the power base is formed

*Results of the first defense of the force

*What exactly is the "support" often mentioned in technical analysis?

*The opposite of buying is selling

6. Check the power of the force and buy it.

*The first acquisition cost of the force and the acquisition price

*Where to go and the cut-off line

*Triple bottom and buying bar

*If you damage the main power base, watch for 5 days.

*Frequent occurrence of buying candles is a stronger signal.

7. The purchase bar and the pressing bar

*Note the increase in trading volume after the upward inflection point.

*20-day moving average double bottom + increasing volume at the rising inflection point = clear face of power

*The flower of trading: pressing the neck and buying and selling candles

*Three conditions for a sharp rise

8. Power withdrawal receipt - common transaction volume

*The most important but unknown transaction volume

*Typical trading volume formula

*Withdrawal record of the trading power

*A-grade high volume is always followed by a significant decline.

*If you can't make a decision from the daily chart, look at the weekly chart.

[3rd grade moving average]

1.

Rewriting moving averages

*Information comes from thinking about what people do.

*The most accurate indicator of moving average trends

2. How to find out the rate of return of a force

*20-day moving average deviation rate and profit and loss rate

*20-day moving average deviation rate and profit and loss rate

*Distance 100 and buying bar

3. Moving average line that provides one more time opportunity

*Information on investor sentiment provided by the gap chart

*Moving average support and pressure points

*There are multiple buying opportunities in a regular arrangement.

4. Recommend a reverse arrangement chart to your enemy.

*Size of the reverse arrangement malicious selling waiting volume

*A gathering of people waiting for the moving average to fall

*Reverse arrangement items to the enemy - I have a regular arrangement item

5. Charts with power! Charts without power!

*Rewritten moving average

*20-day moving average power line

*60-day moving average line: A line that indicates the business conditions, performance, or presence of materials.

*120-day moving average semi-annual performance line

*240-day moving average long-term trend line that signals the end or beginning of price

*The meaning of the golden cross and the dead cross analyzed from the perspective of the powers

*A common mistake beginner investors make is focusing on price.

6. Chart to Hell, Chart to Heaven

*The strongest downward wave on the chart going to hell

*Chart to Heaven - Typical Upward Wave

*There are opportunities even on charts heading to hell: 240 candlestick trading method

*240 - Manual for responding to the purchase order

*240 Practical examples of buying and selling methods

[4th grade advanced]

1.

There is a cost of acquisition of power within the power line.

*The answer lies in the power line

*Double bottom_ Double bottom__ Double bottom created by the powers that be___

*Profit conditions = Double bottom created by force + 100 degree of separation + buying candle

2.

Measure the size of the force with two lines

*Price adjustment and period adjustment

*Two letters A and B that measure the size of the force 20-day AB wave

*Three conditions for a sharp rise and the 20-day AB wave

3.

If you want to profit, keep your eyes open for strong waves.

*Collaboration of AB waves of the 60-day and 20-day moving averages

*The final condition for a strong wave - Zone V

*A truly strong person doesn't even allow a downward turning point.

*Chart to Heaven = Ideal form of the strongest wave

*There are opportunities in stocks that have both influence and good performance.

4.

Grade the work of the forces

*Chart to the preliminary hell

*Quantify the information provided by the chart into numbers

*Practice of giving report cards to charts created by the forces

5.

Buy in installments near the acquisition cost of the force.

*TRIX setup method

*Properties of TRIX

*Trix response manual

*Rising/Bearing Divergence

6.

Special move

*First strategy for finishing moves

*Second strategy for finishing moves

*The lowest trading volume before the upward inflection point is the floor trading volume standard.

*Another floor trading volume standard = 20-day average trading volume

*The bottom comes out on the chart going to hell

*The bottom volume and buying candles are still valid even in the 2060 arrangement.

1. Candle: The result of desire and fear

- Calculating the acquisition cost of a force - An unprecedented technical analysis method

- Think from the perspective of the powers that be

- The three elements of technical analysis

- Two Psychological 60 Candlesticks - Do I Need to Memorize Them All?

- A result of the desire for beekeeping profits

- Inflection point: where a new trend begins

- The result of fear of loss of the negative candlestick

2. Nine candles created by the force

- The first work of the group, Jangdaeyangbong

(Focus on the volume that bursts continuously during the session)

- The second work of the force, Jangdaeumbong

(Withdrawal record of the power)

- The third and fourth works of the force are long upper tail candles (yin candles).

(Traces of the escape of power using volatility)

- The fifth and sixth works of the force are long lower tail candles (yin candles).

(Traces of gathering power through fear)

- The seventh and eighth works of the force - single candles and large crosshair candles (inflection point candles)

(starting point of trend change)

- The ninth work of the force, Maejibong

(A friendly signal of a price explosion)

- The real chart is the weekly chart.

3. Price gap created by power

- Size of the gap rise positive factor

- Conditions for the end of a sideways movement and the beginning of an upward movement: a gap-up candlestick

- A device that prevents individual chase buying in the gap-up trend that appears at the beginning of an upward trend.

- A gap-up from near the high point - The appearance of forces leaving when the mood is good.

- Size of the gap decline negative news

- Gap down is more emotional than gap up.

4. Bottom candle made by force

- Pinwheel candle

- The bottom candle of the buying force's face

- Bottom candle clearly visible in the main candle

- Understanding the Varied Bottom Candle

- Floor candle countermeasure manual created by the force (ultimate move)

5. The power-driven candlestick

- The power is feeding individual investors with two gaps.

- Variation of the topknot candle

- A Response Manual for Inflection Point Candles During an Uptrend - Tips for Professional Investors

6. Finding out the strength of nine candles

- Nine candles created by the force

- The face of the forces revealed above the surface of volatility and gaps

- You need to be able to explain things to invest in stocks.

- Practical problems of top candles/bottom candles created by forces

- Problem explanation section

[2nd year trading volume]

1. Analysis of deposit and withdrawal history of trading volume analysis forces

*Trading volume is the most important indicator, but it is often overlooked because it is difficult to understand.

*The size of interest projected onto the trading volume of the stock

*Trading volume - the primary indicator that most quickly and accurately reflects human psychology.

Love, sneezing, and trading volume have one thing in common: they can't be hidden.

*Trading volume patterns 2-1 and 2-2 you need to know to avoid being scammed

2. Section 1 where the acquisition cost of the force is hidden

*How the powerful make individual investors bored

*Sideways from the perspective of the power's investment funds

*A sideways movement cannot be made by an individual.

3. Section where the acquisition cost of the force is hidden -2

*Why power moves stock prices sideways

*The forces are never kind

*The very place where the power's acquisition cost is hidden

*Narrow box zone section's secret gathering area

*Summary and basic response manual for the sidewalk section

*In-depth manual for responding to the power's acquisition section

4. The true face of the power of Maejibong

*It is ultimately the power that makes the charts.

*The powerful hate attention

*Definition of a buying bar

*Judgment on the purchase price is after 3 o'clock!

*How to determine a buying candlestick during the market: Using a 30-minute candlestick

*Why the powers that be create a buying power

5. The power base is created here.

*The section where the power base is formed

*Results of the first defense of the force

*What exactly is the "support" often mentioned in technical analysis?

*The opposite of buying is selling

6. Check the power of the force and buy it.

*The first acquisition cost of the force and the acquisition price

*Where to go and the cut-off line

*Triple bottom and buying bar

*If you damage the main power base, watch for 5 days.

*Frequent occurrence of buying candles is a stronger signal.

7. The purchase bar and the pressing bar

*Note the increase in trading volume after the upward inflection point.

*20-day moving average double bottom + increasing volume at the rising inflection point = clear face of power

*The flower of trading: pressing the neck and buying and selling candles

*Three conditions for a sharp rise

8. Power withdrawal receipt - common transaction volume

*The most important but unknown transaction volume

*Typical trading volume formula

*Withdrawal record of the trading power

*A-grade high volume is always followed by a significant decline.

*If you can't make a decision from the daily chart, look at the weekly chart.

[3rd grade moving average]

1.

Rewriting moving averages

*Information comes from thinking about what people do.

*The most accurate indicator of moving average trends

2. How to find out the rate of return of a force

*20-day moving average deviation rate and profit and loss rate

*20-day moving average deviation rate and profit and loss rate

*Distance 100 and buying bar

3. Moving average line that provides one more time opportunity

*Information on investor sentiment provided by the gap chart

*Moving average support and pressure points

*There are multiple buying opportunities in a regular arrangement.

4. Recommend a reverse arrangement chart to your enemy.

*Size of the reverse arrangement malicious selling waiting volume

*A gathering of people waiting for the moving average to fall

*Reverse arrangement items to the enemy - I have a regular arrangement item

5. Charts with power! Charts without power!

*Rewritten moving average

*20-day moving average power line

*60-day moving average line: A line that indicates the business conditions, performance, or presence of materials.

*120-day moving average semi-annual performance line

*240-day moving average long-term trend line that signals the end or beginning of price

*The meaning of the golden cross and the dead cross analyzed from the perspective of the powers

*A common mistake beginner investors make is focusing on price.

6. Chart to Hell, Chart to Heaven

*The strongest downward wave on the chart going to hell

*Chart to Heaven - Typical Upward Wave

*There are opportunities even on charts heading to hell: 240 candlestick trading method

*240 - Manual for responding to the purchase order

*240 Practical examples of buying and selling methods

[4th grade advanced]

1.

There is a cost of acquisition of power within the power line.

*The answer lies in the power line

*Double bottom_ Double bottom__ Double bottom created by the powers that be___

*Profit conditions = Double bottom created by force + 100 degree of separation + buying candle

2.

Measure the size of the force with two lines

*Price adjustment and period adjustment

*Two letters A and B that measure the size of the force 20-day AB wave

*Three conditions for a sharp rise and the 20-day AB wave

3.

If you want to profit, keep your eyes open for strong waves.

*Collaboration of AB waves of the 60-day and 20-day moving averages

*The final condition for a strong wave - Zone V

*A truly strong person doesn't even allow a downward turning point.

*Chart to Heaven = Ideal form of the strongest wave

*There are opportunities in stocks that have both influence and good performance.

4.

Grade the work of the forces

*Chart to the preliminary hell

*Quantify the information provided by the chart into numbers

*Practice of giving report cards to charts created by the forces

5.

Buy in installments near the acquisition cost of the force.

*TRIX setup method

*Properties of TRIX

*Trix response manual

*Rising/Bearing Divergence

6.

Special move

*First strategy for finishing moves

*Second strategy for finishing moves

*The lowest trading volume before the upward inflection point is the floor trading volume standard.

*Another floor trading volume standard = 20-day average trading volume

*The bottom comes out on the chart going to hell

*The bottom volume and buying candles are still valid even in the 2060 arrangement.

Detailed image

Into the book

Since trading volume is difficult for beginner investors, study auxiliary indicators first.

But this is just a secondary byproduct created by candles and volume.

It is simply an auxiliary indicator created by economists to provide additional information to the information provided by candles and volume.

In other words, auxiliary indicators are shadows created by candles and volume.

Analyzing charts based on indicators is like a hunter trying to tell whether a shadow in the sunlight is a tiger or a cat.

[p.33]

-The trading volume that explodes continuously in the 30-minute chart is the deposit history of the power.

If you think of this upward trend with continuous volume bursting out on the 30-minute chart, it can be considered as a record of deposits by the powerful.

From a power perspective, the more stocks you can secure that can generate profits, the better.

If there are enough bullets for the operation, the forces will try to accumulate as many shares as possible, which is reflected in the appearance of continuous volume on the 30-minute chart.

[p51]

The results of investors who jump into this and that without knowing the A-class trading volume are disastrous.

Even now, somewhere, someone is probably getting drunk on the volatility generated by the peak and engaging in routine trading.

Personally, I think it's a very unfortunate thing.

When I later found out that my hard-earned wealth was being taken away by the powerful, the sense of emptiness was so great that I ended up leaving the stock market in despair.

Those of you who know this formula, please be sure to avoid over-the-top trading.

[p.89]

A candle made by force is, in a word, a volatile candle.

And sometimes, they use a tool called gap to take away individual investors' holdings or sell off their stocks.

The moment when the face of the hidden force is most clearly revealed is when there is a large decline or, conversely, a large rise, and the candles used in that process are the nine candles and gap rise and fall created by the force explained in the previous chapter.

[p.106]

-Chart to Hell

If there is no new low-buying force for a stock with no power and poor business performance, the future shape of the chart will be the perfect place for a sharp decline.

A stock with no power, poor business performance, and no new low-price buying power is called a "three-nothing" stock, and such a chart is called a "chart to hell."

The chart that leads to hell is where most beginner investors who focus on price end up.

The waves on the chart going to hell are very strong.

Because the psychology of selling is much more impulsive and emotional than buying.

When the chart leading to hell is completed, a strong short-term or medium- to long-term bearish wave appears.

But this is just a secondary byproduct created by candles and volume.

It is simply an auxiliary indicator created by economists to provide additional information to the information provided by candles and volume.

In other words, auxiliary indicators are shadows created by candles and volume.

Analyzing charts based on indicators is like a hunter trying to tell whether a shadow in the sunlight is a tiger or a cat.

[p.33]

-The trading volume that explodes continuously in the 30-minute chart is the deposit history of the power.

If you think of this upward trend with continuous volume bursting out on the 30-minute chart, it can be considered as a record of deposits by the powerful.

From a power perspective, the more stocks you can secure that can generate profits, the better.

If there are enough bullets for the operation, the forces will try to accumulate as many shares as possible, which is reflected in the appearance of continuous volume on the 30-minute chart.

[p51]

The results of investors who jump into this and that without knowing the A-class trading volume are disastrous.

Even now, somewhere, someone is probably getting drunk on the volatility generated by the peak and engaging in routine trading.

Personally, I think it's a very unfortunate thing.

When I later found out that my hard-earned wealth was being taken away by the powerful, the sense of emptiness was so great that I ended up leaving the stock market in despair.

Those of you who know this formula, please be sure to avoid over-the-top trading.

[p.89]

A candle made by force is, in a word, a volatile candle.

And sometimes, they use a tool called gap to take away individual investors' holdings or sell off their stocks.

The moment when the face of the hidden force is most clearly revealed is when there is a large decline or, conversely, a large rise, and the candles used in that process are the nine candles and gap rise and fall created by the force explained in the previous chapter.

[p.106]

-Chart to Hell

If there is no new low-buying force for a stock with no power and poor business performance, the future shape of the chart will be the perfect place for a sharp decline.

A stock with no power, poor business performance, and no new low-price buying power is called a "three-nothing" stock, and such a chart is called a "chart to hell."

The chart that leads to hell is where most beginner investors who focus on price end up.

The waves on the chart going to hell are very strong.

Because the psychology of selling is much more impulsive and emotional than buying.

When the chart leading to hell is completed, a strong short-term or medium- to long-term bearish wave appears.

---From the text

Publisher's Review

Even now, there are too many individuals in the stock market who fail due to lack of skill.

I think the readership of this book will be diverse.

I hope that the weight of responsibility on the shoulders of a father will be lightened through this book—that the profits in the stock account will grow like a steady salary every month (not a jackpot), that someone who has lost their principal and is struggling with a sense of inferiority will gradually recover their principal, that a young adult who is just becoming interested in stocks will not struggle in a harsh place, but will acquire the right knowledge from the beginning and jump into the stock market, that this book will be easily accessible to people who say they know nothing about stocks and only have a headache, that this book will bring vitality to the boring daily lives of housewives who are only called mom or aunt instead of their own names, and that housewives who cannot even invest in themselves because they do not have the money to buy a cup of coffee will have a little more freedom.

There are certainly people who have made a fortune in stocks.

But realistically, it is more important to trade without losing money, and to repeat the trade with a small profit.

It is true and the reality that it is difficult to live on just a salary in a distorted economic structure where apartment prices in Gangnam reach tens of billions of won.

That being said, I hope you don't dream of hitting the jackpot in the stock market.

If you read this book with the mindset of a very realistic trading style, gradually increasing your profits even if it takes longer than you think, then it will be sufficient and rewarding.

I think the readership of this book will be diverse.

I hope that the weight of responsibility on the shoulders of a father will be lightened through this book—that the profits in the stock account will grow like a steady salary every month (not a jackpot), that someone who has lost their principal and is struggling with a sense of inferiority will gradually recover their principal, that a young adult who is just becoming interested in stocks will not struggle in a harsh place, but will acquire the right knowledge from the beginning and jump into the stock market, that this book will be easily accessible to people who say they know nothing about stocks and only have a headache, that this book will bring vitality to the boring daily lives of housewives who are only called mom or aunt instead of their own names, and that housewives who cannot even invest in themselves because they do not have the money to buy a cup of coffee will have a little more freedom.

There are certainly people who have made a fortune in stocks.

But realistically, it is more important to trade without losing money, and to repeat the trade with a small profit.

It is true and the reality that it is difficult to live on just a salary in a distorted economic structure where apartment prices in Gangnam reach tens of billions of won.

That being said, I hope you don't dream of hitting the jackpot in the stock market.

If you read this book with the mindset of a very realistic trading style, gradually increasing your profits even if it takes longer than you think, then it will be sufficient and rewarding.

GOODS SPECIFICS

- Date of issue: August 11, 2017

- Page count, weight, size: 396 pages | 742g | 172*241*30mm

- ISBN13: 9791196119584

- ISBN10: 1196119589

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)