How to save 100 million won that only I didn't know

|

Description

Book Introduction

“If I had known this, I could have gone to the world after 100 million much sooner!”

─ Seo Dae-ri, author of "For Those Who Find Savings Frustrating but Are Afraid of Investing"

NO to tech! NO to side hustles! NO to studying the stocks!

★Amazon's 15-Year Long-Term Bestseller★

★Netflix Original "How to Get Rich"★

★《Linchpin》 by Seth Godin highly recommended!★

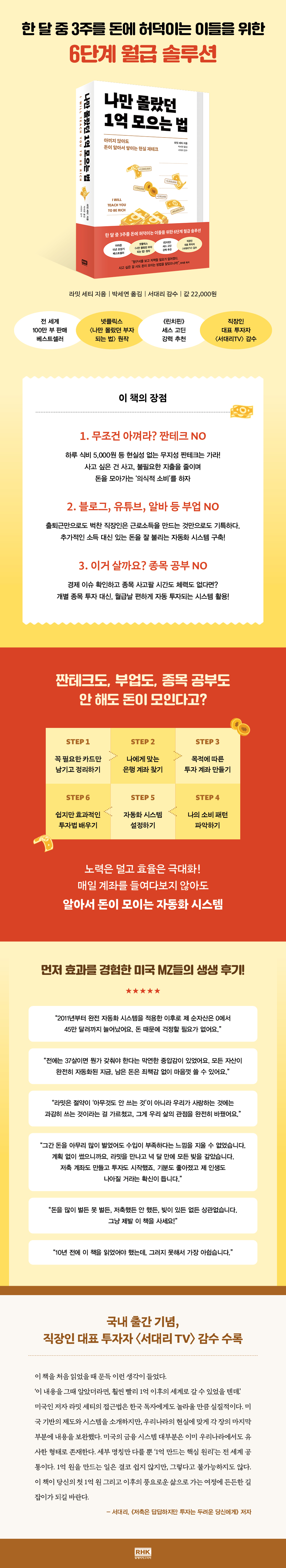

A 6-Step Paycheck Solution for Those Who Struggle with Money Three Weeks a Month

“Do I have to give up even the 2,000 won coffee I buy on my way to work to save money to become rich?”

"How to Save 100 Million Won That Only I Didn't Know", which criticized financial technology books that are based on frugal investing and sold 1 million copies worldwide with the full sympathy of American MZ generation, is now being published in Korea.

This book, which states that "more important than extreme frugality is building a money management system that rolls automatically" and that "you can become rich while buying what you want as much as you want," became a New York Times bestseller immediately after its publication in the United States, and has been an Amazon bestseller for 15 consecutive years since its publication, and is called the "financial management bible for those just starting out in society" in the United States.

Instead of investing in traditional financial books, such as Zantech, individual stock analysis, and building pipelines through side hustles, we share a financial management method that maximizes compound interest in minimal time by building an automated investment system.

Even readers who initially think of savings when it comes to financial planning can, after going through the six-step solution outlined in this book, establish an automated system that analyzes their spending patterns and even prepares for retirement.

In addition, this domestically published version has been reviewed by Seo Dae-ri, a representative office worker investor.

Seo Dae-ri, renowned for his monthly savings ETFs and pension savings-based investments, introduces customized investment strategies that domestic readers can immediately implement in each chapter.

─ Seo Dae-ri, author of "For Those Who Find Savings Frustrating but Are Afraid of Investing"

NO to tech! NO to side hustles! NO to studying the stocks!

★Amazon's 15-Year Long-Term Bestseller★

★Netflix Original "How to Get Rich"★

★《Linchpin》 by Seth Godin highly recommended!★

A 6-Step Paycheck Solution for Those Who Struggle with Money Three Weeks a Month

“Do I have to give up even the 2,000 won coffee I buy on my way to work to save money to become rich?”

"How to Save 100 Million Won That Only I Didn't Know", which criticized financial technology books that are based on frugal investing and sold 1 million copies worldwide with the full sympathy of American MZ generation, is now being published in Korea.

This book, which states that "more important than extreme frugality is building a money management system that rolls automatically" and that "you can become rich while buying what you want as much as you want," became a New York Times bestseller immediately after its publication in the United States, and has been an Amazon bestseller for 15 consecutive years since its publication, and is called the "financial management bible for those just starting out in society" in the United States.

Instead of investing in traditional financial books, such as Zantech, individual stock analysis, and building pipelines through side hustles, we share a financial management method that maximizes compound interest in minimal time by building an automated investment system.

Even readers who initially think of savings when it comes to financial planning can, after going through the six-step solution outlined in this book, establish an automated system that analyzes their spending patterns and even prepares for retirement.

In addition, this domestically published version has been reviewed by Seo Dae-ri, a representative office worker investor.

Seo Dae-ri, renowned for his monthly savings ETFs and pension savings-based investments, introduces customized investment strategies that domestic readers can immediately implement in each chapter.

- You can preview some of the book's contents.

Preview

index

Reviewer's note

prolog

Chapter 1: Optimizing Your Credit Cards: How to Win the Credit Card Game

Common credit card fear tactics│My perspective on credit cards│Approaching aggressively: How to use credit to build a prosperous life│How to build credit with credit cards│Getting a new card│6 commandments of credit cards│Mistakes to avoid│Debt, debt, debt│5 steps to get out of debt│6-week program: Week 1 plan│This is how it's done in Korea

Chapter 2: Beating the Banks: How to Open High-Interest Accounts and Negotiate Fees

Key Takeaways│Best Accounts│Optimizing Your Bank Account│6-Week Program: Week 2 Plan│This is How It's Done in Korea

Chapter 3: Preparing to Invest: Opening a 401k and Roth IRA

Why Your Friends Aren't Investing Yet | The Financial Ladder | Maximizing Your 401k | Eliminating Debt | The Beauty of a Roth IRA | Factors to Consider When Choosing a Broker | Are Robo-Advisors Worth It? | Putting Money in Your Investment Account | HSA: Your Secret Investment Weapon | Beyond Retirement Accounts | 6-Week Program: Week 3 Plan | This is How It's Done in Korea

Chapter 4: Become a Conscious Spender: How to Spend Freely and Save Hundreds of Dollars Each Month

The Difference Between a Frugal Person and a Conscious Spender│Let's Spend Money on Things You Love│How My Friend Spends $21,000 a Year on Extracurricular Activities│Conscious Spending Plan│Optimizing Your Conscious Spending Plan│What If Your Income Is Not Enough?│How to Manage Your Conscious Spending Plan Consistently│The Core Values of a Conscious Spending Plan│6-Week Program: Week 4 Plan

Chapter 5: Money Grows While You Sleep: How to Make Your Accounts Work for You

Asset Management in 90 Minutes a Month│Building Money Automation│Money Now Flows Automatically│6-Week Program: Week 5 Plan

Chapter 6: Should You Trust Financial Experts?: How to Beat the Stock Experts

Even experts don't know where the market will go│How experts hide poor performance│You don't need a financial advisor│When two asset managers tempt me│Active management VS.

Passive Operation│This is how we do it in Korea

Chapter 7: Investing Isn't Just for the Rich: The Simplest Portfolio to Get Rich

A Better Way to Invest: Automated Investing│The Magic of Financial Independence│Convenience or Choice: It's Your Decision│The Components of Investing│Asset Allocation: A Crucial Factor Many Investors Overlook│The Importance of Diversification│Target Date Funds: Investing Made Easy│Choosing and Getting Started│Common Investment Options: 401k│Investing with a Roth IRA│If You Want to Do It Yourself│How About Investing in Other Asset Classes?│6-Week Program: Week 6 Plan│This is How It's Done in Korea

Chapter 8: Maintaining and Growing Your System: How to Manage and Optimize Your Financial System

What's the real reason you want more? │ Fuel the system │ Rebalancing your investments │ Stop worrying about taxes │ Knowing when to sell

Chapter 9: Finding a Rich Life: Financial Planning for Relationships, Marriage, Cars, and First Homes

Student Loans: Which Comes First: Paying Off or Investing? │Love and Money│Ignore Useless Advice│If Your Parents Are Struggling with Debt│Should I Tell My Parents or Friends About My Finances?│Talking About Money with Someone Important to You│When the Income Gap Between You and Your Spouse│When Your Spouse Spends Recklessly│Why Are We Hypocritical at Weddings?│Do We Really Need a Prenuptial Agreement?│Work and Money│The Basics of Negotiation Are Very Simple│How to Save Thousands of Dollars on Big Purchases│A New Perspective on Car Buying│The Biggest Purchase: Buying a Home│Preparing for Big Expenses│Giving Back to Society: Beyond Everyday Goals│A Prosperous Life for You and Us All│This is How It's Done in Korea

Acknowledgements

prolog

Chapter 1: Optimizing Your Credit Cards: How to Win the Credit Card Game

Common credit card fear tactics│My perspective on credit cards│Approaching aggressively: How to use credit to build a prosperous life│How to build credit with credit cards│Getting a new card│6 commandments of credit cards│Mistakes to avoid│Debt, debt, debt│5 steps to get out of debt│6-week program: Week 1 plan│This is how it's done in Korea

Chapter 2: Beating the Banks: How to Open High-Interest Accounts and Negotiate Fees

Key Takeaways│Best Accounts│Optimizing Your Bank Account│6-Week Program: Week 2 Plan│This is How It's Done in Korea

Chapter 3: Preparing to Invest: Opening a 401k and Roth IRA

Why Your Friends Aren't Investing Yet | The Financial Ladder | Maximizing Your 401k | Eliminating Debt | The Beauty of a Roth IRA | Factors to Consider When Choosing a Broker | Are Robo-Advisors Worth It? | Putting Money in Your Investment Account | HSA: Your Secret Investment Weapon | Beyond Retirement Accounts | 6-Week Program: Week 3 Plan | This is How It's Done in Korea

Chapter 4: Become a Conscious Spender: How to Spend Freely and Save Hundreds of Dollars Each Month

The Difference Between a Frugal Person and a Conscious Spender│Let's Spend Money on Things You Love│How My Friend Spends $21,000 a Year on Extracurricular Activities│Conscious Spending Plan│Optimizing Your Conscious Spending Plan│What If Your Income Is Not Enough?│How to Manage Your Conscious Spending Plan Consistently│The Core Values of a Conscious Spending Plan│6-Week Program: Week 4 Plan

Chapter 5: Money Grows While You Sleep: How to Make Your Accounts Work for You

Asset Management in 90 Minutes a Month│Building Money Automation│Money Now Flows Automatically│6-Week Program: Week 5 Plan

Chapter 6: Should You Trust Financial Experts?: How to Beat the Stock Experts

Even experts don't know where the market will go│How experts hide poor performance│You don't need a financial advisor│When two asset managers tempt me│Active management VS.

Passive Operation│This is how we do it in Korea

Chapter 7: Investing Isn't Just for the Rich: The Simplest Portfolio to Get Rich

A Better Way to Invest: Automated Investing│The Magic of Financial Independence│Convenience or Choice: It's Your Decision│The Components of Investing│Asset Allocation: A Crucial Factor Many Investors Overlook│The Importance of Diversification│Target Date Funds: Investing Made Easy│Choosing and Getting Started│Common Investment Options: 401k│Investing with a Roth IRA│If You Want to Do It Yourself│How About Investing in Other Asset Classes?│6-Week Program: Week 6 Plan│This is How It's Done in Korea

Chapter 8: Maintaining and Growing Your System: How to Manage and Optimize Your Financial System

What's the real reason you want more? │ Fuel the system │ Rebalancing your investments │ Stop worrying about taxes │ Knowing when to sell

Chapter 9: Finding a Rich Life: Financial Planning for Relationships, Marriage, Cars, and First Homes

Student Loans: Which Comes First: Paying Off or Investing? │Love and Money│Ignore Useless Advice│If Your Parents Are Struggling with Debt│Should I Tell My Parents or Friends About My Finances?│Talking About Money with Someone Important to You│When the Income Gap Between You and Your Spouse│When Your Spouse Spends Recklessly│Why Are We Hypocritical at Weddings?│Do We Really Need a Prenuptial Agreement?│Work and Money│The Basics of Negotiation Are Very Simple│How to Save Thousands of Dollars on Big Purchases│A New Perspective on Car Buying│The Biggest Purchase: Buying a Home│Preparing for Big Expenses│Giving Back to Society: Beyond Everyday Goals│A Prosperous Life for You and Us All│This is How It's Done in Korea

Acknowledgements

Detailed image

Into the book

I believe in the importance of small actions.

First of all, we need to reduce the number of choices that bore us.

Instead of wasting time searching for the best fund in the world, you should start right now.

This book focuses on that first step.

And focus on recognizing the obstacles that are blocking your money management and working to remove them so that your money flows in the direction you want it to.

--- p.24, from "Prologue"

The time has come to sacrifice yourself to pay off your debt as quickly as possible.

If you don't do that, you will pay a greater price.

Let's not put it off.

There will never be that magical moment where you suddenly win a million dollars in the lottery or have the "free time" to take stock of your finances.

Didn't I say the same thing three years ago? If you want to live a better life than you do now, make money management your top priority.

--- p.95, from “Chapter 1: Optimizing Your Credit Card”

If you take only one lesson from this book, it is that you need to shift from a micro to a macro approach.

Let's focus on the big wins, the major victories that open up a rich life, rather than the small victories that worry about pocket change.

Since creating and automating my investment accounts, I've earned in one year what my savings account would have earned in 500 years.

--- p.125, from “Chapter 2: Beating the Bank”

Another reason people don't invest is the fear of losing money.

But it's ironic that people worry about "maybe" losing money in the stock market, even though they know they "definitely" will lose money if they don't invest.

--- p.159~160, from “Chapter 3: Let’s Prepare for Investment”

Reducing your spending doesn't necessarily mean you're a tightwad.

For example, if you save $2.50 by skipping a Coke when you eat out and save $15 to go see a movie, that's not being stingy.

It is a conscious spending on something you value.

Unfortunately, however, most Americans have never learned how to consume consciously.

Conscious consumption, as we speak of it here, means mercilessly cutting back on things you don't like and spending money generously on things you do like.

--- p.207, from “Chapter 4: Let’s Consciously Consume”

An automated investment system will be the most profitable system you will ever build.

I created an automated financial management system 15 years ago.

Since then, my system has been working behind the scenes every day, making more and more money.

Surprisingly, system administration takes very little time.

You too can create such a system.

Then your thinking about saving, investing, and spending will completely change.

--- p.263~264, from “Chapter 5 Money Grows Even While We Sleep”

In fact, the power to decide whether you will become rich is given to you, not to experts.

How wealthy you are depends entirely on your savings and investment plan.

It takes courage to admit these facts.

That's because you can't blame others if you don't become rich yourself.

You can't blame your financial advisor, your complex investment strategy, or even the market conditions.

But at the same time, this means that you have control over everything that happens to you, including your money, in the long run.

--- p.295~296, from “Chapter 6: Should We Trust Financial Experts?”

Automated investing isn't as glamorous as hedge funds or biotech stocks.

But it still performs better.

Let's think about it again.

Do you want to look flashy or do you want to be rich? --- p.335, from Chapter 7, "Investing Is Not Just for the Rich"

But no one wants to live a life trapped in spreadsheets.

Our lives are more valuable than adjusting asset allocation or investing with Monte Carlo simulations.

You won early in the game.

So now is the time to think about the 'reasons' for playing more games.

If the answer is 'to enjoy a luxurious vacation every year and travel first class,' then that's fine too.

And something like, 'I'm going to save hard for the next three years and move to the neighborhood I've been dreaming of' is fine.

From now on, I would like to show you specific ways to achieve such goals more quickly.

--- p.401, from “Chapter 8 Maintaining and Growing the System”

The challenge of living a rich life is not calculating compound interest, but designing the lifestyle you want.

Will you have children? Will you travel for two months every year? Will you send your parents plane tickets to visit you? Will you save more for retirement in your 40s? I'm writing this from a safari lodge in Kenya, enjoying my six-week honeymoon with Cass.

At the beginning of this dream trip, I stayed in Italy and invited my parents to travel with me and make memories.

It will be a rich life experience that you will never forget.

First of all, we need to reduce the number of choices that bore us.

Instead of wasting time searching for the best fund in the world, you should start right now.

This book focuses on that first step.

And focus on recognizing the obstacles that are blocking your money management and working to remove them so that your money flows in the direction you want it to.

--- p.24, from "Prologue"

The time has come to sacrifice yourself to pay off your debt as quickly as possible.

If you don't do that, you will pay a greater price.

Let's not put it off.

There will never be that magical moment where you suddenly win a million dollars in the lottery or have the "free time" to take stock of your finances.

Didn't I say the same thing three years ago? If you want to live a better life than you do now, make money management your top priority.

--- p.95, from “Chapter 1: Optimizing Your Credit Card”

If you take only one lesson from this book, it is that you need to shift from a micro to a macro approach.

Let's focus on the big wins, the major victories that open up a rich life, rather than the small victories that worry about pocket change.

Since creating and automating my investment accounts, I've earned in one year what my savings account would have earned in 500 years.

--- p.125, from “Chapter 2: Beating the Bank”

Another reason people don't invest is the fear of losing money.

But it's ironic that people worry about "maybe" losing money in the stock market, even though they know they "definitely" will lose money if they don't invest.

--- p.159~160, from “Chapter 3: Let’s Prepare for Investment”

Reducing your spending doesn't necessarily mean you're a tightwad.

For example, if you save $2.50 by skipping a Coke when you eat out and save $15 to go see a movie, that's not being stingy.

It is a conscious spending on something you value.

Unfortunately, however, most Americans have never learned how to consume consciously.

Conscious consumption, as we speak of it here, means mercilessly cutting back on things you don't like and spending money generously on things you do like.

--- p.207, from “Chapter 4: Let’s Consciously Consume”

An automated investment system will be the most profitable system you will ever build.

I created an automated financial management system 15 years ago.

Since then, my system has been working behind the scenes every day, making more and more money.

Surprisingly, system administration takes very little time.

You too can create such a system.

Then your thinking about saving, investing, and spending will completely change.

--- p.263~264, from “Chapter 5 Money Grows Even While We Sleep”

In fact, the power to decide whether you will become rich is given to you, not to experts.

How wealthy you are depends entirely on your savings and investment plan.

It takes courage to admit these facts.

That's because you can't blame others if you don't become rich yourself.

You can't blame your financial advisor, your complex investment strategy, or even the market conditions.

But at the same time, this means that you have control over everything that happens to you, including your money, in the long run.

--- p.295~296, from “Chapter 6: Should We Trust Financial Experts?”

Automated investing isn't as glamorous as hedge funds or biotech stocks.

But it still performs better.

Let's think about it again.

Do you want to look flashy or do you want to be rich? --- p.335, from Chapter 7, "Investing Is Not Just for the Rich"

But no one wants to live a life trapped in spreadsheets.

Our lives are more valuable than adjusting asset allocation or investing with Monte Carlo simulations.

You won early in the game.

So now is the time to think about the 'reasons' for playing more games.

If the answer is 'to enjoy a luxurious vacation every year and travel first class,' then that's fine too.

And something like, 'I'm going to save hard for the next three years and move to the neighborhood I've been dreaming of' is fine.

From now on, I would like to show you specific ways to achieve such goals more quickly.

--- p.401, from “Chapter 8 Maintaining and Growing the System”

The challenge of living a rich life is not calculating compound interest, but designing the lifestyle you want.

Will you have children? Will you travel for two months every year? Will you send your parents plane tickets to visit you? Will you save more for retirement in your 40s? I'm writing this from a safari lodge in Kenya, enjoying my six-week honeymoon with Cass.

At the beginning of this dream trip, I stayed in Italy and invited my parents to travel with me and make memories.

It will be a rich life experience that you will never forget.

--- p.430~431, from “Chapter 9: Finding a Rich Life”

Publisher's Review

A benchmark that changes your life,

How quickly you save up 100 million will determine your future.

According to the Ministry of Land, Infrastructure and Transport's actual transaction price data for September 2025, the average sale price of a 59㎡ apartment in Seoul exceeded 1 billion won.

The days when the phrase “If you save 100 million won, your life will change” was common are now a thing of the past.

However, 100 million is still a huge wall for salaried workers, and economic experts agree that it is an amount that creates momentum for investment.

This is because the lifestyle, mindset, confidence, and investment perspectives that change during the 'saving stage' of reaching 100 million won will affect your financial management after reaching 100 million won and even change your life.

This is why Seo Dae-ri, a famous investor who reviewed this book and is known for his investment method using pension savings, emphasizes 100 million won, saying, "100 million won is the benchmark that can change your life."

This book offers the most realistic plan for ordinary office workers to save 100 million won efficiently and quickly.

We offer a six-step solution to raising $100 million without wasting money, taking on extra labor like a side hustle, or engaging in high-risk investments.

Anyone can save 100 million someday.

However, 100 million is not the end point of wealth, but only the true starting point.

Let's find out the most effective and quick way to reach the starting point of wealth.

With a busy commute, leave your investments to the system.

An automated investment system without loss or FOMO.

It is said in numerous financial management books.

In order to quickly save 100 million won, you need to save money in various ways.

Even if you go to work, you should make time to do a side job, live a comfortable life with minimal spending, and study stocks morning and evening.

It is no exaggeration to say that life is truly about saving money.

Ramit Sethi, the author of this book, overturns this conventional wisdom.

They say that once a month is enough time to invest for a prosperous life.

He says not to live a life immersed in financial investment when there is not enough time to do what you want to do.

Rather than constantly glaring at the market, he advises building an automated system that invests automatically and maximizes the "compounding effect," which Einstein praised as humanity's greatest invention.

There is no need to be conscious of having to transfer management fees or set an alarm to transfer to an investment account.

If you just enjoy your life, the money will automatically move to your investment account and be invested.

This book aims to build a six-step, six-week, automated financial management system.

It consists of Step 1: Checking your current spending patterns and credit score, Step 2: Automating fixed and variable expenses, Step 3: Optimizing credit cards and accounts, Step 4: Setting up automatic savings and long-term investments, Step 5: Using money to match your life goals, and Step 6: Personalized financial strategies. It is divided into weekly steps so that anyone can follow along without burden.

By going through this process, anyone can understand their spending habits, set short- and medium-term financial goals, and build automated systems to achieve them.

Additionally, at the end of each chapter, readers are introduced to monthly savings ETF investment methods using pension accounts, and a customized strategy from Seo Dae-ri, a leading office worker investor, is added to present to readers.

Domestic readers can read this book and immediately apply it to their investment strategies.

What does your dream rich person look like?

Look beyond the small profits in front of you and see the 'big win' of the future!

This book doesn't require complex investment analysis, spreadsheet accounting down to the last penny, or extreme frugality to save 100 million won.

Instead, it allows readers to create automated systems that allow them to spend "consciously" on the values they value most, and let the rest of their money roll in automatically.

Ramit Sethi also offers a warning against extreme frugality.

It's impossible to resist your favorite latte forever.

Instead of using financial management methods that emphasize saving by instilling guilt, such as “Are you sure you can drink a latte every day?”, he argues that you can accumulate sufficient wealth by practicing “conscious spending,” which means spending freely on things you truly like and saving on things you can give up.

As if to prove the author's words, the book contains numerous experiences from readers who have tried it first and experienced the amazing effects.

The 'rich' mentioned in 'How to Save 100 Million Won That Only I Didn't Know' are not people who earn more, but people who proactively design their own lives and create the abundant life they desire.

By the time you finish the last chapter of this book, you will not only be able to draw a picture of the wealthy person you desire, but you will also have the key to making that picture a reality: the power to execute.

How quickly you save up 100 million will determine your future.

According to the Ministry of Land, Infrastructure and Transport's actual transaction price data for September 2025, the average sale price of a 59㎡ apartment in Seoul exceeded 1 billion won.

The days when the phrase “If you save 100 million won, your life will change” was common are now a thing of the past.

However, 100 million is still a huge wall for salaried workers, and economic experts agree that it is an amount that creates momentum for investment.

This is because the lifestyle, mindset, confidence, and investment perspectives that change during the 'saving stage' of reaching 100 million won will affect your financial management after reaching 100 million won and even change your life.

This is why Seo Dae-ri, a famous investor who reviewed this book and is known for his investment method using pension savings, emphasizes 100 million won, saying, "100 million won is the benchmark that can change your life."

This book offers the most realistic plan for ordinary office workers to save 100 million won efficiently and quickly.

We offer a six-step solution to raising $100 million without wasting money, taking on extra labor like a side hustle, or engaging in high-risk investments.

Anyone can save 100 million someday.

However, 100 million is not the end point of wealth, but only the true starting point.

Let's find out the most effective and quick way to reach the starting point of wealth.

With a busy commute, leave your investments to the system.

An automated investment system without loss or FOMO.

It is said in numerous financial management books.

In order to quickly save 100 million won, you need to save money in various ways.

Even if you go to work, you should make time to do a side job, live a comfortable life with minimal spending, and study stocks morning and evening.

It is no exaggeration to say that life is truly about saving money.

Ramit Sethi, the author of this book, overturns this conventional wisdom.

They say that once a month is enough time to invest for a prosperous life.

He says not to live a life immersed in financial investment when there is not enough time to do what you want to do.

Rather than constantly glaring at the market, he advises building an automated system that invests automatically and maximizes the "compounding effect," which Einstein praised as humanity's greatest invention.

There is no need to be conscious of having to transfer management fees or set an alarm to transfer to an investment account.

If you just enjoy your life, the money will automatically move to your investment account and be invested.

This book aims to build a six-step, six-week, automated financial management system.

It consists of Step 1: Checking your current spending patterns and credit score, Step 2: Automating fixed and variable expenses, Step 3: Optimizing credit cards and accounts, Step 4: Setting up automatic savings and long-term investments, Step 5: Using money to match your life goals, and Step 6: Personalized financial strategies. It is divided into weekly steps so that anyone can follow along without burden.

By going through this process, anyone can understand their spending habits, set short- and medium-term financial goals, and build automated systems to achieve them.

Additionally, at the end of each chapter, readers are introduced to monthly savings ETF investment methods using pension accounts, and a customized strategy from Seo Dae-ri, a leading office worker investor, is added to present to readers.

Domestic readers can read this book and immediately apply it to their investment strategies.

What does your dream rich person look like?

Look beyond the small profits in front of you and see the 'big win' of the future!

This book doesn't require complex investment analysis, spreadsheet accounting down to the last penny, or extreme frugality to save 100 million won.

Instead, it allows readers to create automated systems that allow them to spend "consciously" on the values they value most, and let the rest of their money roll in automatically.

Ramit Sethi also offers a warning against extreme frugality.

It's impossible to resist your favorite latte forever.

Instead of using financial management methods that emphasize saving by instilling guilt, such as “Are you sure you can drink a latte every day?”, he argues that you can accumulate sufficient wealth by practicing “conscious spending,” which means spending freely on things you truly like and saving on things you can give up.

As if to prove the author's words, the book contains numerous experiences from readers who have tried it first and experienced the amazing effects.

The 'rich' mentioned in 'How to Save 100 Million Won That Only I Didn't Know' are not people who earn more, but people who proactively design their own lives and create the abundant life they desire.

By the time you finish the last chapter of this book, you will not only be able to draw a picture of the wealthy person you desire, but you will also have the key to making that picture a reality: the power to execute.

GOODS SPECIFICS

- Date of issue: November 10, 2025

- Page count, weight, size: 504 pages | 150*220*35mm

- ISBN13: 9788925573038

- ISBN10: 8925573032

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)