The expert's investment method perfected with derivatives

|

Description

Book Introduction

★ Best Analyst in the Derivatives Field for 10 Consecutive Years

★ Sampro TV, 815 Money Talk Economic YouTube Derivatives Star Instructor

★ Strongly recommended by Yeom Seung-hwan, Lee Hyo-seok, Im Su-yeol, and Kim Su-jeong

If you want to survive in the complex financial market

We need an investment strategy that utilizes derivatives!

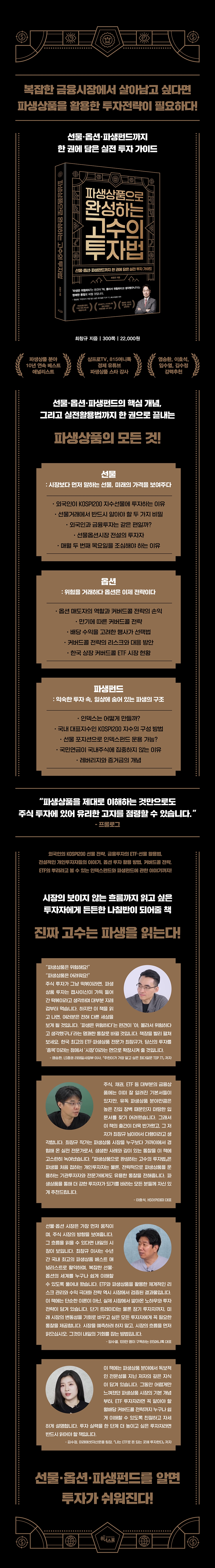

"The Master's Investment Method: Mastering Derivatives" is the first book by derivatives and ETF expert Director Chang-gyu Choi, and was written with the belief that "derivatives are dangerous not because they are dangerous, but because we don't know about them."

The author, who has been selected as the "Best Analyst" in the derivatives sector for 10 consecutive years, explains futures, options, and derivative funds, which have been unfamiliar and difficult for ordinary investors, in a friendly manner by connecting them with practical strategies.

This book covers everything from how to use foreign gifts to covered call option strategies and the derivative fund structure that forms the basis of ETFs.

It will serve as a reliable compass for all investors who wish to read the "invisible trends" in complex financial markets.

★ Sampro TV, 815 Money Talk Economic YouTube Derivatives Star Instructor

★ Strongly recommended by Yeom Seung-hwan, Lee Hyo-seok, Im Su-yeol, and Kim Su-jeong

If you want to survive in the complex financial market

We need an investment strategy that utilizes derivatives!

"The Master's Investment Method: Mastering Derivatives" is the first book by derivatives and ETF expert Director Chang-gyu Choi, and was written with the belief that "derivatives are dangerous not because they are dangerous, but because we don't know about them."

The author, who has been selected as the "Best Analyst" in the derivatives sector for 10 consecutive years, explains futures, options, and derivative funds, which have been unfamiliar and difficult for ordinary investors, in a friendly manner by connecting them with practical strategies.

This book covers everything from how to use foreign gifts to covered call option strategies and the derivative fund structure that forms the basis of ETFs.

It will serve as a reliable compass for all investors who wish to read the "invisible trends" in complex financial markets.

- You can preview some of the book's contents.

Preview

index

prolog

Part 1 Gift

: Futures that speak ahead of the market, showing future prices.

01 Why do foreigners invest in Korean futures?

1.

Foreigners' dominance of the futures market

2.

Why Foreigners Invest in KOSPI 200 Index Futures

3.

Two Secrets You Must Know in Futures Trading

02 You're an institutional investor? Most of them are financial investors.

1.

Classification of institutional investors

2.

Derivatives market making business for financial investment

3.

Are foreigners and financial investors on the same side?

03 There are king ants in the derivatives market.

1.

Why Individual Market Shares Remain at 20%

2.

If you make money from derivatives, you have to pay taxes.

3.

Legendary investor in the futures and options market

04 Samsung Electronics stock price and Samsung Electronics futures move.

1.

Stock futures are now the main characters.

2.

The underlying assets of Korean stock futures are centered on large-cap stocks.

3.

10 Ways to Use Stock Futures

4.

Why You Should Be Careful on the Second Thursday of Every Month

Part 2 option

: Trading Risk: Options Are Now a Strategy

05 Covered Calls: Why Should You Know?

1.

The Birth of Covered Calls and the History of Options Products

2.

Basic Concepts and Implementation Procedures of Covered Call Strategy

3.

Target Audience and Investor Types for Covered Call Strategy

06 Understanding Covered Call Underlying Assets and Options (Calls and Puts)

1.

Basic concepts of options

2.

Criteria for selecting underlying assets

3.

The Role of Option Sellers and the Profit and Loss of Covered Call Strategies

07 Maturity Selection (Zero Day, Weekly, Monthly, Flex Option)

1.

What is option expiration?

2.

Characteristics of various option expirations

3.

Covered call strategy based on maturity

08 Selection of event price

1.

The concept of event

2.

Which event should I choose?

3.

Exercise selection method considering dividend yield

09 Determining the quantity and timing of option sales

1.

Standard Covered Call

2.

Target Covered Call

3.

Fixed Covered Call

4.

Covered Call Strategy Risks and Countermeasures

5.

Analysis of real-world cases and backtest results

10 Understanding Covered Call ETFs Listed in Korea

1.

Current Status of the Korean Listed Covered Call ETF Market

2.

Classification by underlying asset: US index-based covered call ETFs

3.

Classification by underlying asset: US thematic covered call ETFs

4.

Classification by underlying asset: US dividend covered call ETFs

5.

Classification by underlying asset: Domestic index and dividend covered call ETFs

6.

Classification by underlying asset: US bond covered call ETFs

3rd part derivative fund

: The structure of derivatives hidden in everyday life, in familiar investments.

11 You need to know the index, which is the basis of derivatives.

1.

How do I create an index?

2.

The composition method of the KOSPI 200, the representative domestic index

12 Index Funds Hide Various Derivative Trading

1.

Purpose and types of derivative trading

2.

Is it possible to manage index funds with futures positions?

3.

Enhanced strategy through arbitrage

4.

Reasons for the Maturity Effect and Latest Trends

13. National Pension Service Fund Management as Seen by an Index Fund Manager

1.

Why You Need to Know the Management Principles of the National Pension Service (NPS)

2.

National Pension and Arbitrage: The Art of Lost Profits

3.

Why the National Pension Service Doesn't Focus on Domestic Stocks

4.

The need for asset allocation and portfolio

14 Practical Uses of Derivatives

1.

The concept of leverage and margin

2.

The operating principles and pros and cons of various derivatives trading

Part 1 Gift

: Futures that speak ahead of the market, showing future prices.

01 Why do foreigners invest in Korean futures?

1.

Foreigners' dominance of the futures market

2.

Why Foreigners Invest in KOSPI 200 Index Futures

3.

Two Secrets You Must Know in Futures Trading

02 You're an institutional investor? Most of them are financial investors.

1.

Classification of institutional investors

2.

Derivatives market making business for financial investment

3.

Are foreigners and financial investors on the same side?

03 There are king ants in the derivatives market.

1.

Why Individual Market Shares Remain at 20%

2.

If you make money from derivatives, you have to pay taxes.

3.

Legendary investor in the futures and options market

04 Samsung Electronics stock price and Samsung Electronics futures move.

1.

Stock futures are now the main characters.

2.

The underlying assets of Korean stock futures are centered on large-cap stocks.

3.

10 Ways to Use Stock Futures

4.

Why You Should Be Careful on the Second Thursday of Every Month

Part 2 option

: Trading Risk: Options Are Now a Strategy

05 Covered Calls: Why Should You Know?

1.

The Birth of Covered Calls and the History of Options Products

2.

Basic Concepts and Implementation Procedures of Covered Call Strategy

3.

Target Audience and Investor Types for Covered Call Strategy

06 Understanding Covered Call Underlying Assets and Options (Calls and Puts)

1.

Basic concepts of options

2.

Criteria for selecting underlying assets

3.

The Role of Option Sellers and the Profit and Loss of Covered Call Strategies

07 Maturity Selection (Zero Day, Weekly, Monthly, Flex Option)

1.

What is option expiration?

2.

Characteristics of various option expirations

3.

Covered call strategy based on maturity

08 Selection of event price

1.

The concept of event

2.

Which event should I choose?

3.

Exercise selection method considering dividend yield

09 Determining the quantity and timing of option sales

1.

Standard Covered Call

2.

Target Covered Call

3.

Fixed Covered Call

4.

Covered Call Strategy Risks and Countermeasures

5.

Analysis of real-world cases and backtest results

10 Understanding Covered Call ETFs Listed in Korea

1.

Current Status of the Korean Listed Covered Call ETF Market

2.

Classification by underlying asset: US index-based covered call ETFs

3.

Classification by underlying asset: US thematic covered call ETFs

4.

Classification by underlying asset: US dividend covered call ETFs

5.

Classification by underlying asset: Domestic index and dividend covered call ETFs

6.

Classification by underlying asset: US bond covered call ETFs

3rd part derivative fund

: The structure of derivatives hidden in everyday life, in familiar investments.

11 You need to know the index, which is the basis of derivatives.

1.

How do I create an index?

2.

The composition method of the KOSPI 200, the representative domestic index

12 Index Funds Hide Various Derivative Trading

1.

Purpose and types of derivative trading

2.

Is it possible to manage index funds with futures positions?

3.

Enhanced strategy through arbitrage

4.

Reasons for the Maturity Effect and Latest Trends

13. National Pension Service Fund Management as Seen by an Index Fund Manager

1.

Why You Need to Know the Management Principles of the National Pension Service (NPS)

2.

National Pension and Arbitrage: The Art of Lost Profits

3.

Why the National Pension Service Doesn't Focus on Domestic Stocks

4.

The need for asset allocation and portfolio

14 Practical Uses of Derivatives

1.

The concept of leverage and margin

2.

The operating principles and pros and cons of various derivatives trading

Detailed image

Into the book

Compared to the KOSPI 200 futures market, foreign investors accounted for 27% (based on trading value) of the KOSPI market in 2024. Foreign investor trading in the KOSPI 200 index futures market is 2.5 times greater than in the KOSPI market.

The stock market already tends to move according to the stock trading trends of foreign investors, and in the KOSPI 200 index futures market, foreign investors control two-thirds of the volume.

Therefore, some argue that by observing foreign investors' index futures trading, one can get hints about the direction of the Korean stock market.

---From "Why do foreigners invest in Korean futures?"

In 1997, less than a year after the KOSPI 200 index futures market opened, rumors began to circulate in the securities industry that a big player from Mokpo was emerging and dominating the futures market.

It is said that a certain deputy manager of a certain securities company is manipulating futures prices by controlling up to a quarter of the futures market trading volume.

'Mokpo Three-legged Octopus' is a nickname given to the city because at the time, the big shot's workplace was the Mokpo branch of a securities company and Mokpo was famous for its three-legged octopus.

Mokpo Sebal Nakji's market dominance was so powerful that some even circulated that it exceeded the combined futures contracts of several securities firms at the time. Since the KOSPI 200 futures market had been open for less than a year, few investors had a grasp of futures products, and even foreign investors were restricted to very limited amounts of investment in the domestic futures market.

Since there were not many institutional investors and foreign investors were also tied up, individual investors took up the majority of the trading, and among them, Mokpo Sebal Octopus recorded an overwhelming majority of trading.

---From "The King Ants of the Derivatives Market Exist"

In 2024, foreign investors traded a combined 233 trillion won in Samsung Electronics common stock, both buys and sells, and a combined 234 trillion won in Samsung Electronics stock futures.

Foreign investors traded stock futures as much as common stocks.

While we were only looking at the Samsung Electronics stock spot order book, foreign investors were open and weighing both the stock spot and stock futures order books, and we can see that they were employing various trading strategies using stock futures.

---From "Samsung Electronics stock price moves with Samsung Electronics futures"

Covered calls immediately capture the option premium by selling a call option on the underlying asset, and provide stable cash flow when combined with dividend income from the underlying asset.

This is particularly advantageous for retirees and income investors, as they forgo additional upside unless the stock price surges, but can offset some of the downside risk with a premium.

The advantage of the covered call strategy is that it combines dividend income and option premiums to generate profits in various scenarios based on stock price fluctuations.

---From "Understanding Covered Call Underlying Assets and Options (Calls and Puts)"

Another important use of derivatives is hedging, a strategy for risk reduction.

This is a defensive transaction aimed at minimizing potential losses from assets already held, as opposed to speculative transactions aimed at maximizing profits.

The most representative example is the case of investors who hold stocks for a long period of time.

Even if you want to maintain your holdings in the long term, considering the company's growth potential and dividends, you may be concerned about the possibility of a market decline in the short term.

In this case, by taking a short position in the stock futures contract for that stock, you can partially offset the loss in spot valuation due to the stock price decline with the profit generated from the futures contract.

---From "Index funds hide various derivatives transactions"

Long-short strategies can be implemented in a variety of ways.

Strategic combinations are possible, such as long-short positions based on the relative value of individual stocks, long-short positions across industries or sectors, long-short positions between large- and small-cap stocks, or long-short positions between index futures and individual stocks.

The key is that the return on a long position should be higher than that of a short position, and the higher the correlation between the two positions, the more effectively risk can be reduced.

A long-short strategy with a complementary structure like this can contribute to more stable profit generation.

The stock market already tends to move according to the stock trading trends of foreign investors, and in the KOSPI 200 index futures market, foreign investors control two-thirds of the volume.

Therefore, some argue that by observing foreign investors' index futures trading, one can get hints about the direction of the Korean stock market.

---From "Why do foreigners invest in Korean futures?"

In 1997, less than a year after the KOSPI 200 index futures market opened, rumors began to circulate in the securities industry that a big player from Mokpo was emerging and dominating the futures market.

It is said that a certain deputy manager of a certain securities company is manipulating futures prices by controlling up to a quarter of the futures market trading volume.

'Mokpo Three-legged Octopus' is a nickname given to the city because at the time, the big shot's workplace was the Mokpo branch of a securities company and Mokpo was famous for its three-legged octopus.

Mokpo Sebal Nakji's market dominance was so powerful that some even circulated that it exceeded the combined futures contracts of several securities firms at the time. Since the KOSPI 200 futures market had been open for less than a year, few investors had a grasp of futures products, and even foreign investors were restricted to very limited amounts of investment in the domestic futures market.

Since there were not many institutional investors and foreign investors were also tied up, individual investors took up the majority of the trading, and among them, Mokpo Sebal Octopus recorded an overwhelming majority of trading.

---From "The King Ants of the Derivatives Market Exist"

In 2024, foreign investors traded a combined 233 trillion won in Samsung Electronics common stock, both buys and sells, and a combined 234 trillion won in Samsung Electronics stock futures.

Foreign investors traded stock futures as much as common stocks.

While we were only looking at the Samsung Electronics stock spot order book, foreign investors were open and weighing both the stock spot and stock futures order books, and we can see that they were employing various trading strategies using stock futures.

---From "Samsung Electronics stock price moves with Samsung Electronics futures"

Covered calls immediately capture the option premium by selling a call option on the underlying asset, and provide stable cash flow when combined with dividend income from the underlying asset.

This is particularly advantageous for retirees and income investors, as they forgo additional upside unless the stock price surges, but can offset some of the downside risk with a premium.

The advantage of the covered call strategy is that it combines dividend income and option premiums to generate profits in various scenarios based on stock price fluctuations.

---From "Understanding Covered Call Underlying Assets and Options (Calls and Puts)"

Another important use of derivatives is hedging, a strategy for risk reduction.

This is a defensive transaction aimed at minimizing potential losses from assets already held, as opposed to speculative transactions aimed at maximizing profits.

The most representative example is the case of investors who hold stocks for a long period of time.

Even if you want to maintain your holdings in the long term, considering the company's growth potential and dividends, you may be concerned about the possibility of a market decline in the short term.

In this case, by taking a short position in the stock futures contract for that stock, you can partially offset the loss in spot valuation due to the stock price decline with the profit generated from the futures contract.

---From "Index funds hide various derivatives transactions"

Long-short strategies can be implemented in a variety of ways.

Strategic combinations are possible, such as long-short positions based on the relative value of individual stocks, long-short positions across industries or sectors, long-short positions between large- and small-cap stocks, or long-short positions between index futures and individual stocks.

The key is that the return on a long position should be higher than that of a short position, and the higher the correlation between the two positions, the more effectively risk can be reduced.

A long-short strategy with a complementary structure like this can contribute to more stable profit generation.

---From "Practical Use of Derivatives"

Publisher's Review

Derivatives are not risky!

It is the most powerful tool for reducing risk!

“The financial market is always a place where countless news stories and investors are intertwined.

Just understanding the purpose of foreigners and institutions trading within it will change your perspective on the market.

Especially in Korea, where the stock-based futures and options markets are developed, simply understanding derivatives can give you an advantage in stock investment.” _From “Prologue”

This book is a practical introduction to derivatives, helping investors seize the "high ground."

To help investors manage risk and recognize derivatives as a strategic investment tool.

As the author says, if you properly understand the core of derivatives, they can become your most powerful investment weapon.

Let's all make good use of the weapon called 'derivatives' in our investment strategies.

A true expert reads the derivations!

From the basic concepts of futures, options, and derivatives funds to practical strategies!

This book is divided into three parts.

Part 1, "Futures," introduces why major investors, including foreigners, institutions, and individuals, trade futures and what strategies they employ.

It covers foreign investors' KOSPI 200 futures strategies, how to use ETFs and futures, and even the stories of legendary investors in the futures and options market.

Part 2, "Options," begins with the story of the birth of covered calls and covers how options can be utilized for investment, focusing particularly on covered call ETFs, which have recently been attracting attention.

It covers everything from the basic concepts of options to strike price selection and analysis of domestically listed covered call ETFs.

Part 3, "Derivative Funds," explores the importance of index funds and derivative funds, which can be considered the roots of ETFs, and the derivative trading mechanisms hidden within them.

It also presents useful strategies for real-world investing, such as leverage and enhancement.

This book is packed with practical information that will be helpful not only to those looking to invest directly in derivatives, but also to investors seeking to improve their stock investments, those interested in ETFs and covered call strategies, and those seeking to understand major market trends.

It is the most powerful tool for reducing risk!

“The financial market is always a place where countless news stories and investors are intertwined.

Just understanding the purpose of foreigners and institutions trading within it will change your perspective on the market.

Especially in Korea, where the stock-based futures and options markets are developed, simply understanding derivatives can give you an advantage in stock investment.” _From “Prologue”

This book is a practical introduction to derivatives, helping investors seize the "high ground."

To help investors manage risk and recognize derivatives as a strategic investment tool.

As the author says, if you properly understand the core of derivatives, they can become your most powerful investment weapon.

Let's all make good use of the weapon called 'derivatives' in our investment strategies.

A true expert reads the derivations!

From the basic concepts of futures, options, and derivatives funds to practical strategies!

This book is divided into three parts.

Part 1, "Futures," introduces why major investors, including foreigners, institutions, and individuals, trade futures and what strategies they employ.

It covers foreign investors' KOSPI 200 futures strategies, how to use ETFs and futures, and even the stories of legendary investors in the futures and options market.

Part 2, "Options," begins with the story of the birth of covered calls and covers how options can be utilized for investment, focusing particularly on covered call ETFs, which have recently been attracting attention.

It covers everything from the basic concepts of options to strike price selection and analysis of domestically listed covered call ETFs.

Part 3, "Derivative Funds," explores the importance of index funds and derivative funds, which can be considered the roots of ETFs, and the derivative trading mechanisms hidden within them.

It also presents useful strategies for real-world investing, such as leverage and enhancement.

This book is packed with practical information that will be helpful not only to those looking to invest directly in derivatives, but also to investors seeking to improve their stock investments, those interested in ETFs and covered call strategies, and those seeking to understand major market trends.

GOODS SPECIFICS

- Date of issue: July 25, 2025

- Page count, weight, size: 300 pages | 464g | 153*225*18mm

- ISBN13: 9791189352943

- ISBN10: 118935294X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)