currency war

|

Description

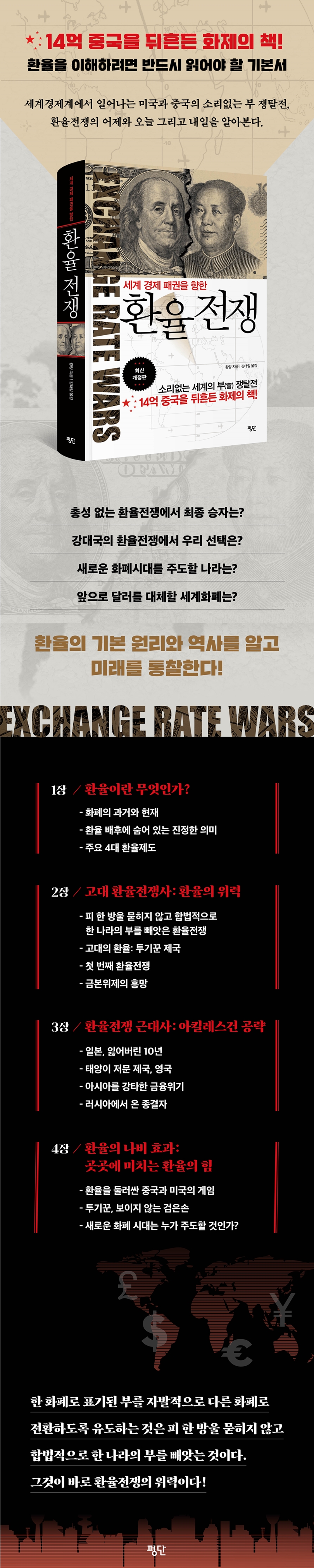

Book Introduction

A must-read for anyone interested in understanding the global economy and exchange rates!

By understanding the fundamental principles and history of exchange rates, which are deeply ingrained in our lives, and the historical facts surrounding US-China relations and the currency war between the two countries, we can develop insight into the future.

Exchange rates can feel even more difficult because they are linked to the political and economic situations of not only domestic but also other countries.

"The Currency War" is an easy-to-understand book that explores the historical roots of how exchange rates began, what determines them, what the modern exchange rate system is like, and the extent to which exchange rates influence the world.

By understanding the fundamental principles and history of exchange rates, which are deeply ingrained in our lives, and the historical facts surrounding US-China relations and the currency war between the two countries, we can develop insight into the future.

Exchange rates can feel even more difficult because they are linked to the political and economic situations of not only domestic but also other countries.

"The Currency War" is an easy-to-understand book that explores the historical roots of how exchange rates began, what determines them, what the modern exchange rate system is like, and the extent to which exchange rates influence the world.

- You can preview some of the book's contents.

Preview

index

prolog

Chapter 1: What is an Exchange Rate?

1.

The Past and Present of Money

The gift of money to humanity

Qualifications for becoming a currency

Why does money have value?

The correlation between supply and value

The absolute factor that determines the value of currency

2.

The true meaning behind exchange rates

What determines the exchange rate?

Is it possible for a one-sided trade surplus to occur in bilateral trade?

The impact of overseas investment on the exchange rate

How do psychological factors affect exchange rates?

3.

The four major exchange rate systems

Dollarization and the Eurozone

The pros and cons of adopting a fixed exchange rate system

Is exchange rate linkage a blessing or a curse?

Pros and Cons of Free Floating Exchange Rate Systems and Managed Floating Exchange Rate Systems

4.

The government's three major exchange rate adjustment policies

The close correlation between interest rates and the economy

Fiscal policy implemented by the government when there is an imbalance between supply and demand

Government measures to control liquidity in the market

Do trade tariffs protect a country's economy?

Measures to be taken by each exchange rate system to stabilize exchange rates and interest rates

Chapter 2: The History of Ancient Currency Wars: The Power of Exchange Rates

1.

Ancient Exchange Rates: The Empire of Speculators

The reason gold and silver were used in ancient times

The period when exchange rates in the modern sense emerged

2.

The First Currency War: In a currency war, paper money is more powerful than weapons.

Why is the currency war a silent battle for wealth?

The over-issuance of paper money led to the downfall of the Yuan Dynasty.

3.

Europe, from Periphery to Center: The Emergence of the Modern Exchange Rate System

Spain's Rise and Fall Through Gold and Silver

Modern banking began as a marketplace.

Background of the emergence of various financial products

Finance during the Ming Dynasty

4.

The rise and fall of the gold standard

A New Facilitator of the World Economy and Trade: The Gold Standard

The ultimate cause of the Qing Dynasty's crushing defeat by Europe in the currency war

The Gold Standard Dilemma

Chapter 3: A Modern History of Currency Wars: Attacking the Achilles' Heel

1.

Dollar and gold

America's move to seize economic hegemony

The role of the Bretton Woods system after the war

How did the US dominate the world economy?

The global interests behind America's deficit

Why did the dollar have no choice but to depreciate?

Why isn't the US the loser of the currency war, despite the dollar's declining value?

2.

Japan's Lost Decade: The Heisei Recession

The impact of Reagan's tax cuts on the U.S. economy

G5 advanced economies: their rules

Why did the dollar interest rate adjustment throw the Japanese economy into chaos?

The real culprit behind Japan's bubble economy

The consequences of the bubble burst for Japan

Was the collapse of the Japanese economy a fabrication of the United States?

3.

The Empire Where the Sun Sets, Britain

Investment Guru Soros' Investment Secrets

How did the economic situations in Germany and the UK differ in the early 1990s?

How Soros Broke the Pound

Was Soros' attack on the pound a disaster for Britain?

4.

The tragedy of Latin America

Chile's successful economic reform and its background

Why did Mexico's tequila crisis occur?

The Fate of Mexico and Argentina After the Currency Crisis

The real cause of the exchange rate crisis

5.

The financial crisis that hit Asia

The impact of foreign capital inflows on the Thai market

Why did Thailand have to suffer a vicious economic cycle despite the massive influx of foreign capital?

How did Thailand's baht fall prey to financial powers?

Hong Kong's Defense Strategy Against Financial Power Attacks

The Great Lessons of the Financial Crisis

6.

Terminator from Russia

Background on Long-Term Capital's High-Yield Strategy

Why Russia fell from rich to poor

Why did Long-Term Capital collapse due to the Russian economic collapse?

Lessons We Can Learn from the Currency Crisis

The Meaning of Economics to Westerners

Who's the real winner: economics or conspiracy theories?

Chapter 4: The Butterfly Effect of Exchange Rates: The Power of Exchange Rates on Everywhere

1.

The game between China and the United States over exchange rates

Who is the Yuan appreciation game for?

Can a Yuan Revaluation Solve the US Government's Fiscal Deficit?

Why did the subprime mortgage crisis occur in the United States?

US and Chinese Views on Yuan Revaluation

2.

Speculators, the invisible black hand

The role of exchange rates in the global economy

Various means of speculation

Prerequisites for financial powers to successfully operate in the market

The game between government and financial power

3.

Why Are McDonald's Prices So High in China? - Exchange Rates in Daily Life

Why the Law of One Price Comes into Being

Why does a Big Mac cost $1.83 in China but $3.57 in the US?

Why do Westerners earn more than Chinese?

Why the world's factories are flocking to low-wage countries

4.

Who will lead the new era of currency?

Is a return to the gold standard the way to end the world economic chaos?

Could a global currency circulation be an alternative to the global economic crisis?

Euro crisis

Will a global currency emerge to replace the dollar?

Epilogue: The Tao that can be spoken of is not the ordinary Tao (道可道, 非常道)

References

Chapter 1: What is an Exchange Rate?

1.

The Past and Present of Money

The gift of money to humanity

Qualifications for becoming a currency

Why does money have value?

The correlation between supply and value

The absolute factor that determines the value of currency

2.

The true meaning behind exchange rates

What determines the exchange rate?

Is it possible for a one-sided trade surplus to occur in bilateral trade?

The impact of overseas investment on the exchange rate

How do psychological factors affect exchange rates?

3.

The four major exchange rate systems

Dollarization and the Eurozone

The pros and cons of adopting a fixed exchange rate system

Is exchange rate linkage a blessing or a curse?

Pros and Cons of Free Floating Exchange Rate Systems and Managed Floating Exchange Rate Systems

4.

The government's three major exchange rate adjustment policies

The close correlation between interest rates and the economy

Fiscal policy implemented by the government when there is an imbalance between supply and demand

Government measures to control liquidity in the market

Do trade tariffs protect a country's economy?

Measures to be taken by each exchange rate system to stabilize exchange rates and interest rates

Chapter 2: The History of Ancient Currency Wars: The Power of Exchange Rates

1.

Ancient Exchange Rates: The Empire of Speculators

The reason gold and silver were used in ancient times

The period when exchange rates in the modern sense emerged

2.

The First Currency War: In a currency war, paper money is more powerful than weapons.

Why is the currency war a silent battle for wealth?

The over-issuance of paper money led to the downfall of the Yuan Dynasty.

3.

Europe, from Periphery to Center: The Emergence of the Modern Exchange Rate System

Spain's Rise and Fall Through Gold and Silver

Modern banking began as a marketplace.

Background of the emergence of various financial products

Finance during the Ming Dynasty

4.

The rise and fall of the gold standard

A New Facilitator of the World Economy and Trade: The Gold Standard

The ultimate cause of the Qing Dynasty's crushing defeat by Europe in the currency war

The Gold Standard Dilemma

Chapter 3: A Modern History of Currency Wars: Attacking the Achilles' Heel

1.

Dollar and gold

America's move to seize economic hegemony

The role of the Bretton Woods system after the war

How did the US dominate the world economy?

The global interests behind America's deficit

Why did the dollar have no choice but to depreciate?

Why isn't the US the loser of the currency war, despite the dollar's declining value?

2.

Japan's Lost Decade: The Heisei Recession

The impact of Reagan's tax cuts on the U.S. economy

G5 advanced economies: their rules

Why did the dollar interest rate adjustment throw the Japanese economy into chaos?

The real culprit behind Japan's bubble economy

The consequences of the bubble burst for Japan

Was the collapse of the Japanese economy a fabrication of the United States?

3.

The Empire Where the Sun Sets, Britain

Investment Guru Soros' Investment Secrets

How did the economic situations in Germany and the UK differ in the early 1990s?

How Soros Broke the Pound

Was Soros' attack on the pound a disaster for Britain?

4.

The tragedy of Latin America

Chile's successful economic reform and its background

Why did Mexico's tequila crisis occur?

The Fate of Mexico and Argentina After the Currency Crisis

The real cause of the exchange rate crisis

5.

The financial crisis that hit Asia

The impact of foreign capital inflows on the Thai market

Why did Thailand have to suffer a vicious economic cycle despite the massive influx of foreign capital?

How did Thailand's baht fall prey to financial powers?

Hong Kong's Defense Strategy Against Financial Power Attacks

The Great Lessons of the Financial Crisis

6.

Terminator from Russia

Background on Long-Term Capital's High-Yield Strategy

Why Russia fell from rich to poor

Why did Long-Term Capital collapse due to the Russian economic collapse?

Lessons We Can Learn from the Currency Crisis

The Meaning of Economics to Westerners

Who's the real winner: economics or conspiracy theories?

Chapter 4: The Butterfly Effect of Exchange Rates: The Power of Exchange Rates on Everywhere

1.

The game between China and the United States over exchange rates

Who is the Yuan appreciation game for?

Can a Yuan Revaluation Solve the US Government's Fiscal Deficit?

Why did the subprime mortgage crisis occur in the United States?

US and Chinese Views on Yuan Revaluation

2.

Speculators, the invisible black hand

The role of exchange rates in the global economy

Various means of speculation

Prerequisites for financial powers to successfully operate in the market

The game between government and financial power

3.

Why Are McDonald's Prices So High in China? - Exchange Rates in Daily Life

Why the Law of One Price Comes into Being

Why does a Big Mac cost $1.83 in China but $3.57 in the US?

Why do Westerners earn more than Chinese?

Why the world's factories are flocking to low-wage countries

4.

Who will lead the new era of currency?

Is a return to the gold standard the way to end the world economic chaos?

Could a global currency circulation be an alternative to the global economic crisis?

Euro crisis

Will a global currency emerge to replace the dollar?

Epilogue: The Tao that can be spoken of is not the ordinary Tao (道可道, 非常道)

References

Detailed image

Into the book

The value of any currency is determined by two factors:

It is the value of the object of exchange and the public's level of trust in the currency.

If a country has a lot of goods and is trustworthy, its currency will appreciate.

Conversely, if a country's stock of goods is very small or unreliable, its currency will be worth less.

In this way, the exchange rate is a comparison of the size of the goods and trustworthiness that can be exchanged for each currency.

--- p.32

Although the free floating exchange rate system has many advantages, it is not without its drawbacks.

The very fact that it is ‘free to change’ is a disadvantage.

In other words, the exchange rate fluctuates freely, so stability is not guaranteed.

High exchange rate volatility increases investment risk, creating headaches for businesses and investors.

Therefore, businesses and investors must consider factors such as exchange rate fluctuations and potential volatility in advance before making business or investment decisions.

This cannot but affect the activism of businesses and investors.

--- p.74

In countries that implement a free floating exchange rate system or a managed floating exchange rate system, when they implement policies to expand fiscal spending or cut taxes, interest rates will rise, which will lead to an inflow of foreign funds, lowering the exchange rate and decreasing exports.

However, if the government lowers interest rates and prints more currency, the exchange rate will rise and exports will increase.

On the other hand, if tariffs are raised, the exchange rate will initially fall due to a decrease in imports and an increase in exports.

However, due to the impact of the depreciation of the exchange rate, the surplus soon disappears, and ultimately, only the increase in the value of the currency remains.

--- p.94

The West's currency stability has become a weapon more threatening than its warships and cannons, allowing the West to acquire wealth from China without shedding a drop of blood.

This is very similar to how the Southern Song Dynasty stole the wealth of the Jin Dynasty in the past.

The only difference is that this history of shame cannot be called a currency war.

Because the gap between the West and China in political, economic, military, and scientific and technological capabilities was so stark, it would be more accurate to describe this as a kind of constant exploitation rather than a war.

As a result, China became increasingly impoverished.

--- p.155

After the rise and fall of the Bretton Woods system, the modern foreign exchange market finally took shape.

Rather than unifying their exchange rate systems with a fixed exchange rate system, each country chose the system that best suited its own situation based on its own interests.

However, the Bretton Woods system was a transitional period from the gold standard to the modern exchange rate system, and its influence has not disappeared even now.

Each topic to be discussed below can find clues in the Bretton Woods system.

--- p.190

The consequences of Japan's bubble burst were indescribably disastrous.

The wealth of the Great Han Dynasty disappeared in an instant, and the real estate price in Ginza, which had reached 1 million dollars per square meter, fell to less than 1% of the original price, or under 10,000 dollars, by 2004.

The prices of houses where the bubble was relatively mild also fell by around 10%.

Many Japanese companies and investors overinvested during the rising price phase, leaving them with massive debts after the bubble burst.

--- p.210

Although Asian countries gradually recovered their economies, many were deeply resentful of the International Monetary Fund's actions at the time.

They resented the IMF's forced measures, which they viewed as imposing American values and economic ideology on their countries through the Washington Consensus.

At the time, many Americans believed that Asian countries were aware of their own mistakes but were refusing to admit them and avoiding responsibility.

But looking back now, the Asians' perspective wasn't entirely unreasonable.

When the subprime mortgage crisis erupted, the United States, instead of adhering to the Washington Consensus, printed a large amount of money and expanded debt to stimulate the economy.

Other scholars, including Nobel Prize winners in economics Joseph Stiglitz and Paul Krugman, believed that many of the IMF's measures were inconsistent with Keynesian principles and would only worsen the economic situation and people's living standards.

--- p.271

Unlike conspiracy theories, economics can be proven wrong.

For example, liberalism could not explain the Great Depression, which proves that liberalism has fundamental problems.

Thus, the Great Depression was explained by the new theory proposed by Keynes.

In this way, as integration of laws increases, awareness of the problem also becomes clearer.

Economics is a perpetual revisionism in the quest for perfection.

This also means that economics itself is imperfect.

So, compared to a perfect conspiracy theory, it shows a weak side.

What's most distressing is that economics holds us, as individuals, accountable, not some conspiracy that will never reveal its true colors.

--- p.300

When financial powers carry out operations, they generally use various means, including the media, to incite people in various ways.

Their ultimate goal is to rally all financial powers to attack their target together, as well as to destabilize normal investors and traders, causing them to withdraw their funds and encourage ordinary citizens to sell their national currencies for fear of losing their wealth.

This is equivalent to putting pressure on the government by simultaneously withdrawing the funds of economic entities from the market, and all economic entities gripped by anxiety are instantly transformed into collaborators of financial power.

In such a situation, no matter how powerful the government may be, there is no way to turn the situation around.

--- p.342

There is one prerequisite for the creation of a currency.

This means that the government must have the power to decide on various policies related to currency circulation.

The fact that the euro has reached a very dangerous situation during this financial crisis demonstrates this fact.

Although unified by the euro, Europe's political system has yet to catch up.

The euro lacks a strong political system behind it, and, moreover, the governments in the eurozone have different agendas.

Ultimately, they are responsible for their own citizens, not for those who belong to the 'European countries'.

Because of these fatal weaknesses, the euro was fundamentally unable to compete with the dollar, and this crisis exposed that flaw.

It is the value of the object of exchange and the public's level of trust in the currency.

If a country has a lot of goods and is trustworthy, its currency will appreciate.

Conversely, if a country's stock of goods is very small or unreliable, its currency will be worth less.

In this way, the exchange rate is a comparison of the size of the goods and trustworthiness that can be exchanged for each currency.

--- p.32

Although the free floating exchange rate system has many advantages, it is not without its drawbacks.

The very fact that it is ‘free to change’ is a disadvantage.

In other words, the exchange rate fluctuates freely, so stability is not guaranteed.

High exchange rate volatility increases investment risk, creating headaches for businesses and investors.

Therefore, businesses and investors must consider factors such as exchange rate fluctuations and potential volatility in advance before making business or investment decisions.

This cannot but affect the activism of businesses and investors.

--- p.74

In countries that implement a free floating exchange rate system or a managed floating exchange rate system, when they implement policies to expand fiscal spending or cut taxes, interest rates will rise, which will lead to an inflow of foreign funds, lowering the exchange rate and decreasing exports.

However, if the government lowers interest rates and prints more currency, the exchange rate will rise and exports will increase.

On the other hand, if tariffs are raised, the exchange rate will initially fall due to a decrease in imports and an increase in exports.

However, due to the impact of the depreciation of the exchange rate, the surplus soon disappears, and ultimately, only the increase in the value of the currency remains.

--- p.94

The West's currency stability has become a weapon more threatening than its warships and cannons, allowing the West to acquire wealth from China without shedding a drop of blood.

This is very similar to how the Southern Song Dynasty stole the wealth of the Jin Dynasty in the past.

The only difference is that this history of shame cannot be called a currency war.

Because the gap between the West and China in political, economic, military, and scientific and technological capabilities was so stark, it would be more accurate to describe this as a kind of constant exploitation rather than a war.

As a result, China became increasingly impoverished.

--- p.155

After the rise and fall of the Bretton Woods system, the modern foreign exchange market finally took shape.

Rather than unifying their exchange rate systems with a fixed exchange rate system, each country chose the system that best suited its own situation based on its own interests.

However, the Bretton Woods system was a transitional period from the gold standard to the modern exchange rate system, and its influence has not disappeared even now.

Each topic to be discussed below can find clues in the Bretton Woods system.

--- p.190

The consequences of Japan's bubble burst were indescribably disastrous.

The wealth of the Great Han Dynasty disappeared in an instant, and the real estate price in Ginza, which had reached 1 million dollars per square meter, fell to less than 1% of the original price, or under 10,000 dollars, by 2004.

The prices of houses where the bubble was relatively mild also fell by around 10%.

Many Japanese companies and investors overinvested during the rising price phase, leaving them with massive debts after the bubble burst.

--- p.210

Although Asian countries gradually recovered their economies, many were deeply resentful of the International Monetary Fund's actions at the time.

They resented the IMF's forced measures, which they viewed as imposing American values and economic ideology on their countries through the Washington Consensus.

At the time, many Americans believed that Asian countries were aware of their own mistakes but were refusing to admit them and avoiding responsibility.

But looking back now, the Asians' perspective wasn't entirely unreasonable.

When the subprime mortgage crisis erupted, the United States, instead of adhering to the Washington Consensus, printed a large amount of money and expanded debt to stimulate the economy.

Other scholars, including Nobel Prize winners in economics Joseph Stiglitz and Paul Krugman, believed that many of the IMF's measures were inconsistent with Keynesian principles and would only worsen the economic situation and people's living standards.

--- p.271

Unlike conspiracy theories, economics can be proven wrong.

For example, liberalism could not explain the Great Depression, which proves that liberalism has fundamental problems.

Thus, the Great Depression was explained by the new theory proposed by Keynes.

In this way, as integration of laws increases, awareness of the problem also becomes clearer.

Economics is a perpetual revisionism in the quest for perfection.

This also means that economics itself is imperfect.

So, compared to a perfect conspiracy theory, it shows a weak side.

What's most distressing is that economics holds us, as individuals, accountable, not some conspiracy that will never reveal its true colors.

--- p.300

When financial powers carry out operations, they generally use various means, including the media, to incite people in various ways.

Their ultimate goal is to rally all financial powers to attack their target together, as well as to destabilize normal investors and traders, causing them to withdraw their funds and encourage ordinary citizens to sell their national currencies for fear of losing their wealth.

This is equivalent to putting pressure on the government by simultaneously withdrawing the funds of economic entities from the market, and all economic entities gripped by anxiety are instantly transformed into collaborators of financial power.

In such a situation, no matter how powerful the government may be, there is no way to turn the situation around.

--- p.342

There is one prerequisite for the creation of a currency.

This means that the government must have the power to decide on various policies related to currency circulation.

The fact that the euro has reached a very dangerous situation during this financial crisis demonstrates this fact.

Although unified by the euro, Europe's political system has yet to catch up.

The euro lacks a strong political system behind it, and, moreover, the governments in the eurozone have different agendas.

Ultimately, they are responsible for their own citizens, not for those who belong to the 'European countries'.

Because of these fatal weaknesses, the euro was fundamentally unable to compete with the dollar, and this crisis exposed that flaw.

--- p.385

Publisher's Review

A hot topic book that shook 1.4 billion Chinese people!

A must-read for understanding exchange rates

Voluntarily denominated in one currency

Encouraging conversion to other currencies

It is to legally take away a country's wealth without shedding a single drop of blood.

That is the power of the currency war!

To understand the flow of global economic hegemony, you must understand the power of exchange rates!

In the global era, exchange rates, along with interest rates, are becoming indicators of the direction of the global economy.

In particular, the trade war between the US and China, the economic powers known as the G2, will soon escalate into a currency war, and neighboring countries will inevitably be greatly affected, like a shrimp's back being broken in a fight between whales.

So why are these two superpowers, and the entire world, so anxious about exchange rates? Because exchange rates will determine wealth in the 21st century.

So, who will be the ultimate winner in the currency war that is becoming more intense than ever?

To help answer this question, the author begins by explaining what an exchange rate is, providing basic knowledge about it, and then examines its origins over 5,000 years of history.

And based on an understanding of exchange rates, we examine famous currency wars in history and explore what implications they offer for current exchange rate issues.

We will also analyze the impact of exchange rates on our daily lives and consider why the currency war between China and the United States occurred, as well as what might happen in the future.

What is a currency war?

Is there a cutting-edge weapon that could steal a country's wealth without shedding a single drop of blood? What if it could even induce an enemy nation to voluntarily transfer its wealth? It may seem far-fetched, but it's a possibility that could easily happen in real life.

If you destroy the credibility of a country's currency and manipulate its exchange rate, it is only a matter of time before you rob that country of its wealth.

That is the terrifying result of the currency war.

In this book, the author examines what the exchange rate is and how the exchange rate system has changed, analyzes why the currency war is a silent battle for wealth, and summarizes the first currency war that occurred during China's Southern Song Dynasty.

The Jin Dynasty, which was on a winning streak in the war with the Southern Song Dynasty, fell for the sweet temptation of paper money and overissued it, leading to inflation.

As a result, in the later years of the Jin Dynasty, too many banknotes were circulated, causing the value of the currency to fall significantly.

People who used silver and coins refused to use paper money as much as possible, and some even moved their wealth to the Southern Song Dynasty.

This situation worsened as the Jin Dynasty issued more banknotes, and eventually, both conditions for a currency war were met: moving assets to the Southern Song Dynasty would lead to greater wealth and greater security, and an unintentional currency war broke out between the two countries.

The Jin Dynasty collapsed internally as its economy collapsed, and it was eventually destroyed by the Mongols.

The United States appears in the modern history of currency wars.

During the two world wars, the gold standard collapsed, and the dollar emerged as the global reserve currency. The United States, which inherited economic hegemony, came to dominate the global economy and wield absolute power.

Even the United States, with its trade deficit continuing, sought its own way of survival, and its first victim was its ally, Japan.

The truth behind Japan's Heisei recession and the collapse of the Russian ruble?

Japan, which had been leading the global economy alongside the United States, has been mired in a recession for over 20 years since the economic bubble burst.

Many people say that America's intentions are behind Japan's economic collapse.

So, was Japan's economic collapse truly driven by the United States? If so, why did the collapse of the British pound, the cyclical bankruptcies in Latin America, the Asian financial crisis, and the collapse of the Russian ruble occur, and what were their consequences? This book will provide answers to these questions.

In particular, the financial crisis that hit Asia was explained using Thailand as an example, which is more realistic because it is similar to the foreign exchange crisis that our country experienced in 1997.

Finally, the author analyzes the game being played between the United States and China over exchange rates.

We examine why the subprime mortgage crisis occurred, the two countries' views on the appreciation of the yuan, the operations of the invisible black hand of speculators, the game between governments and financial powers, and why McDonald's prices vary across countries.

It also analyzes the true causes of the global economic crisis from a macro perspective and, furthermore, provides a sober analysis of whether a new global currency will emerge to replace the dollar in a new monetary era.

If the Chinese yuan appreciates, as the US, with its large trade deficit, demands, will it be able to resolve its massive deficit and restore the dollar's status? If the modern exchange rate system, which relies on the dollar as the world's reserve currency, is flawed, what reserve currency could replace the dollar? The author offers clear and practical answers to these questions, using logical analysis and a wealth of case studies.

A must-read for understanding exchange rates

Voluntarily denominated in one currency

Encouraging conversion to other currencies

It is to legally take away a country's wealth without shedding a single drop of blood.

That is the power of the currency war!

To understand the flow of global economic hegemony, you must understand the power of exchange rates!

In the global era, exchange rates, along with interest rates, are becoming indicators of the direction of the global economy.

In particular, the trade war between the US and China, the economic powers known as the G2, will soon escalate into a currency war, and neighboring countries will inevitably be greatly affected, like a shrimp's back being broken in a fight between whales.

So why are these two superpowers, and the entire world, so anxious about exchange rates? Because exchange rates will determine wealth in the 21st century.

So, who will be the ultimate winner in the currency war that is becoming more intense than ever?

To help answer this question, the author begins by explaining what an exchange rate is, providing basic knowledge about it, and then examines its origins over 5,000 years of history.

And based on an understanding of exchange rates, we examine famous currency wars in history and explore what implications they offer for current exchange rate issues.

We will also analyze the impact of exchange rates on our daily lives and consider why the currency war between China and the United States occurred, as well as what might happen in the future.

What is a currency war?

Is there a cutting-edge weapon that could steal a country's wealth without shedding a single drop of blood? What if it could even induce an enemy nation to voluntarily transfer its wealth? It may seem far-fetched, but it's a possibility that could easily happen in real life.

If you destroy the credibility of a country's currency and manipulate its exchange rate, it is only a matter of time before you rob that country of its wealth.

That is the terrifying result of the currency war.

In this book, the author examines what the exchange rate is and how the exchange rate system has changed, analyzes why the currency war is a silent battle for wealth, and summarizes the first currency war that occurred during China's Southern Song Dynasty.

The Jin Dynasty, which was on a winning streak in the war with the Southern Song Dynasty, fell for the sweet temptation of paper money and overissued it, leading to inflation.

As a result, in the later years of the Jin Dynasty, too many banknotes were circulated, causing the value of the currency to fall significantly.

People who used silver and coins refused to use paper money as much as possible, and some even moved their wealth to the Southern Song Dynasty.

This situation worsened as the Jin Dynasty issued more banknotes, and eventually, both conditions for a currency war were met: moving assets to the Southern Song Dynasty would lead to greater wealth and greater security, and an unintentional currency war broke out between the two countries.

The Jin Dynasty collapsed internally as its economy collapsed, and it was eventually destroyed by the Mongols.

The United States appears in the modern history of currency wars.

During the two world wars, the gold standard collapsed, and the dollar emerged as the global reserve currency. The United States, which inherited economic hegemony, came to dominate the global economy and wield absolute power.

Even the United States, with its trade deficit continuing, sought its own way of survival, and its first victim was its ally, Japan.

The truth behind Japan's Heisei recession and the collapse of the Russian ruble?

Japan, which had been leading the global economy alongside the United States, has been mired in a recession for over 20 years since the economic bubble burst.

Many people say that America's intentions are behind Japan's economic collapse.

So, was Japan's economic collapse truly driven by the United States? If so, why did the collapse of the British pound, the cyclical bankruptcies in Latin America, the Asian financial crisis, and the collapse of the Russian ruble occur, and what were their consequences? This book will provide answers to these questions.

In particular, the financial crisis that hit Asia was explained using Thailand as an example, which is more realistic because it is similar to the foreign exchange crisis that our country experienced in 1997.

Finally, the author analyzes the game being played between the United States and China over exchange rates.

We examine why the subprime mortgage crisis occurred, the two countries' views on the appreciation of the yuan, the operations of the invisible black hand of speculators, the game between governments and financial powers, and why McDonald's prices vary across countries.

It also analyzes the true causes of the global economic crisis from a macro perspective and, furthermore, provides a sober analysis of whether a new global currency will emerge to replace the dollar in a new monetary era.

If the Chinese yuan appreciates, as the US, with its large trade deficit, demands, will it be able to resolve its massive deficit and restore the dollar's status? If the modern exchange rate system, which relies on the dollar as the world's reserve currency, is flawed, what reserve currency could replace the dollar? The author offers clear and practical answers to these questions, using logical analysis and a wealth of case studies.

GOODS SPECIFICS

- Date of issue: September 20, 2024

- Page count, weight, size: 392 pages | 145*215*30mm

- ISBN13: 9788973435784

- ISBN10: 8973435787

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)