Invest half of your salary

|

Description

Book Introduction

“I find investing in stocks and Bitcoin difficult!”

For those who find investing difficult and financial management daunting.

The most reliable financial management guide to protecting and saving your money.

When I see people who have made a fortune investing in stocks or cryptocurrencies like Bitcoin, I feel like I need to jump into investing right away.

But no matter how much I look into it, I can't figure out what will actually be profitable and make me money, and I'm worried that I might just jump in and lose the money I've worked so hard to save.

For those of you just starting out with investing, what you need is a surefire way to never lose your money. This book proposes "Investing with Half Your Salary" as a way to do just that.

The author, PD Kim Min-sik, achieved financial freedom by saving more than half of his income starting in his 20s, living solely on his salary.

This book presents the simplest and safest method he discovered after realizing the need for financial education after experiencing negative returns on his post-retirement pension investments.

This book is a practical introduction for those who find investing difficult and want to learn how to manage their finances.

For those who find investing difficult and financial management daunting.

The most reliable financial management guide to protecting and saving your money.

When I see people who have made a fortune investing in stocks or cryptocurrencies like Bitcoin, I feel like I need to jump into investing right away.

But no matter how much I look into it, I can't figure out what will actually be profitable and make me money, and I'm worried that I might just jump in and lose the money I've worked so hard to save.

For those of you just starting out with investing, what you need is a surefire way to never lose your money. This book proposes "Investing with Half Your Salary" as a way to do just that.

The author, PD Kim Min-sik, achieved financial freedom by saving more than half of his income starting in his 20s, living solely on his salary.

This book presents the simplest and safest method he discovered after realizing the need for financial education after experiencing negative returns on his post-retirement pension investments.

This book is a practical introduction for those who find investing difficult and want to learn how to manage their finances.

- You can preview some of the book's contents.

Preview

index

Prologue: Let's save, save, and study economics.

Chapter 1: The Fun of Saving Money

Another name for a frugal person is a free person | A rich person's mindset that focuses on existence rather than possessions | Working hard in youth while earning money | Is that really necessary now? | Saving habits, self-esteem come first | The lifestyle habits of the wealthy, where saving is a strategy

Chapter 2: The Joy of Earning Your Own Money

A good attitude toward work | Finding what you love is the beginning | The strength to persevere until you start making money | People who are good at their jobs think like rich people | Financial freedom is easily achievable with just a salary | Bet on one thing | It's fun because you're good at it

Chapter 3: Money-Saving Habits of the Rich

YOLO and Work-Life Balance | The Most Powerful Weapon for Saving Money | Do I Really Need a House? | Let's Save Just 100 Million Won | Prepare for the Long, Long Winter | Financial Literacy Shapes Your Life | Receive a Salary After Retirement? | Pension Investments to Prepare for the Cold | A Salary for Yourself in 30 Years

Chapter 4: The Joy of Money Making Money

Capitalism Runs on Debt? | To Live Worry-Free, Start by Learning About Money | A Strong House with Good Debt | The Debt Horizon You Should Never Cross | The Traps Beginning Investors Fall Into | Let's Make Money Cowardly | The Golden Time for Asset Management

Chapter 5: The Happiness of Smart Consumption

FIRE Tribe members write happiness lists | Spending money wisely also requires practice | Don't hesitate to spend money that fulfills your dreams | Enjoy the pleasure of spending money little by little, often | Manage your life with a household budget

Appendix 1: Rich Habits Starting with Reading

Appendix 2: Recommended Books for the Stingy Money Study

Chapter 1: The Fun of Saving Money

Another name for a frugal person is a free person | A rich person's mindset that focuses on existence rather than possessions | Working hard in youth while earning money | Is that really necessary now? | Saving habits, self-esteem come first | The lifestyle habits of the wealthy, where saving is a strategy

Chapter 2: The Joy of Earning Your Own Money

A good attitude toward work | Finding what you love is the beginning | The strength to persevere until you start making money | People who are good at their jobs think like rich people | Financial freedom is easily achievable with just a salary | Bet on one thing | It's fun because you're good at it

Chapter 3: Money-Saving Habits of the Rich

YOLO and Work-Life Balance | The Most Powerful Weapon for Saving Money | Do I Really Need a House? | Let's Save Just 100 Million Won | Prepare for the Long, Long Winter | Financial Literacy Shapes Your Life | Receive a Salary After Retirement? | Pension Investments to Prepare for the Cold | A Salary for Yourself in 30 Years

Chapter 4: The Joy of Money Making Money

Capitalism Runs on Debt? | To Live Worry-Free, Start by Learning About Money | A Strong House with Good Debt | The Debt Horizon You Should Never Cross | The Traps Beginning Investors Fall Into | Let's Make Money Cowardly | The Golden Time for Asset Management

Chapter 5: The Happiness of Smart Consumption

FIRE Tribe members write happiness lists | Spending money wisely also requires practice | Don't hesitate to spend money that fulfills your dreams | Enjoy the pleasure of spending money little by little, often | Manage your life with a household budget

Appendix 1: Rich Habits Starting with Reading

Appendix 2: Recommended Books for the Stingy Money Study

Detailed image

Into the book

Actually, I too have been able to live without worrying about money thanks to my frugal habits rather than my investment management.

There are two ways to live without worrying about money.

The first is to spend less than you earn.

The second is to consistently save the money you save and spend it when you need it.

I realized this simple truth at the age of twenty and have lived my entire life as a frugal person, saving and saving.

As a happy frugal person, I achieved financial freedom at the age of 52 thanks to saving half of my salary throughout my life.

--- p.6

It's easier to save money than to earn it.

Earning money is possible only by satisfying other people's desires, but saving money is possible only by controlling your own desires.

You can make money by doing things that don't cost money or by making things that don't cost money into money.

--- p.25

If you force yourself to save and save money, you will become stressed.

You may think, 'Why can't I do what everyone else does?' and feel pathetic.

In that case, try changing the question.

'What do I enjoy doing?', 'Do I have to spend money to have fun?' Find activities that are enjoyable without spending money, activities that help me grow.

--- p.56

The same goes for investing.

Should I start saving or borrowing to invest? Start simple.

Saving money is the priority.

Before you go into debt and buy a hen, start by getting some eggs.

We need to collect them.

There are three risks to skipping the seed money process and investing with debt or even your soul to buy assets.

--- p.132

First, try to become friendly with the bank.

These days, it's easier than ever to open a savings account online without having to go to a branch. You can even search for interest rates and other conditions.

You can also compare interest rates on time deposits and other products on the Korea Federation of Banks consumer portal or the Financial Supervisory Service website.

Another way is to utilize various apps. When I have some extra money, I carefully compare interest rates and preferential terms through apps like Toss, Kakao Bank, or SB Talk Talk Plus created by the Korea Federation of Savings Banks, and then sign up for a time deposit.

These days, smartphone banking apps are so well-developed that you can compare interest rates and special deposit terms without having to visit each bank branch.

--- p.136

There is a person who decided to save 300 million won in retirement assets by the age of 60.

If you start saving at 6 percent compound interest, how much will your monthly contributions differ at ages 30, 40, and 50? A 30-year-old would need to save 350,000 won per month for 30 years, a 40-year-old would need to save 720,000 won per month for 20 years, and a 50-year-old would need to save 1.95 million won per month for 10 years.

The total amount you need to deposit to reach your target amount also varies.

If you start saving at age 30, your principal will be 126 million won, if you start at age 40, it will be 172 million won, and if you start at age 50, your principal will be a whopping 234 million won.

As the period gets longer, the proportion of the principal in the target amount decreases, and the proportion of compound interest increases.

A person who starts at age 30 will receive 200 million won in interest.

A person who starts at age 50 will receive 84 million won in interest.

So, saving time is important.

Here's why you need to start saving now.

It is always advantageous to start early, even when you are young.

--- p.149

If you are a new employee in your 20s, I recommend starting to save at least 5 percent of your monthly income for your pension.

If your monthly salary is 2 million won, just close your eyes and put 100,000 won into your pension account.

I put 50,000 won each into my pension savings and IRP.

The reason for dividing the account is to prepare for unforeseen circumstances.

Because when something urgent comes up, you only need to close one account.

It's best to start saving for your pension the moment you realize it.

The higher the target rate of return, the riskier it is, but the longer the target subscription period, the more advantageous it is.

--- pp.178-179

Assets have a snowball effect, meaning that the larger the asset, the faster it grows.

If you start saving money in your 30s and save steadily for 20 years, you can buy a house with a fairly high asset value without any debt by your 50s.

If you have also saved wisely for the three major pensions, you will be able to enjoy a long 30 years of retirement when you turn 65.

You can enjoy financial freedom while doing what you want.

There are two ways to live without worrying about money.

The first is to spend less than you earn.

The second is to consistently save the money you save and spend it when you need it.

I realized this simple truth at the age of twenty and have lived my entire life as a frugal person, saving and saving.

As a happy frugal person, I achieved financial freedom at the age of 52 thanks to saving half of my salary throughout my life.

--- p.6

It's easier to save money than to earn it.

Earning money is possible only by satisfying other people's desires, but saving money is possible only by controlling your own desires.

You can make money by doing things that don't cost money or by making things that don't cost money into money.

--- p.25

If you force yourself to save and save money, you will become stressed.

You may think, 'Why can't I do what everyone else does?' and feel pathetic.

In that case, try changing the question.

'What do I enjoy doing?', 'Do I have to spend money to have fun?' Find activities that are enjoyable without spending money, activities that help me grow.

--- p.56

The same goes for investing.

Should I start saving or borrowing to invest? Start simple.

Saving money is the priority.

Before you go into debt and buy a hen, start by getting some eggs.

We need to collect them.

There are three risks to skipping the seed money process and investing with debt or even your soul to buy assets.

--- p.132

First, try to become friendly with the bank.

These days, it's easier than ever to open a savings account online without having to go to a branch. You can even search for interest rates and other conditions.

You can also compare interest rates on time deposits and other products on the Korea Federation of Banks consumer portal or the Financial Supervisory Service website.

Another way is to utilize various apps. When I have some extra money, I carefully compare interest rates and preferential terms through apps like Toss, Kakao Bank, or SB Talk Talk Plus created by the Korea Federation of Savings Banks, and then sign up for a time deposit.

These days, smartphone banking apps are so well-developed that you can compare interest rates and special deposit terms without having to visit each bank branch.

--- p.136

There is a person who decided to save 300 million won in retirement assets by the age of 60.

If you start saving at 6 percent compound interest, how much will your monthly contributions differ at ages 30, 40, and 50? A 30-year-old would need to save 350,000 won per month for 30 years, a 40-year-old would need to save 720,000 won per month for 20 years, and a 50-year-old would need to save 1.95 million won per month for 10 years.

The total amount you need to deposit to reach your target amount also varies.

If you start saving at age 30, your principal will be 126 million won, if you start at age 40, it will be 172 million won, and if you start at age 50, your principal will be a whopping 234 million won.

As the period gets longer, the proportion of the principal in the target amount decreases, and the proportion of compound interest increases.

A person who starts at age 30 will receive 200 million won in interest.

A person who starts at age 50 will receive 84 million won in interest.

So, saving time is important.

Here's why you need to start saving now.

It is always advantageous to start early, even when you are young.

--- p.149

If you are a new employee in your 20s, I recommend starting to save at least 5 percent of your monthly income for your pension.

If your monthly salary is 2 million won, just close your eyes and put 100,000 won into your pension account.

I put 50,000 won each into my pension savings and IRP.

The reason for dividing the account is to prepare for unforeseen circumstances.

Because when something urgent comes up, you only need to close one account.

It's best to start saving for your pension the moment you realize it.

The higher the target rate of return, the riskier it is, but the longer the target subscription period, the more advantageous it is.

--- pp.178-179

Assets have a snowball effect, meaning that the larger the asset, the faster it grows.

If you start saving money in your 30s and save steadily for 20 years, you can buy a house with a fairly high asset value without any debt by your 50s.

If you have also saved wisely for the three major pensions, you will be able to enjoy a long 30 years of retirement when you turn 65.

You can enjoy financial freedom while doing what you want.

--- p.330

Publisher's Review

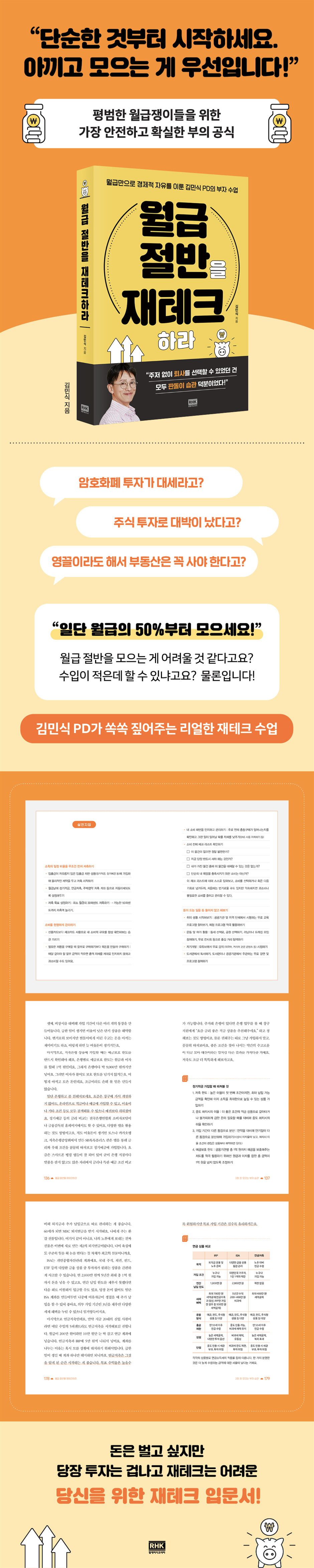

“Start with something simple!

“Saving and saving is the priority!”

The safest and most certain wealth formula for ordinary salaried workers.

During lunchtime, colleagues gather in groups of three or five and talk about the current Bitcoin price and which stocks are good for investment.

Someone else said that he took out a loan to buy a house.

I'm pretending to listen, but I don't really understand.

Honestly, my salary isn't that high, and I have a lot of expenses like rent and living expenses to cover. Isn't investing too much? I want to, but where do I even begin? My new book, "Invest Half Your Salary," is an introductory guide to financial planning that answers these very questions.

The author of this book, PD Kim Min-sik, is a drama PD who has directed numerous hit dramas such as “New Nonstop” and “My Secret Terrius,” and is also a bestselling author of “Have You Memorized an English Book?”

This time, he is introducing a book on financial investment.

Even the title is provocative.

'Invest half of your salary!'

The title alone might read as a call to immediately invest half of your monthly income in stocks or Bitcoin.

But rather the opposite is true.

The author emphasizes that you should never invest hastily.

This means that for ordinary salaried workers, it is easier to increase income through their main job than to make money through investments.

He says to leave investing to the experts and stick to your main job, while saving and saving half of your income unconditionally.

You might be thinking, "Is this possible?" or "It's difficult because my salary is low." However, based on my own know-how that I've been practicing since my 20s, I'll present a step-by-step guide on how to start saving half of my salary.

First is mindset.

Rather than owning something, it's about defining for yourself what makes your existence shine, what you like, and what kind of future you want.

This must be done first so that you can enjoy the fun of saving without sacrificing today, and only then can you sustain it for a long time.

To this end, we will generously share our know-how on how to do things that cost money without spending money, that is, how to enjoy things like self-development or hobbies for free.

The next step is 'Earning Well'. We suggest know-how and specific management methods for creating various income sources in hobbies or professional fields to earn well.

The last is 'collecting', which is the most core message that runs through the entire book.

The 'half salary investment' that the author talks about literally means saving 50% of your income.

It may not be easy to get 50% from the beginning, but we kindly introduce a method to start from 30% and gradually increase the proportion.

It provides detailed information on basic practices such as keeping a household account book, as well as checklists for managing spending wisely and how to use financial products to manage savings more efficiently.

Ultimately, it also provides a simple introduction to managing pension products, which are essential for achieving true financial freedom. You'll also learn about the considerations you need to consider when choosing products like IRPs and ISAs, even terms that may seem unfamiliar.

“Start investing half your salary as soon as possible!”

As introduced, the author of this book, PD Kim Min-sik, chose to retire at the age of 52 after working in various occupations and is now living as a pensioner, doing various jobs as a truly free person.

He says the happiest thing about achieving financial freedom is that he doesn't have to do things he doesn't want to do.

Because you can live the way you want.

And he says that all of this was possible thanks to his frugal habit of saving 50 percent of his income since his 20s.

Although it might seem difficult to call him a 'stingy person', he emphasizes that thanks to that habit, he was able to be happy in everything he did and explore new paths.

But even he had his trials.

The return on the retirement pension I signed up for in hopes of earning a little more profit was -16%.

Afterwards, he dug deep into the principles of money to properly understand why he had suffered investment losses, and based on that realization, he began to deeply contemplate why studying money is necessary in our lives and how to generate stable profits without losing his own money.

This book is a condensed crystallization of that time.

Ultimately, he added theory to everything he had practiced so far and came up with the simplest and safest way to invest.

The methods he proposes may seem ordinary, but that is precisely why they have the advantage of being usable by anyone.

In other words, this means that anyone can win if they consistently accumulate time.

It is said that anyone can get started right away because it contains the experience and know-how of someone who lived as a salaried worker all their life, bought an apartment in Gangnam with just their salary, and designed an asset portfolio to live off just their pension.

This book won't tell you where to invest right now. Rather, it'll help you avoid common pitfalls, drawing on its own experiences of success and failure. It'll also help you understand the fundamentals of how the capitalist economy works, helping you safely manage your money.

"Invest Half Your Salary" is a guidebook that teaches you how to achieve true financial freedom without losing your money. It will also help you prepare for the future while being most faithful to your life today, and guide you to greater life satisfaction and happiness.

“Saving and saving is the priority!”

The safest and most certain wealth formula for ordinary salaried workers.

During lunchtime, colleagues gather in groups of three or five and talk about the current Bitcoin price and which stocks are good for investment.

Someone else said that he took out a loan to buy a house.

I'm pretending to listen, but I don't really understand.

Honestly, my salary isn't that high, and I have a lot of expenses like rent and living expenses to cover. Isn't investing too much? I want to, but where do I even begin? My new book, "Invest Half Your Salary," is an introductory guide to financial planning that answers these very questions.

The author of this book, PD Kim Min-sik, is a drama PD who has directed numerous hit dramas such as “New Nonstop” and “My Secret Terrius,” and is also a bestselling author of “Have You Memorized an English Book?”

This time, he is introducing a book on financial investment.

Even the title is provocative.

'Invest half of your salary!'

The title alone might read as a call to immediately invest half of your monthly income in stocks or Bitcoin.

But rather the opposite is true.

The author emphasizes that you should never invest hastily.

This means that for ordinary salaried workers, it is easier to increase income through their main job than to make money through investments.

He says to leave investing to the experts and stick to your main job, while saving and saving half of your income unconditionally.

You might be thinking, "Is this possible?" or "It's difficult because my salary is low." However, based on my own know-how that I've been practicing since my 20s, I'll present a step-by-step guide on how to start saving half of my salary.

First is mindset.

Rather than owning something, it's about defining for yourself what makes your existence shine, what you like, and what kind of future you want.

This must be done first so that you can enjoy the fun of saving without sacrificing today, and only then can you sustain it for a long time.

To this end, we will generously share our know-how on how to do things that cost money without spending money, that is, how to enjoy things like self-development or hobbies for free.

The next step is 'Earning Well'. We suggest know-how and specific management methods for creating various income sources in hobbies or professional fields to earn well.

The last is 'collecting', which is the most core message that runs through the entire book.

The 'half salary investment' that the author talks about literally means saving 50% of your income.

It may not be easy to get 50% from the beginning, but we kindly introduce a method to start from 30% and gradually increase the proportion.

It provides detailed information on basic practices such as keeping a household account book, as well as checklists for managing spending wisely and how to use financial products to manage savings more efficiently.

Ultimately, it also provides a simple introduction to managing pension products, which are essential for achieving true financial freedom. You'll also learn about the considerations you need to consider when choosing products like IRPs and ISAs, even terms that may seem unfamiliar.

“Start investing half your salary as soon as possible!”

As introduced, the author of this book, PD Kim Min-sik, chose to retire at the age of 52 after working in various occupations and is now living as a pensioner, doing various jobs as a truly free person.

He says the happiest thing about achieving financial freedom is that he doesn't have to do things he doesn't want to do.

Because you can live the way you want.

And he says that all of this was possible thanks to his frugal habit of saving 50 percent of his income since his 20s.

Although it might seem difficult to call him a 'stingy person', he emphasizes that thanks to that habit, he was able to be happy in everything he did and explore new paths.

But even he had his trials.

The return on the retirement pension I signed up for in hopes of earning a little more profit was -16%.

Afterwards, he dug deep into the principles of money to properly understand why he had suffered investment losses, and based on that realization, he began to deeply contemplate why studying money is necessary in our lives and how to generate stable profits without losing his own money.

This book is a condensed crystallization of that time.

Ultimately, he added theory to everything he had practiced so far and came up with the simplest and safest way to invest.

The methods he proposes may seem ordinary, but that is precisely why they have the advantage of being usable by anyone.

In other words, this means that anyone can win if they consistently accumulate time.

It is said that anyone can get started right away because it contains the experience and know-how of someone who lived as a salaried worker all their life, bought an apartment in Gangnam with just their salary, and designed an asset portfolio to live off just their pension.

This book won't tell you where to invest right now. Rather, it'll help you avoid common pitfalls, drawing on its own experiences of success and failure. It'll also help you understand the fundamentals of how the capitalist economy works, helping you safely manage your money.

"Invest Half Your Salary" is a guidebook that teaches you how to achieve true financial freedom without losing your money. It will also help you prepare for the future while being most faithful to your life today, and guide you to greater life satisfaction and happiness.

GOODS SPECIFICS

- Date of issue: February 10, 2025

- Page count, weight, size: 348 pages | 506g | 145*205*22mm

- ISBN13: 9788925574004

- ISBN10: 8925574004

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)