Economic common sense that you will be fooled if you don't know it

|

Description

Book Introduction

“At least you should have this much economic common sense.

Wherever I go, I don't hear any complaints!

For 5 years, we have been consistently providing our readers with

A beloved introduction to economic common sense!

First published in 2019, 『Economic Common Sense: A Fool's Guide to Ignorance』 has been consistently supported by "economically illiterate" readers for over five years since its publication.

The author of this book, Hyunwoo Lee, runs the YouTube channel “Economic Common Sense: If You Don’t Know It, You’ll Be Fooled,” where he provides his subscribers with economic common sense that can help them lead a comfortable and happy life.

This 2024 revised edition encompasses the latest economic knowledge, including the high interest rate trend in the post-COVID-19 era, the resulting changes in various economic situations, the rapid changes in the international situation, and the emergence of new technologies.

This book, "Economic Common Sense: A Guide to Economics", which was selected for the Sejong Books' liberal arts category in the year it was published, was widely recognized for its content and structure, and will continue to serve as a reliable guide for many readers in developing their economic knowledge even in 2024.

Wherever I go, I don't hear any complaints!

For 5 years, we have been consistently providing our readers with

A beloved introduction to economic common sense!

First published in 2019, 『Economic Common Sense: A Fool's Guide to Ignorance』 has been consistently supported by "economically illiterate" readers for over five years since its publication.

The author of this book, Hyunwoo Lee, runs the YouTube channel “Economic Common Sense: If You Don’t Know It, You’ll Be Fooled,” where he provides his subscribers with economic common sense that can help them lead a comfortable and happy life.

This 2024 revised edition encompasses the latest economic knowledge, including the high interest rate trend in the post-COVID-19 era, the resulting changes in various economic situations, the rapid changes in the international situation, and the emergence of new technologies.

This book, "Economic Common Sense: A Guide to Economics", which was selected for the Sejong Books' liberal arts category in the year it was published, was widely recognized for its content and structure, and will continue to serve as a reliable guide for many readers in developing their economic knowledge even in 2024.

- You can preview some of the book's contents.

Preview

index

Author's Note for the 2024 Revised Edition - Are you ready for a new era of change?

Author's Note from the First Edition - The Minimum Economic Sense for Your Happiness

Prologue - If you've decided to start studying economics now

Chapter 1.

Economic common sense that will empty your pockets if you don't know it - Finance

01.

Money just passes by | 02.

Who sets the interest rates? | 03.

Why do interest rates keep changing? | 04.

Is money in the bank really safe? | 05.

The magic of increasing money | 06.

Money has different names? | 07.

Why do stock prices plummet when interest rates rise? | 08.

Why does real estate rise faster than my salary? | 09.

How to know when money is rising and falling? | 10.

No matter how much money you spend, it won't work? | 11.

Why should we reform the currency? | 12.

Why is the dollar so easy to use anywhere in the world? | 13.

Even experts find exchange rates difficult? | 14.

The crazy presence of exchange rates in our everyday lives | 15.

People who prospered due to the exchange rate, people who perished due to the exchange rate | 16.

Where can I check my credit? | 17.

Where should I put my money? | Rereading economic history. The ordeal brought on by the IMF foreign exchange crisis.

Chapter 2.

Economic common sense that the rich know - Investment

01.

How much have real estate prices in Seoul risen over the years? | 02.

Real estate policies that change frequently | 03.

Buying a home without my own money? What's so great about gap investing? | 04.

How to Read Real Estate Rising Signals | 05.

Investing in real estate without knowing the exchange rate? | 06.

Finding properties on the auction market | 07.

How to avoid having your deposit stolen? | 08.

A Really Easy 'Stock User Manual' | 09.

Want to try stocks? | 10.

You can't stop the Donghak ants by any means | 11.

Find undervalued stocks! | 12.

Short Selling Battle | 13.

Stock prices and exchange rates are at odds | 14.

So many fund types… What’s the difference? | 15.

Bonds with interest payable regularly | 16.

A Financial Expert's Guide to Gold Investment | 17.

I make money with Bitcoin | 18.

There are no citizens in the National Pension? | 19.

Our Attitude Toward Year-End Tax Settlement | 20.

The rich do 'setec' | 21.

Jewish Investment Secret: Insurance | Rereading Economic History

How did historical figures invest?

Chapter 3.

Economic common sense that makes economic articles more interesting - Macroeconomics

01.

Prices are rising, excluding my salary… What is inflation? | 02.

Wouldn't it be good if prices went down? | 03.

How are the prices of goods determined? | 04.

Freedom in the Market? Control? | 05.

Unite to Survive? A Good Monopoly | 06.

Where does our country's income level rank in the world? | 07.

Do you know the balance of payments? | 08.

How accurate are unemployment statistics? | 09.

Growth first or distribution first? | 10.

I'm glad I grew up like Bonobono | 11.

Can't we stop the asset market bubble? | 12.

My real estate is a bubble? | 13.

What is the fair price of real estate? | 14.

Real Estate PFs Become Time Bombs | 15.

Is welfare populism? | 16.

Now is the time to talk about basic income | 17.

Lack of effort? Lack of jobs? | 18.

Is low birth rate really that big of a problem? | Rereading Economic History.

The Great Depression in the United States that shocked the world

Chapter 4.

Economic common sense every office worker needs to know - Corporate activities

01.

What is the difference between a joint-stock company and a limited company? | 02.

What will my salary look like? | 03.

What are the four major insurance premiums deducted from my salary? | 04.

The Minimum Wage System: A Diverging Dream... Is There a Solution? | 05.

Why do office workers need to know accounting? | 06.

Corporate Cheating, Accounting Fraud | 07.

Why is our country's corporate governance structure so sick? | 08.

Raid the Company's Coffers | 09.

The corporate tax... should it be raised or lowered? | 10.

What are steamed rice and potatoes? | 11.

A two-faced union? | 12.

The Brutal History of Korean Labor | 13.

Why Low Interest Rates Create Zombie Firms | 14.

What happens when a company goes bankrupt? | Rereading Economic History.

The 2008 global financial crisis brought on by greed

Chapter 5.

Economic common sense: The world's money at a glance - Global Economy

01.

The Rise and Fall of Civilization: The Green New Deal | 02.

Why Japan is stuck in a low-growth swamp | 03.

How America Became the Center of the World Economy | 04.

Is America's "Reshoring" a Retrograde or a Transformation? | 05.

The End of China's 40-Year Boom | 06.

Russia and Ukraine's Future Energy Resources War | 07.

The existence of the euro is the euro's crisis | 08.

Why Oil Became the Devil's Tears | 09.

Let's find out! Global economic alliances | Rereading economic history.

The Economic History of a Cup of Coffee

Chapter 6.

Economic common sense that shows the future of money - New technology trends

01.

The 'Hydrogen Economy': Creating a Perfect Eco-Friendly Energy Source | 02.

How fast is 5G? | 03.

The emergence of smart cars | 04.

The Dream Computer: The Quantum Computer | 05.

Can Blockchain Enable Secure Financial Transactions? | 06.

The emergence of ChatGPT: Is the beginning of the AI era the end of the human era? | 07.

Where is El Dorado in the digital world? | 08.

What Drives Future Wealth? | Rereading Economic History.

The Age of Exploration: The First Step in Writing a New History of Capital

Author's Note from the First Edition - The Minimum Economic Sense for Your Happiness

Prologue - If you've decided to start studying economics now

Chapter 1.

Economic common sense that will empty your pockets if you don't know it - Finance

01.

Money just passes by | 02.

Who sets the interest rates? | 03.

Why do interest rates keep changing? | 04.

Is money in the bank really safe? | 05.

The magic of increasing money | 06.

Money has different names? | 07.

Why do stock prices plummet when interest rates rise? | 08.

Why does real estate rise faster than my salary? | 09.

How to know when money is rising and falling? | 10.

No matter how much money you spend, it won't work? | 11.

Why should we reform the currency? | 12.

Why is the dollar so easy to use anywhere in the world? | 13.

Even experts find exchange rates difficult? | 14.

The crazy presence of exchange rates in our everyday lives | 15.

People who prospered due to the exchange rate, people who perished due to the exchange rate | 16.

Where can I check my credit? | 17.

Where should I put my money? | Rereading economic history. The ordeal brought on by the IMF foreign exchange crisis.

Chapter 2.

Economic common sense that the rich know - Investment

01.

How much have real estate prices in Seoul risen over the years? | 02.

Real estate policies that change frequently | 03.

Buying a home without my own money? What's so great about gap investing? | 04.

How to Read Real Estate Rising Signals | 05.

Investing in real estate without knowing the exchange rate? | 06.

Finding properties on the auction market | 07.

How to avoid having your deposit stolen? | 08.

A Really Easy 'Stock User Manual' | 09.

Want to try stocks? | 10.

You can't stop the Donghak ants by any means | 11.

Find undervalued stocks! | 12.

Short Selling Battle | 13.

Stock prices and exchange rates are at odds | 14.

So many fund types… What’s the difference? | 15.

Bonds with interest payable regularly | 16.

A Financial Expert's Guide to Gold Investment | 17.

I make money with Bitcoin | 18.

There are no citizens in the National Pension? | 19.

Our Attitude Toward Year-End Tax Settlement | 20.

The rich do 'setec' | 21.

Jewish Investment Secret: Insurance | Rereading Economic History

How did historical figures invest?

Chapter 3.

Economic common sense that makes economic articles more interesting - Macroeconomics

01.

Prices are rising, excluding my salary… What is inflation? | 02.

Wouldn't it be good if prices went down? | 03.

How are the prices of goods determined? | 04.

Freedom in the Market? Control? | 05.

Unite to Survive? A Good Monopoly | 06.

Where does our country's income level rank in the world? | 07.

Do you know the balance of payments? | 08.

How accurate are unemployment statistics? | 09.

Growth first or distribution first? | 10.

I'm glad I grew up like Bonobono | 11.

Can't we stop the asset market bubble? | 12.

My real estate is a bubble? | 13.

What is the fair price of real estate? | 14.

Real Estate PFs Become Time Bombs | 15.

Is welfare populism? | 16.

Now is the time to talk about basic income | 17.

Lack of effort? Lack of jobs? | 18.

Is low birth rate really that big of a problem? | Rereading Economic History.

The Great Depression in the United States that shocked the world

Chapter 4.

Economic common sense every office worker needs to know - Corporate activities

01.

What is the difference between a joint-stock company and a limited company? | 02.

What will my salary look like? | 03.

What are the four major insurance premiums deducted from my salary? | 04.

The Minimum Wage System: A Diverging Dream... Is There a Solution? | 05.

Why do office workers need to know accounting? | 06.

Corporate Cheating, Accounting Fraud | 07.

Why is our country's corporate governance structure so sick? | 08.

Raid the Company's Coffers | 09.

The corporate tax... should it be raised or lowered? | 10.

What are steamed rice and potatoes? | 11.

A two-faced union? | 12.

The Brutal History of Korean Labor | 13.

Why Low Interest Rates Create Zombie Firms | 14.

What happens when a company goes bankrupt? | Rereading Economic History.

The 2008 global financial crisis brought on by greed

Chapter 5.

Economic common sense: The world's money at a glance - Global Economy

01.

The Rise and Fall of Civilization: The Green New Deal | 02.

Why Japan is stuck in a low-growth swamp | 03.

How America Became the Center of the World Economy | 04.

Is America's "Reshoring" a Retrograde or a Transformation? | 05.

The End of China's 40-Year Boom | 06.

Russia and Ukraine's Future Energy Resources War | 07.

The existence of the euro is the euro's crisis | 08.

Why Oil Became the Devil's Tears | 09.

Let's find out! Global economic alliances | Rereading economic history.

The Economic History of a Cup of Coffee

Chapter 6.

Economic common sense that shows the future of money - New technology trends

01.

The 'Hydrogen Economy': Creating a Perfect Eco-Friendly Energy Source | 02.

How fast is 5G? | 03.

The emergence of smart cars | 04.

The Dream Computer: The Quantum Computer | 05.

Can Blockchain Enable Secure Financial Transactions? | 06.

The emergence of ChatGPT: Is the beginning of the AI era the end of the human era? | 07.

Where is El Dorado in the digital world? | 08.

What Drives Future Wealth? | Rereading Economic History.

The Age of Exploration: The First Step in Writing a New History of Capital

Detailed image

Into the book

Now we need to change our thinking.

We need to shift the question from "When will interest rates fall again?" to "How do we prepare for the new era ahead?"

Interest rate changes will alter the global money flow, and as a result, companies will move to seek new wealth, bringing about significant changes in jobs and asset markets.

This is a huge trend that individuals cannot change.

It is our choice whether to be swept away by the flow or to ride the changing times.

--- p.4~5, from “Author’s Note for the 2024 Revised Edition - Are You Ready for a New Era of Change?”

This is also how interest rates affect our economy.

If interest rates are high, our money in our savings account will grow well.

However, if the interest rate is too high, many companies may suffer from a cash drought and go bankrupt, and conversely, if the interest rate is too low, the money in our bank accounts will not grow.

I need to be well-versed in interest rates and market conditions to be able to manage my real estate and stock investments well.

--- p.43, 「1-7.

From "Why do stock prices plummet when interest rates rise?"

What should you do if your lease expires and you need to move out, but your landlord says they can't return your deposit because they don't have the funds? This can be a very difficult situation for tenants.

If the worst happens and the landlord's house goes up for auction, I may only get a portion of my deposit back.

To prepare for such situations, tenants must obtain a confirmation date from the community center when they first find a home and move in.

This is a necessary procedure to ensure that my rights are protected to a minimum in the event of the unfortunate event of my house being auctioned off later.

--- p.124~125, 「2-7.

How to avoid having your deposit for rent or monthly rent stolen?

Can we artificially set a fair real estate price? It's generally believed that policies designed to stimulate the real estate market, such as lowering interest rates, can lead to a rise in the real estate market.

But this is half true and half false.

Cutting interest rates means the economy is already in bad shape.

It's about supplying oxygen called money through interest rate cuts.

It's like giving artificial respiration to a patient who has collapsed.

--- p.246, 「3-13.

From "What is the fair price of real estate?"

Zombie companies, which hinder long-term growth, are dead but not dead.

Restructuring is necessary to get rid of zombie companies.

This could cause many people to lose their jobs and have a serious impact on the local economy.

But if we delay restructuring because we don't want short-term pain, we will face greater pain.

It's like if you resist going to the dentist to get your rotten tooth pulled, you'll end up with a bigger illness.

--- p.321~322, 「4-13.

From "Why Low Interest Rates Create Zombie Companies"

China's economic development, which had been growing without a hitch for nearly 40 years, seemed unstoppable.

But recently, the Chinese economy has also been showing warning signs.

The signal is the Chinese real estate market.

China's real estate market accounts for 30% of China's GDP.

It is the combined size of all related industries, including real estate sales, design, construction, steel and building materials, home appliances, and interior design.

Additionally, real estate accounts for approximately 75% of Chinese household assets.

A slump in China's real estate market means a slowdown in China's domestic market.

--- p.350, 「5-5.

From "The End of China's 40-Year Boom"

If Russia takes away Ukraine's resources, the only place at risk is Western Europe.

In the meantime, they have been jointly developing resources with Ukraine to counter resource powerhouses Russia and China.

If the war disrupts the plans of Western European countries, they will have to rely even more on Russia and China for various resources and energy.

Russia's weaponization of energy and resources could accelerate in the future.

--- p.355, 「5-6.

From “Russia and Ukraine’s Future Energy Resources War”

Automotive digital technology has traditionally focused on optimizing in-vehicle functions.

But in recent years, it has evolved to connect with the outside world and enhance the vehicle's driving capabilities.

These vehicles are capable of self-operation and maintenance.

Additionally, onboard sensors and internet connectivity can be used to maximize consumer convenience and safety.

--- p.355, 「6-3.

From "The Emergence of Smart Cars"

The research uncovered something interesting.

The more tasks utilize large amounts of data, the more AI algorithms can perform the task better than humans.

By industry, AI has been superior to humans in high-productivity industries such as information and communications technology, specialized science and technology, and manufacturing.

On the other hand, it was found that people have the upper hand in jobs that involve meeting and forming relationships with people, such as service industry workers and religious workers.

We need to shift the question from "When will interest rates fall again?" to "How do we prepare for the new era ahead?"

Interest rate changes will alter the global money flow, and as a result, companies will move to seek new wealth, bringing about significant changes in jobs and asset markets.

This is a huge trend that individuals cannot change.

It is our choice whether to be swept away by the flow or to ride the changing times.

--- p.4~5, from “Author’s Note for the 2024 Revised Edition - Are You Ready for a New Era of Change?”

This is also how interest rates affect our economy.

If interest rates are high, our money in our savings account will grow well.

However, if the interest rate is too high, many companies may suffer from a cash drought and go bankrupt, and conversely, if the interest rate is too low, the money in our bank accounts will not grow.

I need to be well-versed in interest rates and market conditions to be able to manage my real estate and stock investments well.

--- p.43, 「1-7.

From "Why do stock prices plummet when interest rates rise?"

What should you do if your lease expires and you need to move out, but your landlord says they can't return your deposit because they don't have the funds? This can be a very difficult situation for tenants.

If the worst happens and the landlord's house goes up for auction, I may only get a portion of my deposit back.

To prepare for such situations, tenants must obtain a confirmation date from the community center when they first find a home and move in.

This is a necessary procedure to ensure that my rights are protected to a minimum in the event of the unfortunate event of my house being auctioned off later.

--- p.124~125, 「2-7.

How to avoid having your deposit for rent or monthly rent stolen?

Can we artificially set a fair real estate price? It's generally believed that policies designed to stimulate the real estate market, such as lowering interest rates, can lead to a rise in the real estate market.

But this is half true and half false.

Cutting interest rates means the economy is already in bad shape.

It's about supplying oxygen called money through interest rate cuts.

It's like giving artificial respiration to a patient who has collapsed.

--- p.246, 「3-13.

From "What is the fair price of real estate?"

Zombie companies, which hinder long-term growth, are dead but not dead.

Restructuring is necessary to get rid of zombie companies.

This could cause many people to lose their jobs and have a serious impact on the local economy.

But if we delay restructuring because we don't want short-term pain, we will face greater pain.

It's like if you resist going to the dentist to get your rotten tooth pulled, you'll end up with a bigger illness.

--- p.321~322, 「4-13.

From "Why Low Interest Rates Create Zombie Companies"

China's economic development, which had been growing without a hitch for nearly 40 years, seemed unstoppable.

But recently, the Chinese economy has also been showing warning signs.

The signal is the Chinese real estate market.

China's real estate market accounts for 30% of China's GDP.

It is the combined size of all related industries, including real estate sales, design, construction, steel and building materials, home appliances, and interior design.

Additionally, real estate accounts for approximately 75% of Chinese household assets.

A slump in China's real estate market means a slowdown in China's domestic market.

--- p.350, 「5-5.

From "The End of China's 40-Year Boom"

If Russia takes away Ukraine's resources, the only place at risk is Western Europe.

In the meantime, they have been jointly developing resources with Ukraine to counter resource powerhouses Russia and China.

If the war disrupts the plans of Western European countries, they will have to rely even more on Russia and China for various resources and energy.

Russia's weaponization of energy and resources could accelerate in the future.

--- p.355, 「5-6.

From “Russia and Ukraine’s Future Energy Resources War”

Automotive digital technology has traditionally focused on optimizing in-vehicle functions.

But in recent years, it has evolved to connect with the outside world and enhance the vehicle's driving capabilities.

These vehicles are capable of self-operation and maintenance.

Additionally, onboard sensors and internet connectivity can be used to maximize consumer convenience and safety.

--- p.355, 「6-3.

From "The Emergence of Smart Cars"

The research uncovered something interesting.

The more tasks utilize large amounts of data, the more AI algorithms can perform the task better than humans.

By industry, AI has been superior to humans in high-productivity industries such as information and communications technology, specialized science and technology, and manufacturing.

On the other hand, it was found that people have the upper hand in jobs that involve meeting and forming relationships with people, such as service industry workers and religious workers.

--- p.394, 「6-6.

With the advent of ChatGPT, will the beginning of the AI era also be the end of the human era?

With the advent of ChatGPT, will the beginning of the AI era also be the end of the human era?

Publisher's Review

When it comes to the economy, the first thing that comes to mind is

A Level 0 Economics Guide for Beginners

There's one skill that many adults consider absolutely essential, even though they never learned it properly in school: economic education.

From accurately assessing one's income and expenses and developing a financial management plan to understanding the domestic and international economic landscape surrounding us, financial acumen has become an essential skill for any modern person.

It has become as important to look at money and understand it as it is to earn money.

There is only one reason why author Lee Hyeon-woo, author of the revised edition of “Economic Common Sense That Will Make You a Fool If You Don’t Know” and an economic YouTuber, consistently spreads content such as books and videos to the general public or those who don’t know much about economics.

Because basic economic knowledge is an essential shield that keeps us safe and warm in our daily lives.

From salary savings and interest rates, to stocks and real estate

Chat GPT, self-driving cars, and a future with AI

Everything you need to know about economics, condensed into one book!

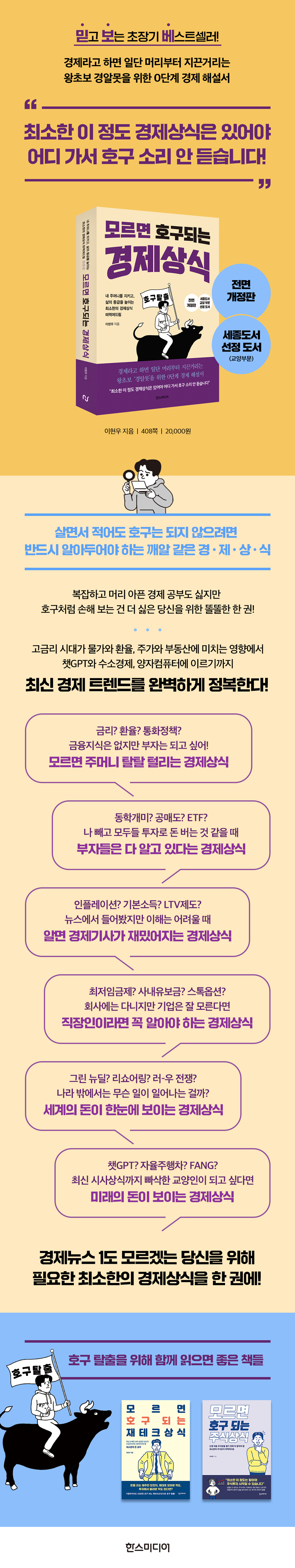

The greatest appeal of this book, "Economic Common Sense: A Fool's Guide to Ignorance," is that it contains a wealth of background knowledge surrounding our economic activities in a single volume.

Starting with the story of banks and interest rates where we save our salaries, it covers essential knowledge for personal economic life such as exchange rates and credit ratings, as well as information on various investment options where we can make money even while playing, such as stocks, real estate, virtual currency, and gold. It also covers the global economy including the US, China, Japan, and Europe, as well as new technologies such as AI and self-driving cars.

The most notable feature of this 2024 revised edition is that it reflects various timely issues that have arisen over the past year or two.

The content reflects not only changes in various statistical figures, but also rapid international changes that have occurred in the past and new technologies that have rapidly penetrated our daily lives.

The book mentions the ripple effects of political and economic issues in other countries, such as the reshoring of advanced countries including the United States, the end of China's 40-year economic boom that was thought to last forever, and the ongoing Russia-Ukraine war that has been going on since 2022, on our economy, and examines how new technologies such as Chat GPT, self-driving cars, and generative AI should be viewed from an economic perspective. This will help readers awaken their latest economic sense.

A Level 0 Economics Guide for Beginners

There's one skill that many adults consider absolutely essential, even though they never learned it properly in school: economic education.

From accurately assessing one's income and expenses and developing a financial management plan to understanding the domestic and international economic landscape surrounding us, financial acumen has become an essential skill for any modern person.

It has become as important to look at money and understand it as it is to earn money.

There is only one reason why author Lee Hyeon-woo, author of the revised edition of “Economic Common Sense That Will Make You a Fool If You Don’t Know” and an economic YouTuber, consistently spreads content such as books and videos to the general public or those who don’t know much about economics.

Because basic economic knowledge is an essential shield that keeps us safe and warm in our daily lives.

From salary savings and interest rates, to stocks and real estate

Chat GPT, self-driving cars, and a future with AI

Everything you need to know about economics, condensed into one book!

The greatest appeal of this book, "Economic Common Sense: A Fool's Guide to Ignorance," is that it contains a wealth of background knowledge surrounding our economic activities in a single volume.

Starting with the story of banks and interest rates where we save our salaries, it covers essential knowledge for personal economic life such as exchange rates and credit ratings, as well as information on various investment options where we can make money even while playing, such as stocks, real estate, virtual currency, and gold. It also covers the global economy including the US, China, Japan, and Europe, as well as new technologies such as AI and self-driving cars.

The most notable feature of this 2024 revised edition is that it reflects various timely issues that have arisen over the past year or two.

The content reflects not only changes in various statistical figures, but also rapid international changes that have occurred in the past and new technologies that have rapidly penetrated our daily lives.

The book mentions the ripple effects of political and economic issues in other countries, such as the reshoring of advanced countries including the United States, the end of China's 40-year economic boom that was thought to last forever, and the ongoing Russia-Ukraine war that has been going on since 2022, on our economy, and examines how new technologies such as Chat GPT, self-driving cars, and generative AI should be viewed from an economic perspective. This will help readers awaken their latest economic sense.

GOODS SPECIFICS

- Date of issue: January 30, 2024

- Page count, weight, size: 408 pages | 698g | 152*215*25mm

- ISBN13: 9791193712078

- ISBN10: 1193712076

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)