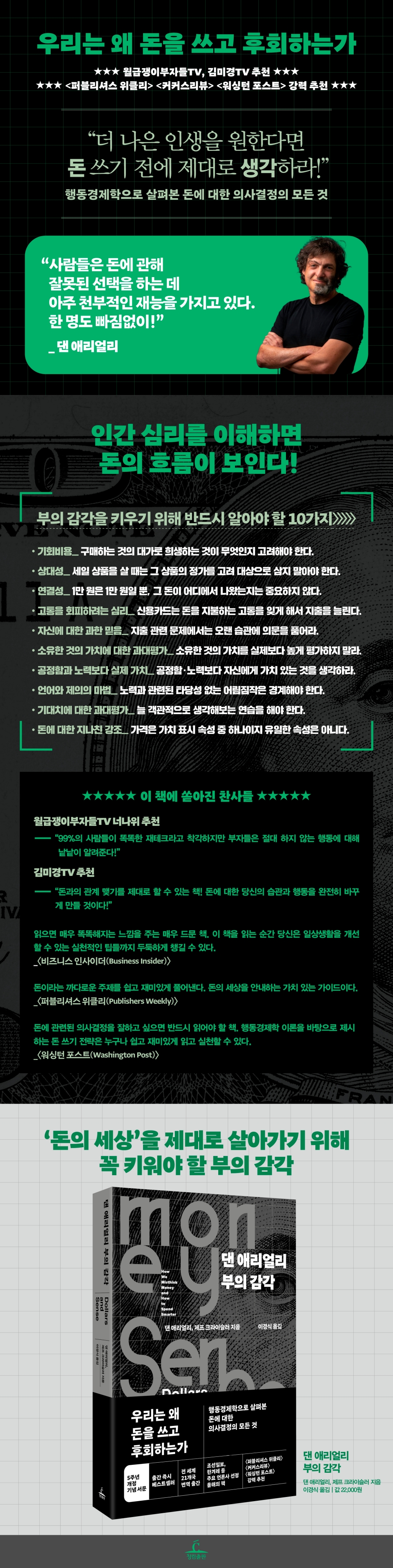

Dan Ariely's Sense of Wealth

|

Description

Book Introduction

“Why do we regret spending money?”

Everything You Need to Know About Money Decisions from a Behavioral Economics Perspective

Amidst the global economic crisis, there is more interest than ever in how to spend money wisely.

When do you feel satisfied with your spending? Why do people regret spending money? How can we use money most effectively?

This book is about the dangerous relationship between humans and money, which Professor Dan Ariely, known for his book "The Unconventional Economics," realized while observing people who constantly make wrong decisions regarding money.

If we could only follow his example and realize how irrational and, in other words, emotional our human sense of economic activity, especially when it comes to money, is—“People have a natural talent for making bad choices when it comes to money,” he says—we could overcome our instincts and reestablish a sound standard for money and decision-making.

Everything You Need to Know About Money Decisions from a Behavioral Economics Perspective

Amidst the global economic crisis, there is more interest than ever in how to spend money wisely.

When do you feel satisfied with your spending? Why do people regret spending money? How can we use money most effectively?

This book is about the dangerous relationship between humans and money, which Professor Dan Ariely, known for his book "The Unconventional Economics," realized while observing people who constantly make wrong decisions regarding money.

If we could only follow his example and realize how irrational and, in other words, emotional our human sense of economic activity, especially when it comes to money, is—“People have a natural talent for making bad choices when it comes to money,” he says—we could overcome our instincts and reestablish a sound standard for money and decision-making.

- You can preview some of the book's contents.

Preview

index

Preface to the revised edition.

Can money be used for more than just money?

introduction.

The most important thing in life

Part 1.

Why We Spend Money and Regret It: Why Financial Decisions Are So Difficult

01 / We don't know money

02 / What is Money?

03 / You need to know the value to use it properly.

Part 2.

10 Things You Must Know About Money _ How to Stop Evaluating Value Without Value

04 / Everything is relative

05 / Money is fungible

06 / Habits of avoiding pain

07 / The misfortune of foolishly believing in oneself

08 / We overestimate the value of what we own.

09 / Excessive concern about fairness and effort

10 / The magic of language and offering

11 / Why You Must Exceed Expectations

12 / People who can't overcome temptation

13 / Money, thinking too much is a problem

Part 3.

How to Develop a Sense of Wealth - The Most Important Money Skill in Life

14 / Spend your money where your heart desires.

15 / Free has a price

16 / Exercise self-control for the future

17 / Various ways to save money

18 / I need time to think

Acknowledgements

main

Can money be used for more than just money?

introduction.

The most important thing in life

Part 1.

Why We Spend Money and Regret It: Why Financial Decisions Are So Difficult

01 / We don't know money

02 / What is Money?

03 / You need to know the value to use it properly.

Part 2.

10 Things You Must Know About Money _ How to Stop Evaluating Value Without Value

04 / Everything is relative

05 / Money is fungible

06 / Habits of avoiding pain

07 / The misfortune of foolishly believing in oneself

08 / We overestimate the value of what we own.

09 / Excessive concern about fairness and effort

10 / The magic of language and offering

11 / Why You Must Exceed Expectations

12 / People who can't overcome temptation

13 / Money, thinking too much is a problem

Part 3.

How to Develop a Sense of Wealth - The Most Important Money Skill in Life

14 / Spend your money where your heart desires.

15 / Free has a price

16 / Exercise self-control for the future

17 / Various ways to save money

18 / I need time to think

Acknowledgements

main

Detailed image

Into the book

People are surprised when you remind them that there are alternative ways to spend their money.

The fact that they are so surprised means that they do not normally think about alternative consumption.

And not considering alternatives means not considering opportunity costs.

This tendency to ignore opportunity cost also indicates a fundamental flaw in our human thinking.

This reveals that the wonderful property of money—the ability to exchange it for a variety of choices, now or in the future—is also why our behavior around money is so problematic.

When spending money, you should think in terms of opportunity cost, meaning that if you spend money on something now, you have to give up something else, but this kind of thinking is too abstract and difficult.

So we don't think like that.

--- p.42 「02.

From "What is Money"

Which of the following two dress shirts would you choose? One has a price tag of $60, and the other has a price tag of $100 with the words "40% off! Only $60!"

Actually, it doesn't matter either way.

No matter what the price tag says, a $60 item is a $60 item.

However, because the concept of relativity operates deep in the mind, people do not view the two prices above as the same.

So, regular customers like Aunt Susan will always choose shirts that are on sale (and will be outraged by price tags that simply say $60 without any additional text).

But is this behavior logical? No.

Is this something that can be fully understood if you understand the concept of relativity? Yes.

Does this happen often? Yes.

Is this important enough to oust the CEO? Absolutely.

--- p.58 「04.

From "Everything is relative"

Yet, people feel they pay no travel expenses whenever they use their cars (whether it's to go shopping, take a weekend trip out of town, or visit friends who live in the countryside).

Therefore, people who live in the city and own a car enjoy the feeling of saving money on taxis or rental cars, as well as the feeling of enjoying free travel.

Although we do incur expenses related to our cars at regular intervals, we do not incur any direct expenses related to this activity (other than gas) when we travel by car.

The same goes for using a timeshare system to secure accommodations for your vacation.

This system allows you to pay a significant amount in advance and then secure the right to use the property on your desired dates. Unlike the initial payment, the actual use is free! However, it's not truly free. While you may be using a condo or resort room for free during your vacation, the cost has already been paid.

This amount is usually paid once a year, but it feels like free when you use the room.

This is because the time of purchase and the time of actual use are different.

_pp.114-115 「05.

From "Money is fungible"

Prepaid cards are also an inherent part of the experience, like gift cards or casino chips.

When money goes into gift cards to Starbucks, Amazon, or Babies "R" Us, we assign that money to our spending list.

If you exchange $20 in cash for a Starbucks card, that $20 is now fixed as money to be used to buy a latte or a scone, not, say, a Coca-Cola or Chinese food.

Once the money is allocated to that category of account, we feel like the payment has already been made.

That's why when you buy something with a gift card, you're not spending your own money, so you don't feel guilty.

Normally, when I buy coffee out of pocket, I choose simple items, but when I use a gift card, I splurge on expensive items like a venti soy chai latte or a biscotti.

Because it feels like it's free.

When you use a gift card, you don't feel any pain in paying.

Because the emotions a gift card evokes are completely different from the emotions you feel when paying with cash.

--- p.142 「06.

From “Habits of Avoiding Pain”

According to the basic laws of supply and demand, it is natural that umbrellas are more expensive when it rains because demand is high, and it is natural that Uber fares are higher when a blizzard hits because supply is low and demand is high.

So it's perfectly natural to pay a higher price.

The value of services like changing engine oil or opening locked doors should have nothing to do with fairness.

All that matters is how quickly and efficiently the work is completed.

But when people are asked to pay a high price for something that seems easy and doesn't take much time, they get upset, glare, stomp their feet, kick the dirt, or threaten to sabotage the business.

Why is that? Because they are fools who believe that prices should be fair.

People reject something when they believe it is unfair, no matter how good its value may be.

Punishing unfairness, and sometimes punishing yourself in the process (like James, who chose to get drenched when he could have avoided it).

--- p.238 「09.

From “Excessive Concerns about Fairness and Effort”

They spent a lot of time trying to figure out how to spend their money, but they still struggled.

So, they were all fools, not just because they failed to grasp the complexities of the world of money, not just because they were obsessed with value cues that were completely irrelevant, and not just because they made mistakes.

It's because I spent too much time worrying about money.

--- p.364 「13.

From "Money, Thinking Too Much is a Trouble"

However, mortgage product sellers know that people struggle with calculations when faced with choices in multidimensional situations.

So, they shout 'quickly!'

So, we are adding more and more options to our loan products.

The rationale for providing a variety of information to 'enable consumers to make diverse choices' is plausible.

But having more information and more options ultimately means people make more mistakes.

The fact that they are so surprised means that they do not normally think about alternative consumption.

And not considering alternatives means not considering opportunity costs.

This tendency to ignore opportunity cost also indicates a fundamental flaw in our human thinking.

This reveals that the wonderful property of money—the ability to exchange it for a variety of choices, now or in the future—is also why our behavior around money is so problematic.

When spending money, you should think in terms of opportunity cost, meaning that if you spend money on something now, you have to give up something else, but this kind of thinking is too abstract and difficult.

So we don't think like that.

--- p.42 「02.

From "What is Money"

Which of the following two dress shirts would you choose? One has a price tag of $60, and the other has a price tag of $100 with the words "40% off! Only $60!"

Actually, it doesn't matter either way.

No matter what the price tag says, a $60 item is a $60 item.

However, because the concept of relativity operates deep in the mind, people do not view the two prices above as the same.

So, regular customers like Aunt Susan will always choose shirts that are on sale (and will be outraged by price tags that simply say $60 without any additional text).

But is this behavior logical? No.

Is this something that can be fully understood if you understand the concept of relativity? Yes.

Does this happen often? Yes.

Is this important enough to oust the CEO? Absolutely.

--- p.58 「04.

From "Everything is relative"

Yet, people feel they pay no travel expenses whenever they use their cars (whether it's to go shopping, take a weekend trip out of town, or visit friends who live in the countryside).

Therefore, people who live in the city and own a car enjoy the feeling of saving money on taxis or rental cars, as well as the feeling of enjoying free travel.

Although we do incur expenses related to our cars at regular intervals, we do not incur any direct expenses related to this activity (other than gas) when we travel by car.

The same goes for using a timeshare system to secure accommodations for your vacation.

This system allows you to pay a significant amount in advance and then secure the right to use the property on your desired dates. Unlike the initial payment, the actual use is free! However, it's not truly free. While you may be using a condo or resort room for free during your vacation, the cost has already been paid.

This amount is usually paid once a year, but it feels like free when you use the room.

This is because the time of purchase and the time of actual use are different.

_pp.114-115 「05.

From "Money is fungible"

Prepaid cards are also an inherent part of the experience, like gift cards or casino chips.

When money goes into gift cards to Starbucks, Amazon, or Babies "R" Us, we assign that money to our spending list.

If you exchange $20 in cash for a Starbucks card, that $20 is now fixed as money to be used to buy a latte or a scone, not, say, a Coca-Cola or Chinese food.

Once the money is allocated to that category of account, we feel like the payment has already been made.

That's why when you buy something with a gift card, you're not spending your own money, so you don't feel guilty.

Normally, when I buy coffee out of pocket, I choose simple items, but when I use a gift card, I splurge on expensive items like a venti soy chai latte or a biscotti.

Because it feels like it's free.

When you use a gift card, you don't feel any pain in paying.

Because the emotions a gift card evokes are completely different from the emotions you feel when paying with cash.

--- p.142 「06.

From “Habits of Avoiding Pain”

According to the basic laws of supply and demand, it is natural that umbrellas are more expensive when it rains because demand is high, and it is natural that Uber fares are higher when a blizzard hits because supply is low and demand is high.

So it's perfectly natural to pay a higher price.

The value of services like changing engine oil or opening locked doors should have nothing to do with fairness.

All that matters is how quickly and efficiently the work is completed.

But when people are asked to pay a high price for something that seems easy and doesn't take much time, they get upset, glare, stomp their feet, kick the dirt, or threaten to sabotage the business.

Why is that? Because they are fools who believe that prices should be fair.

People reject something when they believe it is unfair, no matter how good its value may be.

Punishing unfairness, and sometimes punishing yourself in the process (like James, who chose to get drenched when he could have avoided it).

--- p.238 「09.

From “Excessive Concerns about Fairness and Effort”

They spent a lot of time trying to figure out how to spend their money, but they still struggled.

So, they were all fools, not just because they failed to grasp the complexities of the world of money, not just because they were obsessed with value cues that were completely irrelevant, and not just because they made mistakes.

It's because I spent too much time worrying about money.

--- p.364 「13.

From "Money, Thinking Too Much is a Trouble"

However, mortgage product sellers know that people struggle with calculations when faced with choices in multidimensional situations.

So, they shout 'quickly!'

So, we are adding more and more options to our loan products.

The rationale for providing a variety of information to 'enable consumers to make diverse choices' is plausible.

But having more information and more options ultimately means people make more mistakes.

--- p.403 「17.

Among the various ways to save money

Among the various ways to save money

Publisher's Review

★★★★★ 5th Anniversary Revised Edition ★★★★★

★★★ Bestseller upon publication ★★★

★★★ Published in 21 countries worldwide ★★★

★★★ Recommended by Salaryman Rich TV and Kim Mi-kyung TV ★★★

★★★ Chosun Ilbo, Hankyoreh, and other major media outlets selected as Book of the Year ★★★

★★★ [Publisher's Weekly] [Kirkus Reviews] [The Washington Post] Highly Recommended ★★★

You are spending reasonably

Can you be sure?

_10 Things You Must Know to Avoid Spending Money Without Considering Its Value

√ Which saves you more money: buying things with a credit card or buying things with cash?

√ Who would you rather pay more for: a locksmith who can open a locked door in 2 minutes or a locksmith who can open a locked door in 1 hour?

√ What is the mindset of people who are reluctant to buy a 1,000 won bottle of water at a local convenience store, but do not hesitate to buy a 4,000 won bottle of water when traveling?

We actually know the answer to this question.

So why do people buy things with credit cards even when they already know the answer? Why do they feel bad about paying someone who wasted their time, yet still feel bad about paying someone who fixed their door in two minutes? Why do people who are so stingy with water so mindlessly spend money on expensive food and drinks on summer vacation? We all make mistakes when it comes to spending money.

This is because I think exactly the following:

· We ignore opportunity cost: If we buy something now, we must always keep in mind what we are sacrificing in return.

· We forget that everything is relative: When buying a sale item, you shouldn't consider its regular price.

· We separate and isolate what is connected: We must spend 10,000 won, keeping in mind that it is just 10,000 won.

It doesn't matter where the money came from.

· We avoid pain: Credit cards increase spending by helping us forget the pain of paying.

Keep this in mind.

· We believe in ourselves: If nothing else, when it comes to spending, we need to question our long-held habits.

· We overestimate the value of what we own: Once we own something, we tend to overestimate its value and are reluctant to give it up. Sellers exploit this to sell us products.

· We are concerned about fairness and effort: Don't get caught up in debating whether something is priced fairly.

Instead, think about what is valuable to you.

· We believe in the magic of language and offering: we must be wary of unwarranted guesswork related to effort.

There is no reason why we should pay for flashy rhetoric.

· We overestimate our expectations: We must always practice being objective so that others do not manipulate us.

· We overemphasize money: Price is one of the attributes that indicates value, but not the only one.

When making decisions, remember that price is just a number.

The important thing to remember is that thinking more about money doesn't necessarily mean you'll make better decisions.

Conversely, the more people think about money, the more likely they are to make poor choices.

When people's minds are occupied with money problems, they become relatively more unable to solve any type of problem, and this has already been proven through various experimental results.

Ultimately, people who fail to make value judgments end up making wrong choices and always end up regretting what they spend.

People are not as rational as we think.

And some other people are aware of this very point and use all sorts of strange mental tricks to empty our wallets.

This book is about the forces that can lead us astray when it comes to making decisions related to money.

If you want a better life

Think carefully before spending 'money'!

In this book, Dan Ariely and Jeff Chrysler reveal the complex forces behind the choices we make about money that consume our time and control our lives.

If we knew how those forces work, our choices regarding money would be a little better.

Furthermore, by properly understanding the powerful influence money has on our thinking, we will be better able to make decisions in areas unrelated to money.

Because decisions about money are decisions about more than just money.

The power that money has over us in shaping our identity also influences how we value important aspects of our lives.

For example, we think about “how to spend my time,” “how to manage my career,” “how to embrace others,” “how to improve my relationships,” “how to make myself happy,” “how to ultimately understand the world around me,” and so on, and express our thoughts through spending.

So the problem of spending money is not just about money.

It becomes a yardstick for how we view the world, what we consider important, and where we should focus.

Dan Ariely talks about 'money', which is the standard by which we can understand our own values and those of others, and the most important tool that indicates how we live in this world.

That's why we need to think seriously again before spending money.

Is spending money here the right choice? Or is it simply a waste? This book, co-authored by a leading behavioral economist and a witty behavioral science advocate, will serve as the ultimate tool for developing a "sense of wealth" that will help us manage our money effectively in life.

★★★ Bestseller upon publication ★★★

★★★ Published in 21 countries worldwide ★★★

★★★ Recommended by Salaryman Rich TV and Kim Mi-kyung TV ★★★

★★★ Chosun Ilbo, Hankyoreh, and other major media outlets selected as Book of the Year ★★★

★★★ [Publisher's Weekly] [Kirkus Reviews] [The Washington Post] Highly Recommended ★★★

You are spending reasonably

Can you be sure?

_10 Things You Must Know to Avoid Spending Money Without Considering Its Value

√ Which saves you more money: buying things with a credit card or buying things with cash?

√ Who would you rather pay more for: a locksmith who can open a locked door in 2 minutes or a locksmith who can open a locked door in 1 hour?

√ What is the mindset of people who are reluctant to buy a 1,000 won bottle of water at a local convenience store, but do not hesitate to buy a 4,000 won bottle of water when traveling?

We actually know the answer to this question.

So why do people buy things with credit cards even when they already know the answer? Why do they feel bad about paying someone who wasted their time, yet still feel bad about paying someone who fixed their door in two minutes? Why do people who are so stingy with water so mindlessly spend money on expensive food and drinks on summer vacation? We all make mistakes when it comes to spending money.

This is because I think exactly the following:

· We ignore opportunity cost: If we buy something now, we must always keep in mind what we are sacrificing in return.

· We forget that everything is relative: When buying a sale item, you shouldn't consider its regular price.

· We separate and isolate what is connected: We must spend 10,000 won, keeping in mind that it is just 10,000 won.

It doesn't matter where the money came from.

· We avoid pain: Credit cards increase spending by helping us forget the pain of paying.

Keep this in mind.

· We believe in ourselves: If nothing else, when it comes to spending, we need to question our long-held habits.

· We overestimate the value of what we own: Once we own something, we tend to overestimate its value and are reluctant to give it up. Sellers exploit this to sell us products.

· We are concerned about fairness and effort: Don't get caught up in debating whether something is priced fairly.

Instead, think about what is valuable to you.

· We believe in the magic of language and offering: we must be wary of unwarranted guesswork related to effort.

There is no reason why we should pay for flashy rhetoric.

· We overestimate our expectations: We must always practice being objective so that others do not manipulate us.

· We overemphasize money: Price is one of the attributes that indicates value, but not the only one.

When making decisions, remember that price is just a number.

The important thing to remember is that thinking more about money doesn't necessarily mean you'll make better decisions.

Conversely, the more people think about money, the more likely they are to make poor choices.

When people's minds are occupied with money problems, they become relatively more unable to solve any type of problem, and this has already been proven through various experimental results.

Ultimately, people who fail to make value judgments end up making wrong choices and always end up regretting what they spend.

People are not as rational as we think.

And some other people are aware of this very point and use all sorts of strange mental tricks to empty our wallets.

This book is about the forces that can lead us astray when it comes to making decisions related to money.

If you want a better life

Think carefully before spending 'money'!

In this book, Dan Ariely and Jeff Chrysler reveal the complex forces behind the choices we make about money that consume our time and control our lives.

If we knew how those forces work, our choices regarding money would be a little better.

Furthermore, by properly understanding the powerful influence money has on our thinking, we will be better able to make decisions in areas unrelated to money.

Because decisions about money are decisions about more than just money.

The power that money has over us in shaping our identity also influences how we value important aspects of our lives.

For example, we think about “how to spend my time,” “how to manage my career,” “how to embrace others,” “how to improve my relationships,” “how to make myself happy,” “how to ultimately understand the world around me,” and so on, and express our thoughts through spending.

So the problem of spending money is not just about money.

It becomes a yardstick for how we view the world, what we consider important, and where we should focus.

Dan Ariely talks about 'money', which is the standard by which we can understand our own values and those of others, and the most important tool that indicates how we live in this world.

That's why we need to think seriously again before spending money.

Is spending money here the right choice? Or is it simply a waste? This book, co-authored by a leading behavioral economist and a witty behavioral science advocate, will serve as the ultimate tool for developing a "sense of wealth" that will help us manage our money effectively in life.

GOODS SPECIFICS

- Date of issue: August 23, 2023

- Page count, weight, size: 448 pages | 802g | 152*224*27mm

- ISBN13: 9788935214273

- ISBN10: 8935214272

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)