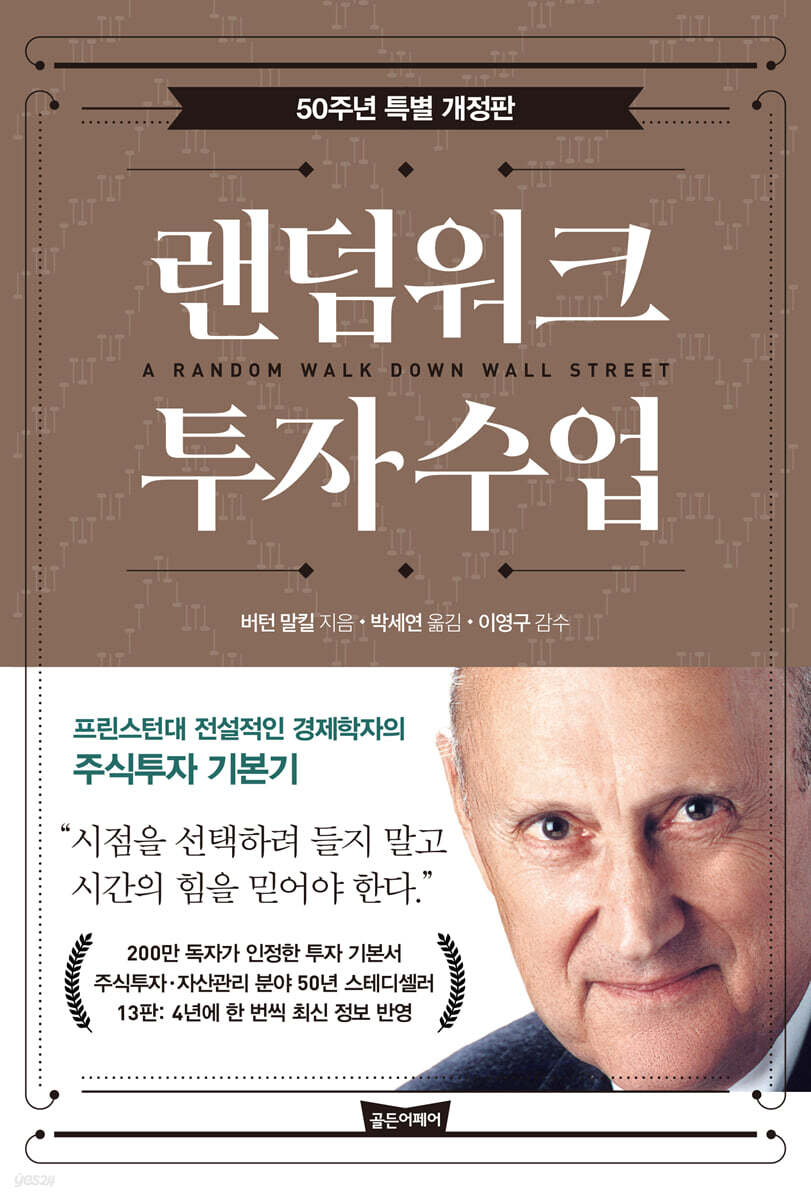

Random Walk Investment Class

|

Description

Book Introduction

A basic stock investment guide recognized by 2 million readers

A 50-year bestseller in stock investment and asset management

13th Edition: Updated every four years

Legendary economist Burton Malkiel has been revising his book "Random Walk: A Guide to Investing" every four to five years for the past 50 years, reflecting the latest information.

This 50th Anniversary Special Revised Edition (13th Edition) is filled with reliable advice on the fundamentals of stock investing, proven over many years and by countless readers.

Drawing on his experience as an economist, market expert, and market participant, the author provides essential knowledge for investors.

This book clearly organizes basic financial terms and concepts, actual performance of each investment strategy, considerations for investment, historical events and current trends, and even investment portfolios, allowing ordinary investors to easily learn the fundamentals of stock investment.

It also persuasively conveys the point that stock investment cannot exist in isolation, like an isolated island, in a rapidly changing financial environment. It also helps you choose the investment strategy that's right for you with time-tested advice.

"Random Walk Investment Class" has been a steady seller for 50 years, with improved reviews and increased sales with each revised edition.

If you read this book and quickly follow Malkiel's advice, you will be able to build a solid retirement fund and enjoy investing in stocks with peace of mind.

"Instead of browsing through the countless new releases flooding the bookstores, read this book again and again." - The New York Times

A 50-year bestseller in stock investment and asset management

13th Edition: Updated every four years

Legendary economist Burton Malkiel has been revising his book "Random Walk: A Guide to Investing" every four to five years for the past 50 years, reflecting the latest information.

This 50th Anniversary Special Revised Edition (13th Edition) is filled with reliable advice on the fundamentals of stock investing, proven over many years and by countless readers.

Drawing on his experience as an economist, market expert, and market participant, the author provides essential knowledge for investors.

This book clearly organizes basic financial terms and concepts, actual performance of each investment strategy, considerations for investment, historical events and current trends, and even investment portfolios, allowing ordinary investors to easily learn the fundamentals of stock investment.

It also persuasively conveys the point that stock investment cannot exist in isolation, like an isolated island, in a rapidly changing financial environment. It also helps you choose the investment strategy that's right for you with time-tested advice.

"Random Walk Investment Class" has been a steady seller for 50 years, with improved reviews and increased sales with each revised edition.

If you read this book and quickly follow Malkiel's advice, you will be able to build a solid retirement fund and enjoy investing in stocks with peace of mind.

"Instead of browsing through the countless new releases flooding the bookstores, read this book again and again." - The New York Times

- You can preview some of the book's contents.

Preview

index

Preface to the '50th Anniversary Special Revised Edition'

Reviewer's Note: For those who want to gain more investment wisdom.

Part 1.

Investment and Value

Chapter 1.

What is Investment?

Thoughts on investing

Theory of Investment

Chapter 2.

mass madness

Tulip bulb craze

Namhae Enterprise Bubble Incident

Wall Street disaster

Chapter 3.

Speculative bubble of the 1960s to 1990s

The Rising 60s

The wonderful 70s

The Roaring 80s

Japanese stocks and real estate

Chapter 4.

The Great Bubble of the 21st Century

Internet bubble

housing market bubble

Meme stocks and SPAC bubbles

Cryptocurrency bubble

Part 2.

Investment Technical Analysis

Chapter 5.

Technical Analysis and Fundamental Analysis

Technical Analysis

Fundamental Analysis

Chapter 6.

Technical Analysis vs. Random Walk

Is there momentum in the stock market?

What exactly does random walk mean?

Technical analysis techniques

Masters of eccentric theories and technical analysis

Why Randomness is Hard to Accept

Technical Analysis and Random Walk

Chapter 7.

Fundamental Analysis vs. Efficient Market Hypothesis

Are securities analysts prophets?

Why is the crystal ball cloudy?

Securities analyst performance

Fundamental Analysis and the Efficient Market Hypothesis

Part 3.

Validating new investment technologies

Chapter 8.

A new approach to reducing risk

Defining and Measuring Risk

Long-term analysis of risk

A new way to reduce risk

Diversification

Chapter 9.

A new approach to increasing rewards

Beta and Systematic Risk

Risk and Return According to the Capital Asset Pricing Model

Evaluation of the usefulness of beta

A new way to increase rewards

Chapter 10.

A New Interpretation of Investment Psychology

irrational investor behavior

Behavioral Finance's Perspective on Market Efficiency

Lessons Investors Can Learn from Behavioral Finance

Chapter 11.

Latest Investment Trends: Smart Beta, Risk Parity, and ESG Investing

Smart Beta

Risk equality

ESG investment

Part 4.

Practical Investment Guide

Chapter 12.

Preparing for real investment

Task 1: Start saving now.

Task 2: Create a Shield for Life

Task 3: Manage your cash assets

Task 4: Learn how to avoid taxes.

Task 5: Establish Investment Goals That Fit You

Task 6: Get interested in real estate.

Task 7: Learn About Bonds

Task 8: Beware of Unfamiliar Investment Targets

Task 9: Controlling Costs

Task 10: Diversify Your Investments

Chapter 13.

Predicting real-world investment returns

What determines the returns of stocks and bonds?

Past Returns Review

Future Return Outlook

Chapter 14.

Practical investment considering life cycle

Basic Guidelines for Asset Allocation

Portfolio by life cycle

Retirement Fund Management

Chapter 15.

Practical Stock Investment for the General Investor

Simple way

DIY method

Agent method

Conclusion

Acknowledgements

Additional Notes

Appendix: Major Funds, ETFs, and Bonds

Reviewer's Note: For those who want to gain more investment wisdom.

Part 1.

Investment and Value

Chapter 1.

What is Investment?

Thoughts on investing

Theory of Investment

Chapter 2.

mass madness

Tulip bulb craze

Namhae Enterprise Bubble Incident

Wall Street disaster

Chapter 3.

Speculative bubble of the 1960s to 1990s

The Rising 60s

The wonderful 70s

The Roaring 80s

Japanese stocks and real estate

Chapter 4.

The Great Bubble of the 21st Century

Internet bubble

housing market bubble

Meme stocks and SPAC bubbles

Cryptocurrency bubble

Part 2.

Investment Technical Analysis

Chapter 5.

Technical Analysis and Fundamental Analysis

Technical Analysis

Fundamental Analysis

Chapter 6.

Technical Analysis vs. Random Walk

Is there momentum in the stock market?

What exactly does random walk mean?

Technical analysis techniques

Masters of eccentric theories and technical analysis

Why Randomness is Hard to Accept

Technical Analysis and Random Walk

Chapter 7.

Fundamental Analysis vs. Efficient Market Hypothesis

Are securities analysts prophets?

Why is the crystal ball cloudy?

Securities analyst performance

Fundamental Analysis and the Efficient Market Hypothesis

Part 3.

Validating new investment technologies

Chapter 8.

A new approach to reducing risk

Defining and Measuring Risk

Long-term analysis of risk

A new way to reduce risk

Diversification

Chapter 9.

A new approach to increasing rewards

Beta and Systematic Risk

Risk and Return According to the Capital Asset Pricing Model

Evaluation of the usefulness of beta

A new way to increase rewards

Chapter 10.

A New Interpretation of Investment Psychology

irrational investor behavior

Behavioral Finance's Perspective on Market Efficiency

Lessons Investors Can Learn from Behavioral Finance

Chapter 11.

Latest Investment Trends: Smart Beta, Risk Parity, and ESG Investing

Smart Beta

Risk equality

ESG investment

Part 4.

Practical Investment Guide

Chapter 12.

Preparing for real investment

Task 1: Start saving now.

Task 2: Create a Shield for Life

Task 3: Manage your cash assets

Task 4: Learn how to avoid taxes.

Task 5: Establish Investment Goals That Fit You

Task 6: Get interested in real estate.

Task 7: Learn About Bonds

Task 8: Beware of Unfamiliar Investment Targets

Task 9: Controlling Costs

Task 10: Diversify Your Investments

Chapter 13.

Predicting real-world investment returns

What determines the returns of stocks and bonds?

Past Returns Review

Future Return Outlook

Chapter 14.

Practical investment considering life cycle

Basic Guidelines for Asset Allocation

Portfolio by life cycle

Retirement Fund Management

Chapter 15.

Practical Stock Investment for the General Investor

Simple way

DIY method

Agent method

Conclusion

Acknowledgements

Additional Notes

Appendix: Major Funds, ETFs, and Bonds

Detailed image

.jpg)

Into the book

To be clear, this book is by no means intended for speculation.

It is also not a book for short-term traders who gamble on ever-changing stock prices and are lured by zero commissions.

So, it would be a good idea to subtitle the book 'How to Get Rich Slowly But Surely'.

--- p.34 「Chapter 1.

From "What is Investment"

Investment performance depends not on how much impact a particular industry will have on society or how much it will grow, but on how consistently it will generate profits.

--- p.108 「Chapter 4.

From "The Great Bubble of the 21st Century"

From now on, I'd like to explain some of the things people have been curious about about Beta but haven't had the courage to ask.

Systematic risk, also known as market risk, refers to the reaction of an individual stock (or portfolio) to fluctuations in the overall market.

--- p.245~246 「Chapter 9.

From “A New Approach to Increasing Compensation”

JP

Morgan had a friend who kept him up at night worrying about stocks.

His friend asked him.

“What should I do with the stock?” Morgan answered.

“I’ll sell it until I can sleep comfortably.” I’m not joking.

Every investor must choose between tossing and turning in their sleep and sleeping soundly.

Judgment is up to the individual.

High rewards come only at the cost of high risk.

Finding a balance point that allows you to sleep soundly is the most important step in investing.

--- p.359 「Chapter 12.

From “Preparing for Real Investment”

Science fiction writer Theodore Sturgeon said:

"95 percent of what we hear and read is garbage." This saying applies even in the investing world.

But I'm sure what I'm talking about here is exactly that 5 percent.

--- p.431 「Chapter 14.

From "Practical Investment Considering Life Cycle"

Past data clearly confirms that index fund returns will continue to easily surpass those of active funds, which often erode investment returns due to high advisory fees and high portfolio turnover.

Perhaps many will realize how attractive it is to be guaranteed an average return every time you invest.

It is also not a book for short-term traders who gamble on ever-changing stock prices and are lured by zero commissions.

So, it would be a good idea to subtitle the book 'How to Get Rich Slowly But Surely'.

--- p.34 「Chapter 1.

From "What is Investment"

Investment performance depends not on how much impact a particular industry will have on society or how much it will grow, but on how consistently it will generate profits.

--- p.108 「Chapter 4.

From "The Great Bubble of the 21st Century"

From now on, I'd like to explain some of the things people have been curious about about Beta but haven't had the courage to ask.

Systematic risk, also known as market risk, refers to the reaction of an individual stock (or portfolio) to fluctuations in the overall market.

--- p.245~246 「Chapter 9.

From “A New Approach to Increasing Compensation”

JP

Morgan had a friend who kept him up at night worrying about stocks.

His friend asked him.

“What should I do with the stock?” Morgan answered.

“I’ll sell it until I can sleep comfortably.” I’m not joking.

Every investor must choose between tossing and turning in their sleep and sleeping soundly.

Judgment is up to the individual.

High rewards come only at the cost of high risk.

Finding a balance point that allows you to sleep soundly is the most important step in investing.

--- p.359 「Chapter 12.

From “Preparing for Real Investment”

Science fiction writer Theodore Sturgeon said:

"95 percent of what we hear and read is garbage." This saying applies even in the investing world.

But I'm sure what I'm talking about here is exactly that 5 percent.

--- p.431 「Chapter 14.

From "Practical Investment Considering Life Cycle"

Past data clearly confirms that index fund returns will continue to easily surpass those of active funds, which often erode investment returns due to high advisory fees and high portfolio turnover.

Perhaps many will realize how attractive it is to be guaranteed an average return every time you invest.

--- p.445 Chapter 15.

From "Practical Stock Investment for Ordinary Investors"

From "Practical Stock Investment for Ordinary Investors"

Publisher's Review

Contains wisdom drawn from human psychology and history.

"Random Walk Investment Class" covers the 400-year history of speculation, from the tulip bubble to the recent cryptocurrency bubble.

It shows that speculation bordering on madness has been repeated throughout history.

He also presents research results on human psychology and warns that such madness will inevitably continue to repeat itself in the future.

When you want to make investments that won't fail, or when you want to invest money right away because you want to become a FIRE investor, you can constantly check whether your investment strategy is actually speculation or a vain desire.

Long history and psychological interpretations remind us how difficult it is to not throw away one's money.

Contains unchanging wisdom and contemporary advice that has evolved over 50 years.

The author states that while he used to have a positive view on gold, his views have now changed to a negative one.

It's because the price was relatively low back then, but now the price has gone up too much.

Meanwhile, when it comes to inflation, everyone consistently advises that we should always keep in mind that inflation could spike at any moment.

When the 12th edition of "Random Walk Investment Class" was published, interest rates and inflation were at their lowest levels in history, so no one was willing to listen. But now, with inflation soaring, reading this book is a real treat.

In this way, over the past 50 years, this book has evolved into a blend of timeless wisdom and advice suited to the rapidly changing times.

A balanced perspective derived from diverse experiences is unique.

Recently, I see a lot of people introducing specific asset allocation portfolios.

However, it mainly deals with how well such portfolios have performed and how to utilize them.

This is the same as only informing about the effects and dosage of the drug and not informing at all about the side effects and precautions.

In "Random Walk Investment Class," we examine not only the advantages of asset allocation portfolios but also their recent performance.

Talking about both the good and the bad can confuse readers.

However, this book informs you of not only the advantages but also the side effects and precautions.

This stems from the author's diverse experiences, explaining investment theories and techniques not only from the perspective of a scholar but also from the perspective of a market expert and participant, and constantly verifying the results achieved in real-world situations.

Given that it's rare to have 65 years of experience in three distinct areas of finance, the balanced perspectives you'll learn from this book are truly valuable.

[This will be helpful to those who read this]

*Those who want to learn the basics of stock investment

*For those who want to know about essential core investment theories

*Those who want to review their investments from the beginning due to poor returns

*Those who want to know about the investment returns and valuation of various investment assets such as stocks.

*Those who need an investment portfolio that serves as a reliable lifelong benchmark

*Those who want to know how to invest and prepare for retirement

"Random Walk Investment Class" covers the 400-year history of speculation, from the tulip bubble to the recent cryptocurrency bubble.

It shows that speculation bordering on madness has been repeated throughout history.

He also presents research results on human psychology and warns that such madness will inevitably continue to repeat itself in the future.

When you want to make investments that won't fail, or when you want to invest money right away because you want to become a FIRE investor, you can constantly check whether your investment strategy is actually speculation or a vain desire.

Long history and psychological interpretations remind us how difficult it is to not throw away one's money.

Contains unchanging wisdom and contemporary advice that has evolved over 50 years.

The author states that while he used to have a positive view on gold, his views have now changed to a negative one.

It's because the price was relatively low back then, but now the price has gone up too much.

Meanwhile, when it comes to inflation, everyone consistently advises that we should always keep in mind that inflation could spike at any moment.

When the 12th edition of "Random Walk Investment Class" was published, interest rates and inflation were at their lowest levels in history, so no one was willing to listen. But now, with inflation soaring, reading this book is a real treat.

In this way, over the past 50 years, this book has evolved into a blend of timeless wisdom and advice suited to the rapidly changing times.

A balanced perspective derived from diverse experiences is unique.

Recently, I see a lot of people introducing specific asset allocation portfolios.

However, it mainly deals with how well such portfolios have performed and how to utilize them.

This is the same as only informing about the effects and dosage of the drug and not informing at all about the side effects and precautions.

In "Random Walk Investment Class," we examine not only the advantages of asset allocation portfolios but also their recent performance.

Talking about both the good and the bad can confuse readers.

However, this book informs you of not only the advantages but also the side effects and precautions.

This stems from the author's diverse experiences, explaining investment theories and techniques not only from the perspective of a scholar but also from the perspective of a market expert and participant, and constantly verifying the results achieved in real-world situations.

Given that it's rare to have 65 years of experience in three distinct areas of finance, the balanced perspectives you'll learn from this book are truly valuable.

[This will be helpful to those who read this]

*Those who want to learn the basics of stock investment

*For those who want to know about essential core investment theories

*Those who want to review their investments from the beginning due to poor returns

*Those who want to know about the investment returns and valuation of various investment assets such as stocks.

*Those who need an investment portfolio that serves as a reliable lifelong benchmark

*Those who want to know how to invest and prepare for retirement

GOODS SPECIFICS

- Date of issue: June 20, 2023

- Page count, weight, size: 486 pages | 720g | 152*225*27mm

- ISBN13: 9791188225736

- ISBN10: 1188225731

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)