Best Stock Quality Investment

|

Description

Book Introduction

Invest only in the "best stocks"! Then, your investing life will change.

This is the best investment strategy proven by many greats, including Warren Buffett, Charlie Munger, Terry Smith, and Peter Ceylon.

In short, it is the surest way to make money by investing in the world's best companies.

This book clearly organizes 'quality investing' according to 13 criteria.

The key is to find the best stocks, buy them at the right price, and hold them for a long time.

And we've compressed it into a 'one-page checklist' so that anyone can easily understand and apply it.

The book is full of 'excellent investment techniques'.

It provides intuitive, practical investment methods that are no less than clear explanations.

It's packed with tips that investors will want to keep an eye on.

This is the best investment strategy proven by many greats, including Warren Buffett, Charlie Munger, Terry Smith, and Peter Ceylon.

In short, it is the surest way to make money by investing in the world's best companies.

This book clearly organizes 'quality investing' according to 13 criteria.

The key is to find the best stocks, buy them at the right price, and hold them for a long time.

And we've compressed it into a 'one-page checklist' so that anyone can easily understand and apply it.

The book is full of 'excellent investment techniques'.

It provides intuitive, practical investment methods that are no less than clear explanations.

It's packed with tips that investors will want to keep an eye on.

- You can preview some of the book's contents.

Preview

index

Introduction - My Journey to Quality Investing

Compiling the Book - Marathon's Capital Cycle Investment Philosophy

Chapter 1: What is 'Quality Investing'?

The Story of Buffett and Munger's Acquisition of See's Candies | Focus on "Very Good Companies" | The Difference Between Value and Growth Investing | The "Best Investment Strategy" Investors Can Choose | Threats Are Everywhere | Secure Top Quality at a Fair Price

Chapter 2: A Checklist for Choosing the Best Stocks

Weeding | 13 Must-Check Criteria | 'Numbers' and 'Story' | Have a Simple, Basic Idea, and Think Seriously | How to Use Stock Search Sites | Practice Makes Perfect | Valuation and Portfolio | 'Quality Company' Checklist

Chapter 3: Qualitative Criteria: What the Numbers Don't Tell Us

1.

Does the company have an easy-to-understand business model?

Try explaining this to a ten-year-old | Numbers can tell you a lot, but not everything | 'Easy' and 'hard' are relative | The misconception that 'I know for sure' | Three options | Key points

2.

Do you have a diverse customer base targeting a global audience?

Risk Management Matters | The Benefits of Geographic Diversification | Foreign Exchange Risk from an Investor's Perspective | How to Smartly Approach "Attractive Growth Markets" | Diverse Customer Base | Key Points

3.

Is this a company with growth potential?

Stagnation is Regression | The Many Facets of Growth | Geographic Expansion | A Bigger Piece of the Pie | Growth Without Direct Investment | 'Differentiation' Offers New Opportunities | The Importance of Innovation | Acquisition Strategies | Cyclical Growth | Sustainable Growth Through Long-Term Trends | 'Digitalization' is Everywhere | The World is Aging | Urbanization | Lifestyles | The Rise of the Middle Class in Emerging Markets | Gentrification | Ideal Cases Benefiting from Structural Trends | Key Points

4.

Do you have a sustainable competitive advantage?

A powerful signal: a "moat" | Brand recognition | Patents | Scale and cost advantages | High switching costs | Network effects | Talent attraction | Competitive advantage requires "management" | Rethinking the "margin of safety" | The vast difference between tangible and intangible assets | The risks of intangible assets | Key points

5.

Do you have pricing power?

Companies that can raise prices without losing customers to competitors | Where does pricing power come from? | Products that customers can't live without | The world of luxury goods | How to understand it in numbers | Key takeaways

6.

Is the company a leading market player?

Amazon in May 1997 | My Thoughts on "Tomorrow's Winners" | The Various Perks of Being a "Market Leader" | Key Points

7.

Do you have a competent management team?

If you take care of your business, it will take care of you | 'Strong company' and 'Strong management' | Capital allocation is key | Skin in the game | The interests of the company and its shareholders come first | Key points

8.

Can you perform well even in a recession?

Why You Should Avoid "Cyclical Stocks" | Companies That Deliver Consistent Performance Even During Recessions | Examples of Defensive Companies | Look at Sales Trends First | Key Points

9.

Is your company less affected by 'technological innovation'?

The disappearance of CDs and record stores | The 'technology' that's changing the market landscape | The biggest enemy of quality investors | Companies in the most vulnerable positions | Why Kodak failed | The 'rebirth' of Netflix | What market leaders can do | Industries with low susceptibility to disruptive innovation | 'Innovation' can happen anywhere | Razors evolving into subscription models | Key points

Chapter 4: Quantitative Criteria: It's Important to Read the "Numbers" Accurately

1.

Have your sales and profits been growing for years?

Past Performance and Future Expectations | A Simple Way to Check the Numbers | It All Starts with Sales | Different Types of Profit | The Correlation Between Sales Growth and Profit Growth | Key Points

2.

Are most of your profits being converted into free cash flow?

Cash determines value | Focus on free cash flow | The most common method for calculating free cash flow | How to assess the quality of earnings | The importance of working capital management | What if cash flow is greater than accounting profit? | Depreciation vs. capital expenditures | Profitable reinvestment | The difference between profit and cash | Key points

3.

Is the return on invested capital high?

A powerful indicator for finding quality stocks | The power of compound interest | 'Profit margin' only tells part of the story | ROE, ROA, and ROIC | The basic ROIC formula | More cash, more value | Another version of ROIC | Additional learning resources | When to use which method? | The balance between 'ROIC' and 'Growth' | Which would you choose: '1 cent' or '1 million dollars'? | The benefits of DuPont analysis | Key points

4.

Are the balance sheets sound?

Be Careful with Debt | An Indicator of Corporate Durability | Debt-to-Equity Ratio | Debt to Free Cash Flow Ratio | Liquidity | Interest Coverage Ratio | Key Points

Chapter 5: How to Evaluate Corporate Value

Why valuation comes later | "Cheap" and "Expensive" are relative terms | The yardstick of "high ROIC" | Relative valuation using "multiples" | Relative valuation using "yield" | How to assess intrinsic value | The useful tool called discounted cash flow | The limitations of forecasting the future | Think about the investment horizon first | Key points

Chapter 6: Portfolio Structure and Management

Keep only the best companies | 'Standards' are tightly linked | 'Principles' and 'Flexibility' are both necessary | Results only match the effort | The process of building a portfolio | The portfolio I envision | Industries not considered | Sufficient diversification | Is there an 'ideal entry point'? | Should I sell or not? | Regular maintenance | Do nothing | A gift for yourself

Translator's Note

Compiling the Book - Marathon's Capital Cycle Investment Philosophy

Chapter 1: What is 'Quality Investing'?

The Story of Buffett and Munger's Acquisition of See's Candies | Focus on "Very Good Companies" | The Difference Between Value and Growth Investing | The "Best Investment Strategy" Investors Can Choose | Threats Are Everywhere | Secure Top Quality at a Fair Price

Chapter 2: A Checklist for Choosing the Best Stocks

Weeding | 13 Must-Check Criteria | 'Numbers' and 'Story' | Have a Simple, Basic Idea, and Think Seriously | How to Use Stock Search Sites | Practice Makes Perfect | Valuation and Portfolio | 'Quality Company' Checklist

Chapter 3: Qualitative Criteria: What the Numbers Don't Tell Us

1.

Does the company have an easy-to-understand business model?

Try explaining this to a ten-year-old | Numbers can tell you a lot, but not everything | 'Easy' and 'hard' are relative | The misconception that 'I know for sure' | Three options | Key points

2.

Do you have a diverse customer base targeting a global audience?

Risk Management Matters | The Benefits of Geographic Diversification | Foreign Exchange Risk from an Investor's Perspective | How to Smartly Approach "Attractive Growth Markets" | Diverse Customer Base | Key Points

3.

Is this a company with growth potential?

Stagnation is Regression | The Many Facets of Growth | Geographic Expansion | A Bigger Piece of the Pie | Growth Without Direct Investment | 'Differentiation' Offers New Opportunities | The Importance of Innovation | Acquisition Strategies | Cyclical Growth | Sustainable Growth Through Long-Term Trends | 'Digitalization' is Everywhere | The World is Aging | Urbanization | Lifestyles | The Rise of the Middle Class in Emerging Markets | Gentrification | Ideal Cases Benefiting from Structural Trends | Key Points

4.

Do you have a sustainable competitive advantage?

A powerful signal: a "moat" | Brand recognition | Patents | Scale and cost advantages | High switching costs | Network effects | Talent attraction | Competitive advantage requires "management" | Rethinking the "margin of safety" | The vast difference between tangible and intangible assets | The risks of intangible assets | Key points

5.

Do you have pricing power?

Companies that can raise prices without losing customers to competitors | Where does pricing power come from? | Products that customers can't live without | The world of luxury goods | How to understand it in numbers | Key takeaways

6.

Is the company a leading market player?

Amazon in May 1997 | My Thoughts on "Tomorrow's Winners" | The Various Perks of Being a "Market Leader" | Key Points

7.

Do you have a competent management team?

If you take care of your business, it will take care of you | 'Strong company' and 'Strong management' | Capital allocation is key | Skin in the game | The interests of the company and its shareholders come first | Key points

8.

Can you perform well even in a recession?

Why You Should Avoid "Cyclical Stocks" | Companies That Deliver Consistent Performance Even During Recessions | Examples of Defensive Companies | Look at Sales Trends First | Key Points

9.

Is your company less affected by 'technological innovation'?

The disappearance of CDs and record stores | The 'technology' that's changing the market landscape | The biggest enemy of quality investors | Companies in the most vulnerable positions | Why Kodak failed | The 'rebirth' of Netflix | What market leaders can do | Industries with low susceptibility to disruptive innovation | 'Innovation' can happen anywhere | Razors evolving into subscription models | Key points

Chapter 4: Quantitative Criteria: It's Important to Read the "Numbers" Accurately

1.

Have your sales and profits been growing for years?

Past Performance and Future Expectations | A Simple Way to Check the Numbers | It All Starts with Sales | Different Types of Profit | The Correlation Between Sales Growth and Profit Growth | Key Points

2.

Are most of your profits being converted into free cash flow?

Cash determines value | Focus on free cash flow | The most common method for calculating free cash flow | How to assess the quality of earnings | The importance of working capital management | What if cash flow is greater than accounting profit? | Depreciation vs. capital expenditures | Profitable reinvestment | The difference between profit and cash | Key points

3.

Is the return on invested capital high?

A powerful indicator for finding quality stocks | The power of compound interest | 'Profit margin' only tells part of the story | ROE, ROA, and ROIC | The basic ROIC formula | More cash, more value | Another version of ROIC | Additional learning resources | When to use which method? | The balance between 'ROIC' and 'Growth' | Which would you choose: '1 cent' or '1 million dollars'? | The benefits of DuPont analysis | Key points

4.

Are the balance sheets sound?

Be Careful with Debt | An Indicator of Corporate Durability | Debt-to-Equity Ratio | Debt to Free Cash Flow Ratio | Liquidity | Interest Coverage Ratio | Key Points

Chapter 5: How to Evaluate Corporate Value

Why valuation comes later | "Cheap" and "Expensive" are relative terms | The yardstick of "high ROIC" | Relative valuation using "multiples" | Relative valuation using "yield" | How to assess intrinsic value | The useful tool called discounted cash flow | The limitations of forecasting the future | Think about the investment horizon first | Key points

Chapter 6: Portfolio Structure and Management

Keep only the best companies | 'Standards' are tightly linked | 'Principles' and 'Flexibility' are both necessary | Results only match the effort | The process of building a portfolio | The portfolio I envision | Industries not considered | Sufficient diversification | Is there an 'ideal entry point'? | Should I sell or not? | Regular maintenance | Do nothing | A gift for yourself

Translator's Note

Detailed image

Into the book

Quality investing is, in a word, the 'cream of the crop.'

First, once you've secured a company that meets most of your quality criteria and has confidence in its potential at a reasonable price, you can "wait with peace of mind."

Because value is constantly being created and time is working in the investor's favor.

--- p.22, from “Chapter 1: What is ‘Quality Investment’”

By building on quality investing as a foundation and adding elements of value investing and growth investing, the strengths of various styles can be blended into something very attractive.

This is the optimal way to invest in individual stocks for the long term.

But such opportunities rarely appear in reality.

In normal market conditions, it is virtually impossible to acquire a quality company at a low price.

Buying quality stocks at cheap prices is usually only possible when a company is in trouble.

In such cases, it is necessary to assess whether the problem is temporary or permanent.

When market perceptions are wrong, these moments present opportunities for agile, quality investors.

The only opportunity to buy quality stocks at a somewhat lower price comes during the occasional moment of blind panic.

--- p.26-27, from “Chapter 1: What is ‘Quality Investment’”

Numbers don't lie and provide a wealth of information.

You can quickly see whether a company is growing, making a profit, generating cash flow, and controlling debt through numbers.

But what the numbers don't tell you is how they came to be.

To understand this, we must first understand the business model.

--- p.49, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

Therefore, quality investors reinterpret the 'margin of safety' to fit the current market situation.

This has a slightly different meaning than the traditional safety margin.

If the competitive advantage is so strong that the company is likely to still dominate the market in a few years, I consider that a significant margin of safety.

If this company's competitive edge weakens, it could lose a significant portion of its profits to competitors.

If this happens, the company's performance and valuation will inevitably decline.

The stronger the competitive advantage, the greater the margin of safety.

Therefore, the value of a quality company depends on the strength of its competitive advantage.

--- p.92, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

Now, let's learn about 'how to determine pricing power numerically'.

However, it should be noted that this is only a rough estimate, as many factors often come into play.

A commonly used quantitative method to determine pricing power is to use the high and stable gross margin.

--- p.107, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

Investors should go through at least two steps when discovering stocks.

Because just finding one ‘innovative product’ in the first step is not enough.

A second step is absolutely necessary and important: to once again select the companies with 'excellent management teams' from among the many companies selected here.

You need to choose a management team that has proven successful at further developing business models, fending off competition, engaging customers, and, above all, continuously innovating.

Amazon's Jeff Bezos and Microsoft's Bill Gates are such CEOs.

For investors, discovering such companies early is like finding the Holy Grail.

--- p.112-113, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

● An ideal portfolio would completely eliminate exposure to economic cycles.

But realistically, we have no choice but to do our best to minimize our exposure to business cycles.

Aim for companies that are resilient even in recessions and select companies that demonstrate stable sales trends over a long period of time.

During a recession, avoid companies that produce durable goods.

And ask yourself what products we use all the time.

--- p.145, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

● Investment is ultimately about predicting future outcomes and then assigning a fair value to them in the present.

But predicting the future involves uncertainty.

To strengthen future expectations, it is useful to consider past performance.

‘Numbers’ serve as evidence of performance and can aid in analysis.

--- p.183, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

Now that you know the most common ways to calculate free cash flow, you can determine how much of your earnings are converted into free cash flow.

And this is also a process of evaluating the ‘quality’ of the profit.

Although there may be some exceptions, when a company's reported accounting profits leave little cash behind, the quality of its profits is considered low.

In other words, the extent to which profits are converted into free cash flow determines the quality of profits.

--- p.188-189, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

As an investor, you must be interested in how companies use their capital to generate profits.

Fortunately, there's a way to gain insight into this: return on invested capital (ROIC).

If a company generates 10 cents of profit for every dollar it invests, its ROIC is 10%.

This ratio tells you how efficiently a company uses its capital and manages its balance sheet to generate profits.

--- p.199-200, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

Even the example figure of 'ROIC 10%' would not satisfy a quality investor.

This is because what quality investors are looking for is not ‘average’ or ‘good’, but ‘excellent’.

In my experience, I aim for a ROIC of at least 15%.

It will attract more attention if it comes with a high ROIC and an attractive valuation.

--- p.209, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

There is no exact rule for a good debt-to-cash-flow ratio, as it can vary across companies and industries.

However, for quality companies that generate predictable profits, a ratio of 0 to 5 can be considered healthy and manageable.

A one-time spike due to a large investment may not be a problem, but anything above 5 is considered risky, and anything above 9 is considered unacceptable.

--- p.231, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

In real estate, it is often said that the first thing that determines the value of real estate is location, secondly, location, and thirdly, location.

And everything else is seen as secondary.

Just as we emphasize the importance of location in real estate value, if I had to pick one thing to emphasize in investing, it would be ROIC.

In this comparison, the prime location of real estate equates to a 'high ROIC' for the business.

Just as a property in an absolutely prime location justifies its high price, so too does a company that stands out in its industry with a high ROIC.

--- p.241, from “Chapter 5_Methods of Evaluating Corporate Value”

Now, we can review the first screening results under the following seven conditions:

· Sales growth rate of 5% or more

· Operating profit growth rate of 7% or more

· Profit quality (FCF/net profit) of 80% or more

· Return on invested capital (ROIC) of 15% or more

· Debt to free cash flow ratio of 5 or less

Debt ratio of 80% or less

· Interest coverage ratio of 5 or higher

--- p.263, from “Chapter 6: Portfolio Composition and Management”

What's left for quality investors now? Lean back and do nothing.

If you have nothing left to do as a shareholder of a top company, that's a good sign.

Because at that very moment, money keeps growing.

Most investors cannot resist the urge to buy or sell stocks, so they must learn to do nothing.

First, once you've secured a company that meets most of your quality criteria and has confidence in its potential at a reasonable price, you can "wait with peace of mind."

Because value is constantly being created and time is working in the investor's favor.

--- p.22, from “Chapter 1: What is ‘Quality Investment’”

By building on quality investing as a foundation and adding elements of value investing and growth investing, the strengths of various styles can be blended into something very attractive.

This is the optimal way to invest in individual stocks for the long term.

But such opportunities rarely appear in reality.

In normal market conditions, it is virtually impossible to acquire a quality company at a low price.

Buying quality stocks at cheap prices is usually only possible when a company is in trouble.

In such cases, it is necessary to assess whether the problem is temporary or permanent.

When market perceptions are wrong, these moments present opportunities for agile, quality investors.

The only opportunity to buy quality stocks at a somewhat lower price comes during the occasional moment of blind panic.

--- p.26-27, from “Chapter 1: What is ‘Quality Investment’”

Numbers don't lie and provide a wealth of information.

You can quickly see whether a company is growing, making a profit, generating cash flow, and controlling debt through numbers.

But what the numbers don't tell you is how they came to be.

To understand this, we must first understand the business model.

--- p.49, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

Therefore, quality investors reinterpret the 'margin of safety' to fit the current market situation.

This has a slightly different meaning than the traditional safety margin.

If the competitive advantage is so strong that the company is likely to still dominate the market in a few years, I consider that a significant margin of safety.

If this company's competitive edge weakens, it could lose a significant portion of its profits to competitors.

If this happens, the company's performance and valuation will inevitably decline.

The stronger the competitive advantage, the greater the margin of safety.

Therefore, the value of a quality company depends on the strength of its competitive advantage.

--- p.92, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

Now, let's learn about 'how to determine pricing power numerically'.

However, it should be noted that this is only a rough estimate, as many factors often come into play.

A commonly used quantitative method to determine pricing power is to use the high and stable gross margin.

--- p.107, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

Investors should go through at least two steps when discovering stocks.

Because just finding one ‘innovative product’ in the first step is not enough.

A second step is absolutely necessary and important: to once again select the companies with 'excellent management teams' from among the many companies selected here.

You need to choose a management team that has proven successful at further developing business models, fending off competition, engaging customers, and, above all, continuously innovating.

Amazon's Jeff Bezos and Microsoft's Bill Gates are such CEOs.

For investors, discovering such companies early is like finding the Holy Grail.

--- p.112-113, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

● An ideal portfolio would completely eliminate exposure to economic cycles.

But realistically, we have no choice but to do our best to minimize our exposure to business cycles.

Aim for companies that are resilient even in recessions and select companies that demonstrate stable sales trends over a long period of time.

During a recession, avoid companies that produce durable goods.

And ask yourself what products we use all the time.

--- p.145, from “Chapter 3_Qualitative Standards: What ‘Numbers’ Don’t Tell Us”

● Investment is ultimately about predicting future outcomes and then assigning a fair value to them in the present.

But predicting the future involves uncertainty.

To strengthen future expectations, it is useful to consider past performance.

‘Numbers’ serve as evidence of performance and can aid in analysis.

--- p.183, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

Now that you know the most common ways to calculate free cash flow, you can determine how much of your earnings are converted into free cash flow.

And this is also a process of evaluating the ‘quality’ of the profit.

Although there may be some exceptions, when a company's reported accounting profits leave little cash behind, the quality of its profits is considered low.

In other words, the extent to which profits are converted into free cash flow determines the quality of profits.

--- p.188-189, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

As an investor, you must be interested in how companies use their capital to generate profits.

Fortunately, there's a way to gain insight into this: return on invested capital (ROIC).

If a company generates 10 cents of profit for every dollar it invests, its ROIC is 10%.

This ratio tells you how efficiently a company uses its capital and manages its balance sheet to generate profits.

--- p.199-200, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

Even the example figure of 'ROIC 10%' would not satisfy a quality investor.

This is because what quality investors are looking for is not ‘average’ or ‘good’, but ‘excellent’.

In my experience, I aim for a ROIC of at least 15%.

It will attract more attention if it comes with a high ROIC and an attractive valuation.

--- p.209, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

There is no exact rule for a good debt-to-cash-flow ratio, as it can vary across companies and industries.

However, for quality companies that generate predictable profits, a ratio of 0 to 5 can be considered healthy and manageable.

A one-time spike due to a large investment may not be a problem, but anything above 5 is considered risky, and anything above 9 is considered unacceptable.

--- p.231, from “Chapter 4_Quantitative Standards: It is important to read ‘numbers’ accurately”

In real estate, it is often said that the first thing that determines the value of real estate is location, secondly, location, and thirdly, location.

And everything else is seen as secondary.

Just as we emphasize the importance of location in real estate value, if I had to pick one thing to emphasize in investing, it would be ROIC.

In this comparison, the prime location of real estate equates to a 'high ROIC' for the business.

Just as a property in an absolutely prime location justifies its high price, so too does a company that stands out in its industry with a high ROIC.

--- p.241, from “Chapter 5_Methods of Evaluating Corporate Value”

Now, we can review the first screening results under the following seven conditions:

· Sales growth rate of 5% or more

· Operating profit growth rate of 7% or more

· Profit quality (FCF/net profit) of 80% or more

· Return on invested capital (ROIC) of 15% or more

· Debt to free cash flow ratio of 5 or less

Debt ratio of 80% or less

· Interest coverage ratio of 5 or higher

--- p.263, from “Chapter 6: Portfolio Composition and Management”

What's left for quality investors now? Lean back and do nothing.

If you have nothing left to do as a shareholder of a top company, that's a good sign.

Because at that very moment, money keeps growing.

Most investors cannot resist the urge to buy or sell stocks, so they must learn to do nothing.

--- p.280, from “Chapter 6: Portfolio Composition and Management”

Publisher's Review

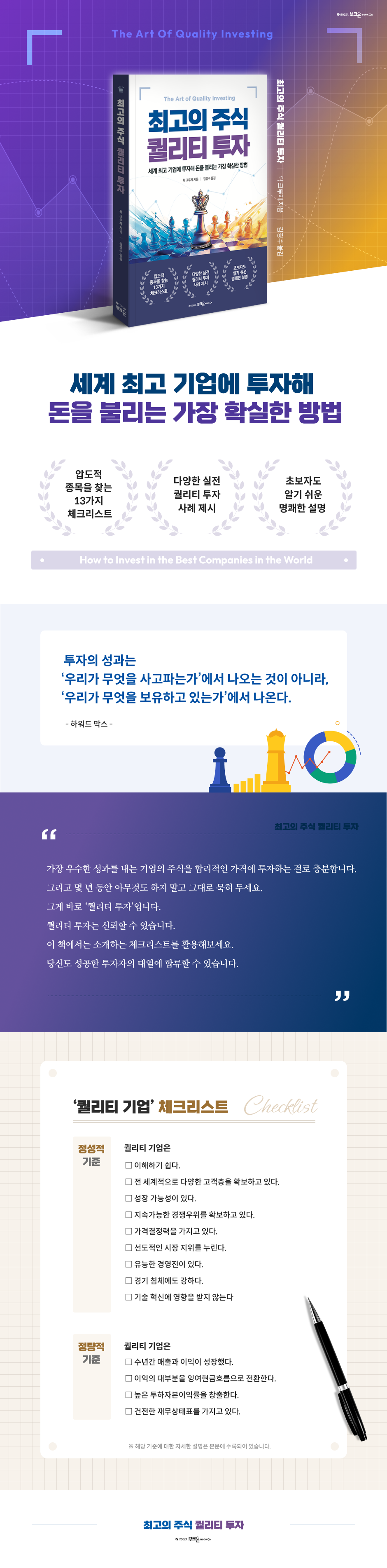

Now is the time to focus on the "best stocks."

"Quality Investment": The Ultimate Strategy Proven by Investment Experts

A 13-Question Checklist to Pick the Best Stocks

● Invest only in the ‘best stocks’!

Investing is about 'eyes'.

The point is, which stock you choose is the key.

It doesn't matter whether it's domestic stocks (domestic stocks) or US stocks (US stocks).

There is also no need to distinguish between value investing and growth investing.

All you have to do is find the 'best stocks'.

Then your investment life will change.

Here is a stock called A.

What would have happened if you had invested in this stock 20 years ago? Its value has risen by a staggering 148,000% since then.

If you had invested $10,000 in this stock 20 years ago, that money would have grown to about $15 million today.

This stock is none other than 'Amazon'.

This is the stock that is now one of the 'Magnificent 7', a name that everyone knows.

The reason the desert is beautiful is because there is an oasis in it.

The same goes for the stock market.

The stock market has always had top-tier stocks like Amazon.

All investors have to do now is find the best stocks.

(Of course, no one knows what the future will be like 20 years from now.

The point is, there is no way in the world to identify stocks like Amazon early on.

That's why Terry Smith said to invest in "companies that are already winners" rather than "potential winners of the future."

Instead of searching for the next Amazon, focus on the best companies that are currently leading the market.)

● The most reliable way for investors to make money!

The essence of 'quality investing' is finding the best stocks, buying them at the right price, and holding them for a long time.

This is the best strategy that has been personally proven by investment giants such as Warren Buffett, Charlie Munger, Terry Smith, and Peter Ceylon.

『The Art of Quality Investing』 is, in a word, a book about the art of excellent investment.

It contains the best ways for investors to make money.

So, it is not just a 'theory' in name only, but it presents very specific 'practical investment methods'.

The greatest strength of this book is that it clearly organizes the philosophy of quality investment according to 13 criteria.

This is a 'one-page checklist' that anyone can easily understand and apply.

As the book explains, if you follow this checklist slowly, you will naturally find the best stocks.

As an investor, you can properly develop your ‘best eye.’

● A checklist to select the best ‘quality companies’!

The "13-question checklist for finding the best stocks" mentioned in this book is like a health checkup questionnaire.

We carefully select the overwhelmingly superior stocks that possess both qualitative and quantitative criteria, that is, 'quality companies.'

A quality company is

□ Easy to understand.

□ We have a diverse customer base worldwide.

□ There is potential for growth.

□ We are securing a sustainable competitive advantage.

□ Has pricing power.

□ Enjoy a leading market position.

□ There is a competent management team.

□ Resistant to economic downturns.

□ Not affected by technological innovation.

A quality company is

□ Sales and profits have grown over the years.

□ Convert most of the profits into free cash flow.

□ Creates a high return on invested capital.

□ Have a sound financial statement.

Now, investors only need to check nine qualitative criteria and four quantitative criteria.

All you have to do is answer 'yes' or 'no'.

● The best investment method to achieve long-term benefits!

Luc Kroeze, the author of this book, is a quality investor from Western Europe.

Since entering the world of investment in 2008, he has dedicated himself to widely disseminating his philosophy and investment methodology, drawing on his extensive investment knowledge and practical experience.

Quality investing is described as the 'most certain way to achieve long-term compound interest.'

In addition to the '13-question checklist', this book is also rich in useful information.

For example, the author's interesting reinterpretation of Benjamin Graham and David Dodd's "margin of safety" and screening criteria to consider when searching for stocks.

In particular, the following seven screening conditions disclosed by the author serve as effective guidelines amidst the 'noise' of so-so sports.

This is a tip that investors should keep an eye on.

① Sales growth rate of 5% or more

② Operating profit growth rate of 7% or more

③ Profit quality (FCF/net profit) 80% or higher

④ Return on invested capital (ROIC) of 15% or more

⑤ Debt to free cash flow ratio of 5 or less

⑥ Debt ratio of 80% or less

⑦ Interest coverage ratio of 5 or higher

"Quality Investment": The Ultimate Strategy Proven by Investment Experts

A 13-Question Checklist to Pick the Best Stocks

● Invest only in the ‘best stocks’!

Investing is about 'eyes'.

The point is, which stock you choose is the key.

It doesn't matter whether it's domestic stocks (domestic stocks) or US stocks (US stocks).

There is also no need to distinguish between value investing and growth investing.

All you have to do is find the 'best stocks'.

Then your investment life will change.

Here is a stock called A.

What would have happened if you had invested in this stock 20 years ago? Its value has risen by a staggering 148,000% since then.

If you had invested $10,000 in this stock 20 years ago, that money would have grown to about $15 million today.

This stock is none other than 'Amazon'.

This is the stock that is now one of the 'Magnificent 7', a name that everyone knows.

The reason the desert is beautiful is because there is an oasis in it.

The same goes for the stock market.

The stock market has always had top-tier stocks like Amazon.

All investors have to do now is find the best stocks.

(Of course, no one knows what the future will be like 20 years from now.

The point is, there is no way in the world to identify stocks like Amazon early on.

That's why Terry Smith said to invest in "companies that are already winners" rather than "potential winners of the future."

Instead of searching for the next Amazon, focus on the best companies that are currently leading the market.)

● The most reliable way for investors to make money!

The essence of 'quality investing' is finding the best stocks, buying them at the right price, and holding them for a long time.

This is the best strategy that has been personally proven by investment giants such as Warren Buffett, Charlie Munger, Terry Smith, and Peter Ceylon.

『The Art of Quality Investing』 is, in a word, a book about the art of excellent investment.

It contains the best ways for investors to make money.

So, it is not just a 'theory' in name only, but it presents very specific 'practical investment methods'.

The greatest strength of this book is that it clearly organizes the philosophy of quality investment according to 13 criteria.

This is a 'one-page checklist' that anyone can easily understand and apply.

As the book explains, if you follow this checklist slowly, you will naturally find the best stocks.

As an investor, you can properly develop your ‘best eye.’

● A checklist to select the best ‘quality companies’!

The "13-question checklist for finding the best stocks" mentioned in this book is like a health checkup questionnaire.

We carefully select the overwhelmingly superior stocks that possess both qualitative and quantitative criteria, that is, 'quality companies.'

A quality company is

□ Easy to understand.

□ We have a diverse customer base worldwide.

□ There is potential for growth.

□ We are securing a sustainable competitive advantage.

□ Has pricing power.

□ Enjoy a leading market position.

□ There is a competent management team.

□ Resistant to economic downturns.

□ Not affected by technological innovation.

A quality company is

□ Sales and profits have grown over the years.

□ Convert most of the profits into free cash flow.

□ Creates a high return on invested capital.

□ Have a sound financial statement.

Now, investors only need to check nine qualitative criteria and four quantitative criteria.

All you have to do is answer 'yes' or 'no'.

● The best investment method to achieve long-term benefits!

Luc Kroeze, the author of this book, is a quality investor from Western Europe.

Since entering the world of investment in 2008, he has dedicated himself to widely disseminating his philosophy and investment methodology, drawing on his extensive investment knowledge and practical experience.

Quality investing is described as the 'most certain way to achieve long-term compound interest.'

In addition to the '13-question checklist', this book is also rich in useful information.

For example, the author's interesting reinterpretation of Benjamin Graham and David Dodd's "margin of safety" and screening criteria to consider when searching for stocks.

In particular, the following seven screening conditions disclosed by the author serve as effective guidelines amidst the 'noise' of so-so sports.

This is a tip that investors should keep an eye on.

① Sales growth rate of 5% or more

② Operating profit growth rate of 7% or more

③ Profit quality (FCF/net profit) 80% or higher

④ Return on invested capital (ROIC) of 15% or more

⑤ Debt to free cash flow ratio of 5 or less

⑥ Debt ratio of 80% or less

⑦ Interest coverage ratio of 5 or higher

GOODS SPECIFICS

- Date of issue: October 10, 2025

- Page count, weight, size: 284 pages | 528g | 152*225*17mm

- ISBN13: 9791198375995

- ISBN10: 119837599X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)