Restarting investment

|

Description

Book Introduction

“Why is the redevelopment and reconstruction of the neighboring neighborhood progressing so quickly?” The answer lies in urban planning! "Investing Again" is a practical and realistic guide for investors. Author Jaewoong Eom wrote this book based on his consulting experience at a foreign real estate consulting firm. This book covers all aspects of real estate, including investment idea generation, trading, development, and urban regeneration. It contains proven investment experience from the field and practical know-how that can be effectively applied throughout one's life. This book answers investors' concerns and increases the likelihood of investment success, making it an essential guide for both investors and those preparing to purchase a home. |

index

Preface | Even in a bear market, some real estate properties are rising.

Part 1.

A Bear Market is an Opportunity: 3 Rules for Picking Rising Real Estate

Chapter 1.

Investing is all about studying

Chapter 2.

[Principle 1] A stronghold is not a superior location.

Chapter 3.

Where it works and where it doesn't

Chapter 4.

Benefits of the base

Chapter 5.

[Principle 2] The basis for investment is the original text of the city's basic plan.

Chapter 6.

[Principle 3] Review the business feasibility yourself.

Part 2.

So, how much should you buy it for?: Calculate the fair price yourself

Chapter 7.

The fair price is not the lowest price.

Chapter 8.

Buy real estate at its golden price (fair price).

Chapter 9.

Real estate favored by big money

Chapter 10.

If you only know the price of gold even in a bear market

TIP.

Understanding the 2030 Seoul Living Area Plan and the Seongsu District Center

Chapter 11.

Understanding the Golden Price of Real Estate

Chapter 12.

Is 100 million won per pyeong for an apartment in Yeouido a reasonable price?

Chapter 13.

Is 100 million won per pyeong for an apartment in Yongsan a reasonable price?

Part 3.

Promising Area Price Analysis: Practical Investment Analysis

Chapter 14.

Where should I choose the first new town reconstruction apartments: Ilsan or Bundang?

TIP.

Gaepo-dong transformed by reconstruction

Chapter 15.

Why We're Paying Attention to Jangandong, Dongdaemun-gu

Chapter 16.

The future of Deungchon-dong, Gangseo-gu

Conclusion.

Start now.

And while doing it, become perfect

Part 1.

A Bear Market is an Opportunity: 3 Rules for Picking Rising Real Estate

Chapter 1.

Investing is all about studying

Chapter 2.

[Principle 1] A stronghold is not a superior location.

Chapter 3.

Where it works and where it doesn't

Chapter 4.

Benefits of the base

Chapter 5.

[Principle 2] The basis for investment is the original text of the city's basic plan.

Chapter 6.

[Principle 3] Review the business feasibility yourself.

Part 2.

So, how much should you buy it for?: Calculate the fair price yourself

Chapter 7.

The fair price is not the lowest price.

Chapter 8.

Buy real estate at its golden price (fair price).

Chapter 9.

Real estate favored by big money

Chapter 10.

If you only know the price of gold even in a bear market

TIP.

Understanding the 2030 Seoul Living Area Plan and the Seongsu District Center

Chapter 11.

Understanding the Golden Price of Real Estate

Chapter 12.

Is 100 million won per pyeong for an apartment in Yeouido a reasonable price?

Chapter 13.

Is 100 million won per pyeong for an apartment in Yongsan a reasonable price?

Part 3.

Promising Area Price Analysis: Practical Investment Analysis

Chapter 14.

Where should I choose the first new town reconstruction apartments: Ilsan or Bundang?

TIP.

Gaepo-dong transformed by reconstruction

Chapter 15.

Why We're Paying Attention to Jangandong, Dongdaemun-gu

Chapter 16.

The future of Deungchon-dong, Gangseo-gu

Conclusion.

Start now.

And while doing it, become perfect

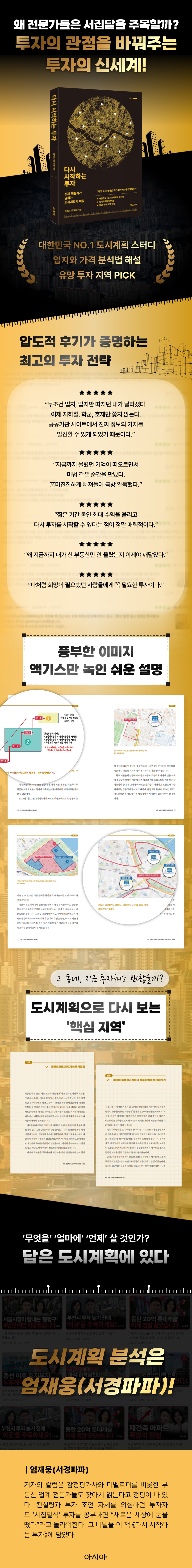

Detailed image

Into the book

The person who pointed to 49 Gaebong-dong is an ordinary working housewife who works in a field unrelated to the real estate industry.

After battling cancer twice and struggling to survive, this investor decided to invest in real estate.

I've taken several real estate courses, but it wasn't until I took yours that I really started to delve deeper into urban planning.

His studies in real estate, which began amidst declining health and anxiety about the future, strengthened him and ultimately made him a skilled professional.

From now on, we will trace how this person discovered the clue to redevelopment at 49 Gaebong-dong.

--- p.44

Have you ever heard of the "greater fool theory"? It's a concept proposed by economist John Maynard Keynes.

This is a phenomenon in which a "fool" who bought an asset at a price higher than its actual value in anticipation of a price increase believes that an "even bigger fool" will come along and buy the asset again.

When applied to real estate, this is equivalent to the unfounded belief that “real estate prices will inevitably rise because supply continues to be insufficient compared to demand,” a situation similar to the creation of a kind of “bubble.”

--- p.57

Why do we need to know the golden price of real estate? In fact, investing is possible even without knowing the fair value.

In fact, many investors do just that.

But that's only possible in a market like Daesangseungjang where there are a lot of bigger fools.

However, since the bull market cycle comes in cycles of about 10 years, you will have to wait a long time.

It is difficult to make an investment 10 times and be successful 10 times.

However, if you just master the three principles presented in Part 1, you can succeed six or seven times.

If you want to succeed the remaining three or four times, and do so with minimal cost and time, you must be able to determine the appropriate price.

--- p.62

So, what types of properties are eligible for phased permits? As the word "permit" suggests, this also involves a "base."

In conclusion, real estate that can receive step-by-step approval is, in principle, 'redevelopment and reconstruction real estate within a base area.'

However, the residence is not usually part of the base.

In particular, areas that have been developed in a planned manner, such as Daechi-dong in Gangnam-gu, Mok-dong in Yangcheon-gu, Bundang New Town, and Dunsan-dong in Daejeon Metropolitan City, have thoroughly separated residential and commercial areas.

Therefore, real estate eligible for phased approval includes not only redevelopment and reconstruction properties but also properties that are not bases but are located near bases and can be developed in conjunction with them.

--- p.94

Young professionals and their parents with limited investment funds often ask about realistic investments they can pursue.

If you are well-versed in the city's basic plan, you can make a good investment even with a small amount of money.

Since Mayor Oh Se-hoon took office, new redevelopment projects called the Rapid Integration Plan and Moatown have been introduced.

Although the specific methods and selection requirements for the two projects are different, the key point is that both projects prioritize 'consistency with the basic urban plan' as their top priority.

After battling cancer twice and struggling to survive, this investor decided to invest in real estate.

I've taken several real estate courses, but it wasn't until I took yours that I really started to delve deeper into urban planning.

His studies in real estate, which began amidst declining health and anxiety about the future, strengthened him and ultimately made him a skilled professional.

From now on, we will trace how this person discovered the clue to redevelopment at 49 Gaebong-dong.

--- p.44

Have you ever heard of the "greater fool theory"? It's a concept proposed by economist John Maynard Keynes.

This is a phenomenon in which a "fool" who bought an asset at a price higher than its actual value in anticipation of a price increase believes that an "even bigger fool" will come along and buy the asset again.

When applied to real estate, this is equivalent to the unfounded belief that “real estate prices will inevitably rise because supply continues to be insufficient compared to demand,” a situation similar to the creation of a kind of “bubble.”

--- p.57

Why do we need to know the golden price of real estate? In fact, investing is possible even without knowing the fair value.

In fact, many investors do just that.

But that's only possible in a market like Daesangseungjang where there are a lot of bigger fools.

However, since the bull market cycle comes in cycles of about 10 years, you will have to wait a long time.

It is difficult to make an investment 10 times and be successful 10 times.

However, if you just master the three principles presented in Part 1, you can succeed six or seven times.

If you want to succeed the remaining three or four times, and do so with minimal cost and time, you must be able to determine the appropriate price.

--- p.62

So, what types of properties are eligible for phased permits? As the word "permit" suggests, this also involves a "base."

In conclusion, real estate that can receive step-by-step approval is, in principle, 'redevelopment and reconstruction real estate within a base area.'

However, the residence is not usually part of the base.

In particular, areas that have been developed in a planned manner, such as Daechi-dong in Gangnam-gu, Mok-dong in Yangcheon-gu, Bundang New Town, and Dunsan-dong in Daejeon Metropolitan City, have thoroughly separated residential and commercial areas.

Therefore, real estate eligible for phased approval includes not only redevelopment and reconstruction properties but also properties that are not bases but are located near bases and can be developed in conjunction with them.

--- p.94

Young professionals and their parents with limited investment funds often ask about realistic investments they can pursue.

If you are well-versed in the city's basic plan, you can make a good investment even with a small amount of money.

Since Mayor Oh Se-hoon took office, new redevelopment projects called the Rapid Integration Plan and Moatown have been introduced.

Although the specific methods and selection requirements for the two projects are different, the key point is that both projects prioritize 'consistency with the basic urban plan' as their top priority.

--- p.157

Publisher's Review

***Korea's No. 1 Urban Planning Study***

***Location and Price Analysis***

***Promising Investment Areas Commentary***

Why doesn't the price go up when I buy it?

If you haven't been satisfied with your investments so far, start over with 'this method'!

Author Jaewoong Eom's new book, 'Investing Starting Again', has been published.

This book contains field-proven investment experience and practical know-how you can apply throughout your life.

This book answers investors' concerns and increases their chances of investment success, making it an essential guide for all investors.

In today's competitive investment environment, marked by rapidly changing policies, rising construction costs, and macroeconomic crises, success requires viable ideas and high-quality experience.

This book takes readers to the next level of investment by presenting step-by-step investment strategies along with practical methods for analyzing business sites used by developers in the field.

Furthermore, it provides past examples necessary to turn investment ideas into reality, opening up new perspectives on investing.

***The Best Investment Strategy Proven by Overwhelming Reviews***

“I used to only care about location, but now I’ve changed.

Now, we don't just chase subways, school districts, and windfalls.

“Because I was able to discover the true value of information on public institution sites.”

“I had a magical moment as memories of the past came to mind.

“I was so drawn in that I read it all in no time.”

“The ability to maximize returns in a short period of time and then start investing again is really appealing.”

“I just realized why the real estate I bought wasn’t the only one that went up in value until now.”

“This is a much-needed investment for people like me who need new hope.”

If you slipped up in your last investment, try starting fresh in a different way.

If you understand the principles of investing in urban planning, you will succeed.

When choosing a location, you need to know the difference between a base area and a high-end area and invest accordingly.

The base is not a superior location.

Since a high-end location is already a high-end location, it does not guarantee the best return on investment, so it is important to understand the true investment value of the base area.

This book provides examples and methodologies through case studies from various areas in Seoul.

Once you have identified a location by analyzing the urban plan, you must personally review its feasibility.

Let's calculate in advance when and how much we can sell it for.

A thorough pre-screening can maximize your investment returns, minimize risks, and increase your chances of success.

This book contains the necessary principles and examples.

People who need this book

- People who did not make enough profit during the last real estate boom

- People who feel that they pay more in taxes than they earn

- People who need to make an investment plan but have limited budget

- People who want to ask for advice from experts but don't know how to say it

- People who are curious about investment trends

- People who want to learn about investing correctly and soundly

***Location and Price Analysis***

***Promising Investment Areas Commentary***

Why doesn't the price go up when I buy it?

If you haven't been satisfied with your investments so far, start over with 'this method'!

Author Jaewoong Eom's new book, 'Investing Starting Again', has been published.

This book contains field-proven investment experience and practical know-how you can apply throughout your life.

This book answers investors' concerns and increases their chances of investment success, making it an essential guide for all investors.

In today's competitive investment environment, marked by rapidly changing policies, rising construction costs, and macroeconomic crises, success requires viable ideas and high-quality experience.

This book takes readers to the next level of investment by presenting step-by-step investment strategies along with practical methods for analyzing business sites used by developers in the field.

Furthermore, it provides past examples necessary to turn investment ideas into reality, opening up new perspectives on investing.

***The Best Investment Strategy Proven by Overwhelming Reviews***

“I used to only care about location, but now I’ve changed.

Now, we don't just chase subways, school districts, and windfalls.

“Because I was able to discover the true value of information on public institution sites.”

“I had a magical moment as memories of the past came to mind.

“I was so drawn in that I read it all in no time.”

“The ability to maximize returns in a short period of time and then start investing again is really appealing.”

“I just realized why the real estate I bought wasn’t the only one that went up in value until now.”

“This is a much-needed investment for people like me who need new hope.”

If you slipped up in your last investment, try starting fresh in a different way.

If you understand the principles of investing in urban planning, you will succeed.

When choosing a location, you need to know the difference between a base area and a high-end area and invest accordingly.

The base is not a superior location.

Since a high-end location is already a high-end location, it does not guarantee the best return on investment, so it is important to understand the true investment value of the base area.

This book provides examples and methodologies through case studies from various areas in Seoul.

Once you have identified a location by analyzing the urban plan, you must personally review its feasibility.

Let's calculate in advance when and how much we can sell it for.

A thorough pre-screening can maximize your investment returns, minimize risks, and increase your chances of success.

This book contains the necessary principles and examples.

People who need this book

- People who did not make enough profit during the last real estate boom

- People who feel that they pay more in taxes than they earn

- People who need to make an investment plan but have limited budget

- People who want to ask for advice from experts but don't know how to say it

- People who are curious about investment trends

- People who want to learn about investing correctly and soundly

GOODS SPECIFICS

- Date of issue: May 30, 2024

- Page count, weight, size: 208 pages | 146*206*20mm

- ISBN13: 9791156627098

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)