Why John Lee's Stocks?

|

Description

Book Introduction

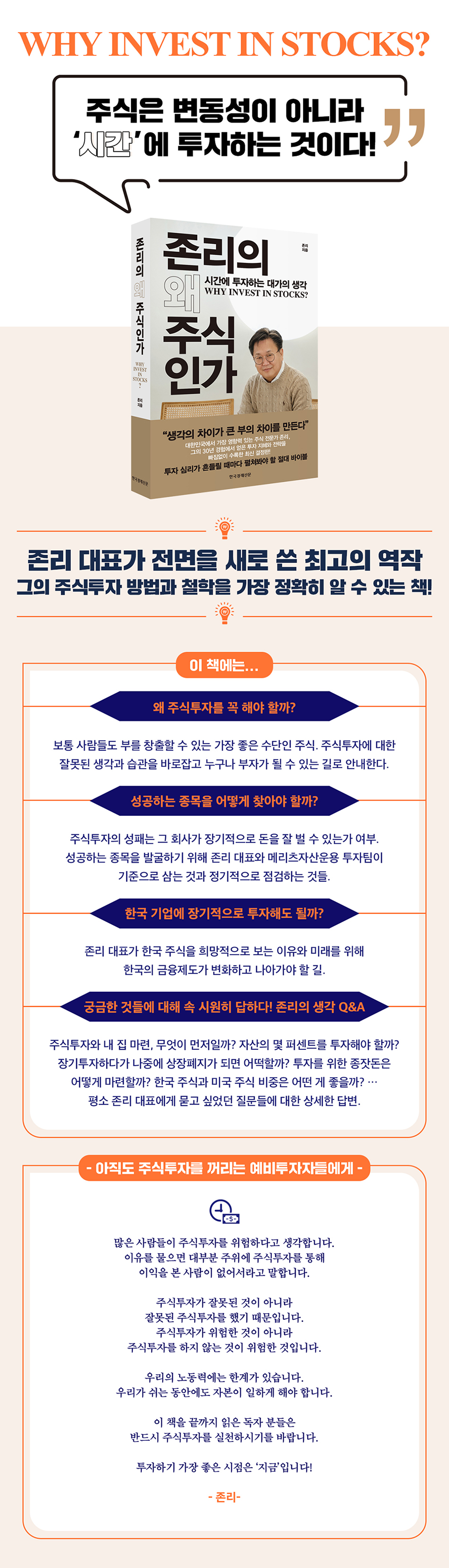

“A book that lets you know exactly what the evolving John Lee is thinking!” John Lee, the most influential stock expert in South Korea His investment philosophy and strategies gained from his 30 years of experience The latest definitive edition, complete with all the best! The more anxious you are, the more stock principles you must follow! “Investing in stocks is like planting a tree and taking all the fruit it produces. If you sell stocks because you expect a decline, you may lose money because of weather forecasts that indicate floods, droughts, or strong winds. “It’s like pulling out an apple tree before it’s even harvested.” - John Lee The masterpiece of CEO John Lee, who sparked a stock investment boom in Korea. Absolute principles and famous sayings to keep in mind as the stock market fluctuates [John Lee's Thoughts Q&A] included to satisfy readers' curiosity A completely revised edition republished after 10 years. All the author's latest thoughts on investing! It is truly the 'age of stocks', and the 'age of big stocks'. It's become harder to find someone who doesn't invest than someone who does, and even elementary school students are entering the challenging world of investing. In the midst of this trend of the times, there is a name called ‘John Lee’. The current CEO of Meritz Asset Management and a former Wall Street fund manager who launched the world's first 'Korea Fund' to promote Korean stocks overseas. Recently, he has been called the 'pioneer of the Donghak Peasant Movement' and 'stock evangelist' in Korea, and has created a 'John Lee craze'. Before asking 'Why stocks?', I even think we should ask 'Why John Lee?' This book, "Why Stocks with John Lee," contains the author's investment philosophy and strategies without exception. This book is truly the definitive edition, a masterpiece that contains the author's 30 years of experience. If you want to know exactly about John Lee's stock investment method, you must read this book! This book, divided into four chapters, contains the expert's unique insights into "Why Ordinary People Should Invest in Stocks," "How to Pick Successful Stocks," "The Author's Investment Criteria," and finally, "The Future of Korean Finance." This book also includes a special section called [John Lee's Thoughts Q&A]. Over the past five years, the author has given over 2,000 lectures to over 50,000 audiences, and has compiled the most frequently asked questions and provided detailed answers. This will provide sufficient answers to questions not only for beginners in stock investing but also for investors already investing in stocks, and will make the path to investing more clear. |

- You can preview some of the book's contents.

Preview

index

Writing a Completely Revised Edition - Stocks, the Hardest-Working Asset

Introduction - To prospective investors who are still hesitant about investing in stocks

Acknowledgements

CHAPTER1.

Is it necessary to invest in stocks?

1.

The only 'wealth creation' opportunity for ordinary people

2.

Three Reasons Why You Should Invest in Stocks

3.

Why should you invest for the long term?

CHAPTER2.

A difference in thinking makes a big difference in wealth.

1.

The money you set aside before spending is your spare money, not the money left over after spending.

2.

Retirement pensions and pension savings funds are a priority.

3.

Funds are more advantageous than individual stocks.

4.

There is no market timing

5.

The market flow has nothing to do with my trading timing.

6.

The chart is just a historical fact.

7.

Shareholders are the owners of the company.

CHAPTER3.

I invest in these companies

1.

How to find a successful stock?

2.

Two approaches to stock discovery? Top-down and bottom-up.

3.

Understand your company's financial health

4.

undervalued companies

5.

Indicators that indicate undervalued corporate value

6.

Great managers are the future of a company.

7.

There are so many good companies.

8.

How do you identify a good fund?

CHAPTER4.

Where will Korea's future go?

1.

Stock investment is essential for national retirement planning.

2.

What does it take to become a leading financial institution?

3.

What problems does Japan face?

4.

Dreaming of becoming Asia's financial hub

Going Out - Now is a Good Time to Invest

Introduction - To prospective investors who are still hesitant about investing in stocks

Acknowledgements

CHAPTER1.

Is it necessary to invest in stocks?

1.

The only 'wealth creation' opportunity for ordinary people

2.

Three Reasons Why You Should Invest in Stocks

3.

Why should you invest for the long term?

CHAPTER2.

A difference in thinking makes a big difference in wealth.

1.

The money you set aside before spending is your spare money, not the money left over after spending.

2.

Retirement pensions and pension savings funds are a priority.

3.

Funds are more advantageous than individual stocks.

4.

There is no market timing

5.

The market flow has nothing to do with my trading timing.

6.

The chart is just a historical fact.

7.

Shareholders are the owners of the company.

CHAPTER3.

I invest in these companies

1.

How to find a successful stock?

2.

Two approaches to stock discovery? Top-down and bottom-up.

3.

Understand your company's financial health

4.

undervalued companies

5.

Indicators that indicate undervalued corporate value

6.

Great managers are the future of a company.

7.

There are so many good companies.

8.

How do you identify a good fund?

CHAPTER4.

Where will Korea's future go?

1.

Stock investment is essential for national retirement planning.

2.

What does it take to become a leading financial institution?

3.

What problems does Japan face?

4.

Dreaming of becoming Asia's financial hub

Going Out - Now is a Good Time to Invest

Detailed image

Into the book

Too many people still think of stock investing as chasing short-term returns.

Almost everyone I meet talks about returns.

The reason for investing in funds or stocks should be to achieve financial independence, that is, to prepare for retirement.

It's like running a marathon.

Obsessing over short-term returns is like being fixated on the 100-meter time while running a marathon.

Rather than saying what percentage of returns you have, you should be able to say how many hundreds or thousands of shares you own of a certain fund or a certain stock.

Funds and stocks are something you accumulate steadily.

When you retire, your retirement funds will be the number of funds or stocks you have accumulated multiplied by their price at the time of retirement.

It's likely to be a pretty surprising amount.

The stock market doesn't always move in a straight line upward.

There will be occasional ups and downs.

But in the long run, it will trend upward.

Because companies constantly strive to maximize sales and profits.

As sales and profits increase, the company's market capitalization inevitably increases, and the profits from this increase are shared by investors who own the stock.

People who trade frequently with the hope of short-term profits are more likely to miss out on big profits.

---From "Writing a Completely Revised Edition"

There are few ways for a salaryman to build wealth without investing in stocks.

Of course, there are many people who make money through real estate investment, but real estate investment requires a large sum of money.

And it is an asset that does not require much work compared to stocks.

Investing in stocks is not only a useful way to make money, but even if you buy a little bit every month, it can add up to a lot of money later on.

If you're thinking about your retirement, the younger you are, the more active you should be in stock investment.

It is impossible for a salaryman to save only his salary and prepare for retirement in 20 or 30 years.

If you set aside a portion of your salary and invest it in stocks, you will at least not face financial difficulties after retirement.

If you buy stocks of companies that will survive and grow continuously and wait 10 or 20 years, the stock price will definitely go up significantly.

In a capitalist country, stock investments are bound to yield much better returns than bonds or bank deposits, both practically and theoretically.

---From "The Only Opportunity for Ordinary People to Create Wealth"

Q: They say individual investors can't win because they don't have the information compared to foreigners or institutions.

Should I still invest in stocks?

A stock is not a matter of having a specialist, it is a matter of training.

Anyone can become an expert.

What's important is the courage to think differently from those around you, the courage to invest for the long term, and the philosophy to not worry too much about stock volatility.

In particular, the most common comments I hear are, “Aren’t I at a disadvantage compared to fund managers?” and “Information is asymmetric.” These are incorrect thoughts.

It's not because we don't have the information, it's because we misinterpret or overreact to information we already know.

Rather, it is not uncommon for an overabundance of short-term information to hinder long-term investment.

In other words, it is not that there is a lack of information, but rather that there are many cases where information is misinterpreted.

In fact, there is too much information, and many times, we make wrong decisions because of useless information.

Since you're going to be investing for 10 or 20 years anyway, yesterday's information isn't that important.

Stock investing is not a battle of information, but a battle of patience and philosophy.

That is, investing in time.

There is also a widespread belief that 'how can small investors profit in the stock market? They are no match for investors with large capital.'

This is a very wrong idea.

Individual investors can be smarter than institutional investors.

Investing in stocks is not just about investing, it's a lifestyle.

It's training.

10% of your salary must be invested in stocks or funds.

Korea has a great pension savings fund system, so you can fully prepare for retirement by taking advantage of it or investing your retirement pension in stock funds instead of principal-protected investments.

---From "John Lee's Thoughts Q&A"

The greater the proportion of stocks in household assets, the greater the likelihood of becoming wealthy in the future.

However, the proportion of stocks among the financial assets of Korean households is around 15%.

Even if you include bonds, investment trusts, and funds, it only amounts to 30%.

On the other hand, investment products account for 70-80% of household financial assets in the United States, and deposits account for only about 12%.

Americans only deposit enough money to last them one or two months in the bank and put the rest of their assets in high-yield investment products.

Until the 1970s, the United States was not much different from our country.

However, with the introduction of retirement pension systems such as 401K in the 1980s, stock funds began to gain popularity.

Of course, the fact that American companies were actively restructuring and implementing shareholder-focused management at the time, the emergence of capable asset management companies, and active investor education also had an impact.

However, in Japan, despite interest rates being much lower than in the United States, deposits did not move to investment.

This was due to the misconception that stock investment was a source of unearned income.

An even bigger problem is that we have made the mistake of focusing solely on real estate instead of investing in stocks.

And that is now acting as a stumbling block to the Japanese economy.

Let's compare the United States, which began actively investing in stocks in the 1980s, with Japan today.

Then, we will have an answer to the question of how our country's household financial assets will flow in the future.

They say there is no nation as dynamic as the Korean people.

However, in the world of investment, Koreans' intelligence has yet to shine.

A change in perception of stock investment is needed, especially training in long-term investment.

Q What is the relationship between stock price and a company's competitiveness?

A If a company's market capitalization is 200 trillion won and its stock price rises to 300 trillion won, then this company's competitiveness has also greatly improved.

This is because the cost of financing is significantly reduced, which improves corporate performance.

For example, Tesla produces less than 1 million electric vehicles per year.

It will work.

However, Tesla's market capitalization has skyrocketed as investors have bought the stock, seeing its growth potential.

Hyundai Motor Company sold 3,909,881 vehicles worldwide in 2021.

Tesla sold 936,172 units.

As of January 21, 2022, Tesla's market capitalization was 1,194.4195 trillion won, and Hyundai Motor's was 42.6268 trillion won.

Hyundai's sales volume is 4 times higher, but Tesla's market capitalization is 28 times higher.

A larger market capitalization lowers the cost of capital and improves competitiveness.

As Korean companies' market capitalization increases, their competitiveness increases.

No matter how well Samsung Electronics, Korea's top company, performs, if investors turn a blind eye and its market capitalization remains low, its competitiveness will decline.

On the other hand, if investment proceeds smoothly, a company like Tesla could emerge in Korea.

As the value of your stock rises, you can hire a lot of talented people from all over the world.

Because you can compensate with stocks.

Mergers and acquisitions (M&A) can also occur naturally.

Tesla doesn't make electric cars with its own original technology either.

The power of market capitalization generated by rising stock prices can be used to acquire competitors or companies with new technologies.

Q: The U.S. market is trending upward, but Korean stocks are staying in a box for a long time. Can ordinary people really achieve high returns through long-term investment?

A You might think so if you just look at the index.

When I first became a fund manager in the US, Americans thought the same thing.

You have to invest in emerging markets to make money, American stocks are boring.

So, US stocks didn't rise much at that time.

Many companies in Korea went bankrupt during the IMF and Lehman Brothers crises.

It's all included in the index.

In the case of the United States, it may be different if we include all but 30 samples.

Also, since it's a market average, rather than simply thinking that the US or Korea are not good, it's more important to see whether there are more companies in Korea that I can invest in.

It's not that it's bad because the overall index isn't rising, but it's a better environment because of that.

Because it means there is greater potential for development.

Korea has a pension fund worth a whopping 230 trillion won, but stocks only account for 3% of it.

In contrast, the United States is approaching 40%.

If pension funds, like in the US, invest in Korean stocks, they could rise significantly.

Another thing is that many people still think that you shouldn't invest in stocks.

That means there's less competition, the stock price is still cheap, and the bubble hasn't arrived yet.

---From "John Lee's Thoughts Q&A"

So how can we identify investments that will survive and generate significant returns? Which companies will survive even recessions and economic crises and continue to grow until we need retirement funds? What criteria should we use to identify successful companies? I'd like to share the key factors my team and I consider when considering investments.

First, look at the qualifications of the management.

Business management is done by people.

Ultimately, a company's success or failure depends on how hard its management and employees work to help the company grow.

The presence of intelligent and ethical management is the most important factor to consider when investing in stocks.

The quality of management is called 'management quality' in English.

(Omitted) Second, pay attention to the company’s scalability.

Companies with scalable businesses will see their market capitalization grow faster than those without.

Assuming you are running a business, the principle behind increasing sales is that you should do wholesale rather than retail.

The reason why the stock prices of Internet-based companies have increased significantly is also because of their future scalability.

Companies whose sales growth is minimal or limited due to structural reasons have less attractive stocks.

Third, invest in companies in industries where it is difficult for competitors to enter.

It is advisable to be interested in companies with high barriers to entry.

Industries that are easy to enter have a lot of competitors, which means higher marketing costs and lower profit margins.

Companies with superior technological capabilities, patents, or high brand power are examples of companies with high barriers to entry.

Almost everyone I meet talks about returns.

The reason for investing in funds or stocks should be to achieve financial independence, that is, to prepare for retirement.

It's like running a marathon.

Obsessing over short-term returns is like being fixated on the 100-meter time while running a marathon.

Rather than saying what percentage of returns you have, you should be able to say how many hundreds or thousands of shares you own of a certain fund or a certain stock.

Funds and stocks are something you accumulate steadily.

When you retire, your retirement funds will be the number of funds or stocks you have accumulated multiplied by their price at the time of retirement.

It's likely to be a pretty surprising amount.

The stock market doesn't always move in a straight line upward.

There will be occasional ups and downs.

But in the long run, it will trend upward.

Because companies constantly strive to maximize sales and profits.

As sales and profits increase, the company's market capitalization inevitably increases, and the profits from this increase are shared by investors who own the stock.

People who trade frequently with the hope of short-term profits are more likely to miss out on big profits.

---From "Writing a Completely Revised Edition"

There are few ways for a salaryman to build wealth without investing in stocks.

Of course, there are many people who make money through real estate investment, but real estate investment requires a large sum of money.

And it is an asset that does not require much work compared to stocks.

Investing in stocks is not only a useful way to make money, but even if you buy a little bit every month, it can add up to a lot of money later on.

If you're thinking about your retirement, the younger you are, the more active you should be in stock investment.

It is impossible for a salaryman to save only his salary and prepare for retirement in 20 or 30 years.

If you set aside a portion of your salary and invest it in stocks, you will at least not face financial difficulties after retirement.

If you buy stocks of companies that will survive and grow continuously and wait 10 or 20 years, the stock price will definitely go up significantly.

In a capitalist country, stock investments are bound to yield much better returns than bonds or bank deposits, both practically and theoretically.

---From "The Only Opportunity for Ordinary People to Create Wealth"

Q: They say individual investors can't win because they don't have the information compared to foreigners or institutions.

Should I still invest in stocks?

A stock is not a matter of having a specialist, it is a matter of training.

Anyone can become an expert.

What's important is the courage to think differently from those around you, the courage to invest for the long term, and the philosophy to not worry too much about stock volatility.

In particular, the most common comments I hear are, “Aren’t I at a disadvantage compared to fund managers?” and “Information is asymmetric.” These are incorrect thoughts.

It's not because we don't have the information, it's because we misinterpret or overreact to information we already know.

Rather, it is not uncommon for an overabundance of short-term information to hinder long-term investment.

In other words, it is not that there is a lack of information, but rather that there are many cases where information is misinterpreted.

In fact, there is too much information, and many times, we make wrong decisions because of useless information.

Since you're going to be investing for 10 or 20 years anyway, yesterday's information isn't that important.

Stock investing is not a battle of information, but a battle of patience and philosophy.

That is, investing in time.

There is also a widespread belief that 'how can small investors profit in the stock market? They are no match for investors with large capital.'

This is a very wrong idea.

Individual investors can be smarter than institutional investors.

Investing in stocks is not just about investing, it's a lifestyle.

It's training.

10% of your salary must be invested in stocks or funds.

Korea has a great pension savings fund system, so you can fully prepare for retirement by taking advantage of it or investing your retirement pension in stock funds instead of principal-protected investments.

---From "John Lee's Thoughts Q&A"

The greater the proportion of stocks in household assets, the greater the likelihood of becoming wealthy in the future.

However, the proportion of stocks among the financial assets of Korean households is around 15%.

Even if you include bonds, investment trusts, and funds, it only amounts to 30%.

On the other hand, investment products account for 70-80% of household financial assets in the United States, and deposits account for only about 12%.

Americans only deposit enough money to last them one or two months in the bank and put the rest of their assets in high-yield investment products.

Until the 1970s, the United States was not much different from our country.

However, with the introduction of retirement pension systems such as 401K in the 1980s, stock funds began to gain popularity.

Of course, the fact that American companies were actively restructuring and implementing shareholder-focused management at the time, the emergence of capable asset management companies, and active investor education also had an impact.

However, in Japan, despite interest rates being much lower than in the United States, deposits did not move to investment.

This was due to the misconception that stock investment was a source of unearned income.

An even bigger problem is that we have made the mistake of focusing solely on real estate instead of investing in stocks.

And that is now acting as a stumbling block to the Japanese economy.

Let's compare the United States, which began actively investing in stocks in the 1980s, with Japan today.

Then, we will have an answer to the question of how our country's household financial assets will flow in the future.

They say there is no nation as dynamic as the Korean people.

However, in the world of investment, Koreans' intelligence has yet to shine.

A change in perception of stock investment is needed, especially training in long-term investment.

Q What is the relationship between stock price and a company's competitiveness?

A If a company's market capitalization is 200 trillion won and its stock price rises to 300 trillion won, then this company's competitiveness has also greatly improved.

This is because the cost of financing is significantly reduced, which improves corporate performance.

For example, Tesla produces less than 1 million electric vehicles per year.

It will work.

However, Tesla's market capitalization has skyrocketed as investors have bought the stock, seeing its growth potential.

Hyundai Motor Company sold 3,909,881 vehicles worldwide in 2021.

Tesla sold 936,172 units.

As of January 21, 2022, Tesla's market capitalization was 1,194.4195 trillion won, and Hyundai Motor's was 42.6268 trillion won.

Hyundai's sales volume is 4 times higher, but Tesla's market capitalization is 28 times higher.

A larger market capitalization lowers the cost of capital and improves competitiveness.

As Korean companies' market capitalization increases, their competitiveness increases.

No matter how well Samsung Electronics, Korea's top company, performs, if investors turn a blind eye and its market capitalization remains low, its competitiveness will decline.

On the other hand, if investment proceeds smoothly, a company like Tesla could emerge in Korea.

As the value of your stock rises, you can hire a lot of talented people from all over the world.

Because you can compensate with stocks.

Mergers and acquisitions (M&A) can also occur naturally.

Tesla doesn't make electric cars with its own original technology either.

The power of market capitalization generated by rising stock prices can be used to acquire competitors or companies with new technologies.

Q: The U.S. market is trending upward, but Korean stocks are staying in a box for a long time. Can ordinary people really achieve high returns through long-term investment?

A You might think so if you just look at the index.

When I first became a fund manager in the US, Americans thought the same thing.

You have to invest in emerging markets to make money, American stocks are boring.

So, US stocks didn't rise much at that time.

Many companies in Korea went bankrupt during the IMF and Lehman Brothers crises.

It's all included in the index.

In the case of the United States, it may be different if we include all but 30 samples.

Also, since it's a market average, rather than simply thinking that the US or Korea are not good, it's more important to see whether there are more companies in Korea that I can invest in.

It's not that it's bad because the overall index isn't rising, but it's a better environment because of that.

Because it means there is greater potential for development.

Korea has a pension fund worth a whopping 230 trillion won, but stocks only account for 3% of it.

In contrast, the United States is approaching 40%.

If pension funds, like in the US, invest in Korean stocks, they could rise significantly.

Another thing is that many people still think that you shouldn't invest in stocks.

That means there's less competition, the stock price is still cheap, and the bubble hasn't arrived yet.

---From "John Lee's Thoughts Q&A"

So how can we identify investments that will survive and generate significant returns? Which companies will survive even recessions and economic crises and continue to grow until we need retirement funds? What criteria should we use to identify successful companies? I'd like to share the key factors my team and I consider when considering investments.

First, look at the qualifications of the management.

Business management is done by people.

Ultimately, a company's success or failure depends on how hard its management and employees work to help the company grow.

The presence of intelligent and ethical management is the most important factor to consider when investing in stocks.

The quality of management is called 'management quality' in English.

(Omitted) Second, pay attention to the company’s scalability.

Companies with scalable businesses will see their market capitalization grow faster than those without.

Assuming you are running a business, the principle behind increasing sales is that you should do wholesale rather than retail.

The reason why the stock prices of Internet-based companies have increased significantly is also because of their future scalability.

Companies whose sales growth is minimal or limited due to structural reasons have less attractive stocks.

Third, invest in companies in industries where it is difficult for competitors to enter.

It is advisable to be interested in companies with high barriers to entry.

Industries that are easy to enter have a lot of competitors, which means higher marketing costs and lower profit margins.

Companies with superior technological capabilities, patents, or high brand power are examples of companies with high barriers to entry.

---From "How to find a successful stock?"

Publisher's Review

“A difference in thinking makes a big difference in wealth!”

A clear answer and perfect guide to the questions, "Why stocks?" and "Why John Lee?"

Correcting existing wrong investment methods and habits

A book that guides ordinary people on the path to wealth through investment!

This is truly the era of stocks.

A lot of people are busy looking for information that can make money.

But there aren't many people who actually became rich through stocks.

Why is that?

It's because your thinking about stock investment is wrong.

There are many things to consider before investing, such as what stocks are, why ordinary people, especially salaried workers, should invest in stocks, what the purpose of stock investment is, and how to do it.

It's time to stop making reckless investments that start too early and end up losing money too early.

In the midst of the current of the stock market, there is a name called 'John Lee'.

The current CEO of Meritz Asset Management and a former star fund manager on Wall Street who launched the world's first 'Korea Fund' to promote Korean stocks overseas.

Recently, he has been called the 'pioneer of the Donghak Peasant Movement' and 'stock evangelist' in Korea, and has created a 'John Lee craze'.

As the stock market fluctuated between crashes and sharp rebounds due to COVID-19, with the KOSPI index surpassing 3,000, CEO John Lee became a strong advisor to individual investors, known as "Donghak Ants," with his firm investment philosophy and principles.

What message does CEO John Lee want to convey to stock investors?

“Stocks are about investing in time, not volatility!”

The more anxious you are, the more important stock market principles you should follow.

The best new work written by CEO John Lee!

There are all kinds of prejudices floating around in the world about stock investment.

The author, a successful fund manager on Wall Street, first tried to change the misconceptions Koreans had about stock investment after returning to Korea.

Chapter 1 of this book also begins with a story about him.

According to the author, nothing can make ordinary people richer than stock investment, if only they understand it properly.

In a capitalist society, it is almost the only way for ordinary people to create wealth.

However, the right philosophy and method for investing are needed.

The core of the method is to start investing in stocks early with a long-term perspective as an investment for retirement, and to wait for 10 or 20 years while steadily purchasing stocks of companies that will survive and grow.

Trying to buy and sell stocks at the right time by following the momentum of the market or individual stocks is not a good idea.

In theory, it seems like a plausible way to predict the market and make a profit by buying when the price falls and selling when it rises, but this method is not always accurate and is practically impossible.

The author is concerned that most people are caught up in this impossible game of guessing the answer.

Thus, the author teaches you how to succeed in investing in your own way, regardless of market trends.

First, the author recommends investing with spare money.

However, spare money is not money left over after spending, but money set aside before spending, and moderation in overspending, symbolized by things like tea, coffee, and luxury goods, is recommended.

After emphasizing the need for pension savings funds or retirement pensions for a stable retirement, it explains how to appropriately invest in stocks and funds.

Perhaps one of the most pressing questions readers may have is, "How can I find investments that will survive and generate significant returns?"

Which companies will survive a recession or economic crisis and continue to grow until I need retirement funds?

What criteria should we use to select companies to find successful ones?

This book details the criteria that the author and Meritz Asset Management's investment team consider important when considering investment targets.

People often say, "Aren't I at a disadvantage compared to fund managers?" or "Information is asymmetric," but according to the author, stocks aren't about having a separate expert, but rather a matter of training.

The problem is misinterpreting or overreacting to information already known, and in many cases, the overabundance of short-term information hinders long-term investment.

So, the author says that instead of making wrong decisions due to useless information, you should study and invest consistently while adhering to the principles taught in this book, and remember that stock investment is not a battle of information, but a battle of patience.

In other words, stocks are an investment in time.

Finally, another point this book emphasizes is the future of Korean finance.

The author points out that Korea's retirement pension system needs improvement.

Additionally, it emphasizes the need for financial education.

The reason is that many Korean companies still have discounted stock prices, and it is believed that the undervaluation of Korean stocks will be resolved if the governance structure of Korean companies improves.

In addition, it emphasizes the reasons why our country's financial industry must develop and explains in detail how to do so.

A clear answer and perfect guide to the questions, "Why stocks?" and "Why John Lee?"

Correcting existing wrong investment methods and habits

A book that guides ordinary people on the path to wealth through investment!

This is truly the era of stocks.

A lot of people are busy looking for information that can make money.

But there aren't many people who actually became rich through stocks.

Why is that?

It's because your thinking about stock investment is wrong.

There are many things to consider before investing, such as what stocks are, why ordinary people, especially salaried workers, should invest in stocks, what the purpose of stock investment is, and how to do it.

It's time to stop making reckless investments that start too early and end up losing money too early.

In the midst of the current of the stock market, there is a name called 'John Lee'.

The current CEO of Meritz Asset Management and a former star fund manager on Wall Street who launched the world's first 'Korea Fund' to promote Korean stocks overseas.

Recently, he has been called the 'pioneer of the Donghak Peasant Movement' and 'stock evangelist' in Korea, and has created a 'John Lee craze'.

As the stock market fluctuated between crashes and sharp rebounds due to COVID-19, with the KOSPI index surpassing 3,000, CEO John Lee became a strong advisor to individual investors, known as "Donghak Ants," with his firm investment philosophy and principles.

What message does CEO John Lee want to convey to stock investors?

“Stocks are about investing in time, not volatility!”

The more anxious you are, the more important stock market principles you should follow.

The best new work written by CEO John Lee!

There are all kinds of prejudices floating around in the world about stock investment.

The author, a successful fund manager on Wall Street, first tried to change the misconceptions Koreans had about stock investment after returning to Korea.

Chapter 1 of this book also begins with a story about him.

According to the author, nothing can make ordinary people richer than stock investment, if only they understand it properly.

In a capitalist society, it is almost the only way for ordinary people to create wealth.

However, the right philosophy and method for investing are needed.

The core of the method is to start investing in stocks early with a long-term perspective as an investment for retirement, and to wait for 10 or 20 years while steadily purchasing stocks of companies that will survive and grow.

Trying to buy and sell stocks at the right time by following the momentum of the market or individual stocks is not a good idea.

In theory, it seems like a plausible way to predict the market and make a profit by buying when the price falls and selling when it rises, but this method is not always accurate and is practically impossible.

The author is concerned that most people are caught up in this impossible game of guessing the answer.

Thus, the author teaches you how to succeed in investing in your own way, regardless of market trends.

First, the author recommends investing with spare money.

However, spare money is not money left over after spending, but money set aside before spending, and moderation in overspending, symbolized by things like tea, coffee, and luxury goods, is recommended.

After emphasizing the need for pension savings funds or retirement pensions for a stable retirement, it explains how to appropriately invest in stocks and funds.

Perhaps one of the most pressing questions readers may have is, "How can I find investments that will survive and generate significant returns?"

Which companies will survive a recession or economic crisis and continue to grow until I need retirement funds?

What criteria should we use to select companies to find successful ones?

This book details the criteria that the author and Meritz Asset Management's investment team consider important when considering investment targets.

People often say, "Aren't I at a disadvantage compared to fund managers?" or "Information is asymmetric," but according to the author, stocks aren't about having a separate expert, but rather a matter of training.

The problem is misinterpreting or overreacting to information already known, and in many cases, the overabundance of short-term information hinders long-term investment.

So, the author says that instead of making wrong decisions due to useless information, you should study and invest consistently while adhering to the principles taught in this book, and remember that stock investment is not a battle of information, but a battle of patience.

In other words, stocks are an investment in time.

Finally, another point this book emphasizes is the future of Korean finance.

The author points out that Korea's retirement pension system needs improvement.

Additionally, it emphasizes the need for financial education.

The reason is that many Korean companies still have discounted stock prices, and it is believed that the undervaluation of Korean stocks will be resolved if the governance structure of Korean companies improves.

In addition, it emphasizes the reasons why our country's financial industry must develop and explains in detail how to do so.

GOODS SPECIFICS

- Date of issue: February 7, 2022

- Format: Hardcover book binding method guide

- Page count, weight, size: 324 pages | 606g | 140*205*30mm

- ISBN13: 9788947547901

- ISBN10: 8947547905

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)