Decoupling

|

Description

Book Introduction

Google, YouTube, Microsoft, Walmart, Nike, BMW… Companies around the world are excited! Why do they want 'decoupling'? A masterpiece that turns today's conventional wisdom about innovation upside down The true nature of market disruption, revealed through eight years of research by a Harvard MBA professor. A management strategy book published by Professor Teixeira of Harvard Business School after eight years of persistent research. We uncover the true nature of the market disruption that shook the world, as well as the secrets to the success of aggressive and reckless emerging companies. Across the globe, a plethora of new companies, including Uber, Airbnb, Zipcar, Netflix, Amazon, Twitch, and TripAdvisor, are disrupting established companies and dominating their markets. Accordingly, existing companies took notice of the 'new technologies' of new companies and called for 'digital innovation', seeking organizational and technological innovation. Meanwhile, Professor Teixeira emphasizes that “the main culprit of market destruction is not new technology, but customers,” and proposes the theory of decoupling. The author actually analyzed real-world cases by visiting hundreds of large and emerging companies over eight years, and discovered that there is a "common pattern" in the way emerging powerhouses change the market landscape. Decoupling is the process of breaking the weak link between customer consumption activities (product exploration, evaluation, purchase, and use) and taking control of that point. The power of decoupling is what made companies like Uber and Airbnb, which didn't seem to have any great technology, into tens of trillions of won worth of dinosaur companies. "Decoupling" presents a highly practical roadmap, drawing on hundreds of case studies, on how established companies can respond to decoupling attacks from new companies, how to innovate their business models by applying the decoupling formula to their own businesses, and even how to build disruptive startups like Airbnb. |

- You can preview some of the book's contents.

Preview

index

Recommendation

To Korean readers

Entering

Part 1: Your Market Is Crashing

Chapter 1: Disruptive Corporate Attacks Have One Thing in Common

The crisis facing Best Buy, America's largest home appliance retailer | Amazon, Birchbox, Supercell... The chaos caused by disruptive companies | So, what is decoupling? | Every industry, from finance to home appliances, automobiles, broadcasting, and even home cooking, is at risk | Why customers want 'decoupling' | Why the Best Buy CEO met with Samsung

Chapter 2: What's Destroying Your Business

Ryanair's Business Model Innovation | How the Innovative Supermarket Makes Money | When a Promising Business Model Takes Off, Disruptors Quickly Ride the Wave | Three Waves of Disruption | Why Buffett Acquired an Unprofitable Car Dealership | Trove and Klarna: Innovation Driven by Model, Not Technology | Is It Really Your Lemonade?

Chapter 3: The culprit of destruction is not technology, but customers.

Airbnb didn't destroy the Four Seasons | What Michael Porter and Game Theory Missed | Decoupling Takes Three Forms | The Power of Decoupling: Customers Want Specialization, Not Integration | Will Your Customers Buy from Walmart or Amazon? | The Customers Who Disrupted Sephora Will Disrupt Your Market, Too

Chapter 4: Anyone Can Be a Decoupler

The billion-dollar Twitch story that captivated gaming enthusiasts | Applying the 3-step business innovation model to Twitch | The 5-step decoupling formula that works for both established companies and startups | Harvard and MIT graduates put it into practice | What type of decoupler do venture capitalists prefer? | How to conquer the market faster and more safely than Twitch.

Part 2: How to Resist the Destroyer's Attack

Chapter 5: Two Ways to Deal with Decouplers

How Dollar Shave Club Destroyed Gillette's Monopoly | Copy, Acquire, or Smother It | Option 1: Simply Reunite | Option 2: Separate and Rebalance | Success Stories of Rebalancing: The Best Buy and Telefónica Story | How to Rebalance Your Business Model | The End of "Pay $5 if You're Just Looking"

Chapter 6: Calculating Market Share at Risk

When Uber Threatens the Global Auto Industry | Assessing Risk (1) Is a Disruptor Threatening My Market? | Assessing Risk (2) Are Customers Leaving My Market? | Self-Selection Mechanisms: What Do Customers Gain and What Do They Give Up? | How Much Can Salary Finance Eat into the UK Loan Market? | Respond or Not? Understanding the Risk Level | The Side Effects of Overreaction: Lessons from Yahoo

Part 3: You, Too, Can Build a Disruptive Business

Chapter 7: Acquiring Your First Thousand Customers

Reselling used luxury bags: The birth of Rebag | Macy's and J.Crew, in the sandwich | The biggest and most difficult startup: Launching an online marketplace | How Airbnb attracted its first 1,000 customers | 7 principles for securing first customers | How Rebag achieved instant success | Early customers do more than internal employees

Chapter 8 From a Thousand Customers to a Million

Step 1 for Rapid Growth for Startups | The Key to Growth Lies in Customer CVC Adjacent Areas | The Secret to Alibaba's Success: 20 Years of Hyper-Growth | Airbnb's CVC Expansion Strategy | How to Organize for Growth | The Light and Shadow of a Growth Strategy Through Integration

Chapter 9: Choosing to Grow Once More: Resetting Yourself as a Customer-Centric Company

Comcast vs.

The Netflix Wars | Blockbuster's Resource Obsession, Netflix's Customer Focus | What Happened at Microsoft, the Innovator | Customer-Centric Innovation: Changing Incentives or Changing People | (1) Changing Incentives: Intuit's Secret to Growth | (2) Changing People: The Axel Springer Story | A Leader's Choice for Realigning with a Customer Focus

Chapter 10: What is the next wave of destruction?

You don't necessarily have to predict the future | Track customer trends by examining the Big Seven | A common global trend: Set it once and forget it | Where is the greatest market potential based on monetary cost? | Where is the greatest market potential based on effort and time cost? | How to make the Big Seven yours

Coming out

Glossary of terms

The Difference Between Decoupling and Disruptive Innovation

Calculating MaR™ and TMaR™

Acknowledgements

References

Search

To Korean readers

Entering

Part 1: Your Market Is Crashing

Chapter 1: Disruptive Corporate Attacks Have One Thing in Common

The crisis facing Best Buy, America's largest home appliance retailer | Amazon, Birchbox, Supercell... The chaos caused by disruptive companies | So, what is decoupling? | Every industry, from finance to home appliances, automobiles, broadcasting, and even home cooking, is at risk | Why customers want 'decoupling' | Why the Best Buy CEO met with Samsung

Chapter 2: What's Destroying Your Business

Ryanair's Business Model Innovation | How the Innovative Supermarket Makes Money | When a Promising Business Model Takes Off, Disruptors Quickly Ride the Wave | Three Waves of Disruption | Why Buffett Acquired an Unprofitable Car Dealership | Trove and Klarna: Innovation Driven by Model, Not Technology | Is It Really Your Lemonade?

Chapter 3: The culprit of destruction is not technology, but customers.

Airbnb didn't destroy the Four Seasons | What Michael Porter and Game Theory Missed | Decoupling Takes Three Forms | The Power of Decoupling: Customers Want Specialization, Not Integration | Will Your Customers Buy from Walmart or Amazon? | The Customers Who Disrupted Sephora Will Disrupt Your Market, Too

Chapter 4: Anyone Can Be a Decoupler

The billion-dollar Twitch story that captivated gaming enthusiasts | Applying the 3-step business innovation model to Twitch | The 5-step decoupling formula that works for both established companies and startups | Harvard and MIT graduates put it into practice | What type of decoupler do venture capitalists prefer? | How to conquer the market faster and more safely than Twitch.

Part 2: How to Resist the Destroyer's Attack

Chapter 5: Two Ways to Deal with Decouplers

How Dollar Shave Club Destroyed Gillette's Monopoly | Copy, Acquire, or Smother It | Option 1: Simply Reunite | Option 2: Separate and Rebalance | Success Stories of Rebalancing: The Best Buy and Telefónica Story | How to Rebalance Your Business Model | The End of "Pay $5 if You're Just Looking"

Chapter 6: Calculating Market Share at Risk

When Uber Threatens the Global Auto Industry | Assessing Risk (1) Is a Disruptor Threatening My Market? | Assessing Risk (2) Are Customers Leaving My Market? | Self-Selection Mechanisms: What Do Customers Gain and What Do They Give Up? | How Much Can Salary Finance Eat into the UK Loan Market? | Respond or Not? Understanding the Risk Level | The Side Effects of Overreaction: Lessons from Yahoo

Part 3: You, Too, Can Build a Disruptive Business

Chapter 7: Acquiring Your First Thousand Customers

Reselling used luxury bags: The birth of Rebag | Macy's and J.Crew, in the sandwich | The biggest and most difficult startup: Launching an online marketplace | How Airbnb attracted its first 1,000 customers | 7 principles for securing first customers | How Rebag achieved instant success | Early customers do more than internal employees

Chapter 8 From a Thousand Customers to a Million

Step 1 for Rapid Growth for Startups | The Key to Growth Lies in Customer CVC Adjacent Areas | The Secret to Alibaba's Success: 20 Years of Hyper-Growth | Airbnb's CVC Expansion Strategy | How to Organize for Growth | The Light and Shadow of a Growth Strategy Through Integration

Chapter 9: Choosing to Grow Once More: Resetting Yourself as a Customer-Centric Company

Comcast vs.

The Netflix Wars | Blockbuster's Resource Obsession, Netflix's Customer Focus | What Happened at Microsoft, the Innovator | Customer-Centric Innovation: Changing Incentives or Changing People | (1) Changing Incentives: Intuit's Secret to Growth | (2) Changing People: The Axel Springer Story | A Leader's Choice for Realigning with a Customer Focus

Chapter 10: What is the next wave of destruction?

You don't necessarily have to predict the future | Track customer trends by examining the Big Seven | A common global trend: Set it once and forget it | Where is the greatest market potential based on monetary cost? | Where is the greatest market potential based on effort and time cost? | How to make the Big Seven yours

Coming out

Glossary of terms

The Difference Between Decoupling and Disruptive Innovation

Calculating MaR™ and TMaR™

Acknowledgements

References

Search

Detailed image

Into the book

In this book, I will explore several specific examples of decoupling.

For example, from the beginning, Amazon separated out the series of activities that customers typically perform to purchase a product.

Customers went to regular stores to check out the actual product, learn more about it, and then made their purchases on Amazon.

Netflix has separated the activities customers take to watch videos.

Netflix left the massive investment required to provide the infrastructure that connects customers' homes to the internet to telecommunications companies, and only delivered the content.

Facebook distributes news widely.

However, unlike traditional media outlets, it does not produce news on its own.

--- p.26

Best Buy has implemented a variety of tactics to prevent showrooming and encourage customers to purchase products in-store.

First, we changed the product barcode so that customers could not scan it.

By introducing Best Buy's unique barcode, the company prevents customers from using their mobile phones to compare prices with other sites or engage in showrooming in-store.

Best Buy has renovated its stores, retrained its employees, launched a new online store, and offered exclusive products like special editions of Blu-ray movies.

It also employed an aggressive strategy of creating its own shopping app.

But none of these methods have stopped customers from showrooming.

--- p.45

The same was true of the video game industry.

Game developers like Zynga, Rovio, and Supercell had no intention of copying the entire business of established video game companies.

The area where they competed with the existing distribution developer, Electronic Arts, was the customer payment method.

…98 percent of mobile game users played games for free, but the 2 percent of game enthusiasts were willing to pay for them.

This strategy, chosen by new game development companies, proved effective.

As of 2019, most mobile game developers have abandoned pay-to-play systems, which require players to pay a certain amount to play the game, in favor of a freemium pricing model.

p--- p.52-53

In 2015, for the first time in history, sales at U.S. restaurants and bars surpassed those at grocery stores.

The problem is that many people don't know how to prepare a hearty meal because they never learned it from their parents.

Plus, you don't have time to prepare lunch all morning or dinner all afternoon.

In response to these circumstances, hundreds of grocery delivery service startups, such as Blue Apron, Chefd, and HelloFresh, have emerged.

…but now, delivery services like Chefd are separating the recipe-finding and ingredient-shopping steps from the cooking process.

When you apply for the service, the company will send you a box containing the ingredients that have been prepared, measured precisely, and prepared according to the recipe.

--- p.63

Ultimately, what Jolly and other company executives realized was this:

The point is that Best Buy can't win by countering customers' desire to showroom or by going head-to-head with Amazon.

The only solution was to somehow find a way to coexist with showrooming customers and Amazon.

Best Buy had to "relearn" how to make money.

And so it was.

Best Buy met with Samsung officials and proposed setting up a dedicated Samsung product area within its offline stores.

Samsung had to pay a fee.

Yes, that's right.

The idea was that retailers would charge manufacturers a fee in exchange for the opportunity to enjoy the privilege of providing them with prominent display space.

--- p.76

Entrepreneurs in innovative companies didn't even realize they were decoupling.

They simply sensed unmet consumer needs and did everything they could to intuitively satisfy them.

In the process, they were rapidly stealing customers from existing companies.

Likewise, executives I interviewed at major companies like Four Seasons Hotels, Westfield, Disney, Paramount Pictures, and Microsoft didn't embrace "decoupling" as a general approach.

They watched the destructive chaos unfolding all around them and feared that their existing businesses were either already under siege or about to be attacked.

Without knowing the root cause, we rushed into superficial responses, but the results were disappointing.

p--- p.103-104

There is nothing in this world that is safe forever.

The same goes for business models with powerful disruptive power, like the razor-blade model.

In early 2011, Michael Dubin, a 30-something entrepreneur with no prior razor experience, founded Dollar Shave Club (DSC), a membership-based website that offered razors online.

This website literally hit the jackpot.

By 2015, DSC had captured 51 percent of all online razor sales, dwarfing Gillette, which had a meager 21 percent share of online sales.

--- p.205

Existing companies try to respond in one of three ways:

This is a method of suffocating competitors by following or acquiring new companies or drastically lowering prices.

But using this method can have unintended consequences throughout the organization.

First, companies that imitate startups may see their profits significantly reduced.

Small startups can operate more effectively than established companies, even if they are less profitable and have less profit margins from decoupling.

But the cost structures of giant organizations like NBC, Telefónica, and Gillette don't allow for that.

Next, acquiring startups, or disruptors, also carries risks.

While the erosion of cash reserves through acquisitions is problematic, existing companies may also face difficulties integrating the new business into their existing operations.

Many technology companies have experienced the pain of acquiring other companies.

The most famous examples include Time Warner's acquisition of AOL (recorded as a $99 billion write-down), HP's acquisition of Autonomy (recorded as a $8.8 billion write-down), and Microsoft's acquisition of Nokia (recorded as a $7.6 billion write-down).

p--- p.211-212

As utilization increases, the number of cars people need will decrease, leading to an unprecedented collapse of the auto industry.

So how significant is this risk? The U.S. Transportation Research Board estimates that each shared vehicle takes 15 private cars off the road.

A report from the European Parliament claims that the number of privately owned cars in European countries could fall by between 63 and 90 percent if car sharing were fully adopted.

The largest decline was also expected in Germany, the world's largest auto exporter and fifth-largest new car market.

Unbeknownst to some auto industry executives, transportation-as-a-service is driving the current business model of private car ownership to the brink of extinction.

p--- p.251-252

The most serious disruptions often come from business models rather than technological innovations.

If people considering buying a car are now considering whether to buy a car or use personal transportation like Turo, Uber, or BlaBlaCar, the auto industry will experience a business model revolution, specifically decoupling.

In this case, established automakers face the greatest risk of disruption, given the sudden and significant shift in market share.

GM, in particular, would be at greatest risk if a significant portion of its current customers began asking, "Do I really need to buy a car?"

These customers will make a significant difference in their purchasing decisions.

In the first phase, you might add ride-hailing or ride-sharing startups to your consideration pool, while in the second phase, you might even remove GM from your consideration pool altogether.

If that happens, the most powerful form of destruction will occur.

p--- p.262-263

A response that is too grandiose can have negative consequences.

Dealing with every startup puts a huge financial burden on you.

Yahoo is one such example.

…Yahoo has been doing corporate shopping for many years.

Mayer has acquired 53 digital and technology startups, spending between $2.3 billion and $2.8 billion.

But in the end, 33 startups were forced to close, 11 stopped production, and 5 were left to fend for themselves.

Overall, Yahoo has only fully integrated two startups.

In 2017, Yahoo, which had lost its growth momentum, was sold to Verizon for $4.8 billion.

Considering that it was valued at $100 billion at its peak, it's the difference between heaven and hell.

p--- p.287-288

By initially using a strategy of securing a minimal number of listings on the site, Airbnb's founders strengthened the supply side.

This tactic allowed them to attract and maintain demand, which in turn slowly but significantly increased the supply of rental housing.

Like a large, heavy wheel that starts out slow but gains momentum once it gains momentum, Airbnb's wheel of success started out slow but then started turning at an increasing pace.

And Airbnb is expected to see tremendous growth in the future.

If you're an entrepreneur, what can you learn from Airbnb's early customer acquisition process, and even from fast-growing online marketplaces like Etsy and Uber? We see the following seven principles at work.

p--- p.314-315

Then one day Google appeared.

Gmail, which came out in 2004, allowed me to search and check email in one place.

Google Maps, which appeared in 2005, showed the location on a map simply by clicking on the address written in Gmail.

Google Flights, launched in 2011, made it easy to purchase airline tickets without having to copy and paste content.

Google caters to all the major areas of my business travel needs.

This has reduced the enormous effort and time costs that had to be paid in the past.

--- p.339

Netflix has adapted to the evolving needs of its customers.

Comcast chose to conserve resources rather than follow its customers' desires, and it paid a huge price for that.

Comcast has responded poorly to the stagnation of its cable television division by putting customers at risk rather than meeting their evolving needs.

Established companies and startups often have different perspectives on the same situation.

While Comcast has seen its resources deplete, Netflix has seen its customer subscriptions increase.

--- p.372

Once consumers experience the time and effort savings, they are more likely to use membership services in other areas of their lives, including housing.

Buying and maintaining a home is one of the most expensive and time-consuming processes for consumers.

Digital startups like SomeTac, TaskRabbit, and Hello Alfred make home repairs and housework easier.

These startups allow consumers to find the best people for specific jobs, and the startups can supply workers on a set schedule.

Set it and forget it! While consumers still have to put in the effort of providing direction and monitoring to ensure it's running as intended, the potential time savings from these services are enormous.

For example, from the beginning, Amazon separated out the series of activities that customers typically perform to purchase a product.

Customers went to regular stores to check out the actual product, learn more about it, and then made their purchases on Amazon.

Netflix has separated the activities customers take to watch videos.

Netflix left the massive investment required to provide the infrastructure that connects customers' homes to the internet to telecommunications companies, and only delivered the content.

Facebook distributes news widely.

However, unlike traditional media outlets, it does not produce news on its own.

--- p.26

Best Buy has implemented a variety of tactics to prevent showrooming and encourage customers to purchase products in-store.

First, we changed the product barcode so that customers could not scan it.

By introducing Best Buy's unique barcode, the company prevents customers from using their mobile phones to compare prices with other sites or engage in showrooming in-store.

Best Buy has renovated its stores, retrained its employees, launched a new online store, and offered exclusive products like special editions of Blu-ray movies.

It also employed an aggressive strategy of creating its own shopping app.

But none of these methods have stopped customers from showrooming.

--- p.45

The same was true of the video game industry.

Game developers like Zynga, Rovio, and Supercell had no intention of copying the entire business of established video game companies.

The area where they competed with the existing distribution developer, Electronic Arts, was the customer payment method.

…98 percent of mobile game users played games for free, but the 2 percent of game enthusiasts were willing to pay for them.

This strategy, chosen by new game development companies, proved effective.

As of 2019, most mobile game developers have abandoned pay-to-play systems, which require players to pay a certain amount to play the game, in favor of a freemium pricing model.

p--- p.52-53

In 2015, for the first time in history, sales at U.S. restaurants and bars surpassed those at grocery stores.

The problem is that many people don't know how to prepare a hearty meal because they never learned it from their parents.

Plus, you don't have time to prepare lunch all morning or dinner all afternoon.

In response to these circumstances, hundreds of grocery delivery service startups, such as Blue Apron, Chefd, and HelloFresh, have emerged.

…but now, delivery services like Chefd are separating the recipe-finding and ingredient-shopping steps from the cooking process.

When you apply for the service, the company will send you a box containing the ingredients that have been prepared, measured precisely, and prepared according to the recipe.

--- p.63

Ultimately, what Jolly and other company executives realized was this:

The point is that Best Buy can't win by countering customers' desire to showroom or by going head-to-head with Amazon.

The only solution was to somehow find a way to coexist with showrooming customers and Amazon.

Best Buy had to "relearn" how to make money.

And so it was.

Best Buy met with Samsung officials and proposed setting up a dedicated Samsung product area within its offline stores.

Samsung had to pay a fee.

Yes, that's right.

The idea was that retailers would charge manufacturers a fee in exchange for the opportunity to enjoy the privilege of providing them with prominent display space.

--- p.76

Entrepreneurs in innovative companies didn't even realize they were decoupling.

They simply sensed unmet consumer needs and did everything they could to intuitively satisfy them.

In the process, they were rapidly stealing customers from existing companies.

Likewise, executives I interviewed at major companies like Four Seasons Hotels, Westfield, Disney, Paramount Pictures, and Microsoft didn't embrace "decoupling" as a general approach.

They watched the destructive chaos unfolding all around them and feared that their existing businesses were either already under siege or about to be attacked.

Without knowing the root cause, we rushed into superficial responses, but the results were disappointing.

p--- p.103-104

There is nothing in this world that is safe forever.

The same goes for business models with powerful disruptive power, like the razor-blade model.

In early 2011, Michael Dubin, a 30-something entrepreneur with no prior razor experience, founded Dollar Shave Club (DSC), a membership-based website that offered razors online.

This website literally hit the jackpot.

By 2015, DSC had captured 51 percent of all online razor sales, dwarfing Gillette, which had a meager 21 percent share of online sales.

--- p.205

Existing companies try to respond in one of three ways:

This is a method of suffocating competitors by following or acquiring new companies or drastically lowering prices.

But using this method can have unintended consequences throughout the organization.

First, companies that imitate startups may see their profits significantly reduced.

Small startups can operate more effectively than established companies, even if they are less profitable and have less profit margins from decoupling.

But the cost structures of giant organizations like NBC, Telefónica, and Gillette don't allow for that.

Next, acquiring startups, or disruptors, also carries risks.

While the erosion of cash reserves through acquisitions is problematic, existing companies may also face difficulties integrating the new business into their existing operations.

Many technology companies have experienced the pain of acquiring other companies.

The most famous examples include Time Warner's acquisition of AOL (recorded as a $99 billion write-down), HP's acquisition of Autonomy (recorded as a $8.8 billion write-down), and Microsoft's acquisition of Nokia (recorded as a $7.6 billion write-down).

p--- p.211-212

As utilization increases, the number of cars people need will decrease, leading to an unprecedented collapse of the auto industry.

So how significant is this risk? The U.S. Transportation Research Board estimates that each shared vehicle takes 15 private cars off the road.

A report from the European Parliament claims that the number of privately owned cars in European countries could fall by between 63 and 90 percent if car sharing were fully adopted.

The largest decline was also expected in Germany, the world's largest auto exporter and fifth-largest new car market.

Unbeknownst to some auto industry executives, transportation-as-a-service is driving the current business model of private car ownership to the brink of extinction.

p--- p.251-252

The most serious disruptions often come from business models rather than technological innovations.

If people considering buying a car are now considering whether to buy a car or use personal transportation like Turo, Uber, or BlaBlaCar, the auto industry will experience a business model revolution, specifically decoupling.

In this case, established automakers face the greatest risk of disruption, given the sudden and significant shift in market share.

GM, in particular, would be at greatest risk if a significant portion of its current customers began asking, "Do I really need to buy a car?"

These customers will make a significant difference in their purchasing decisions.

In the first phase, you might add ride-hailing or ride-sharing startups to your consideration pool, while in the second phase, you might even remove GM from your consideration pool altogether.

If that happens, the most powerful form of destruction will occur.

p--- p.262-263

A response that is too grandiose can have negative consequences.

Dealing with every startup puts a huge financial burden on you.

Yahoo is one such example.

…Yahoo has been doing corporate shopping for many years.

Mayer has acquired 53 digital and technology startups, spending between $2.3 billion and $2.8 billion.

But in the end, 33 startups were forced to close, 11 stopped production, and 5 were left to fend for themselves.

Overall, Yahoo has only fully integrated two startups.

In 2017, Yahoo, which had lost its growth momentum, was sold to Verizon for $4.8 billion.

Considering that it was valued at $100 billion at its peak, it's the difference between heaven and hell.

p--- p.287-288

By initially using a strategy of securing a minimal number of listings on the site, Airbnb's founders strengthened the supply side.

This tactic allowed them to attract and maintain demand, which in turn slowly but significantly increased the supply of rental housing.

Like a large, heavy wheel that starts out slow but gains momentum once it gains momentum, Airbnb's wheel of success started out slow but then started turning at an increasing pace.

And Airbnb is expected to see tremendous growth in the future.

If you're an entrepreneur, what can you learn from Airbnb's early customer acquisition process, and even from fast-growing online marketplaces like Etsy and Uber? We see the following seven principles at work.

p--- p.314-315

Then one day Google appeared.

Gmail, which came out in 2004, allowed me to search and check email in one place.

Google Maps, which appeared in 2005, showed the location on a map simply by clicking on the address written in Gmail.

Google Flights, launched in 2011, made it easy to purchase airline tickets without having to copy and paste content.

Google caters to all the major areas of my business travel needs.

This has reduced the enormous effort and time costs that had to be paid in the past.

--- p.339

Netflix has adapted to the evolving needs of its customers.

Comcast chose to conserve resources rather than follow its customers' desires, and it paid a huge price for that.

Comcast has responded poorly to the stagnation of its cable television division by putting customers at risk rather than meeting their evolving needs.

Established companies and startups often have different perspectives on the same situation.

While Comcast has seen its resources deplete, Netflix has seen its customer subscriptions increase.

--- p.372

Once consumers experience the time and effort savings, they are more likely to use membership services in other areas of their lives, including housing.

Buying and maintaining a home is one of the most expensive and time-consuming processes for consumers.

Digital startups like SomeTac, TaskRabbit, and Hello Alfred make home repairs and housework easier.

These startups allow consumers to find the best people for specific jobs, and the startups can supply workers on a set schedule.

Set it and forget it! While consumers still have to put in the effort of providing direction and monitoring to ensure it's running as intended, the potential time savings from these services are enormous.

--- p.405

Publisher's Review

★ Highly recommended by management guru Jim Collins

★ Eight years of corporate research and case studies by a Harvard MBA professor

★ Five stars! Praise from business leaders and Amazon readers around the world.

★ Special lectures by authors from Google, YouTube, Microsoft, etc.

“People who look but don’t buy”

What Happened at Best Buy, America's Largest Home Appliance Retailer

The inside of the Best Buy store, a large American home appliance retailer, was crowded with people.

People gasped in admiration at the giant wall-mounted TV and crowded around Samsung's new laptop with an Intel Pentium processor.

Then, what he took out was not a wallet, but a smartphone.

They seemed familiar with it, opened a price comparison app or Amazon website, checked the price, and then disappeared.

Showrooming.

This is a shopping behavior where customers only check out products in offline stores and then make the actual purchase online or through mobile devices.

Consumer showrooming has turned brick-and-mortar stores like Best Buy, Walmart, Toys "R" Us, and Macy's into showrooms.

It goes without saying that these companies' sales and profits have plummeted.

Best Buy closed stores and restructured, and Toys "R" Us filed for bankruptcy in 2017.

What happened?

According to Google research, six out of ten smartphone users use their smartphones to get purchasing information in offline stores.

At first glance, this showrooming phenomenon may seem like a problem limited to offline retail stores, but that's not actually the case.

It is shaking up almost every market sector, from media, communications, and finance to accommodation and transportation.

But the bigger problem is that no one really knows why this crisis occurred or how to respond to it.

The threat of showrooming was virtually unprecedented.

Best Buy executives were at a loss, unable to find answers in any history book, any management book, or any consulting book.

“Then what is the cause?”

Amazon, Uber, Netflix, Twitch… They're disrupting the market by "decoupling."

Best Buy executives didn't know two important facts.

First, the disruptive change Best Buy is facing isn't just their problem.

Comcast and broadcasters around the world are facing the destructive power of Netflix and YouTube, AT&T is threatened by Skype, and General Motors is struggling with transportation services like Airbnb and Uber. They are all on the same page.

Sephora, the giant cosmetics retailer, never expected to be swayed by Birchbox, a mere cosmetics sample delivery company.

The crisis patterns of these giant corporations are similar.

The act of being unaware of an attack by a small, agile startup, being indifferent to it, or even after being aware of it, responding without any response due to not knowing the truth, and then being helpless and collapsing.

The same phenomenon is repeated across all markets, across all industries, around the world.

The second thing Best Buy didn't know was this.

There is a 'pattern' to attacks on startups.

It's decoupling.

Decoupling literally means to separate, to dismantle, to cut off.

It refers to the disconnect between the consumption activities that existing companies provide to customers.

It is about separating ‘some’ of the Customer Value Chain (CVC).

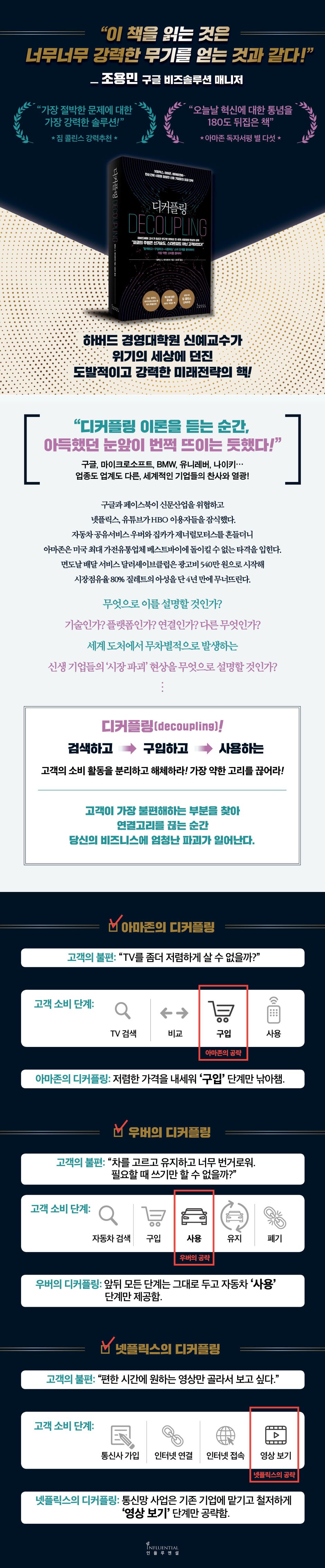

For example, Amazon only captured the 'purchase' stage of the 'search-buy-use' activity of customers looking to buy a TV.

Uber eliminates the hassle of selecting, purchasing, maintaining, and disposing of a car in the 'search-buy-maintain-use-dispose' process and only provides the 'use' stage.

Netflix achieved explosive success by focusing only on the 'watching video' step, leaving the existing steps such as connecting to the Internet and accessing the app intact.

Additionally, the video streaming service Twitch reached a market value of $1 billion (acquired by Amazon in 2014) despite only providing customers with the opportunity to "watch gameplay."

After eight years of persistent research, Harvard Business School professor Teixeira concluded that this dramatic change was not caused by new technologies but by customers, and more specifically, by "decoupling," which focuses on and separates customers' inconvenient activities.

“How did it end up collapsing?”

Nokia's CEO was left in the dark

“We didn’t do anything particularly wrong.

But somehow it collapsed,” said former Nokia CEO Stephen Elop.

“I didn’t know how to cope with the pace of digital change.

“If I could go back 10 years, I would have reacted sooner,” said Mickey Drexler, founder of J.Crew, the so-called national clothing brand of America.

Nokia and J.Crew, two companies that once dominated the market, have become unfortunate examples of "being destroyed by someone and leaving a lesson for others."

As former managers say, did it just happen by accident? Or was it because we couldn't keep up with new digital technologies?

They did not stand by and watch.

He did his best to save the failing company.

Digital disruptioans, that is, they believed that the disruption was caused by new digital technologies, and so they worked hard to innovate in technology.

Nokia has invested heavily in various technologies, including smartphones and touchscreens, and has even won several innovation awards.

J.Crew has invested heavily in digital platforms and digital marketing.

But the results were disastrous.

Forget Christensen's disruptive innovation.

The main culprit in market disruption is not technology, but customers.

Nokia and J.Crew's prescription was wrong.

Technological innovation alone cannot save a company.

Professor Teixeira says:

“The reason I decided to write this book is because of what I heard countless times during my ten years as a professor at Harvard Business School.

Scholars, managers, and consultants have routinely emphasized technology as both the primary cause of market disruption and the solution to it.

But my research across more than 20 industries and hundreds of companies has shown that the primary culprit in market disruption is not technology, but customers.”

In fact, Professor Teixeira has reportedly been asked to write a book for executive training sessions at numerous companies, including Nike, BMW, Netflix, and Siemens.

They confessed that they had long misunderstood the phenomenon of market disruption and blamed it solely on new technologies.

Leading business leaders wanted to understand more about how to interpret and respond to the phenomenon of new companies disrupting incumbents and dominating the market, and most importantly, how to create disruption.

“According to Clayton Christensen’s theory of disruptive innovation, first proposed in 1995, disruptive technologies cause market disruption.

But today, 24 years later, technological innovation and market disruption are not closely related.

We need to change our thinking here.

It's called digital disruption, but the disruption isn't caused by digital, it's caused by customers.

Technology only helps with that.”

Professor Teixeira says Christensen's theory of disruptive innovation is no longer valid.

He talks about Alibaba's success by repeatedly emphasizing that customers are the main culprits of destruction.

"An unprecedented record of 20 years of sustained growth."

How Alibaba Targeted Customers

Alibaba has achieved an incredible 20 years of sustained growth.

This is a pattern that is unimaginable in the normal corporate life cycle.

Alibaba initially found success as a B2B online marketplace.

But his subsequent actions were surprising.

We did not focus on growth in the B2B sector.

They abandoned the old, common methods, the Walmart formula for success.

Alibaba did not develop its successful businesses, but instead focused on expanding its customer value chain.

We used tactics to capture each and every stage of customer consumption.

All steps from searching, comparing, paying, and receiving products can be completed with 'one login, one site.'

Thanks to this, customers find shopping through Alibaba to be the easiest, cheapest, and most efficient.

The secret to Alibaba's continued growth lies in this thorough customer customization.

The key is to focus your thinking on the customer, not the company or the technology.

If we do that, anyone, whether a startup or an established company, with or without new technology, can create a disruptive change in the market.

It can be a decoupler that causes decoupling.

Decoupling has already begun in Korea.

The decoupling trend sweeping Korea, from Market Kurly to Yanolja and Aladdin used bookstores.

Surprisingly, destructive decouplers already exist in the domestic market.

As Professor Teixeira said, “They became decouplers without even knowing what they were doing.

“We explored what customers were struggling with and what they wanted, and we just tried to solve that.”

Market Kurly only provides the 'ingredient delivery' service to consumers who want to cook but have difficulty purchasing ingredients.

Yanolja and Baedal Minjok, which have become unicorn companies with a corporate value of over 1 trillion won, are also decouplers that provide only a very small portion of consumer activities.

Aladdin Used Bookstore, which buys used books from readers and then sells them to other readers, is also a type of decoupler.

Aladdin's 2018 operating profit increased 29.4% year-on-year, and the company cited the used bookstore market as the primary contributor to this growth.

All of these follow the typical pattern of a decoupler.

They only capture a small portion of customer consumption, they don't start their business with a completely new technology, and they quickly penetrate a niche and dominate the market.

“You, too, can build a disruptive business.”

The surest way to become a decoupler, whether you're a startup or an established company.

Professor Teixeira emphasizes that today's market disruption presents a serious challenge, but also a new opportunity.

Because it is an opportunity to develop our way of thinking and business.

Professor Teixeira has compiled the results of eight years of research into his first book, Decoupling.

I've personally visited companies around the world, interviewed executives, and consulted with hundreds of large corporations and startups.

Netflix, Amazon, Airbnb, Microsoft, YouTube, Nike, Supercell, Electronic Arts, TripAdvisor, Dropbox, BMW, General Motors, Comcast, Blockbuster, AT&T, Skype, Sephora, Chefd, Gillette, Dollar Shave Club, Birchbox, Twitch, Rebag, Salary Finance, Costco, Best Buy, and more—it's packed with incredible corporate case studies and analysis results that span a wide range of sizes, sectors, and industries.

It's not just about startup strategies for new companies.

It contains solutions for how existing companies facing crises can innovate their business models and create new markets.

In fact, Best Buy didn't go down.

We reorganized our business model to be customer-centric and achieved success.

If you understand the hidden patterns in the phenomenon of destruction, you will no longer have to grope in the dark.

By utilizing a framework that breaks down the customer value chain, we can respond systematically.

When you look at the market from the customer's perspective, the full picture of the disruption we call digital disruption unfolds before your eyes, and you can rise above the massive tidal wave of opportunity.

The disruptors who are turning the business world upside down today are all those who quickly rose to the occasion, not those who avoided the tsunami.

Through this book, Professor Teixeira will encourage and guide those who do not give up in the face of adversity and seize opportunities, offering a roadmap for riding the wave of change as quickly and safely as possible.

★ Eight years of corporate research and case studies by a Harvard MBA professor

★ Five stars! Praise from business leaders and Amazon readers around the world.

★ Special lectures by authors from Google, YouTube, Microsoft, etc.

“People who look but don’t buy”

What Happened at Best Buy, America's Largest Home Appliance Retailer

The inside of the Best Buy store, a large American home appliance retailer, was crowded with people.

People gasped in admiration at the giant wall-mounted TV and crowded around Samsung's new laptop with an Intel Pentium processor.

Then, what he took out was not a wallet, but a smartphone.

They seemed familiar with it, opened a price comparison app or Amazon website, checked the price, and then disappeared.

Showrooming.

This is a shopping behavior where customers only check out products in offline stores and then make the actual purchase online or through mobile devices.

Consumer showrooming has turned brick-and-mortar stores like Best Buy, Walmart, Toys "R" Us, and Macy's into showrooms.

It goes without saying that these companies' sales and profits have plummeted.

Best Buy closed stores and restructured, and Toys "R" Us filed for bankruptcy in 2017.

What happened?

According to Google research, six out of ten smartphone users use their smartphones to get purchasing information in offline stores.

At first glance, this showrooming phenomenon may seem like a problem limited to offline retail stores, but that's not actually the case.

It is shaking up almost every market sector, from media, communications, and finance to accommodation and transportation.

But the bigger problem is that no one really knows why this crisis occurred or how to respond to it.

The threat of showrooming was virtually unprecedented.

Best Buy executives were at a loss, unable to find answers in any history book, any management book, or any consulting book.

“Then what is the cause?”

Amazon, Uber, Netflix, Twitch… They're disrupting the market by "decoupling."

Best Buy executives didn't know two important facts.

First, the disruptive change Best Buy is facing isn't just their problem.

Comcast and broadcasters around the world are facing the destructive power of Netflix and YouTube, AT&T is threatened by Skype, and General Motors is struggling with transportation services like Airbnb and Uber. They are all on the same page.

Sephora, the giant cosmetics retailer, never expected to be swayed by Birchbox, a mere cosmetics sample delivery company.

The crisis patterns of these giant corporations are similar.

The act of being unaware of an attack by a small, agile startup, being indifferent to it, or even after being aware of it, responding without any response due to not knowing the truth, and then being helpless and collapsing.

The same phenomenon is repeated across all markets, across all industries, around the world.

The second thing Best Buy didn't know was this.

There is a 'pattern' to attacks on startups.

It's decoupling.

Decoupling literally means to separate, to dismantle, to cut off.

It refers to the disconnect between the consumption activities that existing companies provide to customers.

It is about separating ‘some’ of the Customer Value Chain (CVC).

For example, Amazon only captured the 'purchase' stage of the 'search-buy-use' activity of customers looking to buy a TV.

Uber eliminates the hassle of selecting, purchasing, maintaining, and disposing of a car in the 'search-buy-maintain-use-dispose' process and only provides the 'use' stage.

Netflix achieved explosive success by focusing only on the 'watching video' step, leaving the existing steps such as connecting to the Internet and accessing the app intact.

Additionally, the video streaming service Twitch reached a market value of $1 billion (acquired by Amazon in 2014) despite only providing customers with the opportunity to "watch gameplay."

After eight years of persistent research, Harvard Business School professor Teixeira concluded that this dramatic change was not caused by new technologies but by customers, and more specifically, by "decoupling," which focuses on and separates customers' inconvenient activities.

“How did it end up collapsing?”

Nokia's CEO was left in the dark

“We didn’t do anything particularly wrong.

But somehow it collapsed,” said former Nokia CEO Stephen Elop.

“I didn’t know how to cope with the pace of digital change.

“If I could go back 10 years, I would have reacted sooner,” said Mickey Drexler, founder of J.Crew, the so-called national clothing brand of America.

Nokia and J.Crew, two companies that once dominated the market, have become unfortunate examples of "being destroyed by someone and leaving a lesson for others."

As former managers say, did it just happen by accident? Or was it because we couldn't keep up with new digital technologies?

They did not stand by and watch.

He did his best to save the failing company.

Digital disruptioans, that is, they believed that the disruption was caused by new digital technologies, and so they worked hard to innovate in technology.

Nokia has invested heavily in various technologies, including smartphones and touchscreens, and has even won several innovation awards.

J.Crew has invested heavily in digital platforms and digital marketing.

But the results were disastrous.

Forget Christensen's disruptive innovation.

The main culprit in market disruption is not technology, but customers.

Nokia and J.Crew's prescription was wrong.

Technological innovation alone cannot save a company.

Professor Teixeira says:

“The reason I decided to write this book is because of what I heard countless times during my ten years as a professor at Harvard Business School.

Scholars, managers, and consultants have routinely emphasized technology as both the primary cause of market disruption and the solution to it.

But my research across more than 20 industries and hundreds of companies has shown that the primary culprit in market disruption is not technology, but customers.”

In fact, Professor Teixeira has reportedly been asked to write a book for executive training sessions at numerous companies, including Nike, BMW, Netflix, and Siemens.

They confessed that they had long misunderstood the phenomenon of market disruption and blamed it solely on new technologies.

Leading business leaders wanted to understand more about how to interpret and respond to the phenomenon of new companies disrupting incumbents and dominating the market, and most importantly, how to create disruption.

“According to Clayton Christensen’s theory of disruptive innovation, first proposed in 1995, disruptive technologies cause market disruption.

But today, 24 years later, technological innovation and market disruption are not closely related.

We need to change our thinking here.

It's called digital disruption, but the disruption isn't caused by digital, it's caused by customers.

Technology only helps with that.”

Professor Teixeira says Christensen's theory of disruptive innovation is no longer valid.

He talks about Alibaba's success by repeatedly emphasizing that customers are the main culprits of destruction.

"An unprecedented record of 20 years of sustained growth."

How Alibaba Targeted Customers

Alibaba has achieved an incredible 20 years of sustained growth.

This is a pattern that is unimaginable in the normal corporate life cycle.

Alibaba initially found success as a B2B online marketplace.

But his subsequent actions were surprising.

We did not focus on growth in the B2B sector.

They abandoned the old, common methods, the Walmart formula for success.

Alibaba did not develop its successful businesses, but instead focused on expanding its customer value chain.

We used tactics to capture each and every stage of customer consumption.

All steps from searching, comparing, paying, and receiving products can be completed with 'one login, one site.'

Thanks to this, customers find shopping through Alibaba to be the easiest, cheapest, and most efficient.

The secret to Alibaba's continued growth lies in this thorough customer customization.

The key is to focus your thinking on the customer, not the company or the technology.

If we do that, anyone, whether a startup or an established company, with or without new technology, can create a disruptive change in the market.

It can be a decoupler that causes decoupling.

Decoupling has already begun in Korea.

The decoupling trend sweeping Korea, from Market Kurly to Yanolja and Aladdin used bookstores.

Surprisingly, destructive decouplers already exist in the domestic market.

As Professor Teixeira said, “They became decouplers without even knowing what they were doing.

“We explored what customers were struggling with and what they wanted, and we just tried to solve that.”

Market Kurly only provides the 'ingredient delivery' service to consumers who want to cook but have difficulty purchasing ingredients.

Yanolja and Baedal Minjok, which have become unicorn companies with a corporate value of over 1 trillion won, are also decouplers that provide only a very small portion of consumer activities.

Aladdin Used Bookstore, which buys used books from readers and then sells them to other readers, is also a type of decoupler.

Aladdin's 2018 operating profit increased 29.4% year-on-year, and the company cited the used bookstore market as the primary contributor to this growth.

All of these follow the typical pattern of a decoupler.

They only capture a small portion of customer consumption, they don't start their business with a completely new technology, and they quickly penetrate a niche and dominate the market.

“You, too, can build a disruptive business.”

The surest way to become a decoupler, whether you're a startup or an established company.

Professor Teixeira emphasizes that today's market disruption presents a serious challenge, but also a new opportunity.

Because it is an opportunity to develop our way of thinking and business.

Professor Teixeira has compiled the results of eight years of research into his first book, Decoupling.

I've personally visited companies around the world, interviewed executives, and consulted with hundreds of large corporations and startups.

Netflix, Amazon, Airbnb, Microsoft, YouTube, Nike, Supercell, Electronic Arts, TripAdvisor, Dropbox, BMW, General Motors, Comcast, Blockbuster, AT&T, Skype, Sephora, Chefd, Gillette, Dollar Shave Club, Birchbox, Twitch, Rebag, Salary Finance, Costco, Best Buy, and more—it's packed with incredible corporate case studies and analysis results that span a wide range of sizes, sectors, and industries.

It's not just about startup strategies for new companies.

It contains solutions for how existing companies facing crises can innovate their business models and create new markets.

In fact, Best Buy didn't go down.

We reorganized our business model to be customer-centric and achieved success.

If you understand the hidden patterns in the phenomenon of destruction, you will no longer have to grope in the dark.

By utilizing a framework that breaks down the customer value chain, we can respond systematically.

When you look at the market from the customer's perspective, the full picture of the disruption we call digital disruption unfolds before your eyes, and you can rise above the massive tidal wave of opportunity.

The disruptors who are turning the business world upside down today are all those who quickly rose to the occasion, not those who avoided the tsunami.

Through this book, Professor Teixeira will encourage and guide those who do not give up in the face of adversity and seize opportunities, offering a roadmap for riding the wave of change as quickly and safely as possible.

GOODS SPECIFICS

- Date of issue: September 30, 2019

- Format: Hardcover book binding method guide

- Page count, weight, size: 496 pages | 902g | 162*223*35mm

- ISBN13: 9791189995379

- ISBN10: 1189995379

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)