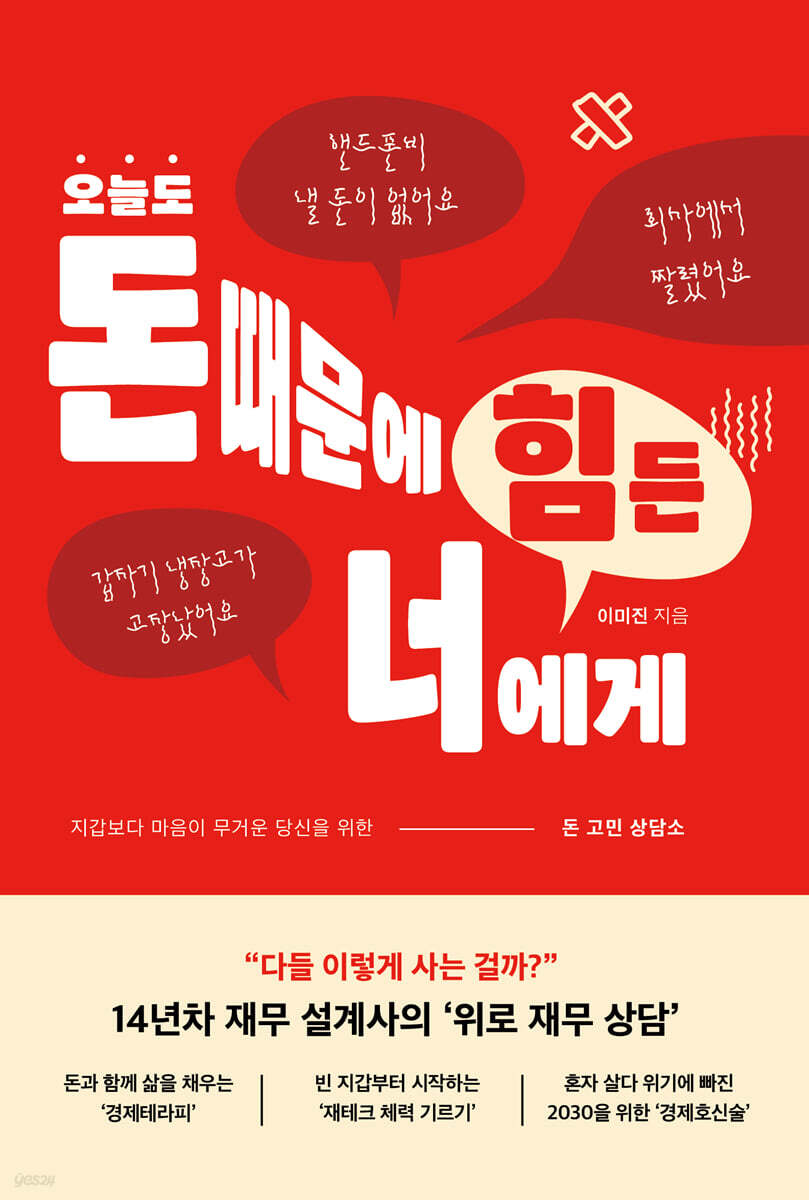

To you who is having a hard time because of money today too

|

Description

Book Introduction

When you save up money? No, from now on!

"Economic Therapy" for Those Who Have Become Unfamiliar with the Word "Savings"

Even if you save a little bit, your wallet is always empty. “I’ll invest when things get better.” That saying is a trap.

If we wait for that moment, we will never get started.

You can start even without money.

From now on, this is the first step to financial management.

"Comforting Financial Counseling" from Im Jin, a financial planner who has dealt with the anxieties of countless people for 14 years.

"are you okay.

You're not the only one.

“Shall we try again?”

Regardless of how much money you have, everyone has had moments when they struggled because of money.

People with a monthly income of '0 won' and people with a monthly income of '10 million won' all say, "I don't have money!" at some point.

This is the era we live in now.

No matter how much money you earn, money is always scarce and insecure.

The problem isn't that you don't have money, but that when you don't have enough money, the entire structure of your life falls apart.

Once a lifestyle is tilted, it is not easily corrected.

Once spending increases, it's difficult to reduce it again, and once consumption patterns change, it's difficult to go back to the way they were before.

In this way, money goes beyond mere numbers and influences our thoughts, choices, and even the direction of our lives.

And at some point, we realize that it's not that we don't have money, but that money controls us.

A realistic, relatable economics class that is even more relevant now.

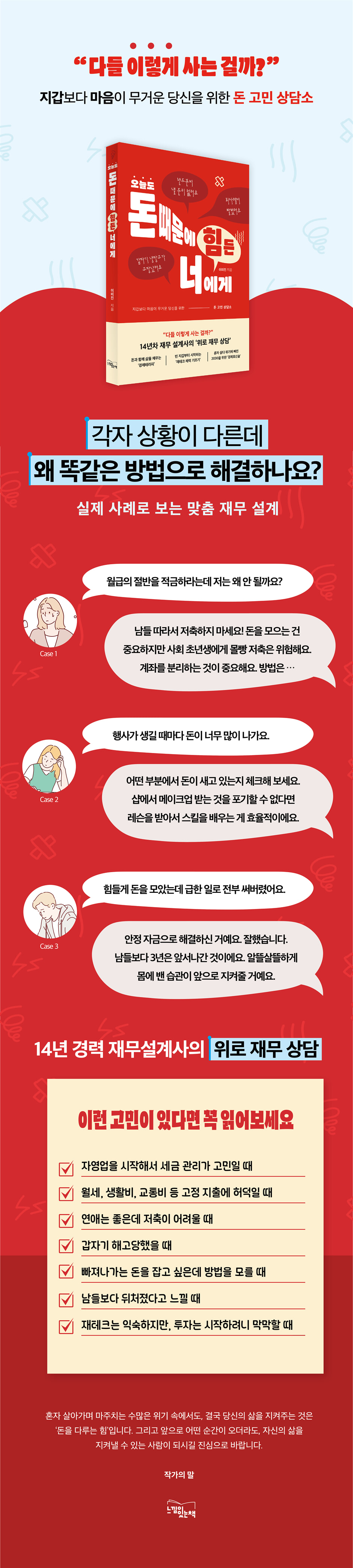

"To You Who Are Having a Hard Time Because of Money Today" is not a book that teaches you flashy investment strategies or advanced financial technology.

It's not about how to make more money, it's about how to stop money from ruling your life.

From how to use money when you unexpectedly get it to managing taxes, loans, and exchange rates, to how to respond to real-world crises like retirement, retirement, and recession, it specifically addresses money issues we've often overlooked.

And it gives us the courage to start again and the strength to rebuild our broken daily lives.

"Economic Therapy" for Those Who Have Become Unfamiliar with the Word "Savings"

Even if you save a little bit, your wallet is always empty. “I’ll invest when things get better.” That saying is a trap.

If we wait for that moment, we will never get started.

You can start even without money.

From now on, this is the first step to financial management.

"Comforting Financial Counseling" from Im Jin, a financial planner who has dealt with the anxieties of countless people for 14 years.

"are you okay.

You're not the only one.

“Shall we try again?”

Regardless of how much money you have, everyone has had moments when they struggled because of money.

People with a monthly income of '0 won' and people with a monthly income of '10 million won' all say, "I don't have money!" at some point.

This is the era we live in now.

No matter how much money you earn, money is always scarce and insecure.

The problem isn't that you don't have money, but that when you don't have enough money, the entire structure of your life falls apart.

Once a lifestyle is tilted, it is not easily corrected.

Once spending increases, it's difficult to reduce it again, and once consumption patterns change, it's difficult to go back to the way they were before.

In this way, money goes beyond mere numbers and influences our thoughts, choices, and even the direction of our lives.

And at some point, we realize that it's not that we don't have money, but that money controls us.

A realistic, relatable economics class that is even more relevant now.

"To You Who Are Having a Hard Time Because of Money Today" is not a book that teaches you flashy investment strategies or advanced financial technology.

It's not about how to make more money, it's about how to stop money from ruling your life.

From how to use money when you unexpectedly get it to managing taxes, loans, and exchange rates, to how to respond to real-world crises like retirement, retirement, and recession, it specifically addresses money issues we've often overlooked.

And it gives us the courage to start again and the strength to rebuild our broken daily lives.

- You can preview some of the book's contents.

Preview

index

Planner's Note

Author's Note

01.

Do I really need to save money?

02.

What should I do? I don't have money to pay my cell phone bill.

03.

In the meantime, the refrigerator broke down.

04.

I really want to be independent, is that okay?

05.

Suddenly they tell me to leave the room.

06.

You need money to date.

07.

I don't have any money for condolence money, should I live alone?

08.

Hospital bills are scarier than the hospital itself.

09.

I got cut off, is this life ruined?

10.

They say I can't even get a loan.

11.

What do you do if you win the lottery?

12.

Even if I earn 300 million won, I won't be happy.

13.

At the age of 31, I became a team leader.

Author's Note

01.

Do I really need to save money?

02.

What should I do? I don't have money to pay my cell phone bill.

03.

In the meantime, the refrigerator broke down.

04.

I really want to be independent, is that okay?

05.

Suddenly they tell me to leave the room.

06.

You need money to date.

07.

I don't have any money for condolence money, should I live alone?

08.

Hospital bills are scarier than the hospital itself.

09.

I got cut off, is this life ruined?

10.

They say I can't even get a loan.

11.

What do you do if you win the lottery?

12.

Even if I earn 300 million won, I won't be happy.

13.

At the age of 31, I became a team leader.

Detailed image

Into the book

For those who haven't even reached the starting line, immediate 'cell phone bills' or 'hospital bills' are much bigger concerns.

--- p.6

But just as you need strong stamina before you can wield any weapon, the most important thing before learning the art of splendid investment is to build 'financial stamina'.

--- p.7

According to an analysis of real income by generation over the past 10 years by the Korea Economic Association, the real income growth rate for those in their 20s was only 1.9% per year on average.

However, the perceived inflation rate is higher at 1.1-2.8% per year, making life increasingly difficult for people in their 20s.

--- p.19

I started saving, so I was at a loss as to whether I should praise him or say something about saving money without any purpose, like following a friend to Gangnam.

--- p.38

Income can suddenly increase or decrease.

My finances could be shaken by a sudden accident that could leave me unable to work or a family member.

--- p.49

Above all, it was a huge mistake to invest in securities products without knowing one's own investment tendencies.

Why was a businessman so helpless in the face of money?

--- p.67

The problem was becoming independent and making investments.

If Y had worked hard to save up money and become independent, and had planned to invest with that money, he would not have made a blind, no-questions-asked investment.

--- p.68

Many people want to invest in stocks, funds, or Bitcoin with the goal of making money.

95% of investors lose money and only 5% of investors dream of a rosy future by investing all their money.

--- p.72

Many people fail at saving.

They are pessimistic about saving.

People always say things like, "I'm not good at saving." "I've never received a maturity deposit." "I don't have the money." "I'm barely making ends meet this month."

--- p.89

Savings are like taxes.

Just like taxes, which must be paid from birth until death, savings must also be paid until death.

--- p.90

He said that tax returns must be filed at the tax office.

He was a negative person who didn't trust people well, but he actually left the most important money issues to the tax office.

--- p.91

Many couples fight over money.

You should never ask someone where they spent their money.

Are you asking because you really don't know where it was written?

After all, isn't it money that the two of you spent together?

--- p.110

I felt bad about wasting money on condolence money, not knowing when I would get it back and not being able to save it right away.

At work, we pool our money together and give gifts as a group, so it's less burdensome, but I felt awkward giving less than 50,000 won to friends and relatives.

There were many times when I had to pay more than 100,000 won just to protect my modest self-esteem.

--- p.121

Because I couldn't concentrate, my work performance was poor and the number of tasks that I couldn't finish on time increased.

Z criticized his team leader and colleagues, saying that he had once been nagged by his team leader for late reports.

To me, it didn't seem strange that Z could be cut off at any time.

--- p.128

If Z can't afford to leave the company, he has to immerse himself in his work.

In order to change Z's image, which has been poor at work, we need to be twice as immersed.

These days, Z is not getting any proper work and is wasting his time doing his seniors' work, making copies, and organizing files.

Once an image is established, it is not easily changed.

--- p.129

Fortunately, it didn't lead to bad debt, but it did give Z the feeling that he could easily borrow money.

Z had been thinking of opening an overdraft account and using it if he needed money.

--- p.131

The safest way to manage a crisis is to save money early and avoid creating debt in the first place.

--- p.133

She didn't realize that self-improvement without a purpose was not a breakthrough in life.

--- p.140

If you want to live the life you want in 10 years, I advise you to start studying how to increase your value and income now.

Then, your income will naturally increase and your salary account, which is the source of money, will also increase.

--- p.145

This corresponds to the interest income you can receive by depositing about 1 billion won in a bank.

In other words, she was doing work worth the same as if she were managing assets worth 1 billion won herself.

--- p.155

Most financial books say that increasing your income is not easy.

Or they say we have no control over our income.

This means that while your income is determined by others, you have 100% control over your expenses, so focus on managing your expenses rather than your income.

--- p.160

Our parents' generation started working in their 20s, worked for 40 years, and were able to make a living without doing anything special for 20 years.

However, we are living in the 100+@ era, not the 100-year era.

--- p.162

It is not easy to start working in your 30s in 2020 and survive in the same job until you are 50.

Even then, you only get 240 monthly salaries.

Now, I want you to calculate how many more paychecks you can receive in the future.

If you suddenly quit your job, you may not even receive your 240th paycheck.

You have to earn 20 years and live off of it for 50+ years.

--- p.163

Empathy and creative imagination are essential qualities for those living in the age of artificial intelligence.

If you don't want to risk your job being replaced by robots, you need to develop empathy, a skill that only humans can possess.

--- p.166

In the future, what you post on social media, your friends, and your lifestyle habits will likely affect your credit score.

This is because loan companies such as ZestFinance in the US, founded by big data experts from Google and loan experts from financial institutions, will emerge.

--- p.175

K said he thought of insurance as just something to protect him when he got sick.

It's not a wrong statement, but the product that K's mother signed up for had a universal function that allowed her to withdraw the cancellation refund in advance after a certain period of time.

--- p.177

If you can use it for a short period of time and repay the loan, it is advantageous to withdraw the necessary funds through a term loan that does not touch the principal and interest.

Because interest rates are falling, products you signed up for in the past have high interest rates, so loan interest rates are also expensive.

--- p.178

He said that intentionally avoiding uncomfortable feelings doesn't solve all problems.

French clinical psychologist Maria Dou said that having the courage to say 'no' can lead to genuine human relationships.

Relationships that are built through self-sacrifice and stress do not last long.

--- p.183

He cherished his life with the belief that he only lives once, and he was planning for the future with his long-term investment experience.

--- p.190

Even quitting a job requires a smart plan.

At age 50, you need to think about whether you will quit your job completely or what type of job you will change.

--- p.196

I didn't care about tax issues.

The problem was that my friend, who majored in taxation, asked me to do it personally.

I found out when I received a call from the National Tax Service saying that my sales were missing.

I was fined for non-payment and have to pay about 300 million won in taxes.

We literally got hit with a tax bomb.

--- p.205

These days, not only high net worth individuals but also anyone with a job should be interested in 'tax saving information.'

In the future, we will have to pay more taxes than we do now due to population decline, etc.

Gift tax and inheritance tax may be higher than you imagine.

--- p.207

If you are an office worker, it is recommended that you sign up for a year-end tax settlement product in advance.

--- p.208

If you have failed to save money or have never received a maturity deposit, you need to start by blocking the small amount of money that is leaking out.

--- p.211

Over time, prices rise and the value of money falls, requiring more money.

Depending on how hard W works, he can overcome the recession and have a happy future.

--- p.213

We analyzed data on her consumption patterns and asset status to create the optimal portfolio.

The app's notification function also allowed for flexible responses to changing market conditions.

A major advantage was that the lack of investment knowledge could be covered by the support and management of artificial intelligence.

--- p.223

When a recession occurs, increase the proportion of bonds, and when a recovery occurs, increase the proportion of stocks.

Additionally, when the set target rate of return is reached, the redemption is automatically made, and this fact can be confirmed through the alarm function.

--- p.6

But just as you need strong stamina before you can wield any weapon, the most important thing before learning the art of splendid investment is to build 'financial stamina'.

--- p.7

According to an analysis of real income by generation over the past 10 years by the Korea Economic Association, the real income growth rate for those in their 20s was only 1.9% per year on average.

However, the perceived inflation rate is higher at 1.1-2.8% per year, making life increasingly difficult for people in their 20s.

--- p.19

I started saving, so I was at a loss as to whether I should praise him or say something about saving money without any purpose, like following a friend to Gangnam.

--- p.38

Income can suddenly increase or decrease.

My finances could be shaken by a sudden accident that could leave me unable to work or a family member.

--- p.49

Above all, it was a huge mistake to invest in securities products without knowing one's own investment tendencies.

Why was a businessman so helpless in the face of money?

--- p.67

The problem was becoming independent and making investments.

If Y had worked hard to save up money and become independent, and had planned to invest with that money, he would not have made a blind, no-questions-asked investment.

--- p.68

Many people want to invest in stocks, funds, or Bitcoin with the goal of making money.

95% of investors lose money and only 5% of investors dream of a rosy future by investing all their money.

--- p.72

Many people fail at saving.

They are pessimistic about saving.

People always say things like, "I'm not good at saving." "I've never received a maturity deposit." "I don't have the money." "I'm barely making ends meet this month."

--- p.89

Savings are like taxes.

Just like taxes, which must be paid from birth until death, savings must also be paid until death.

--- p.90

He said that tax returns must be filed at the tax office.

He was a negative person who didn't trust people well, but he actually left the most important money issues to the tax office.

--- p.91

Many couples fight over money.

You should never ask someone where they spent their money.

Are you asking because you really don't know where it was written?

After all, isn't it money that the two of you spent together?

--- p.110

I felt bad about wasting money on condolence money, not knowing when I would get it back and not being able to save it right away.

At work, we pool our money together and give gifts as a group, so it's less burdensome, but I felt awkward giving less than 50,000 won to friends and relatives.

There were many times when I had to pay more than 100,000 won just to protect my modest self-esteem.

--- p.121

Because I couldn't concentrate, my work performance was poor and the number of tasks that I couldn't finish on time increased.

Z criticized his team leader and colleagues, saying that he had once been nagged by his team leader for late reports.

To me, it didn't seem strange that Z could be cut off at any time.

--- p.128

If Z can't afford to leave the company, he has to immerse himself in his work.

In order to change Z's image, which has been poor at work, we need to be twice as immersed.

These days, Z is not getting any proper work and is wasting his time doing his seniors' work, making copies, and organizing files.

Once an image is established, it is not easily changed.

--- p.129

Fortunately, it didn't lead to bad debt, but it did give Z the feeling that he could easily borrow money.

Z had been thinking of opening an overdraft account and using it if he needed money.

--- p.131

The safest way to manage a crisis is to save money early and avoid creating debt in the first place.

--- p.133

She didn't realize that self-improvement without a purpose was not a breakthrough in life.

--- p.140

If you want to live the life you want in 10 years, I advise you to start studying how to increase your value and income now.

Then, your income will naturally increase and your salary account, which is the source of money, will also increase.

--- p.145

This corresponds to the interest income you can receive by depositing about 1 billion won in a bank.

In other words, she was doing work worth the same as if she were managing assets worth 1 billion won herself.

--- p.155

Most financial books say that increasing your income is not easy.

Or they say we have no control over our income.

This means that while your income is determined by others, you have 100% control over your expenses, so focus on managing your expenses rather than your income.

--- p.160

Our parents' generation started working in their 20s, worked for 40 years, and were able to make a living without doing anything special for 20 years.

However, we are living in the 100+@ era, not the 100-year era.

--- p.162

It is not easy to start working in your 30s in 2020 and survive in the same job until you are 50.

Even then, you only get 240 monthly salaries.

Now, I want you to calculate how many more paychecks you can receive in the future.

If you suddenly quit your job, you may not even receive your 240th paycheck.

You have to earn 20 years and live off of it for 50+ years.

--- p.163

Empathy and creative imagination are essential qualities for those living in the age of artificial intelligence.

If you don't want to risk your job being replaced by robots, you need to develop empathy, a skill that only humans can possess.

--- p.166

In the future, what you post on social media, your friends, and your lifestyle habits will likely affect your credit score.

This is because loan companies such as ZestFinance in the US, founded by big data experts from Google and loan experts from financial institutions, will emerge.

--- p.175

K said he thought of insurance as just something to protect him when he got sick.

It's not a wrong statement, but the product that K's mother signed up for had a universal function that allowed her to withdraw the cancellation refund in advance after a certain period of time.

--- p.177

If you can use it for a short period of time and repay the loan, it is advantageous to withdraw the necessary funds through a term loan that does not touch the principal and interest.

Because interest rates are falling, products you signed up for in the past have high interest rates, so loan interest rates are also expensive.

--- p.178

He said that intentionally avoiding uncomfortable feelings doesn't solve all problems.

French clinical psychologist Maria Dou said that having the courage to say 'no' can lead to genuine human relationships.

Relationships that are built through self-sacrifice and stress do not last long.

--- p.183

He cherished his life with the belief that he only lives once, and he was planning for the future with his long-term investment experience.

--- p.190

Even quitting a job requires a smart plan.

At age 50, you need to think about whether you will quit your job completely or what type of job you will change.

--- p.196

I didn't care about tax issues.

The problem was that my friend, who majored in taxation, asked me to do it personally.

I found out when I received a call from the National Tax Service saying that my sales were missing.

I was fined for non-payment and have to pay about 300 million won in taxes.

We literally got hit with a tax bomb.

--- p.205

These days, not only high net worth individuals but also anyone with a job should be interested in 'tax saving information.'

In the future, we will have to pay more taxes than we do now due to population decline, etc.

Gift tax and inheritance tax may be higher than you imagine.

--- p.207

If you are an office worker, it is recommended that you sign up for a year-end tax settlement product in advance.

--- p.208

If you have failed to save money or have never received a maturity deposit, you need to start by blocking the small amount of money that is leaking out.

--- p.211

Over time, prices rise and the value of money falls, requiring more money.

Depending on how hard W works, he can overcome the recession and have a happy future.

--- p.213

We analyzed data on her consumption patterns and asset status to create the optimal portfolio.

The app's notification function also allowed for flexible responses to changing market conditions.

A major advantage was that the lack of investment knowledge could be covered by the support and management of artificial intelligence.

--- p.223

When a recession occurs, increase the proportion of bonds, and when a recovery occurs, increase the proportion of stocks.

Additionally, when the set target rate of return is reached, the redemption is automatically made, and this fact can be confirmed through the alarm function.

--- p.224

Publisher's Review

The words, “It’s okay if you don’t have money,” and the comforting words, “It’ll get better someday.”

Because I can't sympathize anymore.

It's a harsh statement, but reality is different from romance.

Most people, even if they have money, are always anxious and feel like their whole life will fall apart if they are shaken even a little.

This is why we can't feel secure even when we receive our monthly paychecks, and why we can't shake off our anxiety even when we save systematically.

"To You Who Are Having a Hard Time Because of Money Today" confronts that very anxiety head-on.

The author completely changes the perspective on the economy by saying, “Money is not a skill for survival, but the foundation that supports me.”

What this book is trying to convey is not a 'money-making technique' like stocks or real estate.

Rather, it is a way to strengthen your economic stamina so that money does not shake the center of your life.

In these increasingly unstable times, what we need is not ‘a lot of money,’ but ‘economic strength.’

The book vividly depicts the situations we face in real life, from the journey of a young man who was desperate because his loan was blocked to rebuild his credit and create new opportunities, to the journey of a self-employed person who was hit with a tax bomb and learned a new way to "handle" money, to the frustrated office worker who couldn't afford to pay his cell phone bill.

All of these cases provide a much-needed "real-life lesson" for those who have been frustrated or lost in the face of money.

Furthermore, it is a simple but fundamental truth that “just as you need to build up physical strength before wielding any weapon, the economy also needs basic physical strength.”

Money isn't everything, but it's important to reduce the moments when money ruins your life.

That is the 'role of the economy' that we must learn now.

Changing my finances is ultimately about rebuilding myself.

"To You Who Are Having a Hard Time Because of Money Today" teaches you how to make money not just a means of survival, but a "foundation that protects me."

For anyone who has ever cried over money, anyone who is still anxious, and anyone who wants to start over, this book will be the most realistic and solid economic lesson.

Because I can't sympathize anymore.

It's a harsh statement, but reality is different from romance.

Most people, even if they have money, are always anxious and feel like their whole life will fall apart if they are shaken even a little.

This is why we can't feel secure even when we receive our monthly paychecks, and why we can't shake off our anxiety even when we save systematically.

"To You Who Are Having a Hard Time Because of Money Today" confronts that very anxiety head-on.

The author completely changes the perspective on the economy by saying, “Money is not a skill for survival, but the foundation that supports me.”

What this book is trying to convey is not a 'money-making technique' like stocks or real estate.

Rather, it is a way to strengthen your economic stamina so that money does not shake the center of your life.

In these increasingly unstable times, what we need is not ‘a lot of money,’ but ‘economic strength.’

The book vividly depicts the situations we face in real life, from the journey of a young man who was desperate because his loan was blocked to rebuild his credit and create new opportunities, to the journey of a self-employed person who was hit with a tax bomb and learned a new way to "handle" money, to the frustrated office worker who couldn't afford to pay his cell phone bill.

All of these cases provide a much-needed "real-life lesson" for those who have been frustrated or lost in the face of money.

Furthermore, it is a simple but fundamental truth that “just as you need to build up physical strength before wielding any weapon, the economy also needs basic physical strength.”

Money isn't everything, but it's important to reduce the moments when money ruins your life.

That is the 'role of the economy' that we must learn now.

Changing my finances is ultimately about rebuilding myself.

"To You Who Are Having a Hard Time Because of Money Today" teaches you how to make money not just a means of survival, but a "foundation that protects me."

For anyone who has ever cried over money, anyone who is still anxious, and anyone who wants to start over, this book will be the most realistic and solid economic lesson.

GOODS SPECIFICS

- Date of issue: October 27, 2025

- Page count, weight, size: 230 pages | 135*200*20mm

- ISBN13: 9791161952543

- ISBN10: 1161952543

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)