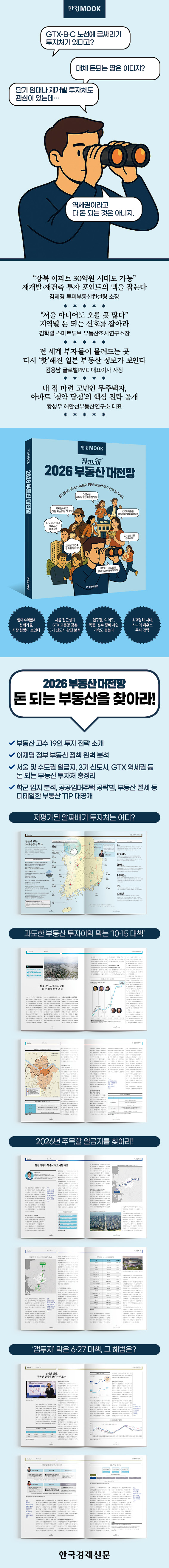

Hankyung Mook's 2026 Real Estate Outlook

|

Description

Book Introduction

What real estate specialists are predicting

2026 Real Estate Market

* Introducing investment strategies of 19 real estate experts, including 'Passion' Kim Hak-ryeol, 'Field Expert' Kim Jong-yul, and 'Tax Saving Instructor' Park Min-su, who participated in 'Home Economy Expo 2025'

* A complete analysis of the Lee Jae-myung administration's real estate policies, including the June 27, September 7, and October 15 measures.

* A comprehensive guide to profitable real estate investment opportunities, including prime locations in Seoul and the metropolitan area, third-generation new towns, and GTX station areas.

* Detailed real estate tips, including school district location analysis, public rental housing strategies, and real estate tax savings, are revealed.

2026 Real Estate Market Trends Forecast and Investment Trend Review

The real estate market is facing a major upheaval in 2025.

This is because the Lee Jae-myung administration has introduced real estate policies one after another in a short period of time, including the June 27 household loan management strengthening plan, the September 7 housing supply expansion plan, and the October 15 housing market stabilization plan.

The government plans to continue to introduce new real estate policies to stabilize the real estate market.

To prepare for potential real estate market variables in this situation, Hankyung MOOK released its "2026 Real Estate Outlook."

The Korea Economic Daily's Construction and Real Estate Department reporters have compiled a comprehensive report on real estate issues, investment destinations, and strategies for 2026.

Top real estate investment experts, including Kim Hak-ryeol, better known by his pen name 'Ppasyon' and director of Smart Tube Real Estate Research Institute, Kim Je-kyung, a 'redevelopment and reconstruction expert' and director of Tumi Real Estate Consulting, and Park Min-soo, a 'real estate tax-saving instructor' and CEO of The Smart Company, will share regional signals of profitability, investment points in redevelopment and reconstruction areas, and the Lee Jae-myung administration's real estate tax-saving measures.

In addition, Kim Yong-nam, CEO and President of Global PMC, a leading domestic overseas real estate investment expert; Kim Jong-yul, CEO of Kim Jong-yul Academy, a commercial real estate expert; and Lee Sang-woo, CEO of Invade Investment Advisory, an industrial materials expert, will analyze and summarize the big issues in the real estate market in 2026.

It also includes an analysis of the Lee Jae-myung administration's real estate policies, including real estate trends for 2026, and the correlation between policies and interest rates.

Investment methods in emerging areas, such as the 1st, 2nd, and 3rd new towns through which the Great Train Express (GTX) passes, and the Yongsan International Business District, which is being reborn as a smart complex business district, were also revealed.

Beyond Korea, the story of Japanese real estate investment, which has recently attracted wealthy people, was also not left out.

With people of all ages and genders interested in real estate these days, we've also prepared a section that covers real estate interests by generation.

It includes strategies for winning apartment subscriptions for students and their parents, young adults and newlyweds, and investment strategies that will benefit middle-aged and older people in our super-aging society.

This book will help people of all generations successfully invest in real estate.

2026 Real Estate Market

* Introducing investment strategies of 19 real estate experts, including 'Passion' Kim Hak-ryeol, 'Field Expert' Kim Jong-yul, and 'Tax Saving Instructor' Park Min-su, who participated in 'Home Economy Expo 2025'

* A complete analysis of the Lee Jae-myung administration's real estate policies, including the June 27, September 7, and October 15 measures.

* A comprehensive guide to profitable real estate investment opportunities, including prime locations in Seoul and the metropolitan area, third-generation new towns, and GTX station areas.

* Detailed real estate tips, including school district location analysis, public rental housing strategies, and real estate tax savings, are revealed.

2026 Real Estate Market Trends Forecast and Investment Trend Review

The real estate market is facing a major upheaval in 2025.

This is because the Lee Jae-myung administration has introduced real estate policies one after another in a short period of time, including the June 27 household loan management strengthening plan, the September 7 housing supply expansion plan, and the October 15 housing market stabilization plan.

The government plans to continue to introduce new real estate policies to stabilize the real estate market.

To prepare for potential real estate market variables in this situation, Hankyung MOOK released its "2026 Real Estate Outlook."

The Korea Economic Daily's Construction and Real Estate Department reporters have compiled a comprehensive report on real estate issues, investment destinations, and strategies for 2026.

Top real estate investment experts, including Kim Hak-ryeol, better known by his pen name 'Ppasyon' and director of Smart Tube Real Estate Research Institute, Kim Je-kyung, a 'redevelopment and reconstruction expert' and director of Tumi Real Estate Consulting, and Park Min-soo, a 'real estate tax-saving instructor' and CEO of The Smart Company, will share regional signals of profitability, investment points in redevelopment and reconstruction areas, and the Lee Jae-myung administration's real estate tax-saving measures.

In addition, Kim Yong-nam, CEO and President of Global PMC, a leading domestic overseas real estate investment expert; Kim Jong-yul, CEO of Kim Jong-yul Academy, a commercial real estate expert; and Lee Sang-woo, CEO of Invade Investment Advisory, an industrial materials expert, will analyze and summarize the big issues in the real estate market in 2026.

It also includes an analysis of the Lee Jae-myung administration's real estate policies, including real estate trends for 2026, and the correlation between policies and interest rates.

Investment methods in emerging areas, such as the 1st, 2nd, and 3rd new towns through which the Great Train Express (GTX) passes, and the Yongsan International Business District, which is being reborn as a smart complex business district, were also revealed.

Beyond Korea, the story of Japanese real estate investment, which has recently attracted wealthy people, was also not left out.

With people of all ages and genders interested in real estate these days, we've also prepared a section that covers real estate interests by generation.

It includes strategies for winning apartment subscriptions for students and their parents, young adults and newlyweds, and investment strategies that will benefit middle-aged and older people in our super-aging society.

This book will help people of all generations successfully invest in real estate.

- You can preview some of the book's contents.

Preview

index

Prologue

006 Real Estate Investment: How to Read the Flow

Opening

008 Real Estate Investment Summary

2026 Real Estate Investment at a Glance

010 Survey

Successive measures from June 27 to October 15

The impact and outlook on the domestic real estate market

014 2026 Real Estate Trends

In the 2026 real estate market

What will happen

Section 1 - Policy

Real Estate Policy and Market Direction

022 Policy Magnifier

The significance of the Lee Jae-myung administration's real estate policy

"Speculation is strictly prohibited, but opportunities are expanded for actual residents."

026 Analyzing the October 15th Measures

Tightening lending and strengthening tax systems

A Complete Analysis of the October 15 Measures

032 Redevelopment and Reconstruction Policy

"A 3 billion won apartment in Gangbuk is possible."

Redevelopment and Reconstruction Investment Points from Kim Je-kyung, Director of Tumi Real Estate Consulting

040 Investment Strategy

Rental yield & lease rate

The market direction is visible

044 Tax Saving Plan

If you own multiple homes, don't delay gifting!

Section 2 - Best Places

Real Estate Investments Based on Key Locations

050 Attention, this area!

There are plenty of places to climb, even outside of Seoul.

What are the local money signals?

058 New City Analysis

Phase 1 reorganization, Phase 2 nearing completion, Phase 3 expected to be effective

A complete overview of the new cities in the metropolitan area that are attracting attention.

066 Seoul's first-class view

Seoul's redevelopment project gains momentum.

A full analysis of the current status of 'Ap·Yeo·Mok·Seong'

074 Station Area Investment

Why Incheon Cheongna is better off than Yangju

078 Station Area Issue 1

Yongsan Seoul Core, a groundbreaking project

084 Station Area Issue 2

There are commercial areas near subway stations that make money!

088 Overseas Investment

Rich people from all over the world flock here

Japanese real estate investment is back in the spotlight

Section 3 - Strategy

Practical Investment Strategies by Real Estate Sector

094 Subscription Strategy

Homeless people worried about buying a home

5 Strategies for Winning an Apartment Subscription

098 Finding a cheap location

Gangnam and Bundang areas

There's an opportunity in an old apartment.

School District 102 Location Analysis

'Chopum-ah', 'Eui·Chi·Han·Su'

Variables that determine investment value

106 Auction Strategy

Expected policy windfall benefits

Gangnam apartments and villas are popular in the auction market.

110 Niche Investments

A Smart Guide to Public Rental Housing

114 Homeownership Strategies

2026 is 'reconsidered'?

118 Market Outlook

The housing crisis is worsening

A signal signaling a turning point in real estate

122 Senior House 1

Super-aging era

Should I invest in a senior home?

126 Senior House 2

We are recruiting 'digital seniors'

Attention Senior Residences!

130 Short-term rentals

"Two years is a long time... Just enough."

Short-term rentals are booming

136 Specialist

The specialist who created the "2026 Real Estate Outlook"

006 Real Estate Investment: How to Read the Flow

Opening

008 Real Estate Investment Summary

2026 Real Estate Investment at a Glance

010 Survey

Successive measures from June 27 to October 15

The impact and outlook on the domestic real estate market

014 2026 Real Estate Trends

In the 2026 real estate market

What will happen

Section 1 - Policy

Real Estate Policy and Market Direction

022 Policy Magnifier

The significance of the Lee Jae-myung administration's real estate policy

"Speculation is strictly prohibited, but opportunities are expanded for actual residents."

026 Analyzing the October 15th Measures

Tightening lending and strengthening tax systems

A Complete Analysis of the October 15 Measures

032 Redevelopment and Reconstruction Policy

"A 3 billion won apartment in Gangbuk is possible."

Redevelopment and Reconstruction Investment Points from Kim Je-kyung, Director of Tumi Real Estate Consulting

040 Investment Strategy

Rental yield & lease rate

The market direction is visible

044 Tax Saving Plan

If you own multiple homes, don't delay gifting!

Section 2 - Best Places

Real Estate Investments Based on Key Locations

050 Attention, this area!

There are plenty of places to climb, even outside of Seoul.

What are the local money signals?

058 New City Analysis

Phase 1 reorganization, Phase 2 nearing completion, Phase 3 expected to be effective

A complete overview of the new cities in the metropolitan area that are attracting attention.

066 Seoul's first-class view

Seoul's redevelopment project gains momentum.

A full analysis of the current status of 'Ap·Yeo·Mok·Seong'

074 Station Area Investment

Why Incheon Cheongna is better off than Yangju

078 Station Area Issue 1

Yongsan Seoul Core, a groundbreaking project

084 Station Area Issue 2

There are commercial areas near subway stations that make money!

088 Overseas Investment

Rich people from all over the world flock here

Japanese real estate investment is back in the spotlight

Section 3 - Strategy

Practical Investment Strategies by Real Estate Sector

094 Subscription Strategy

Homeless people worried about buying a home

5 Strategies for Winning an Apartment Subscription

098 Finding a cheap location

Gangnam and Bundang areas

There's an opportunity in an old apartment.

School District 102 Location Analysis

'Chopum-ah', 'Eui·Chi·Han·Su'

Variables that determine investment value

106 Auction Strategy

Expected policy windfall benefits

Gangnam apartments and villas are popular in the auction market.

110 Niche Investments

A Smart Guide to Public Rental Housing

114 Homeownership Strategies

2026 is 'reconsidered'?

118 Market Outlook

The housing crisis is worsening

A signal signaling a turning point in real estate

122 Senior House 1

Super-aging era

Should I invest in a senior home?

126 Senior House 2

We are recruiting 'digital seniors'

Attention Senior Residences!

130 Short-term rentals

"Two years is a long time... Just enough."

Short-term rentals are booming

136 Specialist

The specialist who created the "2026 Real Estate Outlook"

Detailed image

Into the book

When will the real estate market stabilize?

Can we accurately predict the future? This is a question everyone asks, but it is difficult to give a definitive answer.

Real estate is a function of numerous variables, including policies, interest rate fluctuations, demographics, and global economic conditions.

The market pictured six months from now could look very different from the market pictured today after the government introduces new demand regulation measures.

But that doesn't mean we can just sit back and do nothing.

You can reduce uncertainty by examining key variables and interpreting trends based on objective statistics.

--- p.7, from 「Prologue - Real Estate Investment, How to Read the Flow」

The completion of this government's real estate policy culminates in the 'land holding tax,' which was a key presidential election promise.

It is a concept of imposing a tax on all landowners, rather than only on owners of expensive houses like the existing comprehensive real estate tax.

Land has a strong public good character, and the increase in land value is based on the 'public land concept' that society should share.

However, there are also predictions that the policy of strengthening the holding tax prior to the introduction of the land holding tax will face strong criticism.

The government is likely to focus on increasing the effectiveness of the current comprehensive real estate tax in the short term.

--- p.25, from “The Meaning of the Lee Jae-myung Government’s Real Estate Policy: “Speculation Cracked Down, Opportunities Expanded for Residents””

Another option is to consider public redevelopment and reconstruction.

Ultimately, it's a battle of the ability to pay one's share.

Within the available funds, you should set some criteria for yourself and go for the place with the best business potential.

For example, if your goal is to buy a house in Seoul, you should go to Nowon-gu or Guro-gu.

However, it should be noted that the gap between new construction and existing construction will continue to widen due to the increase in the cost of shared contributions.

By 2026, Mapo and Seongdong-gu will be in the 3 billion won era, and there is a possibility that the 'Gangbuk 3 billion won era' will open in the near future.

It is time to seriously consider what constitutes 'surviving real estate'.

--- p.39, from ““An era of 3 billion won apartments in Gangbuk is possible”, Redevelopment and reconstruction investment points by Kim Je-kyung, Director of Toomi Real Estate Consulting”

It is highly likely that the capital gains tax will be reinstated from May 10, 2026.

If you're a seller, you need to move now.

The balance must be received by May 9th.

If you act quickly, the buyer can take advantage of this situation.

You must always go against the direction in which the masses move.

Multi-homeowners should first analyze what they own.

If you have something bad, sell it without waiting, and if you have something worth keeping, give it away.

This is why the number of donations in Seoul has recently soared to an all-time high.

--- p.46, from “If you own multiple homes, don’t delay gift giving!”

First, we need to look at the value of Busan.

Even just 5-6 years ago, the prices in Haeundae-gu and Suyeong-gu in Busan were similar to those in Mapo-gu and Seongdong-gu in Seoul.

But now, apartment prices in Mapo and Seongdong are heading towards 3 billion won.

Meanwhile, Haeundae and Suyeong-gu remain at half that level.

Although there may be a difference in the status of cities, one may question whether this level of gap is reasonable.

Recently, a unit with an exclusive area of 84㎡ was sold in Haeundae for a price approaching 2 billion won.

Despite concerns from those around the area about the high selling price, the subscription competition rate was high.

It proves that there is still demand in Busan's high-end market.

This suggests that Busan's key location may be significantly undervalued compared to Seoul.

--- p.52, from “There are many places to go even if it’s not Seoul”, what are the signals of profitable growth in each region?

In the Seongsu Strategic Development Zone, all areas from District 1 to District 4 are flat.

The fact that you can have a permanent view of the Han River here is a big attraction.

Seongsu District 1 is evaluated as having the best location among the Seongsu Strategic Development Zones.

Seoul Forest is right next to Treemage, and Gangnam is easily accessible.

Another analysis is that the general distribution ratio is high, so the business viability is also good.

Seongsu District 2 and Seongsu District 3 are expected to benefit from the Hangang Riverside Park as a result of the undergrounding of Gangbyeonbuk-ro.

The Ttukdo City Market is included, which is affecting the speed of business.

Seongsu District 4 is evaluated as having an advantage in terms of business speed and profitability due to its small number of union members.

Accessibility to Gangnam via Yeongdong Bridge is also considered a strength.

--- p.72, from “Seoul Redevelopment Project Accelerates, Full Analysis of the Current Status of ‘Ap·Yeo·Mok·Seong’”

GTX-B is a route that starts in Songdo, Incheon and passes through Yeouido, Yongsan, Seoul Station, and Cheongnyangni before reaching Namyangju and Chuncheon.

Representative Pyo's diagnosis is that the key beneficiary of Line B is Songdo, Incheon.

It is also noteworthy that discussions are underway to build a new Cheonghak Station in Yeonsu-gu, Incheon.

Because the price is cheaper than Songdo.

However, it is expected that the 'GTX premium' will be relatively less in eastern regions such as Namyangju.

The reason lies in the number of operations.

This is because the route is shared with regular trains such as KTX east of Yongsan Station.

It should be noted that GTX may not run as frequently due to 'traffic saturation' issues.

--- p.75, from “Why Incheon Cheongna is better off than Yangju”

Areas where the surrounding environment has changed significantly due to redevelopment and reconstruction also need to be noted.

Recently, the Seoul Metropolitan Government has been carrying out a full-scale 'Southwest Region Redevelopment Project' and is carrying out large-scale redevelopment of the semi-industrial area around Munrae-dong, Yeongdeungpo-gu.

Director Kim predicted, “Once the redevelopment area of Munrae-dong 4-ga begins to be relocated, the commercial district of the area with a high concentration of ironworks will be completely reborn.”

It has been an industrial area until now, but it is said that once redevelopment begins in earnest, it will be transformed into a complex commercial area.

--- p.87, from “There are commercial areas near subway stations that make money!”

Another way is to target a 'niche' within the same complex where demand is relatively low.

Typically, the day before the first round of subscriptions, special supply applications are accepted for families with multiple children, newlyweds, etc.

The status of special supply applications will be announced on the subscription homepage around 8:00 PM on the same day.

Through this, general supply subscribers can identify housing types with high consumer preference.

It is also a good idea to narrow it down to the newlywed type and check the competition rate.

Couples about to get married are sensitive to housing trends, so their preferences are well reflected.

--- p.96, from “5 Strategies for Winning the Apartment Subscription for Non-Homeowners Concerned about Buying a Home”

Seongnam Bundang New Town is also a place that will improve in the future.

If rebuilt, it can cost 80 million won per 3.3㎡.

Currently, Gwacheon is over 80 million won, and Mapo is over 90 million won.

Bundang reconstruction requires purchasing a large area.

This is because reconstruction is more advantageous the larger the land share.

There is not much difference in price between the current 84㎡ exclusive use and larger medium and large units.

That's how undervalued the large ones are.

But these prices won't last long.

--- p.99, from “Opportunities in Old Apartments in Gangnam and Bundang Areas”

If you find it difficult to invest in your current school district, it might be worth considering a future school district.

Future school districts were selected as places where new construction has increased due to reconstruction and redevelopment, such as Banpo-dong in Seocho-gu, Gaepo-dong in Gangnam-gu, Sangil-dong in Gangdong-gu, Mapo-gu, and Seongdong-gu, as well as places with many children due to the nature of new cities, such as Songdo and Cheongna in Incheon, Pangyo in Gyeonggi-do, Dongtan in Hwaseong, Gwanggyo in Suwon, and Hanam.

The representative said, “Incheon Cheongna and Gajeong District used to have a lot of unsold units, but things have changed now,” and “Where young people flock and the population grows, real estate prices ultimately rise.”

--- p.105, from “‘Cho-pum-a’, ‘Eui·chi·han·su’··· Variables that determine investment value”

Although the loan limit has been reduced, apartments priced under 800 million won have not been significantly affected, so it is worth considering if you want to live in one.

The regions selected were Eunpyeong-gu, Seoul, Singil-dong, Munrae-dong, and Dongdaemun-gu in Yeongdeungpo-gu.

“Now is the time to find an apartment you can actually live in,” said CEO Kim. “If the area you were interested in has gone up in price too much, it would be a good idea to look at the surrounding areas.”

Representative Park also advised looking at suburban areas and semi-new construction within the next 10 years rather than new construction.

In Gyeonggi Province, the six major cities were selected: Suwon, Yongin, Goyang, Hwaseong, Seongnam, and Bucheon.

He said, "In Suwon and Yongin, existing apartments are better than new apartments, and in Goyang, there are plans for low-priced new apartments in the 3rd new city (Changneung), so it's worth looking into." He also said, "In Hwaseong, it's better to move within Dongtan New City, and in Seongnam, Pangyo and Bundang are rising a lot, so it's better to look towards redevelopment."

Can we accurately predict the future? This is a question everyone asks, but it is difficult to give a definitive answer.

Real estate is a function of numerous variables, including policies, interest rate fluctuations, demographics, and global economic conditions.

The market pictured six months from now could look very different from the market pictured today after the government introduces new demand regulation measures.

But that doesn't mean we can just sit back and do nothing.

You can reduce uncertainty by examining key variables and interpreting trends based on objective statistics.

--- p.7, from 「Prologue - Real Estate Investment, How to Read the Flow」

The completion of this government's real estate policy culminates in the 'land holding tax,' which was a key presidential election promise.

It is a concept of imposing a tax on all landowners, rather than only on owners of expensive houses like the existing comprehensive real estate tax.

Land has a strong public good character, and the increase in land value is based on the 'public land concept' that society should share.

However, there are also predictions that the policy of strengthening the holding tax prior to the introduction of the land holding tax will face strong criticism.

The government is likely to focus on increasing the effectiveness of the current comprehensive real estate tax in the short term.

--- p.25, from “The Meaning of the Lee Jae-myung Government’s Real Estate Policy: “Speculation Cracked Down, Opportunities Expanded for Residents””

Another option is to consider public redevelopment and reconstruction.

Ultimately, it's a battle of the ability to pay one's share.

Within the available funds, you should set some criteria for yourself and go for the place with the best business potential.

For example, if your goal is to buy a house in Seoul, you should go to Nowon-gu or Guro-gu.

However, it should be noted that the gap between new construction and existing construction will continue to widen due to the increase in the cost of shared contributions.

By 2026, Mapo and Seongdong-gu will be in the 3 billion won era, and there is a possibility that the 'Gangbuk 3 billion won era' will open in the near future.

It is time to seriously consider what constitutes 'surviving real estate'.

--- p.39, from ““An era of 3 billion won apartments in Gangbuk is possible”, Redevelopment and reconstruction investment points by Kim Je-kyung, Director of Toomi Real Estate Consulting”

It is highly likely that the capital gains tax will be reinstated from May 10, 2026.

If you're a seller, you need to move now.

The balance must be received by May 9th.

If you act quickly, the buyer can take advantage of this situation.

You must always go against the direction in which the masses move.

Multi-homeowners should first analyze what they own.

If you have something bad, sell it without waiting, and if you have something worth keeping, give it away.

This is why the number of donations in Seoul has recently soared to an all-time high.

--- p.46, from “If you own multiple homes, don’t delay gift giving!”

First, we need to look at the value of Busan.

Even just 5-6 years ago, the prices in Haeundae-gu and Suyeong-gu in Busan were similar to those in Mapo-gu and Seongdong-gu in Seoul.

But now, apartment prices in Mapo and Seongdong are heading towards 3 billion won.

Meanwhile, Haeundae and Suyeong-gu remain at half that level.

Although there may be a difference in the status of cities, one may question whether this level of gap is reasonable.

Recently, a unit with an exclusive area of 84㎡ was sold in Haeundae for a price approaching 2 billion won.

Despite concerns from those around the area about the high selling price, the subscription competition rate was high.

It proves that there is still demand in Busan's high-end market.

This suggests that Busan's key location may be significantly undervalued compared to Seoul.

--- p.52, from “There are many places to go even if it’s not Seoul”, what are the signals of profitable growth in each region?

In the Seongsu Strategic Development Zone, all areas from District 1 to District 4 are flat.

The fact that you can have a permanent view of the Han River here is a big attraction.

Seongsu District 1 is evaluated as having the best location among the Seongsu Strategic Development Zones.

Seoul Forest is right next to Treemage, and Gangnam is easily accessible.

Another analysis is that the general distribution ratio is high, so the business viability is also good.

Seongsu District 2 and Seongsu District 3 are expected to benefit from the Hangang Riverside Park as a result of the undergrounding of Gangbyeonbuk-ro.

The Ttukdo City Market is included, which is affecting the speed of business.

Seongsu District 4 is evaluated as having an advantage in terms of business speed and profitability due to its small number of union members.

Accessibility to Gangnam via Yeongdong Bridge is also considered a strength.

--- p.72, from “Seoul Redevelopment Project Accelerates, Full Analysis of the Current Status of ‘Ap·Yeo·Mok·Seong’”

GTX-B is a route that starts in Songdo, Incheon and passes through Yeouido, Yongsan, Seoul Station, and Cheongnyangni before reaching Namyangju and Chuncheon.

Representative Pyo's diagnosis is that the key beneficiary of Line B is Songdo, Incheon.

It is also noteworthy that discussions are underway to build a new Cheonghak Station in Yeonsu-gu, Incheon.

Because the price is cheaper than Songdo.

However, it is expected that the 'GTX premium' will be relatively less in eastern regions such as Namyangju.

The reason lies in the number of operations.

This is because the route is shared with regular trains such as KTX east of Yongsan Station.

It should be noted that GTX may not run as frequently due to 'traffic saturation' issues.

--- p.75, from “Why Incheon Cheongna is better off than Yangju”

Areas where the surrounding environment has changed significantly due to redevelopment and reconstruction also need to be noted.

Recently, the Seoul Metropolitan Government has been carrying out a full-scale 'Southwest Region Redevelopment Project' and is carrying out large-scale redevelopment of the semi-industrial area around Munrae-dong, Yeongdeungpo-gu.

Director Kim predicted, “Once the redevelopment area of Munrae-dong 4-ga begins to be relocated, the commercial district of the area with a high concentration of ironworks will be completely reborn.”

It has been an industrial area until now, but it is said that once redevelopment begins in earnest, it will be transformed into a complex commercial area.

--- p.87, from “There are commercial areas near subway stations that make money!”

Another way is to target a 'niche' within the same complex where demand is relatively low.

Typically, the day before the first round of subscriptions, special supply applications are accepted for families with multiple children, newlyweds, etc.

The status of special supply applications will be announced on the subscription homepage around 8:00 PM on the same day.

Through this, general supply subscribers can identify housing types with high consumer preference.

It is also a good idea to narrow it down to the newlywed type and check the competition rate.

Couples about to get married are sensitive to housing trends, so their preferences are well reflected.

--- p.96, from “5 Strategies for Winning the Apartment Subscription for Non-Homeowners Concerned about Buying a Home”

Seongnam Bundang New Town is also a place that will improve in the future.

If rebuilt, it can cost 80 million won per 3.3㎡.

Currently, Gwacheon is over 80 million won, and Mapo is over 90 million won.

Bundang reconstruction requires purchasing a large area.

This is because reconstruction is more advantageous the larger the land share.

There is not much difference in price between the current 84㎡ exclusive use and larger medium and large units.

That's how undervalued the large ones are.

But these prices won't last long.

--- p.99, from “Opportunities in Old Apartments in Gangnam and Bundang Areas”

If you find it difficult to invest in your current school district, it might be worth considering a future school district.

Future school districts were selected as places where new construction has increased due to reconstruction and redevelopment, such as Banpo-dong in Seocho-gu, Gaepo-dong in Gangnam-gu, Sangil-dong in Gangdong-gu, Mapo-gu, and Seongdong-gu, as well as places with many children due to the nature of new cities, such as Songdo and Cheongna in Incheon, Pangyo in Gyeonggi-do, Dongtan in Hwaseong, Gwanggyo in Suwon, and Hanam.

The representative said, “Incheon Cheongna and Gajeong District used to have a lot of unsold units, but things have changed now,” and “Where young people flock and the population grows, real estate prices ultimately rise.”

--- p.105, from “‘Cho-pum-a’, ‘Eui·chi·han·su’··· Variables that determine investment value”

Although the loan limit has been reduced, apartments priced under 800 million won have not been significantly affected, so it is worth considering if you want to live in one.

The regions selected were Eunpyeong-gu, Seoul, Singil-dong, Munrae-dong, and Dongdaemun-gu in Yeongdeungpo-gu.

“Now is the time to find an apartment you can actually live in,” said CEO Kim. “If the area you were interested in has gone up in price too much, it would be a good idea to look at the surrounding areas.”

Representative Park also advised looking at suburban areas and semi-new construction within the next 10 years rather than new construction.

In Gyeonggi Province, the six major cities were selected: Suwon, Yongin, Goyang, Hwaseong, Seongnam, and Bucheon.

He said, "In Suwon and Yongin, existing apartments are better than new apartments, and in Goyang, there are plans for low-priced new apartments in the 3rd new city (Changneung), so it's worth looking into." He also said, "In Hwaseong, it's better to move within Dongtan New City, and in Seongnam, Pangyo and Bundang are rising a lot, so it's better to look towards redevelopment."

--- p.117, from “2026, ‘Regarding’?”

Publisher's Review

Section 1 - Policy

Real Estate Policy and Market Direction

The real estate market is heavily influenced by policy directions, and has recently shifted from a relaxed approach to a more controlled one.

Amid high interest rates and regulatory changes, the market is exhibiting a wait-and-see attitude and polarization, and the sustainability of interest rates, supply, and policies will be key variables determining the future direction.

Section 2 - Best Places

Real Estate Investments Based on Key Locations

The axis of the real estate market is changing.

By following key growth axes such as new city development, redevelopment projects, and expansion of station areas, you can find promising investment opportunities in areas outside of Seoul.

We read profitable signals by location to understand market trends and investment strategies.

Section 3 - Strategy

Practical Investment Strategies by Real Estate Sector

As uncertainty in the real estate market grows, it is imperative for investors to develop a thorough strategy to ensure their survival.

Amidst the complex web of policy and market variables, experts in each field offer practical investment strategies.

Real Estate Policy and Market Direction

The real estate market is heavily influenced by policy directions, and has recently shifted from a relaxed approach to a more controlled one.

Amid high interest rates and regulatory changes, the market is exhibiting a wait-and-see attitude and polarization, and the sustainability of interest rates, supply, and policies will be key variables determining the future direction.

Section 2 - Best Places

Real Estate Investments Based on Key Locations

The axis of the real estate market is changing.

By following key growth axes such as new city development, redevelopment projects, and expansion of station areas, you can find promising investment opportunities in areas outside of Seoul.

We read profitable signals by location to understand market trends and investment strategies.

Section 3 - Strategy

Practical Investment Strategies by Real Estate Sector

As uncertainty in the real estate market grows, it is imperative for investors to develop a thorough strategy to ensure their survival.

Amidst the complex web of policy and market variables, experts in each field offer practical investment strategies.

GOODS SPECIFICS

- Date of issue: November 7, 2025

- Page count, weight, size: 142 pages | 180*230*20mm

- ISBN13: 9788947502115

- ISBN10: 8947502111

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)