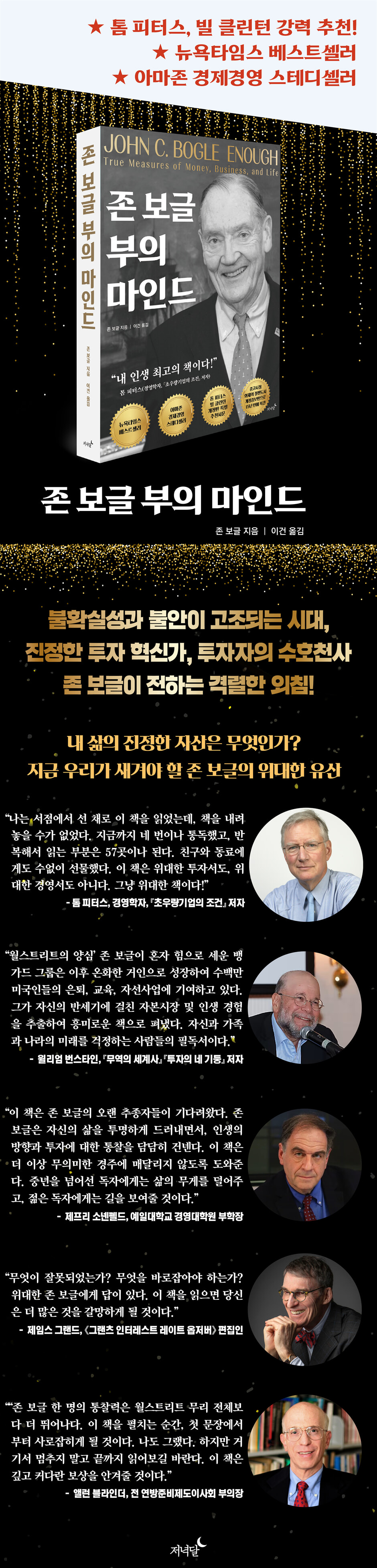

John Bogle's Wealth Mind

|

Description

Book Introduction

*** Tom Peters, Bill Clinton highly recommends!

*** New York Times Bestseller

*** Amazon Economics and Management Steady Seller

*** The out-of-print book that was a hot topic at used bookstores is now being republished after 15 years in a revised and expanded edition.

“This is the best book I’ve ever read!” - Tom Peters (management expert, “The Essentials of a Great Company”)

In an age of heightened uncertainty and anxiety,

A true investment innovator and investor's guardian angel,

A fierce cry from John Bogle!

What should we consider as true assets in life?

John Bogle, founder of Vanguard Group and developer of the first index fund, was called "the saint of Wall Street" and "the guardian angel of investors" for his legendary career, helping investors build their wealth the right way.

He fought tirelessly to restore common sense to the investment industry, warning that obsession with financial success could lead to disastrous consequences.

In his book Enough: True Measures of Money, Business, and Life, John Bogle offers advice on how to deal with this dilemma.

Inspired by the hundreds of lectures John Bogle gave to professional groups and college students, this book has captivated countless readers and become a must-read investment classic for value investors. Even 15 years after its publication, it remains a bestseller in the business and economics category on Amazon.

He points out that it is overflowing with desire, marketing, and speculation, and lacks an investment spirit based on values, responsibility, and trust.

How are the values that enrich us created?

John Bogle reflects on his own life, considers what constitutes enough, and offers suggestions on how we can achieve true enoughness.

This book encourages and awakens us.

In this age of extreme uncertainty and anxiety, he offers brilliant insight into the values we must follow, and argues that we must cultivate our lives based on these values.

This is definitely a book that will elevate your quality of life both financially and philosophically.

*** New York Times Bestseller

*** Amazon Economics and Management Steady Seller

*** The out-of-print book that was a hot topic at used bookstores is now being republished after 15 years in a revised and expanded edition.

“This is the best book I’ve ever read!” - Tom Peters (management expert, “The Essentials of a Great Company”)

In an age of heightened uncertainty and anxiety,

A true investment innovator and investor's guardian angel,

A fierce cry from John Bogle!

What should we consider as true assets in life?

John Bogle, founder of Vanguard Group and developer of the first index fund, was called "the saint of Wall Street" and "the guardian angel of investors" for his legendary career, helping investors build their wealth the right way.

He fought tirelessly to restore common sense to the investment industry, warning that obsession with financial success could lead to disastrous consequences.

In his book Enough: True Measures of Money, Business, and Life, John Bogle offers advice on how to deal with this dilemma.

Inspired by the hundreds of lectures John Bogle gave to professional groups and college students, this book has captivated countless readers and become a must-read investment classic for value investors. Even 15 years after its publication, it remains a bestseller in the business and economics category on Amazon.

He points out that it is overflowing with desire, marketing, and speculation, and lacks an investment spirit based on values, responsibility, and trust.

How are the values that enrich us created?

John Bogle reflects on his own life, considers what constitutes enough, and offers suggestions on how we can achieve true enoughness.

This book encourages and awakens us.

In this age of extreme uncertainty and anxiety, he offers brilliant insight into the values we must follow, and argues that we must cultivate our lives based on these values.

This is definitely a book that will elevate your quality of life both financially and philosophically.

- You can preview some of the book's contents.

Preview

index

Praise for this book

Special Recommendation for the Revised Edition - Tom Peters

Special Recommendation for the Revised Edition - Bill Clinton

Special Author's Preface to the Revised Edition - The Crisis Caused by Lack of Ethics

Starting the book

PART I Attitudes Toward Money

Chapter 1.

High cost, low value

Chapter 2.

Speculation abounds, but investment is scarce.

Chapter 3.

Complexity abounds, but simplicity is lacking.

PART II Attitude Toward Business

Chapter 4.

All we care about is numbers, not trust.

Chapter 5.

Business activities abound, but professional qualities are lacking.

Chapter 6.

There is too much commercialism, but not enough stewardship.

Chapter 7.

Management is abundant, but leadership is lacking.

PART III Attitude Toward Life

Chapter 8.

Too much focus on wealth, not enough on responsibility

Chapter 9.

21st-century values abound, but 18th-century values are lacking.

Chapter 10.

Success abounds, but character is lacking.

PART IV What is enough?

How much is enough for me, for you, for the country?

Concluding the Book: Why I Became a Fighter

Acknowledgements

Translator's Note

Americas

Special Recommendation for the Revised Edition - Tom Peters

Special Recommendation for the Revised Edition - Bill Clinton

Special Author's Preface to the Revised Edition - The Crisis Caused by Lack of Ethics

Starting the book

PART I Attitudes Toward Money

Chapter 1.

High cost, low value

Chapter 2.

Speculation abounds, but investment is scarce.

Chapter 3.

Complexity abounds, but simplicity is lacking.

PART II Attitude Toward Business

Chapter 4.

All we care about is numbers, not trust.

Chapter 5.

Business activities abound, but professional qualities are lacking.

Chapter 6.

There is too much commercialism, but not enough stewardship.

Chapter 7.

Management is abundant, but leadership is lacking.

PART III Attitude Toward Life

Chapter 8.

Too much focus on wealth, not enough on responsibility

Chapter 9.

21st-century values abound, but 18th-century values are lacking.

Chapter 10.

Success abounds, but character is lacking.

PART IV What is enough?

How much is enough for me, for you, for the country?

Concluding the Book: Why I Became a Fighter

Acknowledgements

Translator's Note

Americas

Detailed image

Into the book

We are so focused on material things that we fail to see the precious intangible values.

We are so focused on success (I've never liked success) that we don't see the character well enough.

But without character, success means nothing.

In the pressures of the century to satisfy demands immediately and to accumulate information immediately, we have forgotten the enlightenment values of the century.

Blinded by the false notion of personal satisfaction, we have lost our sense of calling to give meaning to ourselves and to society.

--- p.68, from “Starting the Book”

Exchange-traded funds (ETFs) are undoubtedly the most widely used innovative product these days.

I appreciate that this product has the concept of an index fund and is generally low-cost.

If you hold broad market index ETFs for the long term, or invest a limited amount in broad sector ETFs for specific purposes, this is a perfectly sound investment strategy.

However, serious questions cannot be raised about the excessive trading that occurs in most ETFs and the enormous brokerage fees that arise in the process.

--- pp.140-141, from “Chapter 3: Complexity Abundant but Simplicity Lacking”

My concern is that too many people implicitly assume that stock market history repeats itself.

However, the only valid perspective for looking into the future of the market is not history, but the sources of stock returns (dividends and earnings growth) discussed in Chapter 2.

(…)

It is a well-known fact that experts are often wrong.

We might wonder what kind of foolish expert would look at past returns and predict future returns.

But the world is full of investment advisors and analysts who make predictions just like this.

Let's take a look at the so-called Monte Carlo simulation, which is popular these days.

The problem with this simulation technique is that it relies solely on past returns, ignoring the source of those returns.

(This technique mixes the monthly returns of stocks and then uses probability to create an infinite sequence and combinations.)

Of course, speculative returns (returns derived from fluctuations in price-to-earnings ratios) converge to zero in the long run.

And corporate profit growth is generally similar to the nominal growth rate of our economy.

(No surprise!) However, the dividend yield is not the past average, but the actual dividend yield at the time of predicting the stock's future returns that is important.

--- pp.163-164, from “Chapter 4: Numbers Are the Only Thing You Can Trust”

Corporate executives who vote on behalf of shareholders also pay lip service to their responsibility and represent shareholders.

What else could they possibly say? However, companies that prioritize shareholder interests and preserve and protect corporate resources are rare, to the point of being the exception.

After all, even though CEOs are employees who are accountable to the company through the board of directors, it is difficult to find a CEO who views himself in this way.

These imperial CEOs forget that millions of dedicated workers build the company's value every day, and they believe that they alone create value for shareholders.

What's worse is that they take the huge rewards for themselves, as if the workers' contributions were insignificant.

--- pp.204-205, from “Chapter 5: Business Activities Are Abundant, but Professional Quality Is Lacked”

My fifth dream is to give investors control over their funds.

Only in this way can we fulfill the explicit requirements of the Investment Company Act of 1940, the federal law regulating the fund industry.

According to this law, mutual funds must be established, operated, and managed for the benefit of investors, not for the benefit of advisers or underwriters.

But despite the noble intentions of the law, the fund industry today operates entirely according to these principles.

To be honest, the fund is set up, operated and managed for the benefit of the advisors.

So what should we do? Investor education is painfully time-consuming, and time is money.

The conglomerates that currently dominate the market will not readily accept a decline in their return on equity, nor will they be willing to pass on their profits to customers.

Therefore, the only way to claim control over a mutual fund is to follow the law for exactly one year.

That is, to form an independent board of directors that is primarily accountable to the shareholders who elected it.

--- pp.224-225, from “Chapter 6: Overflowing with Descriptions but Lack of Stewardship Spirit”

At a celebration of Vanguard's $3 billion milestone in 1980, I told my crew:

“Master our work.

Let your imagination run wild in what we create.

Be honest about the products we make.

Evaluate the goals we have set for ourselves.

Be courageous when faced with a crisis, and show humor when faced with adversity.

“Be humble about our accomplishments.”

(…)

In practice, this means that we must serve our human customers to the best of our ability.

It means that we must be careful stewards of the property that our customers have entrusted to us.

It means that when we entrust our property to others, we should treat them as we would like to be treated.

It means that we must serve customers fairly, empathetically, and honestly.

--- pp.238-239, from “Chapter 7: Management is Abundant, but Leadership is Lacking”

Let me give you a word of warning.

Leaders intuitively understand that when the storm rages and things get difficult, they must keep moving forward.

But far fewer people feel they must keep moving forward even when the sun comes out and the situation improves.

Leaders and managers alike must keep in mind that good times and bad times will all pass.

The best way is to keep moving forward regardless of the situation.

--- p.250, from “Chapter 7: Management is Abundant, but Leadership is Lacking”

Where is the wealth by which you can evaluate your life?

I'm still searching for the ultimate answer to this question.

But we must never let such wealth determine our lives.

In a country as materially wealthy as the United States, it's easy to fall into this trap.

2,500 years ago, the Greek philosopher Protagoras said, "Man is the measure of all things."

I am concerned that in today's society, 'wealth is becoming the measure of humanity.'

In fact, there is even a ridiculous saying that the person with the most toys when they die is the winner.

Such a metric is absurd, superficial, and self-destructive.

Even though the world's resources are limited, people rush to spend them on trivial and fleeting things.

There are literally billions of people scattered across the globe, crying out for aid, relief, safety, compassion, education, and opportunity.

--- pp.263-264, from “Chapter 8: Focusing too much on wealth but not enough on responsibility”

In the summer of 1950, while I was working part-time, I received a call from a newspaper asking me to cover a fire.

The fire scene was two stops away from the fire station where I was.

I didn't have a car.

Besides, it was around midnight.

I was exhausted and had no interest in my work.

So I waited until the firefighters got back, listened to their story, and then reported it to the newspaper.

But the proofreader noticed that my report was not detailed enough and stopped me with one question.

“Bogle, what color was the burning house?”

I was embarrassed by my actions and afraid of losing my job, so I replied, “I’ll go right now.”

I did that.

This was a great lesson that warned me against taking easy shortcuts in life.

(I'm truly grateful to that proofreader! If something has to be done, it's best to do it right.)

--- pp.268-269, from “Chapter 8: Focusing too much on wealth but not enough on responsibility”

In The Wealth of Nations, Smith used the metaphor of an invisible hand that moves the economy, which remains an important element of economic philosophy to this day.

'Every individual is concerned only about his own safety.

He strives to produce maximum value for his own benefit, but an invisible hand guides the results in a direction he never intended.

…promotes the interests of society more effectively than when individuals actually intend to promote them.'

--- p.285, from “Chapter 9: The Value of the Century Is Abundant, But Not Enough for the Century”

I said to the dog.

“Do you still participate in races these days?”

“No,” the dog answered.

“Is there a problem? Is it because I’m too old?”

"no.

“I can still run as much as I want.”

“Then what’s the reason? Are your grades bad?”

“I earned over ten thousand dollars for my master.”

“Then what’s the reason? Because the treatment was bad?”

“Not at all.

“They treat you very well during the race.”

“Are you hurt anywhere?”

"no."

“Then why? What’s the reason?”

“I quit,” the dog replied.

“You quit?”

"is it so.

“I quit.”

“Why did you quit?”

“I chased a rabbit countless times, but it turned out that the rabbit I was chasing was fake.

So I quit.”

Is this really true? Probably not.

But most people will understand what it feels like to be an old greyhound.

We too have run around the stadium countless times chasing the fake rabbit called success, only to find that the real rabbit is waiting for us right in front of our noses.

--- pp.297-299, from “Chapter 10: Success is abundant, but character is lacking”

So, while I acknowledge that wealth, fame, and power are the three attributes of success, I still don't accept the traditional way of defining these elements.

I have come to believe that wealth should not be measured by money, fame should not be measured by public praise, and power should not be measured solely by control over others.

In fact, financial wealth is too shallow a measure of success.

If we accept money as the measure of success, then "money becomes the measure of humanity," how foolish could this be? How, then, should we measure wealth? What about a life well-lived? What about a family united in love? Who could be richer than someone who, through their fulfillment of their calling, benefits humanity, their fellow citizens, their community, or their neighbors?

That doesn't mean money isn't important.

Who among us doesn't want enough money to fully enjoy our lives and freedom? We want to be safe from poverty, choose the careers we want, have money for our children's education, and hope for a comfortable retirement.

But how much wealth is needed to achieve this goal? We should question whether the vast wealth held by the very top of our society is a disaster rather than a blessing.

--- pp.300-301, from “Chapter 10: Success is abundant, but character is lacking”

In our world, there is more than enough hatred, guns, old politics, arrogance, deceit, selfishness, vulgarity, shallowness, war, and the conviction that God is on our side.

But there has never been enough love, conscience, tolerance, idealism, justice, and compassion, nor has there ever been enough wisdom, humility, self-sacrifice, honesty, courtesy, poetic inspiration, laughter, and material and spiritual generosity.

Even if you don't remember anything else from this book, I want you to keep this in mind.

In the great game of life, money is not important.

It is important that we do our best to participate in the war to rebuild ourselves, our society, our nation, and the world.

We are so focused on success (I've never liked success) that we don't see the character well enough.

But without character, success means nothing.

In the pressures of the century to satisfy demands immediately and to accumulate information immediately, we have forgotten the enlightenment values of the century.

Blinded by the false notion of personal satisfaction, we have lost our sense of calling to give meaning to ourselves and to society.

--- p.68, from “Starting the Book”

Exchange-traded funds (ETFs) are undoubtedly the most widely used innovative product these days.

I appreciate that this product has the concept of an index fund and is generally low-cost.

If you hold broad market index ETFs for the long term, or invest a limited amount in broad sector ETFs for specific purposes, this is a perfectly sound investment strategy.

However, serious questions cannot be raised about the excessive trading that occurs in most ETFs and the enormous brokerage fees that arise in the process.

--- pp.140-141, from “Chapter 3: Complexity Abundant but Simplicity Lacking”

My concern is that too many people implicitly assume that stock market history repeats itself.

However, the only valid perspective for looking into the future of the market is not history, but the sources of stock returns (dividends and earnings growth) discussed in Chapter 2.

(…)

It is a well-known fact that experts are often wrong.

We might wonder what kind of foolish expert would look at past returns and predict future returns.

But the world is full of investment advisors and analysts who make predictions just like this.

Let's take a look at the so-called Monte Carlo simulation, which is popular these days.

The problem with this simulation technique is that it relies solely on past returns, ignoring the source of those returns.

(This technique mixes the monthly returns of stocks and then uses probability to create an infinite sequence and combinations.)

Of course, speculative returns (returns derived from fluctuations in price-to-earnings ratios) converge to zero in the long run.

And corporate profit growth is generally similar to the nominal growth rate of our economy.

(No surprise!) However, the dividend yield is not the past average, but the actual dividend yield at the time of predicting the stock's future returns that is important.

--- pp.163-164, from “Chapter 4: Numbers Are the Only Thing You Can Trust”

Corporate executives who vote on behalf of shareholders also pay lip service to their responsibility and represent shareholders.

What else could they possibly say? However, companies that prioritize shareholder interests and preserve and protect corporate resources are rare, to the point of being the exception.

After all, even though CEOs are employees who are accountable to the company through the board of directors, it is difficult to find a CEO who views himself in this way.

These imperial CEOs forget that millions of dedicated workers build the company's value every day, and they believe that they alone create value for shareholders.

What's worse is that they take the huge rewards for themselves, as if the workers' contributions were insignificant.

--- pp.204-205, from “Chapter 5: Business Activities Are Abundant, but Professional Quality Is Lacked”

My fifth dream is to give investors control over their funds.

Only in this way can we fulfill the explicit requirements of the Investment Company Act of 1940, the federal law regulating the fund industry.

According to this law, mutual funds must be established, operated, and managed for the benefit of investors, not for the benefit of advisers or underwriters.

But despite the noble intentions of the law, the fund industry today operates entirely according to these principles.

To be honest, the fund is set up, operated and managed for the benefit of the advisors.

So what should we do? Investor education is painfully time-consuming, and time is money.

The conglomerates that currently dominate the market will not readily accept a decline in their return on equity, nor will they be willing to pass on their profits to customers.

Therefore, the only way to claim control over a mutual fund is to follow the law for exactly one year.

That is, to form an independent board of directors that is primarily accountable to the shareholders who elected it.

--- pp.224-225, from “Chapter 6: Overflowing with Descriptions but Lack of Stewardship Spirit”

At a celebration of Vanguard's $3 billion milestone in 1980, I told my crew:

“Master our work.

Let your imagination run wild in what we create.

Be honest about the products we make.

Evaluate the goals we have set for ourselves.

Be courageous when faced with a crisis, and show humor when faced with adversity.

“Be humble about our accomplishments.”

(…)

In practice, this means that we must serve our human customers to the best of our ability.

It means that we must be careful stewards of the property that our customers have entrusted to us.

It means that when we entrust our property to others, we should treat them as we would like to be treated.

It means that we must serve customers fairly, empathetically, and honestly.

--- pp.238-239, from “Chapter 7: Management is Abundant, but Leadership is Lacking”

Let me give you a word of warning.

Leaders intuitively understand that when the storm rages and things get difficult, they must keep moving forward.

But far fewer people feel they must keep moving forward even when the sun comes out and the situation improves.

Leaders and managers alike must keep in mind that good times and bad times will all pass.

The best way is to keep moving forward regardless of the situation.

--- p.250, from “Chapter 7: Management is Abundant, but Leadership is Lacking”

Where is the wealth by which you can evaluate your life?

I'm still searching for the ultimate answer to this question.

But we must never let such wealth determine our lives.

In a country as materially wealthy as the United States, it's easy to fall into this trap.

2,500 years ago, the Greek philosopher Protagoras said, "Man is the measure of all things."

I am concerned that in today's society, 'wealth is becoming the measure of humanity.'

In fact, there is even a ridiculous saying that the person with the most toys when they die is the winner.

Such a metric is absurd, superficial, and self-destructive.

Even though the world's resources are limited, people rush to spend them on trivial and fleeting things.

There are literally billions of people scattered across the globe, crying out for aid, relief, safety, compassion, education, and opportunity.

--- pp.263-264, from “Chapter 8: Focusing too much on wealth but not enough on responsibility”

In the summer of 1950, while I was working part-time, I received a call from a newspaper asking me to cover a fire.

The fire scene was two stops away from the fire station where I was.

I didn't have a car.

Besides, it was around midnight.

I was exhausted and had no interest in my work.

So I waited until the firefighters got back, listened to their story, and then reported it to the newspaper.

But the proofreader noticed that my report was not detailed enough and stopped me with one question.

“Bogle, what color was the burning house?”

I was embarrassed by my actions and afraid of losing my job, so I replied, “I’ll go right now.”

I did that.

This was a great lesson that warned me against taking easy shortcuts in life.

(I'm truly grateful to that proofreader! If something has to be done, it's best to do it right.)

--- pp.268-269, from “Chapter 8: Focusing too much on wealth but not enough on responsibility”

In The Wealth of Nations, Smith used the metaphor of an invisible hand that moves the economy, which remains an important element of economic philosophy to this day.

'Every individual is concerned only about his own safety.

He strives to produce maximum value for his own benefit, but an invisible hand guides the results in a direction he never intended.

…promotes the interests of society more effectively than when individuals actually intend to promote them.'

--- p.285, from “Chapter 9: The Value of the Century Is Abundant, But Not Enough for the Century”

I said to the dog.

“Do you still participate in races these days?”

“No,” the dog answered.

“Is there a problem? Is it because I’m too old?”

"no.

“I can still run as much as I want.”

“Then what’s the reason? Are your grades bad?”

“I earned over ten thousand dollars for my master.”

“Then what’s the reason? Because the treatment was bad?”

“Not at all.

“They treat you very well during the race.”

“Are you hurt anywhere?”

"no."

“Then why? What’s the reason?”

“I quit,” the dog replied.

“You quit?”

"is it so.

“I quit.”

“Why did you quit?”

“I chased a rabbit countless times, but it turned out that the rabbit I was chasing was fake.

So I quit.”

Is this really true? Probably not.

But most people will understand what it feels like to be an old greyhound.

We too have run around the stadium countless times chasing the fake rabbit called success, only to find that the real rabbit is waiting for us right in front of our noses.

--- pp.297-299, from “Chapter 10: Success is abundant, but character is lacking”

So, while I acknowledge that wealth, fame, and power are the three attributes of success, I still don't accept the traditional way of defining these elements.

I have come to believe that wealth should not be measured by money, fame should not be measured by public praise, and power should not be measured solely by control over others.

In fact, financial wealth is too shallow a measure of success.

If we accept money as the measure of success, then "money becomes the measure of humanity," how foolish could this be? How, then, should we measure wealth? What about a life well-lived? What about a family united in love? Who could be richer than someone who, through their fulfillment of their calling, benefits humanity, their fellow citizens, their community, or their neighbors?

That doesn't mean money isn't important.

Who among us doesn't want enough money to fully enjoy our lives and freedom? We want to be safe from poverty, choose the careers we want, have money for our children's education, and hope for a comfortable retirement.

But how much wealth is needed to achieve this goal? We should question whether the vast wealth held by the very top of our society is a disaster rather than a blessing.

--- pp.300-301, from “Chapter 10: Success is abundant, but character is lacking”

In our world, there is more than enough hatred, guns, old politics, arrogance, deceit, selfishness, vulgarity, shallowness, war, and the conviction that God is on our side.

But there has never been enough love, conscience, tolerance, idealism, justice, and compassion, nor has there ever been enough wisdom, humility, self-sacrifice, honesty, courtesy, poetic inspiration, laughter, and material and spiritual generosity.

Even if you don't remember anything else from this book, I want you to keep this in mind.

In the great game of life, money is not important.

It is important that we do our best to participate in the war to rebuild ourselves, our society, our nation, and the world.

--- pp.335-336, from "PART IV: What is Enough"

Publisher's Review

In this age of heightened anxiety and uncertainty

John Bogle's Great Legacy We Must Carve

In the end, long-term and value investing strategies win.

In 2008, Warren Buffett entered into a 10-year bet with a hedge fund called Protege Partners.

The bet was simple.

Buffett claimed that Vanguard Group's low-cost S&P 500 index fund would outperform most hedge funds over a 10-year period, while Protege Partners argued the opposite.

The result was an overwhelming victory for Buffett.

While Buffett's Vanguard index fund returned approximately 126% over the 10 years from January 1, 2008, to December 31, 2017, the hedge funds selected by Protege Partners returned only 36% on average.

This intriguing bet is called the bet of the century and is remembered as a significant and symbolic event in investment history.

Beyond simply competing to see who could generate higher returns, it was a test of the superiority of different investment philosophies and strategies, perfectly demonstrating how long-term and value investing are superior strategies to short-term speculative investing.

Hedge funds attempted to maximize returns through complex strategies and frequent trading, but high fees and inefficient fund management eroded their performance.

In contrast, the Vanguard Group index fund chosen by Buffett simply tracks the overall market and aims for long-term growth at low costs.

This demonstrates that compounding and a low cost structure deliver strong returns over time.

The lesson this bet taught us was that a simple, long-term approach yields far more powerful results than short-term attempts to predict the market or complex strategies.

This also proves the excellence of John Bogle's investment philosophy.

The low-cost S&P 500 index fund that Warren Buffett chose in his bet was an investment product that followed the principles of index funds created by John Bogle.

Bogle has always emphasized that investing across the entire market, minimizing costs, and maintaining a long-term perspective are the keys to investment success, and Buffett's overwhelming victory has shown just how powerful this philosophy truly is.

Investors' Guardian Angel, Wall Street's Saint

A book that contains all of John Bogle's investment philosophy.

John Bogle's Wealthy Mind

John Bogle is considered a true pioneer of long-term investing, offering simple and affordable investment methods for individual investors and embodying the practice of long-term investing.

He founded index funds based on the belief that "simply following the market average returns is sufficient for success," and his strategy was simple and clear.

He advises investors to avoid the temptation of frequent trading or market timing, emphasizing that the easiest way to maximize the power of compounding is to take your time investing.

His investment philosophy and values are contained in his book, “John Bogle’s Wealth Mind” (original title: Enough: True Measures of Money, Business, and Life), which gives us a glimpse into what attitude we should have in order to live a truly abundant life and improve our quality of life.

In this book, Bogle explores the value of life beyond simply making money, and criticizes the phenomenon of money and success being given excessive priority in capitalist society.

In a society that is becoming increasingly inhumane and where the value of material possessions is prioritized as the highest value, it poses the question, “How much more do you need to feel like you have enough?”

It also provides deep insights into how to find true satisfaction in life, as well as in investing and management.

Bogle emphasizes focusing on the essential values of life, valuing community, trust, and sound principles, rather than excessive greed and competition.

The message of this book resonates even more deeply in today's Korean society.

Competition for success, high pressure and anxiety due to social comparison, social conflict, economic inequality…

John Bogle speaks calmly to us as we run without knowing where our obsession with money and success is taking us.

We must find values in life that are more important than money, real estate, and fame.

This book makes us pause for a moment amidst the ever-changing gears of South Korea, and reflect on the essential values of life.

Bogle's writing, like a quiet cry thrown into a noisy world, makes us think about what we need most right now.

We have a real asset in life.

What should be considered

Bogle, an icon of humility and morality, was a man who valued a sense of mission over wealth or fame.

He designed Vanguard Group as a nonprofit, creating a unique system where clients become shareholders, which allowed him to lower investment costs and pass on profits to clients.

His vision is considered a model example of how a company can fulfill its social responsibility.

The reason so many people today know his name and follow his teachings is because of the honesty, transparency, and dedication he displayed throughout his life.

John Bogle's "The Wealth Mind" is still considered a classic by value investors and is a beloved bestseller.

Because it contains profound lessons that apply to all aspects of life, not just our attitudes toward money, but also our attitudes toward work and life.

This book contains the message John Bogle most wants to convey to people in this age of heightened anxiety and uncertainty, with its turbulent society, unstable politics, and gloomy economy.

John Bogle has the answer.

“There is enough hatred, guns, old politics, arrogance, deceit, selfishness, vulgarity, shallowness, war, and the conviction that God is on our side in the world.

But there has never been enough love, conscience, tolerance, idealism, justice, and compassion, nor has there ever been enough wisdom, humility, self-sacrifice, honesty, courtesy, poetic inspiration, laughter, and material and spiritual generosity.

Even if you don't remember anything else from this book, I want you to keep this in mind.

In the great game of life, money is not important.

“It is important that we do our best to participate in the war that will rebuild ourselves, our society, our nation, and the world.”

John Bogle's Great Legacy We Must Carve

In the end, long-term and value investing strategies win.

In 2008, Warren Buffett entered into a 10-year bet with a hedge fund called Protege Partners.

The bet was simple.

Buffett claimed that Vanguard Group's low-cost S&P 500 index fund would outperform most hedge funds over a 10-year period, while Protege Partners argued the opposite.

The result was an overwhelming victory for Buffett.

While Buffett's Vanguard index fund returned approximately 126% over the 10 years from January 1, 2008, to December 31, 2017, the hedge funds selected by Protege Partners returned only 36% on average.

This intriguing bet is called the bet of the century and is remembered as a significant and symbolic event in investment history.

Beyond simply competing to see who could generate higher returns, it was a test of the superiority of different investment philosophies and strategies, perfectly demonstrating how long-term and value investing are superior strategies to short-term speculative investing.

Hedge funds attempted to maximize returns through complex strategies and frequent trading, but high fees and inefficient fund management eroded their performance.

In contrast, the Vanguard Group index fund chosen by Buffett simply tracks the overall market and aims for long-term growth at low costs.

This demonstrates that compounding and a low cost structure deliver strong returns over time.

The lesson this bet taught us was that a simple, long-term approach yields far more powerful results than short-term attempts to predict the market or complex strategies.

This also proves the excellence of John Bogle's investment philosophy.

The low-cost S&P 500 index fund that Warren Buffett chose in his bet was an investment product that followed the principles of index funds created by John Bogle.

Bogle has always emphasized that investing across the entire market, minimizing costs, and maintaining a long-term perspective are the keys to investment success, and Buffett's overwhelming victory has shown just how powerful this philosophy truly is.

Investors' Guardian Angel, Wall Street's Saint

A book that contains all of John Bogle's investment philosophy.

John Bogle's Wealthy Mind

John Bogle is considered a true pioneer of long-term investing, offering simple and affordable investment methods for individual investors and embodying the practice of long-term investing.

He founded index funds based on the belief that "simply following the market average returns is sufficient for success," and his strategy was simple and clear.

He advises investors to avoid the temptation of frequent trading or market timing, emphasizing that the easiest way to maximize the power of compounding is to take your time investing.

His investment philosophy and values are contained in his book, “John Bogle’s Wealth Mind” (original title: Enough: True Measures of Money, Business, and Life), which gives us a glimpse into what attitude we should have in order to live a truly abundant life and improve our quality of life.

In this book, Bogle explores the value of life beyond simply making money, and criticizes the phenomenon of money and success being given excessive priority in capitalist society.

In a society that is becoming increasingly inhumane and where the value of material possessions is prioritized as the highest value, it poses the question, “How much more do you need to feel like you have enough?”

It also provides deep insights into how to find true satisfaction in life, as well as in investing and management.

Bogle emphasizes focusing on the essential values of life, valuing community, trust, and sound principles, rather than excessive greed and competition.

The message of this book resonates even more deeply in today's Korean society.

Competition for success, high pressure and anxiety due to social comparison, social conflict, economic inequality…

John Bogle speaks calmly to us as we run without knowing where our obsession with money and success is taking us.

We must find values in life that are more important than money, real estate, and fame.

This book makes us pause for a moment amidst the ever-changing gears of South Korea, and reflect on the essential values of life.

Bogle's writing, like a quiet cry thrown into a noisy world, makes us think about what we need most right now.

We have a real asset in life.

What should be considered

Bogle, an icon of humility and morality, was a man who valued a sense of mission over wealth or fame.

He designed Vanguard Group as a nonprofit, creating a unique system where clients become shareholders, which allowed him to lower investment costs and pass on profits to clients.

His vision is considered a model example of how a company can fulfill its social responsibility.

The reason so many people today know his name and follow his teachings is because of the honesty, transparency, and dedication he displayed throughout his life.

John Bogle's "The Wealth Mind" is still considered a classic by value investors and is a beloved bestseller.

Because it contains profound lessons that apply to all aspects of life, not just our attitudes toward money, but also our attitudes toward work and life.

This book contains the message John Bogle most wants to convey to people in this age of heightened anxiety and uncertainty, with its turbulent society, unstable politics, and gloomy economy.

John Bogle has the answer.

“There is enough hatred, guns, old politics, arrogance, deceit, selfishness, vulgarity, shallowness, war, and the conviction that God is on our side in the world.

But there has never been enough love, conscience, tolerance, idealism, justice, and compassion, nor has there ever been enough wisdom, humility, self-sacrifice, honesty, courtesy, poetic inspiration, laughter, and material and spiritual generosity.

Even if you don't remember anything else from this book, I want you to keep this in mind.

In the great game of life, money is not important.

“It is important that we do our best to participate in the war that will rebuild ourselves, our society, our nation, and the world.”

GOODS SPECIFICS

- Date of issue: January 30, 2025

- Page count, weight, size: 360 pages | 506g | 148*210*23mm

- ISBN13: 9791189217426

- ISBN10: 1189217422

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)