Just follow accounting

|

Description

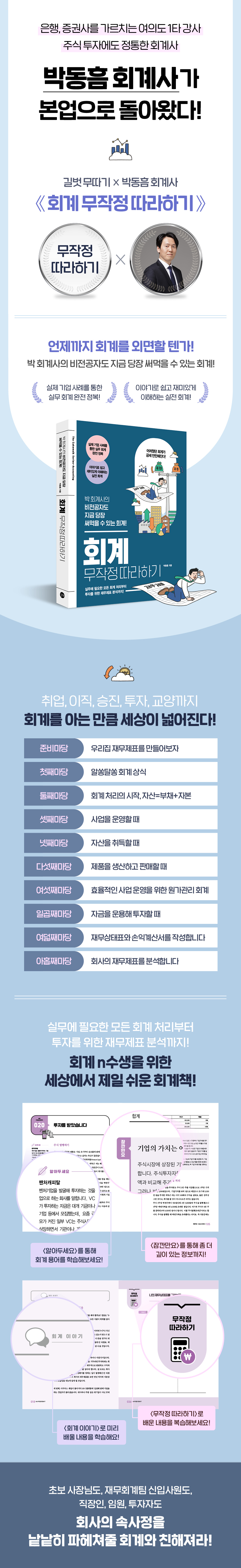

Book Introduction

Everything that happens in a company ultimately comes down to accounting.

Accounting is the 'language' of business!

Members of a company engage in a great deal of activity in their respective departments every day.

The raised capital is used for research and development and facility investments.

The purchasing department buys raw materials, and the production department manufactures them.

The sales department makes sales and collects payments.

The Human Resources, General Affairs, Finance, and Accounting departments support overall tasks related to company management.

The names of departments and the work they do are different for each company, but they generally work like this.

Activities occurring within a company are controlled to achieve the company's goals and avoid risks.

All actions must be documented, verified, and approved by superiors.

During this process, cash flows in and out.

Cash inflows may be from the disposal of assets or the generation of income.

Cash outflows may be repayment of debt or incurrence of expenses.

These parts are processed into accounting statements and prepared as financial statements and income statements.

That's why we call accounting the 'language of business' and the 'language of management.'

Accounting is the 'language' of business!

Members of a company engage in a great deal of activity in their respective departments every day.

The raised capital is used for research and development and facility investments.

The purchasing department buys raw materials, and the production department manufactures them.

The sales department makes sales and collects payments.

The Human Resources, General Affairs, Finance, and Accounting departments support overall tasks related to company management.

The names of departments and the work they do are different for each company, but they generally work like this.

Activities occurring within a company are controlled to achieve the company's goals and avoid risks.

All actions must be documented, verified, and approved by superiors.

During this process, cash flows in and out.

Cash inflows may be from the disposal of assets or the generation of income.

Cash outflows may be repayment of debt or incurrence of expenses.

These parts are processed into accounting statements and prepared as financial statements and income statements.

That's why we call accounting the 'language of business' and the 'language of management.'

- You can preview some of the book's contents.

Preview

index

prolog

To all the Anyoungs in this world

----------------------------------------------

〈Preparation Stage〉 Let's Create Our Household Financial Statements

----------------------------------------------

001 A company's financial health can be determined by looking at its financial statements.

002 Let's create an income statement using year-end tax settlement data.

003 Criteria for Recognizing Revenue and Expenses

004 How much is our household's total assets?

005 Why Corporate Accounting Seems Difficult

----------------------------------------------

〈First Yard〉 Accounting Common Sense

----------------------------------------------

006 The accounting period is from January 1 to December 31?

007 The Difference Between Capital and Assets

008 Borrowings and Debt

009 Criteria for dividing current and non-current assets

010 Are revenues and expenses movements of cash?

011 What is the difference between revenue and profit?

012 Where can I find corporate financial statements?

----------------------------------------------

〈Second Yard〉 The Beginning of Accounting: Assets = Liabilities + Capital

----------------------------------------------

013 Principles of Super-Simple Double-Entry Bookkeeping

014 Accounting is complete if you know only 16 cases.

015 Four Cases of Asset Increase

016 Four Cases of Debt Reduction

017 Four Cases of Capital Decrease

018 Four Cases in Which Costs Occur

----------------------------------------------

When running the “Third Yard” business

----------------------------------------------

019 Start a business by investing capital

020 investment received

021 employees were hired

022 We research and develop new products.

023 We are looking to grow our company through mergers and acquisitions.

----------------------------------------------

〈Fourth Yard〉 When acquiring assets

----------------------------------------------

024 I bought land

025 Get a loan to build a factory

026 I will depreciate it as much as I use it.

027 Sold the assets I was using

----------------------------------------------

When producing and selling products in the 〈Fifth Yard〉

----------------------------------------------

028 Inventory held for sale

029 Purchased raw materials for production

030 Determine the unit cost method for inventory assets.

031 We make and sell products

032 customers purchased the product

033 Accounting for value added tax

034 Managing long-term business sales for more than one year

035 The business partner is not paying the outstanding balance.

036 Product must be discarded

037 Customer returned/refunded the product

I sold product 038 at a discount.

----------------------------------------------

〈Sixth Yard〉 Cost Management Accounting for Efficient Business Operations

----------------------------------------------

039 Four Types of Accounting

040 Direct and indirect costs affecting cost

041 Activity costing, which calculates costs for each activity

042 Let's calculate the break-even point.

043 Fixed cost reduction effect that increases profits

044 Let's decide the product selling price.

045 I am making a loss, should I continue selling?

046 What products should I focus on selling?

----------------------------------------------

When investing by managing funds in the 〈Seventh Yard〉

----------------------------------------------

047 Companies also invest according to their investment tendencies.

048 Invest in savings

049 Invest in stocks and bonds

050 Invest in real estate

----------------------------------------------

〈Eighth Yard〉 Prepare a balance sheet and income statement.

----------------------------------------------

051 Types of Current Assets and Accounting Treatment Examples

052 Types of Non-Current Assets and Accounting Treatment Examples

053 Types of Current Liabilities and Accounting Treatment Examples

054 Types of Non-Current Liabilities and Accounting Treatment Examples

055 Types of Capital and Accounting Treatment Examples

056 Preparation of income statement and accounting treatment summary

----------------------------------------------

〈Ninth Yard〉 Analyzing the company's financial statements

----------------------------------------------

057 Why You Should Know How to Read Financial Statements

058 Let's review financial stability.

059 Let's classify accounts for financial statement analysis.

060 Let's read the income statement properly.

061 What's important in non-business areas

062 Let's find the financial ratios.

063 Let's analyze the cash flow statement.

To all the Anyoungs in this world

----------------------------------------------

〈Preparation Stage〉 Let's Create Our Household Financial Statements

----------------------------------------------

001 A company's financial health can be determined by looking at its financial statements.

002 Let's create an income statement using year-end tax settlement data.

003 Criteria for Recognizing Revenue and Expenses

004 How much is our household's total assets?

005 Why Corporate Accounting Seems Difficult

----------------------------------------------

〈First Yard〉 Accounting Common Sense

----------------------------------------------

006 The accounting period is from January 1 to December 31?

007 The Difference Between Capital and Assets

008 Borrowings and Debt

009 Criteria for dividing current and non-current assets

010 Are revenues and expenses movements of cash?

011 What is the difference between revenue and profit?

012 Where can I find corporate financial statements?

----------------------------------------------

〈Second Yard〉 The Beginning of Accounting: Assets = Liabilities + Capital

----------------------------------------------

013 Principles of Super-Simple Double-Entry Bookkeeping

014 Accounting is complete if you know only 16 cases.

015 Four Cases of Asset Increase

016 Four Cases of Debt Reduction

017 Four Cases of Capital Decrease

018 Four Cases in Which Costs Occur

----------------------------------------------

When running the “Third Yard” business

----------------------------------------------

019 Start a business by investing capital

020 investment received

021 employees were hired

022 We research and develop new products.

023 We are looking to grow our company through mergers and acquisitions.

----------------------------------------------

〈Fourth Yard〉 When acquiring assets

----------------------------------------------

024 I bought land

025 Get a loan to build a factory

026 I will depreciate it as much as I use it.

027 Sold the assets I was using

----------------------------------------------

When producing and selling products in the 〈Fifth Yard〉

----------------------------------------------

028 Inventory held for sale

029 Purchased raw materials for production

030 Determine the unit cost method for inventory assets.

031 We make and sell products

032 customers purchased the product

033 Accounting for value added tax

034 Managing long-term business sales for more than one year

035 The business partner is not paying the outstanding balance.

036 Product must be discarded

037 Customer returned/refunded the product

I sold product 038 at a discount.

----------------------------------------------

〈Sixth Yard〉 Cost Management Accounting for Efficient Business Operations

----------------------------------------------

039 Four Types of Accounting

040 Direct and indirect costs affecting cost

041 Activity costing, which calculates costs for each activity

042 Let's calculate the break-even point.

043 Fixed cost reduction effect that increases profits

044 Let's decide the product selling price.

045 I am making a loss, should I continue selling?

046 What products should I focus on selling?

----------------------------------------------

When investing by managing funds in the 〈Seventh Yard〉

----------------------------------------------

047 Companies also invest according to their investment tendencies.

048 Invest in savings

049 Invest in stocks and bonds

050 Invest in real estate

----------------------------------------------

〈Eighth Yard〉 Prepare a balance sheet and income statement.

----------------------------------------------

051 Types of Current Assets and Accounting Treatment Examples

052 Types of Non-Current Assets and Accounting Treatment Examples

053 Types of Current Liabilities and Accounting Treatment Examples

054 Types of Non-Current Liabilities and Accounting Treatment Examples

055 Types of Capital and Accounting Treatment Examples

056 Preparation of income statement and accounting treatment summary

----------------------------------------------

〈Ninth Yard〉 Analyzing the company's financial statements

----------------------------------------------

057 Why You Should Know How to Read Financial Statements

058 Let's review financial stability.

059 Let's classify accounts for financial statement analysis.

060 Let's read the income statement properly.

061 What's important in non-business areas

062 Let's find the financial ratios.

063 Let's analyze the cash flow statement.

Detailed image

Publisher's Review

Why I Encouraged Ahn Young-yi of "Misaeng" to Study Accounting

Without accounting, there is no growth or success!

Accounting is essential for career success.

To even hope for an executive promotion, you need to develop the ability to see the company's overall numbers, as well as determine how a certain action contributes to increasing the company's assets and revenue, reducing costs and liabilities, and so on.

Of course, there is no big problem if you do well only within your own department, but there are bound to be limits to your growth.

The results of all activities occurring within a company are ultimately expressed as assets, liabilities, revenues, and expenses.

That is why all members of a company are inseparable from accounting.

This means that you should know this to some extent, regardless of your major.

Some companies provide financial training to new employees, but most provide training to those above a certain level.

If you reach a position of mid-level management or higher, you will need to collaborate with other departments and understand the overall flow of the company.

Many companies require accounting studies even for people in seemingly unrelated departments, such as IT departments, shipbuilding departments, and raw materials purchasing departments.

Understand through stories and apply them to real business cases!

"Accounting: Just Follow": Killing Two Birds: Practice and Analysis

For non-majors who need to study accounting and business analysis for career growth, it's best to understand seemingly difficult theoretical content through common sense while applying it to your own economic activities.

Then, if you look at various cases of famous companies, it will become clear.

This book approached it that way.

So, you will be able to kill two birds with one stone: practical and analytical.

I also included the cost management accounting part, which is frequently covered in the company, in the hope that it will be helpful for your career.

If you're good at management accounting at your company, you'll be on the road to success faster, so get a pen and a notebook and try solving the calculation problems in "Just Follow Along."

Accounting is a mountain that must be overcome at some point.

Don't give up halfway through, and make sure to conquer it this time.

I hope this book will help you lighten your steps and plan for the future.

Without accounting, there is no growth or success!

Accounting is essential for career success.

To even hope for an executive promotion, you need to develop the ability to see the company's overall numbers, as well as determine how a certain action contributes to increasing the company's assets and revenue, reducing costs and liabilities, and so on.

Of course, there is no big problem if you do well only within your own department, but there are bound to be limits to your growth.

The results of all activities occurring within a company are ultimately expressed as assets, liabilities, revenues, and expenses.

That is why all members of a company are inseparable from accounting.

This means that you should know this to some extent, regardless of your major.

Some companies provide financial training to new employees, but most provide training to those above a certain level.

If you reach a position of mid-level management or higher, you will need to collaborate with other departments and understand the overall flow of the company.

Many companies require accounting studies even for people in seemingly unrelated departments, such as IT departments, shipbuilding departments, and raw materials purchasing departments.

Understand through stories and apply them to real business cases!

"Accounting: Just Follow": Killing Two Birds: Practice and Analysis

For non-majors who need to study accounting and business analysis for career growth, it's best to understand seemingly difficult theoretical content through common sense while applying it to your own economic activities.

Then, if you look at various cases of famous companies, it will become clear.

This book approached it that way.

So, you will be able to kill two birds with one stone: practical and analytical.

I also included the cost management accounting part, which is frequently covered in the company, in the hope that it will be helpful for your career.

If you're good at management accounting at your company, you'll be on the road to success faster, so get a pen and a notebook and try solving the calculation problems in "Just Follow Along."

Accounting is a mountain that must be overcome at some point.

Don't give up halfway through, and make sure to conquer it this time.

I hope this book will help you lighten your steps and plan for the future.

GOODS SPECIFICS

- Date of issue: May 9, 2025

- Page count, weight, size: 432 pages | 820g | 188*243*20mm

- ISBN13: 9791140713165

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)