Practical Trend Investing Method

|

Description

Book Introduction

The author of this book, Instructor Kojiro, is Japan's leading chart researcher and trading technique researcher. The author uses his uniquely developed "Moving Average Major Cycle Analysis" and "Major Cycle MACD" to help investors achieve stable, targeted returns while investing in trends. In this book, the author demonstrates the best trend investing through advanced buying and selling techniques, in addition to the trading rules of the legendary Turtle Group, a group of traders. Investors will learn about Turtle Group's trading methods developed by the author through this book. You can take advantage of the strengths of both investment methods to create your own trading rules and apply them in practice. |

- You can preview some of the book's contents.

Preview

index

Prologue: You can train traders like you train turtles.

Part 1: Mastering Trend Following with the Turtle Technique

Chapter 1: Is it better to buy or sell?

What is an edge in trading?

Trading is a business of probability.

TE and Expected Value Derived from the Winning Equation

Relationship between RR ratio and win rate

There is no such thing as a 100% win rate.

Let's aim for V-trader

Chapter 2: Money Management to Avoid Volatility

The main premise is not to go bankrupt.

■ Column: Bankruptcy Probability

Money management to avoid bankruptcy

Turtle Group's Fund Management Method

Appropriate trading volume per transaction, unit

■ Column: Unit Calculation Example

Risk diversification and stock diversification

Chapter 3: Risk Management to Minimize Losses

Risk is essential in trading.

How to determine your stop-loss line

Chapter 4: How to Find a Trading Edge

Let's find favorable buying and selling conditions.

Key indicators to help you find your trading edge

Let's pay attention to the moving average cycle.

■ Column: Cognitive Bias

Chapter 5 Entry Rules

Turtle Group Entry Rules

Entry rules using grand cycle analysis

■ Column: How Turtle Made the Rules

Chapter 6 Liquidation Rules

Liquidation rules to determine profits

Liquidation rules to cut losses

Trailing stop

■ Column: Turtle Group's Liquidation Rules

Chapter 7: Pyramiding Rules for Maximizing Profits

1/2N addition rule for turtle groups

1N additional rule for turtle group

Water riding and pyramiding

Long-short strategy

Chapter 8: Market Selection and Stock Analysis Rules

Trading targets excluding Turtle Group

Pros and Cons of Fundamental Analysis and Its Uses

Pros and Cons of Technical Analysis and Its Uses

Chapter 9: Towards the V Trader: Preparation

3 Steps to Becoming a V-Trader

Three Essential Conditions for V Traders

Find your own trading model

Chapter 10: Towards the V-Trader: Practical

Record your trading details

Create your own trading rules

Let's regularly review and upgrade the rules.

Part 2: The Great Circulation

Chapter 11 Moving Average Grand Cycle Analysis

You need your own entry rules

Basics of Moving Averages

What is moving average grand cycle analysis?

Understand the current situation in terms of arrangement status

Reading the strength of a trend by its slope

Check the continuation of the trend at intervals

Basic strategies by phase

Reading the situation with the belt

Identify trading opportunities using moving average grand cycle analysis.

Things to watch out for in moving average grand cycle analysis

Four Key Points from Moving Average Grand Cycle Analysis

How does a change in the situation occur?

How to bring forward the entry timing

Chapter 12: MACD Mastery

MACD, an indicator that analyzes the convergence and divergence of moving averages

The three components that make up the MACD

How to Use MACD Properly

An evolution of moving average macrocyclical analysis, macrocyclical MACD

Towards V Trader

Epilogue: What Are We Investing For?

Part 1: Mastering Trend Following with the Turtle Technique

Chapter 1: Is it better to buy or sell?

What is an edge in trading?

Trading is a business of probability.

TE and Expected Value Derived from the Winning Equation

Relationship between RR ratio and win rate

There is no such thing as a 100% win rate.

Let's aim for V-trader

Chapter 2: Money Management to Avoid Volatility

The main premise is not to go bankrupt.

■ Column: Bankruptcy Probability

Money management to avoid bankruptcy

Turtle Group's Fund Management Method

Appropriate trading volume per transaction, unit

■ Column: Unit Calculation Example

Risk diversification and stock diversification

Chapter 3: Risk Management to Minimize Losses

Risk is essential in trading.

How to determine your stop-loss line

Chapter 4: How to Find a Trading Edge

Let's find favorable buying and selling conditions.

Key indicators to help you find your trading edge

Let's pay attention to the moving average cycle.

■ Column: Cognitive Bias

Chapter 5 Entry Rules

Turtle Group Entry Rules

Entry rules using grand cycle analysis

■ Column: How Turtle Made the Rules

Chapter 6 Liquidation Rules

Liquidation rules to determine profits

Liquidation rules to cut losses

Trailing stop

■ Column: Turtle Group's Liquidation Rules

Chapter 7: Pyramiding Rules for Maximizing Profits

1/2N addition rule for turtle groups

1N additional rule for turtle group

Water riding and pyramiding

Long-short strategy

Chapter 8: Market Selection and Stock Analysis Rules

Trading targets excluding Turtle Group

Pros and Cons of Fundamental Analysis and Its Uses

Pros and Cons of Technical Analysis and Its Uses

Chapter 9: Towards the V Trader: Preparation

3 Steps to Becoming a V-Trader

Three Essential Conditions for V Traders

Find your own trading model

Chapter 10: Towards the V-Trader: Practical

Record your trading details

Create your own trading rules

Let's regularly review and upgrade the rules.

Part 2: The Great Circulation

Chapter 11 Moving Average Grand Cycle Analysis

You need your own entry rules

Basics of Moving Averages

What is moving average grand cycle analysis?

Understand the current situation in terms of arrangement status

Reading the strength of a trend by its slope

Check the continuation of the trend at intervals

Basic strategies by phase

Reading the situation with the belt

Identify trading opportunities using moving average grand cycle analysis.

Things to watch out for in moving average grand cycle analysis

Four Key Points from Moving Average Grand Cycle Analysis

How does a change in the situation occur?

How to bring forward the entry timing

Chapter 12: MACD Mastery

MACD, an indicator that analyzes the convergence and divergence of moving averages

The three components that make up the MACD

How to Use MACD Properly

An evolution of moving average macrocyclical analysis, macrocyclical MACD

Towards V Trader

Epilogue: What Are We Investing For?

Detailed image

Into the book

This book introduces everything about turtle group trading.

Furthermore, I will introduce my own technique, which has been upgraded to suit the changing market over time.

The main purpose of this book is to lead readers to create their own rules based on this.

Each trader has different capital and personality.

Therefore, to win, you need your own 'rules' that you create yourself, not someone else's techniques.

But this task is by no means easy.

This book presents the rules of the Turtle Group as a kind of model and introduces how to individualize them to create your own rules.

Specifically, I adopted the Turtle Group's trading rules for money management and risk management, and applied my own rules for entry.

---- From the "Prologue"

One of them is Trading Edge (TE).

Edge generally means 'superiority'.

In trading, when the price fluctuates and you say, "It's definitely advantageous to buy," or "It's definitely advantageous to sell," you are saying you have an edge.

In short, it refers to the weak points in trading.

(…) Prices rarely stay still in one place, but rather go up and down most of the time.

At any given point in time, the odds of the price going up versus going down are usually 5:5.

But sometimes, there are situations where the trend is clearly tilted towards buying or selling.

A representative example is the situation where a trend occurs.

In an uptrend, it is definitely advantageous to buy.

At this time, you should obviously enter as a 'buy' and not as a 'sell'.

--- From "Chapter 1: Edge in Trading"

The Turtle Group set the trading volume per trade to match the risk they were willing to take on in a single trade (a risk equivalent to 1% of their trading capital), and called it 1 unit.

The unit calculation for the turtle group is as follows:

① Find 1% of trading funds.

· Trading funds × 0.01 = A

② Calculate the risk associated with trading the item in the minimum trading unit.

· Trading unit × ATR = B

③ Divide A by B (round up according to transaction unit).

· Unit = A÷B

--- From "Appropriate trading volume per 2-chapter unit"

Prices rise in waves and fall in waves.

The width of that wave is called noise, and trends are always accompanied by noise.

If the stop loss line gets caught in that noise, the stop loss order will be executed due to a temporary decline.

On the other hand, if the trend reverses, you should quickly liquidate your position.

Considering this, an appropriate stop loss line should be set outside the noise, i.e., close to the maximum amplitude of the noise.

To do that, we first need to know the width of the noise.

(…) The Turtle Group investigated various stocks and found that the average range from the previous high to the current low among noises was ‘2 ATR or less.’

This is why the Turtle Group sets its stop loss line at twice the ATR.

--- From "Chapter 6 Liquidation Rules for Cutting Losses"

When an uptrend occurs, the three moving averages show 'certain characteristics'.

To clarify this feature, the points to note are the arrangement order, slope, and spacing of the three moving averages.

First, let's look at the array order.

The three lines are arranged from top to bottom as 'short-term line/medium-term line/long-term line'.

Looking at the arrangement, you can see the current situation.

Next, let's look at the slope.

The slopes of all three lines are upward.

The slope tells you the strength of the trend.

Finally, let's look at the spacing.

As the price moves smoothly, the gap between the moving averages gradually widens.

The intervals show the continuity of the trend.

Moving average grand cycle analysis is a method of finding favorable situations for buying or selling by paying attention to the arrangement order, slope, and interval of three moving average lines.

--- From "Chapter 11 Moving Average Grand Cycle Analysis"

The macrocyclical MACD is an evolution of the moving average macrocyclical analysis.

While the moving average macrocycle analysis is an indicator that even beginner traders can easily understand, the macrocycle MACD is an indicator for advanced traders.

While the moving average macrocycle analysis aims to firmly grasp the major trend, the macrocycle MACD aims to not miss both the major trend and the minor trend.

(…) If you use the grand cycle MACD to predict the change in the situation, you can enter while reducing the probability of being deceived.

Furthermore, I will introduce my own technique, which has been upgraded to suit the changing market over time.

The main purpose of this book is to lead readers to create their own rules based on this.

Each trader has different capital and personality.

Therefore, to win, you need your own 'rules' that you create yourself, not someone else's techniques.

But this task is by no means easy.

This book presents the rules of the Turtle Group as a kind of model and introduces how to individualize them to create your own rules.

Specifically, I adopted the Turtle Group's trading rules for money management and risk management, and applied my own rules for entry.

---- From the "Prologue"

One of them is Trading Edge (TE).

Edge generally means 'superiority'.

In trading, when the price fluctuates and you say, "It's definitely advantageous to buy," or "It's definitely advantageous to sell," you are saying you have an edge.

In short, it refers to the weak points in trading.

(…) Prices rarely stay still in one place, but rather go up and down most of the time.

At any given point in time, the odds of the price going up versus going down are usually 5:5.

But sometimes, there are situations where the trend is clearly tilted towards buying or selling.

A representative example is the situation where a trend occurs.

In an uptrend, it is definitely advantageous to buy.

At this time, you should obviously enter as a 'buy' and not as a 'sell'.

--- From "Chapter 1: Edge in Trading"

The Turtle Group set the trading volume per trade to match the risk they were willing to take on in a single trade (a risk equivalent to 1% of their trading capital), and called it 1 unit.

The unit calculation for the turtle group is as follows:

① Find 1% of trading funds.

· Trading funds × 0.01 = A

② Calculate the risk associated with trading the item in the minimum trading unit.

· Trading unit × ATR = B

③ Divide A by B (round up according to transaction unit).

· Unit = A÷B

--- From "Appropriate trading volume per 2-chapter unit"

Prices rise in waves and fall in waves.

The width of that wave is called noise, and trends are always accompanied by noise.

If the stop loss line gets caught in that noise, the stop loss order will be executed due to a temporary decline.

On the other hand, if the trend reverses, you should quickly liquidate your position.

Considering this, an appropriate stop loss line should be set outside the noise, i.e., close to the maximum amplitude of the noise.

To do that, we first need to know the width of the noise.

(…) The Turtle Group investigated various stocks and found that the average range from the previous high to the current low among noises was ‘2 ATR or less.’

This is why the Turtle Group sets its stop loss line at twice the ATR.

--- From "Chapter 6 Liquidation Rules for Cutting Losses"

When an uptrend occurs, the three moving averages show 'certain characteristics'.

To clarify this feature, the points to note are the arrangement order, slope, and spacing of the three moving averages.

First, let's look at the array order.

The three lines are arranged from top to bottom as 'short-term line/medium-term line/long-term line'.

Looking at the arrangement, you can see the current situation.

Next, let's look at the slope.

The slopes of all three lines are upward.

The slope tells you the strength of the trend.

Finally, let's look at the spacing.

As the price moves smoothly, the gap between the moving averages gradually widens.

The intervals show the continuity of the trend.

Moving average grand cycle analysis is a method of finding favorable situations for buying or selling by paying attention to the arrangement order, slope, and interval of three moving average lines.

--- From "Chapter 11 Moving Average Grand Cycle Analysis"

The macrocyclical MACD is an evolution of the moving average macrocyclical analysis.

While the moving average macrocycle analysis is an indicator that even beginner traders can easily understand, the macrocycle MACD is an indicator for advanced traders.

While the moving average macrocycle analysis aims to firmly grasp the major trend, the macrocycle MACD aims to not miss both the major trend and the minor trend.

(…) If you use the grand cycle MACD to predict the change in the situation, you can enter while reducing the probability of being deceived.

--- From "Chapter 12: Evolution of Moving Average Major Cycle Analysis, Major Cycle MACD"

Publisher's Review

If you look at the market trend, you can see the buying and selling points!

Added trading from the legendary group of traders, the Turtle Group

Trading strategies from Japan's top chart analyst, Kojiro Instructor!

Trend investing is an investment strategy that follows market trends and captures and trades when prices rise or fall.

And the core strategy of the legendary Turtle Group Trading, a group of traders, is also to trade following market trends.

The author of this book, Instructor Kojiro, is Japan's leading chart researcher and trading technique researcher.

The author uses his uniquely developed "Moving Average Major Cycle Analysis" and "Major Cycle MACD" to help investors achieve stable, targeted returns while investing in trends.

In this book, the author demonstrates the best trend investing through advanced buying and selling techniques, in addition to the trading rules of the legendary Turtle Group, a group of traders.

Investors will learn about Turtle Group's trading methods developed by the author through this book.

You can take advantage of the strengths of both investment methods to create your own trading rules and apply them in practice.

The Turtle Group's fund management and risk management are applied, and for entry, the author's moving average grand cycle analysis and grand cycle MACD technique are used.

These two techniques are highly praised and practiced by tens of thousands of traders in Japan, enabling investors to generate consistent profits without being swayed by market conditions such as bull and bear markets.

Even in Korea, author Kang Hwan-guk highly praised the book, saying, “It is a book that helps investors respond more flexibly to market fluctuations and trends.”

A New Standard in Technical Analysis for Investors

Anyone can become a genius trader if they learn.

This book covers everything investors need to succeed in real-world investing.

These include money management, risk management, and entry and liquidation rules.

This highlights that anyone can become a successful trader.

This is in line with the goal of the legendary 'Turtle Experiment' that shook Wall Street.

Investors who participated in this experiment, which began with the question, "Are genius investors born or nurtured?", achieved an astonishing average annual return of 80%.

In a word, it was a huge success.

In other words, it proves that genius traders can be created through education and training.

Those who participated in the experiment were called 'turtles', with the idea that traders could be raised like turtles.

The author, a chart researcher and trading coach, also believes that anyone can succeed as a trader if they learn properly.

He tracked all the turtles, uncovered their success factors, utilized them in actual investments, and widely shared them in his lectures on training traders.

By applying the Turtle technique to real-world situations, we confirmed that the key success factors for Turtle were capital management and risk management. Furthermore, by adding advanced buying and selling techniques, we increased the probability of success.

The author has put everything he has honed through research and practice into this one book.

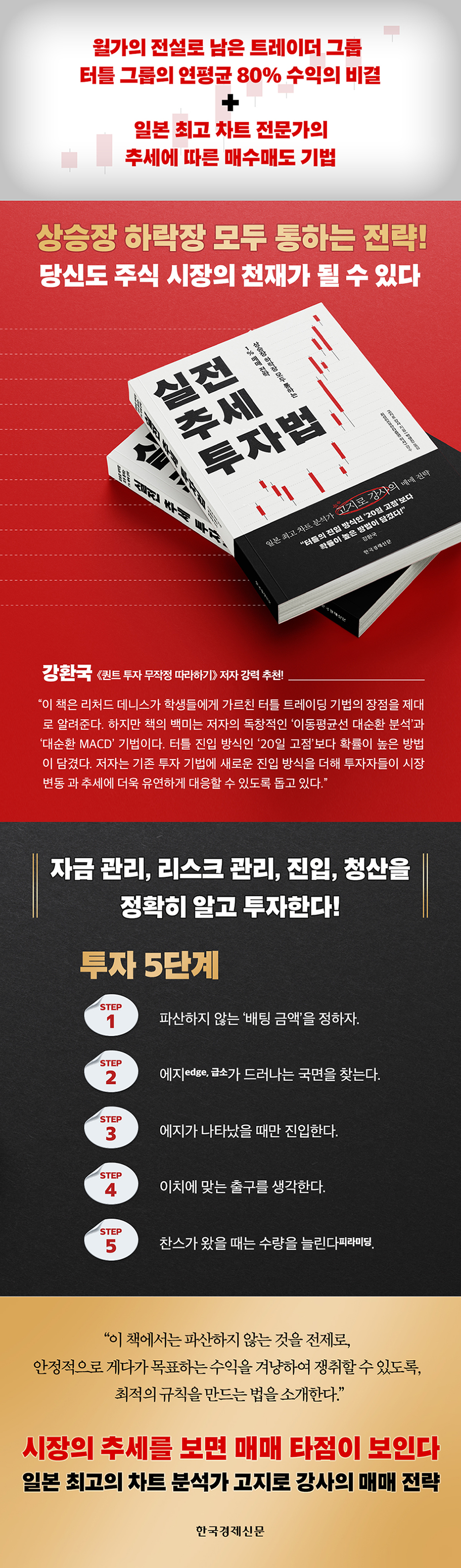

The overall trading flow you will learn in this book is briefly as follows.

Step 1.

Let's set a 'betting amount' that will not lead to bankruptcy.

Step 2.

Find the situation where the edge (critical point) is revealed.

Step 3.

Enter only when an edge appears.

Step 4.

Think of a reasonable exit.

Step 5.

When the chance comes, increase the quantity (pyramiding).

The most important of these is Step 1.

Because no matter how good the entry rules are, a single reckless bet can lead to bankruptcy.

This book introduces how to create optimal rules so that you can achieve your target profits stably and without going bankrupt.

Key Secrets Investors Need

Master of Money Management and Risk Management

This book emphasizes the importance of money management and risk management.

No matter how good your technique is, if you can't manage your money and risks, you'll suffer huge losses.

To avoid bankruptcy and generate consistent profits, investors must adhere to appropriate capital allocation and stop-loss settings for each trade.

These management methods allow investors to minimize losses and maximize profits.

The most basic thing in Turtle's money management was 'not going bankrupt'.

Based on this premise, the appropriate transaction size per session was calculated, and stop-loss setting rules were set after entry and consistently followed.

By doing so, profits were increased while losses were kept to a manageable level.

This is why Turtle members have achieved incredible returns (the ratio of profit to total funds) despite not having a high win rate (the number of times they have made a profit).

If you want to increase your assets through trading, the first thing you need to do is to make sure you have the right amount of funds.

Then you have to calculate how much money you need to spend per synagogue to avoid bankruptcy.

Turtle managed this in units called units, and set a stop-loss level so that the loss did not exceed 2% in each trade.

For example, if your trading capital is $1 million, the maximum risk you take on in that trade is $20,000.

When market volatility is high and price fluctuations are large, stop-loss orders are frequently executed, but this level of loss can be easily recovered with a single profitable trade.

If you're an investor holding a losing stock, you absolutely must learn the Turtles' money management and risk management techniques.

Even if you are lucky enough to make a lot of money, if these two things are lacking, your assets will never grow.

This book will help you master Turtle's money management and risk management techniques, which are still considered the most advanced to date, from the very basics.

The virtue of trend investing lies in its simplicity.

Use moving averages and MACD to find buying and selling points.

The virtue of trend investing lies in its simplicity.

Invest by observing the direction of the market without using complex financial models or macroeconomic indicators.

It reduces the stress of temporary volatility by seeing the big trends with just a few indicators.

The author also emphasizes that making profits from investments does not require complex techniques, and explains 'moving average grand cycle analysis' and 'grand cycle MACD'.

Moving Average Grand Cycle Analysis: A Weapon for Market Trend Analysis

Moving average grand cycle analysis is a method of analyzing market trends using three moving averages.

This method is useful for determining buy and sell points by capturing the upward, downward, and sideways trends of stocks through 20-day, 50-day, and 100-day moving averages.

By classifying market movements into six phases and checking the arrangement, slope, and spacing of moving average lines in each phase, you can identify favorable points for buying and selling.

This is called 'moving average grand cycle analysis', and in fact, this alone has trained numerous traders.

This analysis method is especially helpful for novice investors to understand the major trends of the market and engage in trading.

MACD for a more precise trend view

A step further from the moving average macrocyclical analysis is the macrocyclical MACD.

Enables more detailed market analysis.

This technique uses three MACD indicators to accurately capture even small trend fluctuations.

This allows investors to identify entry and exit points faster than with moving average grand cycle analysis, enabling them to respond quickly to the market and make advantageous trades.

The author emphasizes that the core utility of this book is that every trader can use it to establish their own rules.

For this purpose, Chapter 10 of Part 1 presents nine worksheets.

① Conditions for trading items and candlesticks, ② Trading funds and annual target profit, ③ Transaction volume per transaction, ④ Maximum transaction volume, ⑤ Entry rules, ⑥ Stop-loss rules, ⑦ Trailing stop rules, ⑧ Profit confirmation rules, ⑨ Position addition rules, etc.

By following these nine rules, you can become a "V-trader," earning stable profits without worrying or feeling anxious about price fluctuations.

Because trend investing methods are applicable to a wide range of markets, this book can serve as a bible for all traders, regardless of whether they trade stocks, futures, or FX.

Added trading from the legendary group of traders, the Turtle Group

Trading strategies from Japan's top chart analyst, Kojiro Instructor!

Trend investing is an investment strategy that follows market trends and captures and trades when prices rise or fall.

And the core strategy of the legendary Turtle Group Trading, a group of traders, is also to trade following market trends.

The author of this book, Instructor Kojiro, is Japan's leading chart researcher and trading technique researcher.

The author uses his uniquely developed "Moving Average Major Cycle Analysis" and "Major Cycle MACD" to help investors achieve stable, targeted returns while investing in trends.

In this book, the author demonstrates the best trend investing through advanced buying and selling techniques, in addition to the trading rules of the legendary Turtle Group, a group of traders.

Investors will learn about Turtle Group's trading methods developed by the author through this book.

You can take advantage of the strengths of both investment methods to create your own trading rules and apply them in practice.

The Turtle Group's fund management and risk management are applied, and for entry, the author's moving average grand cycle analysis and grand cycle MACD technique are used.

These two techniques are highly praised and practiced by tens of thousands of traders in Japan, enabling investors to generate consistent profits without being swayed by market conditions such as bull and bear markets.

Even in Korea, author Kang Hwan-guk highly praised the book, saying, “It is a book that helps investors respond more flexibly to market fluctuations and trends.”

A New Standard in Technical Analysis for Investors

Anyone can become a genius trader if they learn.

This book covers everything investors need to succeed in real-world investing.

These include money management, risk management, and entry and liquidation rules.

This highlights that anyone can become a successful trader.

This is in line with the goal of the legendary 'Turtle Experiment' that shook Wall Street.

Investors who participated in this experiment, which began with the question, "Are genius investors born or nurtured?", achieved an astonishing average annual return of 80%.

In a word, it was a huge success.

In other words, it proves that genius traders can be created through education and training.

Those who participated in the experiment were called 'turtles', with the idea that traders could be raised like turtles.

The author, a chart researcher and trading coach, also believes that anyone can succeed as a trader if they learn properly.

He tracked all the turtles, uncovered their success factors, utilized them in actual investments, and widely shared them in his lectures on training traders.

By applying the Turtle technique to real-world situations, we confirmed that the key success factors for Turtle were capital management and risk management. Furthermore, by adding advanced buying and selling techniques, we increased the probability of success.

The author has put everything he has honed through research and practice into this one book.

The overall trading flow you will learn in this book is briefly as follows.

Step 1.

Let's set a 'betting amount' that will not lead to bankruptcy.

Step 2.

Find the situation where the edge (critical point) is revealed.

Step 3.

Enter only when an edge appears.

Step 4.

Think of a reasonable exit.

Step 5.

When the chance comes, increase the quantity (pyramiding).

The most important of these is Step 1.

Because no matter how good the entry rules are, a single reckless bet can lead to bankruptcy.

This book introduces how to create optimal rules so that you can achieve your target profits stably and without going bankrupt.

Key Secrets Investors Need

Master of Money Management and Risk Management

This book emphasizes the importance of money management and risk management.

No matter how good your technique is, if you can't manage your money and risks, you'll suffer huge losses.

To avoid bankruptcy and generate consistent profits, investors must adhere to appropriate capital allocation and stop-loss settings for each trade.

These management methods allow investors to minimize losses and maximize profits.

The most basic thing in Turtle's money management was 'not going bankrupt'.

Based on this premise, the appropriate transaction size per session was calculated, and stop-loss setting rules were set after entry and consistently followed.

By doing so, profits were increased while losses were kept to a manageable level.

This is why Turtle members have achieved incredible returns (the ratio of profit to total funds) despite not having a high win rate (the number of times they have made a profit).

If you want to increase your assets through trading, the first thing you need to do is to make sure you have the right amount of funds.

Then you have to calculate how much money you need to spend per synagogue to avoid bankruptcy.

Turtle managed this in units called units, and set a stop-loss level so that the loss did not exceed 2% in each trade.

For example, if your trading capital is $1 million, the maximum risk you take on in that trade is $20,000.

When market volatility is high and price fluctuations are large, stop-loss orders are frequently executed, but this level of loss can be easily recovered with a single profitable trade.

If you're an investor holding a losing stock, you absolutely must learn the Turtles' money management and risk management techniques.

Even if you are lucky enough to make a lot of money, if these two things are lacking, your assets will never grow.

This book will help you master Turtle's money management and risk management techniques, which are still considered the most advanced to date, from the very basics.

The virtue of trend investing lies in its simplicity.

Use moving averages and MACD to find buying and selling points.

The virtue of trend investing lies in its simplicity.

Invest by observing the direction of the market without using complex financial models or macroeconomic indicators.

It reduces the stress of temporary volatility by seeing the big trends with just a few indicators.

The author also emphasizes that making profits from investments does not require complex techniques, and explains 'moving average grand cycle analysis' and 'grand cycle MACD'.

Moving Average Grand Cycle Analysis: A Weapon for Market Trend Analysis

Moving average grand cycle analysis is a method of analyzing market trends using three moving averages.

This method is useful for determining buy and sell points by capturing the upward, downward, and sideways trends of stocks through 20-day, 50-day, and 100-day moving averages.

By classifying market movements into six phases and checking the arrangement, slope, and spacing of moving average lines in each phase, you can identify favorable points for buying and selling.

This is called 'moving average grand cycle analysis', and in fact, this alone has trained numerous traders.

This analysis method is especially helpful for novice investors to understand the major trends of the market and engage in trading.

MACD for a more precise trend view

A step further from the moving average macrocyclical analysis is the macrocyclical MACD.

Enables more detailed market analysis.

This technique uses three MACD indicators to accurately capture even small trend fluctuations.

This allows investors to identify entry and exit points faster than with moving average grand cycle analysis, enabling them to respond quickly to the market and make advantageous trades.

The author emphasizes that the core utility of this book is that every trader can use it to establish their own rules.

For this purpose, Chapter 10 of Part 1 presents nine worksheets.

① Conditions for trading items and candlesticks, ② Trading funds and annual target profit, ③ Transaction volume per transaction, ④ Maximum transaction volume, ⑤ Entry rules, ⑥ Stop-loss rules, ⑦ Trailing stop rules, ⑧ Profit confirmation rules, ⑨ Position addition rules, etc.

By following these nine rules, you can become a "V-trader," earning stable profits without worrying or feeling anxious about price fluctuations.

Because trend investing methods are applicable to a wide range of markets, this book can serve as a bible for all traders, regardless of whether they trade stocks, futures, or FX.

GOODS SPECIFICS

- Date of issue: August 16, 2024

- Page count, weight, size: 368 pages | 592g | 148*210*21mm

- ISBN13: 9788947549677

- ISBN10: 8947549673

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)