Fundamentals of Stock Investment Learned at Stock Kindergarten

|

Description

Book Introduction

If you don't know anything about stock investing, start at Stock Kindergarten!

We have moved from a time when stocks were vaguely viewed as speculation to an era where everyone is investing in stocks.

As interest rates continue to fall, people are looking for new ways to invest rather than saving, and as funds are released into the market due to COVID-19, corporate stock prices are actually rising.

Investing in stocks no longer feels distant, and interest in stocks continues to grow, even giving rise to the so-called 'Donghak Ant Movement'.

Wherever you go, you hear talk about stocks.

There is literally a stock market frenzy going on.

"Stock Investment Fundamentals Learned at Stock Kindergarten" teaches the basics of stock investment for those who are just starting out in stock investment, or those who have installed apps and traded stocks a few times but don't really know much about stocks.

Many people are anxious to start investing in stocks because everyone is doing it, and with the ability to easily buy and sell stocks with just a smartphone, the number of people who start investing in stocks without even knowing much about it has also increased.

However, just as you wouldn't ask a kindergarten child to write a college thesis, it's important for beginners to build a solid foundation before trading stocks.

At Stock Kindergarten, students begin by learning what stocks are and their investment tendencies. They then learn how to open an account, trade stocks, analyze companies and charts, utilize auxiliary indicators, and learn basic investment principles and how to establish their own. From admission to graduation, students learn by grade level.

We have moved from a time when stocks were vaguely viewed as speculation to an era where everyone is investing in stocks.

As interest rates continue to fall, people are looking for new ways to invest rather than saving, and as funds are released into the market due to COVID-19, corporate stock prices are actually rising.

Investing in stocks no longer feels distant, and interest in stocks continues to grow, even giving rise to the so-called 'Donghak Ant Movement'.

Wherever you go, you hear talk about stocks.

There is literally a stock market frenzy going on.

"Stock Investment Fundamentals Learned at Stock Kindergarten" teaches the basics of stock investment for those who are just starting out in stock investment, or those who have installed apps and traded stocks a few times but don't really know much about stocks.

Many people are anxious to start investing in stocks because everyone is doing it, and with the ability to easily buy and sell stocks with just a smartphone, the number of people who start investing in stocks without even knowing much about it has also increased.

However, just as you wouldn't ask a kindergarten child to write a college thesis, it's important for beginners to build a solid foundation before trading stocks.

At Stock Kindergarten, students begin by learning what stocks are and their investment tendencies. They then learn how to open an account, trade stocks, analyze companies and charts, utilize auxiliary indicators, and learn basic investment principles and how to establish their own. From admission to graduation, students learn by grade level.

- You can preview some of the book's contents.

Preview

index

Stock Kindergarten Admissions

1. Admission to Stock Kindergarten

Chapter 1: The Alphabet of Stocks You Must Learn First

1.

Stocks are so easy to buy and sell. So, what exactly are stocks?|The Alphabet of Stock Investment

2.

Can I buy stocks in any company?|Listed and Unlisted Stocks

3.

So where is the stock market headed? | KOSPI, KOSDAQ, KONEX

4.

What determines a company's size? Market capitalization and stock splits

5.

I understand stock prices, but what is a stock index?|The meaning and types of stock indices.

6.

Where have I heard of steamed potatoes and potatoes? What exactly are they? |Paid steamed potatoes, free steamed potatoes, paid potatoes, free potatoes

7.

Why Do Stock Prices Change? | Factors That Affect Stock Prices

After-School Course 1: Checking Stock Market Statistics

Chapter 2: Things to Check Before Starting Stock Investment

1.

How much initial capital do I need? | Seed money

2.

Understanding Your Investment Tendency and Funding Style | Factors That Affect Your Investment Tendency

3.

What should my target rate of return be?|The Rule of 72

4.

Should We Set Goals for Stock Investment? | The Rationality of Goals

After-School Course 2: Direct and Indirect Investment

2.

Stock Kindergarten 1st grade

Chapter 3: Requirements for Stock Investment: Stock Account and HTS

1.

Which brokerage firm should I open a stock account with? | Things to consider when choosing a brokerage firm

2.

Where and how can I open a stock account? | In-person and remote account opening

3.

I've created an account, but where do I trade stocks? | Installing HTS

4. Examining the components of HTS|Components of the top menu of HTS

After-School Course 3: Level Up Your HTS! Get the Most Out of It

Chapter 4: Getting Started with Stock Trading

1.

What are the trading hours?|Regular market and over-the-counter market

2.

How much should I buy?|Ask price, ask unit, and buy/sell order quantity

3.

How to Buy | Types of Buying and Selling Orders

4.

Want to order more conveniently? | Trading order conditions IOC, FOK

5.

Faster is better?|Principles of Trading

6.

How high or low can I place an order? | Limits and Circuit Breakers

After-School Course 4: Following Trading Orders

Chapter 5: Things You Shouldn't Miss in Stock Trading

1.

Are stock trading and settlement dates different? | Trading and settlement dates, margin, and receivables

2.

Is Credit Risky? | Credit Loans and Collateral Ratios

3.

Can I lend stocks and receive interest?|Lenders, Borrowers, Stock Lending Pools

4.

Is Short Selling Bad? | Short Selling and the Short Squeeze

5.

What's the difference between common and preferred stock? |Voting rights, dividends, and ex-dividend status

After-School Course 5: Calculating Dividend Yields

3.

Stock Kindergarten 2nd grade

Chapter 6: Practical Investment 1.

What should I buy?

1.

If you're not sure, check out the market capitalization rankings. Market capitalization rankings and their history.

2.

Which market is better for companies? KOSPI or KOSDAQ | Market Comparison and More

3.

Finding Investment Ideas in Everyday Life | Observation and Imagination

4.

There's no rule that says you have to choose only stocks. Beginner-friendly ETF investing|The concept and types of ETFs

After-School Course 6: How to Use YouTube to Become a Smart Ant

Chapter 7: Practical Investment 2.

How do I analyze a company? (Fundamental Analysis)

1.

How to Read a Business Report | Components of a Business Report

2.

You said to look at the financial statements. What do you look for in a company's financial statements? | Growth, activity, profitability, and stability ratios

3.

How to Read Securities Analyst Reports | How to Use Reports

4.

Stock Selection Criteria: Investment Indicators | PER, PBR

〈After-School Course 7〉 Checking Stock Prices and Financial Statements at Once Using HTS

4.

Stock Kindergarten 3rd grade

Chapter 8 Practical Investment 3.

When to Buy and When to Sell? (Technical Analysis)

1.

Candlestick Charts: The Beginning of Chart Analysis | Color, Length, Tails, and Gaps

2.

Understanding Trends Using Moving Averages | Trends, Arrays, Support and Resistance Lines

3.

Trading Indicators as Important as Price|Trading Volume and Transaction Amount

After-School Course 8: Judging Trends in Top Market Capitalization Stocks

Chapter 9: Practical Investment 4.

Auxiliary indicators that help you decide when to buy and sell

1.

When Moving Averages Alone Are Not Enough | Trend Indicator MACD

2.

When you want to understand market fear and greed | Momentum indicator RSI

3.

When you want to predict stock price fluctuations | Volatility indicator Bollinger Bands

4.

When you want to know the secrets of stock price fluctuations through trading volume | Trading Volume Indicator OBV

After-School Course 9: Two Momentum Indicators That Show You How to Buy on Fear and Sell on Greed

5.

Graduated from stock kindergarten

Chapter 10: Five Investment Principles for Beginners

1.

Limit the number of stocks you buy to 3 to 5.

2.

Think of cash as another asset

3.

Let's distinguish between a bull market and a bear market.

4.

Let's keep a stock investment journal

5.

Don't check stock prices frequently

After-School Course 10: Writing an Investment Journal

Stock Kindergarten Graduation Ceremony

1. Admission to Stock Kindergarten

Chapter 1: The Alphabet of Stocks You Must Learn First

1.

Stocks are so easy to buy and sell. So, what exactly are stocks?|The Alphabet of Stock Investment

2.

Can I buy stocks in any company?|Listed and Unlisted Stocks

3.

So where is the stock market headed? | KOSPI, KOSDAQ, KONEX

4.

What determines a company's size? Market capitalization and stock splits

5.

I understand stock prices, but what is a stock index?|The meaning and types of stock indices.

6.

Where have I heard of steamed potatoes and potatoes? What exactly are they? |Paid steamed potatoes, free steamed potatoes, paid potatoes, free potatoes

7.

Why Do Stock Prices Change? | Factors That Affect Stock Prices

After-School Course 1: Checking Stock Market Statistics

Chapter 2: Things to Check Before Starting Stock Investment

1.

How much initial capital do I need? | Seed money

2.

Understanding Your Investment Tendency and Funding Style | Factors That Affect Your Investment Tendency

3.

What should my target rate of return be?|The Rule of 72

4.

Should We Set Goals for Stock Investment? | The Rationality of Goals

After-School Course 2: Direct and Indirect Investment

2.

Stock Kindergarten 1st grade

Chapter 3: Requirements for Stock Investment: Stock Account and HTS

1.

Which brokerage firm should I open a stock account with? | Things to consider when choosing a brokerage firm

2.

Where and how can I open a stock account? | In-person and remote account opening

3.

I've created an account, but where do I trade stocks? | Installing HTS

4. Examining the components of HTS|Components of the top menu of HTS

After-School Course 3: Level Up Your HTS! Get the Most Out of It

Chapter 4: Getting Started with Stock Trading

1.

What are the trading hours?|Regular market and over-the-counter market

2.

How much should I buy?|Ask price, ask unit, and buy/sell order quantity

3.

How to Buy | Types of Buying and Selling Orders

4.

Want to order more conveniently? | Trading order conditions IOC, FOK

5.

Faster is better?|Principles of Trading

6.

How high or low can I place an order? | Limits and Circuit Breakers

After-School Course 4: Following Trading Orders

Chapter 5: Things You Shouldn't Miss in Stock Trading

1.

Are stock trading and settlement dates different? | Trading and settlement dates, margin, and receivables

2.

Is Credit Risky? | Credit Loans and Collateral Ratios

3.

Can I lend stocks and receive interest?|Lenders, Borrowers, Stock Lending Pools

4.

Is Short Selling Bad? | Short Selling and the Short Squeeze

5.

What's the difference between common and preferred stock? |Voting rights, dividends, and ex-dividend status

After-School Course 5: Calculating Dividend Yields

3.

Stock Kindergarten 2nd grade

Chapter 6: Practical Investment 1.

What should I buy?

1.

If you're not sure, check out the market capitalization rankings. Market capitalization rankings and their history.

2.

Which market is better for companies? KOSPI or KOSDAQ | Market Comparison and More

3.

Finding Investment Ideas in Everyday Life | Observation and Imagination

4.

There's no rule that says you have to choose only stocks. Beginner-friendly ETF investing|The concept and types of ETFs

After-School Course 6: How to Use YouTube to Become a Smart Ant

Chapter 7: Practical Investment 2.

How do I analyze a company? (Fundamental Analysis)

1.

How to Read a Business Report | Components of a Business Report

2.

You said to look at the financial statements. What do you look for in a company's financial statements? | Growth, activity, profitability, and stability ratios

3.

How to Read Securities Analyst Reports | How to Use Reports

4.

Stock Selection Criteria: Investment Indicators | PER, PBR

〈After-School Course 7〉 Checking Stock Prices and Financial Statements at Once Using HTS

4.

Stock Kindergarten 3rd grade

Chapter 8 Practical Investment 3.

When to Buy and When to Sell? (Technical Analysis)

1.

Candlestick Charts: The Beginning of Chart Analysis | Color, Length, Tails, and Gaps

2.

Understanding Trends Using Moving Averages | Trends, Arrays, Support and Resistance Lines

3.

Trading Indicators as Important as Price|Trading Volume and Transaction Amount

After-School Course 8: Judging Trends in Top Market Capitalization Stocks

Chapter 9: Practical Investment 4.

Auxiliary indicators that help you decide when to buy and sell

1.

When Moving Averages Alone Are Not Enough | Trend Indicator MACD

2.

When you want to understand market fear and greed | Momentum indicator RSI

3.

When you want to predict stock price fluctuations | Volatility indicator Bollinger Bands

4.

When you want to know the secrets of stock price fluctuations through trading volume | Trading Volume Indicator OBV

After-School Course 9: Two Momentum Indicators That Show You How to Buy on Fear and Sell on Greed

5.

Graduated from stock kindergarten

Chapter 10: Five Investment Principles for Beginners

1.

Limit the number of stocks you buy to 3 to 5.

2.

Think of cash as another asset

3.

Let's distinguish between a bull market and a bear market.

4.

Let's keep a stock investment journal

5.

Don't check stock prices frequently

After-School Course 10: Writing an Investment Journal

Stock Kindergarten Graduation Ceremony

Detailed image

Into the book

What do you consider a company to be big? A company whose name is universally recognized? A company that's frequently in the news? A company with significant imports and exports? Or perhaps a company with a high stock price? Everyone's criteria will be different.

However, when evaluating a company and looking at its size, we use the concept of market capitalization.

---From "Chapter 1: The Alphabet of Stocks You Must Learn First"

The nature of the investment funds varies depending on the investor's circumstances, such as age, whether future income sources will increase or decrease, whether economic activity is possible, and the investment period and proportion.

To succeed in stock investment, you must first understand the nature of your investment funds.

To be successful in investing, you need to know whether you are someone who actively takes risks and invests, or someone who hates losing your principal.

When opening a stock account, a message appears asking you to register your investor preferences. This is because you must register your investor preferences in order to invest in financial products offered by securities companies, such as funds, ELS, and public offerings.

---From "Chapter 2 Things to Check Before Starting Stock Investment"

Now that you've created a stock account, you need to install HTS to begin investing in earnest. Beyond installing HTS, stock trading requires basic steps like issuing a joint certificate, registering a certificate from another institution, registering a security card or OTP, and transferring investment funds to your stock account.

These are the basic steps you need to take to conduct financial transactions online.

Okay, now I'll explain it step by step.

---From "Chapter 3: What to prepare for stock investment, stock account and HTS"

Now that you've learned how to place stock orders, you should also understand how buy and sell orders are executed. Stock market execution principles differ during regular trading hours and outside of them.

(Omitted) What happens if the price and time are the same? Supercomputers calculate the exact time orders are received on the exchange, making it difficult for the times to be identical. However, if orders are received at the same time, the law of quantity priority applies, so the order with the larger quantity will be executed first.

---From "Chapter 4: Getting Started with Stock Trading"

Stocks have different trading dates and settlement dates.

When buying things in daily life, you have to pay immediately after purchasing them, but when buying stocks, you pay two business days after the purchase date.

So what happens if someone who decides to buy stocks doesn't pay within two days? To prevent this, securities firms collect a portion of the buyer's payment in advance on the trading day.

This is called a deposit.

Let's take a closer look at stock trading dates, settlement dates, and margin requirements.

---From "Chapter 5 Things You Should Not Miss in Stock Trading"

Looking at the top 10 stocks by market capitalization over the past decade, we can see at a glance the changes in our country's industry that cannot be easily perceived through daily stock price fluctuations alone.

What can we as investors gain from examining changes in market capitalization as a macro trend?

---「Chapter 6 Practical Investment 1.

What should I buy?

How much do you trust the target stock prices in corporate analysis reports written by securities analysts? Do you think analyst reports in Korea are unreliable because they only include buy recommendations and rarely include sell recommendations? (Omitted) As investors, we should not focus solely on the target stock price in analyst reports, but rather on the basis of the analysts' calculations.

Corporate analysis reports are also good, but you should definitely check out industry analysis reports when they come out.

Because it provides valuable investment ideas through in-depth reports on various industries that are difficult for general investors to access.

---「Chapter 7 Practical Investment 2.

How do you analyze a company? From "Fundamental Analysis"

It is more useful to look at the transaction amount rather than just the transaction volume.

It will be easier to understand if you think back to when we studied stock prices and market capitalization.

Just as comparing two companies requires comparing market capitalization rather than simply stock price, comparing trading volume is also more accurate when comparing trading volume, as stocks with lower stock prices naturally have higher trading volume.

---「Chapter 8 Practical Investment 3.

When to Buy and When to Sell? From "Technical Analysis"

If you simply follow the famous saying, “Buy on fear, sell on greed,” you can make a lot of money through stock investment.

The problem is that it is difficult to objectively judge when it is time to live in fear and when it is time to sell in greed.

In this after-school course, we'll explore two additional momentum indicators that will teach you how to buy on fear and sell on greed.

---「Chapter 9 Practical Investment 4.

Among the auxiliary indicators that help determine when to buy and sell,

An investment journal is a diary that records the decisions and actions made while investing in stocks.

The reason for keeping an investment journal is to avoid relying on intuition and emotional responses as much as possible, and to respond according to principles.

When stock prices suddenly plummet or soar, it's easy for anyone to feel swayed by the changes in their initial plans.

When the stock price plummets, you worry that the stock will fall even further, and when the stock price rises sharply, you become greedy and think that the stock price will rise even more, so you cannot respond according to the principles you originally established.

An investment journal serves as a focal point that protects the center of your reed-like mind.

However, when evaluating a company and looking at its size, we use the concept of market capitalization.

---From "Chapter 1: The Alphabet of Stocks You Must Learn First"

The nature of the investment funds varies depending on the investor's circumstances, such as age, whether future income sources will increase or decrease, whether economic activity is possible, and the investment period and proportion.

To succeed in stock investment, you must first understand the nature of your investment funds.

To be successful in investing, you need to know whether you are someone who actively takes risks and invests, or someone who hates losing your principal.

When opening a stock account, a message appears asking you to register your investor preferences. This is because you must register your investor preferences in order to invest in financial products offered by securities companies, such as funds, ELS, and public offerings.

---From "Chapter 2 Things to Check Before Starting Stock Investment"

Now that you've created a stock account, you need to install HTS to begin investing in earnest. Beyond installing HTS, stock trading requires basic steps like issuing a joint certificate, registering a certificate from another institution, registering a security card or OTP, and transferring investment funds to your stock account.

These are the basic steps you need to take to conduct financial transactions online.

Okay, now I'll explain it step by step.

---From "Chapter 3: What to prepare for stock investment, stock account and HTS"

Now that you've learned how to place stock orders, you should also understand how buy and sell orders are executed. Stock market execution principles differ during regular trading hours and outside of them.

(Omitted) What happens if the price and time are the same? Supercomputers calculate the exact time orders are received on the exchange, making it difficult for the times to be identical. However, if orders are received at the same time, the law of quantity priority applies, so the order with the larger quantity will be executed first.

---From "Chapter 4: Getting Started with Stock Trading"

Stocks have different trading dates and settlement dates.

When buying things in daily life, you have to pay immediately after purchasing them, but when buying stocks, you pay two business days after the purchase date.

So what happens if someone who decides to buy stocks doesn't pay within two days? To prevent this, securities firms collect a portion of the buyer's payment in advance on the trading day.

This is called a deposit.

Let's take a closer look at stock trading dates, settlement dates, and margin requirements.

---From "Chapter 5 Things You Should Not Miss in Stock Trading"

Looking at the top 10 stocks by market capitalization over the past decade, we can see at a glance the changes in our country's industry that cannot be easily perceived through daily stock price fluctuations alone.

What can we as investors gain from examining changes in market capitalization as a macro trend?

---「Chapter 6 Practical Investment 1.

What should I buy?

How much do you trust the target stock prices in corporate analysis reports written by securities analysts? Do you think analyst reports in Korea are unreliable because they only include buy recommendations and rarely include sell recommendations? (Omitted) As investors, we should not focus solely on the target stock price in analyst reports, but rather on the basis of the analysts' calculations.

Corporate analysis reports are also good, but you should definitely check out industry analysis reports when they come out.

Because it provides valuable investment ideas through in-depth reports on various industries that are difficult for general investors to access.

---「Chapter 7 Practical Investment 2.

How do you analyze a company? From "Fundamental Analysis"

It is more useful to look at the transaction amount rather than just the transaction volume.

It will be easier to understand if you think back to when we studied stock prices and market capitalization.

Just as comparing two companies requires comparing market capitalization rather than simply stock price, comparing trading volume is also more accurate when comparing trading volume, as stocks with lower stock prices naturally have higher trading volume.

---「Chapter 8 Practical Investment 3.

When to Buy and When to Sell? From "Technical Analysis"

If you simply follow the famous saying, “Buy on fear, sell on greed,” you can make a lot of money through stock investment.

The problem is that it is difficult to objectively judge when it is time to live in fear and when it is time to sell in greed.

In this after-school course, we'll explore two additional momentum indicators that will teach you how to buy on fear and sell on greed.

---「Chapter 9 Practical Investment 4.

Among the auxiliary indicators that help determine when to buy and sell,

An investment journal is a diary that records the decisions and actions made while investing in stocks.

The reason for keeping an investment journal is to avoid relying on intuition and emotional responses as much as possible, and to respond according to principles.

When stock prices suddenly plummet or soar, it's easy for anyone to feel swayed by the changes in their initial plans.

When the stock price plummets, you worry that the stock will fall even further, and when the stock price rises sharply, you become greedy and think that the stock price will rise even more, so you cannot respond according to the principles you originally established.

An investment journal serves as a focal point that protects the center of your reed-like mind.

---From "Chapter 10: Writing an Investment Journal"

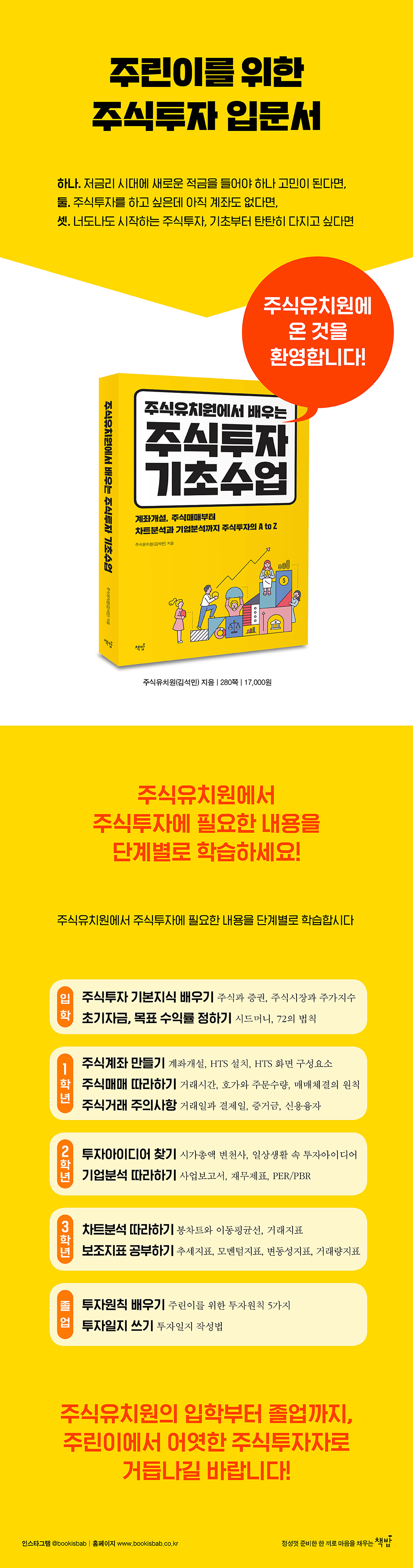

Publisher's Review

From how to open a stock account and trade to how to analyze companies and charts.

Conquer stock investing in one book

People who were investing in stocks are increasing their investment amounts, and even people who were not interested in stocks are starting to invest.

The thought that I should do it too crosses my mind, but I know nothing about stocks.

The terms that people use, such as how to create an account, what is buying, and what is selling, are difficult to understand.

They say that if you start, you'll figure it out on your own, but if you jump in without knowing anything, your hands will tremble.

If you don't know anything, shouldn't you start by learning the terminology commonly used in stock investing? Before you even begin investing, shouldn't you learn the basics? What exactly are the terms used in stock investing? What do you want to gain from it?

This book provides information on the necessary studies to get you started in stock investing and be able to say, "I invest in stocks," at a level appropriate for each grade level.

If you've studied the terminology and basic knowledge used in stock investment and set a stock investment goal upon entering the stock kindergarten, in the first year you'll open an account, install a trading system necessary for stock trading, learn the components, learn how to trade, and learn what to be careful of when doing so.

In the second year, you learn how to come up with investment ideas and analyze companies, and in the third year, you learn how to analyze charts and utilize auxiliary indicators.

Finally, you will graduate from stock kindergarten by establishing your own investment principles through the investment principles you need to know.

If you follow the process step by step from entering the stock kindergarten to graduating, you will be transformed from a child into a full-fledged stock investor in no time.

Conquer stock investing in one book

People who were investing in stocks are increasing their investment amounts, and even people who were not interested in stocks are starting to invest.

The thought that I should do it too crosses my mind, but I know nothing about stocks.

The terms that people use, such as how to create an account, what is buying, and what is selling, are difficult to understand.

They say that if you start, you'll figure it out on your own, but if you jump in without knowing anything, your hands will tremble.

If you don't know anything, shouldn't you start by learning the terminology commonly used in stock investing? Before you even begin investing, shouldn't you learn the basics? What exactly are the terms used in stock investing? What do you want to gain from it?

This book provides information on the necessary studies to get you started in stock investing and be able to say, "I invest in stocks," at a level appropriate for each grade level.

If you've studied the terminology and basic knowledge used in stock investment and set a stock investment goal upon entering the stock kindergarten, in the first year you'll open an account, install a trading system necessary for stock trading, learn the components, learn how to trade, and learn what to be careful of when doing so.

In the second year, you learn how to come up with investment ideas and analyze companies, and in the third year, you learn how to analyze charts and utilize auxiliary indicators.

Finally, you will graduate from stock kindergarten by establishing your own investment principles through the investment principles you need to know.

If you follow the process step by step from entering the stock kindergarten to graduating, you will be transformed from a child into a full-fledged stock investor in no time.

GOODS SPECIFICS

- Publication date: June 21, 2021

- Page count, weight, size: 268 pages | 514g | 152*220*17mm

- ISBN13: 9791190641517

- ISBN10: 1190641518

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)