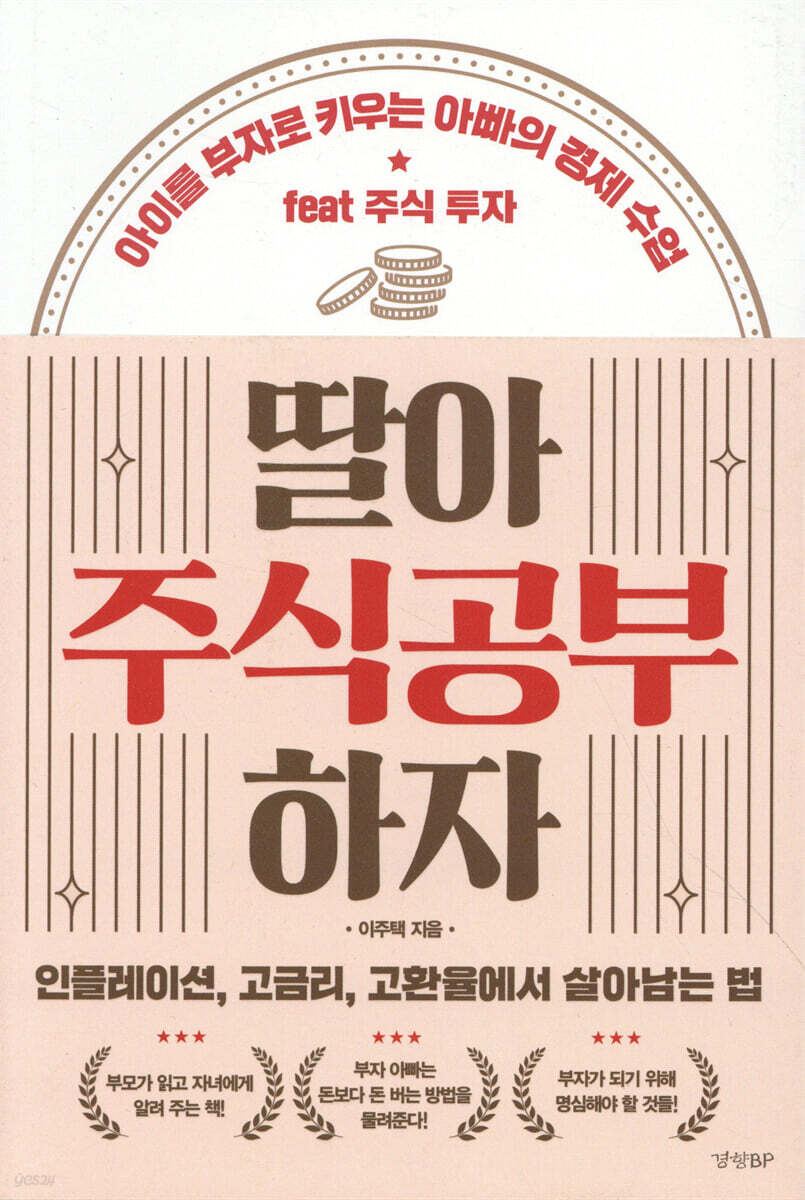

Daughter, let's study stocks.

|

Description

Book Introduction

The sooner you start studying stocks, the better!

How to Survive Inflation, High Interest Rates, and High Exchange Rates

Books for parents to read and teach their children

Things to keep in mind to become rich

"This is the investment opportunity of a lifetime." - Billionaire investor Ron Barron

"If you buy stocks now, you won't regret it a year from now." - Jeremy Segal, world-renowned investment strategist

“Money flows from the impatient to the patient.” - Warren Buffett

Rich dads pass on how to make money, not money.

In a capitalist society, you need to acquire a certain amount of wealth to live freely without mental suffering.

Feeling insecure due to poverty, living in fear of limited access to the necessities of life, being unable to express one's thoughts freely in organizations or society for fear of losing one's job, and being unable to engage in desired activities or travel due to material limitations can all make people unhappy.

The author began investing in stocks in Korea in 1998, when he was a college student, following the IMF crisis. He also began investing in U.S. stocks, bonds, and real estate following the Lehman Brothers crisis in 2008, achieving successful results.

In this book, the author reveals all the secrets he has learned over 20 years of stock investing, with the intention of giving advice to his daughter.

Children who receive economic education from a young age will not live in poverty even as times change.

Because my rich dad passed on to me how to make money rather than money itself.

If you want your children to overcome financial illiteracy and achieve financial independence, if you want them to establish happy investment principles, practice them with willpower, and develop good investment habits to become wealthy, then you need to read this book now and teach your children how to do it.

How to Survive Inflation, High Interest Rates, and High Exchange Rates

Books for parents to read and teach their children

Things to keep in mind to become rich

"This is the investment opportunity of a lifetime." - Billionaire investor Ron Barron

"If you buy stocks now, you won't regret it a year from now." - Jeremy Segal, world-renowned investment strategist

“Money flows from the impatient to the patient.” - Warren Buffett

Rich dads pass on how to make money, not money.

In a capitalist society, you need to acquire a certain amount of wealth to live freely without mental suffering.

Feeling insecure due to poverty, living in fear of limited access to the necessities of life, being unable to express one's thoughts freely in organizations or society for fear of losing one's job, and being unable to engage in desired activities or travel due to material limitations can all make people unhappy.

The author began investing in stocks in Korea in 1998, when he was a college student, following the IMF crisis. He also began investing in U.S. stocks, bonds, and real estate following the Lehman Brothers crisis in 2008, achieving successful results.

In this book, the author reveals all the secrets he has learned over 20 years of stock investing, with the intention of giving advice to his daughter.

Children who receive economic education from a young age will not live in poverty even as times change.

Because my rich dad passed on to me how to make money rather than money itself.

If you want your children to overcome financial illiteracy and achieve financial independence, if you want them to establish happy investment principles, practice them with willpower, and develop good investment habits to become wealthy, then you need to read this book now and teach your children how to do it.

- You can preview some of the book's contents.

Preview

index

preface

Daughter, let's study stocks 1.

Why should you invest in stocks?

How much money do you need to achieve financial freedom?

What kind of life do you want to live?

Have values about money

Increasing risk increases investment returns.

Don't be too trusting or too distrustful

Innovation spreads over time.

Where does the money go?

Know exactly what you're buying

Investing in stocks is like surfing.

Daughter, let's study stocks 2.

Set your own principles

Compound Interest: Remember the Rule of 72

Safety device: Don't try to win money

Asset Allocation: Float Like a Butterfly, Sting Like a Bee

Long-Term Investing: Study Thoroughly Before You Begin

Insight: Study and research constantly.

Diversification: My New Job as a Portfolio Manager

Leveraged Investing: Never Invest with Borrowed Money

Market Forecasting: All Forecasters Are Fraudsters

Principle: Try to practice the principle.

Daughter, let's study stocks 3.

A proper strategy is essential

DCA Accumulative Investment: Good when the stock market is rising.

Value investing: Buy stocks cheaply, no matter what.

Growth Investing: Invest in Companies with Strong Potential

Momentum Investing: The Right-Holding Will Keep Going Up?

Buying and Selling Timing: Crisis is Opportunity

Taking Profits and Hedging Losses: When to Reap the Fruit?

Daughter, let's study stocks 4.

Think from the perspective of the master

As time goes by, everything eventually goes up.

Look at the intrinsic value hidden behind the stock price.

Don't be swayed by the media

Don't regret it.

Opportunity comes again

Get into the habit of buying in installments when the market is at its lowest.

Don't pick flowers and water the weeds.

Listen to the words of a good mentor.

Daughter, let's study stocks 5.

Things to keep in mind to become rich

Long-term stock investing is like life.

The past cannot tell the future.

Adjust your portfolio flexibly in times of crisis.

Patience is more important than passion

Hold on to the waiting time well

Give up the greed to make money and try not to lose it.

Don't be confident, look at the market humbly.

What's done is done.

A true expert doesn't linger around stocks.

Don't invest like a moth, fly like a butterfly.

Invest like you're playing a chessboard.

If you believed and invested, don't waver and just watch.

Individuals have more time and flexibility than institutions.

There is no such thing as a 'god's move'

Maintain the same initial enthusiasm and passion you had when you first invested.

If you don't give up and keep looking, you'll see the end of the tunnel.

Appendix: Am I a Hungry Kid or a Master?

Daughter, let's study stocks 1.

Why should you invest in stocks?

How much money do you need to achieve financial freedom?

What kind of life do you want to live?

Have values about money

Increasing risk increases investment returns.

Don't be too trusting or too distrustful

Innovation spreads over time.

Where does the money go?

Know exactly what you're buying

Investing in stocks is like surfing.

Daughter, let's study stocks 2.

Set your own principles

Compound Interest: Remember the Rule of 72

Safety device: Don't try to win money

Asset Allocation: Float Like a Butterfly, Sting Like a Bee

Long-Term Investing: Study Thoroughly Before You Begin

Insight: Study and research constantly.

Diversification: My New Job as a Portfolio Manager

Leveraged Investing: Never Invest with Borrowed Money

Market Forecasting: All Forecasters Are Fraudsters

Principle: Try to practice the principle.

Daughter, let's study stocks 3.

A proper strategy is essential

DCA Accumulative Investment: Good when the stock market is rising.

Value investing: Buy stocks cheaply, no matter what.

Growth Investing: Invest in Companies with Strong Potential

Momentum Investing: The Right-Holding Will Keep Going Up?

Buying and Selling Timing: Crisis is Opportunity

Taking Profits and Hedging Losses: When to Reap the Fruit?

Daughter, let's study stocks 4.

Think from the perspective of the master

As time goes by, everything eventually goes up.

Look at the intrinsic value hidden behind the stock price.

Don't be swayed by the media

Don't regret it.

Opportunity comes again

Get into the habit of buying in installments when the market is at its lowest.

Don't pick flowers and water the weeds.

Listen to the words of a good mentor.

Daughter, let's study stocks 5.

Things to keep in mind to become rich

Long-term stock investing is like life.

The past cannot tell the future.

Adjust your portfolio flexibly in times of crisis.

Patience is more important than passion

Hold on to the waiting time well

Give up the greed to make money and try not to lose it.

Don't be confident, look at the market humbly.

What's done is done.

A true expert doesn't linger around stocks.

Don't invest like a moth, fly like a butterfly.

Invest like you're playing a chessboard.

If you believed and invested, don't waver and just watch.

Individuals have more time and flexibility than institutions.

There is no such thing as a 'god's move'

Maintain the same initial enthusiasm and passion you had when you first invested.

If you don't give up and keep looking, you'll see the end of the tunnel.

Appendix: Am I a Hungry Kid or a Master?

Detailed image

.jpg)

Publisher's Review

Why should you invest for the long term?

Long-term investments are risky and subject to significant adjustments, so many people are reluctant to buy stocks and hold them for a long time for fear of losing half their value along the way.

On the other hand, many people believe that short-term trading is less likely to result in loss than long-term investing because they can withdraw money immediately upon detecting losses and risks.

However, technical short-term trading through chart analysis is the domain of professional traders who require a lot of study.

Individual investors who lack information are more likely to lose money and fail in these professional fields.

Of course, it is true that long-term investing requires more patience than short-term investing, and it clearly carries its own risks.

However, if you look at asset maintenance from a long-term perspective, you can expect large profits through not only asset value increases through inflation, but also stock price increases due to growth and compound interest effects.

If you understand the power of compound interest, investing in the stock market for a long time while taking appropriate risks will increase your chances of becoming wealthy.

In fact, the masters look at the stock market with a long-term perspective of at least five years.

Most of the investment gurus we know, such as Warren Buffett and Peter Lynch, became wealthy through long-term investment.

Among experts, very few have become rich through short-term trading alone.

This book covers the general principles and philosophy of stock investment, practical techniques, and response strategies.

It teaches you how to choose companies to invest in, establish your own principles, and develop strategies for responding appropriately to changes in the stock market, as well as how to stay calm when times are tough and what to keep in mind to become wealthy.

Build your retirement savings with long-term stock investments.

The stock market has recently experienced a historic downturn, but this phenomenon is a process, not a result.

If you look at stock investment from a long-term perspective, even if you lose money for a year or two, you can easily see that you will make a lot of profit in a bull market later on, so when you average it out over several years, short-term losses do not have a significant impact on your overall profits.

Still, most people are so disheartened by the losses they incur in a year or two that they even give up investing in stocks.

In reality, even if you lose 20-30% over one or two years, if you make an average return of more than 10% over five years, it is considered a great success, and if you factor in the compounding effect, you can more than double your return within seven years.

Long-term investing usually refers to investing in stocks for a period of five years or more, or until retirement.

In the investment market, those who are patient and prepared are more likely to succeed than those who are smart.

The author suggests that to lead a life of financial freedom, you should plan your retirement savings through long-term investments from your early years in society.

Long-term investments allow you to enjoy the benefits of compound interest without being significantly affected by market fluctuations.

If you choose a good company, its stock price will rise in the long run as the company's sales and profits continue to improve along with rising asset prices due to inflation.

Setting achievable goals and investing in them will help you live happier lives today without having to stop investing in your future.

Recommendation

- I'm learning the basics of stock investing and a positive, patient mindset in Mituri Village, which has helped me overcome many of my fears as a beginner investor.

-hyuk*****

With Mituri Village, you can experience the charm and joy of long-term investment through understanding the intrinsic value of a company and practicing investment principles, without being swayed by stock price volatility.

-blood***

- In these difficult times, we are faced with the prospect of a bright and hopeful future.

-pi*********

- I think belief in good stocks is really important.

It may be going down now, but I believe that it will reach its target someday.

I hope this will be a happy investment.

-go*

- I was wondering when I would become a queen ant, but hearing the professor's specific words gave me hope.

Let's all retire as super ants! - La*****

- If you follow everything without fear even though you are not good at it, you will lose your principles and eventually your heart will break…

I'm so grateful that I met you, Professor, when I was just wandering around the ocean, all alone.

-He*******

Long-term investments are risky and subject to significant adjustments, so many people are reluctant to buy stocks and hold them for a long time for fear of losing half their value along the way.

On the other hand, many people believe that short-term trading is less likely to result in loss than long-term investing because they can withdraw money immediately upon detecting losses and risks.

However, technical short-term trading through chart analysis is the domain of professional traders who require a lot of study.

Individual investors who lack information are more likely to lose money and fail in these professional fields.

Of course, it is true that long-term investing requires more patience than short-term investing, and it clearly carries its own risks.

However, if you look at asset maintenance from a long-term perspective, you can expect large profits through not only asset value increases through inflation, but also stock price increases due to growth and compound interest effects.

If you understand the power of compound interest, investing in the stock market for a long time while taking appropriate risks will increase your chances of becoming wealthy.

In fact, the masters look at the stock market with a long-term perspective of at least five years.

Most of the investment gurus we know, such as Warren Buffett and Peter Lynch, became wealthy through long-term investment.

Among experts, very few have become rich through short-term trading alone.

This book covers the general principles and philosophy of stock investment, practical techniques, and response strategies.

It teaches you how to choose companies to invest in, establish your own principles, and develop strategies for responding appropriately to changes in the stock market, as well as how to stay calm when times are tough and what to keep in mind to become wealthy.

Build your retirement savings with long-term stock investments.

The stock market has recently experienced a historic downturn, but this phenomenon is a process, not a result.

If you look at stock investment from a long-term perspective, even if you lose money for a year or two, you can easily see that you will make a lot of profit in a bull market later on, so when you average it out over several years, short-term losses do not have a significant impact on your overall profits.

Still, most people are so disheartened by the losses they incur in a year or two that they even give up investing in stocks.

In reality, even if you lose 20-30% over one or two years, if you make an average return of more than 10% over five years, it is considered a great success, and if you factor in the compounding effect, you can more than double your return within seven years.

Long-term investing usually refers to investing in stocks for a period of five years or more, or until retirement.

In the investment market, those who are patient and prepared are more likely to succeed than those who are smart.

The author suggests that to lead a life of financial freedom, you should plan your retirement savings through long-term investments from your early years in society.

Long-term investments allow you to enjoy the benefits of compound interest without being significantly affected by market fluctuations.

If you choose a good company, its stock price will rise in the long run as the company's sales and profits continue to improve along with rising asset prices due to inflation.

Setting achievable goals and investing in them will help you live happier lives today without having to stop investing in your future.

Recommendation

- I'm learning the basics of stock investing and a positive, patient mindset in Mituri Village, which has helped me overcome many of my fears as a beginner investor.

-hyuk*****

With Mituri Village, you can experience the charm and joy of long-term investment through understanding the intrinsic value of a company and practicing investment principles, without being swayed by stock price volatility.

-blood***

- In these difficult times, we are faced with the prospect of a bright and hopeful future.

-pi*********

- I think belief in good stocks is really important.

It may be going down now, but I believe that it will reach its target someday.

I hope this will be a happy investment.

-go*

- I was wondering when I would become a queen ant, but hearing the professor's specific words gave me hope.

Let's all retire as super ants! - La*****

- If you follow everything without fear even though you are not good at it, you will lose your principles and eventually your heart will break…

I'm so grateful that I met you, Professor, when I was just wandering around the ocean, all alone.

-He*******

GOODS SPECIFICS

- Publication date: July 15, 2022

- Page count, weight, size: 201 pages | 384g | 152*225*13mm

- ISBN13: 9788969525123

- ISBN10: 8969525122

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)