Invest in US dividend stocks that earn you a paycheck while you sleep.

|

Description

Book Introduction

Dividend payments remain steady even during economic crises! Investing in US dividend stocks: No more hesitation! Although many Korean investors are already enjoying both profits and dividends through US dividend growth, it is true that many people are still unable to even get started because they "don't know much" or are "afraid." But it's not too late even now. You can start with a small amount, check the results, and gradually increase your investment. In the process, this book will serve as a compass to guide you through the seas of American dividend growth! "Investing in US Dividend Stocks to Earn a Paycheck While You Sleep" presents US dividend stocks as a new alternative in Korea, where cash flow generation is limited to real estate, based on the author's case, an ordinary office worker. (1) It introduces only the most important information that beginner investors starting out in US stocks should know, such as why dividends exist, why US dividend stocks exist, why Korea has become a dividend wasteland, and how the dividends of US companies differ from those of Korean companies. (2) It contains content that can be immediately utilized as a dividend investor. We help you build a monthly rental income system by providing strategies for setting dividend goals that are right for you, portfolio construction strategies through dividend investments tailored to your personality, theme, and purpose, and ways to avoid the traps of high dividends. In "Covering Living Expenses with Dividends," the authors present practical know-how for specific goals, such as paying telecommunications bills and making rent, based on their own experiences. (3) It provides practical strategies to help you upgrade your portfolio as a U.S. dividend investor by covering the necessary elements for building a more robust portfolio. It contains the investor's success points on how to lead to real profits. (4) As a U.S. stock investor, we provide useful thematic dividend investment stories along with specific data to help investors manage their own investments, covering dividend information sites, blogs, account opening, tax issues, etc. We provide detailed information on key sites and overseas dividend bloggers that can be easily used even by those who do not know English at all. Through these materials, you will receive all the practical know-how you need as a US dividend investor. |

- You can preview some of the book's contents.

Preview

index

Recommendation / Prologue / Note

LESSON 01: Receiving $1 in rent? Investing in US dividend stocks.

Investing is not possible with just a salary.

Why did I start focusing on US dividend growth stocks?

- Why America? - Why dividends?

Falling into the high-dividend trap (My first experience with US dividend stocks)

** Expert's Portfolio 1 Mr. Choi of Guro-dong

LESSON 02 Why Dividend Investing?

Why US Dividend Stocks? The Need for Dividend Investing as a Margin of Safety

How are dividends generated? - Real estate investment: arbitrage vs. rent

- Dividends, sharing corporate performance - Dividend investing, never boring

- Lazy and comfortable dividend investing

Why has Korea become a dividend wasteland?

** Expert's Portfolio 2 Aldison

LESSON 03: Set a goal! What to do with the dividends?

What matters is the goal!

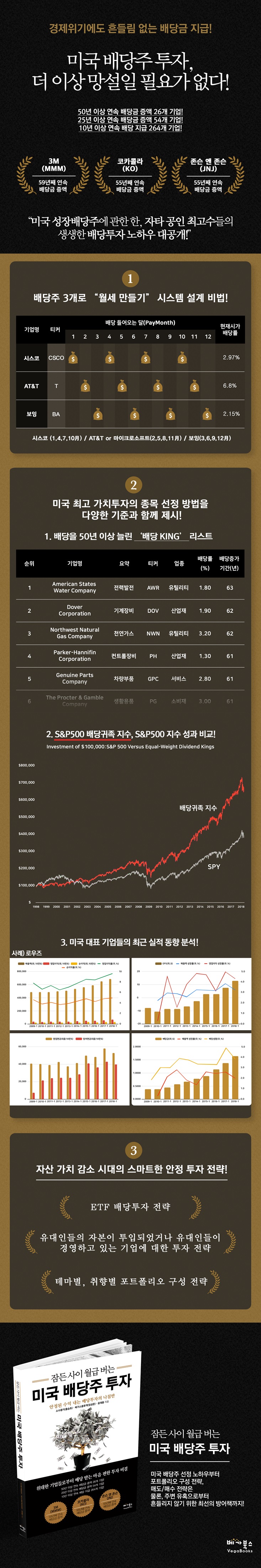

Making monthly rent with 3 dividend stocks

Covering Living Expenses with Dividends (1) - Setting Goals

Covering Living Expenses with Dividends (2) - Case Study/Stock Introduction

Dividend reinvestment (compounding effect)

** Expert's Portfolio 3 Vegas Traveler

LESSON 04 What should you look for when choosing dividend stocks?

What are the key indicators for selecting dividend stocks?

Key Indicator 1: Growth Rate (Sales, Operating Profit, Earnings Per Share, Dividends)

- Key Indicator 2: Dividend Payout Ratio + Market Dividend Yield

Key Indicator 3: Profit and Dividend History (12 Years)

How to Avoid the High Dividend Trap

** Expert's Portfolio 4 Sumisum

LESSON 05: Picking Easy, Powerful Dividend Growth Stocks

Is that dividend now verified?

Where to Invest: The Easiest and Most Powerful Way to Choose a Target

The idea that dividend investing is boring is a misconception. Discover the exciting "Dividend King~Dividend Blue Chip" strategy.

** Expert's Portfolio 5 Minor Monkey

LESSON 06: Securing the Best Trading Timing

Good stocks, when is the 'better' time to buy them?

Dividends, the most honest indicator of all

Choosing Targets for Dividend Stock Trading Strategies

Examine the unique historical dividend range of your investment target.

Let's secure the high-dividend stocks of the future.

Dividend growth + historical dividend yield

Trading strategies utilizing ex-dividend dates

LESSON 07: Dividend Investment Stories by Theme

Stocks owned by Jews or in which Jewish capital has been invested

Investing in dividends with ETFs

How to Choose a US Dividend ETF - Dividend Index Analysis

US Dividend Investment Ideas Based on Trend Changes

LESSON 08 Let's get started, investing in US dividend stocks!

Basics for Investing in Overseas Stocks

- What steps do I need to take to get started?

- How does the US stock market differ from the Korean stock market?

- Tax issues

Sites and insights from overseas and domestic dividend bloggers that will help you invest in dividends.

LESSON 01: Receiving $1 in rent? Investing in US dividend stocks.

Investing is not possible with just a salary.

Why did I start focusing on US dividend growth stocks?

- Why America? - Why dividends?

Falling into the high-dividend trap (My first experience with US dividend stocks)

** Expert's Portfolio 1 Mr. Choi of Guro-dong

LESSON 02 Why Dividend Investing?

Why US Dividend Stocks? The Need for Dividend Investing as a Margin of Safety

How are dividends generated? - Real estate investment: arbitrage vs. rent

- Dividends, sharing corporate performance - Dividend investing, never boring

- Lazy and comfortable dividend investing

Why has Korea become a dividend wasteland?

** Expert's Portfolio 2 Aldison

LESSON 03: Set a goal! What to do with the dividends?

What matters is the goal!

Making monthly rent with 3 dividend stocks

Covering Living Expenses with Dividends (1) - Setting Goals

Covering Living Expenses with Dividends (2) - Case Study/Stock Introduction

Dividend reinvestment (compounding effect)

** Expert's Portfolio 3 Vegas Traveler

LESSON 04 What should you look for when choosing dividend stocks?

What are the key indicators for selecting dividend stocks?

Key Indicator 1: Growth Rate (Sales, Operating Profit, Earnings Per Share, Dividends)

- Key Indicator 2: Dividend Payout Ratio + Market Dividend Yield

Key Indicator 3: Profit and Dividend History (12 Years)

How to Avoid the High Dividend Trap

** Expert's Portfolio 4 Sumisum

LESSON 05: Picking Easy, Powerful Dividend Growth Stocks

Is that dividend now verified?

Where to Invest: The Easiest and Most Powerful Way to Choose a Target

The idea that dividend investing is boring is a misconception. Discover the exciting "Dividend King~Dividend Blue Chip" strategy.

** Expert's Portfolio 5 Minor Monkey

LESSON 06: Securing the Best Trading Timing

Good stocks, when is the 'better' time to buy them?

Dividends, the most honest indicator of all

Choosing Targets for Dividend Stock Trading Strategies

Examine the unique historical dividend range of your investment target.

Let's secure the high-dividend stocks of the future.

Dividend growth + historical dividend yield

Trading strategies utilizing ex-dividend dates

LESSON 07: Dividend Investment Stories by Theme

Stocks owned by Jews or in which Jewish capital has been invested

Investing in dividends with ETFs

How to Choose a US Dividend ETF - Dividend Index Analysis

US Dividend Investment Ideas Based on Trend Changes

LESSON 08 Let's get started, investing in US dividend stocks!

Basics for Investing in Overseas Stocks

- What steps do I need to take to get started?

- How does the US stock market differ from the Korean stock market?

- Tax issues

Sites and insights from overseas and domestic dividend bloggers that will help you invest in dividends.

Detailed image

Publisher's Review

Invest in dividend stocks that remain unshaken even during a recession!

The ultimate dividend investment strategy, hailed as a safe haven in the stock market!

This book is largely comprised of the basics, practical application, and key investment information on US dividend growth investing.

In "The Basics of Dividend Growth Investing in the US," we'll cover the basic concepts that will help you with dividend investing, along with specific details about dividend growth investing in the US, through comparisons with Korea.

In this practical guide to US dividend growth investing, we present specific investment methods, such as criteria for selecting dividend growth stocks and trading timing, along with portfolios for dividend investment tailored to your investment style and purpose.

In particular, in the section on covering living expenses with dividends, investment methods are suggested for specific goals such as paying telecommunications bills or creating a pension.

Finally, the core information on dividend growth investing covers dividend information sites, blogs, account opening, and tax issues to help you invest in dividends on your own.

Through these materials, readers will be able to easily understand and practice the overall aspects of dividend investing.

“Earn a salary with stocks” freely

Investing in stable dividend stocks is smart investment!

As the stock market has become unstable recently, dividend stocks with stability are attracting attention.

Investing in U.S. dividend stocks means becoming partners with leading U.S. companies and sharing in their success.

Warren Buffett, Peter Lynch, and John Neff.

The Wall Street giants known as the 'Three Great Investment Legends' have also invested in dividend stocks for a long time.

As a salaried investor, you need to be consistent in order to earn a salary through stocks.

This book shares the various failures and successes experienced by three authors while investing in U.S. stocks, offering methods and know-how to create a stable cash flow.

By creating an investment strategy tailored to your personality and creating a powerful trading algorithm, we help you find a stable stock investment model that can generate money.

Even beginners in stock investing will gain insight into the trends of the U.S. stock market by following the authors' easy-to-understand explanation of U.S. dividend stocks.

Are you hesitating to jump into the U.S. stock market? Read this book now and transform your life.

The principles of investing in US dividend stocks!

First, no matter how good the stock may look, avoid companies that have cut their dividends.

Second, the way to alleviate all these concerns is the Dividend King~Dividend Blue Chip strategy.

Third, we will sequentially expand the scope of the verification, starting with the 25 dividend kings that have increased their dividends for 50 consecutive years.

Dividend King → Dividend Aristocrat → Dividend Champion → Dividend Blue Chip

The ultimate dividend investment strategy, hailed as a safe haven in the stock market!

This book is largely comprised of the basics, practical application, and key investment information on US dividend growth investing.

In "The Basics of Dividend Growth Investing in the US," we'll cover the basic concepts that will help you with dividend investing, along with specific details about dividend growth investing in the US, through comparisons with Korea.

In this practical guide to US dividend growth investing, we present specific investment methods, such as criteria for selecting dividend growth stocks and trading timing, along with portfolios for dividend investment tailored to your investment style and purpose.

In particular, in the section on covering living expenses with dividends, investment methods are suggested for specific goals such as paying telecommunications bills or creating a pension.

Finally, the core information on dividend growth investing covers dividend information sites, blogs, account opening, and tax issues to help you invest in dividends on your own.

Through these materials, readers will be able to easily understand and practice the overall aspects of dividend investing.

“Earn a salary with stocks” freely

Investing in stable dividend stocks is smart investment!

As the stock market has become unstable recently, dividend stocks with stability are attracting attention.

Investing in U.S. dividend stocks means becoming partners with leading U.S. companies and sharing in their success.

Warren Buffett, Peter Lynch, and John Neff.

The Wall Street giants known as the 'Three Great Investment Legends' have also invested in dividend stocks for a long time.

As a salaried investor, you need to be consistent in order to earn a salary through stocks.

This book shares the various failures and successes experienced by three authors while investing in U.S. stocks, offering methods and know-how to create a stable cash flow.

By creating an investment strategy tailored to your personality and creating a powerful trading algorithm, we help you find a stable stock investment model that can generate money.

Even beginners in stock investing will gain insight into the trends of the U.S. stock market by following the authors' easy-to-understand explanation of U.S. dividend stocks.

Are you hesitating to jump into the U.S. stock market? Read this book now and transform your life.

The principles of investing in US dividend stocks!

First, no matter how good the stock may look, avoid companies that have cut their dividends.

Second, the way to alleviate all these concerns is the Dividend King~Dividend Blue Chip strategy.

Third, we will sequentially expand the scope of the verification, starting with the 25 dividend kings that have increased their dividends for 50 consecutive years.

Dividend King → Dividend Aristocrat → Dividend Champion → Dividend Blue Chip

GOODS SPECIFICS

- Date of issue: January 4, 2019

- Page count, weight, size: 304 pages | 612g | 160*230*30mm

- ISBN13: 9791186137864

- ISBN10: 118613786X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)