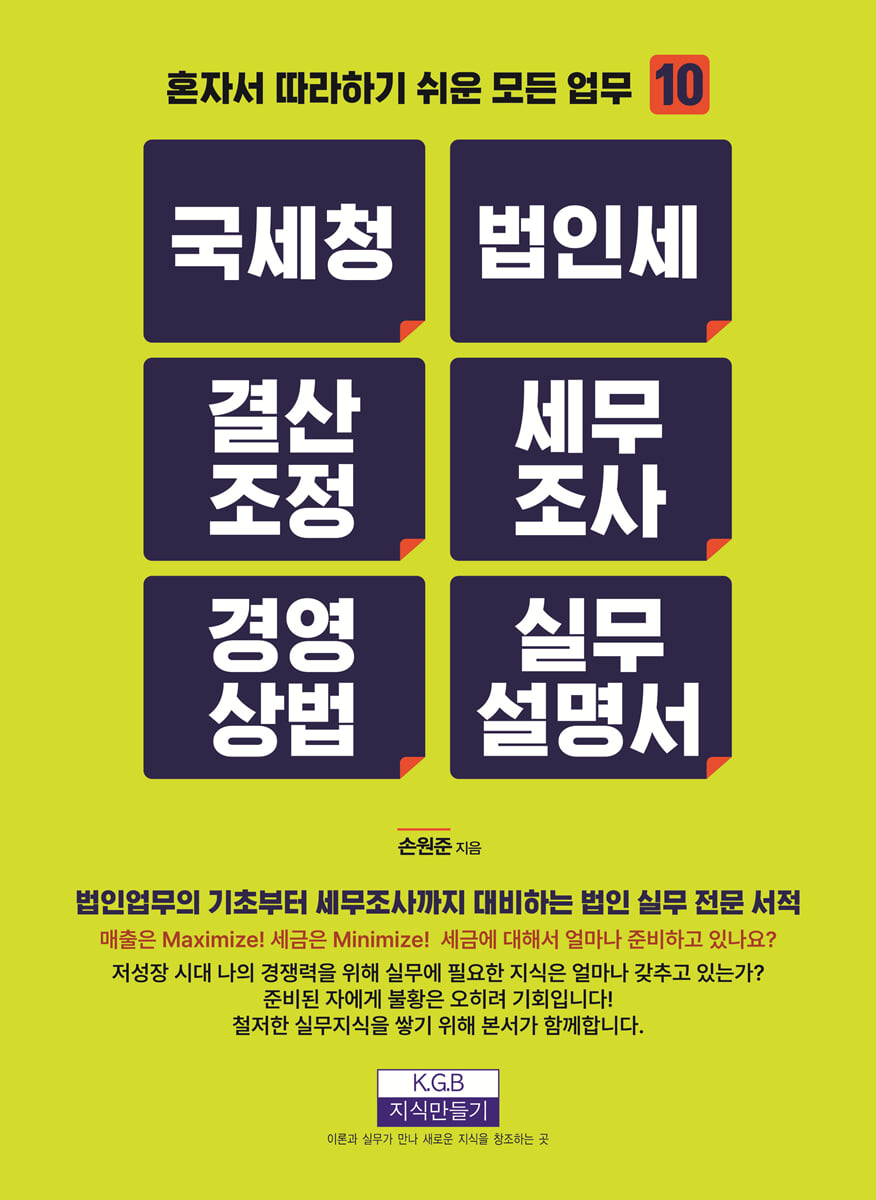

National Tax Service, Corporate Tax, Financial Statement Adjustment, Tax Investigation, Business Law Practice Manual

|

Description

Book Introduction

A professional book on corporate practice, covering everything from the basics of corporate work to tax audits.

Maximize sales and minimize taxes.

How prepared are you for taxes? How much practical knowledge do you have to stay competitive in this low-growth era? For those who are prepared, a recession can actually be an opportunity.

This book will help you build thorough practical knowledge.

Maximize sales and minimize taxes.

How prepared are you for taxes? How much practical knowledge do you have to stay competitive in this low-growth era? For those who are prepared, a recession can actually be an opportunity.

This book will help you build thorough practical knowledge.

index

Chapter 01

Corporate expense processing and documentation management

■ A corporation must not be run as if it were the CEO's personal business.

■ Taxes that corporations must consider in relation to their business

■ Business expense processing methods and tax saving methods using them

1.

Company expense processing process

3.

Types of Eligible Documents

4.

The importance of cost processing and personnel expenses and welfare expenses

5.

The Importance of the Four Major Insurances and Cost Management

6.

How to handle vehicles and related expenses

■ Tax management that corporations must take care of as a basic matter

1.

You shouldn't miss out on sales by encouraging cash payments.

2.

The money that the CEO takes at will is considered as unpaid wages.

3.

Expenses that are not justified are not paid

4.

For business vehicles, keep a driving log after signing up for insurance.

5.

Even if you miss receiving the appropriate proof, you must still have the proof of identity.

6.

Reporting personnel expenses is required to process large expenses.

7.

Prohibition on personal use of corporate cards (expenses unrelated to business)

8.

Long-term outstanding receivables should be treated as bad debts rather than canceled on tax invoices.

9.

We manage surplus through regular dividends.

■ Tax points to check by CEO

[Case] The tax problem of the pants president

[Case] Taxes to Check Before Closing the Book

■ Even beginners can start their work by managing qualified documentation.

1.

Tax invoices and invoices

2.

Credit card sales slips and cash receipts for expenditure verification

3.

Simple receipt

4.

Withholding tax receipt

5.

Wedding invitations, obituaries, etc.

6.

To make it easier to do business, all transactions are account transactions.

7.

If you spend company money personally, it is considered business processing.

■ Examples of proper receipt and management of legally recognized qualified documentation

1.

Transactions without proper documentation

2.

Tax disadvantages if you do not receive proper documentation

3.

Period for which eligible evidence must be kept

■ Issuance and transmission of (electronic) tax invoices

1.

If payment is made by credit card after issuing a tax invoice

2.

Credit card sales receipts are deductible, optionally non-deductible, and mandatory non-deductible.

■ Corporate card usage principles and management of fraudulent use in preparation for tax audits

1.

Corporate Card Usage Principles

┖ Basic principles of corporate card use

┖ Precautions when using a corporate card

[Case] Examples of Industries Where Corporate Card Use Should Be Restricted

[Example] Examples of items for which corporate card use is restricted

┖ Create usage rules for corporate cards.

2.

If you need proof of corporate card use

[Example] When proof of corporate card use is required

3.

Processing of personal usage of corporate card

4.

Beware of fraudulent use of corporate cards

■ Dismissal due to improper use of corporate credit card

┖ Unauthorized use of corporate cards for food, transportation, gas, etc.

┖ Unauthorized use of corporate cards at restricted establishments such as entertainment establishments

┖ Fraudulent cases such as fraudulent purchase of corporate card gift certificates and suspected card fraud

┖ Unauthorized use of corporate individual cards

┖ Overseas use

┖ Check whether the name on the credit card sales slip matches the name actually used.

5.

Corporate card usage details: Key management items during tax audits

6.

Disadvantages of fraudulent use of corporate cards

7.

Expenses for the second karaoke dinner will be processed when using a corporate card.

[Example] Purchase tax deduction when paying for company dinners with a corporate card

[Case] Burden of Proof of Expenditure

8.

How to manage corporate card usage, including corporate card mileage and points

■ Expense processing of condolence money paid to executives (CEO)

[Case] Tax processing when providing condolence goods

■ Three ways to handle expenses when using a personal vehicle for business purposes

1.

How to settle actual expenses with proof of expenditure

[Example] Formula for calculating vehicle fuel costs

2.

In case of replacement with self-driving subsidy

3.

In case of calculating actual expenses and paying self-driving subsidy

■ Tax treatment when selling assets (vehicles) to a special related party

1.

Value added tax when selling a business vehicle

2.

Value added tax when a self-employed person sells a vehicle

3.

Corporate tax (income tax) when selling a vehicle to a special related party

4.

When an individual sells to an individual

5.

When an individual sells to a corporation

6.

When a corporation sells to an individual

7.

When a corporation sells to another corporation

8.

In case of renting an office free of charge to a special related person

■ Tax accounting for elevator replacement

■ Required Checklist for Value Added Tax Reporting

1.

Be especially careful with e-commerce and online transactions.

2.

Be sure to check the cash sales section.

3.

Value-added tax purchase tax management

┖ Items to check for value-added tax input tax deduction

┖ Items that cannot be deducted when filing value-added tax

4.

Things to keep in mind when filing value-added tax

Chapter 02

Corporate financial statements and settlement methods

■ Essential checkpoints for final accounting

1.

Why a preliminary accounting is necessary

2.

Identify the cost shortfall through the final accounting.

┖ Start-up costs are thoroughly expensed.

┖ Report labor costs normally

┖ Report your rent accurately

┖ Be sure to obtain proof of identity, such as a tax invoice, from the other party.

┖ Let's manage bonds and advance payments thoroughly.

┖ Let's take advantage of tax deduction and tax reduction systems.

┖ Let's check the dividend policy.

■ 7 things to check before year-end settlement

1.

Adjusting executive salaries for tax savings

2.

Profit adjustment through retirement pension contributions

3.

Tax deduction item review and dividend strategy

4.

Succession of a company with expected losses

5.

Having a large bank balance and a lot of inventory does not necessarily mean profit.

6.

Recognize the importance of company articles of incorporation.

7.

Let's manage the company's financial ratios after understanding them.

■ Matters to check and note regarding settlement

1.

Things to check when settling accounts

┖ Verification of consistency of financial statements

┖ Check cash and deposit balance

┖ Check inventory assets

┖ Fixed Asset Management

┖ Investment Asset Evaluation

┖ Current/non-current distinction

┖ Settlement of advance payments and advance payments

┖ Analysis of accounts receivable, accounts receivable, advance payments, and prepaid expenses

┖ Prepare contracts, tax invoices, and transaction statements

┖ Analysis of income statement and balance sheet increase and decrease

2.

Things to keep in mind during the settlement process

┖ Importance and precautions for reporting VAT and withholding tax

┖ Complexity of payroll accounting and settlement processes

┖ The importance of organizing revenue and expenses

┖ The necessity and precautions for preparing a cost statement

┖ Checkpoints before closing the financial statements

┖ The Importance of Checking Capital Items

┖ Essentials for Financial Statement Review

┖ The Importance of External Audit Standards and Accounting Treatment

┖ Requirements of investors and financial institutions

┖ Tax invoice processing and accounting processing methods

3.

Precautions when settling corporate accounts

┖ The Importance of Payroll Management

┖ Create executive compensation regulations

┖ Check the dividend policy

┖ Consideration of changes in shareholders and capital

┖ Tax savings through unlisted stock valuation

4.

Materials to be organized after closing

■ Documents to prepare and settlement order when settling accounts [Documents to prepare when filing on behalf of a tax accountant's office (documents to prepare for settlement)]

[Case] Accounting and Tax Adjustment for Retirement Benefit Liabilities (Defined Contribution and Defined Benefit Pension Plans)

[Example] Companies that do not undergo an audit (no need to establish a retirement benefit reserve)

[Case] Company undergoing an audit (establishment of retirement benefit reserve liability)

[Example] When there are accrued or unpaid amounts in the consolidated balance sheet

■ Settlement flow and settlement summary

1.

Flow of accounting books

2.

General order of settlement

3.

Settlement order using the program

4.

Settlement accounting matters

■ Closing journal entry and closing journal entry at the time of settlement

1.

Profit and Loss Account Summary

┖ Player earnings settlement summary

┖ Prepaid Expense Settlement Summary

┖ Settlement of accrued revenue

┖ Settlement of unpaid expenses

2.

Clearance of unused consumables

3.

Securities valuation

4.

Settlement of advance payments and advance payments

5.

VAT offset

6.

Conversion of foreign currency assets and liabilities

7.

Cost confirmation

8.

Inventory asset write-down loss (loss due to inventory asset physical inventory)

9.

Cost of sales accounting

10.

Liquidity replacement for long-term borrowings

11.

Depreciation expense accounting

12.

Annual leave allowance settlement statement

13.

Bad debt allowance settlement statement

14.

Establishment of retirement benefit reserve liabilities

┖ Retirement allowance and DB type retirement pension (average wage)

┖ DC type is total wage

┖ Settlement of retirement pension

15.

Cash over and under account settlement

16.

Accounting for corporate tax expenses

17.

Substitution of retained earnings for net income (profit and loss)

Chapter 03

Corporate tax adjustment by account subject

■ What kind of tax is corporate tax?

1.

Tax on corporate income Corporate tax

2.

Corporate tax subjects and taxpayers

3.

Fiscal year

4.

Corporate tax payment location

■ Special cases of non-deductible expenses that are useful to know

1.

Non-deductibility of expenses not related to work

2.

Non-deduction of expenses due to capital transactions, etc.

3.

Non-deduction of asset valuation loss

[Case] Investment loss deduction

■ Summary of tax adjustment matters

1.

Key Points for Confirming and Amending Settlement Reports

2.

Required items for tax adjustment due to differences between corporate accounting and tax laws

■ Inclusion/Exclusion from Profit

1.

Inclusion of profit

┖ Business income amount

┖ Transfer amount of assets (other than inventory assets)

┖ Rent of assets

┖ Profit from asset acquisition and debt forgiveness

[Example] Cases where it is not considered as a gain on asset acquisition

┖ Debt forgiveness benefit due to debt conversion into equity

┖ Accumulated amount recorded as loss without profit disposal

┖ The amount refunded from the amount included in the electric bill

┖ Profits received through capital transactions from special related parties

┖ Amount of securities purchased at a low price from a special related person

┖ Income amount distributed according to the income distribution regulations for partnership enterprises

┖ Agenda allocation

[Case] A case of agenda allocation based on potatoes

┖ Deemed rent such as rental deposit

[Case] Tax Adjustment Due to Omission of Sales

[Case] Tax Adjustment for Fictitious Assets and Liabilities and Off-Balance Sheet Assets and Liabilities

2.

Non-deduction from income

┖ Stock issuance excess payment

┖ Potato profit

┖ Comprehensive exchange profit of stocks

┖ Comprehensive transfer gains on stocks

┖ Merger profit (excluding merger valuation profit)

┖ Split profit (excluding split valuation profit)

┖ The amount used to cover the loss carried forward from among the gains from asset acquisition and debt forgiveness.

┖ Other income not included

■ Inclusion/Exclusion of Expenses

1.

Distinction between deductible and non-deductible expenses

2.

Deductible items

┖ Purchase price of raw materials and incidental costs for goods or products sold

┖ Book value of the transferred asset at the time of transfer

┖ Labor costs

┖ Repair costs of fixed assets

┖ Depreciation expense for fixed assets

┖ Acquisition of assets at low price from special related parties

┖ Rent of assets

┖ Interest on loan

┖ Debit card

┖ Asset valuation loss

┖ Taxes and charges

┖ Membership fees paid to a business entity that is a corporation or a union or association registered with the competent government agency

┖ Exploration costs for the mining industry (including development costs for exploration)

┖ The amount of free medical treatment provided by the free medical treatment voucher or Saemaul medical treatment voucher determined by the Minister of Health and Welfare

┖ Free donation of surplus food

┖ Overseas inspection and training expenses related to work

┖ Operating expenses or allowances for special classes or industrially affiliated middle and high schools

┖ Book value of company stocks or money contributed to our employee stock ownership association under the Basic Workers' Welfare Act

┖ Office corridor art for decoration and environmental beautification purposes

┖ Technology introduction fee

┖ Handling of compensation for business-related damages

[Case] Deduction of Value Added Tax Purchase Tax from Income Tax Under the Corporate Tax Act

■ Cost processing of labor costs, taxes and duties, and limits on cost recognition under tax law

1.

personnel expenses

┖ Salary of general employees

┖ Executive salary

[Case] Conditions for Recognition of Expenses such as Executive Salaries and Bonuses

[Case] Scope of executives as defined by tax law

┖ Bonus

┖ Welfare expenses

┖ Welfare expenses such as workplace sports expenses and workplace entertainment expenses

┖ Travel expenses and training expenses

[Case] Cost processing of health insurance premiums, employment insurance premiums, etc.

┖ Condolence money

┖ Education expenses for employees or their children

┖ Vehicle subsidy for employee-owned vehicles

┖ Golf fee for executives

┖ Maintenance costs for employee cafeterias, etc.

┖ Severance pay

┖ Corporate tax treatment of retirement pay

[Case] Tax Treatment of Severance Pay in Cases of Unrealistic Retirement

┖ Severance pay

[Example] Allowances paid to non-executive executives, outside directors, etc.

2.

Costs incurred in operating joint organizations and businesses with other corporations

[Example] Tax treatment when acquiring corporate assets under the name of an executive officer

[Case] Expense processing in case of receiving a loan from a bank in the name of the CEO due to exceeding the company's loan limit

3.

Taxes that are and are not recognized as expenses

4.

Utility bills that are recognized as expenses and those that are not recognized as expenses

5.

Fines that are recognized as expenses and fines that are not recognized as expenses

┖ Severance pay

┖ Compensation for industrial accidents and death settlement

[Case] Tax Treatment Methods for Prepayment of Fines Imposed on Employees

6.

Union fee/association fee

■ Expense treatment of business-use passenger vehicles and tax-related expense recognition limits

1.

Applicable vehicles and costs

2.

How to calculate the amount of business expenses recognized as deductible

3.

Subscribe to business-use car insurance and keep a driving log for tax adjustments

┖ Business usage ratio

┖ In case of failure to prepare or keep driving records, etc., the business usage ratio

┖ Special provisions for business use ratio

┖ Preparation, placement, and submission of a business vehicle operation log book

┖ How to calculate fuel expenses

4.

Tax adjustment for signing up for business-only car insurance and not keeping a driving log

5.

Tax adjustment if you do not have business-use car insurance

6.

Income disposition of the amount not deductible from business use

[Case] Tax-Saving Methods for Business-Used Passenger Vehicles

7.

Depreciation method for business passenger cars

┖ Calculation of excess depreciation expense limit

┖ Income disposition of depreciation expense not deductible

┖ Method of approving the amount exceeding the depreciation expense limit

┖ Depreciation expense exceeding the limit is carried forward as loss

┖ Depreciation carryover amount for business-use passenger vehicles

┖ Depreciation expense carryover amount equivalent to the rental fee of a leased business vehicle

┖ Depreciation expense in case of dissolution of a domestic corporation

┖ Depreciation expense when a self-employed person closes a business

┖ Depreciation method for leased business vehicles

┖ Passenger vehicles (lease vehicles) leased from facility rental businesses registered in accordance with the Specialized Financial Business Act

┖ Passenger vehicles (rental vehicles) rented from car rental companies registered under the Passenger Transport Business Act

8.

When disposing of a passenger car (corporations and individuals)

┖ Handling of losses from disposal of business-use passenger vehicles

┖ Handling of profits from disposal of business-use passenger vehicles

9.

Specific corporations such as family companies

┖ Special provisions applied

┖ Specific corporation

[Case] Subscribing to business-specific auto insurance for a private joint venture

10.

When you do not need to write a vehicle driving log

[Case] Recognition of vehicle expenses not registered as corporate fixed assets

■ Expense treatment of interest payments and limits on expense recognition under tax law

1.

Interest on private debt with unclear creditor

2.

Interest on anonymous bonds and securities

3.

Construction fund interest

4.

Interest paid on business-unrelated assets and unpaid wages, etc.

[Case] Disadvantages of Unpaid Wages and Solutions

■ Cost processing of real estate unrelated to business and limits on cost recognition under tax law

1.

Tax treatment of acquisition, possession, and disposal of business-unrelated assets

2.

Scope of business of the corporation

3.

Scope of assets not related to business, etc.

4.

Grace period for not viewing real estate unrelated to business

5.

If it is transferred without being used for business purposes after acquisition

6.

If it cannot be used for special reasons, it is recognized as business use.

■ Preparation of a loan agreement

1.

Preparation of a loan agreement

2.

Tax Precautions When Drafting a Money Loan Agreement

3.

Withholding tax and comprehensive income tax

[Example] It is advantageous to sign a consumer loan contract when paying a down payment.

■ Tax disadvantages of advance payments and advance deposits and solutions

1.

The difference between accrued and unpaid taxes in accounting and tax law

┖ Accounting payments and advances

┖ Tax-related advance payments and advance payments

┖ Difference between accounting deferred payment and tax deferred payment

2.

Tax disadvantages of advance payments

┖ Disadvantages of advance payment

┖ Tax disadvantages of singer's money

[Case] Accounting and Tax Common Sense for Accrued Payments

3.

Problems and solutions regarding advance payments and work processing

┖ Various disadvantages of advance payment

┖ How to deal with overpayments

┖ Solutions to overpayment problems

[Case] Undisposed earnings from unpaid wages resolved through profit burn

4.

Due to a change in CEO? Handling of unpaid wages to the former CEO

┖ Payment to former CEO due to change of CEO or acquisition of company

┖ If there are outstanding payments upon closing the business

5.

Problems and solutions regarding the CEO's compensation and work process

┖ Repayment of singer deposit amount

┖ Tax treatment of singer's money

┖ Conversion of investment into capital

┖ Is it possible to convert unpaid debts other than subscription money into equity?

┖ Documents to prepare for conversion of investment

■ Accounting and tax adjustment of advance payments and advance payments

1.

If there is no agreement between the corporation and the representative director

┖ Withholding tax issue (earned income, not interest income)

┖ If the company pays the bonus amount in advance

2.

If there is an agreement between the corporation and the representative director

┖ Withholding tax issue (interest income, not earned income)

┖ Cases where withholding tax is exempted

3.

Major expenses that can be disposed of as representative bonuses

[Example] In the case of the highest payment upon establishment of a corporation, it is considered as a payment in advance.

[Case] Prohibition on the use of provisional accounts during settlement

■ Accounting for accrued interest and tax adjustment

1.

Accounting for accrued interest in accounting

2.

Accrued interest on general borrowings and loans

┖ Tax principles for interest expense on borrowed money

┖ Practical processing of accrued interest subject to withholding tax on borrowed money

3.

Tax adjustment for accrued interest on unpaid business-related payments

┖ Payment without agreement on interest rate and repayment period

┖ A lump sum payment with an agreement on interest rate and repayment period

┖ Tax adjustment of accrued interest

┖ Tax adjustment for advance payments

■ Issues related to the settlement of corporate debt and receivables related to the CEO

1.

Accounting problems with singer's funds

2.

Tax issues related to singer's fees

┖ Pros and Cons of Singer's Gold

┖ Management of cases where the CEO's personal money is used or lent for company business purposes

■ Cost processing of corporate business expenses and limits on cost recognition under tax law

1.

When to consider it as corporate business expenses and when not to consider it

┖ When viewed as corporate business promotion expenses

┖ If not considered as corporate business expenses

[Example] Examples of advertising and promotional expenses, employee benefits, donations, meeting fees, and corporate business expenses.

2.

Calculating the limit on corporate business expenses

┖ Proper documentation must be provided.

┖ Expenses are recognized only within the limits of corporate business promotion expenses.

┖ How to handle non-deduction of business promotion expenses (Procedures for handling business promotion expenses exceeding the limit)

[Case] Tax treatment when business promotion expenses cannot be proven to be related to business

3.

Tax adjustment examples for corporate business expenses

■ Cost treatment of donations and limits on tax recognition

1.

Conceptual distinction of donations

2.

Types of donations

3.

Evaluation of in-kind donations

4.

Timing of profit and loss attribution of donations

5.

Donation limits and tax adjustments

6.

Donation tax adjustment case

■ Depreciation expense treatment and tax law expense recognition limit

1.

Depreciable assets

2.

The meaning and valuation method of depreciation

3.

How to display depreciation expense in financial statements

4.

How to Determine Depreciation Expenses in Manufacturing

5.

Is it okay not to depreciate? (Is it okay not to reflect depreciation expense in the books?)

[Case] Calculating profit or loss on disposal of depreciable assets

┖ Under the Corporate Tax Act, depreciation is a matter of accounting adjustment.

┖ Depreciation of corporations exempted from or exempted from corporate tax is a matter for reporting adjustment.

6.

Calculation of depreciation denial

7.

Immediate depreciation amount (immediately expense the amount recorded as an expense)

┖ Application of acquisition stage

If the transaction unit is less than 1 million won

If expenses can be processed regardless of the amount

┖ Apply holding phase

┖ Application of disposal stage

8.

Factors determining the depreciation range amount

[Example] Depreciation period when acquiring used assets

9.

Depreciation method

┖ Can I choose the depreciation method as I wish?

┖ Change in depreciation method

┖ Processing method due to change in depreciation method

10.

Transfer of fixed assets

11.

Special provisions for adjustment of depreciation expense reporting

[Case] Request for correction in case of underestimation of depreciation expenses

[Case] Accounting for Parking Lot Construction Costs and Purchase Tax Deduction

[Case] Tax Treatment of Elevator Replacement

[Case] Tax adjustment when electric depreciation is omitted

[Case] Mandatory and Voluntary Depreciation of Depreciation Expenses

12.

Tax treatment of capital expenditures on depreciated assets

[Example] Tax issues and adjustments when capital expenditures are treated as revenue expenditures.

13.

Depreciation of unused and idle assets

14.

Depreciation of assets over their useful life

15.

Depreciation expense correction report, correction request

[Case] Correction request for omission of depreciation expense deduction

[Example] Tax deductions not subject to the depreciation provisions

16.

Depreciation of software

17.

When calculating depreciation, is it done on a daily basis or monthly basis?

18.

Depreciation when receiving government subsidies

┖ Subsidies related to asset acquisition

┖ Subsidies related to revenue (specific cost compensation)

■ Cost treatment of retirement allowance reserves and retirement pension reserves and limits on cost recognition under tax law

1.

Differences between corporate accounting and tax accounting

2.

Retirement benefit accumulation system

┖ Internal Accumulation: Setting up a retirement allowance reserve fund

┖ External savings: Retirement pension system

3.

Tax adjustment of (internal) retirement pay

4.

Tax treatment of defined benefit (DB) retirement pensions

┖ Defined Benefit (DB) Retirement Pension

┖ Tax treatment of retirement allowance reserves

Total salary

Estimated retirement benefits

[Example] Calculating the estimated retirement allowance amount: Regular bonus (performance bonus) and irregular bonus (performance bonus)

Balance of retirement allowance reserve fund carried forward under tax law

Retirement pay conversion

┖ Tax treatment of retirement pension contributions

┖ Tax adjustment of retirement allowance reserve fund

┖ Retirement benefit reserve for defined contribution (DC) retirement pension

5.

Retirement pension reserves (corporate accounting ×, tax law ○)

┖ Inclusion of defined benefit (DB) retirement pension in deductible expenses

┖ Inclusion of defined contribution (DC) retirement pension as deductible expense

6.

Tax adjustment of retirement allowance reserves and retirement pension reserves

┖ Internally accumulated retirement benefit reserve under tax law = Retirement benefit reserve liability under accounting

┖ Externally accumulated retirement pension reserve under tax law = Retirement benefit reserve liability under accounting

┖ Tax adjustment for pension payment upon actual retirement

┖ Understanding Tax Adjustment

Tax adjustment when setting up retirement benefit reserve liabilities and subscribing to retirement pension

Tax adjustment when joining a retirement pension without setting up a retirement benefit reserve liability in accounting

7.

Accounting and tax adjustment of unpaid amounts in defined contribution pension plans

8.

Related formats and writing order

■ Expense treatment of allowance for bad debts and limit on expense recognition under tax law

1.

bad debts

2.

bad debt reserve

3.

Settlement adjustment and report adjustment due to bad debt

[Example] Bad debt write-off when a business partner goes out of business

[Case] Tax adjustment in case of abandonment of bond

[Case] Tax treatment when payment for credit is made in kind

■ Accounting for acquisition and valuation of assets and tax adjustments

1.

Acquisition of assets

┖ General principles

┖ Special provisions for calculating acquisition price

2.

Asset valuation criteria

┖ Asset valuation criteria

In case of recognizing valuation gains

When a valuation loss is recognized

┖ Impairment of fixed assets

┖ Revaluation of fixed assets

3.

Valuation of inventory assets

┖ Types of inventory valuation methods

┖ Selecting an inventory valuation method

┖ Reporting and changing evaluation methods

Reporting and changing evaluation methods

Evaluation method in case of non-reporting or arbitrary changes

┖ Tax adjustment for valuation of inventory assets

┖ Special provisions for the valuation of inventory assets

[Case] Considerations when Valuing Inventory Assets

[Case] Proof processing when inventory quantity is insufficient

[Example] Deduction of loss when inventory assets (goods, products) are damaged upon return

4.

Valuation of securities

┖ Method of evaluating securities

┖ Reporting and changing evaluation methods

┖ Accounting for short-term trading securities

┖ Tax adjustments when acquiring short-term trading securities

┖ Tax adjustment for short-term trading securities valuation gains and losses

┖ Tax adjustment for gains and losses on disposal of short-term trading securities

┖ Accounting for marketable securities

┖ Tax adjustment when acquiring marketable securities

┖ Tax adjustment for gains and losses on valuation of marketable securities

┖ Tax adjustment for gains and losses on disposal of marketable securities

5.

Valuation of foreign currency assets and liabilities

┖ Evaluation target of foreign currency assets and liabilities

┖ Valuation gains and losses on foreign currency assets and liabilities

Tax adjustments for exchange rate application and foreign currency valuation gains and losses

Won balance before evaluation

┖ Gains and losses on repayment of foreign currency assets and liabilities (foreign exchange gains and losses)

┖ How to balance your foreign currency account

■ Tax adjustment of fabricated assets, liabilities, and fabricated expenses

1.

fictitious bonds

2.

Processing inventory assets

3.

Processed raw materials

4.

Processed fixed assets

5.

Tax adjustment of fictitious debt

6.

Tax adjustment of processing expenses

■ Income disposal for sales omissions and fictitious transactions

1.

Omission of sales and disposal of income

2.

Taxes related to missing sales

3.

Tax on receipt of processed tax invoice (processed purchase)

■ Accounting treatment and tax adjustment for arbitrary valuation of fixed assets

■ Accounting and tax adjustment of government subsidies

1.

Accounting for government subsidies in corporate accounting

┖ Government subsidies subject to repayment obligations

┖ Government subsidies without repayment obligations

2.

Timing of accrual of profits from national subsidies

3.

National Treasury Subsidy Tax Adjustment

┖ Tax adjustment of government subsidies for asset acquisition

[Case] Accounting for Government Subsidies Related to Asset Acquisition by Businesses Not Subject to External Audit

┖ Government subsidies related to profits

■ Accounting and tax adjustment of annual leave allowance (annual leave reserve liabilities)

1.

Accounting and tax adjustment of annual leave allowance

┖ Timing of accounting cost and tax deduction of annual leave allowance

[Example] Case of year-end tax settlement for a person who resigned mid-year, excluding annual leave allowance

┖ Tax adjustment cases in cases where annual leave use is not promoted

┖ Tax adjustment cases in cases where annual leave use is promoted

2.

Timing of profit and loss attribution for unpaid wages

Accounting for profit and loss due to electrical error correction and tax adjustment

1.

Electrical error correction profit

┖ If electricity costs are double-processed and accounts payable are omitted

[Case] Tax adjustment and income disposal for double purchases, processing expenses, etc.

┖ In case of recovering the previous year's missed sales amount in the current period

[Case] Tax Adjustment and Income Disposition for Omitted Sales Amounts

2.

Electrical error correction loss

┖ Tax accounting for omissions in electric purchase tax invoices

┖ Tax accounting when expenses before electricity are treated as assets

┖ In case of processing profit and loss due to correction of electric error in the current period without filing a corporate tax correction report

┖ In case of missing electricity revenue or double amount of expenses, the profit for correction of electricity errors is

┖ If electricity costs are omitted or revenue is double-reported

┖ When errors prior to electricity are treated as retained earnings items

■ Accounting for impairment losses and valuation losses on assets and tax adjustments

■ Income disposal and tax payment obligations

1.

Internal reserves (reserves) (increase in tax surplus)

2.

External outflow (bonus)

┖ Refers to the registered representative unless there is objective evidence that he or she is not the representative.

┖ When the representative changes during the fiscal year, each division is assigned.

3.

Outflow (dividend)

4.

External outflow (other income)

5.

External outflow (other external outflow) (attributed to corporations and business individuals)

■ Tax processing when receiving a notice of change in income amount (reporting of withholding tax performance status and data processing procedures when disposing of income)

1.

When the amount included in the income tax return is treated as income

┖ Withholding agent (corporation)

┖ Person who has received income tax disposition (in case a corporation has reported and paid withholding tax)

2.

In case the amount included in profit is treated as income when determining or correcting corporate tax

┖ In the case of a normal business corporation (notice of change in income amount can be delivered)

┖ In cases where the location of the corporation is unclear (when notification cannot be sent)

3.

Collection procedures for failure to withhold tax when disposing of income

■ Flow of preparing a tax adjustment calculation for reporting corporate tax base and paying tax amount

1.

Corporate tax filing deadline

2.

Documents that must be submitted when filing corporate tax returns

3.

Structure of tax adjustment statement and corporate tax reporting order

4.

Application for deduction/reduction

5.

Electronic reporting method

6.

Method of payment of corporate tax

■ Things to check when filing corporate tax returns

■ Subjects and exclusions of corporate tax amendment report

1.

Cases excluded from the subject of corporate tax amendment report

2.

Amended corporate tax return

┖ If you discover that sales have been omitted after filing your corporate tax return

┖ Correction report for corporation's previous year's sales omissions

3.

Surcharge for amended report

[Case] Differences between Tax Treatment and Accounting for Financial Statement Amendments

[Example] How to prepare a revised tax return

[Example] Depreciation expense for the fiscal year that has elapsed when the content period is incorrectly applied

■ Corporate tax interim advance payment reporting and payment method

1.

Corporations subject to interim advance payment reporting and payment

┖ Corporations subject to interim advance payment reporting obligations

┖ Corporations not required to report interim advance payments

2.

Calculation of interim advance payment report and payment amount

┖ Calculation of interim tax payment based on performance of the previous fiscal year

┖ Calculation of interim tax payment based on performance of the current fiscal year (final settlement method)

3.

Interim advance payment report and payment procedures

4.

Correction report for interim tax payment

5.

Corporations that fail to pay interim advance payments

┖ If you have reported an interim tax payment

┖ If you have not reported the interim tax payment amount

┖ Calculation of unpaid surtax

6.

Corporate Tax Interim Payment Q&A

■ Corporate tax reporting and payment due to closure, dissolution, and liquidation of a corporation (corporate tax on liquidation income)

1.

Report of closure of business by corporate business

┖ Termination of business by corporate business operator

┖ Corporate Closure Report and Tax Report

┖ Corporate tax report when a corporation closes

2.

Corporate dissolution and liquidation procedures

[Case] Presumption of Dissolution and Resumption of Business of a Dormant Corporation

┖ Method of dissolution and liquidation

┖ Taxes to be paid during the dissolution and liquidation process

3.

Corporate tax on income for each fiscal year after closure

4.

Corporate tax on liquidation income

┖ Remaining property value on the date of dissolution registration

┖ Equity capital on the date of dissolution registration

5.

Tax refunds for liquidating corporations

■ Even if the business closes, the corporation is still alive, so corporate tax must be reported and paid.

1.

Even if a business closes, the corporation remains alive.

2.

Why do I have to file a corporate tax return after closing my business?

3.

Disposition of CEO bonus based on estimated income

4.

What to do if you miss filing your corporate tax return

5.

Corporate tax return on liquidation income

6.

Fiscal year agenda

■ Matters to be reported when closing a branch

1.

Value-added tax and corporate tax

[Case] Deemed supply upon branch closure (value added tax)

2.

Withholding tax and payment statement

3.

Issuance of revised tax invoice

4.

Processing of the four major insurance business

■ Payment of local income tax for corporate tax

1.

Taxpayer

2.

Tax base and reporting/payment date

3.

Method of calculating the amount of levy and collection

┖ Distribution calculation based on profit contribution ratio such as number of employees and total floor area of building per business location

┖ Even when the business location is relocated, the city/county in charge as of the start date of the delivery period is imposed.

┖ Reporting and Payment

[Case] Reporting and payment when filing and paying corporate tax amendments

┖ Surtax

┖ Small amount collection

┖ Related documents

┖ Correction of tax distribution report and payment

Chapter 04

How to Respond to a National Tax Service Tax Investigation

■ How to respond when the tax office requests documentation

1.

The growing importance and demand for tax clearance from the tax office

2.

How to respond when the tax office requests explanatory materials

3.

Differences between Tax Investigation and Information Submission Guidelines

4.

Causes and cases of requests for explanatory materials

┖ Non-conforming data related to tax invoices

┖ Unfair deduction of purchase tax

┖ Tax investigation derivative data

┖ Request for taxation data verification through analysis of value-added tax returns and attached documents

┖ Request for taxation data verification based on analysis of corporate income tax return and attached documents

┖ Request for proof of payment statement

5.

How to Respond to a Request for Explanatory Documentation

■ How to prevent sales omissions and respond to explanatory notices

1.

How to check for missing sales and surtax

2.

Reasons for receiving a notice from the National Tax Service explaining omitted sales and disadvantages

┖ How the National Tax Service determines sales

┖ Response procedures after receiving the explanatory notice

┖ Disadvantages that may arise from failure to file value-added tax and comprehensive income tax returns

┖ How to avoid missing sales when reporting value-added tax

■ Amended report in response to request for clarification

■ Habitual spending that carries the risk of being subject to a tax audit or request for explanation

[Case] 10 Things to Watch Out for When Asking for Tax Evasion Proof When Filing Your Comprehensive Income Tax Return

■ Instructions for submitting supporting documents for non-conforming data

■ Principles of tax investigation and types of tax investigation

1.

General principles of tax audits

2.

Types and periods of tax audits

3.

Corporate and income tax investigation

4.

Value-added tax investigation

5.

Data investigation

■ Various tax investigation techniques

1.

General research techniques

┖ Ambassador of the ledger record

┖ Ambassador of supporting documents

┖ Ambassador of Accounting Calculation

2.

Individual research techniques

■ How to prepare for and respond to tax audits

[Case Study] Detecting Tax Evasion in the AI Era and Managing Corporate Tax Risk

[Case] General Requirements for Tax Investigations

■ How to Deal with a Successful Tax Audit

1.

Things to prepare for a tax audit

2.

If you are likely to be selected as a subject of investigation

3.

In cases where it is easy to be excluded from the investigation

4.

Response measures and precautions during tax audits

5.

Post-Investigation Response Plan

6.

Handling of tax evasion data

7.

Things managers should keep in mind during tax audits

┖ Thoroughness of supporting documents

┖ Corporate business expenses can be paid by card

┖ Separate use of bankbook

┖ No fictitious transactions are conducted.

┖ Utilizing tax systems

┖ Transaction management outside the usual format

8.

Things the Finance Team Should Keep in Mind During a Tax Investigation

┖ Storage of expenditure documentation

┖ Fill out the voucher

┖ Minimum bookkeeping

┖ Matching of the four major insurance and income tax reporting data

┖ National tax-related work

┖ Other matters

9.

Things to keep in mind when a corporation is being audited by the tax authorities

┖ All items used and consumed by the corporation are in the name of the corporation.

┖ Clearly distinguish between corporation and its employees

┖ To avoid missing sales or processing costs

┖ Acquisition and transfer of real estate and stocks

┖ Pay attention to the period or deadline

┖ Various regulations provided

[Case] The National Tax Service's Recent Tax Evasion Computer Analysis System

■ Tax audit of assets, liabilities, and capital items

■ Tax audit of income and expense items

[Case] Review of Linked Value-Added Tax Reporting and Correction Matters

■ How to deal with tax audits by industry

■ Points to consider when responding to tax audits on value-added tax, corporate tax, and income tax

1.

Value-added tax audit

┖ Missing sales in key management industries

┖ Unfair deduction of purchase tax, etc.

┖ Disruption of distribution order

2.

Corporate tax, income tax tax audit

■ Points to consider when responding to a tax audit of financial transactions

1.

Whether the deposit balance matches the deposit balance certificate

2.

Deposit interest management

3.

Deposit transaction records

■ Points to consider when responding to tax audits of corporate business expenses

1.

Did you calculate the city/county by adding up all corporate business expenses?

2.

Are there any corporate business expenses included in assets under construction, etc.?

3.

Investigate whether there are any processing business promotion expenses

┖ Investigation into whether private expenses were included in corporate business expenses, etc.

┖ Investigation into the appropriateness of overseas business promotion expenses

┖ Investigation into the appropriateness of the requirements for proof of corporate business expenses

┖ Investigation into whether the limit calculation is appropriate

■ Cases discovered during tax audits

1.

Tax investigation cases based on data

2.

Manufacturing Tax Investigation Cases

┖ Be careful when handling account subjects.

┖ The fictitious labor cost was calculated.

┖ In case of deduction through non-deductible tax invoice

3.

Franchise Tax Investigation Case

4.

Tax audit case of a hospital

5.

Tax investigation of pharmaceutical companies

6.

Tax investigation of export businesses

7.

Tax audits of nightclubs and motels

8.

Tax audit cases by experts such as lawyers

9.

Tax audit case of a private academy

10.

Tax investigation cases of entertainment establishments such as room salons

11.

Tax investigation cases of Internet shopping malls, etc.

12.

Tax investigation case of fictitious accounting of service fees

13.

Tax investigation cases of illegal gifts to children, etc.

■ This is definitely caught during a tax audit.

[Case] The chain of all tax investigations begins with the acquisition of real estate.

■ Points to consider when responding to tax audits regarding private use of corporate cards

1.

Personal use of corporate cards

2.

Tax treatment when personal use of a corporate card occurs

3.

The National Tax Service's method of detecting private use of corporate cards

4.

Proof of personal use of corporate card

■ Typical types of tax refunds (tax correction claim consulting)

1.

Year-end tax refunds resulting from over-reliance on simplified year-end tax settlement services

2.

Increasing hiring will result in employment growth tax credits and small business social insurance premium tax credits.

3.

If you purchased business assets, check the integrated investment tax deduction.

4.

Tax reduction for startups and small and medium-sized enterprises

■ Processing of tax investigation derivative data

1.

Contents of tax data

2.

If the content of the data is true, the derivative data is provided

┖ VAT Correction Report

┖ Corporate Tax Amendment Report

┖ Amendment report for recognition award

┖ If the content of the data is different from the facts, provide proof of derivative data.

[Case] Explanation of tax data based on disguised or fabricated data

[Case] How to explain nonconforming documents such as tax invoices

[Case] Handling of tax evasion data

Chapter 05

Business law processing

■ Articles of incorporation that practitioners must check

1.

Articles of Association that Must Be Reviewed

┖ Regulations on executive compensation, bonuses, and retirement pay

[Example] When wanting to increase or decrease the salary of an executive (CEO)

Reorganization of the Articles of Incorporation

Create regulations for executive compensation.

Shareholders' meeting resolution

┖ Interim dividend regulations

┖ Stock transfer restriction regulations

┖ Get it notarized.

[Example] When changing the articles of incorporation, matters to be registered in the copy of the register of real estate

■ Three ways for a CEO to legally take a corporation's money

1.

How to take it as salary

2.

How to take it as retirement pay

3.

How to take it as a dividend

4.

Retirement benefits with less tax burden than salaries and dividends

■ Procedures and methods for regular (cash) dividends

1.

Preliminary review and preparation

2.

Setting and announcement of dividend base date

3.

Board of Directors Resolution

4.

Reporting and publicizing the board of directors' resolutions

5.

Shareholders' meeting resolution

6.

Sending dividend notice

7.

Dividend payment and withholding tax payment

■ Procedures and methods for interim dividends

1.

Requirements for interim dividends

2.

Procedure for interim dividends

3.

Interim dividend limit

4.

Legal Issues to Consider

5.

Tax reporting of dividends

■ How much should the salary of a corporate representative director be determined?

1.

Features of CEO salary processing

2.

The difference between employee compensation and executive compensation

3.

Determinants of CEO salary

4.

The importance of basic principles and salary setting

5.

Determining the appropriate salary of the CEO

■ Guidance on CEO retirement pay and tax strategies

1.

Severance pay regulations and deductible limits

2.

Things to keep in mind when paying severance pay to CEOs

┖ Even if you are a CEO, you cannot pay retirement benefits at any time.

┖ Calculating the severance pay of an unpaid CEO

┖ Even if you give up your retirement allowance, you may still be subject to retirement income tax.

Taxes to Consider When Giving Up Your Retirement Benefits

How to Deal with CEO Severance Pay Waiver

■ Provisions on directors (executives) under the Commercial Act

1.

Registered directors appointed at the general shareholders' meeting

2.

Types of registered directors under the Commercial Act

┖ Inside director

┖ Outside director

┖ Other non-executive directors

3.

Registration of executives

┖ Registration of appointment

┖ Reappointment registration

┖ Resignation registration

┖ How to register a change in executives

4.

Term of office and compensation of directors

┖ Director's term of office

┖ Director's compensation

5.

Non-registered director

6.

Differences between registered and unregistered directors

7.

In practice, the name is executive

■ Tax Law Provisions on Executive Officers

1.

Scope of executives under tax law

2.

The Importance of Executive Compensation Regulations

3.

Things to keep in mind when handling executive personnel expenses

┖ Things to note about salary

┖ Notes regarding bonus payments

┖ Notes regarding retirement pay

┖ Other notes

4.

Scope of expense recognition for CEO salary

[Case] How to Write a Withholding Tax Compliance Report for Exceeding the Executive Severance Pay Limit

■ Things to do when changing the corporate representative director

1.

Change of corporate registration

┖ Document preparation (Registration of resignation and appointment of CEO)

┖ Registration office application

2.

Application for continued use of corporate seal card

3.

Change of business registration certificate

4.

Changes related to the four major insurances

5.

Change of business registration certificate

6.

Change of mail order business registration certificate (if applicable)

7.

Changes to factory registration certificate, small and medium-sized enterprise confirmation certificate, and corporate research institute certification certificate

8.

Changes to various contracts

9.

Rental and leased vehicles

10.

Businesses hiring foreign workers

11.

Change of seal

12.

Withholding tax report and payment statement submission

■ Processing work when an employee is promoted to executive position

1.

Change of worker status

2.

Personnel appointments and notifications

3.

Signing a new contract

4.

Processing of retirement pay and retirement income tax

┖ Severance pay processing

[Case] Problems that arise when executives are recognized as workers and are therefore considered workers

┖ Tax law provisions on retirement income tax

5.

Procedure for registering changes in executives

6.

4 major insurance coverage

┖ Applicable to 4 major insurances

┖ When promoted from employee to executive, employment insurance is lost

■ Family company family business processing

1.

Number of full-time employees in family businesses

┖ If there are 4 family members and 1 non-family employee, how many regular employees are there?

┖ Are the representative’s family members included in regular workers?

2.

Tax processing

3.

Processing of supporting documents

4.

Processing of the four major insurance business

┖ In case of relatives living with the business owner

┖ In case of relatives who do not live with the business owner

[Case] Tax savings and documentation management after processing family personnel expenses

Corporate expense processing and documentation management

■ A corporation must not be run as if it were the CEO's personal business.

■ Taxes that corporations must consider in relation to their business

■ Business expense processing methods and tax saving methods using them

1.

Company expense processing process

3.

Types of Eligible Documents

4.

The importance of cost processing and personnel expenses and welfare expenses

5.

The Importance of the Four Major Insurances and Cost Management

6.

How to handle vehicles and related expenses

■ Tax management that corporations must take care of as a basic matter

1.

You shouldn't miss out on sales by encouraging cash payments.

2.

The money that the CEO takes at will is considered as unpaid wages.

3.

Expenses that are not justified are not paid

4.

For business vehicles, keep a driving log after signing up for insurance.

5.

Even if you miss receiving the appropriate proof, you must still have the proof of identity.

6.

Reporting personnel expenses is required to process large expenses.

7.

Prohibition on personal use of corporate cards (expenses unrelated to business)

8.

Long-term outstanding receivables should be treated as bad debts rather than canceled on tax invoices.

9.

We manage surplus through regular dividends.

■ Tax points to check by CEO

[Case] The tax problem of the pants president

[Case] Taxes to Check Before Closing the Book

■ Even beginners can start their work by managing qualified documentation.

1.

Tax invoices and invoices

2.

Credit card sales slips and cash receipts for expenditure verification

3.

Simple receipt

4.

Withholding tax receipt

5.

Wedding invitations, obituaries, etc.

6.

To make it easier to do business, all transactions are account transactions.

7.

If you spend company money personally, it is considered business processing.

■ Examples of proper receipt and management of legally recognized qualified documentation

1.

Transactions without proper documentation

2.

Tax disadvantages if you do not receive proper documentation

3.

Period for which eligible evidence must be kept

■ Issuance and transmission of (electronic) tax invoices

1.

If payment is made by credit card after issuing a tax invoice

2.

Credit card sales receipts are deductible, optionally non-deductible, and mandatory non-deductible.

■ Corporate card usage principles and management of fraudulent use in preparation for tax audits

1.

Corporate Card Usage Principles

┖ Basic principles of corporate card use

┖ Precautions when using a corporate card

[Case] Examples of Industries Where Corporate Card Use Should Be Restricted

[Example] Examples of items for which corporate card use is restricted

┖ Create usage rules for corporate cards.

2.

If you need proof of corporate card use

[Example] When proof of corporate card use is required

3.

Processing of personal usage of corporate card

4.

Beware of fraudulent use of corporate cards

■ Dismissal due to improper use of corporate credit card

┖ Unauthorized use of corporate cards for food, transportation, gas, etc.

┖ Unauthorized use of corporate cards at restricted establishments such as entertainment establishments

┖ Fraudulent cases such as fraudulent purchase of corporate card gift certificates and suspected card fraud

┖ Unauthorized use of corporate individual cards

┖ Overseas use

┖ Check whether the name on the credit card sales slip matches the name actually used.

5.

Corporate card usage details: Key management items during tax audits

6.

Disadvantages of fraudulent use of corporate cards

7.

Expenses for the second karaoke dinner will be processed when using a corporate card.

[Example] Purchase tax deduction when paying for company dinners with a corporate card

[Case] Burden of Proof of Expenditure

8.

How to manage corporate card usage, including corporate card mileage and points

■ Expense processing of condolence money paid to executives (CEO)

[Case] Tax processing when providing condolence goods

■ Three ways to handle expenses when using a personal vehicle for business purposes

1.

How to settle actual expenses with proof of expenditure

[Example] Formula for calculating vehicle fuel costs

2.

In case of replacement with self-driving subsidy

3.

In case of calculating actual expenses and paying self-driving subsidy

■ Tax treatment when selling assets (vehicles) to a special related party

1.

Value added tax when selling a business vehicle

2.

Value added tax when a self-employed person sells a vehicle

3.

Corporate tax (income tax) when selling a vehicle to a special related party

4.

When an individual sells to an individual

5.

When an individual sells to a corporation

6.

When a corporation sells to an individual

7.

When a corporation sells to another corporation

8.

In case of renting an office free of charge to a special related person

■ Tax accounting for elevator replacement

■ Required Checklist for Value Added Tax Reporting

1.

Be especially careful with e-commerce and online transactions.

2.

Be sure to check the cash sales section.

3.

Value-added tax purchase tax management

┖ Items to check for value-added tax input tax deduction

┖ Items that cannot be deducted when filing value-added tax

4.

Things to keep in mind when filing value-added tax

Chapter 02

Corporate financial statements and settlement methods

■ Essential checkpoints for final accounting

1.

Why a preliminary accounting is necessary

2.

Identify the cost shortfall through the final accounting.

┖ Start-up costs are thoroughly expensed.

┖ Report labor costs normally

┖ Report your rent accurately

┖ Be sure to obtain proof of identity, such as a tax invoice, from the other party.

┖ Let's manage bonds and advance payments thoroughly.

┖ Let's take advantage of tax deduction and tax reduction systems.

┖ Let's check the dividend policy.

■ 7 things to check before year-end settlement

1.

Adjusting executive salaries for tax savings

2.

Profit adjustment through retirement pension contributions

3.

Tax deduction item review and dividend strategy

4.

Succession of a company with expected losses

5.

Having a large bank balance and a lot of inventory does not necessarily mean profit.

6.

Recognize the importance of company articles of incorporation.

7.

Let's manage the company's financial ratios after understanding them.

■ Matters to check and note regarding settlement

1.

Things to check when settling accounts

┖ Verification of consistency of financial statements

┖ Check cash and deposit balance

┖ Check inventory assets

┖ Fixed Asset Management

┖ Investment Asset Evaluation

┖ Current/non-current distinction

┖ Settlement of advance payments and advance payments

┖ Analysis of accounts receivable, accounts receivable, advance payments, and prepaid expenses

┖ Prepare contracts, tax invoices, and transaction statements

┖ Analysis of income statement and balance sheet increase and decrease

2.

Things to keep in mind during the settlement process

┖ Importance and precautions for reporting VAT and withholding tax

┖ Complexity of payroll accounting and settlement processes

┖ The importance of organizing revenue and expenses

┖ The necessity and precautions for preparing a cost statement

┖ Checkpoints before closing the financial statements

┖ The Importance of Checking Capital Items

┖ Essentials for Financial Statement Review

┖ The Importance of External Audit Standards and Accounting Treatment

┖ Requirements of investors and financial institutions

┖ Tax invoice processing and accounting processing methods

3.

Precautions when settling corporate accounts

┖ The Importance of Payroll Management

┖ Create executive compensation regulations

┖ Check the dividend policy

┖ Consideration of changes in shareholders and capital

┖ Tax savings through unlisted stock valuation

4.

Materials to be organized after closing

■ Documents to prepare and settlement order when settling accounts [Documents to prepare when filing on behalf of a tax accountant's office (documents to prepare for settlement)]

[Case] Accounting and Tax Adjustment for Retirement Benefit Liabilities (Defined Contribution and Defined Benefit Pension Plans)

[Example] Companies that do not undergo an audit (no need to establish a retirement benefit reserve)

[Case] Company undergoing an audit (establishment of retirement benefit reserve liability)

[Example] When there are accrued or unpaid amounts in the consolidated balance sheet

■ Settlement flow and settlement summary

1.

Flow of accounting books

2.

General order of settlement

3.

Settlement order using the program

4.

Settlement accounting matters

■ Closing journal entry and closing journal entry at the time of settlement

1.

Profit and Loss Account Summary

┖ Player earnings settlement summary

┖ Prepaid Expense Settlement Summary

┖ Settlement of accrued revenue

┖ Settlement of unpaid expenses

2.

Clearance of unused consumables

3.

Securities valuation

4.

Settlement of advance payments and advance payments

5.

VAT offset

6.

Conversion of foreign currency assets and liabilities

7.

Cost confirmation

8.

Inventory asset write-down loss (loss due to inventory asset physical inventory)

9.

Cost of sales accounting

10.

Liquidity replacement for long-term borrowings

11.

Depreciation expense accounting

12.

Annual leave allowance settlement statement

13.

Bad debt allowance settlement statement

14.

Establishment of retirement benefit reserve liabilities

┖ Retirement allowance and DB type retirement pension (average wage)

┖ DC type is total wage

┖ Settlement of retirement pension

15.

Cash over and under account settlement

16.

Accounting for corporate tax expenses

17.

Substitution of retained earnings for net income (profit and loss)

Chapter 03

Corporate tax adjustment by account subject

■ What kind of tax is corporate tax?

1.

Tax on corporate income Corporate tax

2.

Corporate tax subjects and taxpayers

3.

Fiscal year

4.

Corporate tax payment location

■ Special cases of non-deductible expenses that are useful to know

1.

Non-deductibility of expenses not related to work

2.

Non-deduction of expenses due to capital transactions, etc.

3.

Non-deduction of asset valuation loss

[Case] Investment loss deduction

■ Summary of tax adjustment matters

1.

Key Points for Confirming and Amending Settlement Reports

2.

Required items for tax adjustment due to differences between corporate accounting and tax laws

■ Inclusion/Exclusion from Profit

1.

Inclusion of profit

┖ Business income amount

┖ Transfer amount of assets (other than inventory assets)

┖ Rent of assets

┖ Profit from asset acquisition and debt forgiveness

[Example] Cases where it is not considered as a gain on asset acquisition

┖ Debt forgiveness benefit due to debt conversion into equity

┖ Accumulated amount recorded as loss without profit disposal

┖ The amount refunded from the amount included in the electric bill

┖ Profits received through capital transactions from special related parties

┖ Amount of securities purchased at a low price from a special related person

┖ Income amount distributed according to the income distribution regulations for partnership enterprises

┖ Agenda allocation

[Case] A case of agenda allocation based on potatoes

┖ Deemed rent such as rental deposit

[Case] Tax Adjustment Due to Omission of Sales

[Case] Tax Adjustment for Fictitious Assets and Liabilities and Off-Balance Sheet Assets and Liabilities

2.

Non-deduction from income

┖ Stock issuance excess payment

┖ Potato profit

┖ Comprehensive exchange profit of stocks

┖ Comprehensive transfer gains on stocks

┖ Merger profit (excluding merger valuation profit)

┖ Split profit (excluding split valuation profit)

┖ The amount used to cover the loss carried forward from among the gains from asset acquisition and debt forgiveness.

┖ Other income not included

■ Inclusion/Exclusion of Expenses

1.

Distinction between deductible and non-deductible expenses

2.

Deductible items

┖ Purchase price of raw materials and incidental costs for goods or products sold

┖ Book value of the transferred asset at the time of transfer

┖ Labor costs

┖ Repair costs of fixed assets

┖ Depreciation expense for fixed assets

┖ Acquisition of assets at low price from special related parties

┖ Rent of assets

┖ Interest on loan

┖ Debit card

┖ Asset valuation loss

┖ Taxes and charges

┖ Membership fees paid to a business entity that is a corporation or a union or association registered with the competent government agency

┖ Exploration costs for the mining industry (including development costs for exploration)

┖ The amount of free medical treatment provided by the free medical treatment voucher or Saemaul medical treatment voucher determined by the Minister of Health and Welfare

┖ Free donation of surplus food

┖ Overseas inspection and training expenses related to work

┖ Operating expenses or allowances for special classes or industrially affiliated middle and high schools

┖ Book value of company stocks or money contributed to our employee stock ownership association under the Basic Workers' Welfare Act

┖ Office corridor art for decoration and environmental beautification purposes

┖ Technology introduction fee

┖ Handling of compensation for business-related damages

[Case] Deduction of Value Added Tax Purchase Tax from Income Tax Under the Corporate Tax Act

■ Cost processing of labor costs, taxes and duties, and limits on cost recognition under tax law

1.

personnel expenses

┖ Salary of general employees

┖ Executive salary

[Case] Conditions for Recognition of Expenses such as Executive Salaries and Bonuses

[Case] Scope of executives as defined by tax law

┖ Bonus

┖ Welfare expenses

┖ Welfare expenses such as workplace sports expenses and workplace entertainment expenses

┖ Travel expenses and training expenses

[Case] Cost processing of health insurance premiums, employment insurance premiums, etc.

┖ Condolence money

┖ Education expenses for employees or their children

┖ Vehicle subsidy for employee-owned vehicles

┖ Golf fee for executives

┖ Maintenance costs for employee cafeterias, etc.

┖ Severance pay

┖ Corporate tax treatment of retirement pay

[Case] Tax Treatment of Severance Pay in Cases of Unrealistic Retirement

┖ Severance pay

[Example] Allowances paid to non-executive executives, outside directors, etc.

2.

Costs incurred in operating joint organizations and businesses with other corporations

[Example] Tax treatment when acquiring corporate assets under the name of an executive officer

[Case] Expense processing in case of receiving a loan from a bank in the name of the CEO due to exceeding the company's loan limit

3.

Taxes that are and are not recognized as expenses

4.

Utility bills that are recognized as expenses and those that are not recognized as expenses

5.

Fines that are recognized as expenses and fines that are not recognized as expenses

┖ Severance pay

┖ Compensation for industrial accidents and death settlement

[Case] Tax Treatment Methods for Prepayment of Fines Imposed on Employees

6.

Union fee/association fee

■ Expense treatment of business-use passenger vehicles and tax-related expense recognition limits

1.

Applicable vehicles and costs

2.

How to calculate the amount of business expenses recognized as deductible

3.

Subscribe to business-use car insurance and keep a driving log for tax adjustments

┖ Business usage ratio

┖ In case of failure to prepare or keep driving records, etc., the business usage ratio

┖ Special provisions for business use ratio

┖ Preparation, placement, and submission of a business vehicle operation log book

┖ How to calculate fuel expenses

4.

Tax adjustment for signing up for business-only car insurance and not keeping a driving log

5.

Tax adjustment if you do not have business-use car insurance

6.

Income disposition of the amount not deductible from business use

[Case] Tax-Saving Methods for Business-Used Passenger Vehicles

7.

Depreciation method for business passenger cars

┖ Calculation of excess depreciation expense limit

┖ Income disposition of depreciation expense not deductible

┖ Method of approving the amount exceeding the depreciation expense limit

┖ Depreciation expense exceeding the limit is carried forward as loss

┖ Depreciation carryover amount for business-use passenger vehicles

┖ Depreciation expense carryover amount equivalent to the rental fee of a leased business vehicle

┖ Depreciation expense in case of dissolution of a domestic corporation

┖ Depreciation expense when a self-employed person closes a business

┖ Depreciation method for leased business vehicles

┖ Passenger vehicles (lease vehicles) leased from facility rental businesses registered in accordance with the Specialized Financial Business Act

┖ Passenger vehicles (rental vehicles) rented from car rental companies registered under the Passenger Transport Business Act

8.

When disposing of a passenger car (corporations and individuals)

┖ Handling of losses from disposal of business-use passenger vehicles

┖ Handling of profits from disposal of business-use passenger vehicles

9.

Specific corporations such as family companies

┖ Special provisions applied

┖ Specific corporation

[Case] Subscribing to business-specific auto insurance for a private joint venture

10.

When you do not need to write a vehicle driving log

[Case] Recognition of vehicle expenses not registered as corporate fixed assets

■ Expense treatment of interest payments and limits on expense recognition under tax law

1.

Interest on private debt with unclear creditor

2.

Interest on anonymous bonds and securities

3.

Construction fund interest

4.

Interest paid on business-unrelated assets and unpaid wages, etc.

[Case] Disadvantages of Unpaid Wages and Solutions

■ Cost processing of real estate unrelated to business and limits on cost recognition under tax law

1.

Tax treatment of acquisition, possession, and disposal of business-unrelated assets

2.

Scope of business of the corporation

3.

Scope of assets not related to business, etc.

4.

Grace period for not viewing real estate unrelated to business

5.

If it is transferred without being used for business purposes after acquisition

6.

If it cannot be used for special reasons, it is recognized as business use.

■ Preparation of a loan agreement

1.

Preparation of a loan agreement

2.

Tax Precautions When Drafting a Money Loan Agreement

3.

Withholding tax and comprehensive income tax

[Example] It is advantageous to sign a consumer loan contract when paying a down payment.

■ Tax disadvantages of advance payments and advance deposits and solutions

1.

The difference between accrued and unpaid taxes in accounting and tax law

┖ Accounting payments and advances

┖ Tax-related advance payments and advance payments