Just follow the financial statements

|

Description

Book Introduction

Financial statements that sound like a foreign language,

Now even beginners can interpret things as fluently as accountants!

A company proves its value through financial statements.

Whether you're an employee, a manager running a company, or an investor, you need to know the company's current state to predict its future.

Especially if you are a stock investor, you need to closely examine the status of the company you are investing in or are investing in.

Investing without knowing the financial statements is not investing, it is making a donation.

Financial statements are essential data for a wide range of stakeholders, including managers, shareholders, union officials, and even accounting practitioners.

However, it is not easy to study because it is full of difficult terms and numbers.

"Follow Financial Statements" published by Gilbut provides an easy and thorough explanation of how to interpret financial statements, helping even complete beginners reach the level of a beginner accountant.

After carefully explaining financial statements, which are like a foreign language, by term and concept, you can vividly learn how the theory is applied in practice through real-life examples.

Now even beginners can interpret things as fluently as accountants!

A company proves its value through financial statements.

Whether you're an employee, a manager running a company, or an investor, you need to know the company's current state to predict its future.

Especially if you are a stock investor, you need to closely examine the status of the company you are investing in or are investing in.

Investing without knowing the financial statements is not investing, it is making a donation.

Financial statements are essential data for a wide range of stakeholders, including managers, shareholders, union officials, and even accounting practitioners.

However, it is not easy to study because it is full of difficult terms and numbers.

"Follow Financial Statements" published by Gilbut provides an easy and thorough explanation of how to interpret financial statements, helping even complete beginners reach the level of a beginner accountant.

After carefully explaining financial statements, which are like a foreign language, by term and concept, you can vividly learn how the theory is applied in practice through real-life examples.

- You can preview some of the book's contents.

Preview

index

preface

PART 1.

Understanding Financial Statements

-----------------------------------------

Things to Know Before Reading Financial Statements

-----------------------------------------

001 Financial Statements: Who Needs Them?

002 What are the standards for preparing financial statements?

003 How to prepare financial statements?

-----------------------------------------

〈First Yard〉 Financial Statement Element 1/Statement of Financial Position

-----------------------------------------

004 Principles for preparing and reading financial statements

005 Understanding Balance Sheet Assets

006 Mastering Current Assets ① Current Assets

007 Mastering Current Assets ② Inventory Assets

008 Mastering Illiquid Assets ① Investment Assets

009 Mastering Non-Current Assets ② Tangible Assets

010 Mastering Non-Current Assets ③ Intangible Assets and Other Non-Current Assets

011 Understanding Balance Sheet Liabilities

012 Understanding Equity in the Balance Sheet

013 Understanding the Retained Earnings Disposition Statement

-----------------------------------------

〈Second Yard〉 2 Elements of Financial Statements/Income Statement

-----------------------------------------

014 Principles for Preparing and Reading an Income Statement

015 Gross profit, operating profit

016 Profit from continuing operations, profit from discontinued operations, net income for the period

-----------------------------------------

〈Third Yard〉 Three Elements of Financial Statements/Cash Flow Statement

-----------------------------------------

017 Understanding the Cash Flow Statement

-----------------------------------------

〈Fourth Yard〉 Four Elements of Financial Statements/Statement of Changes in Equity

-----------------------------------------

018 Understanding the Statement of Changes in Equity

-----------------------------------------

〈Fifth Yard〉 Five Elements of Financial Statements/Notes to Financial Statements

-----------------------------------------

019 Understanding the Notes to Financial Statements

PART 2.

Analyzing financial statements

-----------------------------------------

〈Sixth Yard〉 Financial Statements through Real-World Case Studies

-----------------------------------------

020 Analyzing Financial Statements

021 Good Companies and Financial Statement Analysis

022 What kind of company is it?

023 How profitable is the company?

024 How is the company's safety?

025 How active is the company?

026 What is the company's growth potential?

027 Comparing Corporate Value and Market Value on Financial Statements

028 Does this company adhere to social ethics standards?

supplement

PART 1.

Understanding Financial Statements

-----------------------------------------

Things to Know Before Reading Financial Statements

-----------------------------------------

001 Financial Statements: Who Needs Them?

002 What are the standards for preparing financial statements?

003 How to prepare financial statements?

-----------------------------------------

〈First Yard〉 Financial Statement Element 1/Statement of Financial Position

-----------------------------------------

004 Principles for preparing and reading financial statements

005 Understanding Balance Sheet Assets

006 Mastering Current Assets ① Current Assets

007 Mastering Current Assets ② Inventory Assets

008 Mastering Illiquid Assets ① Investment Assets

009 Mastering Non-Current Assets ② Tangible Assets

010 Mastering Non-Current Assets ③ Intangible Assets and Other Non-Current Assets

011 Understanding Balance Sheet Liabilities

012 Understanding Equity in the Balance Sheet

013 Understanding the Retained Earnings Disposition Statement

-----------------------------------------

〈Second Yard〉 2 Elements of Financial Statements/Income Statement

-----------------------------------------

014 Principles for Preparing and Reading an Income Statement

015 Gross profit, operating profit

016 Profit from continuing operations, profit from discontinued operations, net income for the period

-----------------------------------------

〈Third Yard〉 Three Elements of Financial Statements/Cash Flow Statement

-----------------------------------------

017 Understanding the Cash Flow Statement

-----------------------------------------

〈Fourth Yard〉 Four Elements of Financial Statements/Statement of Changes in Equity

-----------------------------------------

018 Understanding the Statement of Changes in Equity

-----------------------------------------

〈Fifth Yard〉 Five Elements of Financial Statements/Notes to Financial Statements

-----------------------------------------

019 Understanding the Notes to Financial Statements

PART 2.

Analyzing financial statements

-----------------------------------------

〈Sixth Yard〉 Financial Statements through Real-World Case Studies

-----------------------------------------

020 Analyzing Financial Statements

021 Good Companies and Financial Statement Analysis

022 What kind of company is it?

023 How profitable is the company?

024 How is the company's safety?

025 How active is the company?

026 What is the company's growth potential?

027 Comparing Corporate Value and Market Value on Financial Statements

028 Does this company adhere to social ethics standards?

supplement

Detailed image

Publisher's Review

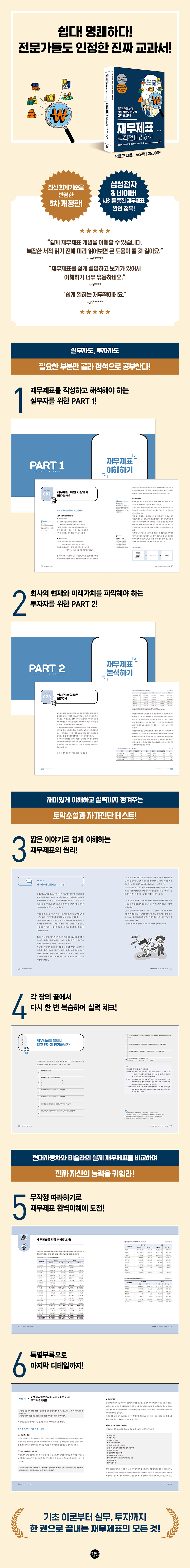

The fifth revision proves readers' trust.

Established as a leading textbook for learning financial statements!

Since its first publication in 2007, 『Follow Financial Statements』 has been published in its fifth revised edition thanks to the continued love of readers.

In this revised edition, the content has been supplemented and updated in accordance with the changed accounting standards, and in particular, the parts for practitioners (Part 1 to Part 5) and the part for investors (Part 6) have been separated so that each person can choose and study according to their own needs.

Above all, by including the latest financial statements of Samsung Electronics and Naver, we have provided practice in comparing them with the financial statements of domestic companies in the same industry and global competitors (Apple, Google), allowing learners to learn and apply financial statement analysis methods on their own.

Additionally, for stock investors, this book is designed to be of practical help by showing how to use which account items in financial statements to evaluate the profitability, stability, and activity of a company, which are the most important factors to consider when looking at financial statements.

Accordingly, this revised edition will become the representative textbook on financial statements, covering everything from basic theory to practice and investors in one volume.

Finally, to help beginners easily access financial statements, we included [short stories] in each chapter to break down the barrier to understanding financial statements.

The self-diagnosis [TEST] that checks your skills at the end of each chapter further enhances your learning ability, allowing learners to progress with a sense of accomplishment.

Investors, test takers, practitioners, etc… … .

Provides the ability to analyze financial statements to suit your needs!

The numbers in financial statements are just numbers in themselves.

Only when these numbers are compared and analyzed with other numbers can we obtain living investment or management information.

This book explains how to view a company's financial performance at a glance, so that it can be actively utilized, especially for stock investments.

Those who know how to interpret financial statements will have an advantage in various aspects of economic life.

It will be of practical help to investors who require accurate and up-to-date information, as well as accounting exam candidates and practitioners involved in corporate financial statements.

Established as a leading textbook for learning financial statements!

Since its first publication in 2007, 『Follow Financial Statements』 has been published in its fifth revised edition thanks to the continued love of readers.

In this revised edition, the content has been supplemented and updated in accordance with the changed accounting standards, and in particular, the parts for practitioners (Part 1 to Part 5) and the part for investors (Part 6) have been separated so that each person can choose and study according to their own needs.

Above all, by including the latest financial statements of Samsung Electronics and Naver, we have provided practice in comparing them with the financial statements of domestic companies in the same industry and global competitors (Apple, Google), allowing learners to learn and apply financial statement analysis methods on their own.

Additionally, for stock investors, this book is designed to be of practical help by showing how to use which account items in financial statements to evaluate the profitability, stability, and activity of a company, which are the most important factors to consider when looking at financial statements.

Accordingly, this revised edition will become the representative textbook on financial statements, covering everything from basic theory to practice and investors in one volume.

Finally, to help beginners easily access financial statements, we included [short stories] in each chapter to break down the barrier to understanding financial statements.

The self-diagnosis [TEST] that checks your skills at the end of each chapter further enhances your learning ability, allowing learners to progress with a sense of accomplishment.

Investors, test takers, practitioners, etc… … .

Provides the ability to analyze financial statements to suit your needs!

The numbers in financial statements are just numbers in themselves.

Only when these numbers are compared and analyzed with other numbers can we obtain living investment or management information.

This book explains how to view a company's financial performance at a glance, so that it can be actively utilized, especially for stock investments.

Those who know how to interpret financial statements will have an advantage in various aspects of economic life.

It will be of practical help to investors who require accurate and up-to-date information, as well as accounting exam candidates and practitioners involved in corporate financial statements.

GOODS SPECIFICS

- Publication date: December 23, 2022

- Page count, weight, size: 472 pages | 906g | 188*243*23mm

- ISBN13: 9791140702312

- ISBN10: 1140702319

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)