Let's graduate from stock market beginner and start making real profits.

|

Description

Book Introduction

If you're just getting started with stocks, you'll likely want to read a few well-organized glossaries and beginner-friendly stock books.

Beginners in the stock market are very determined to study for a while as it is a new challenge.

Once you become somewhat familiar with stock terminology, you will have the courage to start investing in stocks.

However, many beginners complain that they have difficulty in actually opening HTS and feeling lost as to which stocks to invest in.

The question of which stocks to invest in is, well, back to square one.

It is also difficult to determine whether now is the time to invest in stocks.

If a beginner with these concerns is reading this, I want to tell you that this is the book for you.

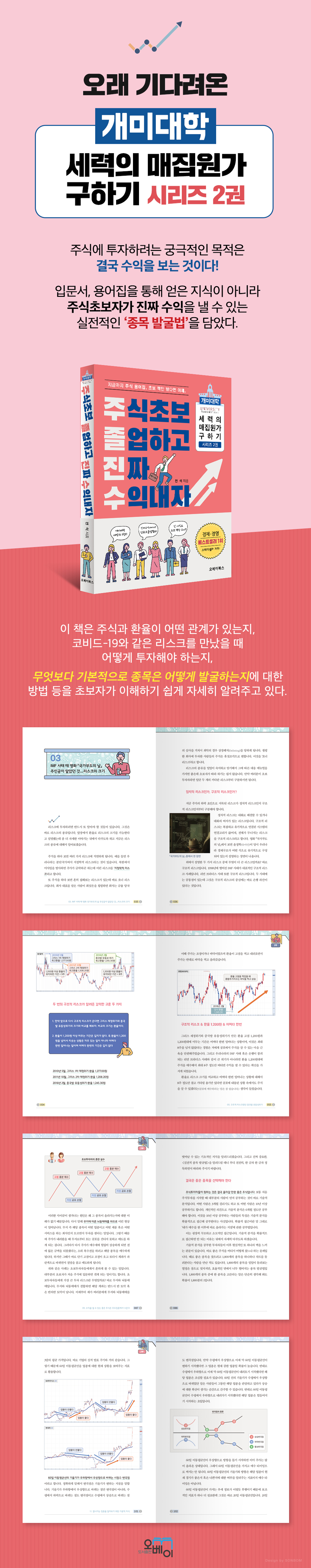

This book provides detailed, easy-to-understand information for beginners, including the relationship between stocks and exchange rates, how to invest when faced with risks like COVID-19, and, most importantly, how to identify fundamental stocks.

The author says that although there are many stock books on the market, he decided to write this book after years of contemplation to include stories about stocks and investment methods that are not available on the market.

This book is thoroughly practical.

This book will be useful not only for those who want to start investing in stocks but also for beginners who have already started studying stocks, and for beginners who have studied a lot but are hesitant when it comes to actual practice.

Beginners in the stock market are very determined to study for a while as it is a new challenge.

Once you become somewhat familiar with stock terminology, you will have the courage to start investing in stocks.

However, many beginners complain that they have difficulty in actually opening HTS and feeling lost as to which stocks to invest in.

The question of which stocks to invest in is, well, back to square one.

It is also difficult to determine whether now is the time to invest in stocks.

If a beginner with these concerns is reading this, I want to tell you that this is the book for you.

This book provides detailed, easy-to-understand information for beginners, including the relationship between stocks and exchange rates, how to invest when faced with risks like COVID-19, and, most importantly, how to identify fundamental stocks.

The author says that although there are many stock books on the market, he decided to write this book after years of contemplation to include stories about stocks and investment methods that are not available on the market.

This book is thoroughly practical.

This book will be useful not only for those who want to start investing in stocks but also for beginners who have already started studying stocks, and for beginners who have studied a lot but are hesitant when it comes to actual practice.

- You can preview some of the book's contents.

Preview

index

Part 1

If I had known this during the IMF crisis, I would be rich now…

01.

A stock investment expert with 19 years of experience turned 200 million won into 100 million won in just 15 days.

02.

I didn't know this during the IMF crisis! If only I had known this, I would be here now...

03. What the protagonist of the movie "The Day the Nation Bankrupted" knew during the IMF crisis - The size of the risk

04.

The essence of crisis is that it happens once in a while!

05.

The liquidity crisis originating in China was a structural risk.

06.

Trump's election as president was a political risk.

07.

Abe's trade retaliation, another political risk

08.

The magnitude of risk revealed through four crises and COVID-19

Part 2

A very specific and surefire way to get on a running horse

09.

Good stocks that can generate profits come from leading industries.

10.

The most effective way to reduce failures: choosing a successful industry.

11.

Basic knowledge to identify successful industries

12.

The principle of emergence of leading industries

13.

Finding Leading Stocks with a Top-Down Approach

14.

Identify leading industries with just 4 pieces of information

15.

How to identify stronger leading industries

16.

Characteristics of leading industries that can be more clearly seen through waves

17.

How to Find Leading Stocks in Leading Industries

18.

The most obvious characteristic of a leading stock as seen through waves

19.

Trading volume provides clear evidence of a dominant stock.

20.

If you don't know the trading volume, look at the supply and demand.

21.

An effective perspective on supply and demand - nevertheless

22.

Now let's learn the specifics of how to mount a running horse.

Part 3

Nagging! Nagging! Nagging you don't want to hear! But it's nagging that helps.

23.

Why Beginners Can't Help But Love the Sport

24.

Shh! Only you know, this is a plan!

25.

A chart-topping veteran in his thirties gets a slap in the face from a woman in her fifties.

26.

Why I gave up on studying fundamental analysis

27.

If you were my younger sibling, I would definitely teach you these stock investment tips, even if it meant hitting you!

28.

It's definitely not because I'm good that I made money.

Be humble, be humble, be humble

29.

Advise your enemies of credit and debt

30.

My choice after abandoning fundamental analysis studies - cheating

31.

Improving the Quality of Cunning - Best Analyst

32.

Analyst reports drive buying momentum through HTS

33.

Foreign or institutional investors don't buy just because the charts look pretty.

34.

Institutional investors - the only visible force

35.

The Perfection of Cheating - Reports and Supply from the Best Analysts

If I had known this during the IMF crisis, I would be rich now…

01.

A stock investment expert with 19 years of experience turned 200 million won into 100 million won in just 15 days.

02.

I didn't know this during the IMF crisis! If only I had known this, I would be here now...

03. What the protagonist of the movie "The Day the Nation Bankrupted" knew during the IMF crisis - The size of the risk

04.

The essence of crisis is that it happens once in a while!

05.

The liquidity crisis originating in China was a structural risk.

06.

Trump's election as president was a political risk.

07.

Abe's trade retaliation, another political risk

08.

The magnitude of risk revealed through four crises and COVID-19

Part 2

A very specific and surefire way to get on a running horse

09.

Good stocks that can generate profits come from leading industries.

10.

The most effective way to reduce failures: choosing a successful industry.

11.

Basic knowledge to identify successful industries

12.

The principle of emergence of leading industries

13.

Finding Leading Stocks with a Top-Down Approach

14.

Identify leading industries with just 4 pieces of information

15.

How to identify stronger leading industries

16.

Characteristics of leading industries that can be more clearly seen through waves

17.

How to Find Leading Stocks in Leading Industries

18.

The most obvious characteristic of a leading stock as seen through waves

19.

Trading volume provides clear evidence of a dominant stock.

20.

If you don't know the trading volume, look at the supply and demand.

21.

An effective perspective on supply and demand - nevertheless

22.

Now let's learn the specifics of how to mount a running horse.

Part 3

Nagging! Nagging! Nagging you don't want to hear! But it's nagging that helps.

23.

Why Beginners Can't Help But Love the Sport

24.

Shh! Only you know, this is a plan!

25.

A chart-topping veteran in his thirties gets a slap in the face from a woman in her fifties.

26.

Why I gave up on studying fundamental analysis

27.

If you were my younger sibling, I would definitely teach you these stock investment tips, even if it meant hitting you!

28.

It's definitely not because I'm good that I made money.

Be humble, be humble, be humble

29.

Advise your enemies of credit and debt

30.

My choice after abandoning fundamental analysis studies - cheating

31.

Improving the Quality of Cunning - Best Analyst

32.

Analyst reports drive buying momentum through HTS

33.

Foreign or institutional investors don't buy just because the charts look pretty.

34.

Institutional investors - the only visible force

35.

The Perfection of Cheating - Reports and Supply from the Best Analysts

Detailed image

Into the book

In the early stages of the COVID-19 outbreak, various news outlets praised our country for its successful national quarantine efforts.

At the end of February, when I heard the news that the number of confirmed cases had reached zero, I thought this was a minor risk.

Compared to the risk of Japan's trade retaliation (more on this later), which previously dragged down the index, the risk posed by COVID-19 when purchasing KODEX leverage was not that great and was expected to end soon.

I had a strong mental muscle thanks to the experience and knowledge I had gained from trading stocks for about 19 years.

So, I was able to literally go all-in with 200 million won on KODEX leverage.

--- p.16~17

Seven years have passed since I started investing in stocks in 2001 and until 2008.

But why didn't I jump into the stock market during the 2008 Lehman Brothers crisis, which was on par with the IMF crisis? The answer is, like Yoon Jeong-hak, the protagonist of "The Day the Nation Bankrupted," I didn't understand the magnitude of the risks.

--- p.24

The highest exchange rate since 2011 was 1,277 won, during the Greek financial crisis.

By analyzing two sets of data, I was able to estimate the scale and duration of the crisis brought about by COVID-19.

During the Greek financial crisis, the exchange rate was 1,277 won, and during the Chinese liquidity crisis, the exchange rate stayed above 1,200 won for 8 weeks. These two data points are what I judged to be the size and duration of the risk I will face in the future.

--- p.76

There are things that stock investors find difficult, and one of them is corporate analysis.

Most stock investors don't know how to read financial statements.

No, there are many people who trade solely based on charts, even though they hate looking at them.

There are ways for people who don't like or can't do business analysis to reduce their mistakes.

This is how I find out what industry the company I'm thinking of buying is in.

--- p.92

Then one day, a woman in her fifties who was an acquaintance of mine called me and asked if we could meet up.

The reason was that he was very anxious even though he had invested a large amount of money into a certain stock.

I asked what kind of stock it was.

They said it was 'Namyang Dairy Products'.

I asked her where she bought it and she replied that she bought it at a pretty high price.

When I asked how much the purchase price was, the woman hesitated and then said it was in the hundreds of millions.

I immediately opened the Namyang Dairy chart.

The place I bought it from was not good.

So I asked the lady why she bought it in this position.

Then the lady said

“There was a fake milk powder scandal in China.

The answer was, “I bought it because I thought Chinese people would buy our country’s powdered milk instead of their own.”

I'm embarrassed, I'm really embarrassed, but I felt bad at that time.

It wasn't that the question was offensive, it was just that I felt really bad about myself.

While studying stocks, I only studied the candles, moving averages, and trading volume in HTS and found answers there.

But I was shocked by the fact that this person invested hundreds of millions of dollars in stocks based on just one news report, without any knowledge of the knowledge, experience, or chart information I had studied for eight years.

At the end of February, when I heard the news that the number of confirmed cases had reached zero, I thought this was a minor risk.

Compared to the risk of Japan's trade retaliation (more on this later), which previously dragged down the index, the risk posed by COVID-19 when purchasing KODEX leverage was not that great and was expected to end soon.

I had a strong mental muscle thanks to the experience and knowledge I had gained from trading stocks for about 19 years.

So, I was able to literally go all-in with 200 million won on KODEX leverage.

--- p.16~17

Seven years have passed since I started investing in stocks in 2001 and until 2008.

But why didn't I jump into the stock market during the 2008 Lehman Brothers crisis, which was on par with the IMF crisis? The answer is, like Yoon Jeong-hak, the protagonist of "The Day the Nation Bankrupted," I didn't understand the magnitude of the risks.

--- p.24

The highest exchange rate since 2011 was 1,277 won, during the Greek financial crisis.

By analyzing two sets of data, I was able to estimate the scale and duration of the crisis brought about by COVID-19.

During the Greek financial crisis, the exchange rate was 1,277 won, and during the Chinese liquidity crisis, the exchange rate stayed above 1,200 won for 8 weeks. These two data points are what I judged to be the size and duration of the risk I will face in the future.

--- p.76

There are things that stock investors find difficult, and one of them is corporate analysis.

Most stock investors don't know how to read financial statements.

No, there are many people who trade solely based on charts, even though they hate looking at them.

There are ways for people who don't like or can't do business analysis to reduce their mistakes.

This is how I find out what industry the company I'm thinking of buying is in.

--- p.92

Then one day, a woman in her fifties who was an acquaintance of mine called me and asked if we could meet up.

The reason was that he was very anxious even though he had invested a large amount of money into a certain stock.

I asked what kind of stock it was.

They said it was 'Namyang Dairy Products'.

I asked her where she bought it and she replied that she bought it at a pretty high price.

When I asked how much the purchase price was, the woman hesitated and then said it was in the hundreds of millions.

I immediately opened the Namyang Dairy chart.

The place I bought it from was not good.

So I asked the lady why she bought it in this position.

Then the lady said

“There was a fake milk powder scandal in China.

The answer was, “I bought it because I thought Chinese people would buy our country’s powdered milk instead of their own.”

I'm embarrassed, I'm really embarrassed, but I felt bad at that time.

It wasn't that the question was offensive, it was just that I felt really bad about myself.

While studying stocks, I only studied the candles, moving averages, and trading volume in HTS and found answers there.

But I was shocked by the fact that this person invested hundreds of millions of dollars in stocks based on just one news report, without any knowledge of the knowledge, experience, or chart information I had studied for eight years.

--- p.235

Publisher's Review

Part 1 - If I had known this during the IMF crisis, I would be rich now...

Part 1 details the size of the risk and when to buy stocks, as in "The Day of National Bankruptcy" by Jeonghak Yoon, with an emphasis on exchange rates and types of risk.

We analyzed the risks that have jeopardized the global economy since 2011, as well as the magnitude of the risks created by COVID-19, which hit the world in 2020.

In the future, when another crisis arises, the correlation between exchange rates and stocks was covered in detail so that stock investors could refer to the risks they had previously experienced and jump into the stock market with courage, even if not as much as Yoon Jeong-hak.

Part 2 - A very specific and surefire way to get on a running horse.

Part 2 gives you a literal, concrete and definitive guide to what a running horse looks like and how to mount it.

When you look at stocks from a psychological perspective after they become something people do, there are signs that will inevitably appear.

We've covered these signs in detail, from the basics to how to discover stocks through HTS.

Part 3 - Nagging, but helpful nagging

Part 3 contains the author's personal trial and error experiences.

In this book, he very honestly shares his reasons for starting to invest in stocks without any knowledge, his failures, his illusions about strategic stocks, the valuable experiences he gained while studying charts, and the results of his own efforts to obtain information about stocks.

As you read Chapter 3, you may find yourself empathizing with the story and saying, "That's my story."

If you are giving up on technical analysis or are studying fundamental analysis and are confused, I recommend reading Part 3 first.

It goes into great detail about how to study stocks and how to get specific information about stocks.

Reading Part 3 will help you learn a lot about how to study and how long it will take to study.

Although it is a bit of a rant, it contains some things I would definitely tell my family if they were investing in stocks.

Part 1 details the size of the risk and when to buy stocks, as in "The Day of National Bankruptcy" by Jeonghak Yoon, with an emphasis on exchange rates and types of risk.

We analyzed the risks that have jeopardized the global economy since 2011, as well as the magnitude of the risks created by COVID-19, which hit the world in 2020.

In the future, when another crisis arises, the correlation between exchange rates and stocks was covered in detail so that stock investors could refer to the risks they had previously experienced and jump into the stock market with courage, even if not as much as Yoon Jeong-hak.

Part 2 - A very specific and surefire way to get on a running horse.

Part 2 gives you a literal, concrete and definitive guide to what a running horse looks like and how to mount it.

When you look at stocks from a psychological perspective after they become something people do, there are signs that will inevitably appear.

We've covered these signs in detail, from the basics to how to discover stocks through HTS.

Part 3 - Nagging, but helpful nagging

Part 3 contains the author's personal trial and error experiences.

In this book, he very honestly shares his reasons for starting to invest in stocks without any knowledge, his failures, his illusions about strategic stocks, the valuable experiences he gained while studying charts, and the results of his own efforts to obtain information about stocks.

As you read Chapter 3, you may find yourself empathizing with the story and saying, "That's my story."

If you are giving up on technical analysis or are studying fundamental analysis and are confused, I recommend reading Part 3 first.

It goes into great detail about how to study stocks and how to get specific information about stocks.

Reading Part 3 will help you learn a lot about how to study and how long it will take to study.

Although it is a bit of a rant, it contains some things I would definitely tell my family if they were investing in stocks.

GOODS SPECIFICS

- Date of issue: April 5, 2021

- Page count, weight, size: 330 pages | 172*240*30mm

- ISBN13: 9791196119553

- ISBN10: 1196119554

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)