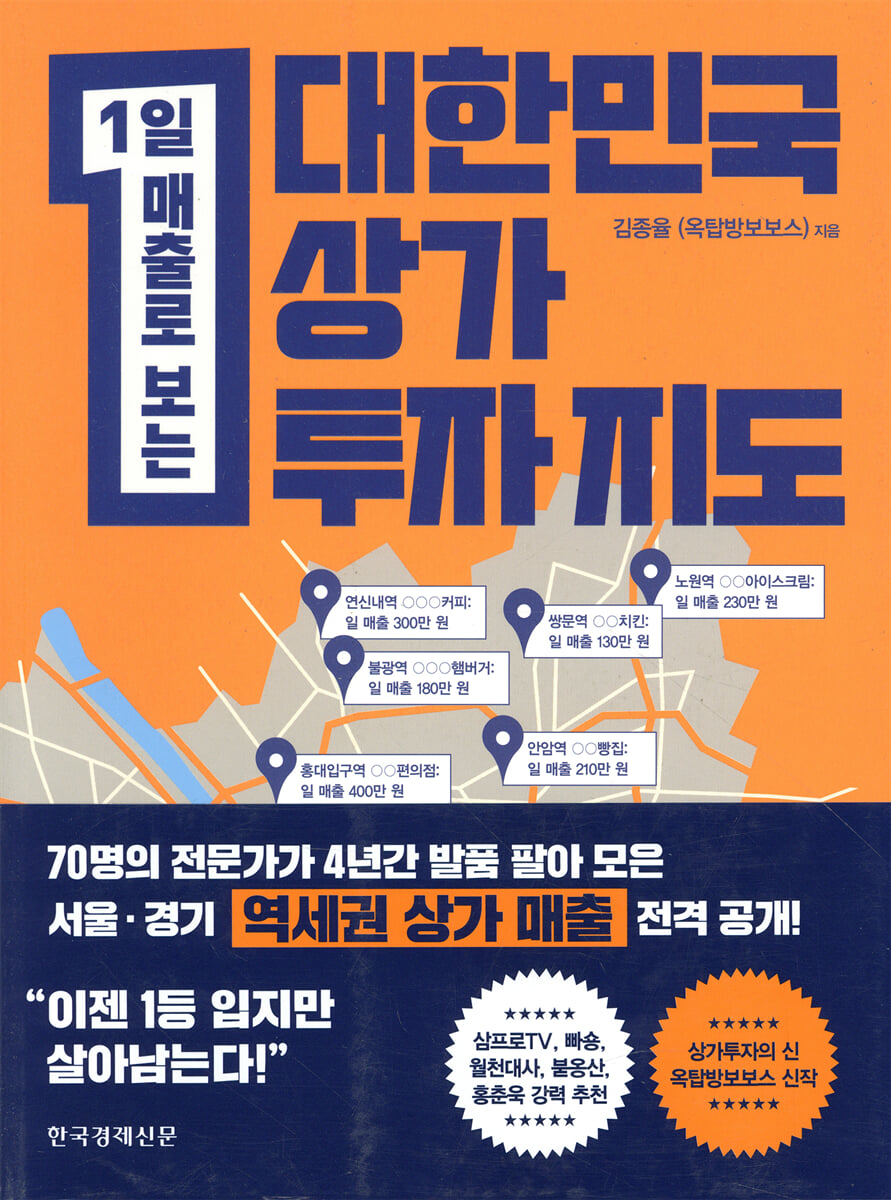

South Korea Commercial Investment Map

|

Description

Book Introduction

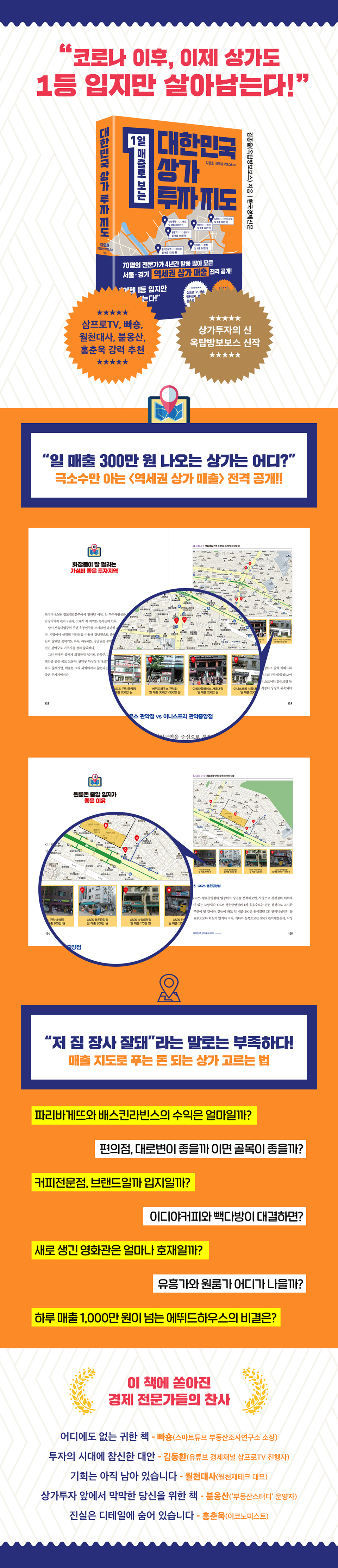

“After COVID-19, only the best stores will survive!” 70 experts worked hard for 4 years to gather Sales figures for commercial properties near subway stations in Seoul and Gyeonggi Province revealed! -A new work by the god of commercial investment, Rooftop Boss - Highly recommended by Sampro TV's Kim Dong-hwan, Passion, Wolcheon Ambassador, Buongsan, and Hong Chun-wook Considering the economic downturn and the COVID-19 pandemic, it seems like commercial real estate investment will have to take a break for a while. However, it is also true that the environment of low growth, low interest rates, and abundant liquidity is increasing the desire to own commercial properties, which are income-generating real estate. Moreover, in a situation where housing is subject to extreme regulations, the number of people interested in investing in commercial properties is not decreasing as much as expected. The problem is that finding a good commercial space is no easy task. In that respect, this new book by Attic Boss (CEO Jong-yul Kim) will be a great guide. The author, a leading lecturer and practical investor in the field of commercial real estate investment, reveals the sales figures of franchise stores, known only to a select few. This is because we believe that a more reliable and clear investment guide is needed in a situation where starting a business or investing in commercial properties is becoming difficult due to infectious diseases, a stagnant economy, and rising labor costs. If you can analyze which stores in which locations generate how much sales and what causes them, your chances of success in commercial real estate investment will definitely increase. In a low interest rate environment, the desire to own a commercial property that pays regular rent is greater than ever. Also, the worse the economy, the greater the desire of business owners to do business in good locations. This book will provide answers to these people. This is not a vague story that anyone or any expert can tell, but rather, we will explain each point one by one based on 'sales' by pointing out the map. If you have the "Commercial Sales Map" included in this book, it will be an excellent resource to refer to whenever you are preparing to invest in commercial properties or start a business. |

- You can preview some of the book's contents.

Preview

index

Recommendation

A Precious Book You Can't Find Anywhere - Kim Hak-ryeol (Passion)

There's still a chance - Lee Ju-hyeon (Wolcheon Ambassador)

For those of you who are feeling overwhelmed by commercial investment - Buongsan

The truth is hidden in the details - Hong Chun-wook

Opening remarks

There are some stores that survive even in recessions.

Part 1.

This is the correct answer for commercial district analysis.

Chapter 1.

Which is more important, commercial district or location?

01.

Even in the worst commercial districts, there are good locations.

02.

Don't be fooled by the floating population.

03.

The key is the main movement line

04.

Don't be fooled by the signs

Chapter 2.

The Essentials of Location Analysis: Commercial Sales

05.

A world of unprofessional experts

06.

Ask for purchase data rather than sales data.

07.

A failing position vs. a successful position

08.

How much profit do Paris Baguette and Baskin-Robbins make?

09.

Food and beverage franchises with lower sales than expected

10.

The crucial difference between a kimbap restaurant and a tteokbokki restaurant

11.

There are many good shops on the outskirts of the city.

TIP.

Draw an Amoeba Map: The Foundation of Commercial Area Analysis and Sales Forecasting

Part 2.

Sales map of station area

Chapter 3.

Naksungdae Station

12.

Convenience store, is it better to go on the main street or in an alley?

13.

Why it's in a great central location in Wonroom Village

14.

Why did Lotteria close?

15.

Ediya Coffee and Juicy are on the same route, which one would you choose?

16.

Bakery, must have at least 2,000 households with valid demand

17.

Coffee shops: brand or location?

TIP.

What is the best location for a takeout coffee shop?

18.

Convenience store & chicken restaurant in the commercial district south of Naksungdae Station

Chapter 4.

Seoul National University Station

19.

A cost-effective investment area where cosmetics sell well

20.

The best location is not in front of the exit, but at the first corner.

21.

If Ediya Coffee and Paikdabang compete

22.

Convenience stores are in one-room villages, bakeries are in apartment villages.

23.

A place where monthly sales of 60 million won and monthly rent of 1 million won are possible

24.

There's unexpected value in a cramped, backwater location.

25.

The classic small investment: Ssukgoge-gil Mini Store

Chapter 5.

Nowon Station

26.

The pitfalls of street-side shopping malls

27.

Finding a niche among large fast food restaurants

28.

It must be well suited to the nature and industry of the commercial area.

29.

In front of a subway station is not necessarily a good location.

Chapter 6.

Cheonho Station

30.

It is a concept without new development

31.

Why does Paris Baguette do better business than Tous Les Jours?

32.

How well will a convenience store in an entertainment district do?

33.

How much of a boon is a new movie theater?

Chapter 7.

Bulkwang Station & Yeonsinnae Station

34.

Two hot subway stations in Eunpyeong-gu

TIP.

Do you have the vision to become a KFC building owner?

35.

A God-given Tactic to Boost Sales: Creating a Backdoor

36.

Coffee shops: exterior is more important than interior

37.

I need to get takeout, but the coffee shop is on the second floor?

38.

Both the main street and the alley are equally great - Northern part of Yeonsinnae Station

39.

One-room district rather than entertainment district - Southern part of Yeonsinnae Station

Chapter 8.

Guro Digital Complex Station

40.

How well will the convenience store in the knowledge industry center do?

41.

Can a bakery in an entertainment district succeed?

Chapter 9.

Hongik University Station

42.

How do rents rise?

43.

Twosome Place: Sales 4x Higher Than Average

44.

Etude House's Secret to 10 Million Won in Daily Sales

45.

Invest in a commercial space suitable for a cosmetics store.

TIP.

Characteristics of university districts

Chapter 10.

Anam Station & Korea University Station

46.

Innisfree promoted on college campuses

47.

The perfect place for a college student gathering! A chicken place with beer.

48.

Korea University Station, where Korea University students do not come

Chapter 11.

Kyunghee University commercial district and franchise sales

49.

A gathering place for Kyung Hee University students and hospital staff

Chapter 12.

gyeonggi-do

50.

New Town Commercial Buildings: Avoiding Risky Investments - Dongtan New Town

51.

If you're in an entertainment district, buy an inside seat - Ansan

52.

Even with vacant properties overflowing, there are still successful locations: Wirye New Town.

Conclusion

Survive till the end and find a position to win

A Precious Book You Can't Find Anywhere - Kim Hak-ryeol (Passion)

There's still a chance - Lee Ju-hyeon (Wolcheon Ambassador)

For those of you who are feeling overwhelmed by commercial investment - Buongsan

The truth is hidden in the details - Hong Chun-wook

Opening remarks

There are some stores that survive even in recessions.

Part 1.

This is the correct answer for commercial district analysis.

Chapter 1.

Which is more important, commercial district or location?

01.

Even in the worst commercial districts, there are good locations.

02.

Don't be fooled by the floating population.

03.

The key is the main movement line

04.

Don't be fooled by the signs

Chapter 2.

The Essentials of Location Analysis: Commercial Sales

05.

A world of unprofessional experts

06.

Ask for purchase data rather than sales data.

07.

A failing position vs. a successful position

08.

How much profit do Paris Baguette and Baskin-Robbins make?

09.

Food and beverage franchises with lower sales than expected

10.

The crucial difference between a kimbap restaurant and a tteokbokki restaurant

11.

There are many good shops on the outskirts of the city.

TIP.

Draw an Amoeba Map: The Foundation of Commercial Area Analysis and Sales Forecasting

Part 2.

Sales map of station area

Chapter 3.

Naksungdae Station

12.

Convenience store, is it better to go on the main street or in an alley?

13.

Why it's in a great central location in Wonroom Village

14.

Why did Lotteria close?

15.

Ediya Coffee and Juicy are on the same route, which one would you choose?

16.

Bakery, must have at least 2,000 households with valid demand

17.

Coffee shops: brand or location?

TIP.

What is the best location for a takeout coffee shop?

18.

Convenience store & chicken restaurant in the commercial district south of Naksungdae Station

Chapter 4.

Seoul National University Station

19.

A cost-effective investment area where cosmetics sell well

20.

The best location is not in front of the exit, but at the first corner.

21.

If Ediya Coffee and Paikdabang compete

22.

Convenience stores are in one-room villages, bakeries are in apartment villages.

23.

A place where monthly sales of 60 million won and monthly rent of 1 million won are possible

24.

There's unexpected value in a cramped, backwater location.

25.

The classic small investment: Ssukgoge-gil Mini Store

Chapter 5.

Nowon Station

26.

The pitfalls of street-side shopping malls

27.

Finding a niche among large fast food restaurants

28.

It must be well suited to the nature and industry of the commercial area.

29.

In front of a subway station is not necessarily a good location.

Chapter 6.

Cheonho Station

30.

It is a concept without new development

31.

Why does Paris Baguette do better business than Tous Les Jours?

32.

How well will a convenience store in an entertainment district do?

33.

How much of a boon is a new movie theater?

Chapter 7.

Bulkwang Station & Yeonsinnae Station

34.

Two hot subway stations in Eunpyeong-gu

TIP.

Do you have the vision to become a KFC building owner?

35.

A God-given Tactic to Boost Sales: Creating a Backdoor

36.

Coffee shops: exterior is more important than interior

37.

I need to get takeout, but the coffee shop is on the second floor?

38.

Both the main street and the alley are equally great - Northern part of Yeonsinnae Station

39.

One-room district rather than entertainment district - Southern part of Yeonsinnae Station

Chapter 8.

Guro Digital Complex Station

40.

How well will the convenience store in the knowledge industry center do?

41.

Can a bakery in an entertainment district succeed?

Chapter 9.

Hongik University Station

42.

How do rents rise?

43.

Twosome Place: Sales 4x Higher Than Average

44.

Etude House's Secret to 10 Million Won in Daily Sales

45.

Invest in a commercial space suitable for a cosmetics store.

TIP.

Characteristics of university districts

Chapter 10.

Anam Station & Korea University Station

46.

Innisfree promoted on college campuses

47.

The perfect place for a college student gathering! A chicken place with beer.

48.

Korea University Station, where Korea University students do not come

Chapter 11.

Kyunghee University commercial district and franchise sales

49.

A gathering place for Kyung Hee University students and hospital staff

Chapter 12.

gyeonggi-do

50.

New Town Commercial Buildings: Avoiding Risky Investments - Dongtan New Town

51.

If you're in an entertainment district, buy an inside seat - Ansan

52.

Even with vacant properties overflowing, there are still successful locations: Wirye New Town.

Conclusion

Survive till the end and find a position to win

Detailed image

Into the book

The core of this book is the sales map.

This book tells you how much each location and franchise sells.

In that respect, I boldly used the name ‘Jeongdapji’.

But if you just look at the correct answer, your skills won't improve.

So, let's take a look at the answer key after understanding the basic concepts of how to conduct a commercial area analysis, where to start a business, and what kind of commercial building to purchase.

And let's also address some common misconceptions about good location.

--- From "Even in the worst commercial districts, there are good locations"

I opened a convenience store believing in the effective demand, not the floating population, and after 5 years, I was running a business in my own store. I could pay the interest by receiving it from the store next door, and since business was going well, the threshold for bank branches was low, and the franchise headquarters also provided support.

I bought the store without spending a single penny of my own money and I don't even have to pay interest.

Moreover, since there is a police station right in front, robbers do not even come near the area.

If you envy this case, please listen carefully to what I am about to say.

For reference, this store is a very low-priced, high-quality store with a daily floating population of 500, over 400 in-store customers, and daily sales of well over 2 million won.

This one picture doesn't do it justice, but I think it at least explains it.

That ‘a location with a lot of floating population is not a good location’ is not true.

--- From "Don't be fooled by the floating population"

So, how can we avoid these losses? The transferor also takes into account the fact that the transferee will want to see the sales data.

So, it is not uncommon to falsify sales figures through POS manipulation that lasts from several months to as long as a year.

Therefore, the assignee must request 'purchase data' rather than 'sales data'.

For example, if it's a bakery, they ask for one year's worth of purchase data, and you can consider sales to be about 150% of that purchase data.

You can figure out the cost ratio and calculate it backwards through various franchise analysis data that will be introduced in the future.

--- From "Ask for purchase data rather than sales data"

So, what about Baskin-Robbins' profits, even after deducting the store rental costs (the sum of the deposit and key money), which amount to 150 million won? How much monthly rent can the landlord collect? Let's examine them one by one.

Let’s look at the map in [Figure 2-5].

Looking at the number of apartment units surrounding Paris Baguette, there are well over 7,000 households.

If Paris Baguette monopolized this large generation without competition, its sales would be enormous.

But is that really the case in the retail business environment?

There are some competing points that are not marked on the map, so please take note of that.

Let's just analyze the current sales and the resulting profit and loss.

There will be countless sales analysis data coming out in the future, so let's put off studying it for a while.

Paris Baguette's Seohyeon-dong branch in Bundang is expected to have monthly sales of 75 million won.

A simple analysis of the profits and losses is as shown in [Table 2-4].

--- From "How much profit will Paris Baguette and Baskin Robbins make?"

This time, let's take a look at Isu Station.

Before that, let me ask you, the readers, one thing.

Which commercial district is better, Isu Station or Naebang Station? Any reader who has driven through either area, even once, will likely say Isu Station.

Of course, real estate prices are much more expensive near Isu Station.

However, when investing in commercial properties or starting a business, location is more important than the commercial district.

It's not the area that matters, it's the location within the area that matters.

Let’s analyze the location of Kimgane Kimbap Isu Station branch by looking at [Figure 2-11].

First of all, there are no elementary, middle, or high schools within the commercial district.

If so, there will not be many places with children in elementary, middle, and high school within the effective demand.

There would have been almost no school districts within the commercial district.

Moreover, the main effective demand for the location will be people living in residential areas including Bangbae Lotte Castle Apartments.

However, if you analyze the route as indicated by the blue solid line on the map, you get disappointing results.

--- From "The Crucial Difference Between a Kimbap Restaurant and a Tteokbokki Restaurant"

Let’s look at [Figure 3-1].

On the map, there are 7-Eleven Bongcheon 2, an affiliate of Lotte Group, and CU Gwanak Naksung, an affiliate of Bogwang Group.

How will these two locations perform? Will they be similar or different? This is where countless debates arise during store development.

In other words, the question is whether to open a branch on the main street or inside.

If you open a convenience store on the main street, it will look neat at first glance.

Visibility is good and there are usually a lot of people passing through.

On the other hand, the rent is expensive, and above all, I am worried that if a competitor opens in the alley, I will lose my sales.

Meanwhile, the stores in the back alley have the opposite problem.

It lacks a nice taste, has poor visibility, and has a low foot traffic.

But it also seems like it could give them a competitive edge by (in industry terms) tapping into internal demand.

However, it is questionable whether business can be done with only internal demand.

Moreover, since there are fewer people passing through, the commercial district feels less active than the main street.

It is a difficult location for a beginner to decide on.

Let's narrow it down to 2017 or mid-2018.

At that time, the daily sales of the 7-Eleven Bongcheon 2nd branch on the main street were around 1.8 million won.

And the CU Gwanak Naksung branch seemed to be slightly higher at around 2 million won.

The exact rent is unknown, but anyone can tell that the space at the 7-Eleven Bongcheon 2nd branch on the main street is more expensive.

But why are sales higher at CU Gwanak Naksung branch?

This book tells you how much each location and franchise sells.

In that respect, I boldly used the name ‘Jeongdapji’.

But if you just look at the correct answer, your skills won't improve.

So, let's take a look at the answer key after understanding the basic concepts of how to conduct a commercial area analysis, where to start a business, and what kind of commercial building to purchase.

And let's also address some common misconceptions about good location.

--- From "Even in the worst commercial districts, there are good locations"

I opened a convenience store believing in the effective demand, not the floating population, and after 5 years, I was running a business in my own store. I could pay the interest by receiving it from the store next door, and since business was going well, the threshold for bank branches was low, and the franchise headquarters also provided support.

I bought the store without spending a single penny of my own money and I don't even have to pay interest.

Moreover, since there is a police station right in front, robbers do not even come near the area.

If you envy this case, please listen carefully to what I am about to say.

For reference, this store is a very low-priced, high-quality store with a daily floating population of 500, over 400 in-store customers, and daily sales of well over 2 million won.

This one picture doesn't do it justice, but I think it at least explains it.

That ‘a location with a lot of floating population is not a good location’ is not true.

--- From "Don't be fooled by the floating population"

So, how can we avoid these losses? The transferor also takes into account the fact that the transferee will want to see the sales data.

So, it is not uncommon to falsify sales figures through POS manipulation that lasts from several months to as long as a year.

Therefore, the assignee must request 'purchase data' rather than 'sales data'.

For example, if it's a bakery, they ask for one year's worth of purchase data, and you can consider sales to be about 150% of that purchase data.

You can figure out the cost ratio and calculate it backwards through various franchise analysis data that will be introduced in the future.

--- From "Ask for purchase data rather than sales data"

So, what about Baskin-Robbins' profits, even after deducting the store rental costs (the sum of the deposit and key money), which amount to 150 million won? How much monthly rent can the landlord collect? Let's examine them one by one.

Let’s look at the map in [Figure 2-5].

Looking at the number of apartment units surrounding Paris Baguette, there are well over 7,000 households.

If Paris Baguette monopolized this large generation without competition, its sales would be enormous.

But is that really the case in the retail business environment?

There are some competing points that are not marked on the map, so please take note of that.

Let's just analyze the current sales and the resulting profit and loss.

There will be countless sales analysis data coming out in the future, so let's put off studying it for a while.

Paris Baguette's Seohyeon-dong branch in Bundang is expected to have monthly sales of 75 million won.

A simple analysis of the profits and losses is as shown in [Table 2-4].

--- From "How much profit will Paris Baguette and Baskin Robbins make?"

This time, let's take a look at Isu Station.

Before that, let me ask you, the readers, one thing.

Which commercial district is better, Isu Station or Naebang Station? Any reader who has driven through either area, even once, will likely say Isu Station.

Of course, real estate prices are much more expensive near Isu Station.

However, when investing in commercial properties or starting a business, location is more important than the commercial district.

It's not the area that matters, it's the location within the area that matters.

Let’s analyze the location of Kimgane Kimbap Isu Station branch by looking at [Figure 2-11].

First of all, there are no elementary, middle, or high schools within the commercial district.

If so, there will not be many places with children in elementary, middle, and high school within the effective demand.

There would have been almost no school districts within the commercial district.

Moreover, the main effective demand for the location will be people living in residential areas including Bangbae Lotte Castle Apartments.

However, if you analyze the route as indicated by the blue solid line on the map, you get disappointing results.

--- From "The Crucial Difference Between a Kimbap Restaurant and a Tteokbokki Restaurant"

Let’s look at [Figure 3-1].

On the map, there are 7-Eleven Bongcheon 2, an affiliate of Lotte Group, and CU Gwanak Naksung, an affiliate of Bogwang Group.

How will these two locations perform? Will they be similar or different? This is where countless debates arise during store development.

In other words, the question is whether to open a branch on the main street or inside.

If you open a convenience store on the main street, it will look neat at first glance.

Visibility is good and there are usually a lot of people passing through.

On the other hand, the rent is expensive, and above all, I am worried that if a competitor opens in the alley, I will lose my sales.

Meanwhile, the stores in the back alley have the opposite problem.

It lacks a nice taste, has poor visibility, and has a low foot traffic.

But it also seems like it could give them a competitive edge by (in industry terms) tapping into internal demand.

However, it is questionable whether business can be done with only internal demand.

Moreover, since there are fewer people passing through, the commercial district feels less active than the main street.

It is a difficult location for a beginner to decide on.

Let's narrow it down to 2017 or mid-2018.

At that time, the daily sales of the 7-Eleven Bongcheon 2nd branch on the main street were around 1.8 million won.

And the CU Gwanak Naksung branch seemed to be slightly higher at around 2 million won.

The exact rent is unknown, but anyone can tell that the space at the 7-Eleven Bongcheon 2nd branch on the main street is more expensive.

But why are sales higher at CU Gwanak Naksung branch?

--- From "Convenience stores, is it better to be on the main street or in an alley?"

Publisher's Review

Where is the store that makes 3 million won in sales per day?

How to Choose a Profitable Commercial Property Using a Sales Map

Although the country has the highest percentage of self-employed people among OECD countries, no country provides transparent and objective data on how much business owners invest and how much they earn.

The fair value of a commercial property should not be assessed based on the amount presented by the developer or sales company.

The store owner should be evaluated based on the profits that he or she can generate through business, that is, sales.

Under that premise, this book discloses the startup investment and sales of stores in key commercial districts in Seoul and Gyeonggi Province.

From 2016 to the present, the author has been conducting research with approximately 70 real estate members over the past four years, investigating sales figures for stores near subway stations in Seoul and Gyeonggi Province and analyzing their location based on the results.

In other words, the author and members analyzed the value of the store by directly receiving franchise consultations and interviewing franchise owners.

And we decided to organize the vast amount of data we have collected and share this information with people who are preparing to invest in commercial properties or start a business.

This book reveals the daily sales figures of franchise stores we frequent every day, including convenience stores, cosmetics stores, coffee shops, bakeries, snack bars, and fried chicken restaurants. How much do your local convenience stores like GS25, 7-Eleven, and Ministop make in a day? How much do your favorite Twosome Place, Ediya Coffee, and Paikdabang make? How much would it cost to open a Baskin-Robbins or Paris Baguette, and how much would you earn in profit?

The daily sales figures of the franchise stores we were curious about are revealed.

And the author, who is the country's top commercial real estate expert, analyzes in detail why such results were achieved.

By backtracking based on the sales results, it is easier to analyze the difference between a store that succeeds and a store that fails depending on its location, even if it is just a single intersection.

Just crossed the street… What’s the difference between a hit and a bust?

The commercial market is polarized, but find a position to survive and win!

Considering the economic downturn and the COVID-19 pandemic, it seems like commercial real estate investment will have to take a break for a while.

In particular, the business environment for retail stores is worsening as gatherings decrease and online shopping increases due to COVID-19.

Not long ago, there was a media report that the Lotte Group, a real estate conglomerate, was carrying out its first restructuring since its founding.

The seriousness of the situation is becoming increasingly apparent.

The government is seeking to stimulate the economy by increasing spending through fiscal expansion policies such as disaster relief basic income.

This isn't just our story; it's likely to become a global trend. The IMF has focused on the issue of limited foreign exchange reserves in some Asian countries, but isn't COVID-19 a global problem?

This leads to expectations of a massive increase in liquidity due to increased government spending worldwide.

This will lead to lower interest rates and, inevitably, lower growth.

An environment of low growth, low interest rates, and abundant liquidity will increase the desire to own commercial properties, which are income-generating real estate.

The problem is that it is not easy to find a good commercial space here.

In that respect, this book will be a great guide.

By looking at the sales of franchise stores in numerous regions, you can easily distinguish between those that will survive and those that will not.

What is particularly noteworthy is that when stores close in places where business is slow, stores that are doing well do even better.

In other words, if a convenience store with daily sales of 1.3 million won closes, the sales of a nearby convenience store with daily sales of 2 million won in a better location will increase to 2.5 million won.

Polarization isn't limited to apartments.

The commercial market is also heading towards polarization.

The term 'smart house' is no longer limited to apartments.

For example, Seven Eleven Seogyo 5th Branch and CU Seogyo 1st Branch in Seogyo-dong are located in the same commercial district and have similar location conditions.

But recently, one store closed.

Since this was just before the COVID-19 pandemic, it is highly likely that the biggest cause was the minimum wage increase.

The closed store is Seven Eleven Seogyo Branch No. 5.

The store's daily sales were in the low 1 million won range, so it wasn't very profitable, but it was a position where the owner could earn enough to cover his labor costs.

However, with a minimum wage of 8,590 won, even if the monthly rent is 0 won, there is not much profit that can be returned to the store owner.

GS25's average sales in 2019 were around 1.9 million won.

This is a whopping 50% increase compared to early 2010, when it was 1.3 million won.

Inflation may be one factor, but the decisive reason is that many struggling stores with prices in the low 1 million won range have closed, leaving only the successful ones to survive.

This phenomenon will become more severe in commercial areas affected by COVID-19.

A representative example is the university district.

A franchise store in front of Korea University had monthly sales of about 60 million won in March 2019.

However, in March 2020, due to COVID-19, the figure plummeted to around 28 million won due to the lack of students attending school.

In addition, sales in commercial areas where people gather, such as entertainment districts, fell by about 10%.

On the other hand, there was no decline in sales in residential commercial areas.

The space where 7-Eleven Seogyo Branch 5 was located was vacant for a while and then a food distribution center moved in.

It is a place that mainly does delivery business rather than store business.

It's fortunate that the vacancy has been filled, but it's clear that this is a less desirable tenant than a convenience store.

Let me emphasize again that we must choose a position that will allow us to survive and win the recession.

In that respect, this book will be of great use to readers.

How to Choose a Profitable Commercial Property Using a Sales Map

Although the country has the highest percentage of self-employed people among OECD countries, no country provides transparent and objective data on how much business owners invest and how much they earn.

The fair value of a commercial property should not be assessed based on the amount presented by the developer or sales company.

The store owner should be evaluated based on the profits that he or she can generate through business, that is, sales.

Under that premise, this book discloses the startup investment and sales of stores in key commercial districts in Seoul and Gyeonggi Province.

From 2016 to the present, the author has been conducting research with approximately 70 real estate members over the past four years, investigating sales figures for stores near subway stations in Seoul and Gyeonggi Province and analyzing their location based on the results.

In other words, the author and members analyzed the value of the store by directly receiving franchise consultations and interviewing franchise owners.

And we decided to organize the vast amount of data we have collected and share this information with people who are preparing to invest in commercial properties or start a business.

This book reveals the daily sales figures of franchise stores we frequent every day, including convenience stores, cosmetics stores, coffee shops, bakeries, snack bars, and fried chicken restaurants. How much do your local convenience stores like GS25, 7-Eleven, and Ministop make in a day? How much do your favorite Twosome Place, Ediya Coffee, and Paikdabang make? How much would it cost to open a Baskin-Robbins or Paris Baguette, and how much would you earn in profit?

The daily sales figures of the franchise stores we were curious about are revealed.

And the author, who is the country's top commercial real estate expert, analyzes in detail why such results were achieved.

By backtracking based on the sales results, it is easier to analyze the difference between a store that succeeds and a store that fails depending on its location, even if it is just a single intersection.

Just crossed the street… What’s the difference between a hit and a bust?

The commercial market is polarized, but find a position to survive and win!

Considering the economic downturn and the COVID-19 pandemic, it seems like commercial real estate investment will have to take a break for a while.

In particular, the business environment for retail stores is worsening as gatherings decrease and online shopping increases due to COVID-19.

Not long ago, there was a media report that the Lotte Group, a real estate conglomerate, was carrying out its first restructuring since its founding.

The seriousness of the situation is becoming increasingly apparent.

The government is seeking to stimulate the economy by increasing spending through fiscal expansion policies such as disaster relief basic income.

This isn't just our story; it's likely to become a global trend. The IMF has focused on the issue of limited foreign exchange reserves in some Asian countries, but isn't COVID-19 a global problem?

This leads to expectations of a massive increase in liquidity due to increased government spending worldwide.

This will lead to lower interest rates and, inevitably, lower growth.

An environment of low growth, low interest rates, and abundant liquidity will increase the desire to own commercial properties, which are income-generating real estate.

The problem is that it is not easy to find a good commercial space here.

In that respect, this book will be a great guide.

By looking at the sales of franchise stores in numerous regions, you can easily distinguish between those that will survive and those that will not.

What is particularly noteworthy is that when stores close in places where business is slow, stores that are doing well do even better.

In other words, if a convenience store with daily sales of 1.3 million won closes, the sales of a nearby convenience store with daily sales of 2 million won in a better location will increase to 2.5 million won.

Polarization isn't limited to apartments.

The commercial market is also heading towards polarization.

The term 'smart house' is no longer limited to apartments.

For example, Seven Eleven Seogyo 5th Branch and CU Seogyo 1st Branch in Seogyo-dong are located in the same commercial district and have similar location conditions.

But recently, one store closed.

Since this was just before the COVID-19 pandemic, it is highly likely that the biggest cause was the minimum wage increase.

The closed store is Seven Eleven Seogyo Branch No. 5.

The store's daily sales were in the low 1 million won range, so it wasn't very profitable, but it was a position where the owner could earn enough to cover his labor costs.

However, with a minimum wage of 8,590 won, even if the monthly rent is 0 won, there is not much profit that can be returned to the store owner.

GS25's average sales in 2019 were around 1.9 million won.

This is a whopping 50% increase compared to early 2010, when it was 1.3 million won.

Inflation may be one factor, but the decisive reason is that many struggling stores with prices in the low 1 million won range have closed, leaving only the successful ones to survive.

This phenomenon will become more severe in commercial areas affected by COVID-19.

A representative example is the university district.

A franchise store in front of Korea University had monthly sales of about 60 million won in March 2019.

However, in March 2020, due to COVID-19, the figure plummeted to around 28 million won due to the lack of students attending school.

In addition, sales in commercial areas where people gather, such as entertainment districts, fell by about 10%.

On the other hand, there was no decline in sales in residential commercial areas.

The space where 7-Eleven Seogyo Branch 5 was located was vacant for a while and then a food distribution center moved in.

It is a place that mainly does delivery business rather than store business.

It's fortunate that the vacancy has been filled, but it's clear that this is a less desirable tenant than a convenience store.

Let me emphasize again that we must choose a position that will allow us to survive and win the recession.

In that respect, this book will be of great use to readers.

GOODS SPECIFICS

- Date of publication: September 14, 2020

- Page count, weight, size: 336 pages | 628g | 165*220*30mm

- ISBN13: 9788947546294

- ISBN10: 8947546291

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)