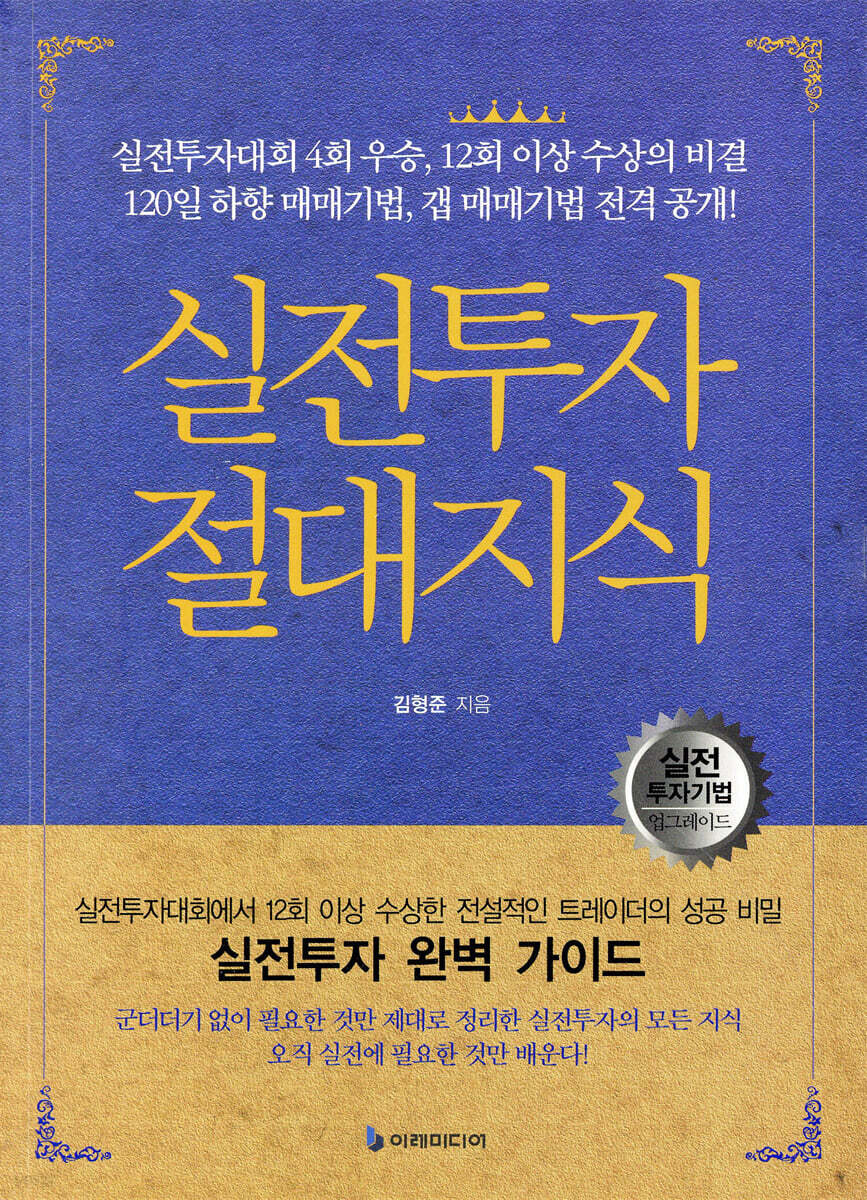

Absolute knowledge of practical investment

|

Description

Book Introduction

The essence of real-world investing, shared by the 12th consecutive winner of the Real-World Investment Competition.

3rd place in the 2006 2nd CJ Investment & Securities Real Investment Competition Baekgun League

2nd place in the 3rd CJ Investment & Securities Real Investment Competition Baekgun League in 2007

2nd place in the 4th CJ Investment & Securities Real Investment Competition, Blue Army League, 2008

2009 1st Mirae Asset Real Investment Competition 3,000 League Excellence Award

2009 Kiwoom King of Kings Real Investment Competition 500 League 1st Place

2010 2nd Mirae Asset Real Investment Competition 1000 League 3rd place

2010 Kiwoom King of Kings Real Investment Competition 3000 League 3rd Place

2011 Mirae Asset Real Investment Competition 1000 League 1st Place

2014 Kiwoom Securities Real Investment Competition 3,000 Club 3rd Place

1st place in the 2016 Mirae Asset Real Investment Competition 100 Million League

2017 Kiwoom Securities Real Investment Competition 3,000 League 1st Place

2nd place in the 2018 KB Investment & Securities Real Investment Competition 100 Million League

Won the real investment competition 4 times from 2006 to 2018.

Proven practical know-how with over 12 awards!

The expert's secret weapon: the 120-day downward trading technique and gap trading technique revealed!

“I invested using the 120-day downward trading method and gap trading method.

“Every year, 300 million won is withdrawn from the stock account.”

[Absolute Knowledge of Practical Investment] is a revised and expanded edition of [Secrets of Practical Investment for Beginners] by author Kim Hyeong-jun.

As you can guess from the phrase 'Absolute Knowledge for Practical Investment', author Kim Hyeong-jun has already taught general investors how to win in the market based on his vivid stock investment experience in his previous work, and in the revised and expanded edition of [Absolute Knowledge for Practical Investment], the author has revealed his investment secrets.

The author's secret weapon that allows him to consistently make over 300 million won in cash each year through stock investment is the 120-day downward trading method and the gap trading method.

It takes great courage for the author, who is arguably an investment guru, to reveal his secret weapon.

Learning the secrets to successful investing from this author, a proven practitioner of both theory and practice, who has won over 12 awards in real-world investment competitions, will be one of the most valuable experiences of your investing life.

3rd place in the 2006 2nd CJ Investment & Securities Real Investment Competition Baekgun League

2nd place in the 3rd CJ Investment & Securities Real Investment Competition Baekgun League in 2007

2nd place in the 4th CJ Investment & Securities Real Investment Competition, Blue Army League, 2008

2009 1st Mirae Asset Real Investment Competition 3,000 League Excellence Award

2009 Kiwoom King of Kings Real Investment Competition 500 League 1st Place

2010 2nd Mirae Asset Real Investment Competition 1000 League 3rd place

2010 Kiwoom King of Kings Real Investment Competition 3000 League 3rd Place

2011 Mirae Asset Real Investment Competition 1000 League 1st Place

2014 Kiwoom Securities Real Investment Competition 3,000 Club 3rd Place

1st place in the 2016 Mirae Asset Real Investment Competition 100 Million League

2017 Kiwoom Securities Real Investment Competition 3,000 League 1st Place

2nd place in the 2018 KB Investment & Securities Real Investment Competition 100 Million League

Won the real investment competition 4 times from 2006 to 2018.

Proven practical know-how with over 12 awards!

The expert's secret weapon: the 120-day downward trading technique and gap trading technique revealed!

“I invested using the 120-day downward trading method and gap trading method.

“Every year, 300 million won is withdrawn from the stock account.”

[Absolute Knowledge of Practical Investment] is a revised and expanded edition of [Secrets of Practical Investment for Beginners] by author Kim Hyeong-jun.

As you can guess from the phrase 'Absolute Knowledge for Practical Investment', author Kim Hyeong-jun has already taught general investors how to win in the market based on his vivid stock investment experience in his previous work, and in the revised and expanded edition of [Absolute Knowledge for Practical Investment], the author has revealed his investment secrets.

The author's secret weapon that allows him to consistently make over 300 million won in cash each year through stock investment is the 120-day downward trading method and the gap trading method.

It takes great courage for the author, who is arguably an investment guru, to reveal his secret weapon.

Learning the secrets to successful investing from this author, a proven practitioner of both theory and practice, who has won over 12 awards in real-world investment competitions, will be one of the most valuable experiences of your investing life.

- You can preview some of the book's contents.

Preview

index

Recommendation

Author's Note

Introduction: Things to Know Before Investing in Stocks

Practical Investment Absolute Knowledge Part 1.

The true face of the stock market

Part 1.

What is stock investment?

01.

What is the stock market like?

02.

The stock market resembles a sand dune being torn down

03.

Why do you need to know your own capabilities before starting to invest in stocks?

Part 2.

How do stocks move?

04.

People who move stocks based on the company's value

05.

People who move stocks based on people's psychology

06.

People who cleverly distort the stock market

Part 3.

HTS, the weapon of stock investment

07. You must know HTS as if it were your own body.

08.

Set up your environment

09.

View chart

10.

Order

11.

Register your interest

12.

Stop & Stop Loss & Monitoring

13.

Useful HTS features to know

Vocal's Column 1.

Stock Investing: Losers vs. Winners

successful person

Practical Investment Absolute Knowledge Part 2: How to Understand Stocks

Part 4.

Understanding a company is the beginning of investing.

14.

If you invest only by looking at the chart, you will fail!

15.

The impact of markets and industries on businesses

Vocal's Column 2.

Look for opportunities

16.

A report that tells everything about the company

17.

Capital changes

Practical Investment Absolute Knowledge Part 3.

Everything is hidden in the charts

Part 5.

What is technical analysis?

18.

Technical analysis is essential in the stock market.

Part 6.

What is a candle?

19.

Starting price of the chart

20.

Basic candlestick model

21.

Candle relationship

22.

Persistent candle

23.

Reversal candle

Part 7.

stock price flow and trend

24.

Support and resistance

25.

Support and resistance flow trend

Part 8.

Don't invest in stocks without knowing moving averages and trading volume.

26.

What is a moving average?

27.

Analysis method using moving average lines

28.

The flower of stocks, trading volume

Part 9.

Patterns that predict stock prices through shape and other auxiliary indicators

29.

Reversal patterns that indicate a change in trend

30.

Continuation patterns that show changes in trend movement

31.

Other auxiliary indicators

Practical Investment Absolute Knowledge Part 4.

Applications of Fundamental and Technical Analysis

Part 10.

Applications of Fundamental Analysis

31.

How to Pick Growth Stocks: William O'Neil's CAN SLIM

32.

When the index falls, it's shopping time. Warren Buffett's stock picks.

Vocal's Column 3.

Long-term investment story

Part 11.

Applications of technical analysis

33.

Don't go in to win, go in after you've won.

34.

Safety first, safety second, safety third

35.

No matter how difficult it is, you must cut your losses without fail.

[Appendix] Upgrade your absolute knowledge of practical investment

120-day downward trading method

Gap trading method

Stock Trading Methods You Need to Know More About

Things to watch out for in the stock market

The Investment Mind of a Smart Investor

In closing the book

Author's Note

Introduction: Things to Know Before Investing in Stocks

Practical Investment Absolute Knowledge Part 1.

The true face of the stock market

Part 1.

What is stock investment?

01.

What is the stock market like?

02.

The stock market resembles a sand dune being torn down

03.

Why do you need to know your own capabilities before starting to invest in stocks?

Part 2.

How do stocks move?

04.

People who move stocks based on the company's value

05.

People who move stocks based on people's psychology

06.

People who cleverly distort the stock market

Part 3.

HTS, the weapon of stock investment

07. You must know HTS as if it were your own body.

08.

Set up your environment

09.

View chart

10.

Order

11.

Register your interest

12.

Stop & Stop Loss & Monitoring

13.

Useful HTS features to know

Vocal's Column 1.

Stock Investing: Losers vs. Winners

successful person

Practical Investment Absolute Knowledge Part 2: How to Understand Stocks

Part 4.

Understanding a company is the beginning of investing.

14.

If you invest only by looking at the chart, you will fail!

15.

The impact of markets and industries on businesses

Vocal's Column 2.

Look for opportunities

16.

A report that tells everything about the company

17.

Capital changes

Practical Investment Absolute Knowledge Part 3.

Everything is hidden in the charts

Part 5.

What is technical analysis?

18.

Technical analysis is essential in the stock market.

Part 6.

What is a candle?

19.

Starting price of the chart

20.

Basic candlestick model

21.

Candle relationship

22.

Persistent candle

23.

Reversal candle

Part 7.

stock price flow and trend

24.

Support and resistance

25.

Support and resistance flow trend

Part 8.

Don't invest in stocks without knowing moving averages and trading volume.

26.

What is a moving average?

27.

Analysis method using moving average lines

28.

The flower of stocks, trading volume

Part 9.

Patterns that predict stock prices through shape and other auxiliary indicators

29.

Reversal patterns that indicate a change in trend

30.

Continuation patterns that show changes in trend movement

31.

Other auxiliary indicators

Practical Investment Absolute Knowledge Part 4.

Applications of Fundamental and Technical Analysis

Part 10.

Applications of Fundamental Analysis

31.

How to Pick Growth Stocks: William O'Neil's CAN SLIM

32.

When the index falls, it's shopping time. Warren Buffett's stock picks.

Vocal's Column 3.

Long-term investment story

Part 11.

Applications of technical analysis

33.

Don't go in to win, go in after you've won.

34.

Safety first, safety second, safety third

35.

No matter how difficult it is, you must cut your losses without fail.

[Appendix] Upgrade your absolute knowledge of practical investment

120-day downward trading method

Gap trading method

Stock Trading Methods You Need to Know More About

Things to watch out for in the stock market

The Investment Mind of a Smart Investor

In closing the book

Into the book

Outside the stock market, people who are so rational are swayed by emotions inside the market.

The people who make up this market are me and the readers of this book.

That's why when everyone gets excited about a rise, there's a sudden surge, and when it falls, fear breeds fear, leading to a strong plunge.

(Omitted) What gives you confidence in your own thinking, what allows you to hold on to the stocks you have bought, and what allows you to cope when things don't go according to your scenario, comes from a solid study of stock investment.

--- [Part 1.

[What is stock investment?]

Stocks are like meeting people and living your own life.

Even the author who is writing this now should not be 100% sure.

You have to doubt yourself and think about why that is so before you come to a conclusion.

If you don't know, you'll be taken advantage of.

And if you believe it carelessly, you could lose everything.

Vision is 'the invisible thing between the eyebrows'.

Unless you ask 'why' and ponder it, you will never be able to come up with an answer for yourself.

Only then can you realize it and get used to it.

But if you tell this story to someone who hasn't experienced that moment of worry, they might think it's so obvious and trivial and just brush it off.

So, even if you read many books, you end up missing out on all the important words, and this vicious cycle repeats itself.

I hope you will think deeply about and understand the words in this book.

--- [Part 2.

How do stocks move?]

I, too, have looked at many books on the market to study fundamental analysis.

However, it was confusing because it always only listed rigid formulas and included a lot of theoretical content that was not actually necessary.

So, through this opportunity, I wanted to show how fundamental analysis interacts with each other in stock investment, how the big picture flows, and how it can be utilized in practice.

However, I believe that it can serve as a guide to help you navigate the fog of the stock market (although not everything) by helping you get to where you need to go without getting lost, like the faint light of a lighthouse in the distance.

As people become more knowledgeable and skilled in the stock market, I've seen them move away from fundamental analysis, only to eventually hit a wall and become frustrated.

If you always strengthen your foundation of fundamental analysis and never forget it, you will be able to overcome the obstacles that will come one day more easily than anyone else.

--- [Part 4.

Understanding the company is the beginning of investment]

Technical analysis isn't about finding secrets or winning big. It's about understanding the countless investors who exist beyond the HTS and how they manifest on charts.

Ultimately, the goal is not to 'predict' but to read their reactions and thoughts and 'respond' accordingly.

Furthermore, beyond these 'responses', it becomes possible to make predictions that increase the odds of winning, even if they are not absolute and immutable laws.

So, this book explains in an easy-to-understand way how to understand technical analysis and how to represent it through charts.

If you understand everything explained in this book, you probably won't need to look at any other books on technical analysis.

The people who make up this market are me and the readers of this book.

That's why when everyone gets excited about a rise, there's a sudden surge, and when it falls, fear breeds fear, leading to a strong plunge.

(Omitted) What gives you confidence in your own thinking, what allows you to hold on to the stocks you have bought, and what allows you to cope when things don't go according to your scenario, comes from a solid study of stock investment.

--- [Part 1.

[What is stock investment?]

Stocks are like meeting people and living your own life.

Even the author who is writing this now should not be 100% sure.

You have to doubt yourself and think about why that is so before you come to a conclusion.

If you don't know, you'll be taken advantage of.

And if you believe it carelessly, you could lose everything.

Vision is 'the invisible thing between the eyebrows'.

Unless you ask 'why' and ponder it, you will never be able to come up with an answer for yourself.

Only then can you realize it and get used to it.

But if you tell this story to someone who hasn't experienced that moment of worry, they might think it's so obvious and trivial and just brush it off.

So, even if you read many books, you end up missing out on all the important words, and this vicious cycle repeats itself.

I hope you will think deeply about and understand the words in this book.

--- [Part 2.

How do stocks move?]

I, too, have looked at many books on the market to study fundamental analysis.

However, it was confusing because it always only listed rigid formulas and included a lot of theoretical content that was not actually necessary.

So, through this opportunity, I wanted to show how fundamental analysis interacts with each other in stock investment, how the big picture flows, and how it can be utilized in practice.

However, I believe that it can serve as a guide to help you navigate the fog of the stock market (although not everything) by helping you get to where you need to go without getting lost, like the faint light of a lighthouse in the distance.

As people become more knowledgeable and skilled in the stock market, I've seen them move away from fundamental analysis, only to eventually hit a wall and become frustrated.

If you always strengthen your foundation of fundamental analysis and never forget it, you will be able to overcome the obstacles that will come one day more easily than anyone else.

--- [Part 4.

Understanding the company is the beginning of investment]

Technical analysis isn't about finding secrets or winning big. It's about understanding the countless investors who exist beyond the HTS and how they manifest on charts.

Ultimately, the goal is not to 'predict' but to read their reactions and thoughts and 'respond' accordingly.

Furthermore, beyond these 'responses', it becomes possible to make predictions that increase the odds of winning, even if they are not absolute and immutable laws.

So, this book explains in an easy-to-understand way how to understand technical analysis and how to represent it through charts.

If you understand everything explained in this book, you probably won't need to look at any other books on technical analysis.

--- [Part 5.

[Technical analysis is a must in the stock market]

[Technical analysis is a must in the stock market]

Publisher's Review

All the knowledge about stock investing, organized in a practical way without unnecessary details - learn only what you need for real-world use!

Many people jump into stocks thinking they are easy.

When you first start investing and your account starts to grow, your confidence doubles.

Then, when they fail, they become frustrated and end up making increasingly risky investments.

Books that teach you how to invest in stocks warn against this type of investment and tell you to follow their secret methods.

Of course, studying is essential to succeed in stock investment.

But there is no need to look any longer at books that explain difficult and complex formulas as if they contain secrets.

What makes this book different from other stock investment books is that it is helpful in practice.

The author has won awards in real investment competitions more than 12 times.

This means that it is strong in real-world situations.

Hearing proper investment methods from an author with such a strong track record in real-world investing will be one of the most valuable experiences of your investing life.

Before studying stock investment, you must have a solid foundation.

The author also reached his current position after much trial and error.

In order to build a solid foundation, it is also necessary to know basic concepts and terminology.

However, the author says that these terms are used only because they are commonly covered in other books, and are not important in practice.

As the author says, in real life, we need methods that can be applied in real life.

Theory doesn't matter.

What matters is practice!

Anyone can invest in stocks, but not everyone can succeed!

Stock investing is a game of probability.

To win this game, you need to analyze and understand it properly and ensure stability.

If this is not done properly, your money may end up as worthless scraps of paper.

For this to happen, solid study must be supported.

But you can't just study through books.

You need to be able to get a feel for the direction of the market by experiencing it firsthand.

In this respect, the author suggests a method that best suits the term "practical investment."

The author, who was an ordinary office worker, achieved a 1,000% return in just six months and became a full-time investor.

However, there were also times when I jumped into the stock market without any basic knowledge and experienced great failure.

This book reveals all the methods the author personally experienced and discovered to restore his profitability.

The author's investment methods, based on his own personal experience, can be applied immediately in real-world situations and will guide you on the most useful path to successful investing.

The know-how of winning over 12 real-world profit competitions has been incorporated into this book!

The author, a winner of the Real-Life Return Investment Competition more than 12 times, presents investment techniques that can be applied immediately in real-life situations.

The author has tasted the best returns and also kicked the can.

Based on his own experience, he presents readers with a proper method to avoid trial and error.

The methods the author presents are easy.

But it won't be easy to follow along.

This is because it is a method that requires abandoning pride, being patient, and building a solid foundation of one's own skills.

Let's embark on the path to becoming a stock expert, guided by the author who combines theory and practice.

[Absolute knowledge of real investment 1.

[The True Face of the Stock Market] explains the stock market so that you can fully understand it before you start investing.

It allows you to understand the stock market without being caught up in illusions, to understand your own investment capabilities, and to develop your own response strategy through explanations of the market's moving factors.

It also explains how to use HTS, which can be used successfully if you know it inside and out, just like your own body, in order to invest in stocks.

It also briefly explains the tools essential for real-world investing so that they can be used immediately in real-world situations.

[Practical Investment Absolute Knowledge 2.

[How to Understand Stocks] explains fundamental analysis for stock investment.

From corporate analysis to how to read financial statements, this book focuses on explaining only the essentials you need to know to invest in stocks.

If you listen to the author's explanation, you will get a clear idea of the company you are considering buying.

[Absolute knowledge of real investment 3.

[Everything is Hidden in the Charts] explains technical analysis for stock investment.

It covers essential technical analysis concepts, including candlestick patterns, support and resistance, moving averages, and other auxiliary indicators that you must see on the chart.

Of course, the author says that concepts or theories are not important.

We explain all the concepts so that you can understand them at a glance just by looking at the chart, and only cover the essentials.

If you look at the chart after hearing the author's explanation, everything will make sense.

[Practical Investment Absolute Knowledge 4.

[Technical Analysis and Fundamental Analysis Applications] explains the techniques actually used by William O'Neil and Warren Buffett.

You don't have to use the same methods as them.

I could just use it as a way to broaden my investment horizons.

[Appendix_ Upgraded Real Trading Secret Techniques] introduces the 120-day downward trading technique and gap trading technique, which are the techniques that have enabled the author to achieve the highest returns, as well as trading methods that serve as a guide to successful investment.

He also kindly explains the investment mindset he has honed.

There is no need to follow the author's investment mindset.

However, the author's advice will be of great help in establishing your own solid investment mindset.

In [Vocal's Investment Column], which is interspersed throughout the text, the author shares his experiences from the field in a vivid voice.

Hearing the author's real-world investment experiences directly will provide direct lessons for my own investing.

Living up to his title as a winner of over 12 real-world investment competitions, the author presents investment methods that can be applied perfectly in real life, with no unnecessary details.

There are many books that explain the rules of stock investment.

However, if you want to learn investment methods that can actually be put to use right away, the book [Absolute Knowledge for Practical Investment] is enough.

The author's explanation of stock investment methods that can be applied immediately in real life is easy.

However, it is the most effective way to deal with stock investment, which is never easy.

Stock investment is easy, yet not easy. This book, [Absolute Knowledge for Practical Investment], contains the path to success.

Many people jump into stocks thinking they are easy.

When you first start investing and your account starts to grow, your confidence doubles.

Then, when they fail, they become frustrated and end up making increasingly risky investments.

Books that teach you how to invest in stocks warn against this type of investment and tell you to follow their secret methods.

Of course, studying is essential to succeed in stock investment.

But there is no need to look any longer at books that explain difficult and complex formulas as if they contain secrets.

What makes this book different from other stock investment books is that it is helpful in practice.

The author has won awards in real investment competitions more than 12 times.

This means that it is strong in real-world situations.

Hearing proper investment methods from an author with such a strong track record in real-world investing will be one of the most valuable experiences of your investing life.

Before studying stock investment, you must have a solid foundation.

The author also reached his current position after much trial and error.

In order to build a solid foundation, it is also necessary to know basic concepts and terminology.

However, the author says that these terms are used only because they are commonly covered in other books, and are not important in practice.

As the author says, in real life, we need methods that can be applied in real life.

Theory doesn't matter.

What matters is practice!

Anyone can invest in stocks, but not everyone can succeed!

Stock investing is a game of probability.

To win this game, you need to analyze and understand it properly and ensure stability.

If this is not done properly, your money may end up as worthless scraps of paper.

For this to happen, solid study must be supported.

But you can't just study through books.

You need to be able to get a feel for the direction of the market by experiencing it firsthand.

In this respect, the author suggests a method that best suits the term "practical investment."

The author, who was an ordinary office worker, achieved a 1,000% return in just six months and became a full-time investor.

However, there were also times when I jumped into the stock market without any basic knowledge and experienced great failure.

This book reveals all the methods the author personally experienced and discovered to restore his profitability.

The author's investment methods, based on his own personal experience, can be applied immediately in real-world situations and will guide you on the most useful path to successful investing.

The know-how of winning over 12 real-world profit competitions has been incorporated into this book!

The author, a winner of the Real-Life Return Investment Competition more than 12 times, presents investment techniques that can be applied immediately in real-life situations.

The author has tasted the best returns and also kicked the can.

Based on his own experience, he presents readers with a proper method to avoid trial and error.

The methods the author presents are easy.

But it won't be easy to follow along.

This is because it is a method that requires abandoning pride, being patient, and building a solid foundation of one's own skills.

Let's embark on the path to becoming a stock expert, guided by the author who combines theory and practice.

[Absolute knowledge of real investment 1.

[The True Face of the Stock Market] explains the stock market so that you can fully understand it before you start investing.

It allows you to understand the stock market without being caught up in illusions, to understand your own investment capabilities, and to develop your own response strategy through explanations of the market's moving factors.

It also explains how to use HTS, which can be used successfully if you know it inside and out, just like your own body, in order to invest in stocks.

It also briefly explains the tools essential for real-world investing so that they can be used immediately in real-world situations.

[Practical Investment Absolute Knowledge 2.

[How to Understand Stocks] explains fundamental analysis for stock investment.

From corporate analysis to how to read financial statements, this book focuses on explaining only the essentials you need to know to invest in stocks.

If you listen to the author's explanation, you will get a clear idea of the company you are considering buying.

[Absolute knowledge of real investment 3.

[Everything is Hidden in the Charts] explains technical analysis for stock investment.

It covers essential technical analysis concepts, including candlestick patterns, support and resistance, moving averages, and other auxiliary indicators that you must see on the chart.

Of course, the author says that concepts or theories are not important.

We explain all the concepts so that you can understand them at a glance just by looking at the chart, and only cover the essentials.

If you look at the chart after hearing the author's explanation, everything will make sense.

[Practical Investment Absolute Knowledge 4.

[Technical Analysis and Fundamental Analysis Applications] explains the techniques actually used by William O'Neil and Warren Buffett.

You don't have to use the same methods as them.

I could just use it as a way to broaden my investment horizons.

[Appendix_ Upgraded Real Trading Secret Techniques] introduces the 120-day downward trading technique and gap trading technique, which are the techniques that have enabled the author to achieve the highest returns, as well as trading methods that serve as a guide to successful investment.

He also kindly explains the investment mindset he has honed.

There is no need to follow the author's investment mindset.

However, the author's advice will be of great help in establishing your own solid investment mindset.

In [Vocal's Investment Column], which is interspersed throughout the text, the author shares his experiences from the field in a vivid voice.

Hearing the author's real-world investment experiences directly will provide direct lessons for my own investing.

Living up to his title as a winner of over 12 real-world investment competitions, the author presents investment methods that can be applied perfectly in real life, with no unnecessary details.

There are many books that explain the rules of stock investment.

However, if you want to learn investment methods that can actually be put to use right away, the book [Absolute Knowledge for Practical Investment] is enough.

The author's explanation of stock investment methods that can be applied immediately in real life is easy.

However, it is the most effective way to deal with stock investment, which is never easy.

Stock investment is easy, yet not easy. This book, [Absolute Knowledge for Practical Investment], contains the path to success.

GOODS SPECIFICS

- Date of issue: February 25, 2014

- Page count, weight, size: 472 pages | 946g | 172*245*30mm

- ISBN13: 9788991998872

- ISBN10: 8991998879

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)