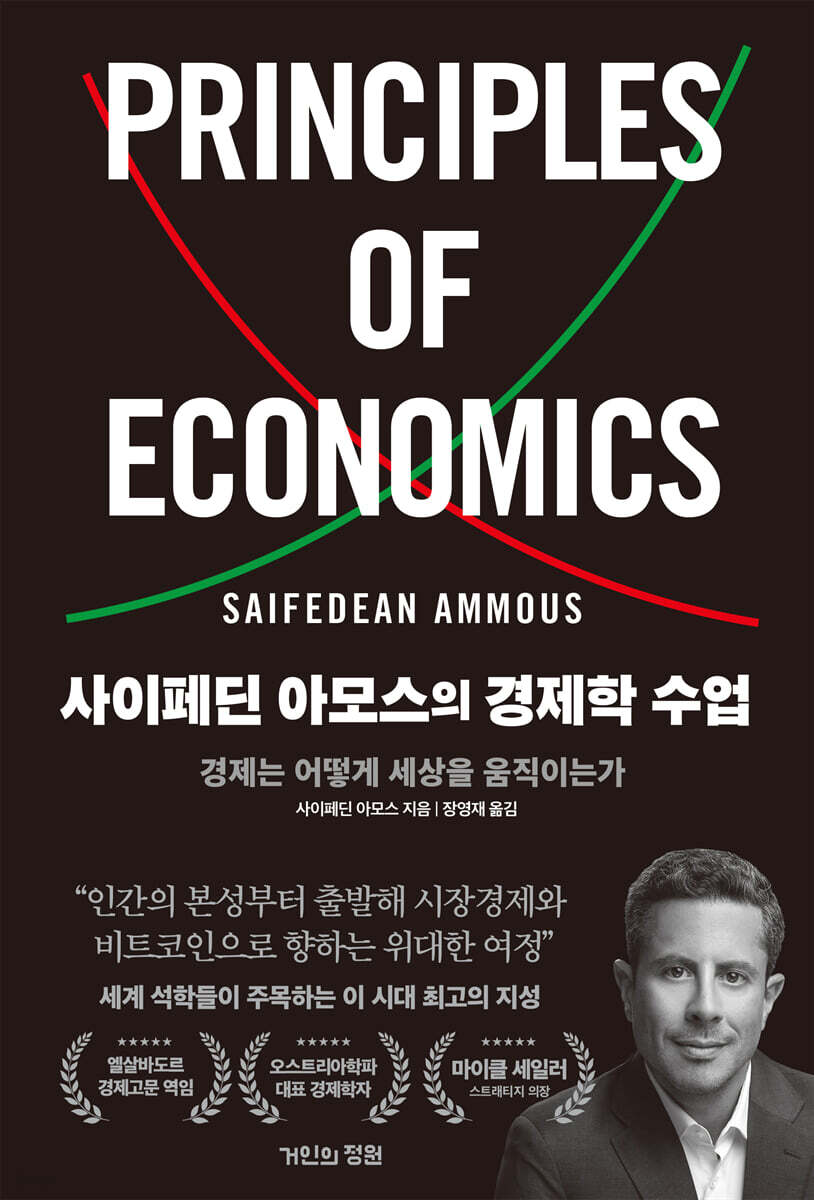

Saifeddin Amos's Economics Class

|

Description

Book Introduction

Starting from human nature and market economy

The Great Journey to Bitcoin

The greatest intellectual of this era, drawing the attention of world scholars

A masterpiece that encapsulates the thoughts of Saifeddin Amos.

* His works have been published in 39 languages worldwide, and he is the leading authority on Bitcoin. *

* El Salvador's economic advisor, an Austrian School master drawing attention from the global financial community *

* The scholar who became the philosophical foundation of Michael Shaler, the strategy that shook Wall Street *

There is a saying that the economy makes me poor, but economics makes me rich.

Whether we are aware of it or not, everyone lives every moment of every day in the world of the 'economy', making 'economic decisions'.

This is why you absolutely must know ‘economics.’

Saifeddine Amos, who is attracting attention in the global economics community, explains various economic elements such as value, time, labor, ownership, transaction, and money through "Saifeddine Amos's Economics," which is a collection of his thoughts.

It clearly explains what the scarcest resource for humans is, how transactions are conducted, and what role money plays in the economy.

In particular, it provides a new perspective on the economy by critically criticizing points that mainstream economics has overlooked so far.

Bitcoin, a phenomenon that mainstream economics, which emphasized the importance of controlling the economy by managing fiat currency, found unacceptable or unwilling to accept, is now gradually emerging as a core part of the global economy. The ideas of Saifedine Amos, a leading figure in the Austrian School of Economics who is attracting attention as an alternative to mainstream economics, offer a guide to understanding today's economic phenomena.

This book, which concisely provides the most useful and actionable insights on economic thinking, will serve as an excellent guide to leading an 'economically' life.

The Great Journey to Bitcoin

The greatest intellectual of this era, drawing the attention of world scholars

A masterpiece that encapsulates the thoughts of Saifeddin Amos.

* His works have been published in 39 languages worldwide, and he is the leading authority on Bitcoin. *

* El Salvador's economic advisor, an Austrian School master drawing attention from the global financial community *

* The scholar who became the philosophical foundation of Michael Shaler, the strategy that shook Wall Street *

There is a saying that the economy makes me poor, but economics makes me rich.

Whether we are aware of it or not, everyone lives every moment of every day in the world of the 'economy', making 'economic decisions'.

This is why you absolutely must know ‘economics.’

Saifeddine Amos, who is attracting attention in the global economics community, explains various economic elements such as value, time, labor, ownership, transaction, and money through "Saifeddine Amos's Economics," which is a collection of his thoughts.

It clearly explains what the scarcest resource for humans is, how transactions are conducted, and what role money plays in the economy.

In particular, it provides a new perspective on the economy by critically criticizing points that mainstream economics has overlooked so far.

Bitcoin, a phenomenon that mainstream economics, which emphasized the importance of controlling the economy by managing fiat currency, found unacceptable or unwilling to accept, is now gradually emerging as a core part of the global economy. The ideas of Saifedine Amos, a leading figure in the Austrian School of Economics who is attracting attention as an alternative to mainstream economics, offer a guide to understanding today's economic phenomena.

This book, which concisely provides the most useful and actionable insights on economic thinking, will serve as an excellent guide to leading an 'economically' life.

- You can preview some of the book's contents.

Preview

index

introduction

Part 1 Basics

Chapter 1 Human Behavior

Action, Purpose, and Reason

Economic Analysis

quantitative analysis

Contrasting approaches

Chapter 2 Value

Utility and value

Valuation: Ordinal and Cardinal Numbers

Value and Price

Free exchange

Determinants of value

marginal theory

marginal utility

Law of Diminishing Marginal Utility

Valuation based on the lowest value use

Water-Diamond Paradox

Chapter 3 Time

Ultimate resource

opportunity cost

material abundance

Simon's Bet

Time preference

Save time

economic behavior

Part 2 Economy

Chapter 4 Labor

Labor and Leisure

production

labor productivity

unemployment

Will things ever end?

Is labor exploitative?

Chapter 5 ownership

Scarcity and ownership

Types of property

self-ownership

The Importance of Ownership

Chapter 6 Capital

Extension of production structure

saving

Increased productivity

high cost of capital

Capital and time preference

Savings Fallacy

The limits of capital

Chapter 7 Technology

Technology and Labor

Technology and productivity

Technological Innovation and Entrepreneurship

software

Ownership of ideas

Chapter 8 Energy and Power

Energy in human history

Energy abundance

Scarcity of power

Power to replace hydrocarbons

Energy and freedom

3rd part market order

Chapter 9 Transactions

subjective valuation

absolute advantage

comparative advantage

Specialization and division of labor

Market size

Chapter 10 Currency

Problems that money solves

Saleability

Sales potential over time

Why one currency?

Currency and the State

The value of money

The singularity of currency

How much currency should there be?

Chapter 11 Market

consumer goods market

balance

producer goods market

Saving within the market order

consumer sovereignty

Contrast of approaches

Chapter 12: Capitalism

capital market

Capitalism is not about managers, it's about entrepreneurs.

Profit and Loss

A problem of economic calculation

Modern economics and computation

The Effects of Entrepreneurial Investment

Part 4: Monetary Economics

Chapter 13 Time Preference

Time preference and money

Time preference and savings

Time Preference and Civilization

Time Preference and Bitcoin

Chapter 14 Credit and Finance

Finance

credit

Product Credit

interest rate

Can interest be eliminated?

Chapter 15: Expansion of Currency

Distribution credit

Mises's typology of money

business cycle

Business Cycle in a Diagram

Central planning of capital markets

Part 5 Civilization

Chapter 16 Violence

non-aggression principle

government coercion

The basis of government violence

Rationality in Economics

Chapter 17 Defense

defense market

The Market of Law and Order

State monopoly on defense and justice

Types of failure of state monopolies

Free market in defense

Chapter 18 Civilization

The cost of civilization

Apology for Civilization

Statutory Slavery as an Alternative to Civilization

The triumph of reason

References / Appendix / Index / Notes

Part 1 Basics

Chapter 1 Human Behavior

Action, Purpose, and Reason

Economic Analysis

quantitative analysis

Contrasting approaches

Chapter 2 Value

Utility and value

Valuation: Ordinal and Cardinal Numbers

Value and Price

Free exchange

Determinants of value

marginal theory

marginal utility

Law of Diminishing Marginal Utility

Valuation based on the lowest value use

Water-Diamond Paradox

Chapter 3 Time

Ultimate resource

opportunity cost

material abundance

Simon's Bet

Time preference

Save time

economic behavior

Part 2 Economy

Chapter 4 Labor

Labor and Leisure

production

labor productivity

unemployment

Will things ever end?

Is labor exploitative?

Chapter 5 ownership

Scarcity and ownership

Types of property

self-ownership

The Importance of Ownership

Chapter 6 Capital

Extension of production structure

saving

Increased productivity

high cost of capital

Capital and time preference

Savings Fallacy

The limits of capital

Chapter 7 Technology

Technology and Labor

Technology and productivity

Technological Innovation and Entrepreneurship

software

Ownership of ideas

Chapter 8 Energy and Power

Energy in human history

Energy abundance

Scarcity of power

Power to replace hydrocarbons

Energy and freedom

3rd part market order

Chapter 9 Transactions

subjective valuation

absolute advantage

comparative advantage

Specialization and division of labor

Market size

Chapter 10 Currency

Problems that money solves

Saleability

Sales potential over time

Why one currency?

Currency and the State

The value of money

The singularity of currency

How much currency should there be?

Chapter 11 Market

consumer goods market

balance

producer goods market

Saving within the market order

consumer sovereignty

Contrast of approaches

Chapter 12: Capitalism

capital market

Capitalism is not about managers, it's about entrepreneurs.

Profit and Loss

A problem of economic calculation

Modern economics and computation

The Effects of Entrepreneurial Investment

Part 4: Monetary Economics

Chapter 13 Time Preference

Time preference and money

Time preference and savings

Time Preference and Civilization

Time Preference and Bitcoin

Chapter 14 Credit and Finance

Finance

credit

Product Credit

interest rate

Can interest be eliminated?

Chapter 15: Expansion of Currency

Distribution credit

Mises's typology of money

business cycle

Business Cycle in a Diagram

Central planning of capital markets

Part 5 Civilization

Chapter 16 Violence

non-aggression principle

government coercion

The basis of government violence

Rationality in Economics

Chapter 17 Defense

defense market

The Market of Law and Order

State monopoly on defense and justice

Types of failure of state monopolies

Free market in defense

Chapter 18 Civilization

The cost of civilization

Apology for Civilization

Statutory Slavery as an Alternative to Civilization

The triumph of reason

References / Appendix / Index / Notes

Detailed image

Into the book

The tradition of Mises and the Austrian School understands and defines human behavior as rational action.

In this context, the word 'rational' does not mean the correctness of an action according to objective standards or the appropriateness of an action to achieve the goals of the actor.

It also does not offer a moral judgment on behavior.

Rather, rational here is defined as the product of careful reason.

Humans act rationally whenever they reason and act.

Whether such actions serve one's own ends and win the approval of other parties evaluating the actions is irrelevant to 'rationality' as understood and defined by Mises.

---From "Action, Purpose, and Reason"

Beyond the problems of measurement and experimentation, a more serious logical problem with quantitative approaches to economics is that they conflate measurable factors with the causal factors that shape the world around us.

Quantitative methods for establishing relationships between collective measurements regard the aggregate as the driving force of causality, simply because of its measurable nature and consistency.

While in natural science, regularities and constants are discovered through repeated open experiments, empirical economists simply infer laws based on the assumption that their data are regular.

---From "Quantitative Analysis"

As discussed earlier, economic scarcity is ultimately a scarcity of human time.

Then we can also understand that saving time is central to human frugal behavior.

That is, we strive to increase the amount and subjective value of the time given on Earth.

The lack of time means that humans are constantly trying to save time so that they can use it in the most satisfying or valuable way.

---From "Saving Time"

The limit to capital investment is the current opportunity cost of current goods.

The high opportunity cost of capital that comes with owning too much capital can never be exhausted.

The reason why no more productive ships are built than the Annelis Ileana is because potential investors value other investment opportunities or spending more than taking the risk of building such a large vessel.

As more capital accumulates, the productivity of our time increases, and as the value of time increases, the value of leisure also increases, increasing the cost of sacrificing leisure for labor and capital.

---From "The Limits of Capital"

The belief that resources are scarce and limited misunderstands the nature of scarcity, a core concept in economics.

The absolute amount of all raw materials on Earth is too large for humans to measure or understand, so there can be no practical limit to how much humans can produce.

We have barely scratched the surface of the Earth in search of the minerals we need.

The more you explore and dig deeper, the more resources you can find.

The only realistic and practical limit to the quantity of any resource is the human time invested in its production.

Because human time is the only scarce resource.

---From "Abundance of Energy"

One of the most common misconceptions in economics is confusing value with price.

The mere fact that people voluntarily participate in exchanges shows that such thinking is flawed.

A person who pays $10 for a good does not value the good at $10.

We value it at more than $10 because we are willing to give up $10 in exchange for the good.

On the other hand, it is clear that the seller will value the goods at less than $10.

Because they are willing to give up goods for $10.

---From "Subjective Value Assessment"

The process by which money emerges and is selected in the market can be understood entirely in terms of human behavior.

There is no need to invoke coercive authority to select or manufacture a monetary medium.

Money, like all goods, is given value by appearing in the market and providing utility to people.

This assertion is supported by historical and empirical evidence that clearly demonstrates that monetary media precede government monetary mandates.

Gold's role as a global currency was not imposed by any government authority.

Gold acquired the role of currency in the market, and any government that wanted to run its country successfully had to accept gold as its currency in the market.

In this context, the word 'rational' does not mean the correctness of an action according to objective standards or the appropriateness of an action to achieve the goals of the actor.

It also does not offer a moral judgment on behavior.

Rather, rational here is defined as the product of careful reason.

Humans act rationally whenever they reason and act.

Whether such actions serve one's own ends and win the approval of other parties evaluating the actions is irrelevant to 'rationality' as understood and defined by Mises.

---From "Action, Purpose, and Reason"

Beyond the problems of measurement and experimentation, a more serious logical problem with quantitative approaches to economics is that they conflate measurable factors with the causal factors that shape the world around us.

Quantitative methods for establishing relationships between collective measurements regard the aggregate as the driving force of causality, simply because of its measurable nature and consistency.

While in natural science, regularities and constants are discovered through repeated open experiments, empirical economists simply infer laws based on the assumption that their data are regular.

---From "Quantitative Analysis"

As discussed earlier, economic scarcity is ultimately a scarcity of human time.

Then we can also understand that saving time is central to human frugal behavior.

That is, we strive to increase the amount and subjective value of the time given on Earth.

The lack of time means that humans are constantly trying to save time so that they can use it in the most satisfying or valuable way.

---From "Saving Time"

The limit to capital investment is the current opportunity cost of current goods.

The high opportunity cost of capital that comes with owning too much capital can never be exhausted.

The reason why no more productive ships are built than the Annelis Ileana is because potential investors value other investment opportunities or spending more than taking the risk of building such a large vessel.

As more capital accumulates, the productivity of our time increases, and as the value of time increases, the value of leisure also increases, increasing the cost of sacrificing leisure for labor and capital.

---From "The Limits of Capital"

The belief that resources are scarce and limited misunderstands the nature of scarcity, a core concept in economics.

The absolute amount of all raw materials on Earth is too large for humans to measure or understand, so there can be no practical limit to how much humans can produce.

We have barely scratched the surface of the Earth in search of the minerals we need.

The more you explore and dig deeper, the more resources you can find.

The only realistic and practical limit to the quantity of any resource is the human time invested in its production.

Because human time is the only scarce resource.

---From "Abundance of Energy"

One of the most common misconceptions in economics is confusing value with price.

The mere fact that people voluntarily participate in exchanges shows that such thinking is flawed.

A person who pays $10 for a good does not value the good at $10.

We value it at more than $10 because we are willing to give up $10 in exchange for the good.

On the other hand, it is clear that the seller will value the goods at less than $10.

Because they are willing to give up goods for $10.

---From "Subjective Value Assessment"

The process by which money emerges and is selected in the market can be understood entirely in terms of human behavior.

There is no need to invoke coercive authority to select or manufacture a monetary medium.

Money, like all goods, is given value by appearing in the market and providing utility to people.

This assertion is supported by historical and empirical evidence that clearly demonstrates that monetary media precede government monetary mandates.

Gold's role as a global currency was not imposed by any government authority.

Gold acquired the role of currency in the market, and any government that wanted to run its country successfully had to accept gold as its currency in the market.

---From "Money and the State"

Publisher's Review

A new era requires a new economics!

Bitcoin's rise as a financial hub and the rapidly changing international landscape

The most complete textbook for understanding today's economy

“A great intellectual achievement that will lead the advancement of humanity.”

Jesús Huerta de Soto (Professor of Political Economy, University of Rey Juan Carlos)

The algorithmic economy that moves the world

Humans inevitably live within the algorithm of the economy.

An individual's desires, expectations, and fears are input as variables like data, and output as results in the form of prices, transactions, and resource distribution in the computational device called the market.

The economy determines the rise and fall of nations, companies, and individuals, and drives the evolution of civilization.

Therefore, understanding 'economics' is no different from understanding the world, and an individual's wealth depends on how well he or she understands 'economics'.

This is why you must know economics.

The problem is that these algorithms cannot be perfectly diagrammed.

Even the value of a specific good varies depending on an individual's subjective judgment.

Like the laws of natural science, the economy has too many variables to be definitively determined through assumptions and experiments, making it difficult to create perfect formulas and models.

The emergence of Bitcoin, a variable that changes the economic landscape.

Saifeddine Amos makes this point in his book, "The Economics of Saifeddine Amos."

He has criticized mainstream economics for its excessive reliance on statistics and mathematical models.

Based on the Austrian School perspective, he argues that Keynesian stimulus policies stem from the illusion that the economy can be designed and controlled like physics, and that they ignore human subjective value judgments, time preferences, and uncertainty.

The reason Saifeddin Amos is noteworthy is because his ideas offer many insights into understanding today's global economy.

Bitcoin, once denounced by many as a "scam," has now become a undeniable asset in the global economy.

Its market capitalization rivals that of big tech companies like Microsoft and Apple, and it has even launched a physical ETF, making it eligible for inclusion in US retirement plans.

It's clear why so many economists and media outlets have failed to correctly predict Bitcoin's growth and have criticized it.

A completely new form of currency has emerged, one that has never existed before, and attempts have been made to analyze the phenomenon using mainstream economics, which has been in the spotlight until now.

From a mainstream economics perspective, Bitcoin was an unacceptable and undesirable phenomenon.

Saifeddin Amos has become a thought leader in the Bitcoin community and has emerged as a globally recognized scholar by providing a near-perfect explanation of Bitcoin's phenomenon from an Austrian School economic theoretical perspective.

And this is where the value of this book lies.

A New Perspective on Currency and Economics in an Age of Upheaval

Saifeddin Amos does not view the economy as a simple predictive model in an age of constant uncertainty and variables.

It emphasizes subjective human behavior and introduces key economic concepts such as price, time, scarcity, opportunity cost, money, markets, and inflation.

Through examples such as the classic novel Robinson Crusoe and government policies occurring in the real world, we gradually expand our thinking to include the role of money, capital accumulation and production structure, market failure, and even the meaning of non-state currencies such as Bitcoin.

In particular, the part that points out the negative effects of the central bank's monopoly on money supply and the debt-based monetary structure is the highlight of this book.

He demonstrates, with various arguments and logic, that fiat money, rather than providing people with the stability they need to prepare for future uncertainty, turns them into indebted slaves to the government's financial cartel.

This book, which penetrates the essence of money and economics today, will serve as a significant milestone for many readers seeking independent and free economic thinking.

Bitcoin's rise as a financial hub and the rapidly changing international landscape

The most complete textbook for understanding today's economy

“A great intellectual achievement that will lead the advancement of humanity.”

Jesús Huerta de Soto (Professor of Political Economy, University of Rey Juan Carlos)

The algorithmic economy that moves the world

Humans inevitably live within the algorithm of the economy.

An individual's desires, expectations, and fears are input as variables like data, and output as results in the form of prices, transactions, and resource distribution in the computational device called the market.

The economy determines the rise and fall of nations, companies, and individuals, and drives the evolution of civilization.

Therefore, understanding 'economics' is no different from understanding the world, and an individual's wealth depends on how well he or she understands 'economics'.

This is why you must know economics.

The problem is that these algorithms cannot be perfectly diagrammed.

Even the value of a specific good varies depending on an individual's subjective judgment.

Like the laws of natural science, the economy has too many variables to be definitively determined through assumptions and experiments, making it difficult to create perfect formulas and models.

The emergence of Bitcoin, a variable that changes the economic landscape.

Saifeddine Amos makes this point in his book, "The Economics of Saifeddine Amos."

He has criticized mainstream economics for its excessive reliance on statistics and mathematical models.

Based on the Austrian School perspective, he argues that Keynesian stimulus policies stem from the illusion that the economy can be designed and controlled like physics, and that they ignore human subjective value judgments, time preferences, and uncertainty.

The reason Saifeddin Amos is noteworthy is because his ideas offer many insights into understanding today's global economy.

Bitcoin, once denounced by many as a "scam," has now become a undeniable asset in the global economy.

Its market capitalization rivals that of big tech companies like Microsoft and Apple, and it has even launched a physical ETF, making it eligible for inclusion in US retirement plans.

It's clear why so many economists and media outlets have failed to correctly predict Bitcoin's growth and have criticized it.

A completely new form of currency has emerged, one that has never existed before, and attempts have been made to analyze the phenomenon using mainstream economics, which has been in the spotlight until now.

From a mainstream economics perspective, Bitcoin was an unacceptable and undesirable phenomenon.

Saifeddin Amos has become a thought leader in the Bitcoin community and has emerged as a globally recognized scholar by providing a near-perfect explanation of Bitcoin's phenomenon from an Austrian School economic theoretical perspective.

And this is where the value of this book lies.

A New Perspective on Currency and Economics in an Age of Upheaval

Saifeddin Amos does not view the economy as a simple predictive model in an age of constant uncertainty and variables.

It emphasizes subjective human behavior and introduces key economic concepts such as price, time, scarcity, opportunity cost, money, markets, and inflation.

Through examples such as the classic novel Robinson Crusoe and government policies occurring in the real world, we gradually expand our thinking to include the role of money, capital accumulation and production structure, market failure, and even the meaning of non-state currencies such as Bitcoin.

In particular, the part that points out the negative effects of the central bank's monopoly on money supply and the debt-based monetary structure is the highlight of this book.

He demonstrates, with various arguments and logic, that fiat money, rather than providing people with the stability they need to prepare for future uncertainty, turns them into indebted slaves to the government's financial cartel.

This book, which penetrates the essence of money and economics today, will serve as a significant milestone for many readers seeking independent and free economic thinking.

GOODS SPECIFICS

- Date of issue: August 29, 2025

- Page count, weight, size: 520 pages | 954g | 152*225*32mm

- ISBN13: 9791193869277

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)