Bowl of wealth

|

Description

Book Introduction

“How much wealth do you want?”

Find and fill your own vessel of wealth to change your reality.

From an ordinary office worker to an ‘ETF expert’

What my rich salaried dad says

Investment Philosophy and How to Design Real Wealth

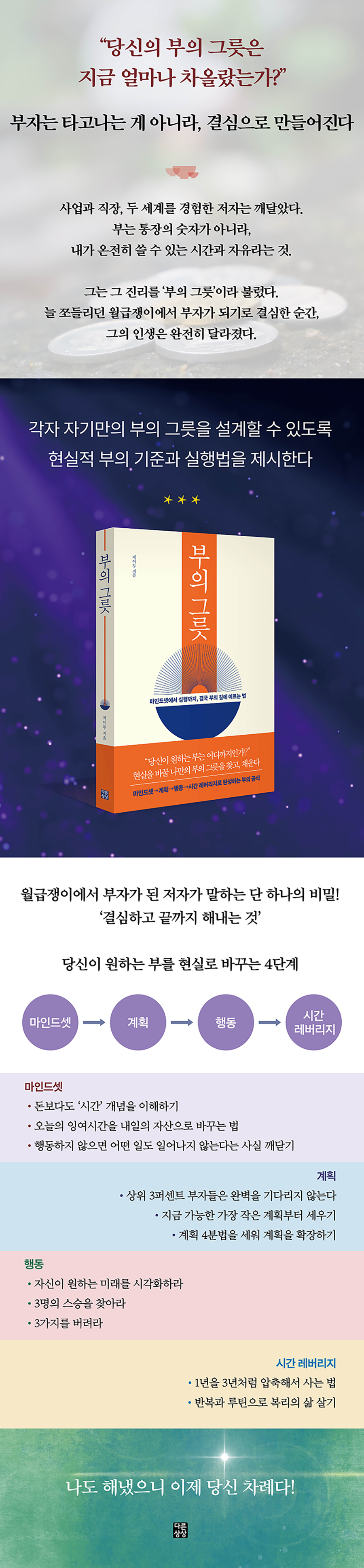

Rich people are not born rich, they are made rich.

The author says that his life changed the moment he decided to become rich from a salaryman who was always struggling.

It proves that anyone can grow their wealth pot and make it a reality through a four-step practice that begins with determination, continues with mindset, planning, action, and leveraging time.

In his early 20s, he started a restaurant business with a burning passion and devoted himself to serving customers. One day, he realized something.

Even if sales are high, the only thing that business leaves behind is exhaustion and anxiety.

That realization led him to marriage and a stable job, and his 12 years in the pharmaceutical company's sales team were more than just a simple job; it was a time to learn firsthand how to 'create results.'

During the day, I worked at hospitals and pharmacies to secure contracts, and at night and on weekends, I divided my days between studying investment and writing.

His experience of navigating the two worlds of business and work gave him an insight.

Wealth is not simply the sum of money you have, but also the time you have to spend and the freedom to choose.

He summarized this realization in the simple yet powerful phrase, “vessel of wealth.”

The 'vessel of wealth' is not a grand theory.

This is a product of practical experience, having experienced the limits of the profit structure in the restaurant industry and designing automatic income within the routine of an office worker.

The successes and failures he experienced in stock investing sometimes pushed him to the edge of a cliff, but through each bounce back, he learned why some choices lead to losses and others to wealth.

What these experiences have created isn't a fancy financial formula, but a practical guide that connects small everyday decisions, from how to spend your time to setting long-term goals.

Eventually, he succeeded in designing an investment plan that would generate a second salary, and was finally able to embark on the journey to creating a true 'vessel of wealth'.

We often understand wealth as having 'more'.

But the author asks:

If someone earns a significant amount of money each month but spends most of their days earning it, is that person truly wealthy? True wealth isn't found in comparisons and show-offs.

It's about designing your own life and having the time and freedom to maintain that life.

This book provides practical strategies based on that philosophy.

Beyond investment methodology, it also includes how to discern which choices are traps, how to turn failure into assets, and techniques for designing a work-life balance.

In other words, it is a guide that simultaneously develops the skills to increase money and an attitude to improve the quality of life.

Finally, this book is by no means a guide for a select few.

As the author demonstrates, even ordinary office workers can build their own pot of wealth by accumulating small accomplishments.

If you don't act now, nothing will happen.

But one small step can change your day, and each day's changes can add up to change the trajectory of your life.

Is your bowl empty right now, or has it already begun to fill with something?

《The Vessel of Wealth》 will be a reliable companion on your journey to find the answer to that question.

Find and fill your own vessel of wealth to change your reality.

From an ordinary office worker to an ‘ETF expert’

What my rich salaried dad says

Investment Philosophy and How to Design Real Wealth

Rich people are not born rich, they are made rich.

The author says that his life changed the moment he decided to become rich from a salaryman who was always struggling.

It proves that anyone can grow their wealth pot and make it a reality through a four-step practice that begins with determination, continues with mindset, planning, action, and leveraging time.

In his early 20s, he started a restaurant business with a burning passion and devoted himself to serving customers. One day, he realized something.

Even if sales are high, the only thing that business leaves behind is exhaustion and anxiety.

That realization led him to marriage and a stable job, and his 12 years in the pharmaceutical company's sales team were more than just a simple job; it was a time to learn firsthand how to 'create results.'

During the day, I worked at hospitals and pharmacies to secure contracts, and at night and on weekends, I divided my days between studying investment and writing.

His experience of navigating the two worlds of business and work gave him an insight.

Wealth is not simply the sum of money you have, but also the time you have to spend and the freedom to choose.

He summarized this realization in the simple yet powerful phrase, “vessel of wealth.”

The 'vessel of wealth' is not a grand theory.

This is a product of practical experience, having experienced the limits of the profit structure in the restaurant industry and designing automatic income within the routine of an office worker.

The successes and failures he experienced in stock investing sometimes pushed him to the edge of a cliff, but through each bounce back, he learned why some choices lead to losses and others to wealth.

What these experiences have created isn't a fancy financial formula, but a practical guide that connects small everyday decisions, from how to spend your time to setting long-term goals.

Eventually, he succeeded in designing an investment plan that would generate a second salary, and was finally able to embark on the journey to creating a true 'vessel of wealth'.

We often understand wealth as having 'more'.

But the author asks:

If someone earns a significant amount of money each month but spends most of their days earning it, is that person truly wealthy? True wealth isn't found in comparisons and show-offs.

It's about designing your own life and having the time and freedom to maintain that life.

This book provides practical strategies based on that philosophy.

Beyond investment methodology, it also includes how to discern which choices are traps, how to turn failure into assets, and techniques for designing a work-life balance.

In other words, it is a guide that simultaneously develops the skills to increase money and an attitude to improve the quality of life.

Finally, this book is by no means a guide for a select few.

As the author demonstrates, even ordinary office workers can build their own pot of wealth by accumulating small accomplishments.

If you don't act now, nothing will happen.

But one small step can change your day, and each day's changes can add up to change the trajectory of your life.

Is your bowl empty right now, or has it already begun to fill with something?

《The Vessel of Wealth》 will be a reliable companion on your journey to find the answer to that question.

- You can preview some of the book's contents.

Preview

index

Get started and design your own path to wealth.

Part 1: Mindset: Shift to a Money-Cultivating Mindset

Step 1.

Wealth comes to those who understand 'time'.

Step 2.

The Law of Surplus Time

Step 3.

Memento mori is needed

Step 4.

How much wealth do you want?

Step 5.

There is no wealth without action.

Step 6.

How to Get on the Virtuous Cycle of Wealth

Step 7.

Why do rich people live simply?

Step 8.

The Secret Weapon of the Rich: The Power of Forgetting

Step 9.

Conditions for climbing the ladder of wealth

Step 10.

The more you wish for it, the more likely it is to come true.

Part 2: Wealth Never Comes by Chance

Step 1.

What the 3 percent who made it rich did

Step 2.

A small plan is enough

Step 3.

Expand your plan

Part 3: Action: The moment you hesitate, it disappears.

Step 1.

There is a second chance in life.

Step 2.

Design my life expectations

Step 3.

Attitude determines wealth

Step 4.

Find three teachers

Step 5.

Don't hesitate, act now.

Step 6.

Throw away three things

Step 7.

The power of routine is strong

Step 8.

Draw a vivid picture of the wealth you desire.

Step 9.

How to Avoid the Wealth Trap

Part 4: Time Leverage: Live One Year Like Three

Step 1.

How would my life change if I lived one year like three years?

Step 2.

Two things rich people have in common

Step 3.

The 5 Stages of the Wealth Cycle

Part 5: The Vessel of Wealth: If You Only Pursue Money, Unhappiness Is Inevitable

There is no concept higher than health.

Every day is a festival

My own philosophy is my best weapon.

In the end, anyone can become rich.

Part 1: Mindset: Shift to a Money-Cultivating Mindset

Step 1.

Wealth comes to those who understand 'time'.

Step 2.

The Law of Surplus Time

Step 3.

Memento mori is needed

Step 4.

How much wealth do you want?

Step 5.

There is no wealth without action.

Step 6.

How to Get on the Virtuous Cycle of Wealth

Step 7.

Why do rich people live simply?

Step 8.

The Secret Weapon of the Rich: The Power of Forgetting

Step 9.

Conditions for climbing the ladder of wealth

Step 10.

The more you wish for it, the more likely it is to come true.

Part 2: Wealth Never Comes by Chance

Step 1.

What the 3 percent who made it rich did

Step 2.

A small plan is enough

Step 3.

Expand your plan

Part 3: Action: The moment you hesitate, it disappears.

Step 1.

There is a second chance in life.

Step 2.

Design my life expectations

Step 3.

Attitude determines wealth

Step 4.

Find three teachers

Step 5.

Don't hesitate, act now.

Step 6.

Throw away three things

Step 7.

The power of routine is strong

Step 8.

Draw a vivid picture of the wealth you desire.

Step 9.

How to Avoid the Wealth Trap

Part 4: Time Leverage: Live One Year Like Three

Step 1.

How would my life change if I lived one year like three years?

Step 2.

Two things rich people have in common

Step 3.

The 5 Stages of the Wealth Cycle

Part 5: The Vessel of Wealth: If You Only Pursue Money, Unhappiness Is Inevitable

There is no concept higher than health.

Every day is a festival

My own philosophy is my best weapon.

In the end, anyone can become rich.

Detailed image

Into the book

Food requires a process.

Convenience store convenience foods can be made quickly in the microwave, but proper cooking takes time and effort.

The standards for wealth are also the same.

Wealth is not something that can be achieved instantly like instant food.

It must go through a process, and the most important salt in that process is 'time'.

If you understand time and accept the process, anyone can let go of excessive greed, enjoy the process, and set their own standards for wealth.

--- p.19 From “Wealth comes to those who understand ‘time’”

My coworker, Manager Kim, enjoys investing in stocks.

But he complains that he has never earned money every day.

The account is always in the red.

Every time you invest by picking thematic stocks that you are told not to do, stocks that are rising rapidly, and stocks that are brain-boggling, you fail.

I don't understand how people invest so recklessly.

When Manager Kim buys Sector A, Sector B rises dramatically.

And when you go to sector B, sector A rises again.

It is clear why Manager Kim has recurring bad forgetfulness symptoms.

He has no philosophy of his own about investing and no understanding of the fundamental principles.

Instead, the desire to make money quickly comes first.

Manager Kim relies solely on certain YouTubers' leading broadcasts and TV information, but by the time he accesses this information, its value has often already faded.

--- p.82-83 From “The Secret Weapon of the Rich, the Power of Forgetting”

Why are you still wandering, unable to find your way to wealth? The reason is simple.

Because we are just repeating the same method we have been using so far.

If you want to get on the road to wealth, you have to do the opposite.

The answer lies in the annoying things, the difficult things, the things you don't want to do, and the things you've never done before.

It is in encountering those unfamiliar challenges that your own vessel of wealth is created.

--- p.107 From “What the 3% Who Achieved Wealth Did”

We must aim for long-term planning from the beginning.

If you set a long-term goal and reach it a little faster, you can live with a grateful heart. Even if you reach your goal slowly, you can think of it as a process of becoming rich and live happily.

Spend only what you need now, and let the rest grow steadily.

As time passes, your assets will grow at an accelerating rate like compound interest, but you must be patient until that moment.

Even if your assets grow slowly, you must love yourself as your inner self and philosophy become stronger in the process.

In this way, the process itself becomes a path to creating great wealth.

--- p.107 From "Expand the Plan"

After I made my first plan, I decided to visualize it.

I wrote down my goals in visible places like my laptop, cell phone, car, books, and reading stand and visualized them every day.

And in the morning, I read my goals 10 times to strengthen my resolve.

What was the result? Was it effective, or did it produce no change, contrary to expectations?

The effect was amazing.

80 percent of what was planned and visualized at the time was accomplished.

The reason visualization is important is because of focus.

--- p.178 From “Draw Vividly the Wealth I Desire”

Office workers commute to and from work by subway every day.

We board the subway for a short period of 30 minutes, or even for a long period of over an hour.

There are always 'subway zombies' there.

Everyone holds their cell phone in one hand, their heads bowed, absorbed in the world on the screen.

It's as if he can't stand being in a crowded room without being glued to his phone.

This is no different from Kids Cafe Zombie.

Without realizing the value of time, they chose smartphones as a means of escaping reality.

But the deeper we dive into the smartphone world, the more our time disappears without a trace.

I only remember feeling engrossed in something, but what remains in my mind is an inexplicable feeling of unease.

--- p.200-201 From “How would my life change if I lived one year like three years?”

My current income structure is diverse, including salary, stock investments, dividends, publishing royalties, and ad posts.

In the past, I relied solely on my salary and stock investments, but now I understand the five stages of the wealth cycle and apply them to my life. This has led to successful publication and a stable investment return structure.

Thanks to this, the acceleration of wealth is accelerating.

What I've realized from getting here is that there is a set path to wealth.

These are the so-called five stages of the wealth cycle.

Anyone can enter the path to wealth by taking each step.

As you progress through each stage of the wealth cycle, your chances of achieving wealth increase.

And when we reach the stage of time leverage, we can live the life of the 0.1 percent, the life of the rich.

Convenience store convenience foods can be made quickly in the microwave, but proper cooking takes time and effort.

The standards for wealth are also the same.

Wealth is not something that can be achieved instantly like instant food.

It must go through a process, and the most important salt in that process is 'time'.

If you understand time and accept the process, anyone can let go of excessive greed, enjoy the process, and set their own standards for wealth.

--- p.19 From “Wealth comes to those who understand ‘time’”

My coworker, Manager Kim, enjoys investing in stocks.

But he complains that he has never earned money every day.

The account is always in the red.

Every time you invest by picking thematic stocks that you are told not to do, stocks that are rising rapidly, and stocks that are brain-boggling, you fail.

I don't understand how people invest so recklessly.

When Manager Kim buys Sector A, Sector B rises dramatically.

And when you go to sector B, sector A rises again.

It is clear why Manager Kim has recurring bad forgetfulness symptoms.

He has no philosophy of his own about investing and no understanding of the fundamental principles.

Instead, the desire to make money quickly comes first.

Manager Kim relies solely on certain YouTubers' leading broadcasts and TV information, but by the time he accesses this information, its value has often already faded.

--- p.82-83 From “The Secret Weapon of the Rich, the Power of Forgetting”

Why are you still wandering, unable to find your way to wealth? The reason is simple.

Because we are just repeating the same method we have been using so far.

If you want to get on the road to wealth, you have to do the opposite.

The answer lies in the annoying things, the difficult things, the things you don't want to do, and the things you've never done before.

It is in encountering those unfamiliar challenges that your own vessel of wealth is created.

--- p.107 From “What the 3% Who Achieved Wealth Did”

We must aim for long-term planning from the beginning.

If you set a long-term goal and reach it a little faster, you can live with a grateful heart. Even if you reach your goal slowly, you can think of it as a process of becoming rich and live happily.

Spend only what you need now, and let the rest grow steadily.

As time passes, your assets will grow at an accelerating rate like compound interest, but you must be patient until that moment.

Even if your assets grow slowly, you must love yourself as your inner self and philosophy become stronger in the process.

In this way, the process itself becomes a path to creating great wealth.

--- p.107 From "Expand the Plan"

After I made my first plan, I decided to visualize it.

I wrote down my goals in visible places like my laptop, cell phone, car, books, and reading stand and visualized them every day.

And in the morning, I read my goals 10 times to strengthen my resolve.

What was the result? Was it effective, or did it produce no change, contrary to expectations?

The effect was amazing.

80 percent of what was planned and visualized at the time was accomplished.

The reason visualization is important is because of focus.

--- p.178 From “Draw Vividly the Wealth I Desire”

Office workers commute to and from work by subway every day.

We board the subway for a short period of 30 minutes, or even for a long period of over an hour.

There are always 'subway zombies' there.

Everyone holds their cell phone in one hand, their heads bowed, absorbed in the world on the screen.

It's as if he can't stand being in a crowded room without being glued to his phone.

This is no different from Kids Cafe Zombie.

Without realizing the value of time, they chose smartphones as a means of escaping reality.

But the deeper we dive into the smartphone world, the more our time disappears without a trace.

I only remember feeling engrossed in something, but what remains in my mind is an inexplicable feeling of unease.

--- p.200-201 From “How would my life change if I lived one year like three years?”

My current income structure is diverse, including salary, stock investments, dividends, publishing royalties, and ad posts.

In the past, I relied solely on my salary and stock investments, but now I understand the five stages of the wealth cycle and apply them to my life. This has led to successful publication and a stable investment return structure.

Thanks to this, the acceleration of wealth is accelerating.

What I've realized from getting here is that there is a set path to wealth.

These are the so-called five stages of the wealth cycle.

Anyone can enter the path to wealth by taking each step.

As you progress through each stage of the wealth cycle, your chances of achieving wealth increase.

And when we reach the stage of time leverage, we can live the life of the 0.1 percent, the life of the rich.

--- p.229 From “The 5 Stages of the Wealth Cycle”

Publisher's Review

A vessel of true wealth that fills life, not just money.

Realistic wealth standards and implementation methods that anyone can achieve

The author in his youth was more sincere than anyone else.

I spent most of my day at work, believing that if I worked hard enough, I would eventually become rich.

But the reality was different.

Even though sales increased, my peace of mind decreased.

At that time, for the first time, he thought about 'living as the master of time' rather than 'having a lot or little money'.

After getting married, I became a salaried worker, but the stability of being a salaried worker did not last long.

Is a life lived by following other people's goals truly a success?

That question led him down a completely different path.

Instead of quitting his job, he set his sights on a "second paycheck."

Office worker by day, investor by night.

That's how the double life began.

I experienced great failure in stock investment, but I learned something through that process.

The essence of wealth is not money, but the ability to manage time.

The confidence that he could create his own system within the company's framework set him free.

At age 39, he finally succeeded in generating income outside of his salary.

He became rich without quitting his job.

The real turning point came from an unexpected daily life.

One weekend, he found himself at a kids' cafe where he took his child.

I thought silently among the parents who were killing time with their children glued to their smartphones.

“I won’t just waste this time.” From that day on, the kids’ cafe became his office.

While his children played, he read, wrote, and designed his investment routine.

A year later, he published three books and demonstrated with his own body the power of compression, how to live one year as if it were three.

Of course, he did not build a solid vessel of wealth from the beginning.

Although he was a successful salesman, he always hesitated when faced with grand plans.

Then one day I asked myself:

“Did I live today according to my own will?” I realized that the company’s goals could not necessarily be my life’s goals.

From then on, he found ways to build his wealth without leaving the company.

Instead of quitting my job, I used the company and regained control of my time.

《The Vessel of Wealth》 is a book born from that experience.

Wealth, he says, is not achieved through grand success, but through the accumulation of small choices and the freedom to control your time rather than chasing money.

Rather than showcasing flashy financial tips, this book ultimately asks the question:

“How much of my time am I using as I wish?”

If you're someone who sighs on the subway every morning or someone who just lets time pass by after work, this book will help you recapture that time.

It's not the size of your wealth, but the direction of it that changes your life. That simple shift.

What does your wealth vessel look like now?

This question will make you pause and move at the same time.

“Design your own wealth routine!”

Mindset → Plan → Action → Time Leverage

A realistic wealth formula in four steps

There are days when I can't wait for payday.

The moment the money passes through my bank account, I feel a sense of emptiness, and even though I worked hard all day, I feel like my life is not mine.

《The Bowl of Wealth》 starts from that very emotion.

The author worked as a restaurant owner in his 20s and as a pharmaceutical salesperson in his 30s.

Having experienced both the business and the workplace, he has come to one conclusion.

Wealth comes not from the amount of money you have, but from the power to manage your time.

That realization is the starting point of this book.

Part 1, ‘Mindset’, deals with changing your mindset.

The author asserts that “wealth comes to those who understand time.”

What the rich have in common is that they prioritize time over money.

They know how to turn today's spare time into tomorrow's assets.

And the starting proposition is 'there is no wealth without action'.

Also, understanding the question, "Why do rich people live simply?" can change the direction of your life.

Ultimately, if you don't take action, nothing will change, and the more desperate you are, the more solid your vessel of wealth will become.

This realization naturally leads to the theme of Part 2: Planning.

In Part 2, “The Plan,” the author says:

“Wealth doesn’t come by accident.” The top 3 percent of wealthy people don’t wait for perfection.

They make the 'smallest plan possible now' and evolve the plan as they put it into practice.

If you dream big from the beginning, fear will come first, but small plans lead to action, and action leads to achievement.

The four-part plan he proposes—dividing your actions into short-term, medium-term, and long-term plans—builds wealth like compound interest.

For a plan like this to be realized, 'action' is ultimately necessary.

In Part 3, “Action,” he says, “The moment you hesitate, the opportunity is gone.”

I've seen countless people miss out on opportunities because they waited for the perfect timing.

Those who act learn from their failures, but those who hesitate learn nothing.

He emphasizes a life with a 'second chance'.

Failure is not an end, it is a process.

A positive attitude, a consistent routine, and the imagination to envision the future you desire? These are the three principles of action.

But actions alone have their limits.

Even if you live the same day, some people get three times the results.

The difference is 'time compression'.

In Part 4, 'Time Leverage', he talks about techniques for manipulating time.

One day, while I was busy with childcare and work, I found myself wasting time at a kids' cafe, and that was the turning point.

From then on, he turned his free time into learning time.

I wrote, read books, and designed an investment routine.

A year later, he published three books and realized “how to live one year as if it were three years.”

This experience extends to 'Time Management of the Rich'.

The rich are not those who save time, but those who increase the density of time.

Their days are simple, but they grow like a compound interest through repetition and routine.

Only those who have effectively managed their time need a true philosophy of wealth.

So the last chapter ends with 'philosophy'.

Part 5, “The Vessel of Wealth,” is the conclusion and culmination of the book.

He says.

“If you only chase money, unhappiness is inevitable.” After 12 years of successful work at a pharmaceutical company, he realized this one day.

That he was losing his own life to grow the company's wealth.

So he started earning time instead of a salary.

Thanks to the automatic income that comes in every month even after leaving my job, I regained control of my time and redefine the true meaning of wealth.

Ultimately, wealth is about creating a ‘vessel’ that suits you.

It's not about having a big bowl, it's about having enough wealth to handle.

It's not the person who has a lot of money who is happy, but the person who is free and satisfied who is rich.

This book is not simply about how to become rich, but about how to actively redesign your life.

The author, a salaried worker and rich dad, strongly conveys the fact that only those who prioritize time over money and meaning over success can become truly rich.

Realistic wealth standards and implementation methods that anyone can achieve

The author in his youth was more sincere than anyone else.

I spent most of my day at work, believing that if I worked hard enough, I would eventually become rich.

But the reality was different.

Even though sales increased, my peace of mind decreased.

At that time, for the first time, he thought about 'living as the master of time' rather than 'having a lot or little money'.

After getting married, I became a salaried worker, but the stability of being a salaried worker did not last long.

Is a life lived by following other people's goals truly a success?

That question led him down a completely different path.

Instead of quitting his job, he set his sights on a "second paycheck."

Office worker by day, investor by night.

That's how the double life began.

I experienced great failure in stock investment, but I learned something through that process.

The essence of wealth is not money, but the ability to manage time.

The confidence that he could create his own system within the company's framework set him free.

At age 39, he finally succeeded in generating income outside of his salary.

He became rich without quitting his job.

The real turning point came from an unexpected daily life.

One weekend, he found himself at a kids' cafe where he took his child.

I thought silently among the parents who were killing time with their children glued to their smartphones.

“I won’t just waste this time.” From that day on, the kids’ cafe became his office.

While his children played, he read, wrote, and designed his investment routine.

A year later, he published three books and demonstrated with his own body the power of compression, how to live one year as if it were three.

Of course, he did not build a solid vessel of wealth from the beginning.

Although he was a successful salesman, he always hesitated when faced with grand plans.

Then one day I asked myself:

“Did I live today according to my own will?” I realized that the company’s goals could not necessarily be my life’s goals.

From then on, he found ways to build his wealth without leaving the company.

Instead of quitting my job, I used the company and regained control of my time.

《The Vessel of Wealth》 is a book born from that experience.

Wealth, he says, is not achieved through grand success, but through the accumulation of small choices and the freedom to control your time rather than chasing money.

Rather than showcasing flashy financial tips, this book ultimately asks the question:

“How much of my time am I using as I wish?”

If you're someone who sighs on the subway every morning or someone who just lets time pass by after work, this book will help you recapture that time.

It's not the size of your wealth, but the direction of it that changes your life. That simple shift.

What does your wealth vessel look like now?

This question will make you pause and move at the same time.

“Design your own wealth routine!”

Mindset → Plan → Action → Time Leverage

A realistic wealth formula in four steps

There are days when I can't wait for payday.

The moment the money passes through my bank account, I feel a sense of emptiness, and even though I worked hard all day, I feel like my life is not mine.

《The Bowl of Wealth》 starts from that very emotion.

The author worked as a restaurant owner in his 20s and as a pharmaceutical salesperson in his 30s.

Having experienced both the business and the workplace, he has come to one conclusion.

Wealth comes not from the amount of money you have, but from the power to manage your time.

That realization is the starting point of this book.

Part 1, ‘Mindset’, deals with changing your mindset.

The author asserts that “wealth comes to those who understand time.”

What the rich have in common is that they prioritize time over money.

They know how to turn today's spare time into tomorrow's assets.

And the starting proposition is 'there is no wealth without action'.

Also, understanding the question, "Why do rich people live simply?" can change the direction of your life.

Ultimately, if you don't take action, nothing will change, and the more desperate you are, the more solid your vessel of wealth will become.

This realization naturally leads to the theme of Part 2: Planning.

In Part 2, “The Plan,” the author says:

“Wealth doesn’t come by accident.” The top 3 percent of wealthy people don’t wait for perfection.

They make the 'smallest plan possible now' and evolve the plan as they put it into practice.

If you dream big from the beginning, fear will come first, but small plans lead to action, and action leads to achievement.

The four-part plan he proposes—dividing your actions into short-term, medium-term, and long-term plans—builds wealth like compound interest.

For a plan like this to be realized, 'action' is ultimately necessary.

In Part 3, “Action,” he says, “The moment you hesitate, the opportunity is gone.”

I've seen countless people miss out on opportunities because they waited for the perfect timing.

Those who act learn from their failures, but those who hesitate learn nothing.

He emphasizes a life with a 'second chance'.

Failure is not an end, it is a process.

A positive attitude, a consistent routine, and the imagination to envision the future you desire? These are the three principles of action.

But actions alone have their limits.

Even if you live the same day, some people get three times the results.

The difference is 'time compression'.

In Part 4, 'Time Leverage', he talks about techniques for manipulating time.

One day, while I was busy with childcare and work, I found myself wasting time at a kids' cafe, and that was the turning point.

From then on, he turned his free time into learning time.

I wrote, read books, and designed an investment routine.

A year later, he published three books and realized “how to live one year as if it were three years.”

This experience extends to 'Time Management of the Rich'.

The rich are not those who save time, but those who increase the density of time.

Their days are simple, but they grow like a compound interest through repetition and routine.

Only those who have effectively managed their time need a true philosophy of wealth.

So the last chapter ends with 'philosophy'.

Part 5, “The Vessel of Wealth,” is the conclusion and culmination of the book.

He says.

“If you only chase money, unhappiness is inevitable.” After 12 years of successful work at a pharmaceutical company, he realized this one day.

That he was losing his own life to grow the company's wealth.

So he started earning time instead of a salary.

Thanks to the automatic income that comes in every month even after leaving my job, I regained control of my time and redefine the true meaning of wealth.

Ultimately, wealth is about creating a ‘vessel’ that suits you.

It's not about having a big bowl, it's about having enough wealth to handle.

It's not the person who has a lot of money who is happy, but the person who is free and satisfied who is rich.

This book is not simply about how to become rich, but about how to actively redesign your life.

The author, a salaried worker and rich dad, strongly conveys the fact that only those who prioritize time over money and meaning over success can become truly rich.

GOODS SPECIFICS

- Date of issue: November 20, 2025

- Page count, weight, size: 260 pages | 145*210*16mm

- ISBN13: 9791193808412

- ISBN10: 1193808413

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)