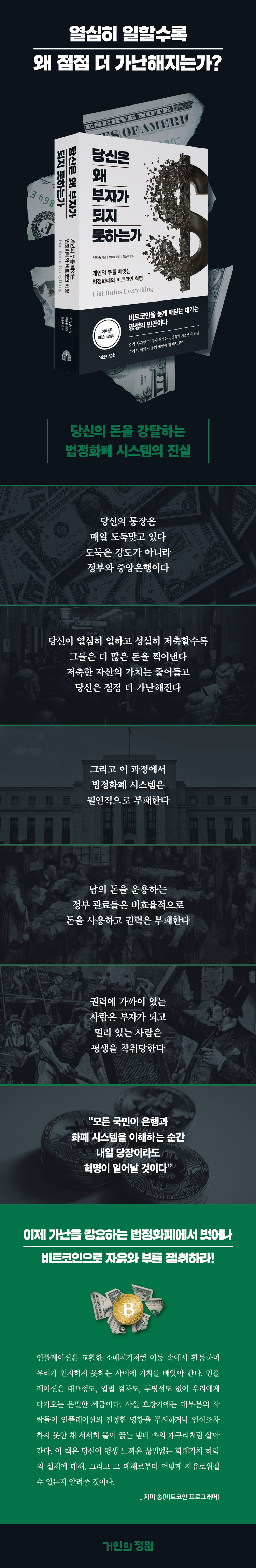

Why You Can't Get Rich

|

Description

Book Introduction

“Why am I poor even though I work hard?”

The Truth About the Fiat Money System That's Stealing Your Money

Escape from designed poverty and achieve freedom and wealth.

☆ Includes 1-month Bitsaving pass ☆

People work hard and save to become rich.

However, few people feel that they are being rewarded for their efforts.

Real estate prices and inflation are rising rapidly, and the purchasing power of your savings is declining over time.

Why aren't you rich? It's not just a lack of effort.

Today's financial system was designed from the ground up to protect the power of the privileged and rob ordinary people.

The value of my assets has nothing to do with how much effort and time I put into them.

It is determined by how much fiat currency the government and central bank print and what policies they implement.

In this process, fiat money inevitably becomes corrupted.

Bureaucrats who use public money, not their own, for the public good, not private gain, do not utilize capital efficiently but rather act according to political objectives.

Those who are close to this system are unfairly benefited, while those who are not are thoroughly exploited.

The inconvenient truth is that the money issued under the pretext of public interest actually comes from the pockets of people far removed from this legal tender system.

A more serious problem is that fiat money goes beyond the corruption of capital and destroys civilization.

This book delves into the reality that the fiat currency system exploits individuals, hinders the development of social morality and technology, and destroys civilization.

And while it reveals the "invisible design" of fiat currencies that are destroying society, it also shows that Bitcoin, which is shaking up the global financial system, is the only solution to destroying the evils of fiat currencies.

The Truth About the Fiat Money System That's Stealing Your Money

Escape from designed poverty and achieve freedom and wealth.

☆ Includes 1-month Bitsaving pass ☆

People work hard and save to become rich.

However, few people feel that they are being rewarded for their efforts.

Real estate prices and inflation are rising rapidly, and the purchasing power of your savings is declining over time.

Why aren't you rich? It's not just a lack of effort.

Today's financial system was designed from the ground up to protect the power of the privileged and rob ordinary people.

The value of my assets has nothing to do with how much effort and time I put into them.

It is determined by how much fiat currency the government and central bank print and what policies they implement.

In this process, fiat money inevitably becomes corrupted.

Bureaucrats who use public money, not their own, for the public good, not private gain, do not utilize capital efficiently but rather act according to political objectives.

Those who are close to this system are unfairly benefited, while those who are not are thoroughly exploited.

The inconvenient truth is that the money issued under the pretext of public interest actually comes from the pockets of people far removed from this legal tender system.

A more serious problem is that fiat money goes beyond the corruption of capital and destroys civilization.

This book delves into the reality that the fiat currency system exploits individuals, hinders the development of social morality and technology, and destroys civilization.

And while it reveals the "invisible design" of fiat currencies that are destroying society, it also shows that Bitcoin, which is shaking up the global financial system, is the only solution to destroying the evils of fiat currencies.

- You can preview some of the book's contents.

Preview

index

Recommendation

Introduction: The Hidden Truth About Fiat Currency

Part 1: Fiat Money is the Devil

Chapter 1: Fiat Money Undermining Civilization

Chapter 2: Fiat Money: The Money That Stole Dreams and Changed the Meaning of Life

Chapter 3: Legal Tenderness That Undermines Morality

Chapter 4: Fiat Money Undermines Faith

Part 2: Fiat money destroys individual incentives

Chapter 5: The Treadmill of Fiat Currency

Chapter 6: The Land of Land Seekers

Chapter 7: Fiat Money Destroying Marriage

Chapter 8: Fiat Money That Destroys Families

Chapter 9: Fiat Money Destroys Human Relationships

Chapter 10: The Triumph of Postmodern Investment

Fiat money destroys the incentives of the three-tiered organization.

Chapter 11: The Impact of Fiat Currency on Businesses

Chapter 12: The New Money-Sucking Magnet: Startups

Chapter 13: Fiat Money Undermines the Value of Work

Chapter 14: Fiat Money Creates a Technological Monopoly

Chapter 15: The First Altcoin, Airline Mileage

Chapter 16: Fiat Money: The Decline of Charity

Chapter 17: Fiat Money Devaluing Universities

Fiat money destroys national incentives

Chapter 18: Fiat Money Encourages National Corruption

Chapter 19: The State that Exploits Corporations

Chapter 20: Taxes are a play for government revenue.

Chapter 21: The False Reality of Real Estate

Chapter 22: Fiat Money Politicizes Everything

Part 5: Fiat Money Destroys the Incentives of Globalization

Chapter 23: Fiat Money: The Ruin of Globalization

Chapter 24: Fiat Money Ruins Science

Chapter 25: Wind and Solar Are the Altcoins of Energy

Chapter 26: Fiat Money Corrupts Art

Chapter 27: Fiat Money Corrupts Knowledge

Part 6: The End of the Fiat Monetary System

Chapter 28: Fiat Money Must Be Destroyed

Chapter 29: The Delusion and Naivety of Altcoins

Chapter 30: How Altcoin Advocates Use Bitcoin for Rent-Seeking

Chapter 31: The Wrong Lesson of Pizza Day

Conclusion: Values, Self-Sovereignty, and a Future of Hope

Conclusion: Values, Self-Sovereignty, and a Future of Hope

Acknowledgements

annotation

Introduction: The Hidden Truth About Fiat Currency

Part 1: Fiat Money is the Devil

Chapter 1: Fiat Money Undermining Civilization

Chapter 2: Fiat Money: The Money That Stole Dreams and Changed the Meaning of Life

Chapter 3: Legal Tenderness That Undermines Morality

Chapter 4: Fiat Money Undermines Faith

Part 2: Fiat money destroys individual incentives

Chapter 5: The Treadmill of Fiat Currency

Chapter 6: The Land of Land Seekers

Chapter 7: Fiat Money Destroying Marriage

Chapter 8: Fiat Money That Destroys Families

Chapter 9: Fiat Money Destroys Human Relationships

Chapter 10: The Triumph of Postmodern Investment

Fiat money destroys the incentives of the three-tiered organization.

Chapter 11: The Impact of Fiat Currency on Businesses

Chapter 12: The New Money-Sucking Magnet: Startups

Chapter 13: Fiat Money Undermines the Value of Work

Chapter 14: Fiat Money Creates a Technological Monopoly

Chapter 15: The First Altcoin, Airline Mileage

Chapter 16: Fiat Money: The Decline of Charity

Chapter 17: Fiat Money Devaluing Universities

Fiat money destroys national incentives

Chapter 18: Fiat Money Encourages National Corruption

Chapter 19: The State that Exploits Corporations

Chapter 20: Taxes are a play for government revenue.

Chapter 21: The False Reality of Real Estate

Chapter 22: Fiat Money Politicizes Everything

Part 5: Fiat Money Destroys the Incentives of Globalization

Chapter 23: Fiat Money: The Ruin of Globalization

Chapter 24: Fiat Money Ruins Science

Chapter 25: Wind and Solar Are the Altcoins of Energy

Chapter 26: Fiat Money Corrupts Art

Chapter 27: Fiat Money Corrupts Knowledge

Part 6: The End of the Fiat Monetary System

Chapter 28: Fiat Money Must Be Destroyed

Chapter 29: The Delusion and Naivety of Altcoins

Chapter 30: How Altcoin Advocates Use Bitcoin for Rent-Seeking

Chapter 31: The Wrong Lesson of Pizza Day

Conclusion: Values, Self-Sovereignty, and a Future of Hope

Conclusion: Values, Self-Sovereignty, and a Future of Hope

Acknowledgements

annotation

Detailed image

Into the book

Such indiscriminate spending is possible because it is not the government itself, but bureaucrats acting on behalf of the government who are responsible for procuring products and services.

These bureaucrats, acting on behalf of the government, are empowered to spend government funds, a system that is prone to abuse.

The reason is simple.

Because bureaucrats use other people's money, not their own, and for other people's benefit, not their own.

This results in a lack of incentive to trade efficiently, leading to misinvestment and waste.

--- p.30, from “Fiat Money and Distorted Incentives”

In a system where the government can print money, the people who benefit most are those who have first access to that money.

This phenomenon, known as the "Cantillon effect," explains why the rich get richer without creating any special value.

For example, why do so many members of Congress become so incredibly wealthy after serving only a few terms?

Even though they only have a role to play in making laws.

--- p.33, from “The ‘Cantillon Effect’ that Weakens Meritocracy”

The reason there is such a lack of effective stores of value is because government economists and Keynesians have deliberately created it.

They believe that hoarding money through savings is not productive.

They believe that prosperity is achieved only when money circulates actively within the economy, and for this reason, they consider the velocity of money circulation a key indicator of economic health.

However, this perspective often fails to properly reflect economic stability and prosperity.

--- p.89, from “Why Do We Lack Savings?”

The proliferation of fiat money and the resulting inflation creates two powerful dynamics.

First, it injects a significant amount of money into the economy, and that money has to end up somewhere.

Second, the owners of this currency are driven by an instinctive desire to preserve their wealth in an environment where the currency's value is constantly declining.

Given the impressive returns and productivity of the stock market compared to other means of storing wealth, a significant portion of this newly issued money is bound to flow into the stock market.97 Since there is no opportunity cost for this inflow of funds, people chase dividends and yield, and dividends end up having little impact on returns.

--- p.153, from “Fiat Money and Postmodern Investment”

In a free market, the health of a listed company is measured by its stock price, but in a fiat economy, this indicator can be manipulated through share repurchases.

In fact, large corporations often use borrowed money to buy back their own stock, thereby masking declining earnings and creating the illusion of growth.

Buying back shares replaces innovation, and for CEOs whose pay is tied to the stock price, this strategy is a far less risky and faster way to accumulate wealth than simply providing better products and services to the market.

--- p.175, from “Zombification of Large Corporations”

Governments can offer various benefits to win the support of diverse voters.

This includes everything from health care to food and pensions.

In fact, since the advent of fiat money, welfare benefits have become widespread worldwide.

Welfare is usually 'sold' to the public as a form of compassion, and is popular because of its perception of being 'free'.

But the hidden 'tax' of inflation is hardly even recognized, let alone considered a problem.

The problem with welfare is that the costs soon become so large that they become uncontrollable, like a black hole.

These bureaucrats, acting on behalf of the government, are empowered to spend government funds, a system that is prone to abuse.

The reason is simple.

Because bureaucrats use other people's money, not their own, and for other people's benefit, not their own.

This results in a lack of incentive to trade efficiently, leading to misinvestment and waste.

--- p.30, from “Fiat Money and Distorted Incentives”

In a system where the government can print money, the people who benefit most are those who have first access to that money.

This phenomenon, known as the "Cantillon effect," explains why the rich get richer without creating any special value.

For example, why do so many members of Congress become so incredibly wealthy after serving only a few terms?

Even though they only have a role to play in making laws.

--- p.33, from “The ‘Cantillon Effect’ that Weakens Meritocracy”

The reason there is such a lack of effective stores of value is because government economists and Keynesians have deliberately created it.

They believe that hoarding money through savings is not productive.

They believe that prosperity is achieved only when money circulates actively within the economy, and for this reason, they consider the velocity of money circulation a key indicator of economic health.

However, this perspective often fails to properly reflect economic stability and prosperity.

--- p.89, from “Why Do We Lack Savings?”

The proliferation of fiat money and the resulting inflation creates two powerful dynamics.

First, it injects a significant amount of money into the economy, and that money has to end up somewhere.

Second, the owners of this currency are driven by an instinctive desire to preserve their wealth in an environment where the currency's value is constantly declining.

Given the impressive returns and productivity of the stock market compared to other means of storing wealth, a significant portion of this newly issued money is bound to flow into the stock market.97 Since there is no opportunity cost for this inflow of funds, people chase dividends and yield, and dividends end up having little impact on returns.

--- p.153, from “Fiat Money and Postmodern Investment”

In a free market, the health of a listed company is measured by its stock price, but in a fiat economy, this indicator can be manipulated through share repurchases.

In fact, large corporations often use borrowed money to buy back their own stock, thereby masking declining earnings and creating the illusion of growth.

Buying back shares replaces innovation, and for CEOs whose pay is tied to the stock price, this strategy is a far less risky and faster way to accumulate wealth than simply providing better products and services to the market.

--- p.175, from “Zombification of Large Corporations”

Governments can offer various benefits to win the support of diverse voters.

This includes everything from health care to food and pensions.

In fact, since the advent of fiat money, welfare benefits have become widespread worldwide.

Welfare is usually 'sold' to the public as a form of compassion, and is popular because of its perception of being 'free'.

But the hidden 'tax' of inflation is hardly even recognized, let alone considered a problem.

The problem with welfare is that the costs soon become so large that they become uncontrollable, like a black hole.

--- p.261, from “Welfare Benefits”

Publisher's Review

“The moment when all citizens understand the banking and monetary system

“A revolution will happen tomorrow!”

The Truth About the Fiat Currency System: Only the Rich Get Richer

Inflation, the thief that steals your wealth

On the surface, the fiat currency system appears to be in good shape.

Because money works so well when we buy and sell things in our daily lives.

But the truth is different.

Governments and central banks are the controllers of the fiat currency system, holding the reins of the money supply and deciding when and how much money to inject.

This creates inflation, which subtly reduces the value of money and weakens the purchasing power of the public's savings.

During boom times, most people live like frogs in a pot of boiling water, ignoring or even unaware of the true impact of inflation.

Inflation is a secret tax that comes to us without representation, legislative process, or transparency.

The important thing is that the majority of people have no choice but to have their pockets emptied in the fiat currency system.

The real debtors of national debt are the citizens, but we don't realize that we are being robbed because the money in our bank accounts remains intact.

In other words, the new money 'issued' by the government is actually money 'stolen' from the public's accounts.

A fiat currency system that breeds capital inefficiency and political corruption

Fiat money inevitably leads to the politicization of the economy.

People try to achieve maximum efficiency when purchasing things.

We carefully consider the price, performance, durability, and even brand recognition.

But the government's budget doesn't work that way.

Bureaucrats who manage public money, not their own, make policy decisions based on their own comfort and political objectives rather than on the efficient use of capital.

Because the quicker you can access the newly supplied money, the more you benefit, this system inevitably leads to the politicization and corruption of the economy.

In fact, we constantly see cases where corporations collude with politicians to gain advantage by preemptively obtaining information, or where budgets in public services are being spent indiscriminately.

When capital is used inefficiently and the system is corrupt, the privileged class prints more money and promises more public services to maintain their power.

But more money only leads to more corruption.

And naturally, as money increases, the value of the money that individuals have saved through time and effort decreases.

Fiat money destroys all social incentives

The real problem with the fiat currency system is that it destroys every aspect of our lives, every positive aspect of humanity.

Within the fiat currency system, people become immoral and seek to stay close to the system and gain vested interests rather than doing things that actually benefit humanity.

Talented people want to work in finance and make money by just playing with numbers rather than developing innovative products.

Companies invest more resources in strengthening their market dominance by colluding with the government rather than innovating.

Above all, people who have no means to effectively store value and whose future is uncertain end up living an unsatisfactory life, focusing on the comfort of reality rather than ideal dreams.

A new store of value to protect your money

The lack of effective stores of value is a deliberate creation by governments and economists.

They believe that money should not be hoarded but should be actively circulating in the market.

Because it can justify expanding the government's powers.

Does this mean we are doomed to live as slaves, robbed forever? The author of this book asserts that Bitcoin is the only way to escape the fiat currency system and reclaim personal wealth.

Why is Bitcoin, once seen as a small egg thrown into a fiat currency system that seemed like a solid rock, growing in influence? Can Bitcoin truly dismantle the evils of fiat currency and restore wealth to individuals? This book will reveal the truth about the fiat currency system, which was designed to exploit you, and prove the value of Bitcoin, which can restore your path to wealth.

“A revolution will happen tomorrow!”

The Truth About the Fiat Currency System: Only the Rich Get Richer

Inflation, the thief that steals your wealth

On the surface, the fiat currency system appears to be in good shape.

Because money works so well when we buy and sell things in our daily lives.

But the truth is different.

Governments and central banks are the controllers of the fiat currency system, holding the reins of the money supply and deciding when and how much money to inject.

This creates inflation, which subtly reduces the value of money and weakens the purchasing power of the public's savings.

During boom times, most people live like frogs in a pot of boiling water, ignoring or even unaware of the true impact of inflation.

Inflation is a secret tax that comes to us without representation, legislative process, or transparency.

The important thing is that the majority of people have no choice but to have their pockets emptied in the fiat currency system.

The real debtors of national debt are the citizens, but we don't realize that we are being robbed because the money in our bank accounts remains intact.

In other words, the new money 'issued' by the government is actually money 'stolen' from the public's accounts.

A fiat currency system that breeds capital inefficiency and political corruption

Fiat money inevitably leads to the politicization of the economy.

People try to achieve maximum efficiency when purchasing things.

We carefully consider the price, performance, durability, and even brand recognition.

But the government's budget doesn't work that way.

Bureaucrats who manage public money, not their own, make policy decisions based on their own comfort and political objectives rather than on the efficient use of capital.

Because the quicker you can access the newly supplied money, the more you benefit, this system inevitably leads to the politicization and corruption of the economy.

In fact, we constantly see cases where corporations collude with politicians to gain advantage by preemptively obtaining information, or where budgets in public services are being spent indiscriminately.

When capital is used inefficiently and the system is corrupt, the privileged class prints more money and promises more public services to maintain their power.

But more money only leads to more corruption.

And naturally, as money increases, the value of the money that individuals have saved through time and effort decreases.

Fiat money destroys all social incentives

The real problem with the fiat currency system is that it destroys every aspect of our lives, every positive aspect of humanity.

Within the fiat currency system, people become immoral and seek to stay close to the system and gain vested interests rather than doing things that actually benefit humanity.

Talented people want to work in finance and make money by just playing with numbers rather than developing innovative products.

Companies invest more resources in strengthening their market dominance by colluding with the government rather than innovating.

Above all, people who have no means to effectively store value and whose future is uncertain end up living an unsatisfactory life, focusing on the comfort of reality rather than ideal dreams.

A new store of value to protect your money

The lack of effective stores of value is a deliberate creation by governments and economists.

They believe that money should not be hoarded but should be actively circulating in the market.

Because it can justify expanding the government's powers.

Does this mean we are doomed to live as slaves, robbed forever? The author of this book asserts that Bitcoin is the only way to escape the fiat currency system and reclaim personal wealth.

Why is Bitcoin, once seen as a small egg thrown into a fiat currency system that seemed like a solid rock, growing in influence? Can Bitcoin truly dismantle the evils of fiat currency and restore wealth to individuals? This book will reveal the truth about the fiat currency system, which was designed to exploit you, and prove the value of Bitcoin, which can restore your path to wealth.

GOODS SPECIFICS

- Date of issue: November 12, 2025

- Page count, weight, size: 484 pages | 866g | 152*225*28mm

- ISBN13: 9791193869321

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)