First study of corporate analysis

|

Description

Book Introduction

“For investors who have entered the vast ocean of corporate analysis,

I am confident that it will point you in the right direction.”

-Jeong Chae-jin

Recommended by the best players in the field, Jeong Chae-jin, Peter K, Seon Jin-jjang, and basketball genius!

The ultimate quantitative analysis expert and a leading expert in financial statement analysis.

Cherry Brothers' corporate analysis method established over 28 years!

When asked, “How much do you know about business?” most people will talk about financial statements and pretend to know something.

But how many of them actually look at electronic disclosures? The reality is that few investors are still closely analyzing companies.

"Corporate Analysis: A Beginner's Guide" aims to help investors make "investments that don't lose money" by going through the steps of corporate analysis from a beginner's perspective.

Cherry Hyung-bu, the author of this book, who has established himself as a leading expert in the field by establishing a framework for quantitative analysis and financial statement analysis for 28 years, also felt the keen need for corporate analysis after experiencing the IMF and financial crises.

His experiences, his feelings at the time, and the resulting desperation are all captured in this book.

The book is broadly divided into quantitative and qualitative analysis.

Quantitative analysis involves electronic disclosure and financial statement analysis, while qualitative analysis involves rationally inferring the company's future based on its business characteristics and macroeconomics.

As the table of contents shows, the electronic disclosure is explained in such a friendly manner that you can completely understand it by reading just this one book.

Another strength of this book is that it repeatedly provides examples from various companies.

I am confident that it will point you in the right direction.”

-Jeong Chae-jin

Recommended by the best players in the field, Jeong Chae-jin, Peter K, Seon Jin-jjang, and basketball genius!

The ultimate quantitative analysis expert and a leading expert in financial statement analysis.

Cherry Brothers' corporate analysis method established over 28 years!

When asked, “How much do you know about business?” most people will talk about financial statements and pretend to know something.

But how many of them actually look at electronic disclosures? The reality is that few investors are still closely analyzing companies.

"Corporate Analysis: A Beginner's Guide" aims to help investors make "investments that don't lose money" by going through the steps of corporate analysis from a beginner's perspective.

Cherry Hyung-bu, the author of this book, who has established himself as a leading expert in the field by establishing a framework for quantitative analysis and financial statement analysis for 28 years, also felt the keen need for corporate analysis after experiencing the IMF and financial crises.

His experiences, his feelings at the time, and the resulting desperation are all captured in this book.

The book is broadly divided into quantitative and qualitative analysis.

Quantitative analysis involves electronic disclosure and financial statement analysis, while qualitative analysis involves rationally inferring the company's future based on its business characteristics and macroeconomics.

As the table of contents shows, the electronic disclosure is explained in such a friendly manner that you can completely understand it by reading just this one book.

Another strength of this book is that it repeatedly provides examples from various companies.

- You can preview some of the book's contents.

Preview

index

Introduction - Why should we do corporate analysis?

[Chapter 1] How to Conduct Corporate Analysis?

[Chapter 2] The First Step in Business Analysis: Screening and Listing

① How to select a company to purchase?

(1) Primary screening - Check the performance of all listed companies every quarter.

(2) Secondary screening - quantitative and qualitative analysis

② Listing companies good for investment 034

[Chapter 3] The Core of Corporate Analysis: Quantitative Analysis

① Overview

② Stock price increase catalyst

(1) Improving (increasing) profit margin + improving (decreasing) costs

(2) P, Q, C analysis

(3) Surge in new products or Q

1) Use the integrated electronic disclosure search

2) Using indicator combinations in business reports

(4) Qualitative business analysis

1) Comparative analysis with the performance of competitors in the same sector.

2) Comparative analysis of customer performance

3) Linkage with macro indicators

③ Risk hedging

(1) Excellent cash flow maintained over a long period of time

1) What is a cash flow statement?

2) Important checkpoints through the cash flow statement

(2) Analysis of accounts receivable and inventory assets

1) Check accounts receivable and inventory assets in operating cash flow

2) Check accounts receivable turnover and inventory turnover ratios.

(3) CAPEX/inventory assets

1) Definition and calculation method of CAPEX

[Chapter 4] Using Electronic Disclosures for Corporate Analysis

① What part of the electronic disclosure should I look at?

(1) Understanding the concept and elements of electronic disclosure

Ⅰ.

Company Overview - 3.

Capital changes

Ⅰ.

Company Overview - 4.

Total number of shares, etc.

Ⅱ.

Business Description - 1.

Business Overview

Ⅱ.

Business Description - 2.

Main Products and Services

Ⅱ.

Business Description - 3.

Raw materials and production facilities

Ⅱ.

Business Description - 4.

Sales and order status

Ⅱ.

Business Description - 6.

Major contracts and research and development activities

Ⅲ.

Financial Matters - 2.

Consolidated financial statements (or 4.

Financial statements)

1) (Consolidated) financial statements

2) (Consolidated) Income Statement

② What should be determined from cost of sales?

③ Identify investment points through changes in the judge's fee.

[Chapter 5] Practical Investment Know-How: Corporate Analysis and Financial Statement Analysis

① What should you understand from financial statements?

② Companies with high quality cash flow

(1) Classification of cash flow conditions

(2) Finding signals for a shift in growth strategy

③ Excel input guidance

(1) Excel chart input guidance

(2) Guidance on creating Excel combination charts

[Chapter 6] Practical Case Studies of Individual Company Analysis

(1) Kotec

(2) Hyosung Advanced Materials

(3) PNT, Zeus: Considerations When Investing in Equipment Stocks

1) Review of PNT accounts receivable/contract assets

2) PNT inventory asset review

3) Review of Zeus accounts receivable/contract assets

Conclusion

[Chapter 1] How to Conduct Corporate Analysis?

[Chapter 2] The First Step in Business Analysis: Screening and Listing

① How to select a company to purchase?

(1) Primary screening - Check the performance of all listed companies every quarter.

(2) Secondary screening - quantitative and qualitative analysis

② Listing companies good for investment 034

[Chapter 3] The Core of Corporate Analysis: Quantitative Analysis

① Overview

② Stock price increase catalyst

(1) Improving (increasing) profit margin + improving (decreasing) costs

(2) P, Q, C analysis

(3) Surge in new products or Q

1) Use the integrated electronic disclosure search

2) Using indicator combinations in business reports

(4) Qualitative business analysis

1) Comparative analysis with the performance of competitors in the same sector.

2) Comparative analysis of customer performance

3) Linkage with macro indicators

③ Risk hedging

(1) Excellent cash flow maintained over a long period of time

1) What is a cash flow statement?

2) Important checkpoints through the cash flow statement

(2) Analysis of accounts receivable and inventory assets

1) Check accounts receivable and inventory assets in operating cash flow

2) Check accounts receivable turnover and inventory turnover ratios.

(3) CAPEX/inventory assets

1) Definition and calculation method of CAPEX

[Chapter 4] Using Electronic Disclosures for Corporate Analysis

① What part of the electronic disclosure should I look at?

(1) Understanding the concept and elements of electronic disclosure

Ⅰ.

Company Overview - 3.

Capital changes

Ⅰ.

Company Overview - 4.

Total number of shares, etc.

Ⅱ.

Business Description - 1.

Business Overview

Ⅱ.

Business Description - 2.

Main Products and Services

Ⅱ.

Business Description - 3.

Raw materials and production facilities

Ⅱ.

Business Description - 4.

Sales and order status

Ⅱ.

Business Description - 6.

Major contracts and research and development activities

Ⅲ.

Financial Matters - 2.

Consolidated financial statements (or 4.

Financial statements)

1) (Consolidated) financial statements

2) (Consolidated) Income Statement

② What should be determined from cost of sales?

③ Identify investment points through changes in the judge's fee.

[Chapter 5] Practical Investment Know-How: Corporate Analysis and Financial Statement Analysis

① What should you understand from financial statements?

② Companies with high quality cash flow

(1) Classification of cash flow conditions

(2) Finding signals for a shift in growth strategy

③ Excel input guidance

(1) Excel chart input guidance

(2) Guidance on creating Excel combination charts

[Chapter 6] Practical Case Studies of Individual Company Analysis

(1) Kotec

(2) Hyosung Advanced Materials

(3) PNT, Zeus: Considerations When Investing in Equipment Stocks

1) Review of PNT accounts receivable/contract assets

2) PNT inventory asset review

3) Review of Zeus accounts receivable/contract assets

Conclusion

Detailed image

Into the book

The purpose and necessity of quantitative analysis are clear.

The purpose of this is to analyze the past financial indicators of a stock to determine whether it is a good company run by good management, and to hedge risks by minimizing losses through investments that do not lose money.

--- p.38

Recently, I've compiled a list of frequently asked questions and curiosities from people who call themselves "Joo-rin." Many of them seem to find reading, interpreting, and analyzing financial statements, which are considered the foundation of corporate analysis, very difficult.

And many people didn't know how to access the electronic disclosure system and which items to focus on.

Personally, I believe the first step in stock investing is to become familiar with the business reports of the companies you wish to invest in or are currently investing in.

If you have a thorough understanding of the business and financial statements of the company you've invested in, you can maintain your confidence and remain unshaken even in the volatile stock market.

This psychological stability is a very important virtue that investors need.

Even if you read and study a corporate analysis written by someone else for a hundred days, it will still be someone else's.

I want to emphasize once again that developing the habit of reading and familiarizing yourself with business reports is the secret and essential element for long-term survival in the stock market.

--- p.106~107

If you want to survive and succeed in the stock market for the long term, you must have the patience to trust and stick with the companies you invest in, even through the market's various ups and downs.

The entire process of corporate analysis is actually tedious.

However, this is a process to acquire 'patience', the most essential virtue for value investors.

In other words, through this book, you will take the first step toward gaining the patience and insight to discern the inner workings of a company.

So, even if it is a bit boring and difficult, I hope you will read it all the way through without giving up.

--- p.195

Most of the country's major industries are cyclical and highly dependent on exports.

Due to the characteristics of these industries, the domestic stock market has shown sensitivity to changes in global macroeconomic conditions, and its index volatility is also higher than that of the global stock market.

Therefore, except for a small number of companies with excellent business models, it is difficult to find stocks that show long-term upward trends.

It is difficult to sustain long-term investment.

Due to these domestic stock market conditions, selecting the right time to sell individual stocks is quite difficult.

The response plan has to be different for each item.

Furthermore, the selling point can vary depending on factors such as the investor's investment status and the investment weighting for the stock in question. Therefore, I believe that a selling formula cannot be generalized or even exist.

So there seems to be a stock market adage that selling is the realm of the gods and an art.

The purpose of this is to analyze the past financial indicators of a stock to determine whether it is a good company run by good management, and to hedge risks by minimizing losses through investments that do not lose money.

--- p.38

Recently, I've compiled a list of frequently asked questions and curiosities from people who call themselves "Joo-rin." Many of them seem to find reading, interpreting, and analyzing financial statements, which are considered the foundation of corporate analysis, very difficult.

And many people didn't know how to access the electronic disclosure system and which items to focus on.

Personally, I believe the first step in stock investing is to become familiar with the business reports of the companies you wish to invest in or are currently investing in.

If you have a thorough understanding of the business and financial statements of the company you've invested in, you can maintain your confidence and remain unshaken even in the volatile stock market.

This psychological stability is a very important virtue that investors need.

Even if you read and study a corporate analysis written by someone else for a hundred days, it will still be someone else's.

I want to emphasize once again that developing the habit of reading and familiarizing yourself with business reports is the secret and essential element for long-term survival in the stock market.

--- p.106~107

If you want to survive and succeed in the stock market for the long term, you must have the patience to trust and stick with the companies you invest in, even through the market's various ups and downs.

The entire process of corporate analysis is actually tedious.

However, this is a process to acquire 'patience', the most essential virtue for value investors.

In other words, through this book, you will take the first step toward gaining the patience and insight to discern the inner workings of a company.

So, even if it is a bit boring and difficult, I hope you will read it all the way through without giving up.

--- p.195

Most of the country's major industries are cyclical and highly dependent on exports.

Due to the characteristics of these industries, the domestic stock market has shown sensitivity to changes in global macroeconomic conditions, and its index volatility is also higher than that of the global stock market.

Therefore, except for a small number of companies with excellent business models, it is difficult to find stocks that show long-term upward trends.

It is difficult to sustain long-term investment.

Due to these domestic stock market conditions, selecting the right time to sell individual stocks is quite difficult.

The response plan has to be different for each item.

Furthermore, the selling point can vary depending on factors such as the investor's investment status and the investment weighting for the stock in question. Therefore, I believe that a selling formula cannot be generalized or even exist.

So there seems to be a stock market adage that selling is the realm of the gods and an art.

--- p.294~295

Publisher's Review

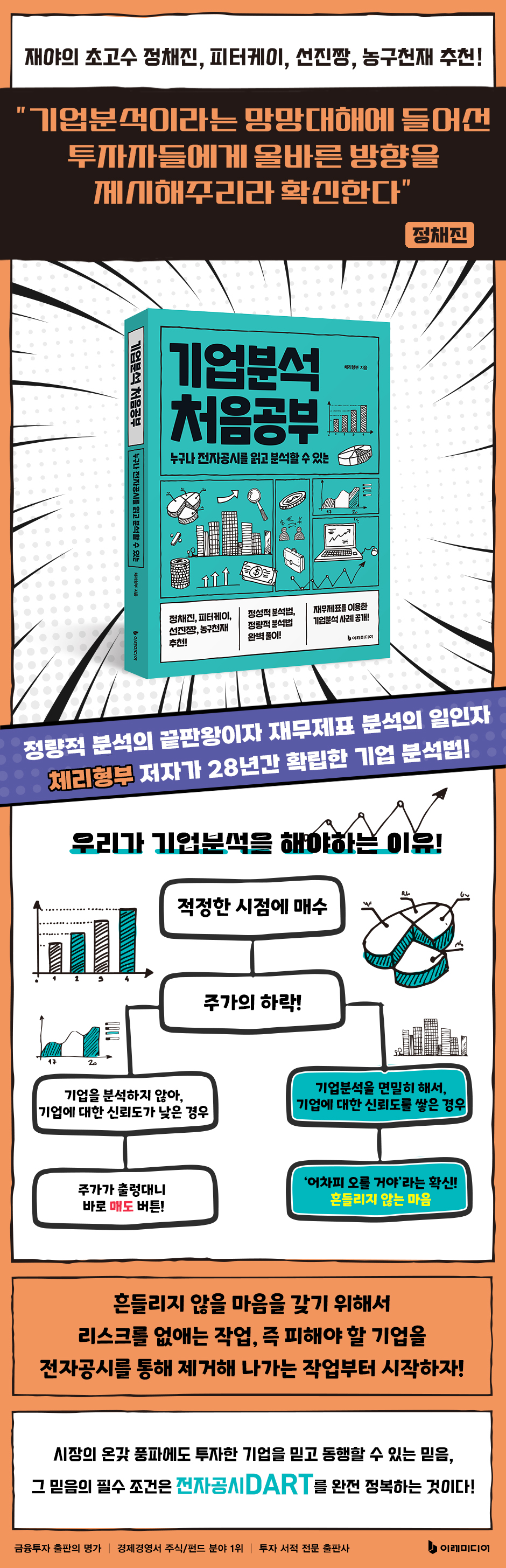

We need to be confident that 'it will go up anyway'!!

Why we need to do corporate analysis!

There is a stock market adage that says, “One thing I know is that I don’t know.”

The person who said this was Howard Marks, who is well known in Korea for his book, “The Most Important Thing About Investment.”

The author paraphrases Howard Marks' words as follows:

"When investing in stocks, you should start with the assumption that you know absolutely nothing about the company." Why should you do this? Because doing so allows you to analyze the company more closely.

This soon becomes a question of probability.

Efforts to increase the probability of success, or conversely, to reduce the probability of error, lead to seeking the most favorable conditions.

Probability issues are very important in stock investing.

Because it provides psychological stability to investors.

Even if you buy at the right time, the stock price can fall.

In a stock market like this, what would investors do if they didn't analyze a company and therefore had low confidence in it? They'd probably be tempted to sell even if the stock price fluctuated only slightly.

On the other hand, if you have conducted thorough corporate analysis and built up trust in the company as a result, you will not be shaken even if the stock price falls.

This is because the mindset that ‘it will go up anyway’ is ingrained.

The confidence to trust and accompany the company you invested in despite all the market ups and downs.

The prerequisite for that belief is to completely conquer electronic disclosure!

This book is nothing less than a project to instill in people a mindset that will not waver even when stock prices fall.

Because it introduces a method for closely analyzing a company.

Just as you can win every battle if you know your enemy, if you know your company clearly, you will not be shaken.

There are two main methods of analysis.

There are quantitative and qualitative analyses.

Quantitative analysis is the analysis of financial statements (electronic disclosure) that is commonly thought of when analyzing a company, while qualitative analysis is an analysis that reasonably infers the future of the company in relation to the nature of the company's business and macroeconomics.

The author says that while there is no need to distinguish between importance levels, if you want to achieve high returns, it will depend on how rationally you reason during the qualitative analysis process.

Of course, it will be necessary to have a good quantitative analysis as a foundation.

If we use a building metaphor, the invisible foundation underground is quantitative analysis, and the process of successfully constructing a building is qualitative analysis.

In particular, this book analyzes electronic disclosures as if digging into them.

The table of contents in Chapter 4 is proof of this.

We explain what we need to look at at the level of readers who are looking at electronic disclosure for the first time.

For example, what is necessary to maintain a stable mind even when stock prices fall? The most important thing is to achieve peace of mind, or, conversely, to eliminate risk.

So, we start by examining, "Is this a good management team? Is there a long-term capital increase?"

In other words, the priority is to eliminate companies that should be avoided through electronic disclosure.

Cherry Brother, the author of this book, has established his own unique framework through 28 years of investment activities.

He describes the corporate analysis process as boring and difficult.

However, there is a valuable reward for investors who go through this process: patience.

In other words, readers who complete this book are rewarded with patience and the ability to discern the inner workings of a company.

If you want to survive and succeed in the stock market for the long term, you must have the patience to trust and stick with the companies you invest in, even through the market's various ups and downs.

An essential condition for that patience is corporate analysis represented by electronic disclosure and qualitative analysis.

I hope everyone who reads this book will reap this precious fruit!

Why we need to do corporate analysis!

There is a stock market adage that says, “One thing I know is that I don’t know.”

The person who said this was Howard Marks, who is well known in Korea for his book, “The Most Important Thing About Investment.”

The author paraphrases Howard Marks' words as follows:

"When investing in stocks, you should start with the assumption that you know absolutely nothing about the company." Why should you do this? Because doing so allows you to analyze the company more closely.

This soon becomes a question of probability.

Efforts to increase the probability of success, or conversely, to reduce the probability of error, lead to seeking the most favorable conditions.

Probability issues are very important in stock investing.

Because it provides psychological stability to investors.

Even if you buy at the right time, the stock price can fall.

In a stock market like this, what would investors do if they didn't analyze a company and therefore had low confidence in it? They'd probably be tempted to sell even if the stock price fluctuated only slightly.

On the other hand, if you have conducted thorough corporate analysis and built up trust in the company as a result, you will not be shaken even if the stock price falls.

This is because the mindset that ‘it will go up anyway’ is ingrained.

The confidence to trust and accompany the company you invested in despite all the market ups and downs.

The prerequisite for that belief is to completely conquer electronic disclosure!

This book is nothing less than a project to instill in people a mindset that will not waver even when stock prices fall.

Because it introduces a method for closely analyzing a company.

Just as you can win every battle if you know your enemy, if you know your company clearly, you will not be shaken.

There are two main methods of analysis.

There are quantitative and qualitative analyses.

Quantitative analysis is the analysis of financial statements (electronic disclosure) that is commonly thought of when analyzing a company, while qualitative analysis is an analysis that reasonably infers the future of the company in relation to the nature of the company's business and macroeconomics.

The author says that while there is no need to distinguish between importance levels, if you want to achieve high returns, it will depend on how rationally you reason during the qualitative analysis process.

Of course, it will be necessary to have a good quantitative analysis as a foundation.

If we use a building metaphor, the invisible foundation underground is quantitative analysis, and the process of successfully constructing a building is qualitative analysis.

In particular, this book analyzes electronic disclosures as if digging into them.

The table of contents in Chapter 4 is proof of this.

We explain what we need to look at at the level of readers who are looking at electronic disclosure for the first time.

For example, what is necessary to maintain a stable mind even when stock prices fall? The most important thing is to achieve peace of mind, or, conversely, to eliminate risk.

So, we start by examining, "Is this a good management team? Is there a long-term capital increase?"

In other words, the priority is to eliminate companies that should be avoided through electronic disclosure.

Cherry Brother, the author of this book, has established his own unique framework through 28 years of investment activities.

He describes the corporate analysis process as boring and difficult.

However, there is a valuable reward for investors who go through this process: patience.

In other words, readers who complete this book are rewarded with patience and the ability to discern the inner workings of a company.

If you want to survive and succeed in the stock market for the long term, you must have the patience to trust and stick with the companies you invest in, even through the market's various ups and downs.

An essential condition for that patience is corporate analysis represented by electronic disclosure and qualitative analysis.

I hope everyone who reads this book will reap this precious fruit!

GOODS SPECIFICS

- Date of issue: December 8, 2023

- Page count, weight, size: 296 pages | 614g | 170*235*18mm

- ISBN13: 9791193394083

- ISBN10: 1193394082

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)