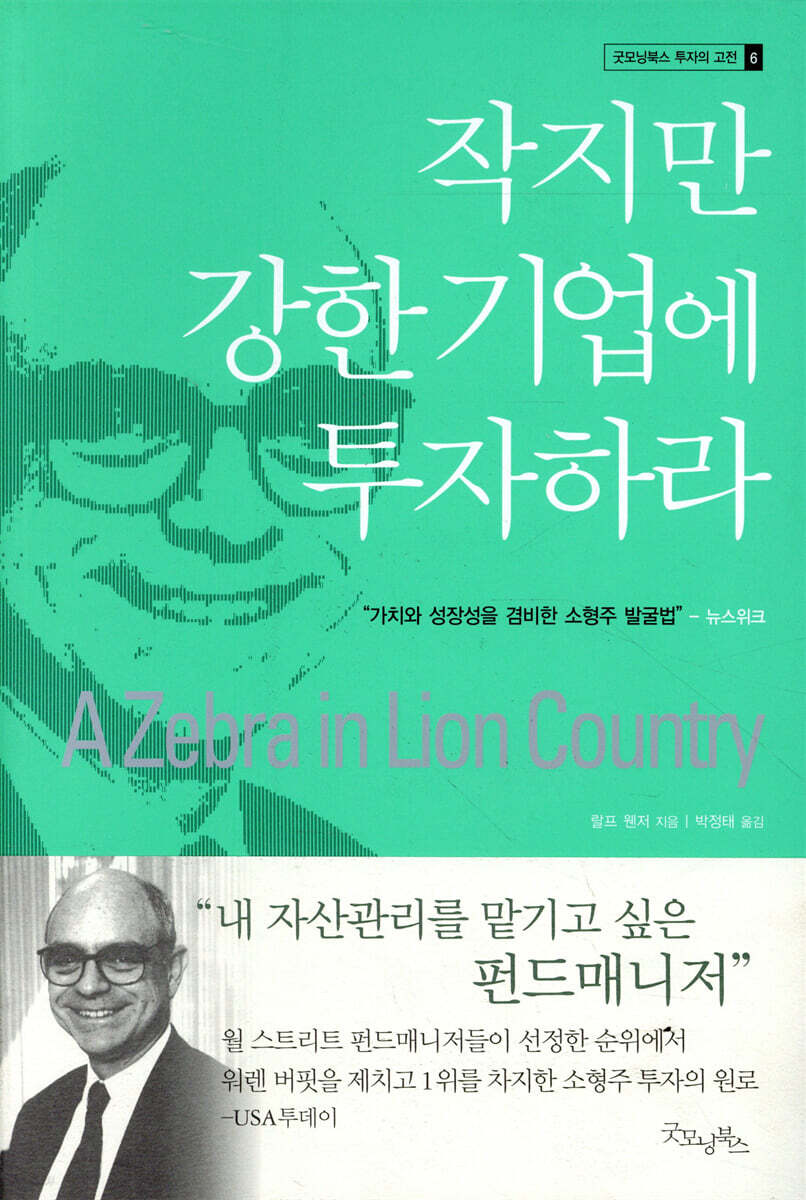

Invest in small but strong companies

|

Description

Book Introduction

An investment guide by Ralph Wenger, a pioneer in small-cap investing on Wall Street.

It embodies his investment philosophy of focusing solely on discovering small-cap stocks with both value and growth potential until his official retirement.

It embodies his investment philosophy of focusing solely on discovering small-cap stocks with both value and growth potential until his official retirement.

- You can preview some of the book's contents.

Preview

index

Introduction - A Lighthearted Guide to Investment

What Determines Success in Stock Investing / A Time That Tests Human Patience / Step Back and See It from a Different Perspective

Chapter 1: Zebras in Lion Country

"Nifty Fifty" and Institutional Investors / The Stock Market Herd / The Persistent Herd Psychology

Chapter 2: Focus on Small Businesses

Ask the Owner / Small Businesses Generate Big Profits / The Evolution of the Stock Market / The Hidden Charm of Small Businesses / Four Reasons Why Stock Prices Rise / Two Investment Strategies: A Fable / The Smaller the Business, the Greater the Risk / How to Reduce Risk / Corporate Growth Strategies and Natural Life's Growth Strategies / Diversification and Long-Term Holdings Are Necessary

Chapter 3 Growth Stocks at Reasonable Prices

Value or Growth? / Investor, Know Thyself / Men's Stocks and Women's Stocks / Combining the Best of Both Value and Growth / The Odds Are Value Stocks Slightly Better / Why Can't Trees Grow to the Sky? / My Grand Slam Stock

Chapter 4: Bad News Creates Good Opportunity

Psychological factors that lead to overestimation of risk / Stock price distortions and good investment opportunities / The savvy tailor

Chapter 5: Investing Yourself or Leaving It to the Experts?

What's your style? / How to accept risk / Lessons learned in the trenches / Hire a pro / My recommendation / Find a trustworthy fund manager with a hot heart and a cool head.

Chapter 6 Theme and Modulation

Spotting Trends / Looking into the Future Through a Crystal Ball / Themes That Will Shape the Market / What Can We Say About the Future? / Good Portfolios and Evil Portfolios / Where the Stock Market Scammers Hang Out / Monopoly Positions in Niche Markets

Chapter 7: Find Where Technology Flows

Focus on the user, not the producer / The omnipotent computer / What will the pastures of the future be like?

Chapter 8: Three Supporting Forces of Small but Strong Companies

Where do investment ideas come from? / Growth potential / What standards should we use to evaluate them? / Financial soundness / Intrinsic value / Funes, the genius of memory / How to apply them / Would computers be better? / The stock market and the chessboard / When to sell / A day in the life of a fund manager / The golden finger syndrome

Chapter 9: Can You Tim the Market?

The Past as a Faulty Messenger / The Super Bowl and the Crystal Ball / Do Patterns Really Exist? / Spot the Faulty Metaphor / The Enchanted Bull Market / The Human Variable / One Company at a Time

Chapter 10: The Meaning of the Stock Market Crash

Friday, October 16 / Monday, October 19 / Tuesday, October 20 / Wednesday, October 21 / Thursday, October 22 / After the Great Chaos / Lessons from the 1973-74 Bear Market / The Tulip Mania Crash / Risk Premium and Bull and Bear Markets / Are You Tightening Your Seatbelt?

Chapter 11 Once you decide to do it, do it on the world stage

The Triumph of the Free Market / The Overseas Stock Investing Frenzy / Still Want to Buy US Stocks? / Proven Methods / Investment Risks and Unique Cultures / Foreign Stock Investing Needs Themes Too / The Tiger Comes Out of the Cage / China Wakes Up / Widen Your Betting Range / It's Too Much to Do Alone / What's the Reward?

Chapter 12: Five Rules of Stock Investing

Law 1: The Marshal of Compound Interest / Law 2: Reversion to the Mean / Law 3: Options embedded in stocks are very important / Law 4: Many investment products are, in fact, Ponzi schemes / Law 5: Even bad ideas started out as good ideas / You, too, can be a successful investor.

What Determines Success in Stock Investing / A Time That Tests Human Patience / Step Back and See It from a Different Perspective

Chapter 1: Zebras in Lion Country

"Nifty Fifty" and Institutional Investors / The Stock Market Herd / The Persistent Herd Psychology

Chapter 2: Focus on Small Businesses

Ask the Owner / Small Businesses Generate Big Profits / The Evolution of the Stock Market / The Hidden Charm of Small Businesses / Four Reasons Why Stock Prices Rise / Two Investment Strategies: A Fable / The Smaller the Business, the Greater the Risk / How to Reduce Risk / Corporate Growth Strategies and Natural Life's Growth Strategies / Diversification and Long-Term Holdings Are Necessary

Chapter 3 Growth Stocks at Reasonable Prices

Value or Growth? / Investor, Know Thyself / Men's Stocks and Women's Stocks / Combining the Best of Both Value and Growth / The Odds Are Value Stocks Slightly Better / Why Can't Trees Grow to the Sky? / My Grand Slam Stock

Chapter 4: Bad News Creates Good Opportunity

Psychological factors that lead to overestimation of risk / Stock price distortions and good investment opportunities / The savvy tailor

Chapter 5: Investing Yourself or Leaving It to the Experts?

What's your style? / How to accept risk / Lessons learned in the trenches / Hire a pro / My recommendation / Find a trustworthy fund manager with a hot heart and a cool head.

Chapter 6 Theme and Modulation

Spotting Trends / Looking into the Future Through a Crystal Ball / Themes That Will Shape the Market / What Can We Say About the Future? / Good Portfolios and Evil Portfolios / Where the Stock Market Scammers Hang Out / Monopoly Positions in Niche Markets

Chapter 7: Find Where Technology Flows

Focus on the user, not the producer / The omnipotent computer / What will the pastures of the future be like?

Chapter 8: Three Supporting Forces of Small but Strong Companies

Where do investment ideas come from? / Growth potential / What standards should we use to evaluate them? / Financial soundness / Intrinsic value / Funes, the genius of memory / How to apply them / Would computers be better? / The stock market and the chessboard / When to sell / A day in the life of a fund manager / The golden finger syndrome

Chapter 9: Can You Tim the Market?

The Past as a Faulty Messenger / The Super Bowl and the Crystal Ball / Do Patterns Really Exist? / Spot the Faulty Metaphor / The Enchanted Bull Market / The Human Variable / One Company at a Time

Chapter 10: The Meaning of the Stock Market Crash

Friday, October 16 / Monday, October 19 / Tuesday, October 20 / Wednesday, October 21 / Thursday, October 22 / After the Great Chaos / Lessons from the 1973-74 Bear Market / The Tulip Mania Crash / Risk Premium and Bull and Bear Markets / Are You Tightening Your Seatbelt?

Chapter 11 Once you decide to do it, do it on the world stage

The Triumph of the Free Market / The Overseas Stock Investing Frenzy / Still Want to Buy US Stocks? / Proven Methods / Investment Risks and Unique Cultures / Foreign Stock Investing Needs Themes Too / The Tiger Comes Out of the Cage / China Wakes Up / Widen Your Betting Range / It's Too Much to Do Alone / What's the Reward?

Chapter 12: Five Rules of Stock Investing

Law 1: The Marshal of Compound Interest / Law 2: Reversion to the Mean / Law 3: Options embedded in stocks are very important / Law 4: Many investment products are, in fact, Ponzi schemes / Law 5: Even bad ideas started out as good ideas / You, too, can be a successful investor.

Publisher's Review

Fables full of humor and insight

Chapter 1 of this book begins with the story of “The Zebra in Lion Country.”

Zebras moving in a herd symbolize stock investors.

It is always safe to graze in the middle of the herd, eating grass that has been left half-eaten by others or has been trampled by horses' hooves.

On the other hand, if you go to the outermost part of the herd and eat your fill of fresh grass, you may end up being eaten by a lion.

Stock investors also have to take on high risks to achieve high returns.

Therefore, most fund managers working at investment institutions like mutual funds never get to go out to the outermost part and eat their fill of fresh grass.

They always stay in the middle of the group.

There is absolutely no reason to be criticized for buying only large, blue-chip stocks that are popular with the public and are known to be safe.

On the other hand, if you buy little-known stocks to increase your returns, you run the risk of being “cut” if things go wrong.

In this book, the author argues that we should never be a zebra, a person who is somewhere in the middle.

It suggests ways to reduce the risk of becoming lion food while grazing on fresh grass from the outermost part.

That is Wenger's investment philosophy: "Invest in small but strong companies."

“I want a small company run by a creative, entrepreneurial management team that benefits from significant economic, social, and technological trends, while also being a strong leader in a niche market and poised for significant future growth with significant earnings potential.

“I also only buy stocks of small but strong companies like this when their stock prices are reasonable.”

Throughout this book, you will find fables imbued with the author's sense of humor and insight.

In addition to “The Zebra in the Land of the Lions,” the fable about “Two Investment Strategies” (Chapter 2) is a metaphorical teaching not found in other stock-related books, and the story of “Golden Finger Syndrome” (Chapter 8) contains the message of caution against the vain pride that stock investors can easily fall into.

A candid look back on "over 30 years of investing" from a veteran of small-cap investing.

In this book, you can read not only the author's success stories but also his honest failure stories.

It is evident that efforts were made to convey the truth as it is.

For example, in Chapter 3, the author introduces the “grand slam home run” he discovered, but in Chapter 10, through his diary, we can vividly read that he is just an individual who cannot help but worry and feel hurt in the face of the great currents of the market.

Another attractive feature of this book is that it is written in a very concise and easy-to-understand manner.

If you just understand the five rules of stock investment introduced in Chapter 12, you will gain value for the time and money you invested in this book.

In addition, valuable tips such as “Bad News Creates Good Opportunities” (Chapter 4), “Capture themes and trends first” (Chapter 6), “Invest in downstream stocks” (Chapter 7), and “Expand your betting range with global investments” (Chapter 11) are bonus points you'll receive when reading this book.

This book draws on the author's extensive experience spanning over 30 years. Having earned his bachelor's and master's degrees in industrial management from MIT, Wenger entered the investment industry in 1961 and published the first edition of this book in 1997. (The translated version of this book is a revised edition published in 1999.)

Throughout this book, you will find content that you will never be able to read once and then just brush off.

For example, the author theoretically refutes the fiction of so-called “market prophets” who attempt to predict market timing, while acknowledging that humans are inherently pattern-seeking creatures.

His advice that stock prices are determined by optimists and therefore that one should always be prepared for mistakes when evaluating stocks is also based on his long experience.

The author also recalls the stock market crash of October 19, 1987, known as Black Monday, and attributes its significance to the fact that bear markets, in retrospect, are always good opportunities to increase stock holdings.

Especially when the stock market is frozen solid, it's worth heeding the point that falling stock prices are not part of the problem, but part of the solution.

In this book, the author honestly reflects on the path he has walked, and tells the story with very interesting metaphors.

This book is worthy of being considered an investment classic, as it clearly and easily conveys the investment philosophy of a pioneer in small-cap investing: investing in "small but strong companies," not just small-cap stocks.

Chapter 1 of this book begins with the story of “The Zebra in Lion Country.”

Zebras moving in a herd symbolize stock investors.

It is always safe to graze in the middle of the herd, eating grass that has been left half-eaten by others or has been trampled by horses' hooves.

On the other hand, if you go to the outermost part of the herd and eat your fill of fresh grass, you may end up being eaten by a lion.

Stock investors also have to take on high risks to achieve high returns.

Therefore, most fund managers working at investment institutions like mutual funds never get to go out to the outermost part and eat their fill of fresh grass.

They always stay in the middle of the group.

There is absolutely no reason to be criticized for buying only large, blue-chip stocks that are popular with the public and are known to be safe.

On the other hand, if you buy little-known stocks to increase your returns, you run the risk of being “cut” if things go wrong.

In this book, the author argues that we should never be a zebra, a person who is somewhere in the middle.

It suggests ways to reduce the risk of becoming lion food while grazing on fresh grass from the outermost part.

That is Wenger's investment philosophy: "Invest in small but strong companies."

“I want a small company run by a creative, entrepreneurial management team that benefits from significant economic, social, and technological trends, while also being a strong leader in a niche market and poised for significant future growth with significant earnings potential.

“I also only buy stocks of small but strong companies like this when their stock prices are reasonable.”

Throughout this book, you will find fables imbued with the author's sense of humor and insight.

In addition to “The Zebra in the Land of the Lions,” the fable about “Two Investment Strategies” (Chapter 2) is a metaphorical teaching not found in other stock-related books, and the story of “Golden Finger Syndrome” (Chapter 8) contains the message of caution against the vain pride that stock investors can easily fall into.

A candid look back on "over 30 years of investing" from a veteran of small-cap investing.

In this book, you can read not only the author's success stories but also his honest failure stories.

It is evident that efforts were made to convey the truth as it is.

For example, in Chapter 3, the author introduces the “grand slam home run” he discovered, but in Chapter 10, through his diary, we can vividly read that he is just an individual who cannot help but worry and feel hurt in the face of the great currents of the market.

Another attractive feature of this book is that it is written in a very concise and easy-to-understand manner.

If you just understand the five rules of stock investment introduced in Chapter 12, you will gain value for the time and money you invested in this book.

In addition, valuable tips such as “Bad News Creates Good Opportunities” (Chapter 4), “Capture themes and trends first” (Chapter 6), “Invest in downstream stocks” (Chapter 7), and “Expand your betting range with global investments” (Chapter 11) are bonus points you'll receive when reading this book.

This book draws on the author's extensive experience spanning over 30 years. Having earned his bachelor's and master's degrees in industrial management from MIT, Wenger entered the investment industry in 1961 and published the first edition of this book in 1997. (The translated version of this book is a revised edition published in 1999.)

Throughout this book, you will find content that you will never be able to read once and then just brush off.

For example, the author theoretically refutes the fiction of so-called “market prophets” who attempt to predict market timing, while acknowledging that humans are inherently pattern-seeking creatures.

His advice that stock prices are determined by optimists and therefore that one should always be prepared for mistakes when evaluating stocks is also based on his long experience.

The author also recalls the stock market crash of October 19, 1987, known as Black Monday, and attributes its significance to the fact that bear markets, in retrospect, are always good opportunities to increase stock holdings.

Especially when the stock market is frozen solid, it's worth heeding the point that falling stock prices are not part of the problem, but part of the solution.

In this book, the author honestly reflects on the path he has walked, and tells the story with very interesting metaphors.

This book is worthy of being considered an investment classic, as it clearly and easily conveys the investment philosophy of a pioneer in small-cap investing: investing in "small but strong companies," not just small-cap stocks.

GOODS SPECIFICS

- Date of issue: March 15, 2007

- Page count, weight, size: 349 pages | 520g | 188*257*30mm

- ISBN13: 9788991378117

- ISBN10: 8991378110

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)