Minimum economic study

|

Description

Book Introduction

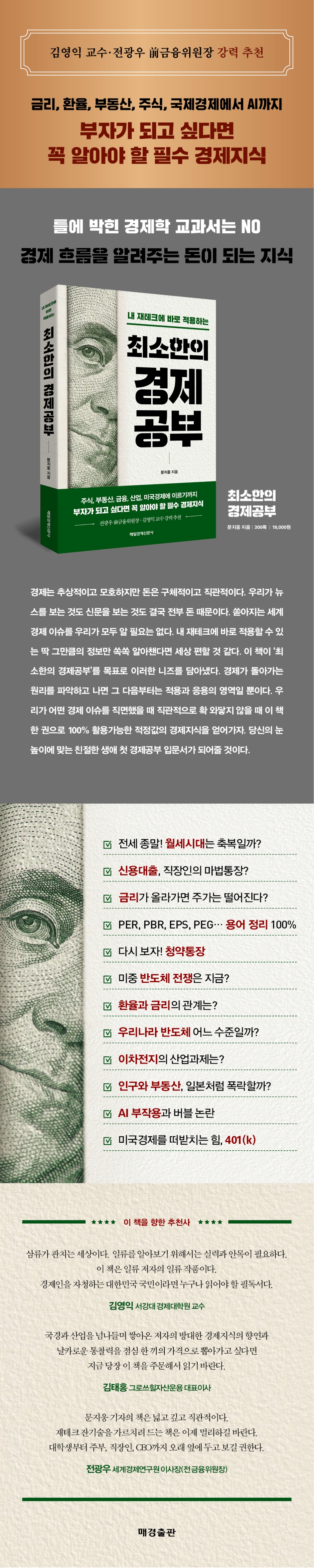

Professor Kim Young-ik and former Financial Services Commission Chairman Jeon Kwang-woo strongly recommend

From stocks, real estate, finance, industry, to the US economy.

Essential Economic Knowledge You Must Know if You Want to Become Rich

Economics is abstract and vague, but money is concrete and intuitive.

The reason we watch the news and read the newspapers is ultimately because of money.

We don't need to know all the global economic issues that are pouring in.

If only I could find out just the right amount of information that I could immediately apply to my finances, the world would be a much better place.

This book aims to address these needs by providing a 'minimum level of economic study'.

This book is written in an easy-to-understand manner so that anyone can intuitively understand the flow of the economy, based on economic knowledge and information directly acquired by the author, who has been working in the field for 15 years as an economic journalist.

Once you understand how the economy works, the rest is simply a matter of application and implementation.

When we face economic issues that don't seem intuitive, let's acquire 100% usable, appropriate economic knowledge with this one book.

It will be your first introductory economics book, tailored to your level.

From stocks, real estate, finance, industry, to the US economy.

Essential Economic Knowledge You Must Know if You Want to Become Rich

Economics is abstract and vague, but money is concrete and intuitive.

The reason we watch the news and read the newspapers is ultimately because of money.

We don't need to know all the global economic issues that are pouring in.

If only I could find out just the right amount of information that I could immediately apply to my finances, the world would be a much better place.

This book aims to address these needs by providing a 'minimum level of economic study'.

This book is written in an easy-to-understand manner so that anyone can intuitively understand the flow of the economy, based on economic knowledge and information directly acquired by the author, who has been working in the field for 15 years as an economic journalist.

Once you understand how the economy works, the rest is simply a matter of application and implementation.

When we face economic issues that don't seem intuitive, let's acquire 100% usable, appropriate economic knowledge with this one book.

It will be your first introductory economics book, tailored to your level.

- You can preview some of the book's contents.

Preview

index

Introduction

Part 1 Financial Insights

1.

Central banks are inflation fighters

Base interest rate, economy, prices, unemployment rate

The cascade effect of interest rate hikes and cuts

Inflation Fighter 2.

Why You Shouldn't Underestimate Savings

Classic savings instruments: time deposits and regular savings

Compare interest rates at a glance

If you feel the 15.4% interest income tax is a waste…

3.

Loans, are they really 'goddesses'?

Loans are credit

Credit loans, the magic savings account for office workers?

The basic is a 30-year 'stock loan'

The benchmark interest rate for housing loans, 'COFIX'

Let's ask the bank to lower interest rates.

4.

All About Loan Interest Rates

Loan base rate and additional rate

Fixed, floating, and mixed interest rates

5. LTV, DTI, DSR, and the three factors that determine the mortgage loan limit

LTV collateral recognition ratio

DTI total debt service ratio

DSR Total Debt Service Ratio

6.

Exchange rates and remittances

The exchange rate is not difficult

Telegraphic transfer selling rate? Spread?

The basic exchange rate preference is 50%

Interest rates and exchange rates that affect imports and exports

7.

Foreign exchange reserves and currency swaps

foreign exchange reserves

currency swap

9.

About the combination and safe

Understanding Combinations and Safes

Using the combination and safe

Signs of a safe's failure

10.

Post Office Unlimited Depositor Protection

Depositor protection limit: 50 million won

Post office guarantees unlimited

11.

bank run

Part 2 Stock Insights

1.

A glance at our country's stock market

Large-cap and blue-chip stocks are listed on the KOSPI market.

The KOSDAQ market driven by secondary batteries and pushed by biotechnology

2.

Stock prices, interest rates, economy, and performance

When interest rates rise, stock prices fall?

Interest rates and the economy must be viewed together.

Past performance? Future performance? And consensus?

3. PER, PBR, EPS, and PEG

4.

Bond ABC

Comparing Bonds and Stocks

Surface interest rate, yield to maturity, duration

5.

Hot Potato, Short Selling

Short selling, which involves selling stocks even by borrowing them

Double the profits, infinite losses

Short selling in South Korea

6. IPO, public offering, and stocks

IPO process and listing

ABC of public offering subscription

Ttasang, Ttasang is in history

7.

Steamed rice and potatoes

Free stock dividend

The more bad news there is, the more likely it is that a paid-in capital increase will be a good thing.

Free potatoes without any compensation

Shareholder-friendly capital increase

8.

public offering

The public offering price is key

22% public offering transfer tax

Introduction of a mandatory public offering system?

Part 3 Real Estate Insights

1.

Kick the Ladder Off the Korean Housing Market

Buying a home is not speculation.

Let's recognize the dual status of multiple homeowners.

2.

Will population and real estate plummet like in Japan?

Global low birth rates, aging population, and population decline

Single-person households and the number of households are increasing…

The conclusion is a Japanese-style collapse?

3.

Is the end of jeonse and the era of monthly rent a blessing?

Half of new lease contracts are jeonse

Jeonse to ease the burden of housing costs

The road to reversal

4.

You need to know about the subscription system

How many new apartments are being supplied?

Let's see again, subscription account

1st place, extra points, lottery

Everything you need to know about taxes related to subscription rights

5.

Paying property tax and also comprehensive real estate tax?

History of the introduction of the comprehensive real estate tax

Inheritance tax, who pays how much?

If the assessed value of a home exceeds 1.2 billion won, a comprehensive real estate tax is imposed.

Part 4 Industry Insights

1.

South Korean companies and industrial structure

Companies that move Korea

Korea's leading industry

Corporate tax that cannot keep up with corporate competitiveness

2.

Trade balance and current account balance

Trade balance must pass through customs

Current account balance including foreign dividends and overseas travel expenditures

3.

Semiconductor Industry Analysis and Outlook

Semiconductor market and industry at a glance

US-China semiconductor war

4.

Secondary Battery Industry Analysis and Outlook

Structure of secondary batteries

Domestic secondary battery materials value chain

Secondary battery industry challenges

5.

Inflation Reduction Act

6.

Automotive Industry Analysis Outlook

global automobile market

The era of electric vehicles

7.

The age of artificial intelligence

ChatGPT, the turning point toward singularity

NVIDIA's AI semiconductor launch

AI side effects and bubble controversy

Part 5: U.S. Economic Insights

1.

Consumption, the core of the US economy: Walmart and Costco

Walmart vs. Costco

Small but mighty Trader Joe's

2.

The US Federal Reserve is holding the world economy in its hands

Fed Chairman = FRB Chairman = FOMC Chairman

The FOMC is drawing global attention

3.

The three major U.S. price levels: oil, rent, and electricity.

CPI vs. PCE… The Fed is PCE

perceived prices

4.

Operation Twist and Yield Curve Control

5.

The 401(k): A Powerhouse of the American Economy

Part 1 Financial Insights

1.

Central banks are inflation fighters

Base interest rate, economy, prices, unemployment rate

The cascade effect of interest rate hikes and cuts

Inflation Fighter 2.

Why You Shouldn't Underestimate Savings

Classic savings instruments: time deposits and regular savings

Compare interest rates at a glance

If you feel the 15.4% interest income tax is a waste…

3.

Loans, are they really 'goddesses'?

Loans are credit

Credit loans, the magic savings account for office workers?

The basic is a 30-year 'stock loan'

The benchmark interest rate for housing loans, 'COFIX'

Let's ask the bank to lower interest rates.

4.

All About Loan Interest Rates

Loan base rate and additional rate

Fixed, floating, and mixed interest rates

5. LTV, DTI, DSR, and the three factors that determine the mortgage loan limit

LTV collateral recognition ratio

DTI total debt service ratio

DSR Total Debt Service Ratio

6.

Exchange rates and remittances

The exchange rate is not difficult

Telegraphic transfer selling rate? Spread?

The basic exchange rate preference is 50%

Interest rates and exchange rates that affect imports and exports

7.

Foreign exchange reserves and currency swaps

foreign exchange reserves

currency swap

9.

About the combination and safe

Understanding Combinations and Safes

Using the combination and safe

Signs of a safe's failure

10.

Post Office Unlimited Depositor Protection

Depositor protection limit: 50 million won

Post office guarantees unlimited

11.

bank run

Part 2 Stock Insights

1.

A glance at our country's stock market

Large-cap and blue-chip stocks are listed on the KOSPI market.

The KOSDAQ market driven by secondary batteries and pushed by biotechnology

2.

Stock prices, interest rates, economy, and performance

When interest rates rise, stock prices fall?

Interest rates and the economy must be viewed together.

Past performance? Future performance? And consensus?

3. PER, PBR, EPS, and PEG

4.

Bond ABC

Comparing Bonds and Stocks

Surface interest rate, yield to maturity, duration

5.

Hot Potato, Short Selling

Short selling, which involves selling stocks even by borrowing them

Double the profits, infinite losses

Short selling in South Korea

6. IPO, public offering, and stocks

IPO process and listing

ABC of public offering subscription

Ttasang, Ttasang is in history

7.

Steamed rice and potatoes

Free stock dividend

The more bad news there is, the more likely it is that a paid-in capital increase will be a good thing.

Free potatoes without any compensation

Shareholder-friendly capital increase

8.

public offering

The public offering price is key

22% public offering transfer tax

Introduction of a mandatory public offering system?

Part 3 Real Estate Insights

1.

Kick the Ladder Off the Korean Housing Market

Buying a home is not speculation.

Let's recognize the dual status of multiple homeowners.

2.

Will population and real estate plummet like in Japan?

Global low birth rates, aging population, and population decline

Single-person households and the number of households are increasing…

The conclusion is a Japanese-style collapse?

3.

Is the end of jeonse and the era of monthly rent a blessing?

Half of new lease contracts are jeonse

Jeonse to ease the burden of housing costs

The road to reversal

4.

You need to know about the subscription system

How many new apartments are being supplied?

Let's see again, subscription account

1st place, extra points, lottery

Everything you need to know about taxes related to subscription rights

5.

Paying property tax and also comprehensive real estate tax?

History of the introduction of the comprehensive real estate tax

Inheritance tax, who pays how much?

If the assessed value of a home exceeds 1.2 billion won, a comprehensive real estate tax is imposed.

Part 4 Industry Insights

1.

South Korean companies and industrial structure

Companies that move Korea

Korea's leading industry

Corporate tax that cannot keep up with corporate competitiveness

2.

Trade balance and current account balance

Trade balance must pass through customs

Current account balance including foreign dividends and overseas travel expenditures

3.

Semiconductor Industry Analysis and Outlook

Semiconductor market and industry at a glance

US-China semiconductor war

4.

Secondary Battery Industry Analysis and Outlook

Structure of secondary batteries

Domestic secondary battery materials value chain

Secondary battery industry challenges

5.

Inflation Reduction Act

6.

Automotive Industry Analysis Outlook

global automobile market

The era of electric vehicles

7.

The age of artificial intelligence

ChatGPT, the turning point toward singularity

NVIDIA's AI semiconductor launch

AI side effects and bubble controversy

Part 5: U.S. Economic Insights

1.

Consumption, the core of the US economy: Walmart and Costco

Walmart vs. Costco

Small but mighty Trader Joe's

2.

The US Federal Reserve is holding the world economy in its hands

Fed Chairman = FRB Chairman = FOMC Chairman

The FOMC is drawing global attention

3.

The three major U.S. price levels: oil, rent, and electricity.

CPI vs. PCE… The Fed is PCE

perceived prices

4.

Operation Twist and Yield Curve Control

5.

The 401(k): A Powerhouse of the American Economy

Detailed image

Into the book

In fact, if we go into detail, the work that central banks do is more extensive and complex.

One of the important roles of a central bank like the Bank of Korea is to determine how much money is in circulation (controlling the money supply).

In the case of the Bank of Korea, to control the money supply, it purchases government bonds (increases the money supply) and sells them (decreases the money supply).

Increasing lending to commercial banks also leads to an increase in the money supply.

As the money supply increases, the value of the currency falls.

When there is a lot of money in circulation, the value of money, or interest rates, decreases according to the law of supply and demand.

When market interest rates fall, it means that the value of money is falling.

As the value of money falls, the number of people taking out loans increases.

Also, since the value of the same 100 won has fallen, the amount of goods that can be purchased has decreased, and we feel that prices have risen.

---From "Central Banks are Inflation Fighters"

When it comes to getting a mortgage, nothing is more important than the interest rate.

This is because it is a loan that must be repaid over a period of up to 50 years (maturity of 50 years).

Even for loans that last 1-2 years, interest rates are important, so it goes without saying that it is even more important for home equity loans.

Just like credit loans, the interest rate for home equity loans is calculated using the system of ‘base rate + additional rate - preferential rate.’

The COFIX interest rate or financial bond interest rate is often used as the base interest rate, and the additional interest rate is different for each borrower, and is calculated by the bank by considering the borrower's default risk, loan type, margin, etc.

The most commonly used benchmark interest rate these days is the Copix rate.

We don't need to know the formula for calculating the Copix interest rate.

The really important part is knowing whether the Copix interest rate calculated according to the formula is high or low compared to financial bonds or other interest rates, and whether it will rise or fall in the future.

There are four types of Copix: Copix based on new handling amount, Copix based on balance, Copix based on new balance, and Copix based on short-term.

Since the new handling amount standard and the balance standard are used in almost all cases, it is sufficient to know only these two.

The new handling amount-based Copix is more sensitive to market interest rate fluctuations than the balance-based Copix.

The balance criteria is a bit slow to work.

Therefore, if the interest rate is rising, the balance standard rises more slowly, and if the interest rate is falling, the balance standard falls more slowly.

---From "The Base Rate for Housing Mortgage Loans, 'COFIX'"

A bank run is cited as the decisive reason why Silicon Valley Bank (SVB) in the United States went bankrupt just 36 hours after rumors of a crisis emerged in early March 2023.

A bank run is a situation where customers who have deposited money in a bank suddenly withdraw large amounts of money in an instant.

In the past, the word 'run' was used because people had to run to the bank and wait in long lines to withdraw money.

The reason bank runs occur is because if a bank fails, you may not be able to get your deposited money back.

Although each country has its own deposit protection system, in the case of SVB, more than 90% of customers had deposited funds exceeding the deposit protection limit of $250,000, so rumors of a crisis arose and a bank run occurred in just one day with $42 billion (55 trillion won) of deposits being withdrawn.

SVB's losses snowballed as it sold off its US Treasury bonds at a low price to pay out deposits to customers, and when it was no longer able to pay out deposits, it eventually went bankrupt.

The company went bankrupt at lightning speed just 36 hours after the crisis rumors were announced.

---From "Bank Run"

Stock prices move according to many variables, but none are as important as supply and demand.

The same goes for KOSPI.

KOSPI and KOSPI-listed stocks basically rise and fall according to demand (buyers) and supply (sellers).

In particular, the key to supply and demand are foreigners.

Foreigners mostly refer to foreign institutional investors, and they have a significant influence on stock prices, holding more than 30% of the KOSPI market capitalization.

Individual investors are like grains of sand, and their information is different, making it difficult to predict their buying and selling patterns. However, foreign investors have a similar level of limited information and react sensitively to exchange rate variables, showing a characteristic of moving in a relatively coordinated manner.

---From "Our country's stock market at a glance"

A PBR of 1x means that the market capitalization is equal to the value of all assets sold by the company.

If the company goes bankrupt and goes into liquidation, and the PBR is 1, shareholders are likely to recover almost all of their investment.

Therefore, if the PBR is greater than 1, it can be seen as an overvalued situation because the market capitalization is greater than the net assets, while if the PBR is less than 1, it can be seen as an undervalued situation.

Of course, the PBR 1x standard also varies by industry and stock.

For example, many people believe that when SK Hynix's stock price falls below PBR 1, it is a good time to buy.

This is because historically, there have been many cases where a rebound occurred when the PBR fell below 1x.

As can be inferred from the formula, a low PBR stock corresponds to a case where the company has a lot of assets but a low stock price.

If a company has a lot of assets but its operating performance and profit growth are not promising, it will be difficult for it to escape a low PBR.

---From "PER, PBR, EPS and PEG"

If the jeonse system disappears, the number of new apartments for sale will inevitably decrease rapidly.

This is because a lot of investment is made by giving out a jeonse deposit when it is time to move in after receiving a new apartment.

The deposit is used to cover the loan, because the deposit that the landlord receives from the tenant is interest-free money.

The argument that jeonse deposits should be regulated because they serve as a type of private finance is gaining traction.

However, it is difficult to view this as an unequal or unfair private loan contract because the landlord does not borrow money completely for free, but rather lends the house and pays all kinds of taxes.

The reason why the world is maintained is because of this structure and reason.

As jeonse (long-term lease) disappears and new apartment sales decrease, the supply of new apartments will decrease, which will inevitably lead to rising prices.

If demand for new apartments also decreases similarly, prices will not rise, but demand for new apartments is expected to remain high, both now and in the future.

Of course, if prices rise too much, demand may involuntarily decrease.

If all jeonse (long-term deposits) are converted to monthly rent, the burden of housing costs will increase and disposable income will decrease, which could lead to a contraction in domestic demand.

As expected, the savings rate also goes down.

---From "The End of the Jeonse Era, Is the Era of Monthly Rent a Blessing?"

If you apply for a new apartment and are selected, you will have the right to purchase the apartment until you move in.

In the past, subscription rights were not considered as housing when considering the tax exemption conditions for one house per household, but subscription rights acquired after January 1, 2021 are considered as housing.

Therefore, if you own a house and acquire the right to purchase, you must dispose of the existing house within two years to be considered a temporary second home owner and exempt from transfer tax.

The temporary exemption from transfer tax on two homes (one home + one subscription right/occupancy right) was significantly improved in January 2023 to revitalize the frozen housing market.

First, the deadline for disposing of existing homes has been extended by one year, from two years to three years.

Now, if you dispose of your existing home within 3 years (basic disposal period) after acquiring the right to sell, you can receive the benefit of exemption from transfer tax.

In addition, if the right to move in or the right to purchase is completed as a house and the house is occupied, even if 3 years have passed from the date of acquisition of the right to move in or the right to purchase, the transfer tax does not have to be paid if the existing house is sold within 3 years (special disposal period) after completion.

There is no actual residency requirement for the basic disposal period of 3 years, but there is an actual residency requirement for the special disposal period of 3 years.

---From "Everything About Taxes Related to Pre-sale Rights"

It is no exaggeration to say that the domestic secondary battery industry ecosystem is almost completely established, from raw materials to finished products (cells).

In the semiconductor industry, integrated semiconductor manufacturers (IDMs) such as Samsung Electronics and SK Hynix, which focus on memory semiconductors, are at the top, and an ecosystem of materials, parts, and equipment companies is established below them.

There is also a high dependence on overseas countries, including the United States, for key equipment.

However, in the secondary battery industry, four key material companies (positive electrode materials, negative electrode materials, separators, and electrolytes) are leading the entire battery industry ecosystem.

Of course, the three cell companies (LG Energy Solution, Samsung SDI, and SK On) are overwhelmingly large in terms of market capitalization and sales, but domestic material companies have global competitiveness and have established themselves as the central axis of the secondary battery industry ecosystem on an equal footing with cell companies.

In particular, cathode material companies, which account for 40-50% of the cost of secondary batteries and determine the capacity and performance of the battery, are effectively dominating the secondary battery ecosystem.

This is because domestic cell manufacturers cannot produce batteries without collaborating with domestic cathode material companies.

Domestic cathode material manufacturers are evaluated to have achieved the status of 'super-B' by possessing ternary and tetravalent battery technologies.

---From "Domestic Secondary Battery Materials Value Chain"

Among the Federal Reserve's organizations, the Federal Reserve Board (FRB) manages, monitors, and supervises the U.S. financial system to ensure its stable operation. While the FRB's board of directors meets biweekly, it rarely receives significant media or public attention.

On the other hand, the FOMC holds a high profile, attracting the attention of not only Americans but the entire world. On days when the former chairman stands before a microphone after a meeting to deliver a statement and hold a Q&A session with reporters, investors in stocks and bonds, in particular, closely watch every word and phrase to determine its potential market impact. The FOMC is the decision-making body for monetary policy within the Fed, with a total of 19 members, including seven Federal Reserve Board members and 12 regional bank presidents.

Of the 19 members, eight, including the seven Federal Reserve Board members and the New York Federal Reserve Bank president, always have voting rights. The FOMC chair is the Fed chairman, and the New York Federal Reserve Bank president serves as vice chair.

The remaining 11 regional presidents are divided into groups of 2-3 (Boston, Philadelphia, Richmond, Cleveland, Chicago, Atlanta, St. Louis, Dallas, Minneapolis, Kansas City, San Francisco) and the four of them take turns voting for one year.

Therefore, when the FOMC meets, there are a total of 12 members who have voting rights.

Of course, there are occasional vacancies on the FRB board, resulting in fewer than 12 members. The FOMC meets eight times a year.

It will be held at six-week intervals, and the schedule for the 2024 regular meeting is as follows.

One of the important roles of a central bank like the Bank of Korea is to determine how much money is in circulation (controlling the money supply).

In the case of the Bank of Korea, to control the money supply, it purchases government bonds (increases the money supply) and sells them (decreases the money supply).

Increasing lending to commercial banks also leads to an increase in the money supply.

As the money supply increases, the value of the currency falls.

When there is a lot of money in circulation, the value of money, or interest rates, decreases according to the law of supply and demand.

When market interest rates fall, it means that the value of money is falling.

As the value of money falls, the number of people taking out loans increases.

Also, since the value of the same 100 won has fallen, the amount of goods that can be purchased has decreased, and we feel that prices have risen.

---From "Central Banks are Inflation Fighters"

When it comes to getting a mortgage, nothing is more important than the interest rate.

This is because it is a loan that must be repaid over a period of up to 50 years (maturity of 50 years).

Even for loans that last 1-2 years, interest rates are important, so it goes without saying that it is even more important for home equity loans.

Just like credit loans, the interest rate for home equity loans is calculated using the system of ‘base rate + additional rate - preferential rate.’

The COFIX interest rate or financial bond interest rate is often used as the base interest rate, and the additional interest rate is different for each borrower, and is calculated by the bank by considering the borrower's default risk, loan type, margin, etc.

The most commonly used benchmark interest rate these days is the Copix rate.

We don't need to know the formula for calculating the Copix interest rate.

The really important part is knowing whether the Copix interest rate calculated according to the formula is high or low compared to financial bonds or other interest rates, and whether it will rise or fall in the future.

There are four types of Copix: Copix based on new handling amount, Copix based on balance, Copix based on new balance, and Copix based on short-term.

Since the new handling amount standard and the balance standard are used in almost all cases, it is sufficient to know only these two.

The new handling amount-based Copix is more sensitive to market interest rate fluctuations than the balance-based Copix.

The balance criteria is a bit slow to work.

Therefore, if the interest rate is rising, the balance standard rises more slowly, and if the interest rate is falling, the balance standard falls more slowly.

---From "The Base Rate for Housing Mortgage Loans, 'COFIX'"

A bank run is cited as the decisive reason why Silicon Valley Bank (SVB) in the United States went bankrupt just 36 hours after rumors of a crisis emerged in early March 2023.

A bank run is a situation where customers who have deposited money in a bank suddenly withdraw large amounts of money in an instant.

In the past, the word 'run' was used because people had to run to the bank and wait in long lines to withdraw money.

The reason bank runs occur is because if a bank fails, you may not be able to get your deposited money back.

Although each country has its own deposit protection system, in the case of SVB, more than 90% of customers had deposited funds exceeding the deposit protection limit of $250,000, so rumors of a crisis arose and a bank run occurred in just one day with $42 billion (55 trillion won) of deposits being withdrawn.

SVB's losses snowballed as it sold off its US Treasury bonds at a low price to pay out deposits to customers, and when it was no longer able to pay out deposits, it eventually went bankrupt.

The company went bankrupt at lightning speed just 36 hours after the crisis rumors were announced.

---From "Bank Run"

Stock prices move according to many variables, but none are as important as supply and demand.

The same goes for KOSPI.

KOSPI and KOSPI-listed stocks basically rise and fall according to demand (buyers) and supply (sellers).

In particular, the key to supply and demand are foreigners.

Foreigners mostly refer to foreign institutional investors, and they have a significant influence on stock prices, holding more than 30% of the KOSPI market capitalization.

Individual investors are like grains of sand, and their information is different, making it difficult to predict their buying and selling patterns. However, foreign investors have a similar level of limited information and react sensitively to exchange rate variables, showing a characteristic of moving in a relatively coordinated manner.

---From "Our country's stock market at a glance"

A PBR of 1x means that the market capitalization is equal to the value of all assets sold by the company.

If the company goes bankrupt and goes into liquidation, and the PBR is 1, shareholders are likely to recover almost all of their investment.

Therefore, if the PBR is greater than 1, it can be seen as an overvalued situation because the market capitalization is greater than the net assets, while if the PBR is less than 1, it can be seen as an undervalued situation.

Of course, the PBR 1x standard also varies by industry and stock.

For example, many people believe that when SK Hynix's stock price falls below PBR 1, it is a good time to buy.

This is because historically, there have been many cases where a rebound occurred when the PBR fell below 1x.

As can be inferred from the formula, a low PBR stock corresponds to a case where the company has a lot of assets but a low stock price.

If a company has a lot of assets but its operating performance and profit growth are not promising, it will be difficult for it to escape a low PBR.

---From "PER, PBR, EPS and PEG"

If the jeonse system disappears, the number of new apartments for sale will inevitably decrease rapidly.

This is because a lot of investment is made by giving out a jeonse deposit when it is time to move in after receiving a new apartment.

The deposit is used to cover the loan, because the deposit that the landlord receives from the tenant is interest-free money.

The argument that jeonse deposits should be regulated because they serve as a type of private finance is gaining traction.

However, it is difficult to view this as an unequal or unfair private loan contract because the landlord does not borrow money completely for free, but rather lends the house and pays all kinds of taxes.

The reason why the world is maintained is because of this structure and reason.

As jeonse (long-term lease) disappears and new apartment sales decrease, the supply of new apartments will decrease, which will inevitably lead to rising prices.

If demand for new apartments also decreases similarly, prices will not rise, but demand for new apartments is expected to remain high, both now and in the future.

Of course, if prices rise too much, demand may involuntarily decrease.

If all jeonse (long-term deposits) are converted to monthly rent, the burden of housing costs will increase and disposable income will decrease, which could lead to a contraction in domestic demand.

As expected, the savings rate also goes down.

---From "The End of the Jeonse Era, Is the Era of Monthly Rent a Blessing?"

If you apply for a new apartment and are selected, you will have the right to purchase the apartment until you move in.

In the past, subscription rights were not considered as housing when considering the tax exemption conditions for one house per household, but subscription rights acquired after January 1, 2021 are considered as housing.

Therefore, if you own a house and acquire the right to purchase, you must dispose of the existing house within two years to be considered a temporary second home owner and exempt from transfer tax.

The temporary exemption from transfer tax on two homes (one home + one subscription right/occupancy right) was significantly improved in January 2023 to revitalize the frozen housing market.

First, the deadline for disposing of existing homes has been extended by one year, from two years to three years.

Now, if you dispose of your existing home within 3 years (basic disposal period) after acquiring the right to sell, you can receive the benefit of exemption from transfer tax.

In addition, if the right to move in or the right to purchase is completed as a house and the house is occupied, even if 3 years have passed from the date of acquisition of the right to move in or the right to purchase, the transfer tax does not have to be paid if the existing house is sold within 3 years (special disposal period) after completion.

There is no actual residency requirement for the basic disposal period of 3 years, but there is an actual residency requirement for the special disposal period of 3 years.

---From "Everything About Taxes Related to Pre-sale Rights"

It is no exaggeration to say that the domestic secondary battery industry ecosystem is almost completely established, from raw materials to finished products (cells).

In the semiconductor industry, integrated semiconductor manufacturers (IDMs) such as Samsung Electronics and SK Hynix, which focus on memory semiconductors, are at the top, and an ecosystem of materials, parts, and equipment companies is established below them.

There is also a high dependence on overseas countries, including the United States, for key equipment.

However, in the secondary battery industry, four key material companies (positive electrode materials, negative electrode materials, separators, and electrolytes) are leading the entire battery industry ecosystem.

Of course, the three cell companies (LG Energy Solution, Samsung SDI, and SK On) are overwhelmingly large in terms of market capitalization and sales, but domestic material companies have global competitiveness and have established themselves as the central axis of the secondary battery industry ecosystem on an equal footing with cell companies.

In particular, cathode material companies, which account for 40-50% of the cost of secondary batteries and determine the capacity and performance of the battery, are effectively dominating the secondary battery ecosystem.

This is because domestic cell manufacturers cannot produce batteries without collaborating with domestic cathode material companies.

Domestic cathode material manufacturers are evaluated to have achieved the status of 'super-B' by possessing ternary and tetravalent battery technologies.

---From "Domestic Secondary Battery Materials Value Chain"

Among the Federal Reserve's organizations, the Federal Reserve Board (FRB) manages, monitors, and supervises the U.S. financial system to ensure its stable operation. While the FRB's board of directors meets biweekly, it rarely receives significant media or public attention.

On the other hand, the FOMC holds a high profile, attracting the attention of not only Americans but the entire world. On days when the former chairman stands before a microphone after a meeting to deliver a statement and hold a Q&A session with reporters, investors in stocks and bonds, in particular, closely watch every word and phrase to determine its potential market impact. The FOMC is the decision-making body for monetary policy within the Fed, with a total of 19 members, including seven Federal Reserve Board members and 12 regional bank presidents.

Of the 19 members, eight, including the seven Federal Reserve Board members and the New York Federal Reserve Bank president, always have voting rights. The FOMC chair is the Fed chairman, and the New York Federal Reserve Bank president serves as vice chair.

The remaining 11 regional presidents are divided into groups of 2-3 (Boston, Philadelphia, Richmond, Cleveland, Chicago, Atlanta, St. Louis, Dallas, Minneapolis, Kansas City, San Francisco) and the four of them take turns voting for one year.

Therefore, when the FOMC meets, there are a total of 12 members who have voting rights.

Of course, there are occasional vacancies on the FRB board, resulting in fewer than 12 members. The FOMC meets eight times a year.

It will be held at six-week intervals, and the schedule for the 2024 regular meeting is as follows.

---From "FOMC, which the whole world is watching"

Publisher's Review

NO to stereotypical economics textbooks

Money-making knowledge that informs economic trends

Everyone in society earns money, goes to the bank, buys a house, and spends money to live.

It is no exaggeration to say that every action we take in life is related to the economy.

I have included only the essential economic knowledge that you need to know at least this much to avoid being left behind.

These are essential knowledge that we must know for financial investment, which has become a part of our daily lives.

This book approaches economic issues, ranging from finance, stocks, real estate, industry, and the U.S. economy, as a matter of 'money' rather than as overly difficult and complex theories.

Part 1, Financial Insights, explains the process by which an increase in the money supply leads to a decline in the value of money, lower interest rates, increased lending, and rising prices. It covers the role of central banks, as well as basic concepts such as interest rates, lending, foreign exchange, and exchange rates.

It also provides useful information on the basics and combinations of savings, safe deposit boxes, post offices, and other financial institutions.

The reporter's experience working at a bank and his long-term experience covering the financial sector stand out.

"Part 2: Stock Insights" compares and analyzes the KOSPI and KOSDAQ markets, explains the factors that influence the stock market and how to apply them in a balanced way to your investment, and even provides easy-to-understand explanations of terms like PER, PBR, EPS, and PEG.

Furthermore, it clearly contains the concept of stocks at just the right level, including short selling, IPOs, public offerings, stock splits, capital increases, and stock reductions.

Part 3: Real Estate Insights examines the current state of Korea's housing market and covers fundamental economic knowledge applicable to real estate investment, including the relationship between the low birth rate and aging population and the rise of single-person households, the subscription system, the jeonse system, and real estate taxes.

You can obtain useful information based on the experience of the author, who has extensive knowledge of the subject and has even published a book on the topic of 'real estate'.

Part 4, "Industry Insights," examines the industrial structure of the companies and key industries driving our country, covering basic concepts such as the trade balance and current account balance, as well as Korea's key industries such as semiconductors, automobiles, secondary batteries, and the emerging AI industry.

It contains practical content based on the author's extensive experience covering industrial sites and research on companies.

Part 5: U.S. Economic Insights covers the fundamental concepts of the U.S. economy that have a direct impact on our country's economic policy.

Based on the author's experience living in the United States during a period of peak inflation, this book provides practical information on the American economy, starting with the functions and roles of the Federal Reserve, which attracts worldwide attention, and exploring the forces that support the American economy.

Money-making knowledge that informs economic trends

Everyone in society earns money, goes to the bank, buys a house, and spends money to live.

It is no exaggeration to say that every action we take in life is related to the economy.

I have included only the essential economic knowledge that you need to know at least this much to avoid being left behind.

These are essential knowledge that we must know for financial investment, which has become a part of our daily lives.

This book approaches economic issues, ranging from finance, stocks, real estate, industry, and the U.S. economy, as a matter of 'money' rather than as overly difficult and complex theories.

Part 1, Financial Insights, explains the process by which an increase in the money supply leads to a decline in the value of money, lower interest rates, increased lending, and rising prices. It covers the role of central banks, as well as basic concepts such as interest rates, lending, foreign exchange, and exchange rates.

It also provides useful information on the basics and combinations of savings, safe deposit boxes, post offices, and other financial institutions.

The reporter's experience working at a bank and his long-term experience covering the financial sector stand out.

"Part 2: Stock Insights" compares and analyzes the KOSPI and KOSDAQ markets, explains the factors that influence the stock market and how to apply them in a balanced way to your investment, and even provides easy-to-understand explanations of terms like PER, PBR, EPS, and PEG.

Furthermore, it clearly contains the concept of stocks at just the right level, including short selling, IPOs, public offerings, stock splits, capital increases, and stock reductions.

Part 3: Real Estate Insights examines the current state of Korea's housing market and covers fundamental economic knowledge applicable to real estate investment, including the relationship between the low birth rate and aging population and the rise of single-person households, the subscription system, the jeonse system, and real estate taxes.

You can obtain useful information based on the experience of the author, who has extensive knowledge of the subject and has even published a book on the topic of 'real estate'.

Part 4, "Industry Insights," examines the industrial structure of the companies and key industries driving our country, covering basic concepts such as the trade balance and current account balance, as well as Korea's key industries such as semiconductors, automobiles, secondary batteries, and the emerging AI industry.

It contains practical content based on the author's extensive experience covering industrial sites and research on companies.

Part 5: U.S. Economic Insights covers the fundamental concepts of the U.S. economy that have a direct impact on our country's economic policy.

Based on the author's experience living in the United States during a period of peak inflation, this book provides practical information on the American economy, starting with the functions and roles of the Federal Reserve, which attracts worldwide attention, and exploring the forces that support the American economy.

GOODS SPECIFICS

- Date of issue: May 13, 2024

- Page count, weight, size: 300 pages | 560g | 152*225*18mm

- ISBN13: 9791164846825

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)