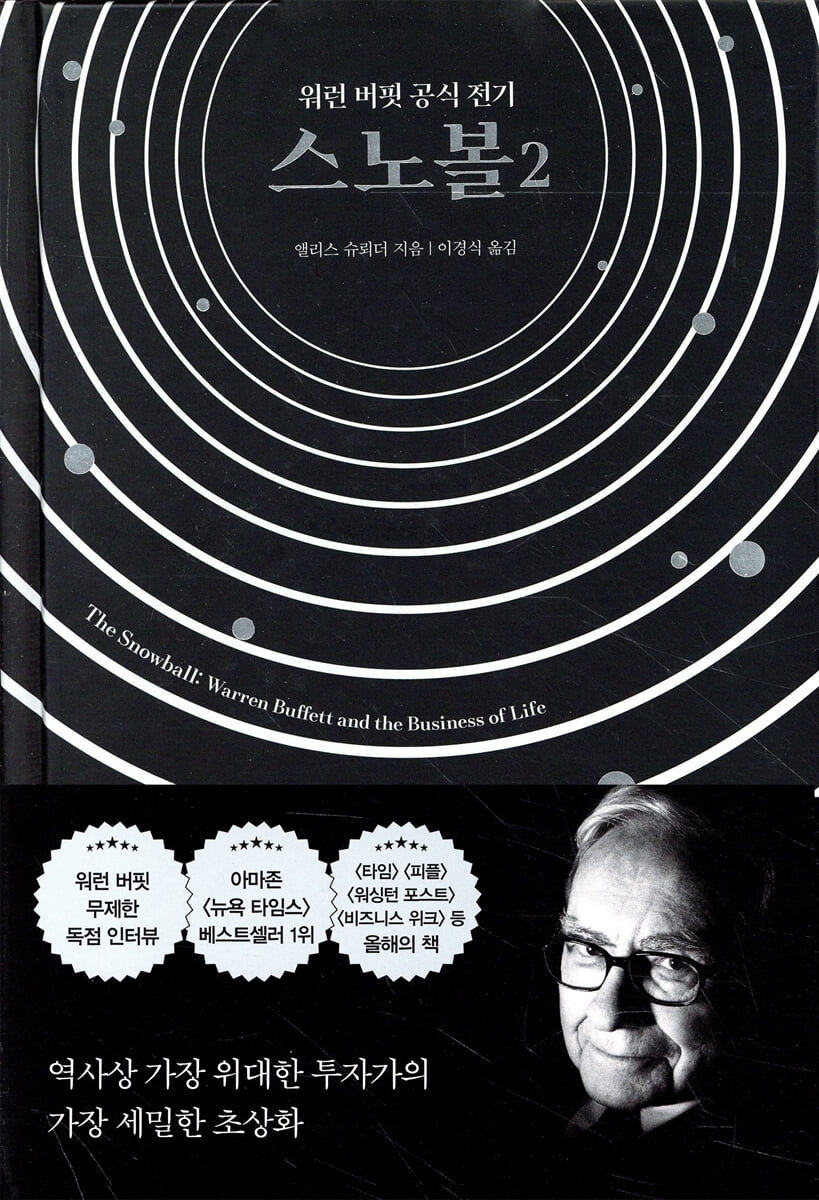

Snowball 2

|

Description

Book Introduction

*** Warren Buffett Unlimited Exclusive Interview ***

*** Amazon·[New York Times] #1 Bestseller ***

*** Book of the Year by [Time], [People], [Washington Post], [Business Week], etc. ***

The most detailed portrait of Warren Buffett, the greatest investor in history.

“Can you write my story?”

One day, Alice Schroeder, who was working as an executive at Morgan Stanley, receives an unbelievable offer.

The person who made this suggestion was none other than the great investor Warren Buffett, known as the 'Sage of Omaha.'

He has held the top spot on Wall Street, the center of global finance, for over 50 years, but has never written a single book, and is only remembered as a legend. He has finally decided to take off his veil and share his story with the world.

Alice Schroeder then devoted herself entirely to writing his story, researching and analyzing Buffett for five years.

For this project, Warren Buffett promises her unlimited interview opportunities, extensive information about himself, and active support from those around him.

As a result, the unique biography "Snowball" was born, which records Buffett's life without omission.

As soon as this book was published in 2009, it not only won the title of 'Book of the Year' selected by major media outlets, but also became a bestseller simultaneously around the world.

This is partly due to the fervent interest in the great investor Warren Buffett, but also thanks to Alice Schroeder's persistent efforts to convey Buffett's investment performance, as well as his unusual private life and foolish mistakes, as objectively and meticulously as possible.

This revised edition, which is being republished in response to popular demand, corrects errors from the previous edition and features a new cover that faithfully captures the meaning of the title.

In Volume 2, which chronicles Buffett's life after his 40s, you can see his mature side as an "entrepreneur" who went beyond being a simple "investor" to trying to rectify the problems of companies in which he invested, such as Salomon Brothers and Coca-Cola.

After amassing enormous wealth, his unconventional donation philosophy of giving back to society without leaving his name behind is also noteworthy.

It is also impressive that he always faithfully fulfills his role to his family and friends to avoid any conflicts arising due to wealth.

The colorful photographs of Buffett and those around him included in Volume 1 further flesh out the biography of this remarkable man.

Warren Buffett, who still holds a reputation as the world's number one investor even after more than 10 years since the book was published.

For those wondering where his insight, which has allowed him to continue making "winning investments" in a turbulent stock market for over half a century, comes from, this book will provide the most definitive answer.

*** Amazon·[New York Times] #1 Bestseller ***

*** Book of the Year by [Time], [People], [Washington Post], [Business Week], etc. ***

The most detailed portrait of Warren Buffett, the greatest investor in history.

“Can you write my story?”

One day, Alice Schroeder, who was working as an executive at Morgan Stanley, receives an unbelievable offer.

The person who made this suggestion was none other than the great investor Warren Buffett, known as the 'Sage of Omaha.'

He has held the top spot on Wall Street, the center of global finance, for over 50 years, but has never written a single book, and is only remembered as a legend. He has finally decided to take off his veil and share his story with the world.

Alice Schroeder then devoted herself entirely to writing his story, researching and analyzing Buffett for five years.

For this project, Warren Buffett promises her unlimited interview opportunities, extensive information about himself, and active support from those around him.

As a result, the unique biography "Snowball" was born, which records Buffett's life without omission.

As soon as this book was published in 2009, it not only won the title of 'Book of the Year' selected by major media outlets, but also became a bestseller simultaneously around the world.

This is partly due to the fervent interest in the great investor Warren Buffett, but also thanks to Alice Schroeder's persistent efforts to convey Buffett's investment performance, as well as his unusual private life and foolish mistakes, as objectively and meticulously as possible.

This revised edition, which is being republished in response to popular demand, corrects errors from the previous edition and features a new cover that faithfully captures the meaning of the title.

In Volume 2, which chronicles Buffett's life after his 40s, you can see his mature side as an "entrepreneur" who went beyond being a simple "investor" to trying to rectify the problems of companies in which he invested, such as Salomon Brothers and Coca-Cola.

After amassing enormous wealth, his unconventional donation philosophy of giving back to society without leaving his name behind is also noteworthy.

It is also impressive that he always faithfully fulfills his role to his family and friends to avoid any conflicts arising due to wealth.

The colorful photographs of Buffett and those around him included in Volume 1 further flesh out the biography of this remarkable man.

Warren Buffett, who still holds a reputation as the world's number one investor even after more than 10 years since the book was published.

For those wondering where his insight, which has allowed him to continue making "winning investments" in a turbulent stock market for over half a century, comes from, this book will provide the most definitive answer.

- You can preview some of the book's contents.

Preview

index

PART 5 The King of Wall Street

43.

Pharaoh | 44.

Rose | 45.

Call a tow truck | 46.

Crossing the Rubicon | 47.

White Night | 48.

Thumb sucking | 49.

Angry Gods | 50.

Lotto | 51.

Bear market whatever | 52.

chicken feed

PART 6 RESERVATION

53.

Genie of the Lamp | 54.

Semicolon | 55.

The Last K-Party | 56.

By the rich, for the rich | 57.

Wise Man | 58.

Oral cancer | 59.

Winter | 60.

Frozen Coke | 61.

Seventh Fire | 62.

Deposit certificate

Reviews

main

Search

Note

Photo copyright

Acknowledgements

43.

Pharaoh | 44.

Rose | 45.

Call a tow truck | 46.

Crossing the Rubicon | 47.

White Night | 48.

Thumb sucking | 49.

Angry Gods | 50.

Lotto | 51.

Bear market whatever | 52.

chicken feed

PART 6 RESERVATION

53.

Genie of the Lamp | 54.

Semicolon | 55.

The Last K-Party | 56.

By the rich, for the rich | 57.

Wise Man | 58.

Oral cancer | 59.

Winter | 60.

Frozen Coke | 61.

Seventh Fire | 62.

Deposit certificate

Reviews

main

Search

Note

Photo copyright

Acknowledgements

Into the book

Carol Loomis pushed hard for the Pocheon newspaper to publish a cover story titled "Should All Wealth Be Left to Children?"

Many people said that family comes first.

But Warren said:

“Our children will make their own place in this world.

And they know that I support them no matter what they want to do.”

But giving children trust funds simply because they were born into wealthy families (which Warren saw as giving them "a lifetime of free lunch coupons") could be harmful and even antisocial.

This was Warren's logic.

--- 「43.

From "Pharaoh"

At the time, Feuerstein informed Gutfreund that Moser's actions could be considered fundamentally criminal.

He believed that Salomon Brothers had no legal obligation to report the matter on procedural grounds, but that failure to report the matter would put the company in serious conflict with regulators, which would undoubtedly lead to revelations at the Federal Reserve.

And he conveyed this judgment to Gutfreund.

Gutfreund said the issue would be handled well.

Interestingly, however, Gutfreund had no concrete plans to go to the Federal Reserve Bank's ornate Italianate building and break the news to Gerald Corrigan.

Moreover, it concluded that the forged bid was a "one-time, isolated act," and kept Moser in charge of the Treasury department.

Upon hearing this, Munger said:

“That’s thumb sucking.

People are always sucking their thumbs like that.”

Munger later said that what he meant by thumb-sucking was "sitting around, thinking, brooding, and deliberating when you really need to act right away."

--- 「48.

From "Thumb Sucking"

Warren decided to play the last card he had at his disposal against Corrigan.

And then I made a phone call.

“Jerry, I haven’t accepted the position of interim president yet.

Due to the decision made by the Treasury Department, we have not yet completed the Board of Directors' resolution.

I am not the chairman of Salomon Brothers anymore.

I could be president in 30 seconds, but I don't want to spend the rest of my life cleaning up the mess of the biggest financial disaster in history.

Whichever way I choose, there will be over fifty people suing me in the future.

But I've been living my life

I have no intention of spending my days mopping up the mess caused by the street disaster.

“I’m just saying that I’m going to dedicate a certain amount of my life to protecting this damn place.”

Charlie Munger advised Warren not to do that under any circumstances.

“That won’t do.

“It might be exciting the first day, but from the next day on, you’ll be stuck and have to spend the next 20 years in court.”

But Corrigan took this warning more seriously than any other official.

“I'll call you back.”

As Warren waited for the call, he mentally mapped out what he would do next.

I imagined myself getting into the elevator.

Get off on the 6th floor.

I go into the press conference room alone.

And he says this in front of reporters.

“We just declared bankruptcy.”

--- 「48.

From "Thumb Sucking"

Warren set aside other topics and asked Gates directly whether IBM would do well in the future and whether IBM was a competitor to Microsoft.

He also asked why countless computer companies appear and disappear.

Gates began to explain and recommended that Warren buy two stocks.

It was Intel and Microsoft.

Then he asked Warren about running a newspaper.

He replied that newspapers are having an increasingly difficult time because of other media.

Within minutes of meeting, the two were already deep in conversation.

(…) Celebrities gathered around the two, but their conversation continued without interruption.

Gates and Warren strolled along the pebbly beach.

The two began to feel attracted to each other.

--- 「50.

From "Lotto"

As you know, I've been doing pretty well in this world.

The odds of me being born in the United States in 1930 were about 50 to 1 against me.

But I won the lottery when I came out of my mother's womb and was born in a country called America.

If I had been born in another country, my chances of success would have been much smaller.

Let's say there are two twins in the mother's womb.

Both are bright and energetic.

Let's say the genie in the lamp says this to these children:

'One of you will be born in the United States, and another will be born in Bangladesh.

If you were born in Bangladesh, you wouldn't pay a single penny in taxes.

So, what percentage of the income of a child born in Bangladesh is that of a child born in the United States?' This suggests that a person's fate is tied to the society in which he or she lives and is not determined solely by innate characteristics.

(…) That is the ‘ovarian lottery’.

--- 「50.

From "Lotto"

Berkshire Hathaway's greatest opportunities have always come during times of uncertainty.

Berkshire Hathaway's opportunity arose when other companies lacked the insight, resources, and fortitude to make sound decisions and execute them.

In this regard, Warren said:

“In a crisis, when cash is combined with courage, its value is infinite.”

Now it's Warren Buffett's time again.

A person of ordinary spirit would have thrown up his hands, but Warren had been waiting for this kind of opportunity to descend like sleet on Kiewit Plaza for a long time.

It seemed like all his powers were working at once.

He bought a significant amount of junk bonds in the name of Berkshire Hathaway, which ended up being like a butt.

--- 「56.

From “By the rich, for the rich”

On June 26, 2006, Warren announced that he would transfer 85 percent of his Berkshire Hathaway stock to several foundations over several years.

At the time, it was a huge asset worth 37 billion dollars.

It was an unprecedented scale of charity work in history.

Five-sixths of his Berkshire Hathaway holdings have already gone to the Bill & Melinda Gates Foundation, the world's largest charitable foundation.16 The combined fortunes of two tycoons have been used to create a better world.

Here he attached a condition.

The idea was that the money donated would remain with the foundation and not be used to permanently expand the foundation, but would be used directly for charitable purposes.

To cushion the blow of what could have been the world's largest family foundation, he split his remaining stock, worth about $6 billion, giving $1 billion to each of his three children's foundations and the remaining $3 billion to the Susan Thompson Buffett Foundation.

Many people said that family comes first.

But Warren said:

“Our children will make their own place in this world.

And they know that I support them no matter what they want to do.”

But giving children trust funds simply because they were born into wealthy families (which Warren saw as giving them "a lifetime of free lunch coupons") could be harmful and even antisocial.

This was Warren's logic.

--- 「43.

From "Pharaoh"

At the time, Feuerstein informed Gutfreund that Moser's actions could be considered fundamentally criminal.

He believed that Salomon Brothers had no legal obligation to report the matter on procedural grounds, but that failure to report the matter would put the company in serious conflict with regulators, which would undoubtedly lead to revelations at the Federal Reserve.

And he conveyed this judgment to Gutfreund.

Gutfreund said the issue would be handled well.

Interestingly, however, Gutfreund had no concrete plans to go to the Federal Reserve Bank's ornate Italianate building and break the news to Gerald Corrigan.

Moreover, it concluded that the forged bid was a "one-time, isolated act," and kept Moser in charge of the Treasury department.

Upon hearing this, Munger said:

“That’s thumb sucking.

People are always sucking their thumbs like that.”

Munger later said that what he meant by thumb-sucking was "sitting around, thinking, brooding, and deliberating when you really need to act right away."

--- 「48.

From "Thumb Sucking"

Warren decided to play the last card he had at his disposal against Corrigan.

And then I made a phone call.

“Jerry, I haven’t accepted the position of interim president yet.

Due to the decision made by the Treasury Department, we have not yet completed the Board of Directors' resolution.

I am not the chairman of Salomon Brothers anymore.

I could be president in 30 seconds, but I don't want to spend the rest of my life cleaning up the mess of the biggest financial disaster in history.

Whichever way I choose, there will be over fifty people suing me in the future.

But I've been living my life

I have no intention of spending my days mopping up the mess caused by the street disaster.

“I’m just saying that I’m going to dedicate a certain amount of my life to protecting this damn place.”

Charlie Munger advised Warren not to do that under any circumstances.

“That won’t do.

“It might be exciting the first day, but from the next day on, you’ll be stuck and have to spend the next 20 years in court.”

But Corrigan took this warning more seriously than any other official.

“I'll call you back.”

As Warren waited for the call, he mentally mapped out what he would do next.

I imagined myself getting into the elevator.

Get off on the 6th floor.

I go into the press conference room alone.

And he says this in front of reporters.

“We just declared bankruptcy.”

--- 「48.

From "Thumb Sucking"

Warren set aside other topics and asked Gates directly whether IBM would do well in the future and whether IBM was a competitor to Microsoft.

He also asked why countless computer companies appear and disappear.

Gates began to explain and recommended that Warren buy two stocks.

It was Intel and Microsoft.

Then he asked Warren about running a newspaper.

He replied that newspapers are having an increasingly difficult time because of other media.

Within minutes of meeting, the two were already deep in conversation.

(…) Celebrities gathered around the two, but their conversation continued without interruption.

Gates and Warren strolled along the pebbly beach.

The two began to feel attracted to each other.

--- 「50.

From "Lotto"

As you know, I've been doing pretty well in this world.

The odds of me being born in the United States in 1930 were about 50 to 1 against me.

But I won the lottery when I came out of my mother's womb and was born in a country called America.

If I had been born in another country, my chances of success would have been much smaller.

Let's say there are two twins in the mother's womb.

Both are bright and energetic.

Let's say the genie in the lamp says this to these children:

'One of you will be born in the United States, and another will be born in Bangladesh.

If you were born in Bangladesh, you wouldn't pay a single penny in taxes.

So, what percentage of the income of a child born in Bangladesh is that of a child born in the United States?' This suggests that a person's fate is tied to the society in which he or she lives and is not determined solely by innate characteristics.

(…) That is the ‘ovarian lottery’.

--- 「50.

From "Lotto"

Berkshire Hathaway's greatest opportunities have always come during times of uncertainty.

Berkshire Hathaway's opportunity arose when other companies lacked the insight, resources, and fortitude to make sound decisions and execute them.

In this regard, Warren said:

“In a crisis, when cash is combined with courage, its value is infinite.”

Now it's Warren Buffett's time again.

A person of ordinary spirit would have thrown up his hands, but Warren had been waiting for this kind of opportunity to descend like sleet on Kiewit Plaza for a long time.

It seemed like all his powers were working at once.

He bought a significant amount of junk bonds in the name of Berkshire Hathaway, which ended up being like a butt.

--- 「56.

From “By the rich, for the rich”

On June 26, 2006, Warren announced that he would transfer 85 percent of his Berkshire Hathaway stock to several foundations over several years.

At the time, it was a huge asset worth 37 billion dollars.

It was an unprecedented scale of charity work in history.

Five-sixths of his Berkshire Hathaway holdings have already gone to the Bill & Melinda Gates Foundation, the world's largest charitable foundation.16 The combined fortunes of two tycoons have been used to create a better world.

Here he attached a condition.

The idea was that the money donated would remain with the foundation and not be used to permanently expand the foundation, but would be used directly for charitable purposes.

To cushion the blow of what could have been the world's largest family foundation, he split his remaining stock, worth about $6 billion, giving $1 billion to each of his three children's foundations and the remaining $3 billion to the Susan Thompson Buffett Foundation.

--- 「62.

From the "Retention Certificate"

From the "Retention Certificate"

Publisher's Review

“Life is like rolling a snowball.

The key is to find the ‘wet eyes’ and the ‘long, long hills.’

The passion and wisdom of a giant who has navigated the history of American capitalism head-on.

In June 2021, Warren Buffett announced that he was stepping down as trustee of the Bill & Melinda Gates Foundation.

He said on the day, “After announcing in 2006 that he would donate all of his Berkshire Hathaway stock, which is more than 99 percent of his net worth, to charity, we have now reached half of that goal by 2021.”

It was a bold decision on his part to not want things like having one's name on a building under the pretext of making a donation or for the foundation to be run carelessly after the donor's death.

Just by looking at this appearance, you can easily guess that he is a truly 'extraordinary person' with a different level of philosophy and rational thinking.

Warren Buffett's official biography, "Snowball," is a masterpiece that traces the life and times of one of the most fascinating figures of our time.

There have been many books written about Buffett, but he has never written a memoir.

There was also no book that comprehensively covered Warren Buffett's life and values, not just his investment methods.

The public was always watching his every move, but he was unwilling to tell his full story.

Because of his private life, which was so thoroughly shrouded in secrecy, people thought of him as someone who pursued a simple life that did not match his immense wealth.

But like everyone else, his life wasn't that simple.

When Alice Schroeder, the author of this book, discovered Buffett, she was already widely known in the industry for her extensive knowledge of finance, sharp analytical skills, and her witty and insightful writing.

Buffett was so impressed by the report she wrote about Berkshire Hathaway that he asked her, then a director at Morgan Stanley, to write his own story and gave her his full support.

Yet, he never interfered, and when his story differed from someone else's, he asked that it be written 'in a less flattering way.'

Buffett warned against the so-called "shoe button complex" (a term from the book that refers to pretending to be an expert in another field because one is knowledgeable in one field).

He clearly knew that everyone had a certain range of abilities that they could excel at, and he always drew a line between what was beyond his capabilities and what he could do well.

And he said this is one of the reasons why he has been successful for so many years.

It was thanks to his humble attitude that 《Snowball》 was able to be born.

This book could have been a billionaire's success story, but he didn't want to package himself.

The author, who didn't need to keep an eye on Buffett, used his analyst's unique analytical and observational skills to sharply identify Warren Buffett's strengths and weaknesses.

Buffett's controversial private life was not glossed over either.

The meticulous verification, extensive data collection, and thorough annotation of every single act, every single statement, and every single event unfolding around Buffett, who has been at the center of his time, have made this book more than just a biography of a single person; it is a saga that surveys the history of American capitalism.

Buffett's judgments and actions at critical junctures in American and global finance, including the post-war boom, the American Express crisis, the oil crisis, the prolonged recession in the United States, the Salomon Brothers crisis that nearly triggered the Great Depression, the bankruptcy of Long-Term Capital Management, the September 11 attacks, and the recent economic crisis stemming from subprime mortgage loans, provide vivid lessons for understanding modern capitalism.

Just as he warned of the internet bubble boom, he also warned against derivatives, calling them "financial weapons of mass destruction," and the fact that he managed the risks of derivatives at the insurance companies he ran clearly shows why we should listen to him.

20% average annual return for over 50 years!

Where did his extraordinary insight come from?

In an era where even five years of consistent investment performance is considered impressive, Warren Buffett has maintained his position at the top for over half a century, achieving returns of over 20%.

His wealth is unparalleled in that he did not inherit it but earned it entirely through his own efforts.

But these investment performances are just one adjective that sets him apart.

What made him not only "the world's richest man" but also "a respected sage"? What is it about him that earns him such acclaim as an investor and as a human being?

Born the son of a banker who lost his job during the Great Depression, Buffett began selling gum at the age of six to earn money, driven by a desire to become rich.

Then, at the age of eleven, he started investing in stocks and experienced all kinds of part-time jobs, including delivering newspapers, and learned the 'snowball' principle of modern capitalism, or the principle of 'compound interest', which states that 'if you start with a small amount of money and gradually increase it, eventually money will make more money.'

Welfare is like rolling a snowball down a hill.

If you start with a small lump and keep rolling the snowball, it will eventually become a really big snowball.

He says he first made a small snowball when he was 14 years old while delivering newspapers, and that he has been rolling it very carefully down a long hill ever since.

The incredible story of how he realized this principle early on and effectively utilized it to create enormous wealth is not only admirable in itself, but also provides a profound lesson.

Surprisingly, the lesson isn't about money.

Buffett's incredible focus and learning curve, which allows him to tirelessly absorb all available information at a terrifying pace; the complete trust of shareholders he earned by thoroughly pursuing 'honesty' in a stock market rife with fraud and trickery; his independent thinking that strictly follows his 'internal scoreboard' in a market swayed by cutting-edge financial engineering and rumors; and his incredible judgment that allows him to instantly find the best method when faced with complex problems.

Warren Buffett's life is a life filled with opportunities, yet fraught with pitfalls and pitfalls, and a source of inspiration for everyone in the world of investing and business, as well as countless others who aspire to succeed in life.

Katharine Graham and her two wives,

The never-before-seen true face of Warren Buffett

When the book was first published, the part that aroused the most curiosity was Warren's personal life.

Born into a family with a history of mental illness, his mother abused him and his older sister, and an aunt and a nephew committed suicide.

While he was working as a director of the Washington Post and was obsessed with Katharine Graham, who had the same complex, his wife Susie, whom he loved and cared for dearly, left him. After that, he lived with Astrid, whom Susie sent to him, and 'Susie became his official wife, and Astrid became his de facto wife who lives with him.'

Having unintentionally had two wives, he did not hide this fact from his family and friends, as befitting his personality of thoroughly pursuing 'honesty'.

He never gave up on something precious, whether it was money or a person, and he never let go of the love of his life, Suzy, even after breaking away from monogamy.

Likewise, he built a strong network of trustworthy, wise people and maintained lifelong friendships with them.

In terms of investment, we have shared a true sense of partnership with like-minded shareholders through a 'web of trust built seamlessly.'

This has created an organic structure where Berkshire Hathaway can freely move capital with its subsidiaries, which hold enormous amounts of cash, and has enabled it to function as a continuous system that creates wealth for shareholders as a compounding engine.

To him, shareholders were not just customers, but students who learned his 'investment philosophy' and 'life philosophy', and life companions.

He felt a sense of responsibility for their lives, even advising them on the best way to manage their investments when they were withdrawing their money.

This sense of responsibility led him to live a life of 'noblesse oblige'.

He participated in the campaign to repeal the estate tax, opposing policies "by the rich, for the rich" during the Bush administration.

He also criticized the reality that the world's richest people have lower income tax rates than their secretaries.

He recognized his exceptional ability to make money as an innate calling to accumulate vast wealth without squandering it and to distribute it efficiently to all sectors of society.

For him, his astronomical wealth was a depository, indicating that he had temporarily set aside resources that should have been used for society.

And in 2006, he opened the doors of his warehouse and gave back his wealth to society.

Through this book, readers will once again be able to experience his outstanding insight into reading economic trends.

Moreover, you will be able to glimpse the humble attitude and resonant values of someone who has risen to the top of the world through his own intuition and vision.

It can be said to be a great biography.

The key is to find the ‘wet eyes’ and the ‘long, long hills.’

The passion and wisdom of a giant who has navigated the history of American capitalism head-on.

In June 2021, Warren Buffett announced that he was stepping down as trustee of the Bill & Melinda Gates Foundation.

He said on the day, “After announcing in 2006 that he would donate all of his Berkshire Hathaway stock, which is more than 99 percent of his net worth, to charity, we have now reached half of that goal by 2021.”

It was a bold decision on his part to not want things like having one's name on a building under the pretext of making a donation or for the foundation to be run carelessly after the donor's death.

Just by looking at this appearance, you can easily guess that he is a truly 'extraordinary person' with a different level of philosophy and rational thinking.

Warren Buffett's official biography, "Snowball," is a masterpiece that traces the life and times of one of the most fascinating figures of our time.

There have been many books written about Buffett, but he has never written a memoir.

There was also no book that comprehensively covered Warren Buffett's life and values, not just his investment methods.

The public was always watching his every move, but he was unwilling to tell his full story.

Because of his private life, which was so thoroughly shrouded in secrecy, people thought of him as someone who pursued a simple life that did not match his immense wealth.

But like everyone else, his life wasn't that simple.

When Alice Schroeder, the author of this book, discovered Buffett, she was already widely known in the industry for her extensive knowledge of finance, sharp analytical skills, and her witty and insightful writing.

Buffett was so impressed by the report she wrote about Berkshire Hathaway that he asked her, then a director at Morgan Stanley, to write his own story and gave her his full support.

Yet, he never interfered, and when his story differed from someone else's, he asked that it be written 'in a less flattering way.'

Buffett warned against the so-called "shoe button complex" (a term from the book that refers to pretending to be an expert in another field because one is knowledgeable in one field).

He clearly knew that everyone had a certain range of abilities that they could excel at, and he always drew a line between what was beyond his capabilities and what he could do well.

And he said this is one of the reasons why he has been successful for so many years.

It was thanks to his humble attitude that 《Snowball》 was able to be born.

This book could have been a billionaire's success story, but he didn't want to package himself.

The author, who didn't need to keep an eye on Buffett, used his analyst's unique analytical and observational skills to sharply identify Warren Buffett's strengths and weaknesses.

Buffett's controversial private life was not glossed over either.

The meticulous verification, extensive data collection, and thorough annotation of every single act, every single statement, and every single event unfolding around Buffett, who has been at the center of his time, have made this book more than just a biography of a single person; it is a saga that surveys the history of American capitalism.

Buffett's judgments and actions at critical junctures in American and global finance, including the post-war boom, the American Express crisis, the oil crisis, the prolonged recession in the United States, the Salomon Brothers crisis that nearly triggered the Great Depression, the bankruptcy of Long-Term Capital Management, the September 11 attacks, and the recent economic crisis stemming from subprime mortgage loans, provide vivid lessons for understanding modern capitalism.

Just as he warned of the internet bubble boom, he also warned against derivatives, calling them "financial weapons of mass destruction," and the fact that he managed the risks of derivatives at the insurance companies he ran clearly shows why we should listen to him.

20% average annual return for over 50 years!

Where did his extraordinary insight come from?

In an era where even five years of consistent investment performance is considered impressive, Warren Buffett has maintained his position at the top for over half a century, achieving returns of over 20%.

His wealth is unparalleled in that he did not inherit it but earned it entirely through his own efforts.

But these investment performances are just one adjective that sets him apart.

What made him not only "the world's richest man" but also "a respected sage"? What is it about him that earns him such acclaim as an investor and as a human being?

Born the son of a banker who lost his job during the Great Depression, Buffett began selling gum at the age of six to earn money, driven by a desire to become rich.

Then, at the age of eleven, he started investing in stocks and experienced all kinds of part-time jobs, including delivering newspapers, and learned the 'snowball' principle of modern capitalism, or the principle of 'compound interest', which states that 'if you start with a small amount of money and gradually increase it, eventually money will make more money.'

Welfare is like rolling a snowball down a hill.

If you start with a small lump and keep rolling the snowball, it will eventually become a really big snowball.

He says he first made a small snowball when he was 14 years old while delivering newspapers, and that he has been rolling it very carefully down a long hill ever since.

The incredible story of how he realized this principle early on and effectively utilized it to create enormous wealth is not only admirable in itself, but also provides a profound lesson.

Surprisingly, the lesson isn't about money.

Buffett's incredible focus and learning curve, which allows him to tirelessly absorb all available information at a terrifying pace; the complete trust of shareholders he earned by thoroughly pursuing 'honesty' in a stock market rife with fraud and trickery; his independent thinking that strictly follows his 'internal scoreboard' in a market swayed by cutting-edge financial engineering and rumors; and his incredible judgment that allows him to instantly find the best method when faced with complex problems.

Warren Buffett's life is a life filled with opportunities, yet fraught with pitfalls and pitfalls, and a source of inspiration for everyone in the world of investing and business, as well as countless others who aspire to succeed in life.

Katharine Graham and her two wives,

The never-before-seen true face of Warren Buffett

When the book was first published, the part that aroused the most curiosity was Warren's personal life.

Born into a family with a history of mental illness, his mother abused him and his older sister, and an aunt and a nephew committed suicide.

While he was working as a director of the Washington Post and was obsessed with Katharine Graham, who had the same complex, his wife Susie, whom he loved and cared for dearly, left him. After that, he lived with Astrid, whom Susie sent to him, and 'Susie became his official wife, and Astrid became his de facto wife who lives with him.'

Having unintentionally had two wives, he did not hide this fact from his family and friends, as befitting his personality of thoroughly pursuing 'honesty'.

He never gave up on something precious, whether it was money or a person, and he never let go of the love of his life, Suzy, even after breaking away from monogamy.

Likewise, he built a strong network of trustworthy, wise people and maintained lifelong friendships with them.

In terms of investment, we have shared a true sense of partnership with like-minded shareholders through a 'web of trust built seamlessly.'

This has created an organic structure where Berkshire Hathaway can freely move capital with its subsidiaries, which hold enormous amounts of cash, and has enabled it to function as a continuous system that creates wealth for shareholders as a compounding engine.

To him, shareholders were not just customers, but students who learned his 'investment philosophy' and 'life philosophy', and life companions.

He felt a sense of responsibility for their lives, even advising them on the best way to manage their investments when they were withdrawing their money.

This sense of responsibility led him to live a life of 'noblesse oblige'.

He participated in the campaign to repeal the estate tax, opposing policies "by the rich, for the rich" during the Bush administration.

He also criticized the reality that the world's richest people have lower income tax rates than their secretaries.

He recognized his exceptional ability to make money as an innate calling to accumulate vast wealth without squandering it and to distribute it efficiently to all sectors of society.

For him, his astronomical wealth was a depository, indicating that he had temporarily set aside resources that should have been used for society.

And in 2006, he opened the doors of his warehouse and gave back his wealth to society.

Through this book, readers will once again be able to experience his outstanding insight into reading economic trends.

Moreover, you will be able to glimpse the humble attitude and resonant values of someone who has risen to the top of the world through his own intuition and vision.

It can be said to be a great biography.

GOODS SPECIFICS

- Publication date: December 22, 2021

- Format: Hardcover book binding method guide

- Page count, weight, size: 792 pages | 1,202g | 149*219*40mm

- ISBN13: 9788925579092

- ISBN10: 892557909X

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)