Super Trader

|

Description

Book Introduction

This is the Korean version of [Super Trader], which has been a huge hit among professional investors since its first publication in 2009. It introduces methods for success in the trading field where most people fail, and presents a scientific approach through specific trading training methods, strategy development, and simulation.

The content of this book is identical to the Super Trader program taught at the Van Tharp Institute.

After a brief overview of the five-step program, we present ideas and methods for consistently generating profits in all market types.

In this book, Dr. Van Tharp offers time-tested strategies that will take your trading to levels you never imagined possible.

Offering expert insights into trading and psychology, he teaches you how to minimize losses and achieve your investment goals through position sizing.

By leveraging Dr. Van Tharp's wisdom, insight, and strategic skills through his robust and proven techniques, you can achieve above-average returns in volatile markets.

The content of this book is identical to the Super Trader program taught at the Van Tharp Institute.

After a brief overview of the five-step program, we present ideas and methods for consistently generating profits in all market types.

In this book, Dr. Van Tharp offers time-tested strategies that will take your trading to levels you never imagined possible.

Offering expert insights into trading and psychology, he teaches you how to minimize losses and achieve your investment goals through position sizing.

By leveraging Dr. Van Tharp's wisdom, insight, and strategic skills through his robust and proven techniques, you can achieve above-average returns in volatile markets.

- You can preview some of the book's contents.

Preview

index

Acknowledgements

preface

prolog

Part 1: Self-Innovation

How to get a satisfactory deal?

Evaluate yourself objectively

What type of trader am I?

immersion

Do what you love

responsible attitude

What excuses are you making?

Empower yourself

Record your faith

Enjoy the obstacles

Trade with Mindfulness

Become friends with your inner commentator.

Learn to 'separate'

Keep your trading balanced

Overcome the psychological dilemma

Does failure fuel your motivation?

You don't necessarily have to be happy

Soul Vitamins for Better Trading

Training to achieve goals

Let go of old feelings

Continuously carry out self-improvement work.

Part 2: Writing a Business Plan

Plan before trading

Write down your mission statement on paper.

What are the goals and objectives?

Beliefs about the market

Understand the big picture

What is my trading strategy?

Achieve your goals through position sizing.

Strengthen your weaknesses

What's on the daily schedule

What kind of educational plan do you have?

Prepare for the worst

Psychologically rehearse for disaster

Other systems that must be equipped

Quadrant coordinates

Part 3: Trading System Development

Design a system that works for me

Trading principles

Setup isn't as important as you think

Entering the market

Is stock selection important?

The secret to making money is liquidation.

Liquidate by jumping the initial stop

Think in terms of reward and risk

Key Challenge: Tracking the R-multiplier

Key elements for building an excellent system

Common denominator of success

“It didn’t work!”

Check the trading reality

What it takes to be confident

Part 4: Developing a Position Sizing Strategy

System quality and positioning

Position sizing is much more important than you think.

3 Elements of Position Sizing

CPR Model Position Sizing

The Basics of Position Sizing

Types of equity models

Various position sizing models

The purpose of position sizing

How to Use Position Sizing: Simulation

Problems with R-multiplier simulations

Troubleshooting simulation problems

Part 5: Ideas for Optimal Trading

Keep it simple

Understand the "magic cup" of trading.

Simple ways to make money trading

Predictions are forbidden in the market.

Mistakes and self-sabotage

To avoid repeating mistakes

You can't ignore the basics

Appendix Glossary

preface

prolog

Part 1: Self-Innovation

How to get a satisfactory deal?

Evaluate yourself objectively

What type of trader am I?

immersion

Do what you love

responsible attitude

What excuses are you making?

Empower yourself

Record your faith

Enjoy the obstacles

Trade with Mindfulness

Become friends with your inner commentator.

Learn to 'separate'

Keep your trading balanced

Overcome the psychological dilemma

Does failure fuel your motivation?

You don't necessarily have to be happy

Soul Vitamins for Better Trading

Training to achieve goals

Let go of old feelings

Continuously carry out self-improvement work.

Part 2: Writing a Business Plan

Plan before trading

Write down your mission statement on paper.

What are the goals and objectives?

Beliefs about the market

Understand the big picture

What is my trading strategy?

Achieve your goals through position sizing.

Strengthen your weaknesses

What's on the daily schedule

What kind of educational plan do you have?

Prepare for the worst

Psychologically rehearse for disaster

Other systems that must be equipped

Quadrant coordinates

Part 3: Trading System Development

Design a system that works for me

Trading principles

Setup isn't as important as you think

Entering the market

Is stock selection important?

The secret to making money is liquidation.

Liquidate by jumping the initial stop

Think in terms of reward and risk

Key Challenge: Tracking the R-multiplier

Key elements for building an excellent system

Common denominator of success

“It didn’t work!”

Check the trading reality

What it takes to be confident

Part 4: Developing a Position Sizing Strategy

System quality and positioning

Position sizing is much more important than you think.

3 Elements of Position Sizing

CPR Model Position Sizing

The Basics of Position Sizing

Types of equity models

Various position sizing models

The purpose of position sizing

How to Use Position Sizing: Simulation

Problems with R-multiplier simulations

Troubleshooting simulation problems

Part 5: Ideas for Optimal Trading

Keep it simple

Understand the "magic cup" of trading.

Simple ways to make money trading

Predictions are forbidden in the market.

Mistakes and self-sabotage

To avoid repeating mistakes

You can't ignore the basics

Appendix Glossary

Detailed image

Into the book

The best performing traders do whatever it takes to become the best.

And because you feel fully responsible for whatever happens, you learn from your mistakes.

They think of trading as a business, so they have a business plan for trading.

Having a business plan will help you know exactly what you need to do to make the most of your money in the marketplace, and it will also help you learn from your mistakes.

--- p.37

If you want to maximize your trading profits, it's a good idea to identify investment geniuses and study their techniques.

You can also find geniuses in other fields and apply their practices to your trading.

I often wonder, 'What would Einstein think about today's market?'

--- p.95

There is something that people don't know.

At some point, when four or five people take a long position, another four or five people take a short position or liquidate their positions.

They all have different systems and philosophies.

But anyone can make a profit.

Also, although everyone has different thoughts about the market, they trade those thoughts because they have confirmed that they are low-risk.

--- p.242

If you have a system or concept, you need to know when that system or concept doesn't work.

Even if it's a good idea, if it doesn't work, you have to give it up.

If a system or concept doesn't work, it doesn't produce the desired level of performance.

If so, you need to know why.

Knowing why a system or concept isn't working can give you a sense of direction on what steps to take.

--- p.247

Keep it simple.

The more complicated you make things, the harder it is to succeed.

The principle of 'simplicity' applies both in real life and in the marketplace.

Human consciousness can accommodate about seven chunks of information.

Consciousness cannot accept any more information.

Because of this limitation, if someone gives you a 10-digit number, it's difficult to remember more than 5 digits.

Trying to do something too complex in the market is bound to fail.

And because you feel fully responsible for whatever happens, you learn from your mistakes.

They think of trading as a business, so they have a business plan for trading.

Having a business plan will help you know exactly what you need to do to make the most of your money in the marketplace, and it will also help you learn from your mistakes.

--- p.37

If you want to maximize your trading profits, it's a good idea to identify investment geniuses and study their techniques.

You can also find geniuses in other fields and apply their practices to your trading.

I often wonder, 'What would Einstein think about today's market?'

--- p.95

There is something that people don't know.

At some point, when four or five people take a long position, another four or five people take a short position or liquidate their positions.

They all have different systems and philosophies.

But anyone can make a profit.

Also, although everyone has different thoughts about the market, they trade those thoughts because they have confirmed that they are low-risk.

--- p.242

If you have a system or concept, you need to know when that system or concept doesn't work.

Even if it's a good idea, if it doesn't work, you have to give it up.

If a system or concept doesn't work, it doesn't produce the desired level of performance.

If so, you need to know why.

Knowing why a system or concept isn't working can give you a sense of direction on what steps to take.

--- p.247

Keep it simple.

The more complicated you make things, the harder it is to succeed.

The principle of 'simplicity' applies both in real life and in the marketplace.

Human consciousness can accommodate about seven chunks of information.

Consciousness cannot accept any more information.

Because of this limitation, if someone gives you a 10-digit number, it's difficult to remember more than 5 digits.

Trying to do something too complex in the market is bound to fail.

--- p.298

Publisher's Review

The One Golden Rule Every Super Trader Must Have

“You don’t trade the market, you trade your belief in the market!”

This is the Korean version of "Super Trader," which has been a huge hit among professional investors since its first publication in 2009. It introduces methods for success in the trading field where most people fail, and presents a scientific approach through specific trading training methods, strategy development, and simulations.

The author, Dr. Van Tharp, is a world-renowned consultant and investment coach, and the author of bestselling books on trading and investing, including Safe Strategies for Financial Freedom, Financial Freedom through Electronic Day Trading, and Trade Your Way to Financial Freedom.

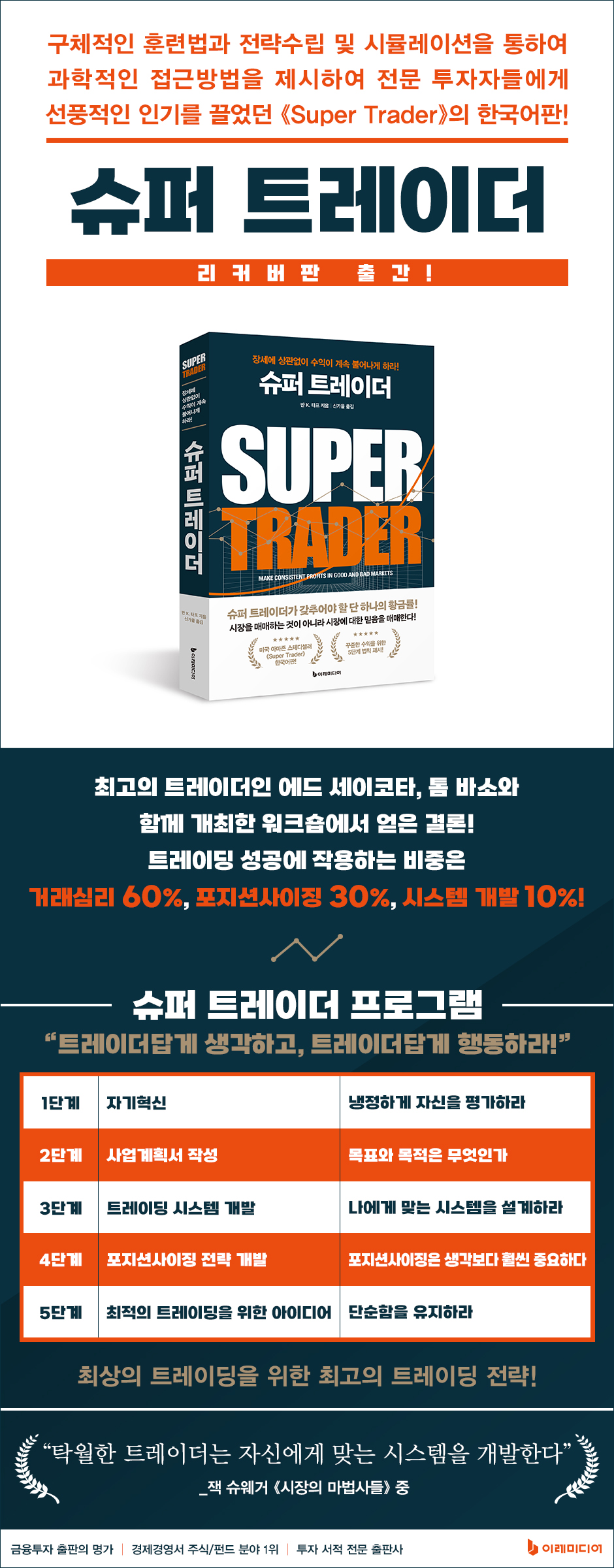

● Super Trader Program: Think like a trader, act like a trader!

In Dr. Van Tharp's previous work, "How to Build a Profitable Investment System," he presented solutions to all the challenges traders face through the investment models of experts ranging from Warren Buffett to Perry Kauffman.

In his later book, "Super Trader," Dr. Van Tharp offers practical methods for investors to adjust their attitudes to achieve successful profits.

The goal of the Super Trader program he presents is to help traders run their businesses and achieve consistent, above-average returns in a variety of market environments.

If you want to get serious about investing, you need to read this book right now.

The content of this book is identical to the Super Trader program taught at the Van Tharp Institute.

This book provides a general overview of the program, which is divided into five stages, and then presents ideas and methods for consistently generating profits in all market types.

● Step 1: Self-Reform: Assess Yourself Critically

In 1990, the author held a workshop with top traders Ed Seykota and Tom Basso.

At this time, it was concluded that trading psychology accounts for 60% of the success of trading, position sizing accounts for 30%, and system development accounts for 10%.

The author, having studied these three areas, now claims that trading psychology plays a 100% role in trading success.

Rather than focusing on "the latest investment techniques," we guide you on the path to successful trading by teaching you how to maintain the optimal psychological state for optimal trading.

● Step 2: Writing a Business Plan: What are your goals and objectives?

How would you react if someone gave you information about the market? Sometimes you'd believe it and act on it, and sometimes you'd distrust it.

An alternative to this is to consider whether the information fits with my business plan.

You need to develop a business plan that can handle the 'unmistakable information that you absolutely cannot afford to miss.'

It's about setting trading goals and developing discipline to achieve those goals.

If you don't know where your destination is, you can't proceed smoothly.

You can't develop a system without considering how much profit you want and how much loss you're willing to accept.

● Develop a 3-Step Trading System: Design a System That's Right for You

Warren Buffett's investment principle is to invest in businesses that have excellent systems that generate high returns on capital.

If you have a system that generates high returns on capital, there's nothing else to do.

Because if you invest, money will roll in on its own.

Jack Schwager said in "Market Wizards" that "great traders develop systems that work for them."

This is one of the secrets to success.

To develop a system that works for you, you must first know yourself.

Then, set a goal and design a system suitable for achieving the goal.

Systems must be developed based on beliefs about the long-term prospects of the market.

What we trade is our faith in the market.

"What beliefs do I have about the market? And can these beliefs determine my advantage?" Once these criteria are established, I can design a specific system that suits me.

● Develop a 4-step position sizing strategy: Position sizing is much more important than you think.

Position sizing is part of a system that is used to achieve goals.

Even if you have the best system in the world, if you bet 100% on losing trades, you could go bankrupt.

The reason is that position sizing was not set.

The purpose of the system is to help you achieve your goals easily through position sizing.

Looking at the ratio of expected returns and R-multiple variance produced by the system, we can see that setting goals using position sizing is easy.

The most important thing to consider when setting position sizing is the concept of 'how much?'

It is to set a certain percentage of the balance as risk for each transaction.

If you are a trader, just mastering this concept will be like buying a mountain of gold.

● 5 Steps to Optimal Trading: Keep It Simple

To trade well, you must first keep it simple.

The more complicated you make things, the harder it is to succeed.

Successful trading requires a simple focus, dedication, and a simple system to track your trades.

Making money through trading is simple.

First, we devise a new, better trading system.

Second, discover markets where each system can be applied.

Third, increase the number of traders.

Fourth, it improves trader work efficiency.

Fifth, optimize position sizing to achieve goals.

The real shortcut to making money in trading is to limit your losses, maximize your profits, and manage your risk to stay relevant in the market.

But mistakes happen every day in the market.

If you make a mistake, you have to start a new mission.

"What was the environment when I made the mistake? Will it happen again?" In the circumstances where you made the mistake, think of ways to avoid repeating the same mistake.

If you do this, your annual profit will increase from 20% to 50%.

The Best Trading Strategies for Optimal Trading

If you can focus on the market's movements, you can focus solely on the current situation without being swayed by preconceptions or biases.

Dr. Van Taap's message to investors is clear.

The key to trading success lies in understanding yourself, continuing the process of self-improvement, setting clear goals, and developing a system that suits you.

The shortcut to making money in the markets lies in deciding how to discipline yourself.

If you are trading stocks yourself, you must follow the guidelines provided by Dr. Van Tharp.

In "Super Trader," Dr. Van Tharp offers time-tested strategies that will take your trading to levels you never imagined possible.

Offering expert insights into trading and psychology, he teaches how to reduce losses and achieve investment goals through position sizing.

By leveraging Dr. Taff's wisdom, insight, and strategic skills through his robust and proven techniques, you can achieve above-average returns in a volatile market.

“You don’t trade the market, you trade your belief in the market!”

This is the Korean version of "Super Trader," which has been a huge hit among professional investors since its first publication in 2009. It introduces methods for success in the trading field where most people fail, and presents a scientific approach through specific trading training methods, strategy development, and simulations.

The author, Dr. Van Tharp, is a world-renowned consultant and investment coach, and the author of bestselling books on trading and investing, including Safe Strategies for Financial Freedom, Financial Freedom through Electronic Day Trading, and Trade Your Way to Financial Freedom.

● Super Trader Program: Think like a trader, act like a trader!

In Dr. Van Tharp's previous work, "How to Build a Profitable Investment System," he presented solutions to all the challenges traders face through the investment models of experts ranging from Warren Buffett to Perry Kauffman.

In his later book, "Super Trader," Dr. Van Tharp offers practical methods for investors to adjust their attitudes to achieve successful profits.

The goal of the Super Trader program he presents is to help traders run their businesses and achieve consistent, above-average returns in a variety of market environments.

If you want to get serious about investing, you need to read this book right now.

The content of this book is identical to the Super Trader program taught at the Van Tharp Institute.

This book provides a general overview of the program, which is divided into five stages, and then presents ideas and methods for consistently generating profits in all market types.

● Step 1: Self-Reform: Assess Yourself Critically

In 1990, the author held a workshop with top traders Ed Seykota and Tom Basso.

At this time, it was concluded that trading psychology accounts for 60% of the success of trading, position sizing accounts for 30%, and system development accounts for 10%.

The author, having studied these three areas, now claims that trading psychology plays a 100% role in trading success.

Rather than focusing on "the latest investment techniques," we guide you on the path to successful trading by teaching you how to maintain the optimal psychological state for optimal trading.

● Step 2: Writing a Business Plan: What are your goals and objectives?

How would you react if someone gave you information about the market? Sometimes you'd believe it and act on it, and sometimes you'd distrust it.

An alternative to this is to consider whether the information fits with my business plan.

You need to develop a business plan that can handle the 'unmistakable information that you absolutely cannot afford to miss.'

It's about setting trading goals and developing discipline to achieve those goals.

If you don't know where your destination is, you can't proceed smoothly.

You can't develop a system without considering how much profit you want and how much loss you're willing to accept.

● Develop a 3-Step Trading System: Design a System That's Right for You

Warren Buffett's investment principle is to invest in businesses that have excellent systems that generate high returns on capital.

If you have a system that generates high returns on capital, there's nothing else to do.

Because if you invest, money will roll in on its own.

Jack Schwager said in "Market Wizards" that "great traders develop systems that work for them."

This is one of the secrets to success.

To develop a system that works for you, you must first know yourself.

Then, set a goal and design a system suitable for achieving the goal.

Systems must be developed based on beliefs about the long-term prospects of the market.

What we trade is our faith in the market.

"What beliefs do I have about the market? And can these beliefs determine my advantage?" Once these criteria are established, I can design a specific system that suits me.

● Develop a 4-step position sizing strategy: Position sizing is much more important than you think.

Position sizing is part of a system that is used to achieve goals.

Even if you have the best system in the world, if you bet 100% on losing trades, you could go bankrupt.

The reason is that position sizing was not set.

The purpose of the system is to help you achieve your goals easily through position sizing.

Looking at the ratio of expected returns and R-multiple variance produced by the system, we can see that setting goals using position sizing is easy.

The most important thing to consider when setting position sizing is the concept of 'how much?'

It is to set a certain percentage of the balance as risk for each transaction.

If you are a trader, just mastering this concept will be like buying a mountain of gold.

● 5 Steps to Optimal Trading: Keep It Simple

To trade well, you must first keep it simple.

The more complicated you make things, the harder it is to succeed.

Successful trading requires a simple focus, dedication, and a simple system to track your trades.

Making money through trading is simple.

First, we devise a new, better trading system.

Second, discover markets where each system can be applied.

Third, increase the number of traders.

Fourth, it improves trader work efficiency.

Fifth, optimize position sizing to achieve goals.

The real shortcut to making money in trading is to limit your losses, maximize your profits, and manage your risk to stay relevant in the market.

But mistakes happen every day in the market.

If you make a mistake, you have to start a new mission.

"What was the environment when I made the mistake? Will it happen again?" In the circumstances where you made the mistake, think of ways to avoid repeating the same mistake.

If you do this, your annual profit will increase from 20% to 50%.

The Best Trading Strategies for Optimal Trading

If you can focus on the market's movements, you can focus solely on the current situation without being swayed by preconceptions or biases.

Dr. Van Taap's message to investors is clear.

The key to trading success lies in understanding yourself, continuing the process of self-improvement, setting clear goals, and developing a system that suits you.

The shortcut to making money in the markets lies in deciding how to discipline yourself.

If you are trading stocks yourself, you must follow the guidelines provided by Dr. Van Tharp.

In "Super Trader," Dr. Van Tharp offers time-tested strategies that will take your trading to levels you never imagined possible.

Offering expert insights into trading and psychology, he teaches how to reduce losses and achieve investment goals through position sizing.

By leveraging Dr. Taff's wisdom, insight, and strategic skills through his robust and proven techniques, you can achieve above-average returns in a volatile market.

GOODS SPECIFICS

- Date of issue: December 15, 2023

- Page count, weight, size: 336 pages | 622g | 152*225*20mm

- ISBN13: 9791193394007

- ISBN10: 1193394007

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)