The Fed, the king of printing money

|

Description

Book Introduction

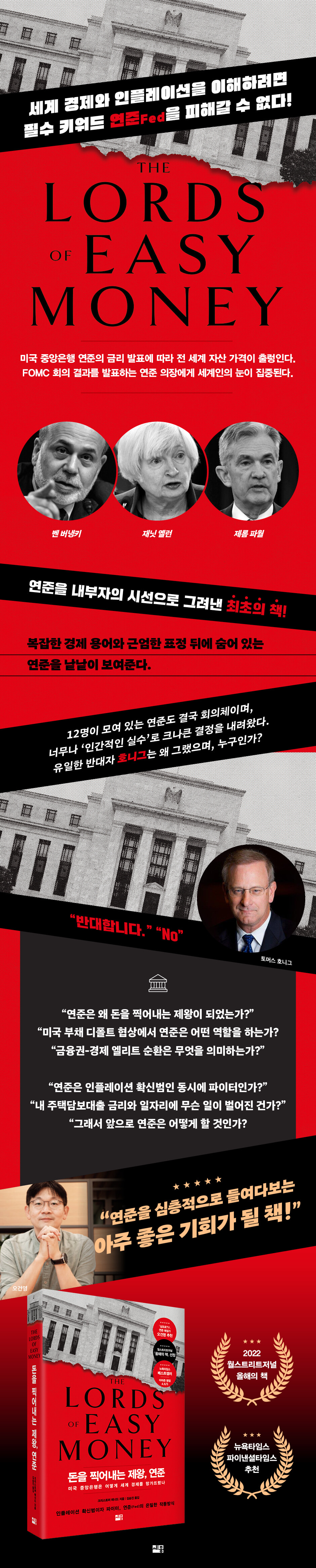

The essential keyword for understanding the global economy and inflation is ‘Fed’. The first book written from an insider's perspective! *Recommended by Sampro TV Fed commentator Oh Geon-young* Is the Federal Reserve the world's savior, or the epicenter of crisis and inequality? The first book to delve into America's most secretive organization, the Federal Reserve, from an insider's perspective has been published. This book provides a vivid understanding of how the Federal Reserve works and its ripple effects on the global economy. Team leader Oh Geon-young, known as the Fed commentator for Sampro TV, said, “Author Christopher Leonard goes beyond the generally known story of the Fed and includes a wealth of behind-the-scenes stories. The Federal Reserve is a human institution before it is a consultative body. “At a time when the Federal Reserve’s decisions are shaking the markets, I hope that Korean readers will have a good opportunity to take a closer, more in-depth look at the U.S. central bank through this book,” he said in his recommendation. The book became an instant New York Times bestseller and was named a 2022 Book of the Year by the Wall Street Journal. “I respectfully disagree.” And disagree, disagree, disagree… Why did Kansas City Federal Reserve Bank President Thomas Honig, a typical financier, have to become such a hawk? In March 2023, we were shocked by the news of the bankruptcy of Silicon Valley Bank (SVB). The reason why events that happened in the distant United States felt like they were happening close to home is because, not so long ago, in September 2008, the global financial markets froze when Lehman Brothers, one of the world's four largest investment banks, went bankrupt. When the Federal Open Market Committee (FOMC), the central bank of the United States, holds a meeting to determine interest rates, the world's attention is focused on the Fed. This is because other countries also have to adjust their interest rates depending on the interest rate situation in the United States. The author embarks on a challenging investigation to reveal the shocking yet fascinating story of how the Fed's unprecedented quantitative easing program devastated the U.S. economy, along with the pitfalls of monetary policy decisions made by successive Federal Reserve Chairs—Paul Volcker, Alan Greenspan, Ben Bernanke, Janet Yellen, and Jerome Powell—and the risks it posed. And it follows in the footsteps of Kansas City Fed President Thomas Honig, who dared to step outside the Fed's ranks and speak out against its policies. Honig argued that quantitative easing (QE) and zero interest rates (ZIRP) would lead to speculation and inflation, but the vast majority of Fed officials opposed him, and as a result, our "citizen" John Feltner, whose dream was to own a comfortable home for his family, lost his job. As you follow author Christopher Leonard's insights, sometimes fascinating and sometimes infuriating, into how the Fed's policies are driving up my mortgage rates and why the Fed is forcing us to face a fearful future, you will see how our financial markets are gripped by panic at the Fed's "worried words" and conclude that global inflation is not only due to the COVID-19 pandemic or the Russia-Ukraine war, but also that the Fed has a role to play. And we also learn that the long collapse of 2008 evolved into the long collapse of 2020 and beyond, and the price has not yet been fully paid. |

- You can preview some of the book's contents.

Preview

index

Recommendation

Recommendation

Part 1: "I respectfully object"

Chapter 1.

Go below zero

Chapter 2.

Important numbers

Chapter 3.

Great Inflation(s)

Chapter 4.

Fed language

Chapter 5.

omnipotent citizen

Chapter 6.

currency bomb

Part 2: The Zero Interest Rate Era

Chapter 7.

quantitative quagmire

Chapter 8.

Problem solver

Chapter 9.

Risk generation machine

Chapter 10. ZIRP System

Chapter 11.

Honig's Rule

Chapter 12.

Completely normal

If you don't have bread, tell them to eat the assets.

Chapter 13.

Invisible bailout

Chapter 14.

infection

Chapter 15.

Winners and Losers

Chapter 16.

long collapse

Americas

Glossary of Terms

Acknowledgements

Search

Recommendation

Part 1: "I respectfully object"

Chapter 1.

Go below zero

Chapter 2.

Important numbers

Chapter 3.

Great Inflation(s)

Chapter 4.

Fed language

Chapter 5.

omnipotent citizen

Chapter 6.

currency bomb

Part 2: The Zero Interest Rate Era

Chapter 7.

quantitative quagmire

Chapter 8.

Problem solver

Chapter 9.

Risk generation machine

Chapter 10. ZIRP System

Chapter 11.

Honig's Rule

Chapter 12.

Completely normal

If you don't have bread, tell them to eat the assets.

Chapter 13.

Invisible bailout

Chapter 14.

infection

Chapter 15.

Winners and Losers

Chapter 16.

long collapse

Americas

Glossary of Terms

Acknowledgements

Search

Detailed image

Into the book

Honig worried about what would happen if the Fed pushed all the money out of safe investments and into riskier ones.

If money were to move further outward on the yield curve, it could lead to the second major problem Honig warned about in 2010.

It's an asset bubble.

The housing market that collapsed in 2008 was an asset bubble.

The dot-com stock crash in 2000 was also an asset bubble.

When a bubble bursts, the public tends to blame those at the scene of the disaster, and those people are usually the greedy folks on Wall Street.

People like brokers who constantly inflate prices in the stock market for short-term profits, or dishonest mortgage brokers who fueled the housing bubble.

But during these two asset bubbles and their subsequent collapses, Honig was on the FOMC and saw firsthand the central role the Fed played in creating those bubbles.

---From "Chapter 1: Going Below Zero"

In the 1970s, the Federal Reserve effectively encouraged banks to make increasingly risky loans, while the FOMC kept interest rates extremely low.

This was partly due to two recessions, in 1970 and 1975.

The Fed has kept interest rates low, even as the negative consequences of printing too much money become clearer each year, as it seeks to create jobs, stimulate investment, and boost overall economic growth.

The most obvious side effect of this policy was the rise in consumer prices for food, fuel, electronics, and other goods.

In 1973, the consumer price inflation rate was 3.6%, meaning that the things people buy on a daily basis became 3.6% more expensive in one year.

In 1979, the inflation rate reached a whopping 10.7%.

Anyone could not help but feel this level of price increase.

It was evident in grocery stores, gas stations, and even in corporate payrolls, where workers had to pay higher wages to make ends meet.

---From "Chapter 2: Important Numbers"

Paul Volcker's career as Federal Reserve Chairman did not end on a happy note.

He beat inflation and then went back to being a savage. At FOMC meetings, members voted against him more than any other chairman in modern Fed history.

When his second term ended in 1987, he declined renomination for a third term.

Volcker's merits were recognized much later, when economic historians recognized that his efforts to end inflation were uniquely effective, a decision made by a leader running an independent agency.

But he never returned to the center stage of American power again.

---From "Chapter 3 Great Inflation(s)"

Greenspan's use of the Fed language had a long and profound impact.

This accelerated a long process of removing monetary policy from American public discourse at a time when it was becoming increasingly important to the economy.

When the average citizen heard Greenspan's remarks, it was natural to think that whatever the Fed was doing was something so complex and incomprehensible that it was difficult for the average person to even discuss it, let alone criticize it.

Greenspan's remarks reinforced the image of the Fed as a collection of genius-level decision-makers.

They are said to be people who understand and deal with extremely complex problems for the people of Earth from the celestial realm of Olympus.

---From "Chapter 4: Fed Language"

Honig knew that his vote would change nothing.

Even before the meeting began, the FOMC had practically decided on quantitative easing.

He voted against the motion partly because he felt it was his duty, but there was another reason as well.

He was sending a message to the American public.

His vote was a signal that there is dissent within the Fed about what it should do.

That there was internal debate over this issue, and that at least one person thought the risks were too great to justify quantitative easing.

---From "Chapter 6: Currency Bomb"

Warren Buffett called Brady directly to explain the Salomon incident, and the Treasury Department soon reversed its decision and retained Salomon's primary dealer status.

Bell attributed this success and Salomon's rescue to Jay Powell.

“I know Jay was instrumental in getting Treasury Secretary Brady the information he needed to make his decision.” This decision gave Buffett the time he needed to do the cleanup work at Salomon.

---From "Chapter 8: The Problem Solver"

Years later, looking back, it's easy to point the finger at Wall Street traders for piling up towers of risky corporate debt.

But they were simply doing what the Fed incentivized them to do.

None of this should have come as a surprise to Federal Reserve decision-makers. In 2013, when the FOMC was conducting its largest quantitative easing program, Dallas Fed President Richard Fisher explicitly noted that the policy would primarily benefit private equity funds.

Places like the Carlyle Group where Jay Powell was.

Fisher questioned the idea that higher asset prices would lead to a "wealth effect" in the way Bernanke expected (i.e., owners of assets like stocks and homes would feel wealthier and thus consume more), leading to more jobs and higher wages for workers.

---From "Chapter 9 Risk-Generating Machines"

The core of the Honig rule was to separate the riskier parts of the banking industry from the more economically necessary parts, such as corporate lending, so that when a bank made a risky bet wrong, it could fail alone rather than drag the entire system down with it.

Allan Sloan, a financial columnist who writes for Fortune, The Washington Post, and others, wrote a widely read column after Honig's Senate hearing, suggesting that Honig's rule is exactly what Wall Street needs right now.

“It’s very simple and excellent.

“This [Honig’s Rule] is the idea of wisely separating high-risk from low-risk behaviors.”

---From "Chapter 11 Honig's Rules"

When the Fed took action, everything was affected.

Market turbulence in 2018 manifested itself in numerous ways and in numerous places.

But one important factor drove them.

What appeared to be unrelated market panics were actually the result of smart investors responding rationally to the Fed's actions.

Investors listened to Powell and took him seriously. The era of ZIRP was gradually coming to an end.

Big money had to move in different directions to adapt to this new reality.

---From "Chapter 12 Completely Normal"

But this system was destroyed during the Bernanke era when the Fed decided to pursue quantitative easing and zero interest rates for years.

One of the side effects of quantitative easing was that the delicate ecosystem of open market operations became overrun with too much cash.

When the Fed entered the repo market directly, it bought and sold repo loans with precision and accuracy, much like a piano tuner carefully pulling and releasing a string to keep it just the right amount of tension.

Traders manipulated the money supply precisely to the Fed's desired level through very limited transactions, such as buying or selling $6 billion worth of repo loans.

A repo transaction injects cash, while a reverse repo transaction removes some cash.

The important thing here was that this cash was going into and out of the banks' reserve accounts.

---From "Chapter 13: Invisible Bailouts"

Within the Fed, there was growing sensitivity about the Fed's public image.

Jay Powell has tried to portray the Fed as a middle-class advocate.

In 2019, before the pandemic, Powell embarked on a "listening tour."

It was a place to listen to the concerns and thoughts of the working masses and discuss how the Fed could help them.

There was a strategic reason for this move.

Senior Fed officials were well aware that policies that helped only the very wealthy while others struggled were unpopular.

The Fed's bailouts in 2008 and 2009 helped fuel both the right-wing Tea Party movement and the left-wing Occupy Wall Street movement.

The backlash was particularly fierce from conservatives, who aggressively argued that the Fed should be audited, more heavily regulated, and even broken up.

---From "Chapter 15 Winners and Losers"

In many important ways, the financial crisis of 2008 never ended.

The financial crisis of 2008 was a 'long collapse' that caused dislocations in the economy for a long time.

Almost none of the problems that caused the financial crisis were resolved.

And this financial collapse was made all the more difficult to deal with by the long-term breakdown in the capacity of America's democratic institutions.

When the United States relied on the Federal Reserve to solve its economic problems, it was relying on a fundamentally flawed tool to solve its problems.

The Fed's money has widened the gap between winners and losers and created a foundation for greater instability.

The pandemic hit the financial system, which was thus left vulnerable, and the Fed responded by printing more money, amplifying the previous distortions.

If money were to move further outward on the yield curve, it could lead to the second major problem Honig warned about in 2010.

It's an asset bubble.

The housing market that collapsed in 2008 was an asset bubble.

The dot-com stock crash in 2000 was also an asset bubble.

When a bubble bursts, the public tends to blame those at the scene of the disaster, and those people are usually the greedy folks on Wall Street.

People like brokers who constantly inflate prices in the stock market for short-term profits, or dishonest mortgage brokers who fueled the housing bubble.

But during these two asset bubbles and their subsequent collapses, Honig was on the FOMC and saw firsthand the central role the Fed played in creating those bubbles.

---From "Chapter 1: Going Below Zero"

In the 1970s, the Federal Reserve effectively encouraged banks to make increasingly risky loans, while the FOMC kept interest rates extremely low.

This was partly due to two recessions, in 1970 and 1975.

The Fed has kept interest rates low, even as the negative consequences of printing too much money become clearer each year, as it seeks to create jobs, stimulate investment, and boost overall economic growth.

The most obvious side effect of this policy was the rise in consumer prices for food, fuel, electronics, and other goods.

In 1973, the consumer price inflation rate was 3.6%, meaning that the things people buy on a daily basis became 3.6% more expensive in one year.

In 1979, the inflation rate reached a whopping 10.7%.

Anyone could not help but feel this level of price increase.

It was evident in grocery stores, gas stations, and even in corporate payrolls, where workers had to pay higher wages to make ends meet.

---From "Chapter 2: Important Numbers"

Paul Volcker's career as Federal Reserve Chairman did not end on a happy note.

He beat inflation and then went back to being a savage. At FOMC meetings, members voted against him more than any other chairman in modern Fed history.

When his second term ended in 1987, he declined renomination for a third term.

Volcker's merits were recognized much later, when economic historians recognized that his efforts to end inflation were uniquely effective, a decision made by a leader running an independent agency.

But he never returned to the center stage of American power again.

---From "Chapter 3 Great Inflation(s)"

Greenspan's use of the Fed language had a long and profound impact.

This accelerated a long process of removing monetary policy from American public discourse at a time when it was becoming increasingly important to the economy.

When the average citizen heard Greenspan's remarks, it was natural to think that whatever the Fed was doing was something so complex and incomprehensible that it was difficult for the average person to even discuss it, let alone criticize it.

Greenspan's remarks reinforced the image of the Fed as a collection of genius-level decision-makers.

They are said to be people who understand and deal with extremely complex problems for the people of Earth from the celestial realm of Olympus.

---From "Chapter 4: Fed Language"

Honig knew that his vote would change nothing.

Even before the meeting began, the FOMC had practically decided on quantitative easing.

He voted against the motion partly because he felt it was his duty, but there was another reason as well.

He was sending a message to the American public.

His vote was a signal that there is dissent within the Fed about what it should do.

That there was internal debate over this issue, and that at least one person thought the risks were too great to justify quantitative easing.

---From "Chapter 6: Currency Bomb"

Warren Buffett called Brady directly to explain the Salomon incident, and the Treasury Department soon reversed its decision and retained Salomon's primary dealer status.

Bell attributed this success and Salomon's rescue to Jay Powell.

“I know Jay was instrumental in getting Treasury Secretary Brady the information he needed to make his decision.” This decision gave Buffett the time he needed to do the cleanup work at Salomon.

---From "Chapter 8: The Problem Solver"

Years later, looking back, it's easy to point the finger at Wall Street traders for piling up towers of risky corporate debt.

But they were simply doing what the Fed incentivized them to do.

None of this should have come as a surprise to Federal Reserve decision-makers. In 2013, when the FOMC was conducting its largest quantitative easing program, Dallas Fed President Richard Fisher explicitly noted that the policy would primarily benefit private equity funds.

Places like the Carlyle Group where Jay Powell was.

Fisher questioned the idea that higher asset prices would lead to a "wealth effect" in the way Bernanke expected (i.e., owners of assets like stocks and homes would feel wealthier and thus consume more), leading to more jobs and higher wages for workers.

---From "Chapter 9 Risk-Generating Machines"

The core of the Honig rule was to separate the riskier parts of the banking industry from the more economically necessary parts, such as corporate lending, so that when a bank made a risky bet wrong, it could fail alone rather than drag the entire system down with it.

Allan Sloan, a financial columnist who writes for Fortune, The Washington Post, and others, wrote a widely read column after Honig's Senate hearing, suggesting that Honig's rule is exactly what Wall Street needs right now.

“It’s very simple and excellent.

“This [Honig’s Rule] is the idea of wisely separating high-risk from low-risk behaviors.”

---From "Chapter 11 Honig's Rules"

When the Fed took action, everything was affected.

Market turbulence in 2018 manifested itself in numerous ways and in numerous places.

But one important factor drove them.

What appeared to be unrelated market panics were actually the result of smart investors responding rationally to the Fed's actions.

Investors listened to Powell and took him seriously. The era of ZIRP was gradually coming to an end.

Big money had to move in different directions to adapt to this new reality.

---From "Chapter 12 Completely Normal"

But this system was destroyed during the Bernanke era when the Fed decided to pursue quantitative easing and zero interest rates for years.

One of the side effects of quantitative easing was that the delicate ecosystem of open market operations became overrun with too much cash.

When the Fed entered the repo market directly, it bought and sold repo loans with precision and accuracy, much like a piano tuner carefully pulling and releasing a string to keep it just the right amount of tension.

Traders manipulated the money supply precisely to the Fed's desired level through very limited transactions, such as buying or selling $6 billion worth of repo loans.

A repo transaction injects cash, while a reverse repo transaction removes some cash.

The important thing here was that this cash was going into and out of the banks' reserve accounts.

---From "Chapter 13: Invisible Bailouts"

Within the Fed, there was growing sensitivity about the Fed's public image.

Jay Powell has tried to portray the Fed as a middle-class advocate.

In 2019, before the pandemic, Powell embarked on a "listening tour."

It was a place to listen to the concerns and thoughts of the working masses and discuss how the Fed could help them.

There was a strategic reason for this move.

Senior Fed officials were well aware that policies that helped only the very wealthy while others struggled were unpopular.

The Fed's bailouts in 2008 and 2009 helped fuel both the right-wing Tea Party movement and the left-wing Occupy Wall Street movement.

The backlash was particularly fierce from conservatives, who aggressively argued that the Fed should be audited, more heavily regulated, and even broken up.

---From "Chapter 15 Winners and Losers"

In many important ways, the financial crisis of 2008 never ended.

The financial crisis of 2008 was a 'long collapse' that caused dislocations in the economy for a long time.

Almost none of the problems that caused the financial crisis were resolved.

And this financial collapse was made all the more difficult to deal with by the long-term breakdown in the capacity of America's democratic institutions.

When the United States relied on the Federal Reserve to solve its economic problems, it was relying on a fundamentally flawed tool to solve its problems.

The Fed's money has widened the gap between winners and losers and created a foundation for greater instability.

The pandemic hit the financial system, which was thus left vulnerable, and the Fed responded by printing more money, amplifying the previous distortions.

---From "Chapter 16: The Long Collapse"

Publisher's Review

“If there is no bread, tell them to eat the property.”

Full of very human mistakes that couldn't be more honest.

The reality of the Federal Reserve

The policies of the Federal Reserve, the central bank of the United States, have been deeply influencing our daily lives for some time now.

The Fed was praised when the economy was growing, and it was also praised as the economy's savior when the economy collapsed in 2008.

But the Federal Reserve, which has the unique power to restructure the economy for the worse, still has the aftereffects of its radical market intervention in November 2010, known as "quantitative easing," more than a decade later.

There is a growing suspicion that the Federal Reserve is responsible for the unprecedented income inequality and financial risks the world is experiencing today.

In just a few years, the Fed quadrupled the money supply to encourage banks and investors to make more risky loans.

The Fed's decision-makers knew this was a bold experiment that would create few jobs while raising long-term risks that were difficult to assess, but they went ahead with it and were soon caught in the trap.

They printed so much money, but there was no way out.

The trap that the Fed has unknowingly set is having a negative impact not only on the Fed but also on all of us who live ordinary lives.

John Feltner, who dreamed of owning his own home after landing a job at Rexnord, which he considered a stable job, lost his job without any fault of his own (Chapter 10), and countless other 'John Feltners' are now burdened with credit card debt, car loans, and student loans as their wages have not increased for the past 10 years.

The main culprit behind all this is the Federal Reserve, which claimed to be the firefighter of the 2010 global financial crisis, but brought about the 2022 global economic crisis just 10 years later.

The Federal Reserve, which acted as a firefighter during the 2010 global financial crisis,

Become the main culprit of the global economic crisis in 2022

Just as it is said that my current appearance is almost the final result of the choices I have made so far, the problems of the global economic crisis we are currently experiencing cannot be simply attributed to COVID-19.

The United States has been implementing quantitative easing policies for over a decade since the 2008 financial crisis, and the repercussions are still felt today.

Quantitative easing injects massive amounts of liquidity into the financial system, while simultaneously purchasing large quantities of long-term bonds, lowering their yields and making them less attractive as investments.

With money overflowing and the appeal of long-term bonds fading, banks are looking for bonds with much longer maturities or riskier assets that offer slightly higher interest rates to generate profits.

The Fed has tried to roll back quantitative easing several times, but each time, the market showed signs of collapse, so they just opened the money tap again.

Even during the COVID-19 pandemic, the Fed printed in two months the equivalent of the amount of money that would have been created in 300 years.

In those ten years, the gap between rich and poor has widened dramatically.

American corporate debt is at an unprecedented high, and this debt is repackaged into complex financial instruments and traded among the biggest Wall Street banks, increasing the instability of the banking system.

Just as it was during the period just before the 2008 crisis when mortgage lending was booming.

US debt default crisis, etc.

As democratic institutions become more dysfunctional,

What central banks of each country have been doing at the forefront

As we watch the frequent congressional conflicts and 'national default negotiations' in the US Congress, people all over the world are concerned about the bankruptcy crisis of the most powerful country, the United States.

As political conflict intensifies and Congress and the executive branch become less able to function, the Federal Reserve, with its expertise, often steps forward and acts as if it were proposing inconvenient and unfair solutions, while omitting the various disagreements and coordination processes across all sectors.

The author argues that the Fed has been making deeply political decisions behind a veil of difficult economic jargon.

This is also a global phenomenon. (Chapter 7)

“As democratically accountable institutions around the world increasingly become dysfunctional, central banks have become the linchpins of economic development.

The problem was that central banks weren't designed to do this.

All the central bank could do was create more money.

The world has come to depend on central banks, institutions with very limited resources to address the challenges at hand.

And 'the longer these policies continue, the more likely it is that the costs and risks will outweigh the benefits' (Chapter 12)

From Private Equity Funds to the Fed: The 'Elite Circular Economy'

What decisions will Bernanke and Powell make going forward?

In "The Fed, the King of Money Printing," the author of a New York Times bestseller takes a look inside one of America's most secretive institutions, the Federal Reserve, and traces how the Fed's policies over the past decade have worsened income inequality and jeopardized economic stability.

And we learn anew that in a Fed where decisions are mostly made by consensus, there was Thomas Honig, the president of the Kansas City Fed, who said, “I respectfully disagree” when everyone else was in favor.

Honig challenges Fed Chairman Ben Bernanke head-on, knowing that his dissenting vote cannot reverse the FOMC's choice.

Despite this recklessness, Honig's thought that "my dissenting vote is necessary to show the public that even within the Fed, the risks of this kind of loose monetary policy are being seriously considered" resonates deeply.

The author also examines the life trajectory of Jerome Powell, the current Federal Reserve Chairman, before joining the Fed, including his time at the large private equity firm Carlyle Group and his sale of Rexnord, where John Feltner worked, at a huge profit (Chapter 15). He also explains in detail how his experiences before joining the Fed significantly influenced his response to the post-COVID-19 crisis, and includes behind-the-scenes stories that go beyond the media's coverage of the Fed (Chapter 7). The fact that Jerome Powell, who is called the world's economic president, is suffering the humiliation of having the lowest level of trust among all Fed Chairmen is evidence that people's views on the Fed are becoming colder.

At a time when the Fed's tightening measures are shaking global markets, I hope this book provides a valuable opportunity to examine the Fed more closely.

Full of very human mistakes that couldn't be more honest.

The reality of the Federal Reserve

The policies of the Federal Reserve, the central bank of the United States, have been deeply influencing our daily lives for some time now.

The Fed was praised when the economy was growing, and it was also praised as the economy's savior when the economy collapsed in 2008.

But the Federal Reserve, which has the unique power to restructure the economy for the worse, still has the aftereffects of its radical market intervention in November 2010, known as "quantitative easing," more than a decade later.

There is a growing suspicion that the Federal Reserve is responsible for the unprecedented income inequality and financial risks the world is experiencing today.

In just a few years, the Fed quadrupled the money supply to encourage banks and investors to make more risky loans.

The Fed's decision-makers knew this was a bold experiment that would create few jobs while raising long-term risks that were difficult to assess, but they went ahead with it and were soon caught in the trap.

They printed so much money, but there was no way out.

The trap that the Fed has unknowingly set is having a negative impact not only on the Fed but also on all of us who live ordinary lives.

John Feltner, who dreamed of owning his own home after landing a job at Rexnord, which he considered a stable job, lost his job without any fault of his own (Chapter 10), and countless other 'John Feltners' are now burdened with credit card debt, car loans, and student loans as their wages have not increased for the past 10 years.

The main culprit behind all this is the Federal Reserve, which claimed to be the firefighter of the 2010 global financial crisis, but brought about the 2022 global economic crisis just 10 years later.

The Federal Reserve, which acted as a firefighter during the 2010 global financial crisis,

Become the main culprit of the global economic crisis in 2022

Just as it is said that my current appearance is almost the final result of the choices I have made so far, the problems of the global economic crisis we are currently experiencing cannot be simply attributed to COVID-19.

The United States has been implementing quantitative easing policies for over a decade since the 2008 financial crisis, and the repercussions are still felt today.

Quantitative easing injects massive amounts of liquidity into the financial system, while simultaneously purchasing large quantities of long-term bonds, lowering their yields and making them less attractive as investments.

With money overflowing and the appeal of long-term bonds fading, banks are looking for bonds with much longer maturities or riskier assets that offer slightly higher interest rates to generate profits.

The Fed has tried to roll back quantitative easing several times, but each time, the market showed signs of collapse, so they just opened the money tap again.

Even during the COVID-19 pandemic, the Fed printed in two months the equivalent of the amount of money that would have been created in 300 years.

In those ten years, the gap between rich and poor has widened dramatically.

American corporate debt is at an unprecedented high, and this debt is repackaged into complex financial instruments and traded among the biggest Wall Street banks, increasing the instability of the banking system.

Just as it was during the period just before the 2008 crisis when mortgage lending was booming.

US debt default crisis, etc.

As democratic institutions become more dysfunctional,

What central banks of each country have been doing at the forefront

As we watch the frequent congressional conflicts and 'national default negotiations' in the US Congress, people all over the world are concerned about the bankruptcy crisis of the most powerful country, the United States.

As political conflict intensifies and Congress and the executive branch become less able to function, the Federal Reserve, with its expertise, often steps forward and acts as if it were proposing inconvenient and unfair solutions, while omitting the various disagreements and coordination processes across all sectors.

The author argues that the Fed has been making deeply political decisions behind a veil of difficult economic jargon.

This is also a global phenomenon. (Chapter 7)

“As democratically accountable institutions around the world increasingly become dysfunctional, central banks have become the linchpins of economic development.

The problem was that central banks weren't designed to do this.

All the central bank could do was create more money.

The world has come to depend on central banks, institutions with very limited resources to address the challenges at hand.

And 'the longer these policies continue, the more likely it is that the costs and risks will outweigh the benefits' (Chapter 12)

From Private Equity Funds to the Fed: The 'Elite Circular Economy'

What decisions will Bernanke and Powell make going forward?

In "The Fed, the King of Money Printing," the author of a New York Times bestseller takes a look inside one of America's most secretive institutions, the Federal Reserve, and traces how the Fed's policies over the past decade have worsened income inequality and jeopardized economic stability.

And we learn anew that in a Fed where decisions are mostly made by consensus, there was Thomas Honig, the president of the Kansas City Fed, who said, “I respectfully disagree” when everyone else was in favor.

Honig challenges Fed Chairman Ben Bernanke head-on, knowing that his dissenting vote cannot reverse the FOMC's choice.

Despite this recklessness, Honig's thought that "my dissenting vote is necessary to show the public that even within the Fed, the risks of this kind of loose monetary policy are being seriously considered" resonates deeply.

The author also examines the life trajectory of Jerome Powell, the current Federal Reserve Chairman, before joining the Fed, including his time at the large private equity firm Carlyle Group and his sale of Rexnord, where John Feltner worked, at a huge profit (Chapter 15). He also explains in detail how his experiences before joining the Fed significantly influenced his response to the post-COVID-19 crisis, and includes behind-the-scenes stories that go beyond the media's coverage of the Fed (Chapter 7). The fact that Jerome Powell, who is called the world's economic president, is suffering the humiliation of having the lowest level of trust among all Fed Chairmen is evidence that people's views on the Fed are becoming colder.

At a time when the Fed's tightening measures are shaking global markets, I hope this book provides a valuable opportunity to examine the Fed more closely.

GOODS SPECIFICS

- Date of issue: May 25, 2023

- Page count, weight, size: 468 pages | 726g | 150*225*29mm

- ISBN13: 9788984078956

- ISBN10: 8984078956

You may also like

카테고리

korean

korean

![ELLE 엘르 스페셜 에디션 A형 : 12월 [2025]](http://librairie.coreenne.fr/cdn/shop/files/b8e27a3de6c9538896439686c6b0e8fb.jpg?v=1766436872&width=3840)